Bluegreen Vacations Holding Corporation (NYSE: BVH) (OTCQX:

BVHBB) (the “Company" or “Bluegreen Vacations”) announced today

that it has entered into a definitive agreement to be acquired by

Hilton Grand Vacations Inc. (NYSE: HGV) (“HGV”) for $75.00 per

share in an all cash transaction, representing a total enterprise

value of approximately $1.5 billion, inclusive of net debt.

Under the terms of the merger agreement, the Company’s

stockholders will receive $75.00 in cash for each share of the

Company’s Class A Common Stock and Class B Common Stock that they

hold at the time of closing of the merger.

In the 1970’s, Alan B. Levan founded the predecessor to

Bluegreen Vacations Holding Corporation, and it has been a

diversified holding company for over 50 years. During that time, it

previously held controlling interests in IRE Financial Corporation

(former NYSE) (real estate funds), BankAtlantic (former NYSE)

(100-branch bank), Levitt Corporation (former NYSE) (America’s

oldest homebuilder), BBX Capital Corporation (Real Estate:

multi-family housing, industrial, affordable housing;

chocolate/confections; manufacturing) and more recently, became the

holding company for Bluegreen Vacations in 2020. BBX Capital was

spun out into a separate public company in 2020.

Bluegreen Vacations is well recognized as a leading vacation

ownership company. With headquarters in Boca Raton, Florida,

Bluegreen Vacations has 49 Club Resorts and 24 Associate Resorts.

It proudly develops, markets, and operates a system of high-quality

vacation ownership resorts in selected vacation destinations such

as Orlando, Panama City Beach, Las Vegas, the Smoky Mountains,

Myrtle Beach, Charleston, the Branson, Missouri area, Nashville and

New Orleans, among others.

Alan Levan, the Company’s Chairman and Chief Executive Officer,

said, “Today’s announcement represents another exciting chapter for

Bluegreen Vacations. Combining with HGV will create an even more

compelling vacation ownership offering, continuing to provide our

owners and guests with enjoyable and unique experiences across a

broader range of world-class destinations. I am extremely proud of

the entire Bluegreen team for helping build Bluegreen into a

leading vacation ownership company.”

“I’m excited to enhance the breadth and quality of our already

best-in-class vacation ownership and experiences offering with the

announcement of our agreement to acquire Bluegreen Vacations,” said

Mark Wang, president and CEO of Hilton Grand Vacations. “Bluegreen

Vacations has a strong track record of demonstrated organic growth,

a dedicated customer base of more than 200,000 members, and boasts

key lead-generating strategic partnerships that will broaden our

reach and diversify our tour flow. Along with our long-standing

relationship with Hilton, this highly complementary combination

will also unlock additional upside by leveraging the infrastructure

we have built over the past few years with the launch of the Hilton

Vacation Club brand, our HGV Max membership offering, the HGV

Ultimate Access experiential platform. I’m particularly excited

about the opportunity to enter into a new relationship with Bass

Pro Shops and its actively engaged, loyal community of outdoor

enthusiasts. We’re confident that our members and guests will all

significantly benefit from the combination of these exceptional

organizations.”

Closing of the transaction is subject to the approval of the

Company’s stockholders and other customary closing conditions,

including regulatory approvals. Subject to the satisfaction of the

closing conditions, the transaction is expected to close during the

first half of 2024.

It is expected that HGV’s management team, including President

and CEO Mark Wang, chief financial officer Dan Mathewes, and chief

operating officer Gordon Gurnik, will continue to serve in their

current roles in the combined company upon closing the transaction.

The transaction is expected to increase HGV’s membership base from

525,000 to more than 740,000 owners and its resort portfolio from

150 to nearly 200 properties.

Credit Suisse Securities and Wells Fargo are acting as exclusive

financial advisors to the Company, and Stearns, Weaver, Miller is

acting as legal counsel. BofA Securities is acting as the exclusive

financial advisor for HGV, and Alston & Bird LLP, Simpson

Thacher & Bartlett LLP and Foley & Lardner LLP, are acting

as legal counsel.

About Bluegreen Vacations Holding Corporation Bluegreen

Vacations Holding Corporation (NYSE: BVH; OTCQX: BVHBB) is a

leading vacation ownership company that markets and sells vacation

ownership interests and manages resorts in popular leisure and

urban destinations. The Bluegreen Vacation Club is a flexible,

points-based, deeded vacation ownership plan with 73 Club and Club

Associate Resorts and access to nearly 11,600 other hotels and

resorts through partnerships and exchange networks.

Forward-Looking Statements This press release contains

forward-looking statements. Forward-looking statements are based on

current information and current expectations of management.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are beyond the Company’s control,

which may cause actual results to differ materially from the

results expressed or implied by the forward-looking statements.

These risks and uncertainties include, but are not limited to, the

possibility that the conditions to the closing of the transaction

may not be satisfied, including the risk that required regulatory

approvals may not be obtained, risks related to the ability of each

party to consummate the transaction, uncertainties as to the timing

of the consummation of the transaction, the risk that the

transaction may not otherwise be consummated in accordance with the

contemplated terms, or at all, potential litigation relating to the

transaction, and the risk that the transaction, including the

announcement or pendency of the transaction, may disrupt or

otherwise adversely impact the Company’s business.. Reference is

also made to the risks and uncertainties detailed in reports filed

by the Company with the SEC, including the “Risk Factors” sections

thereof, which may be viewed on the SEC's website at www.sec.gov

and on the Company’s website at www.bvhcorp.com. The Company

cautions that the foregoing factors are not exclusive. The Company

does not assume any obligation to update the forward-looking

statements, including to reflect events that occur or circumstances

that exist after the date hereof, except as required by law.

Additional Information and Where to Find It This

communication is being made in respect of the proposed acquisition

of the Company. The proposed transaction will be submitted to the

shareholders of the Company for their consideration at a special

meeting of the Company’s shareholders. In connection with the

proposed transaction, the Company will prepare a proxy statement to

be filed with the SEC. Promptly after filing the definitive proxy

statement with the SEC, the Company will mail the definitive proxy

statement and a proxy card to each shareholder of the Company

entitled to vote at the special meeting to consider the

transaction. The Company may also file with the SEC other documents

regarding the proposed transaction. SHAREHOLDERS OF THE COMPANY ARE

URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED

TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND

ANY OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement,

including all amendments and supplements thereto, and all other

documents filed by the Company with the SEC, in each case, upon

filing with the SEC, will be available, free of charge, on the

SEC’s website at www.sec.gov and on the Company’s website at

www.bvhcorp.com in the Investor Relations – Regulatory Filings

section thereof. In addition, the Company’s shareholders may obtain

free copies of the documents filed with by the Company with the

SEC, including the proxy statement and all supplements and

amendments thereto, when available, by directing a request by mail

to Bluegreen Vacations Holding Corporation, Corporate Secretary,

4960 Conference Way North, Suite 100, Boca Raton, Florida 33431, or

by phone at 561-912-8000.

Participant Information The Company and its directors and

executive officers may, under the rules of the SEC, be deemed to be

participants in the solicitation of proxies from the shareholders

of the Company in connection with the proposed transaction.

Information regarding the Company’s directors and executive

officers is set forth in Amendment No. 1 to the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

which was filed with the SEC on April 24, 2023. Additional

information regarding persons who may be deemed to be participants

in the solicitation of proxies in respect of the proposed

transaction will be contained in the proxy statement to be filed by

the Company with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106410750/en/

Bluegreen Vacations Investor Relations: Sharon Stennett

954-399-7193 IR@BVHcorp.com

Bluegreen Vacations Media: Kip Hunter 954-303-5551

Kip@kiphuntermarketing.com

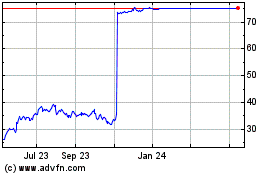

Bluegreen Vacations (NYSE:BVH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bluegreen Vacations (NYSE:BVH)

Historical Stock Chart

From Jan 2024 to Jan 2025