Allegheny's 1Q View Disappoints - Analyst Blog

April 19 2013 - 1:20PM

Zacks

Allegheny Technologies Inc. (ATI) said that it

envisions first-quarter 2013 profit of roughly $10 million or 9

cents per share, a sharp decline from $56.2 million or 50 cents a

share earned a year ago.

The Pittsburgh-based company expects sales of around $1.18 billion

for the first quarter. This indicates a roughly 13% decline from

revenues of $1.35 billion logged in the prior-year quarter.

Allegheny, which is among the prominent players in the U.S.

specialty steel industry along with Carpenter

Technology (CRS), Haynes International

(HAYN) and Precision Castparts (PCP), noted that

it saw lower pricing and soft demand for its products in the first

quarter. It witnessed record low selling prices for cold-rolled

standard sheet as a result of low-cost imports. Demand for

zirconium and related alloys was also weak.

Allegheny further noted that declining raw materials prices

continued to hurt its sales. While its contract business was stable

in the quarter, transactional business was negatively impacted by

lower raw materials prices and short lead times.

Allegheny reported its fourth-quarter 2012 results in Jan 2013. The

company’s profit slid 67% year over year as sluggish economic

conditions hurt demand for its products. Adjusted earnings of 18

cents per share, however, managed to beat the Zacks Consensus

Estimate by a penny. Sales fell at a double-digit clip and

missed the Zacks Consensus Estimate.

While Allegheny is expected to continue benefiting from its new

alloys/products and diversified global growth markets, it is

contending with a soft economy. Moreover, reduced raw material

surcharges and low base prices for standard stainless products are

affecting the results of the company’s Flat-Rolled Products

division. Its business environment is expected to remain

challenging through first-half 2013 given the uncertain global

economy.

Nevertheless, Allegheny sees growth in its key end-markets such as

aerospace, oil and gas, electrical energy and medical over the long

term. The company also expects improved results in its Flat-Rolled

Products segment, driven by the Hot-Rolling and Processing

Facility. Construction of the facility is expected to complete by

end-2013 with official commissioning is expected in first-half

2014.

Allegheny, which currently holds a short-term Zacks Rank #5 (Strong

Sell), will announce its first quarter results before the opening

bell on Apr 24.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

HAYNES INTL INC (HAYN): Free Stock Analysis Report

PRECISION CASTP (PCP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

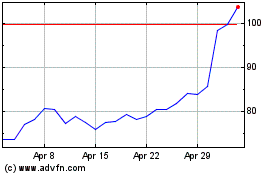

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

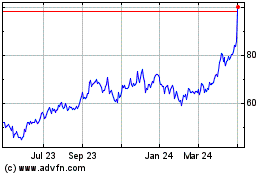

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024