FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated September 25, 2014

Commission File Number 1-15148

BRF S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

1400 R. Hungria, 5th Floor

Jd América-01455000-São Paulo – SP, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

* * *

This material includes certain forward-looking statements that are based principally on current expectations and on projections of future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: September 25, 2014 |

|

|

|

|

|

|

BRF S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Augusto Ribeiro Junior |

|

|

|

Name: |

Augusto Ribeiro Junior |

|

|

|

Title: |

CFO AND IRO |

POLICY ON DISCLOSURE OF MATERIAL ACTS OR FACTS

AND TRADING OF SECURITIES

This document establishes the Policy on Disclosure of Material Acts or Facts and Trading of Securities of Brasil Foods S.A. (“Company” or “BRF”), approved by BRF’s Board of Directors at the meeting of [date], and produced in accordance with the prevailing text of the Brazilian Securities and Exchange Commission (“CVM”)’s Instruction 358 of January 3, 2002 (“CVM Instruction 358/02”).

1. PURPOSE AND SCOPE:

1.1 BRF has always maintained relations with its investors and the market in general based on high standards of conduct and transparency, as demanded by laws and regulations applicable to publicly traded companies listed in Brazil and abroad.

1.2 The purpose of BRF’s Policy on Disclosure of Material Acts or Facts and Trading of Securities (“Policy”) is to establish the rules and procedures that must be observed and applied by Related Persons in the disclosure of information and trading of securities issued by the Company, in order to prevent the improper use of inside information and ensure the regular and transparent trading of securities issued by BRF.

1.3 Everyone subject to this Policy must act in compliance with the principles of good faith, loyalty, transparency and honesty, as well as the with rules established in this Policy, the Company’s Code of Ethics, the regulations of the São Paulo Stock Exchange’s Novo Mercado, the disclosure best practice rules of the Brazilian Association of Publicly Traded Companies (ABRASCA), and the pronouncements of the Guidance Committee for Disclosing Market Information (CODIM).

2. DEFINITIONS: The terms and expressions listed below, when used in this Policy, will have the following meanings:

“Controlling Shareholders” or “Controlling Companies” or “Controller”: The shareholder or group of shareholders related through a shareholders’ agreement or under common control that (i) owns the partnership rights that permanently ensure predominance in corporate decision taking

and the power to appoint the majority of administrators; and (ii) effectively exercises the power to control the direction of corporate activities and guide the functioning of the Company’s bodies, under the terms of Law 6,404/76.

“Administrators”: The statutory directors and members of the board of directors (full and alternate members) of a company or entity.

“Material Act or Fact” or “Material Acts or Facts”: Any decisions by Controlling Shareholders, general meetings or administrative bodies of the Company, or any other act or fact of political/administrative, technical, business or economic/financial nature, occurring in or related to its business, that could significantly influence: (i) the price of the Company’s Securities; (ii) investors’ decision to buy, sell or hold these Securities; or (iii) investors’ decision to exercise any rights arising from ownership of the Company’s Securities.

“BM&FBOVESPA”: BM&FBOVESPA S.A.: Bolsa de Valores, Mercadorias e Futuros [Stock, Commodities and Futures Exchange Market].

“Stock Exchanges and/or Over-the-Counter Market”: Stock exchanges and/or organized over-the-counter (OTC) market entities through which securities issued by BRF are traded, now or in the future, in the country or abroad.

“Company” or “BRF”: Brasil Foods S.A. (BRF)

“Fiscal Council Members”: Members of a company’s Fiscal Council, either full or alternate members.

“Commercial Contacts”: All persons who have knowledge of information concerning BRF’s Material Acts or Facts, arising from their commercial or professional relationship, or relationship of trust, with BRF, such as independent auditors, lawyers, consultants and institutions in the securities distribution system.

“CVM”: Comissão de Valores Mobiliários, the Brazilian Securities and Exchange Commission.

“CFO”: The Chief Financial Officer and Investor Relations Director of BRF, responsible for providing information to the Investing Public, the CVM, the SEC, and Stock Exchanges and/or OTC Markets, in Brazil or abroad, and for maintaining BRF’s public company registration up to date.

“Former Administrators”: Former statutory directors and members of the Board of Directors (full or alternate members) who no longer participate in the administration of a company.

“Employees and Collaborators”: BRF employees and executives, as well as any people who, due to their position at the Company, have access to any Inside Information.

“Inside Information”: Material Acts or Facts not yet reported to the CVM, the United States Securities and Exchange Commission (“SEC”), the Stock Exchange and/or the OTC Market and, simultaneously, to the Investing Public.

“CVM Instruction 358/02”: CVM Instruction 358 of January 3, 2002 (including subsequent amendments), or an equivalent standard that may succeed it, which governs the disclosure and use of information about Material Acts or Facts related to public companies, as well as the trading of securities issued by public companies pending Material Facts not yet disclosed to the market, among other subjects.

“Law 6,404/76” or “Corporations Act”: Law 6,404 of December 15, 1976 (including subsequent amendments), which governs corporations.

“Bodies with Technical or Advisory Functions”: BRF’s bodies created by its bylaws, with technical functions or having the purpose of advising its administrators.

“Associated Persons”: People who have the following kinds of relationships with Related Persons (as applicable): (i) spouse, not legally separated; (ii) companion; (iii) family member; (iv) any dependent person included on a Related Person’s annual income tax declaration; (v) Subsidiaries, controlled directly or indirectly, whether through the Company’s Administrators, Fiscal Council Members or members of Bodies with Technical or Advisory Functions, or through Associated Persons; (vi) investment funds managed by Related Persons; (vii) any body whose Director or Board Member is also a member of BRF’s Executive Board or Board of Directors; and (viii) people hierarchically superior or subordinate to Related Persons.

“Related Persons”: This term can mean: (i) the Company itself; (ii) its Administrators, Controlling Shareholders, Fiscal Council Members, and members of other Bodies with Technical or Advisory Functions of BRF; (iii) its Employees and Collaborators; and (iv) any person who, due to his/her position or function at the Company, at a Subsidiary, at Subsidiaries, or at Affiliates, is aware of information that could constitute a Material Act or Fact concerning BRF.

“Policy”: The present Policy on Disclosure of Material Acts or Facts and Trading of Securities of BRF.

“Investing Public”: Securities investors, analysts and other capital market agents.

“SEC”: The Securities and Exchange Commission, the securities market regulator of the United States of America.

“Affiliates”: All companies over which BRF has significant influence, as defined in article 243 of the Brazilian Corporation Law, as amended by Law 11,941/091, in Brazil or abroad, and which are also identified as Related Parties, as defined by the International Financial Reporting Standards (IFRS) adopted by the Company.

“Subsidiaries”: All companies that are controlled by BRF, directly or indirectly, as defined in article 243, section 2 of the Brazilian Corporation Law2, in Brazil or abroad, and which are also identified as Related Parties, as defined by the International Financial Reporting Standards (IFRS) adopted by the Company.

1Section 4 of article 243 of Law 6,404/76 considers “significant influence” to exist when the investor holds or exerts power to participate in decisions concerning the affiliate’s financial or operational policies, without controlling it; section 5 of this same article, in turn, establishes that there is a presumption of significant influence when the investor owns 20% (twenty percent) or more of the capital of the affiliate, without controlling it.

2Control is characterized by the power effectively used to direct corporate activities and guide the functioning of the respective company’s bodies, directly or indirectly, in practice or law. There is a relative presumption of control regarding a person or group of persons related through a shareholders’ agreement or under common control that holds shares giving an absolute majority of votes of shareholders present at the company’s last three general meetings, even if this person or group does not own enough shares to ensure the absolute majority of voting capital.

“Declaration of Acceptance”: Document to be signed in accordance with article 15, section 1, part I, and article 16, section 1 of CVM Instruction 358/02, and in line with the template presented in Appendix I.

“Securities”: These encompass any shares, debentures, subscription warrants, receipts (including those issued outside Brazil backed by shares), subscription rights, promissory notes, call or put options, bonds, indexes and derivatives of any kind, any other collective investment titles or contracts issued by BRF, or titles or instruments related to them that are considered in law to be securities.

3. POLICY ON DISCLOSURE OF MATERIAL ACTS OR FACTS:

3.1 The aim of the present policy adopted by BRF for disclosing Material Acts or Facts is to ensure achievement of the objectives of amplitude, quality, transparency, efficiency and equal treatment for shareholders in the disclosure of information that constitutes Material Acts or Facts related to the Company’s Securities.

3.2 The present policy on information disclosure also seeks to ensure that the Investing Public, Employees and Collaborators, and capital market participants in general retain their trust in the accuracy of BRF’s operational and financial information, and that of its Subsidiaries. This policy also governs the disclosure of material information to the specialist press, the company’s Employees and Collaborators, and the general public.

Material Acts or Facts

3.3 In line with the definition used in this Policy, a Material Act or Fact means any decision by Controlling Shareholders, general meetings or administrative bodies of the Company, or any other act or fact of political/administrative, technical, business or economic/financial nature, occurring in or related to its business, that could significantly influence: (i) the price of the Company’s Securities; (ii) investors’ decision to buy, sell or hold these Securities; or (iii) investors’ decision to exercise any rights arising from ownership of the Company’s Securities.

3.4 In order to facilitate the identification of situations that represent Material Acts or Facts, article 2 of CVM Instruction 358/02 provides non-exhaustive examples of Material Acts or Facts.

3.5 BRF’s Administrators are responsible for thoroughly analyzing any concrete situations that may arise in the Company’s operations, always considering their materiality, concreteness or strategic importance, in order to verify whether or not such situations constitute Material Acts or Facts.

3.6 With regard to the hypotheses referred to in CVM Instruction 358/02 concerning (i) the acquisition of other companies or the operating assets of other companies by BRF or its Subsidiaries or Affiliates, (ii) the disposal of equity stakes or operating assets by the Company or its Subsidiaries or Affiliates, (iii) mergers, incorporations or the incorporation of shares involving the Company or its Subsidiaries or Affiliates, and (iv) investments by the Company, or its Subsidiaries or Affiliates, the existence of a Material Act or Fact will be

verified when the operation represents five percent (5%) or more of the market value of the Company and also:

(i) if an audit has been initiated to execute the operation; or

(ii) if a binding proposal has been made in order to execute the operation; or

(iii) if BRF, or one of its Subsidiaries or Affiliates, has the intention to conduct a competitive process to execute the operation, without prejudice to other situations in which the concrete and effectively demonstrable intention to execute it may be verified.

3.7 For the purposes of this Policy, the mere prospecting for investment or business opportunities by BRF will not constitute a Material Act or Fact, even if this involves the signing of confidentiality agreements, which must be kept in the strictest confidence by the Related Persons.

3.8 The Company will immediate disclose any of the situations described in items 3.5 to 3.7, even though they are not characterized as a Material Act or Fact, if its existence is leaked to the market and results in an atypical fluctuation in the price or trading volume of the Company’s Securities.

3.9 Any Related Person or Associated Person who is unsure of whether a determined situation constitutes a Material Act or Fact, or the appropriate conduct for such a situation under the terms of this Policy, must contact BRF’s CFO or its Investor Relations area to obtain the necessary clarification.

Duties of the CFO

3.10 The CFO is responsible for the following:

a) Disclosing and reporting any Material Act or Fact that has occurred or is related to the Company’s business, immediately after its occurrence, to the CVM, the SEC, the Stock Exchanges and/or the OTC Market and organized OTC entities through which BRF’s Security are traded;

b) Striving to distribute this information widely, immediately and simultaneously to all markets on which these Securities are traded, in Brazil or abroad;

c) Providing requested information, if the CVM, the SEC, Stock Exchanges and/or the OTC Market demand clarifications to support the reporting and disclosure of the Material Act or Fact;

d) Evaluating the need to request the suspension of trading in BRF’s Securities – always simultaneously to Brazilian and foreign Stock Exchanges and/or the OTC Market – for the time required for the adequate communication of the Material Act or Fact;

e) If it is essential to disclose information during trading hours, trading in Brazil will not be suspended while Stock Exchanges and/or the OTC Market in other countries

are functioning, and while trading in Securities has not been equally suspended on these Stock Exchange and/or the OTC Market; and

f) If there are atypical fluctuations in the price or trading volume of BRF’s Securities or related securities, the CFO will, at his/her sole discretion, investigate any people who may have information not yet disclosed to the market, in order to assess the need to disclose it immediately in accordance with this Policy, and to keep records of this procedure.

Duties of Controlling Shareholders, Administrators, Fiscal Council Members, Employees and Collaborators, and the Members of Any Bodies with Technical or Advisory Functions

3.11 Controlling Shareholders, Administrators, Fiscal Council Members, Employees and Collaborators with access to Inside Information, and members of any Bodies with Technical or Advisory Functions, are responsible for the following:

a) Informing the CFO or, in his/her absence, BRF’s Investor Relations area, of any information deemed to characterize a Material Act or Fact. The CFO (or Investor Relations area) will then be responsible for deciding on the need to disclose the information to the market and the level of detail to be disclosed;

b) Promptly responding to requests for clarification made by the CFO to verify the occurrence of a Material Act or Fact;

c) Following disclosure under the terms of part “a” above (a decision having been made not to maintain the information’s confidentiality as provided for in article 6 of CVM Instruction 358), if it is found that the CFO failed to disclose the Material Act or Fact widely to the market, this Material Act or Fact must be reported immediately to the CVM, in writing, under the terms of section 2, article 3 of CVM Instruction 358; and

d) Maintaining the confidentiality of Inside Information to which they have access due to the position or function they hold, until it has been properly reported to the market under the terms of this Policy, and striving for subordinates and third parties in their trust to do the same.

BRF’s Disclosure Procedures

3.12 Disclosure will take place (i) through electronic means to the relevant regulatory authorities and the Stock Exchanges and/or OTC Market on which the Company’s Securities are traded, and (ii) through publication in newspapers of large circulation used regularly by the Company. Such notices in newspapers may be summaries provided that BRF’s Investor Relations website address is stated, where the complete information will be available in clear, precise form and in accessible language. The notices governed by this Policy will be given in Portuguese and English. The information provided to regulatory authorities and disclosed on the Company’s Investor Relations website must be constantly updated and will include identical information to that submitted to the CVM, the SEC, and the Stock Exchanges and/or OTC Market on which BRF’s Securities are traded.

3.13 The disclosure of a Material Act or Fact must take place simultaneously on all the markets where BRF’s Securities are traded, whenever possible before the start or after the end of trading on Stock Exchanges and/or the OTC Market located in Brazil or abroad. If there is incompatibility, the Brazilian market’s trading hours will prevail.

3.14 Material information must be disclosed to the public through (a) the webpage of the Valor Econômico news portal (http://www.valor.com.br/valor-ri), (b) the webpage of PR News portal (http://www.prnewswire.com) (c) the webpage of the Company (http://www.brf-br.com/ri) and (d) the submission of Informações Periódicas e Eventuais CVM (CVM´s IPE system) as power conferred by Instruction of the Brazilian Securities Commission ("CVM") nº 547, dated February 5, 2014. In addition to the disclosure of Relevant Information by communication channels mentioned above, any material information may also be published in major newspapers used by the Company the announcement may contain a summarized description of the Material Information provided that it indicates the Internet address where the complete description of the Material Information is available, in content at least equal to that sent to CVM, stock exchanges and other entities as applicable.

3.15 Still the obligation of the Company to disclose relevant Acts and Facts in newspapers of general circulation in the State where the Company´s headquarters are located will remain, as well as in the Official Gazette of that State.

3.16 The disclosure of information to the Investing Public must take place in a general manner. If information characterized as a Material Act or Fact is inadvertently revealed to a person or specific group of people, the Company, through the CFO, will immediately disclose the information extensively to the market, in accordance with this Policy.

Exception from Immediate Disclosure

3.17 It will be permitted to not disclose Material Acts or Facts to the market in exceptional cases when Controlling Shareholders or Administrators, as appropriate, understand that their disclosure would endanger BRF’s legitimate interests.

3.18 In the circumstances described in the previous item, the Controlling Shareholders or Administrators (the latter through the CFO), as appropriate, may decide to submit to the CVM a request to not disclose to the public the Material Act or Fact. In this case, the request must be sent to the President of the CVM, in a sealed envelope marked with the word “Confidential,” setting out the justification for the request for confidentiality.

3.19 The Controlling Shareholders or Administrators (the latter through the CFO), as appropriate, are obliged to immediately inform the market of a Material Act or Fact if the information escapes their control, or if there is an atypical fluctuation in the price or trading volume of the Company’s Securities or related securities.

3.20 The requirement specified in item 3.16 will not relieve Controlling Shareholders and Administrators of their responsibility to disclose the Material Act or Fact.

Disclosing Results and Other Information

3.21 It is not BRF’s policy to disclose comments on results forecasts and reports produced by investment analysts. However, the CFO may provide investment analysts and the market in general with information deemed pertinent to enable proper evaluations of the Company’s Securities. To this effect, he/she may comment on the facts and premises present in models used by such analysts. The conclusions that these analysts have arrived at in their reports will not be commented on. The Company will not circulate to any interested parties, nor endorse, any report that has been produced by investment analysts.

3.22 Any disclosed information that relates to forecasts of any kind will be accompanied by statements (i) indicating that this information should be evaluated by market participants with particular caution, as it concerns information that is not yet confirmed, but rather based on the mere expectations of the Company’s administration, and (ii) identifying factors considered important, which could lead to different results from those expected by the Company’s administration.

3.23 If BRF’s Administrators find that a previously disclosed Material Act or Fact, including any forecast, was or became significantly inaccurate, the CFO will immediately disclose the correct information as soon as the error has been identified, and will then correct the periodic information submitted to the CVM.

3.24 Information that is unfavorable or negative with respect to the Company will be disclosed in the same manner and in the same timescale as favorable information.

Disclosure of Quarterly and Annual Results

3.25 Without prejudice to other information required by the CVM and the SEC, BRF will prepare and submit to these two organizations the following information:

To the CVM3

a) Reference form, which must be submitted annually in up to five (5) months counting from the end of the financial year;

b) Annual financial statements, which must be reported, in Portuguese and English versions, within the timeframes established in the Brazilian Corporation Law;

c) Standardized financial statement form (known by Portuguese acronym “DFP”), which must be submitted to the CVM within three (3) months of the end of the financial year, or on the same date that the financial statements are disclosed, whichever occurs first;

d) Quarterly financial information form (known by Portuguese acronym “ITR”), which must be submitted by the issuer within one (1) month of the end of each quarter;

To the SEC

[4]

e) 20F Form: In accordance with the timeframes established by the SEC; and

3The documents related to CVM Instruction 481 of December 17, 2009 will be presented at the moment when the Ordinary General Meeting of BRF’s shareholders is convened.

4All forms submitted to the SEC must be delivered to the CVM through the IPE system, translated into Portuguese, concurrently with the registration of this information at the SEC.

f) 6K Forms: Any documents submitted to the CVM through the CVM’s “IPE” document submission system, at the same time as the publication (or provision) of such information in the Portuguese version.5

3.26 Information will be disclosed to the Brazilian and foreign markets on which the Company’s Securities are traded, outside the trading hours of the Stock Exchanges and/or OTC Market.

3.27 The information referred to in item 3.23 will be simultaneously posted on BRF’s website and sent to analysts and investors in the Company’s records.

3.28 On these occasions, the Company will seek to hold press conferences with the specialist press, in order to promote widespread knowledge of its quarterly and annual results, but without disclosing other information not disclosed to the capital market.

Annual Calendar

3.29 By December 10 of each year, BRF must send BM&FBOVESPA and publicly disclose an Annual Calendar for the following calendar year, specifying at least the names and dates of company acts, events and public meetings with analysts and any other interested parties, and the reporting of financial information scheduled for the following calendar year.

3.30 Any subsequent delays in relation to the events contained in the Annual Calendar presented must be reported to BM&FBOVESPA and publicly disclosed at least five (5) days before the planned date for holding the event. If the alteration is not disclosed within this timeframe, besides altering the Annual Calendar, the Company must issue a statement to the market before holding the event, specifying the reasons for the alteration to the Annual Calendar.

Quiet Period6

3.31 The “Quiet Period” before the public disclosure of financial statements is the conduct that must be followed by companies, in accordance with prevailing legislation and regulations, to not disclose inside information about their results to people other than the professionals involved in preparing these financial statements, having them approved by the Executive Board and Board of Directors (which precedes submitting this information to the CVM and the Stock Exchanges and/or OTC Market), and publicly disclosing it.

3.32 BRF adopts the Quiet Period system in the period of fifteen (15) days before the public disclosure of the Company’s quarterly information (ITR) and annual information (DFP), the submission of Reference Forms to the CVM, and the sending of 20-F Forms to the SEC.

3.33 Related Persons are subject to the Quiet Period.

5These documents must also be simultaneously filed at the stock exchanges and/or organized OTC market entities through which securities issued by BRF are traded, now or in the future, in Brazil or abroad.

6CODIM Guidance Ruling 7, of September 22, 2009.

3.34 Information classified as a Material Act or Fact, and that is not directly related to as-yet undisclosed financial information, must continue to be disclosed normally to the market in accordance with this Policy.

3.35 Information about financial statements that could yet be adjusted and that have not yet been audited and approved by the Executive Board and Board of Directors will not be disclosed.

3.36 BRF will declare an internal Quiet Period for Related Persons during periods when public offerings and/or structured operations are under way, as provided for in capital market legislation. In such cases, Related Persons will not participate in public meetings and press conferences.

3.37 In exceptional cases of involuntary leakage of this information, and in atypical or accidental cases, the Company must inform the CVM and report the data that have leaked into the market as quickly as possible, using the procedures established in this Policy, in order to equalize information in the market.

Teleconferences / Simultaneous Transmissions

3.38 Teleconferences or simultaneous transmissions will be held after results are announced. In addition, one-off teleconferences may be held whenever necessary, at the CFO’s discretion.

3.39 During teleconferences or simultaneous transmissions, information disclosed to the market through notices published in the press may be discussed in greater depth.

3.40 Teleconferences or simultaneous transmissions will always be conducted by the CFO, but other Company directors may also participate in them.

3.41 Such conferences or simultaneous transmissions will be transcribed and posted on BRF’s Investor Relations website.

Meetings with Analysts and Investors

3.42 The Company may give public presentations, in Brazil or abroad, at events organized by capital market entities or financial institutions, or arranged following a decision taken by its Administrators.

3.43 Whenever deemed appropriate and under the CFO’s supervision, the Company may organize meetings with investors, whether current or potential, or participate in conferences organized by market institutions.

3.44 Contact with investors and investment analysts will always be made by the CFO and/or representatives of the Investor Relations area, who may invite other Company directors and executives to accompany them.

3.45 The CFO may forward information or material about BRF that is already publicly known and disclosed to the market, to meet requests made by investors and investment analysts.

3.46 All information and presentations used at these meetings will be filed at the CVM, SEC, Stock Exchanges and/or OTC Market, and posted on BRF’s Investor Relations website.

Responses to Rumors

3.47 It is BRF’s policy not to comment on rumors or speculation originating in the market, except in extreme situations that cause, or could cause, significant volatility in the Company’s Securities or related securities.

Relations with Strategic Partners

3.48 When necessary, the exchange of non-public material information with strategic partners will always be accompanied by a formal confidentiality agreement. If such information is inadvertently disclosed to any third party, by any of the parties to the confidentiality agreement, the CFO will immediately provide for the widespread disclosure of this same content to the market.

Sharing of Information between the Investor Relations Area and Other Areas of BRF’s Administration

3.49 The Company’s other Administrators will keep the CFO continuously updated with extensive information of strategic, operational, technical or financial nature. The CFO will be responsible for deciding on the need to disclose this information to the public and the level of detail to be disclosed.

Procedures for Reporting Information on Share Transactions Made by Administrators and Other Parties

3.50 The Administrators, Fiscal Council Members and the members of any of BRF’s Bodies with Technical or Advisory Functions are obliged to inform the Company, in line with Appendix II, of the quantity, characteristics and form of acquisition: (i) of BRF Securities, or securities issued by Subsidiaries or Parent Companies (that are public companies), or related securities, which they possess; and (ii) changes to their positions. They must also specify the Securities and/or securities issued by Subsidiaries or Parent Companies (that are public companies), or related securities, held by: (i) their spouse, from whom they have not legally separated; (ii) their companion; (iii) any dependent included in their annual income tax declaration; and (iv) directly or indirectly controlled companies.

3.51 The Company must be informed: (i) immediately after the people mentioned in the item above take office; and (ii) no more than five (5) working days after the end of the month in which there has been a change in their securities, indicating the balance of their position in the period.

3.52 If any of the Administrators, Fiscal Council Members, or members of any of BRF’s Bodies with Technical or Advisory Functions assumed their respective positions before the

present Policy came into force, such persons must promptly inform the Company, in accordance with Appendix III, of the current quantity, characteristics and the form of acquisition of Securities issued by the Company and/or securities issued by Subsidiaries or Parent Companies (that are public companies), or related securities, that they own, in order for the Company to adopt the same procedure described in item 3.51 below.

3.53 The CFO, through the Company’s Investor Relations area, will submit all information received to the CVM and, if appropriate, to the SEC and the Stock Exchanges and/or the OTC Market on which the Securities are traded, no more than ten (10) days after the end of the reference month.

Procedures for Reporting and Disclosing Acquisitions or Disposals of Significant Equity Stakes

3.54 The Controlling Shareholders, direct or indirect, and the shareholders who appointed members of the Board of Directors or Fiscal Council, as well as any individual, legal entity or group of people acting together or representing a shared interest that obtains a direct or indirect stake corresponding to 5% (five percent) or more of the type or class of shares (or any rights to shares and other securities) representing BRF’s capital, must send the Company a notice in line with Appendix IV of the present Policy, immediately after reaching the aforementioned stake.

3.55 Likewise, the same information must be disclosed by a person or group of people representing a shared interest that owns an equity stake of or above the percentage specified in item 3.52 above, each time that this stake: (i) rises by 5% (five percent) of the type or class of shares representing BRF’s equity capital; or (ii) falls by 5% (five percent) of the total type or class of shares representing the Company’s equity capital, due to sale or liquidation.

3.56 In cases where the acquisition results in, or was executed in order to bring about, a change in the composition of control or administrative structure of BRF, and in cases in which the acquisition generates the obligation to conduct a public offering, under the terms of CVM Instruction 361, of March 5, 2002, the acquirer must also publish a notice related to the Material Act or Fact, containing the information specified in article 12 of CVM Instruction 358/02.

3.57 As soon as this information is received by the Company, the CFO is responsible for sending it, through BRF’s Investor Relations area, to the CVM and, if appropriate, to the SEC and the Stock Exchanges and/or OTC Market on which the Company’s Securities are traded.

3.58 Regardless of the provisions of items 3.52 and 3.53 above, the Controlling Shareholders, and their respective spouses, companions and dependents included in the annual income tax declaration of Controlling Shareholders, must inform BRF of any trades that they have made, or any changes that have occurred in their ownership of Securities, and the price, if appropriate. Every month, no more than ten (10) days after the end of each month, the Company must send BM&FBOVESPA the information specified in this item, in individual and consolidated form.

4. POLICY ON TRADING:

4.1 The present Policy on Trading determines: (i) the rules to be observed by Related Persons when trading Securities issued by BRF, imposed by CVM Instruction 358/02; and (ii) the internal Securities trading policy adopted by BRF. One of its main objectives is to contribute to compliance with laws and rules prohibiting insider trading.

4.1

4.2 Related Persons must sign the respective Declaration of Acceptance of the present Policy, in accordance with article 15, section 1, part I and article 16, section 1 of CVM Instruction 358/02, in line with the template in Appendix I, and are prohibited from trading Securities issued by BRF during the prohibition periods provided for in this Policy.

4.3 At its head office, BRF will keep a list of people who have signed the Declaration of Acceptance, which will be continually updated by the Company and made available to the CVM. Whenever there are changes in their registration details, those who have signed the Declaration of Acceptance must report them immediately to the Company.

4.4 The prohibitions established in this Policy must also be observed by Associated Persons and Commercial Contacts, and the respective Related Persons will be responsible for guiding them on the start and end of Blackout Periods.

Prohibition on Trading Pending the Disclosure of Material Acts or Facts

4.5 Trading in Securities by Related Persons is prohibited during the period of 15 (fifteen) days before the disclosure or publication, as appropriate, of the Company’s quarterly information (ITR), annual information (DFP) and 20-F Form.

4.6 Trading in Securities by Related Persons is also prohibited until the Company discloses Material Acts or Facts to the market, in the following cases:

a) Whenever there is a Material Act or Fact in BRF’s business of which Related Persons are aware;

b) Whenever there is the intention to conduct an incorporation, total or partial spin-off, merger, transformation or corporate reorganization; and

c) When a public distribution of Securities issued by the Company is under way;

4.7 The direct and indirect Controlling Shareholders and the Administrators of BRF and its Subsidiaries may not trade in the Company’s Securities, or related securities, whenever an acquisition or disposal of the Company’s shares is being undertaken by the Company itself, its Subsidiaries or Affiliates, or another company under shared control, or if an option or mandate for the same purpose has been granted.

4.8 In the cases specified in item 4.6, even after the disclosure of a Material Act or Fact, the prohibition on trading will remain in effect if BRF considers that such trading could interfere with the Company’s share dealing conditions and so result in losses for BRF itself or its shareholders. Whenever BRF decides to prolong a trading prohibition, the CFO will report the decision in an internal memo.

Establishment of Blackout Periods

4.9 If the existence of a Material Act or Fact is verified, the CFO may establish a Blackout Period, without being obliged to present any justification, until this Material Act or Fact has been duly reported to the market. If he/she exercises this option, the CFO must explicitly specify the start and end dates of the Blackout Period, and the Related Persons must maintain confidentiality during this period.

4.10 The lack of a notice from the CFO about the Blackout Period will not exempt anyone from the duty to comply with the present Policy, as well as the provisions of Instruction 358/02 and other regulatory acts issued by the CVM.

Prohibition on BRF Deliberating on the Acquisition or Disposal of Shares Issued by Itself

4.11 BRF’s Board of Directors may not deliberate on the acquisition or disposal of shares issued by itself until the events described below have been disclosed through the publication of a Material Act or Fact:

a) Signing of any agreement or contract to transfer control of the Company, or to grant an option or mandate for the same purpose; and

b) The existence of the intention to undertake an incorporation, total or partial spin-off, merger, transformation or corporate reorganization.

4.12 If, following approval of the buyback program, a fact that fits any of the hypotheses above occurs, BRF will immediately suspend operations involving shares that it has issued until the respective Material Act or Fact has been disclosed.

Exceptions to the Prohibition on Trading in BRF’s Securities

4.13 The prohibition provided for in item 4.5 (period of 15 days before the disclosure or publication of quarterly and annual information, and 20-F Form) and item 4.6, part “a” and “b” (pending the disclosure of a Material Act or Fact) and the intention to undertake an incorporation, total or partial spin-off, merger, transformation or corporate reorganization do not apply to operations involving treasury stock, through private trades, linked to the exercise of call options in accordance with the stock option award plan approved by BRF’s general meeting.

Individual Investment Programs

4.14 The prohibition provided for in item 4.5 (period of 15 days before the disclosure or publication of quarterly and annual information, and 20-F Form) does not apply to trading in Securities conducted by the Administrators, Fiscal Council Members, and the members of other Company Bodies with Technical or Advisory Functions created by statutory provision, as well as those of the Company’s Subsidiaries and Affiliates, who have joined

Individual Investment Programs, provided that such programs meet the requirements established in this Policy, and provided that the Company has approved a schedule setting specific dates for the disclosure of quarterly and annual information.

4.15 The Individual Investment Program must: (i) be filed in advance with the CFO, 15 (fifteen) days before the start of its implementation; and (ii) have a duration of at least 90 (ninety) days. The interested party must specify, at least, the approximate quantity of Company Securities, or related securities, that the Related Person intends to trade during the period and the respective price parameters. Once the Individual Investment Program has ended, the interested party must present a brief report about the operations conducted.

4.16 The Individual Investment Program must also establish: (i) the irrevocable and irreversible commitment of its participants to trade Company Securities or related securities during the period in accordance with the quantity and price parameters established in it; (ii) the impossibility of implementing the plan if a Material Act or Fact undisclosed to the market is pending, and during the 15 (fifteen) days before the disclosure of quarterly information (ITR) and annual information (DFP), as well as the 20-F Form; (iii) the obligation to extend the trading commitment, even after the end of the originally planned period to bind the participant to the plan, if a Material Act or Fact undisclosed to the market is pending, and during the 15 (fifteen) days before the disclosure of quarterly and annual information; and (iv) the obligation of its participants to return to the Company any losses avoided or gains made in trades involving shares issued by the Company arising from any alteration in the disclosure dates of quarterly and annual information, calculated using reasonable criteria determined in the plan itself.

BRF’s Stock Option Plan

4.17 It is BRF’s policy to award options to purchase Company-issued shares to determined executives, in accordance with the plan approved by the general meeting, in order to align the interests of this plan’s participants with the Company’s long-term objectives.

4.18 The shares acquired through the exercise of awarded options, in accordance with the plan specified in item 4.17, may not be disposed of during the periods of prohibited or limited share trading established in this Policy, nor during periods when the share buyback program is being executed by the Company itself.

BRF’s Share Buyback Program

4.19 The programs to buy back shares issued by BRF are designed to retain treasury stock (and subsequently dispose of and/or cancel it without reducing the capital stock), in order to: (i) meet the Company’s obligations arising from stock option plans; and/or (ii) maximize the generation of value for shareholders through the efficient administration of the Company’s capital structure.

4.20 The buyback programs will determine the timeframes for their execution and the maximum quantity of shares that the Company intends to acquire.

4.21 Share buybacks under the terms of the approved programs will be conducted in linear form over the execution period established by BRF’s Executive Board (this period must comply with the maximum buyback period stipulated by the Board of Directors) regardless of the share price, provided that the CVM’s regulations are respected. This means that the daily buyback limit will be determined by dividing the maximum quantity of shares that the Company intends to acquire by the number of days established to execute the program.

4.22 The buybacks must not significantly influence the daily stock exchange trading volume of these shares.

4.23 The prohibitions and limits on the acquisition of BRF’s Securities established in items 4.5 and 4.6 of this Policy apply to the share buyback programs.

General Provisions

4.24 Former Administrators may not trade in the Company’s Securities during the following periods:

a) For six (6) months after they have left the Company; or

b) Until the Company has informed the market of the Material Act or Fact related to the operations that the former Administrator participated in or knew about while performing his/her functions. If appropriate, a requirement to abstain from trading as described in item 4.8 of this Policy will apply to the former Administrator, and in this case, this requirement will be communicated to him/her in advance by the CFO.

4.25 The prohibitions on trading established in this Policy apply to trading conducted directly by Related Persons, as well as that conducted indirectly, through: (i) Associated Persons, or (ii) third parties with whom Related Persons have entered into trust agreements or share portfolio administration arrangements.

4.26 For the purposes of the provisions of item 4.25, trading conducted by investment funds that the people subject to the present Policy own shares in is not considered to be indirect trading, provided that: (i) the investment funds are not exclusive; and (ii) the trading decisions of the investment fund administrator or manager cannot be influenced by the fund’s share owners.

Changes to the Policy on Trading

4.27 The Policy on Trading established herein may only be altered by a resolution of the Board of Directors, and in no circumstances may it be altered while the disclosure of a Material Act or Fact is pending.

5. FINAL PROVISIONS AND PENALTIES:

5.1 The Company’s CFO is the person responsible for executing and monitoring BRF’s Policy on Disclosure of Material Acts or Facts and Trading of Securities.

5.2 BRF’s Governance, Sustainability and Strategy Committee is responsible for issuing analyses and official opinions concerning subjects related to the Policy, when this is requested by the Board of Directors.

5.3 Violations of the provisions of this Policy constitute a serious offense, for the purposes of section 3, article 11 of Law 6,385/76, and offenders will be subject to penalties to be imposed by the CVM, without prejudice to disciplinary and legal sanctions that may be imposed by BRF itself.

5.4 The occurrence of events constituting indications of crime must be reported by the CVM to the Public Prosecution Ministry, under the terms of the law.

5.5 The provisions of this Policy do not remove the responsibility, arising from legal and regulatory provisions, of third parties not directly linked to the Company, who know of Material Acts or Facts, and trade in Securities issued by the Company.

6. CONTRACT TERM:

The standards established in this instrument come into force on the date it is approved by the Board of Directors. The Policy will remain in effect indefinitely until changed by a new resolution of the Board of Directors. BRF will amply disclose this Policy, which will be posted on the Company’s intranet for immediate consultation to resolve people’s queries, and will take all necessary measures to obtain the formal acceptance of the people who ought to submit to it, in accordance with Appendix I.

Appendix I

DECLARATION OF ACCEPTANCE OF THE POLICY ON DISCLOSURE OF MATERIAL ACTS OR FACTS AND TRADING OF SECURITIES

Through this instrument, for the purposes of article 15, section 1, part I and article 16, section 1 of CVM Instruction 358/02, I, [name and position], resident and domiciled at [full address], holder of CPF (“Cadastro de Pessoas Físicas”) number [CPF number] and [state whether “RG” or “RNE”] identity number [ID number and name of entity that issued it], as [position, function or relationship with the company] of [company], a corporation headquartered at [address], registered with the Finance Ministry’s National Registry of Legal Entities (CNPJ) under number [CNPJ number], hereby declare through this Declaration of Acceptance: (i) that I am fully aware of the rules established by BRF’s Policy on Disclosure of Material Acts or Facts and Trading of Securities (“Policy”), a copy of which I have received; (ii) that I explicitly assume the obligation to faithfully abide by these rules; and (iii) that I know that violations of the provisions of this Policy constitute a serious offense, for the purposes of section 3, article 11 of Law 6,385/76, and offenders will be subject to penalties to be imposed by the CVM, without prejudice to disciplinary and legal sanctions that may be imposed by BRF itself.

OPTIONAL PARAGRAPHS:

I, [name], also declare that I committed to abide by the Policy on Trading of [name of entity], on [date], whose rules are specified in detail in Appendix I of the present Declaration of Acceptance.

I, [name], also declare that I possess my own copy of the Policy on Trading, whose rules are specified in detail in Appendix I of the present Declaration of Acceptance.

The present Declaration of Acceptance is signed in three (3) copies of equal content and form, in the presence of the two (2) witnesses specified below.

[Location and date of signing]

_________________________________

[Name of person making the declaration]

Witnesses:

|

1. _____________________

Name:

ID number:

CPF number: |

2. _____________________

Name:

ID number:

CPF number: |

Appendix II

TRADES CONDUCTED WITH SECURITIES ISSUED BY

|

Period: |

[month / year] |

Name of person acquiring or disposing of the securities: |

|

Position: |

|

Date of trade: |

|

Nature of trade: |

|

Value of security: |

|

Total quantity: |

|

Quantity per type and class: |

|

Price: |

|

Broker used: |

|

Other relevant information: |

|

Location and date: |

Signature: |

Appendix III

OWNERSHIP OF SECURITIES ISSUED BY

|

Name of owner: |

|

Position: |

|

Value of securities: |

|

Total quantity: |

|

Quantity per type and class: |

|

Form of acquisition: |

|

Other relevant information: |

|

Location and date: |

Signature: |

Appendix IV

ACQUISITION OR DISPOSAL OF SIGNIFICANT EQUITY STAKE IN

|

Period: |

[month / year] |

Name of person acquiring or disposing of the securities: |

|

Position: |

|

CNPJ/CPF number: |

Date of trade: |

|

Nature of trade: |

|

Value of security: |

|

Envisaged quantity: |

|

Quantity per type and class: |

|

Price: |

|

Broker used: |

|

Objective of ownership: |

|

Quantity of debentures convertible into shares, already owned, directly or indirectly: |

|

Quantity of shares subject to conversion of debentures, per type and class, as applicable: |

|

Quantity of other securities already owned, directly or indirectly: |

|

Details of any agreement or contract regulating the exercise of the right to vote or the purchase and sale of securities issued by the Company: |

|

Other relevant information: |

|

Location and date: |

Signature: |

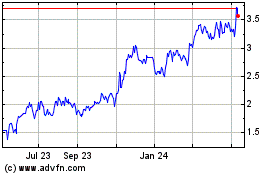

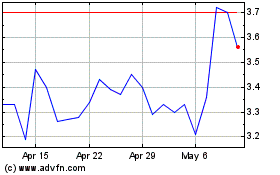

BRF (NYSE:BRFS)

Historical Stock Chart

From Jul 2024 to Aug 2024

BRF (NYSE:BRFS)

Historical Stock Chart

From Aug 2023 to Aug 2024