Center Coast Brookfield MLP & Energy Infrastructure Fund Announces Monthly Distributions

January 03 2020 - 4:39PM

Center Coast Brookfield MLP & Energy Infrastructure Fund (NYSE:

CEN) (the “Fund”) today announced that its Board of Trustees

declared its monthly distributions for January, February and March

2020.

|

Month |

Record Date |

Ex Date |

Payable Date |

Amount per Share |

|

January 2020 |

January 15, 2020 |

January 14, 2020 |

January 23, 2020 |

$0.1042 |

|

February 2020 |

February 12, 2020 |

February 11, 2020 |

February 20, 2020 |

$0.1042 |

|

March 2020 |

March 18, 2020 |

March 17, 2020 |

March 26, 2020 |

$0.1042 |

Based on current estimates, it is anticipated

that a portion of the distributions paid in calendar 2020 will be

treated for U.S. federal income tax purposes as a return of

capital. The final determination of the tax status of those 2020

distributions will be made in early 2021 and provided to

shareholders on Form 1099-DIV.

Please contact your financial advisor with any

questions. Distributions may include net investment income, capital

gains and/or return of capital. Any portion of the Fund’s

distributions that is a return of capital does not necessarily

reflect the Fund’s investment performance and should not be

confused with “yield” or “income.” The tax status of distributions

will be determined at the end of the taxable year.

Brookfield Public Securities Group LLC (“PSG”)

is an SEC-registered investment adviser that represents the Public

Securities platform of Brookfield Asset Management Inc., providing

global listed real assets strategies including real estate

equities, infrastructure equities, energy infrastructure equities,

multi-strategy real asset solutions and real asset debt. With more

than $19 billion of assets under management as of November 30,

2019, PSG manages separate accounts, registered funds and

opportunistic strategies for financial institutions, public and

private pension plans, insurance companies, endowments and

foundations, sovereign wealth funds and individual investors. PSG

is a wholly owned subsidiary of Brookfield Asset Management Inc., a

leading global alternative asset manager with over $500 billion of

assets under management as of September 30, 2019. For more

information, go to www.brookfield.com.

Center Coast Brookfield MLP & Energy

Infrastructure Fund is managed by Brookfield Public Securities

Group LLC. The Fund uses its website as a channel of distribution

of material company information. Financial and other material

information regarding the Fund is routinely posted on and

accessible at www.brookfield.com.

COMPANY CONTACTCenter Coast

Brookfield MLP & Energy Infrastructure Fund

Brookfield Place250 Vesey Street, 15th FloorNew

York, NY 10281-1023(855)

777-8001publicsecurities.enquiries@brookfield.com

Investing involves risk; principal loss

is possible. Past performance is not a guarantee of future

results.

RisksThe Fund’s investments are

concentrated in the energy infrastructure industry with an emphasis

on securities issued by master limited partnerships (“MLPs”), which

may increase price fluctuation. The value of commodity-linked

investments such as the MLPs and energy infrastructure companies

(including midstream MLPs and energy infrastructure companies) in

which the Fund invests are subject to risks specific to the

industry they serve, such as fluctuations in commodity prices,

reduced volumes of available natural gas or other energy

commodities, slowdowns in new construction and acquisitions, a

sustained reduced demand for crude oil, natural gas and refined

petroleum products, depletion of the natural gas reserves or other

commodities, changes in the macroeconomic or regulatory

environment, environmental hazards, rising interest rates and

threats of attack by terrorists on energy assets, each of which

could affect the Fund’s profitability.

MLPs are subject to significant regulation and

may be adversely affected by changes in the regulatory environment

including the risk that an MLP could lose its tax status as a

partnership. If an MLP was obligated to pay federal income tax on

its income at the corporate tax rate, the amount of cash available

for distribution would be reduced and such distributions received

by the Fund would be taxed under federal income tax laws applicable

to corporate dividends received (as dividend income, return of

capital, or capital gain).

In addition, investing in MLPs involves

additional risks as compared to the risks of investing in common

stock, including risks related to cash flow, dilution and voting

rights. Such companies may trade less frequently than larger

companies due to their smaller capitalizations which may result in

erratic price movement or difficulty in buying or selling.

The Fund is a non-diversified, closed-end

management investment company. As a result, the Fund’s returns may

fluctuate to a greater extent than those of a diversified

investment company. Shares of closed-end management investment

companies, such as the Fund, frequently trade at a discount to

their net asset value, which may increase investors’ risk of loss.

The Fund is not a complete investment program and you may lose

money investing in the Fund.

Because of the Fund’s concentration in MLP

investments, the Fund is not eligible to be treated as a “regulated

investment company” under the Internal Revenue Code of 1986, as

amended. Instead, the Fund will be treated as a regular

corporation, or “C” corporation, for U.S. federal income tax

purposes and, as a result, unlike most investment companies, will

be subject to corporate income tax to the extent the Fund

recognizes taxable income.

An investment in MLP units involves risks that

differ from a similar investment in equity securities, such as

common stock, of a corporation. Holders of MLP units have the

rights typically afforded to limited partners in a limited

partnership. As compared to common shareholders of a corporation,

holders of MLP units have more limited control and limited rights

to vote on matters affecting the partnership. There are certain tax

risks associated with an investment in MLP units. Additionally,

conflicts of interest may exist between common unit holders,

subordinated unit holders and the general partner of an MLP.

The Fund currently seeks to enhance the level of

its current distributions by utilizing financial leverage through

borrowing, including loans from financial institutions, or the

issuance of commercial paper or other forms of debt, through the

issuance of senior securities such as preferred shares, through

reverse repurchase agreements, dollar rolls or similar transactions

or through a combination of the foregoing. Financial leverage is a

speculative technique and investors should note that there are

special risks and costs associated with financial leverage.

Foreside Fund Services, LLC; distributor.

Center Coast Brookfield ... (NYSE:CEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

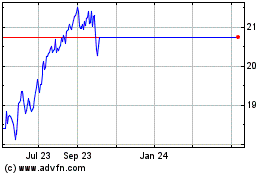

Center Coast Brookfield ... (NYSE:CEN)

Historical Stock Chart

From Mar 2024 to Mar 2025