0001525221false00015252212023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

| | |

| Bristow Group Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-35701 | | 72-1455213 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 3151 Briarpark Drive, Suite 700, | Houston, | Texas | | 77042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | | | | | | | |

Registrant’s telephone number, including area code | | (713) | 267-7600 |

| | | | | | | | | | | | | | |

| None |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered

|

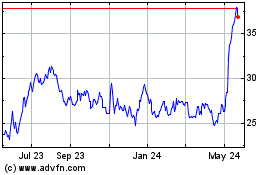

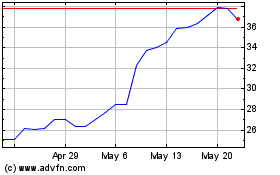

| Common Stock | | VTOL | | NYSE |

Item 2.02 Results of Operations and Financial Condition

On November 1, 2023, Bristow Group Inc. (“Bristow Group”) issued a press release setting forth its third quarter 2023 financial results. A copy of the press release is attached hereto as Exhibit 99.1 and hereby incorporated by reference. The information furnished pursuant to Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On November 2, 2023, Bristow Group will make a presentation about its third quarter 2023 earnings as noted in the press release described in Item 2.02 above. A copy of the presentation slides is attached hereto as Exhibit 99.2. Additionally, Bristow Group has posted the presentation on its website at www.bristowgroup.com. The information furnished pursuant to Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| | | | | |

| (d) Exhibits | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | Bristow Group Inc. |

| | | | | |

| November 1, 2023 | | By: | | /s/ Jennifer D. Whalen |

| | | | | Name: Jennifer D. Whalen |

| | | | | Title: Senior Vice President, Chief Financial Officer |

Exhibit Index

| | | | | |

| | |

| (d) Exhibits | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

Exhibit 99.1

PRESS RELEASE

BRISTOW GROUP REPORTS

THIRD QUARTER 2023 RESULTS

Houston, Texas

November 1, 2023

•Total revenues of $338.1 million in Q3 2023 compared to $319.4 million in Q2 2023

•Net income of $4.3 million, or $0.15 per diluted share, in Q3 2023 compared to net loss of $1.6 million, or $0.06 per diluted share, in Q2 2023

•EBITDA adjusted to exclude special items, asset dispositions and foreign exchange gains (losses) was $56.6 million in Q3 2023 compared to $39.0 million in Q2 2023(1)

•Raised 2023 Adjusted EBITDA(1) outlook mid-point and reaffirmed 2024 financial outlook

FOR IMMEDIATE RELEASE — Bristow Group Inc. (NYSE: VTOL) today reported net income attributable to the Company of $4.3 million, or $0.15 per diluted share, for its quarter ended September 30, 2023 (the “Current Quarter”) on operating revenues of $330.3 million compared to net loss attributable to the Company of $1.6 million, or $0.06 per diluted share, for the quarter ended June 30, 2023 (the “Preceding Quarter”) on operating revenues of $311.5 million.

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was $54.9 million in the Current Quarter compared to $12.3 million in the Preceding Quarter. EBITDA adjusted to exclude special items, gains or losses on asset dispositions and foreign exchange gains (losses) was $56.6 million in the Current Quarter compared to $39.0 million in the Preceding Quarter. The following table provides a reconciliation of net income (loss) to EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding gains or losses on asset dispositions and foreign exchange gains (losses) (in thousands, unaudited). See “Non-GAAP Financial Measures” for further information on the use of non-GAAP financial measures used herein.

| | | | | | | | | | | |

| Three Months Ended, |

| September 30, 2023 | | June 30,

2023 |

| Net income (loss) | $ | 4,345 | | | $ | (1,637) | |

| Depreciation and amortization expense | 17,862 | | | 18,292 | |

| Interest expense, net | 10,008 | | | 9,871 | |

| Income tax expense (benefit) | 22,637 | | | (14,209) | |

EBITDA(1) | $ | 54,852 | | | $ | 12,317 | |

| Special items: | | | |

| | | |

| | | |

| PBH amortization | 3,751 | | | 3,697 | |

| Merger and integration costs | 738 | | | 677 | |

| | | |

| Reorganization items, net | 3 | | | 39 | |

| | | |

| Non-cash insurance adjustment | — | | | 3,977 | |

Other special items(2) | 2,966 | | | 2,097 | |

| $ | 7,458 | | | $ | 10,487 | |

Adjusted EBITDA(1) | $ | 62,310 | | | $ | 22,804 | |

| (Gains) losses on disposal of assets | (1,179) | | | 3,164 | |

| Foreign exchange (gains) losses | (4,541) | | | 13,021 | |

| Adjusted EBITDA excluding asset dispositions and foreign exchange | $ | 56,590 | | | $ | 38,989 | |

__________________(1) EBITDA and Adjusted EBITDA are non-GAAP financial measures. See definitions of these measures and the reconciliation of GAAP to non-GAAP financial measures in the Non-GAAP Financial Reconciliation tables.

(2) Other special items include professional services fees that are not related to continuing business operations and other nonrecurring costs.

“Consistent with our outlook that the second half of 2023 would mark the positive inflection point for Bristow’s financial results, Q3 Adjusted EBITDA of $56.6 million represents a 45% sequential quarter improvement and supports our outlook for stronger financial results in 2024 and beyond,” said Chris Bradshaw, President and CEO of Bristow Group. “We are raising the Company’s full-year 2023 Adjusted EBITDA guidance range to $165-$175 million. The fundamentals for Bristow’s business continue to strengthen, supporting our belief that we are in the early stages of a multi-year growth cycle. With the largest and most diverse aircraft fleet in the industry and the largest operational footprint, Bristow is well-positioned to benefit from opportunities in this upcycle.”

Sequential Quarter Results

Operating revenues in the Current Quarter were $18.7 million higher compared to the Preceding Quarter. Operating revenues from offshore energy services were $17.8 million higher primarily due to higher utilization in each geographic region and higher lease payments received from Cougar Helicopters Inc. (“Cougar”). Operating revenues from government services were $1.8 million lower in the Current Quarter primarily due to the transition from an interim contract to the tendered contract for the Dutch Caribbean Coast Guard, partially offset by higher utilization and the strengthening of the British pound sterling (“GBP”) relative to the U.S. dollar (“USD”). Operating revenues from fixed wing services were $2.7 million higher in the Current Quarter primarily due to higher utilization.

Operating expenses were consistent with the Preceding Quarter. Personnel and fuel costs were higher in the Current Quarter, offset by lower insurance costs, repairs and maintenance and other operating costs.

General and administrative expenses were $1.6 million higher primarily due to higher professional services fees.

During the Current Quarter, the Company sold or otherwise disposed of two helicopters and other assets, resulting in a net gain of $1.2 million. During the Preceding Quarter, the Company sold or otherwise disposed of three helicopters and other assets, resulting in a net loss of $3.2 million.

Earnings from unconsolidated affiliates were $2.4 million higher in the Current Quarter primarily due to higher earnings at Cougar.

Other income, net of $4.8 million in the Current Quarter primarily resulted from foreign exchange gains of $4.5 million. Other expense, net of $13.0 million in the Preceding Quarter primarily resulted from foreign exchange losses of $13.0 million, of which $7.6 million was due to the significant devaluation in the Nigerian Naira.

Income tax expense was $22.6 million in the Current Quarter compared to an income tax benefit of $14.2 million in the Preceding Quarter primarily due to increased earnings during the Current Quarter, the earnings mix of the Company’s global operations and changes to deferred tax valuation allowances.

Liquidity and Capital Allocation

As of September 30, 2023, the Company had $207.5 million of unrestricted cash and $66.8 million of remaining availability under its amended asset-based revolving credit facility (the “ABL Facility”) for total liquidity of $274.4 million. Borrowings under the amended ABL Facility are subject to certain conditions and requirements.

In the Current Quarter, purchases of property and equipment were $18.4 million, of which $4.7 million were maintenance capital expenditures, and cash proceeds from dispositions of property and equipment were $7.3 million. In the Preceding Quarter, purchases of property and equipment were $12.2 million, of which $2.5 million were maintenance capital expenditures, and cash proceeds from dispositions of property and equipment were $3.3 million. See Adjusted Free Cash Flow Reconciliation for a reconciliation of Adjusted Free Cash Flow.

Increased 2023 Outlook and Affirmed 2024 Outlook

Please refer to the paragraph entitled "Forward Looking Statements Disclosure" below for further discussion regarding the risks and uncertainties as well as other important information regarding Bristow’s guidance. The following guidance also contains the non-GAAP financial measure of Adjusted EBITDA. Please read the section entitled “Non-GAAP Financial Measures” for further information.

Select financial targets for the calendar years 2023 and 2024 are as follows (in USD, millions):

| | | | | | | | | | | |

| 2023E | | 2024E |

| Operating revenues: | | | |

| Offshore energy services | $795 - $810 | | $850 - $970 |

| Government services | $330 - $340 | | $340 - $365 |

| Fixed wing services | $105 - $110 | | $95 - $115 |

| Other services | $10 - $12 | | $10 - $15 |

| Total operating revenues | $1,240 - $1,272 | | $1,295 - $1,465 |

| | | |

| Adjusted EBITDA, excluding asset dispositions and foreign exchange | $165 - $175 | | $190 - $220 |

| | | |

| Cash interest | ~$40 | | ~$40 |

| Cash taxes | $15 - $20 | | $25 - $30 |

| Maintenance capital expenditures | $15 - $20 | | $15 - $20 |

Conference Call

Management will conduct a conference call starting at 10:00 a.m. ET (9:00 a.m. CT) on Thursday, November 2, 2023, to review the results for the third quarter ended September 30, 2023. The conference call can be accessed using the following link:

Link to Access Earnings Call: https://www.veracast.com/webcasts/bristow/webcasts/VTOL3Q23.cfm

Replay

A replay will be available through November 23, 2023 by using the link above. A replay will also be available on the Company’s website at www.bristowgroup.com shortly after the call and will be accessible through November 23, 2023. The accompanying investor presentation will be available on November 2, 2023, on Bristow’s website at www.bristowgroup.com.

For additional information concerning Bristow, contact Jennifer Whalen at InvestorRelations@bristowgroup.com, (713) 369-4636 or visit Bristow Group’s website at https://ir.bristowgroup.com/.

About Bristow Group

Bristow Group Inc. is the leading global provider of innovative and sustainable vertical flight solutions. Bristow primarily provides aviation services to a broad base of offshore energy companies and government entities. The Company’s aviation services include personnel transportation, search and rescue (“SAR”), medevac, fixed wing transportation, unmanned systems, and ad-hoc helicopter services.

Bristow currently has customers in Australia, Brazil, Canada, Chile, the Dutch Caribbean, the Falkland Islands, India, Ireland, Mexico, the Netherlands, Nigeria, Norway, Spain, Suriname, Trinidad, the UK and the U.S.

Forward-Looking Statements Disclosure

This press release contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words and, for the avoidance of doubt, include all statements herein regarding the Company’s financial targets for Calendar Year 2023 and 2024 and operational outlook. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements (including the Company’s financial targets for Calendar Year 2023 and 2024 and operational outlook) speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof, except as may be required by applicable law.

Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (including COVID-19) and epidemics, and any related government policies and actions; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; our inability to execute our business strategy for diversification efforts related to, government services, offshore wind, and advanced air mobility; our reliance on a limited number of customers and the reduction of our customer base as a result of consolidation and/or the energy transition; the potential for cyberattacks or security breaches that could disrupt operations, compromise confidential or sensitive information, damage reputation, expose to legal liability, or cause financial losses; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of alternative modes of transportation and solutions; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of the governments that impact oil and gas operations or favor renewable energy projects; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that portions of our fleet may be grounded for extended periods of time or indefinitely (including due to severe weather events); the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies where we are seeking contracts could adversely affect or lead to modifications of the procurement process or that such reductions in spending could adversely affect search and rescue (“SAR”) contract terms or otherwise delay service or the receipt of payments under such contracts; the effectiveness of our environmental, social and governance initiatives; the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; our reliance on a limited number of helicopter manufacturers and suppliers and the impact of a shortfall in availability of aircraft components and parts required for maintenance and repairs of our helicopters, including significant delays in the delivery of parts for our S92 fleet.

If one or more of the foregoing risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Transition Report on Form 10-KT for the year ended December 31, 2022 (the “Transition Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov.

| | | | | | | | | | | | | | | | | |

BRISTOW GROUP INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited, in thousands, except per share amounts)

|

| Three Months Ended | | Favorable/ (Unfavorable) |

| | September 30, 2023 | | June 30,

2023 | |

| | | | | |

| Revenues: | | | | | |

| Operating revenues | $ | 330,252 | | | $ | 311,522 | | | $ | 18,730 | |

| Reimbursable revenues | 7,838 | | | 7,861 | | | (23) | |

| Total revenues | 338,090 | | | 319,383 | | | 18,707 | |

| | | | | |

| Costs and expenses: | | | | | |

| Operating expenses | 240,682 | | | 240,659 | | | (23) | |

| Reimbursable expenses | 7,836 | | | 7,680 | | | (156) | |

| General and administrative expenses | 46,256 | | | 44,616 | | | (1,640) | |

| Merger and integration costs | 738 | | | 677 | | | (61) | |

| | | | | |

| Depreciation and amortization expense | 17,862 | | | 18,292 | | | 430 | |

| Total costs and expenses | 313,374 | | | 311,924 | | | (1,450) | |

| | | | | |

| | | | | |

| Gains (losses) on disposal of assets | 1,179 | | | (3,164) | | | 4,343 | |

| Earnings from unconsolidated affiliates | 3,722 | | | 1,279 | | | 2,443 | |

| Operating income | 29,617 | | | 5,574 | | | 24,043 | |

| | | | | |

| Interest income | 2,532 | | | 1,527 | | | 1,005 | |

| Interest expense, net | (10,008) | | | (9,871) | | | (137) | |

| | | | | |

| Reorganization items, net | (3) | | | (39) | | | 36 | |

| | | | | |

| Other, net | 4,844 | | | (13,037) | | | 17,881 | |

| Total other income (expense), net | (2,635) | | | (21,420) | | | 18,785 | |

| Income (loss) before income taxes | 26,982 | | | (15,846) | | | 42,828 | |

| Income tax benefit (expense) | (22,637) | | | 14,209 | | | (36,846) | |

| Net income (loss) | 4,345 | | | (1,637) | | | 5,982 | |

| Net income attributable to noncontrolling interests | (28) | | | — | | | (28) | |

| Net income (loss) attributable to Bristow Group Inc. | $ | 4,317 | | | $ | (1,637) | | | $ | 5,954 | |

| | | | | |

| Basic earnings (losses) per common share | $ | 0.15 | | | $ | (0.06) | | | $ | 0.21 | |

| Diluted earnings (losses) per common share | $ | 0.15 | | | $ | (0.06) | | | $ | 0.21 | |

| | | | | |

| Weighted average common shares outstanding, basic | 28,217 | | | 28,058 | | | |

| Weighted average common shares outstanding, diluted | 28,959 | | | 28,058 | | | |

| | | | | |

| EBITDA | $ | 54,852 | | | $ | 12,317 | | | $ | 42,535 | |

| Adjusted EBITDA | $ | 62,310 | | | $ | 22,804 | | | $ | 39,506 | |

| Adjusted EBITDA excluding asset dispositions and foreign exchange | $ | 56,590 | | | $ | 38,989 | | | $ | 17,601 | |

| | | | | | | | | | | |

BRISTOW GROUP INC. OPERATING REVENUES BY LINE OF SERVICE (unaudited, in thousands) |

| | | |

| Three Months Ended |

| September 30, 2023 | | June 30,

2023 |

| Offshore energy services: | | | |

| Europe | $ | 94,346 | | | $ | 87,331 | |

| Americas | 91,099 | | | 80,884 | |

| Africa | 27,545 | | | 26,979 | |

| Total offshore energy services | 212,990 | | | 195,194 | |

| Government services | 85,549 | | | 87,320 | |

| Fixed wing services | 29,168 | | | 26,448 | |

| Other | 2,545 | | | 2,560 | |

| $ | 330,252 | | | $ | 311,522 | |

| | | | | | | | | | | |

FLIGHT HOURS BY LINE OF SERVICE (unaudited) |

| | | |

| Three Months Ended |

| September 30, 2023 | | June 30,

2023 |

| Offshore energy services: | | | |

| Europe | 10,783 | | | 10,532 | |

| Americas | 9,767 | | | 8,676 | |

| Africa | 3,572 | | | 3,241 | |

| Total offshore energy services | 24,122 | | | 22,449 | |

| Government services | 5,232 | | | 5,008 | |

| Fixed wing services | 2,956 | | | 2,691 | |

| 32,310 | | | 30,148 | |

| | | | | | | | | | | |

BRISTOW GROUP INC. CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited, in thousands)

|

| September 30,

2023 | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 209,736 | | | $ | 163,683 | |

| Accounts receivable, net | 219,114 | | | 215,131 | |

| Inventories | 94,987 | | | 81,886 | |

| | | |

| Prepaid expenses and other current assets | 33,986 | | | 32,425 | |

| Total current assets | 557,823 | | | 493,125 | |

| Property and equipment, net | 882,270 | | | 915,251 | |

| Investment in unconsolidated affiliates | 19,627 | | | 17,000 | |

| Right-of-use assets | 282,194 | | | 240,977 | |

| Other assets | 147,779 | | | 145,648 | |

| Total assets | $ | 1,889,693 | | | $ | 1,812,001 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 73,267 | | | $ | 89,610 | |

| Accrued liabilities | 239,754 | | | 184,324 | |

| Short-term borrowings and current maturities of long-term debt | 12,683 | | | 11,656 | |

| Total current liabilities | 325,704 | | | 285,590 | |

| Long-term debt, less current maturities | 531,319 | | | 499,765 | |

| Deferred taxes | 11,557 | | | 48,633 | |

| Long-term operating lease liabilities | 211,505 | | | 165,955 | |

| Deferred credits and other liabilities | 14,410 | | | 25,119 | |

| Total liabilities | 1,094,495 | | | 1,025,062 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock | 306 | | | 306 | |

| Additional paid-in capital | 722,066 | | | 709,319 | |

| Retained earnings | 225,906 | | | 224,748 | |

| Treasury stock, at cost | (65,722) | | | (63,009) | |

| Accumulated other comprehensive loss | (87,015) | | | (84,057) | |

| Total Bristow Group Inc. stockholders’ equity | 795,541 | | | 787,307 | |

| Noncontrolling interests | (343) | | | (368) | |

| Total stockholders’ equity | 795,198 | | | 786,939 | |

| Total liabilities and stockholders’ equity | $ | 1,889,693 | | | $ | 1,812,001 | |

Non-GAAP Financial Measures

The Company’s management uses EBITDA and Adjusted EBITDA to assess the performance and operating results of its business. Each of these measures, as well as Free Cash Flow and Adjusted Free Cash Flow, each as detailed below, have limitations, and are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in the Company's financial statements prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”) (including the notes), included in the Company's filings with the SEC and posted on the Company's website. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for certain special items that occurred during the reported period, as noted below. The Company includes EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of its operating performance. Management believes that the use of EBITDA and Adjusted EBITDA is meaningful to investors because it provides information with respect to the Company's ability to meet its future debt service, capital expenditures and working capital requirements and the financial performance of the Company's assets without regard to financing methods, capital structure or historical cost basis. Neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP. Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies.

There are two main ways in which foreign currency fluctuations impact Bristow’s reported financials. The first is primarily non-cash foreign exchange gains (losses) that are reported in the Other Income line on the Income Statement. These are related to the revaluation of balance sheet items, typically do not impact cash flows, and thus are excluded in the Adjusted EBITDA presentation. The second is through impacts to certain revenue and expense items, which impact the Company’s cash flows. The primary exposure is the GBP/USD exchange rate.

The Company is unable to provide a reconciliation of forecasted Adjusted EBITDA for 2023 and 2024 included in this release to projected net income (GAAP) for the same periods because components of the calculation are inherently unpredictable. The inability to forecast certain components of the calculation would significantly affect the accuracy of the reconciliation. Additionally, the Company does not provide guidance on the items used to reconcile projected Adjusted EBITDA due to the uncertainty regarding timing and estimates of such items. Therefore, the Company does not present a reconciliation of forecasted Adjusted EBITDA to net income (GAAP) for 2023 or 2024.

The following tables provide a reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands, unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | LTM |

| Net income (loss) | $ | 4,345 | | | $ | (1,637) | | | $ | (1,525) | | | $ | (6,931) | | | $ | (5,748) | |

| Depreciation and amortization expense | 17,862 | | | 18,292 | | | 17,445 | | | 17,000 | | | 70,599 | |

| Interest expense, net | 10,008 | | | 9,871 | | | 10,264 | | | 10,457 | | | 40,600 | |

| Income tax expense (benefit) | 22,637 | | | (14,209) | | | (5,094) | | | (853) | | | 2,481 | |

| EBITDA | $ | 54,852 | | | $ | 12,317 | | | $ | 21,090 | | | $ | 19,673 | | | $ | 107,932 | |

Special items(1) | 7,458 | | | 10,487 | | | 6,986 | | | 5,683 | | | 30,614 | |

| Adjusted EBITDA | $ | 62,310 | | | $ | 22,804 | | | $ | 28,076 | | | $ | 25,356 | | | $ | 138,546 | |

| (Gains) losses on disposal of assets | (1,179) | | | 3,164 | | | (3,256) | | | 1,747 | | | 476 | |

| Foreign exchange (gains) losses | (4,541) | | | 13,021 | | | 4,103 | | | 9,243 | | | 21,826 | |

| Adjusted EBITDA excluding asset dispositions and foreign exchange | $ | 56,590 | | | $ | 38,989 | | | $ | 28,923 | | | $ | 36,346 | | | $ | 160,848 | |

(1) Special items include the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | LTM |

| | | | | | | | | |

| | | | | | | | | |

| PBH amortization | $ | 3,751 | | | $ | 3,697 | | | $ | 3,803 | | | $ | 3,700 | | | $ | 14,951 | |

| Merger and integration costs | 738 | | | 677 | | | 439 | | | 335 | | | 2,189 | |

| | | | | | | | | |

| | | | | | | | | |

| Reorganization items, net | 3 | | | 39 | | | 44 | | | 21 | | | 107 | |

| Non-cash insurance adjustment | — | | | 3,977 | | | — | | | — | | | 3,977 | |

| | | | | | | | | |

Other special items(2) | 2,966 | | | 2,097 | | | 2,700 | | | 1,627 | | | 9,390 | |

| | | | | | | | | |

| $ | 7,458 | | | $ | 10,487 | | | $ | 6,986 | | | $ | 5,683 | | | $ | 30,614 | |

______________________ (2) Other special items include professional services fees that are not related to continuing business operations and other nonrecurring costs

Reconciliation of Free Cash Flow and Adjusted Free Cash Flow

Free Cash Flow represents the Company’s net cash provided by operating activities less maintenance capital expenditures. In prior periods, the Company’s Free Cash Flow was calculated as net cash provided by (used in) operating activities plus proceeds from disposition of property and equipment less purchases of property and equipment. Management believes that the change in the Company’s free cash flow calculation, as presented herein, better represents the Company’s cash flow available for discretionary purposes, including growth capital expenditures. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude costs paid in relation to a PBH maintenance agreement buy-in, reorganization items, costs associated with recent mergers, acquisitions and ongoing integration efforts, as well as other special items which include nonrecurring professional services fees and other nonrecurring costs or costs that are not related to continuing business operations. Management believes that Free Cash Flow and Adjusted Free Cash Flow are meaningful to investors because they provide information with respect to the Company’s ability to generate cash from the business. The GAAP measure most directly comparable to Free Cash Flow and Adjusted Free Cash Flow is net cash provided by operating activities. Since neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net cash provided by operating activities. Investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Free Cash Flow and Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. As such, they may not be comparable to other similarly titled measures used by other companies.

The following table provides a reconciliation of net cash provided by operating activities, the most directly comparable GAAP measure, to Free Cash Flow and Adjusted Free Cash Flow (in thousands, unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | LTM |

| Net cash provided by (used in) operating activities | $ | 16,711 | | | $ | 18,210 | | | $ | 6,615 | | | $ | (18,484) | | | $ | 23,052 | |

| Less: Maintenance capital expenditures | (4,656) | | | (2,533) | | | (2,952) | | | (1,911) | | | (12,052) | |

| Free Cash Flow | $ | 12,055 | | | $ | 15,677 | | | $ | 3,663 | | | $ | (20,395) | | | $ | 11,000 | |

| Plus: PBH buy-in costs | — | | | — | | | — | | | 24,179 | | | 24,179 | |

| | | | | | | | | |

| Plus: Merger and integration costs | 712 | | | 488 | | | 571 | | | 275 | | | 2,046 | |

| Plus: Reorganization items, net | 25 | | | 58 | | | 20 | | | 28 | | | 131 | |

Plus: Other special items(1) | 1,580 | | | 1,650 | | | 1,509 | | | 1,877 | | | 6,616 | |

| | | | | | | | | |

| Adjusted Free Cash Flow | $ | 14,372 | | | $ | 17,873 | | | $ | 5,763 | | | $ | 5,964 | | | $ | 43,972 | |

__________________________ (1) Other special items include professional services fees that are not related to continuing business operations and other nonrecurring costs

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

BRISTOW GROUP INC. FLEET COUNT (unaudited) |

| | | | | | | | | | | |

| | Number of Aircraft | | | | |

| Type | Owned

Aircraft | | Leased

Aircraft | | | | Total Aircraft | | Max Pass.

Capacity | | Average Age (years)(1) |

| Heavy Helicopters: | | | | | | | | | | | |

| S92 | 38 | | | 29 | | | | | 67 | | | 19 | | | 14 | |

| AW189 | 17 | | | 4 | | | | | 21 | | | 16 | | | 7 | |

| S61 | 2 | | | 1 | | | | | 3 | | | 19 | | | 52 | |

| 57 | | | 34 | | | | | 91 | | | | | |

| Medium Helicopters: | | | | | | | | | | | |

| AW139 | 49 | | | 4 | | | | | 53 | | | 12 | | | 13 | |

| S76 D/C++ | 15 | | | — | | | | | 15 | | | 12 | | | 12 | |

| AS365 | 1 | | | — | | | | | 1 | | | 12 | | | 34 | |

| 65 | | | 4 | | | | | 69 | | | | | |

| Light—Twin Engine Helicopters: | | | | | | | | | | | |

| AW109 | 4 | | | — | | | | | 4 | | | 7 | | | 16 | |

| EC135 | 9 | | | 1 | | | | | 10 | | | 6 | | | 14 | |

| 13 | | | 1 | | | | | 14 | | | | | |

| Light—Single Engine Helicopters: | | | | | | | | | | | |

| AS350 | 15 | | | — | | | | | 15 | | | 4 | | | 25 | |

| AW119 | 13 | | | — | | | | | 13 | | | 7 | | | 17 | |

| 28 | | | — | | | | | 28 | | | | | |

| | | | | | | | | | | |

| Total Helicopters | 163 | | | 39 | | | | | 202 | | | | | 15 | |

| Fixed Wing | 8 | | | 5 | | | | | 13 | | | | | |

| Unmanned Aerial Systems (“UAS”) | 4 | | | — | | | | | 4 | | | | | |

| Total Fleet | 175 | | | 44 | | | | | 219 | | | | | |

______________________(1)Reflects the average age of helicopters that are owned by the Company.

The chart below presents the number of aircraft in our fleet and their distribution among the regions in which we operate as of September 30, 2023 and the percentage of operating revenue that each of our regions provided during the Current Quarter (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Percentage

of Current

Quarter

Operating

Revenue | | | | | | | |

| | | | | | | | Fixed Wing | | UAS | | | |

| | Heavy | | Medium | | Light Twin | | Light Single | Total |

| Europe | 55 | % | | 63 | | | 7 | | | — | | | 3 | | | — | | | 4 | | | 77 | | |

| Americas | 29 | % | | 24 | | | 50 | | | 11 | | | 25 | | | — | | | — | | | 110 | | |

| Africa | 9 | % | | 4 | | | 10 | | | 3 | | | — | | | 2 | | | — | | | 19 | | |

| Asia Pacific | 7 | % | | — | | | 2 | | | — | | | — | | | 11 | | | — | | | 13 | | |

| Total | 100 | % | | 91 | | | 69 | | | 14 | | | 28 | | | 13 | | | 4 | | | 219 | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

November 2, 2023 Q3 2023 Earnings Presentation Exhibit 99.2

2 Introduction Redeate (Red) Tilahun Senior Manager, Investor Relations and Financial Reporting 01 02 03 04 05 Operational Highlights Chris Bradshaw President and CEO Financial Review Jennifer Whalen SVP, Chief Financial Officer Concluding Remarks Chris Bradshaw President and CEO Questions & Answers Q3 2023 Earnings Call

3 Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words and, for the avoidance of doubt, include all statements herein regarding the Company's financial targets for Calendar Years 2023 and 2024 and operational outlook. These forward-looking statements include statements regarding expectations with respect to the Irish Coast Guard Aviation Service contract and related procurement process. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward- looking statements (including the Company's financial targets for Calendar Years 2023 and 2024 and operational outlook) speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof except as may be required by applicable law. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (including COVID-19) and epidemics, and any related government policies and actions; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; our inability to execute our business strategy for diversification efforts related to, government services, offshore wind, and advanced air mobility; our reliance on a limited number of customers and the reduction of our customer base as a result of consolidation and/or the energy transition; the potential for cyberattacks or security breaches that could disrupt operations, compromise confidential or sensitive information, damage reputation, expose to legal liability, or cause financial losses; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of alternative modes of transportation and solutions; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of the governments that impact oil and gas operations or favor renewable energy projects; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that portions of our fleet may be grounded for extended periods of time or indefinitely (including due to severe weather events); the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies where we are seeking contracts could adversely affect or lead to modifications of the procurement process or that such reductions in spending could adversely affect search and rescue (“SAR”) contract terms or otherwise delay service or the receipt of payments under such contracts; the effectiveness of our environmental, social and governance initiatives; the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; our reliance on a limited number of helicopter manufacturers and suppliers and the impact of a shortfall in availability of aircraft components and parts required for maintenance and repairs of our helicopters, including significant delays in the delivery of parts for our S92 fleet. If one or more of the foregoing risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Transition Report on Form 10- KT for the year ended December 31, 2022 (the “Transition Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Transition Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov.

4 Non-GAAP Financial Measures Reconciliation In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. Each of these measures, detailed below, have limitations, and are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our filings with the SEC and posted on our website. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Management believes that the use of EBITDA and Adjusted EBITDA is meaningful to investors because it provides information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements and the financial performance of our assets without regard to financing methods, capital structure or historical cost basis. Neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP. Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. There are two main ways in which foreign currency fluctuations impact on the Company’s reported financials. The first is primarily non-cash foreign exchange gains (losses) that are reported in the Other Income line on the Income Statement. These are related to the revaluation of balance sheet items, typically do not impact cash flows, and thus are excluded in the Adjusted EBITDA presentation. The second is through impacts to certain revenue and expense items, which impact the Company’s cash flows. The primary exposure is the GBP/USD exchange rate. This presentation provides a reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands, unaudited). The Company is unable to provide a reconciliation of forecasted Adjusted EBITDA for Calendar Years 2023 and 2024 included in this presentation to projected net income (GAAP) for the same periods because components of the calculation are inherently unpredictable. The inability to forecast certain components of the calculation would significantly affect the accuracy of the reconciliation. Additionally, the Company does not provide guidance on the items used to reconcile projected Adjusted EBITDA due to the uncertainty regarding timing and estimates of such items. Therefore, the Company does not present a reconciliation of forecasted Adjusted EBITDA to net income (GAAP) for Calendar Years 2023 and 2024. Free Cash Flow represents the Company’s net cash provided by operating activities less maintenance capital expenditures. In prior periods, the Company’s Free Cash Flow was calculated as net cash provided by (used in) operating activities plus proceeds from disposition of property and equipment less purchases of property and equipment. Management believes that the change in the Company’s free cash flow calculation, as presented herein, better represents the Company’s cash flow available for discretionary purposes, including growth capital expenditures. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude costs paid in relation to a PBH maintenance agreement buy-in, reorganization items, costs associated with recent mergers, acquisitions and ongoing integration efforts, as well as other special items which include nonrecurring professional services fees and other nonrecurring costs or costs that are not related to continuing business operations. Management believes that Free Cash Flow and Adjusted Free Cash Flow are meaningful to investors because they provide information with respect to the Company’s ability to generate cash from the business. The GAAP measure most directly comparable to Free Cash Flow and Adjusted Free Cash Flow is net cash provided by operating activities. Since neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net cash provided by operating activities. Investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Free Cash Flow and Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. As such, they may not be comparable to other similarly titled measures used by other companies The Company also presents Net Debt, which is a non-GAAP measure, defined as total principal balance on borrowings less unrestricted cash and cash equivalents. The GAAP measure most directly comparable to Net Debt is total debt. Since Net Debt is not a recognized term under GAAP, it should not be used as an indicator of, or an alternative to, total debt. Management uses Net Debt to determine the Company’s outstanding debt obligations that would not be readily satisfied by its cash and cash equivalents on hand. Management believes this metric is useful to investors in determining the Company’s leverage position since the Company has the ability to, and may decide to, use a portion of its cash and cash equivalents to reduce debt. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow, and Net Debt is included elsewhere in this presentation.

5 Leading Global Provider of Innovative and Sustainable Vertical Flight Solutions Global Employees 3,314 Total 849 Pilots 869 Mechanics Headquartered in Houston, TX Lines of Services: 4 Offshore Energy Services Government Services Fixed Wing Services Other Services Publicly Traded on NYSE (VTOL) Presence on 6 Continents Customers in 17 Countries Diverse fleet of 219 Aircraft LTM operating revenues of $1.2 billion Aircraft Type Rotary Wing Fixed Wing UAS As of 9/30/2023

6 (1) As of 9/30/2023. See slide 18 for further details (2) Reflects LTM operating revenues by region as of 9/30/2023; see slide 23 for reconciliation (3) Reflects LTM operating revenues by end market as of 9/30/2023; see slide 22 for reconciliation Operating Revenues by Region(2)Aircraft Fleet(1) Operating Revenues by End Market(3) 6% Light Twin 13% Single Engine 8% Fixed Wing/ UAS 31% S92 10% AW189 24% AW139 8% Other Heavy/ Medium 30% Americas 54% Europe 7% Asia Pacific 9% Africa 1% Other 64% Offshore Energy 8% Fixed Wing 27% Government219 $1.2 bn $1.2 bn Aircraft and Revenue Mix

7 Recent Quarter Highlights Increased 2023 Adjusted EBITDA range from $150-$170mm to $165-$175mm and tightened guidance for the year. Reaffirmed 2024 Adjusted EBITDA outlook range of $190-$220mm on projected operating revenues of $1,295- $1,465mm. See slide 10 for more details. Increased 2023 Adjusted EBITDA Outlook and Reaffirmed 2024 Outlook Agreement to Purchase H135 Light- Twin Helicopters for Offshore Energy Services Advancing Bristow’s AAM Strategy Bristow and Elroy Air Secured early delivery slots with Elroy for five Chaparral hybrid- electric cargo VTOL aircraft. Plans to use the Chaparral internationally to move time-sensitive cargo for logistics, healthcare, and energy applications. Bristow and Volocopter Signed an agreement with Volocopter to explore and develop passenger and cargo services for eVTOLs in the U.S. and UK. Bristow placed a firm order for two aircraft to be delivered after certification with options to purchase a further 78 vehicles in the future. Bristow signed a contract with the Irish Department of Transport to provide SAR services to the Irish Coast Guard (“IRCG”), finalizing the procurement process. The 10-year ~€670mm contract is set to commence in October 2024. The contract will provide for day and night-time operations out of four helicopter bases and will be a significant addition to Bristow’s Government Services offering. Signed the €670 million Irish Coast Guard Aviation Service Contract Entered into an agreement to purchase five new Airbus H135 light-twin helicopters for approximately $33 million and options to purchase an additional ten H135 helicopters. The new aircraft are expected to be delivered in 2024 and 2025, and will be used to support the increasing demand in Bristow’s Offshore Energy Services business.

8 Key Financial Highlights Adj. EBITDA Excl. Asset Sales & Foreign Exchange(1),(4) $338mm Total Revenues(1) QTD Financial Highlights $161mm $274mm $360mm LTM Adj. EBITDA Excl. Asset Sales & Foreign Exchange(1),(4) Available Liquidity(1),(2) Net Debt(1),(3) 45% increase QoQ 6% increase QoQ (1) Amounts shown as of 9/30/2023 (2) Comprised of $207.5 million in unrestricted cash balances and $66.8 million of remaining availability under ABL Facility (3) See slide 19 for reconciliation of Net Debt (4) See slide 20 for reconciliation of Adjusted EBITDA excluding asset dispositions and foreign exchange $57mm

9 Quarterly Results – Sequential Quarter Comparison Operating revenues were $18.7 million higher than the Preceding Quarter(1) primarily due to higher utilization in Offshore Energy Services, higher lease payments received from Cougar Helicopters Inc. and higher revenues from Fixed Wing Services Operating expenses were consistent with the Preceding Quarter. Higher personnel and fuel costs were offset by lower insurance costs, repairs and maintenance and other operating costs General and administrative expenses were $1.6 million higher primarily due to higher professional services fees Net gain on disposal of assets was $1.2 million in the Current Quarter compared to a net loss of $3.2 million in the Preceding Quarter Other income, inclusive of foreign exchange gains, was $4.8 million in the Current Quarter compared to other expense of $13.0 million in the Preceding Quarter (1) “Current Quarter” refers to the three months ended September 30, 2023, and the “Preceding Quarter” refers to the three months ended June 30, 2023 (2) Adjusted EBITDA excludes special items. See slide 20 for a description of special items and reconciliation to net income $312 $330 0 50 100 150 200 250 300 350 Q2 2023 Q3 2023 $ i n m il li o n s Operating Revenues Adjusted EBITDA, excl. Asset Sales & Foreign Exchange $39 $57 $0 $20 $40 $60 Q2 2023 Q3 2023 $ i n m il li o n s Adjusted EBITDA, excl. asset sales and foreign exchange(2), increased by $17.6 million

10 A Positive Outlook (1) The outlook projections provided for 2023 and 2024 are based on the Company’s current estimates, using information available at this point in time, and are not a guarantee of future performance. Please refer to Cautionary Statement Regarding Forward-Looking Statements on slide 3, which discusses risks that could cause actual results to differ materially. REPORTED UPDATED AFFIRMED Operating revenues (in USD, millions)(1) (2) 2022A 2023E 2024E Offshore energy services $780 $795 - $810 $850 - $970 Government services $283 $330 - $340 $340 - $365 Fixed wing services $96 $105 - $110 $95 - $115 Other services $13 $10 - $12 $10 - $15 Total operating revenues $1,173 $1,240 - $1,272 $1,295 - $1,465 Adjusted EBITDA, excluding asset dispositions and foreign exchange losses (gains)(1) $137 $165 - $175 $190 - $220 Cash interest $32 ~$40 ~$40 Cash taxes $18 $15 - $20 $25 - $30 Maintenance capital expenditures $10 $15 - $20 $15 - $20

Full Year Impact of contracts that commenced in Brazil, Norway and GOM in 2023 expected to contribute to a stronger 2024 Attractive Rates new and renewing contracts expected to be at more favorable rates compared to expiring contracts Higher Flight Hours from short-term campaigns and offshore energy exploration anticipated in 2024 Additional Activity is expected in Brazil, Africa and the GOM Strong Momentum in 2024

12 Source: IHS Petrodata, Barclays Research, October 2023 57 94 66 130 97 32 90 126 92 44 167 107 89 0 20 40 60 80 100 120 140 160 180 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 ($bn) Offshore project FIDs Offshore FIDs taken Offshore FIDs expected 136 498 0 50 100 150 200 250 300 2 0 1 3 Q 1 2 0 1 3 Q 2 2 0 1 3 Q 3 2 0 1 3 Q 4 2 0 1 4 Q 1 2 0 1 4 Q 2 2 0 1 4 Q 3 2 0 1 4 Q 4 2 0 1 5 Q 1 2 0 1 5 Q 2 2 0 1 5 Q 3 2 0 1 5 Q 4 2 0 1 6 Q 1 2 0 1 6 Q 2 2 0 1 6 Q 3 2 0 1 6 Q 4 2 0 1 7 Q 1 2 0 1 7 Q 2 2 0 1 7 Q 3 2 0 1 7 Q 4 2 0 1 8 Q 1 2 0 1 8 Q 2 2 0 1 8 Q 3 2 0 1 8 Q 4 2 0 1 9 Q 1 2 0 1 9 Q 2 2 0 1 9 Q 3 2 0 1 9 Q 4 2 0 2 0 Q 1 2 0 2 0 Q 2 2 0 2 0 Q 3 2 0 2 0 Q 4 2 0 2 1 Q 1 2 0 2 1 Q 2 2 0 2 1 Q 3 2 0 2 1 Q 4 2 0 2 2 Q 1 2 0 2 2 Q 2 2 0 2 2 Q 3 2 0 2 2 Q 4 2 0 2 3 Q 1 2 0 2 3 Q 2 2 0 2 3 Q 3 2 0 2 3 Q 4 2 0 2 4 Q 1 2 0 2 4 Q 2 2 0 2 4 Q 3 2 0 2 4 Q 4 2 0 2 5 Q 1 2 0 2 5 Q 2 2 0 2 5 Q 3 2 0 2 5 Q 4 Offshore floater rig count Barclays Offshore Floater Rig Count Forecast All-time peak (2014 Q1): 265 Forecast (2025 Q4): 142 Forecast (2024 Q4): 136 Current (Oct 2023): 124 Offshore project FIDs are expected to remain at elevated levels in 2023 and increase by 22% y/y in 2024 to nearly $170bn

13 Reactivations and Lead Times – Offshore Floating Drilling Rigs “As the modern floater fleet approached full contracted utilization last year with average contract lead times and duration extending, pricing quickly inflected to the level that incentivized the reactivation of cold stacked rigs and the purchase/preparation of previously stranded newbuilds” “Based on reactivation times, we expect remaining stacked drillships (including uncommitted newbuilds) are likely competing for programs that start in 2025” The area between the “Contracted” line and the “Under Contract” area represents actual and expected lead times for reactivation, contract preparation, and mobilization, with a median time of ~13 months for drillships. Source: Petrodata, PEP Research, October 2023 Reactivations Since 3Q22Demand Increase 80.0 90.0 100.0 110.0 120.0 130.0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Pre 3Q22 Marketed 3Q22+ Reactivations 0 1 2 3 4 5 6 7 8 9 10 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Under Contract Options Open Availability Contracted

14 “Super-medium offshore types are at full utilisation… new orders will take 18 months (at least) to build.” “Requirements for additional heavy / super-medium aircraft can therefore only be met by use of inactive S92s. The ability to reactivate AOG will be critical in this emerging cycle.” Steve Robertson, Director Air & Sea Analytics Effective Utilization of Heavy and Medium Offshore Helicopters Tightening Asset Market in Offshore Helicopters Source: Air and Sea Analytics, October 2023 285 35 37 160 55 3 6 36 26 0 0 8 92% 100% 100% 96% Active Helicopters Inactive Helicopters (Total) Inactive Helicopters (Known Stored / Uncontracted) Effective Utilisation S-92 AW189 H175 AW139

15 An Effective Transition Plan Investing capital to ensure a successful transition of operations to the new £1.6 billion UKSAR2G contract Significant Addition to Bristow’s Government Services Offering The newly awarded 10-year, approximately €670 million contract will provide for day and night-time operations of four helicopter bases New contract transitions beginning September 30, 2024, through December 31, 2026 Estimated capital investment range of $155-$165 million for six new AW139 aircraft and modifications to existing aircraft New contract combines existing rotary and fixed wing services into fully integrated, innovative solution led by Bristow New contract transitions beginning October 1, 2024, through July 1, 2025. Contract term of 10 years + 3-year extension option Estimated capital investment range of $135-$145 million for five new AW189 aircraft and modifications to an existing aircraft In addition to the helicopter service, the new Coast Guard aviation service will, for the first time, also include a fixed wing aircraft element. Provides for the day and night-time operation of four helicopter bases Plans to fund the investment with cash on hand, operating cash flows, new debt financing and aircraft leasing CY22-2023 CY2024 CY2025 Total Investment (UKSAR2G) $51mm $97mm $10mm $158mm Investment (IRCG) $35mm $99mm $8mm $142mm Total $86mm $196mm $18mm $300mm Advancing Government SAR 2nd Generation UK SAR Contract (UKSAR2G) Irish Coast Guard Contract (IRCG)

16 Government SAR – A Timeline of Investment & Returns UKSAR-H Tender Investment Period Base Contract Option Period Cash Yield 2024 2025 2026 2027-2032 2033-20382022 2023 UKSAR2G IRCG DCCG NLSAR Falklands Acquisition Retender Contracts Time

APPENDIX Fleet Overview Strong Balance Sheet and Liquidity Position Reconciliation of Adjusted EBITDA Adjusted Free Cash Flow Reconciliation Operating Revenues and Flight Hours by Line of Service LTM Operating Revenues by Region

18 Fleet Overview NUMBER OF AIRCRAFT(1) TYPE OWNED AIRCRAFT LEASED AIRCRAFT TOTAL AIRCRAFT AVERAGE AGE (YEARS)(2) Heavy Helicopters: S92 38 29 67 14 AW189 17 4 21 7 S61 2 1 3 52 57 34 91 Medium Helicopters: AW139 49 4 53 13 S76 D/C++ 15 — 15 12 AS365 1 — 1 34 65 4 69 Light—Twin Engine Helicopters: AW109 4 — 4 16 EC135 9 1 10 14 13 1 14 Light—Single Engine Helicopters: AS350 15 — 15 25 AW119 13 — 13 17 28 — 28 Total Helicopters 163 39 202 15 Fixed wing 8 5 13 Unmanned Aerial Systems (“UAS”) 4 — 4 Total Fleet 175 44 219 (1) As of 9/30/2023 (2) Reflects the average age of helicopters that are owned by the Company.

19 Strong Balance Sheet and Liquidity Position (1) Balances reflected as of 9/30/2023 (2) As of 9/30/2023, the ABL facility had $3.0 million in letters of credit drawn against it (3) Principal balance Actual Amount Rate Maturity ($mm, as of 9/30/2023) Cash $ 210 ABL Facility ($85mm)(2) — S+200 bps May-27 Senior Secured Notes 400 6.875% Mar-28 NatWest Debt 168 S+275 bps Mar-36 Total Debt(3) $ 568 Less: Unrestricted Cash $ (208) Net Debt $ 360 $207.5 million of unrestricted cash and total liquidity of $274.4 million(1) As of September 30, 2023, the availability under the amended ABL facility was $66.8 million(2)

20 Reconciliation of Adjusted EBITDA (2) Other special items include professional services fees that are not related to ongoing business operations and other nonrecurring costs Three Months Ended ($000s) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 LTM Net income (loss) $ 4,345 $ (1,637) $ (1,525) $ (6,931) $ (5,748) Depreciation and amortization expense 17,862 18,292 17,445 17,000 70,599 Interest expense, net 10,008 9,871 10,264 10,457 40,600 Income tax expense (benefit) 22,637 (14,209) (5,094) (853) 2,481 EBITDA $ 54,852 $ 12,317 $ 21,090 $ 19,673 $ 107,932 Special items (1) 7,458 10,487 6,986 5,683 30,614 Adjusted EBITDA $ 62,310 $ 22,804 $ 28,076 $ 25,356 $ 138,546 (Gains) losses on disposals of assets, net (1,179) 3,164 (3,256) 1,747 476 Foreign exchange (gains) losses (4,541) 13,021 4,103 9,243 21,826 Adjusted EBITDA excluding asset dispositions and foreign exchange $ 56,590 $ 38,989 $ 28,923 $ 36,346 $ 160,848 Three Months Ended (1) Special items include the following: September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 LTM PBH amortization $ 3,751 $ 3,697 $ 3,803 $ 3,700 $ 14,951 Merger and integration costs 738 677 439 335 2,189 Reorganization items, net 3 39 44 21 107 Non-cash insurance adjustment — 3,977 — — 3,977 Other special items(2) 2,966 2,097 2,700 1,627 9,390 $ 7,458 $ 10,487 $ 6,986 $ 5,683 $ 30,614

21 Adjusted Free Cash Flow Reconciliation (1) Other special items include professional services fees that are not related to ongoing business operations and other nonrecurring costs Three Months Ended ($000s) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 LTM Net cash provided by (used in) operating activities $ 16,711 $ 18,210 $ 6,615 $ (18,484) $ 23,052 Less: Maintenance capital expenditures (4,656) (2,533) (2,952) (1,911) (12,052) Free Cash Flow $ 12,055 $ 15,677 $ 3,663 $ (20,395) $ 11,000 Plus: PBH buy-in costs — — — 24,179 24,179 Plus: Merger and integration costs 712 488 571 275 2,046 Plus: Reorganization items, net 25 58 20 28 131 Plus: Other special items(1) 1,580 1,650 1,509 1,877 6,616 Adjusted Free Cash Flow $ 14,372 $ 17,873 $ 5,763 $ 5,964 $ 43,972

22 Operating Revenues and Flight Hours by Line of Service Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 LTM Operating revenues ($000s) Offshore energy services: Europe $ 94,346 $ 87,331 $ 85,291 $ 87,321 $ 354,289 Americas 91,099 80,884 70,982 87,164 330,129 Africa 27,545 26,979 25,356 24,120 104,000 Total offshore energy services 212,990 195,194 181,629 198,605 788,418 Government services 85,549 87,320 82,334 77,013 332,216 Fixed wing services 29,168 26,448 25,919 25,065 106,600 Other services 2,545 2,560 3,049 3,658 11,812 $ 330,252 $ 311,522 $ 292,931 $ 304,341 $ 1,239,046 Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Flight hours by line of service Offshore energy services: Europe 10,783 10,532 10,298 10,658 Americas 9,767 8,676 8,129 9,218 Africa 3,572 3,241 2,905 3,292 Total offshore energy services 24,122 22,449 21,332 23,168 Government services 5,232 5,008 3,944 4,659 Fixed wing services 2,956 2,691 2,533 2,826 32,310 30,148 27,809 30,653

23 LTM Operating Revenues by Region Three Months Ended (in millions) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 LTM Revenues Europe $ 176.8 $ 170.7 $ 164.4 $ 160.9 $ 672.8 Americas 99.7 89.9 79.1 96.0 364.7 Africa 29.9 29.9 28.4 27.4 115.6 Asia Pacific 23.9 21.0 21.0 20.0 85.9 Total $ 330.3 $ 311.5 $ 292.9 $ 304.3 $ 1,239.0

v3.23.3

Cover Page

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-35701

|

| Entity Tax Identification Number |

72-1455213

|

| Entity Registrant Name |

Bristow Group Inc.

|

| Entity Address, Address Line One |

3151 Briarpark Drive, Suite 700,

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77042

|

| City Area Code |

(713)

|

| Local Phone Number |

267-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

VTOL

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001525221

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |