(40-17F2)

October 16 2013 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-17f-2

Certificate of Accounting of Securities and Similar

Investments in the Custody of

Management Investment Companies

Pursuant to Rule 17f-2 [7 CFR 270.17f-2]

|

|

|

|

|

|

1.

|

Investment Company Act File Number:

|

Date examination completed:

|

|

|

|

811-10475

|

05-20-2013

|

|

|

|

|

|

|

|

2.

|

State identification number

|

|

AL X

|

AK X

|

AZ X

|

AR X

|

CA X

|

CO X

|

|

CT

|

DE

|

DC

|

FL X

|

GA X

|

HI

|

|

ID X

|

IL X

|

IN X

|

IA X

|

KS X

|

KY X

|

|

LA

|

ME

|

MD

|

MA

|

MI

|

MN X

|

|

MS

|

MO X

|

MT

|

NE X

|

NV X

|

NH

|

|

NJ X

|

NM

|

NY X

|

NC X

|

ND X

|

OH X

|

|

OK X

|

OR X

|

PA X

|

RI

|

SC

|

SD

|

|

TN X

|

TX X

|

UT X

|

VT

|

VA X

|

WA X

|

|

WV

|

WI X

|

WY

|

PUERTO RICO

|

|

Other (specify):

|

|

3.

|

Exact number of investment company as specified in registration statement: COUNTRY Mutual Funds Trust 333-68270

|

|

4.

|

Address of principal executive office (number, street, city, state, zip code): 1705 Towanda Avenue, Bloomington, IL 61701

|

This Form must be completed by the investment companies that have custody of securities or similar investments.

Investment Company

|

1.

|

All items must be completed by the investment company.

|

|

2.

|

Give this Form to the independent public accountant who, in compliance with Rule 17f-2 under the Act and applicable state law, examines securities and similar investments in the custody of the investment company.

|

Accountant

|

3.

|

Submit this Form to the Securities and Exchange Commission and appropriate state securities administrators when filing the certificate of accounting required by Rule 17f-2 under the Act and applicable state law. File the original and one copy with the Securities and Exchange Commission’s principal office in Washington, D.C., and one copy with the regional office for the region in which the investment company’s principal business operations are conducted, and one copy with the appropriate state administrator(s), if applicable.

|

THIS FORM MUST BE GIVEN TO YOUR INDEPENDENT PUBLIC ACCOUNTANT

Report of Independent Registered Public Accounting Firm

The Board of Trustees of

COUNTRY Mutual Funds Trust:

We have examined management’s assertion, included in the accompanying Management Statement Regarding Compliance With Certain Provisions of the Investment Company Act of 1940, that COUNTRY Growth Fund and COUNTRY Bond Fund (two series constituting the COUNTRY Mutual Funds Trust (the “Trust”)) complied with the requirements of subsections (b) and (c) of rule 17f-2 under the Investment Company Act of 1940 (the Act) as of May 20, 2013. Management is responsible for the Funds’ compliance with those requirements. Our responsibility is to express an opinion on management’s assertion about the Trust’s compliance based on our examination.

Our examination was conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States) and, accordingly, included examining, on a test basis, evidence about the Trust’s compliance with those requirements and performing such other procedures as we considered necessary in the circumstances. Included among our procedures were the following tests performed as of May 20, 2013 and with respect to agreement of security purchases and sales, for the period from November 28, 2012 (the date of our last examination), through May 20, 2013:

|

·

|

Confirmation of all securities held by institutions in book entry form with Depository

Trust Company (DTC) and Northern Trust (for non-DTC eligible securities);

|

|

·

|

Confirmation of all mutual fund holdings with the transfer agent of each mutual fund complex;

|

|

·

|

Reconciliation of all such securities to the books and records of the Trust and

COUNTRY Trust Bank, N.A., the Custodian; and

|

|

·

|

Agreement of six security purchases and five security sales or maturities since our last report from the books and records of the Trust to broker confirmations.

|

We believe that our examination provides a reasonable basis for our opinion. Our examination does not provide a legal determination on the Trust’s compliance with specified requirements.

In our opinion, management's assertion that the Trust complied with the requirements of subsections (b) and (c) of rule 17f-2 of the Act as of May 20, 2013, with respect to securities reflected in the investment account of the Trust is fairly stated, in all material respects.

This report is intended solely for the information and use of management and the Board of Trustees of the Trust and the Securities and Exchange Commission and is not intended to be and should not be used by anyone other than these specified parties.

Minneapolis, Minnesota

September 17, 2013

|

|

|

|

|

615 East Michigan Street

PO Box 701

Milwaukee, WI 53201-0701

toll free(800) 245-2100

www.countrymutualfunds.com

|

September 17, 2013

Ernst

&

Young LLP

220

South

6

1

th

St., Suite 1400

Minneapolis, MN 55402

In connection with your attestation engagement relating to COUNTRY Grow1h Fund's and COUNTRY Bond Fund's (two series constituting the COUNTRY Mutual Funds Trust (the "Trust")) compliance with the requirements of subsections (b) and (c) of Rule 17f-2 "Custody of Investments by Registered Management Investment Companies," of the Investment Company Act of 1940 ("Rule 17f-2"), as of May 20, 2013, we recognize that obtaining representations from us concerning the information contained in this letter is a significant procedure in enabling you to form an opinion on whether the Trust complied with the specified requirements, in all material respects. Accordingly we make the following representations with respect to our compliance with the requirements of subsections (b) end (c) of Rule 17f-2 as of May 20, 2013 and for the penod from November 28,

2012 (the date of the last examination) through May 20, 2013, which are true to the best of our knowledge and belief.

We acknowledge that, as members of management of the Trust we are responsible for complying with the requirements of subsections (b) and (c) of Rule 17f-2 and for establishing and maintaining effective Internal control over compliance with those requirements. We have performed an evaluation of the Trusts' compliance with the requirements of subsections (b) and (c) of Rule 17f-2 as of May 20, 2013 and for the period from November 28, 2012 (the date of the last examination) through May 20, 2013. We also acknowledge that we are responsible for determining that such criteria are appropriate for its purposes.

We assert that the Trust was in compliance with the requirements of subsections (b) and (c) of Rule

17f-2 of the Investment Company Act of 1940 with respect to securities and similar investments reflected in the investment accounts of the Trust as of May 20, 2013 and for the period from November 28, 2012 (the date ofthe last examination) through May 20, 2013.

We have made available to you all documentation relevant to compliance with the requirements of subsections (b) and (c) of Rule 17f-2.

There has been no known noncompliance with the requirements of subsections (b) and (c) of Rule

17f-2 for the period from November 28, 2012 (the date of the last examination) through May 20,

2013, and through the date of your attestation examination report.

There have been no communications from regulatory agencies or internal auditors concerning possible noncompliance With the requirements of subsections (b) and

(C)

of Rule 17f-2 for the period from November 28, 2012 (the date of the last examination) through May 20, 2013, and through the date of your attestation examination report.

No events or transactions have occurred since May 20, 2013 or are pending that would have an effect on our compliance with the requirements of subsections (b) and (c) of Rule 17f-2 at that date or for the period from November 28, 2012 (the last date of the examination) through May 20, 2013.

We are not aware of any capital lease, material cooperative arrangement or other business relationship between the Trust and Ernst & Young LLP or any other member firm of the global Ernst

& Young organization.

We are not aware of any reason that Ernst

&

Young LLP would not be considered to be independent.

We understand that your examination was conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants, and was, therefore, designed primarily for the purpose of expressing an opinion on whether the Trust complied with the requirements of subsections (b) and (c) of Rule 17f-2. We further understand that your tests of our records and performance of other procedures were limited to those that you considered necessary for that purpose.

|

|

|

|

|

615 East Michigan Street

PO Box 701

Milwaukee, WI 53201-0701

toll free(800) 245-2100

www.countrymutualfunds.com

|

Management Statement Regarding Compliance With Certain Provisions of the

Investment Company Act of 1940

September 17, 2013

We, as members of management of COUNTRY Growth Fund and COUNTRY Bond Fund (two series constituting the COUNTRY Mutual Funds Trust (the "Trust")) are responsible for complying with the requirements of subsections (b) and (c) of rule 17f-2, "Custody of Investments by Registered Management Investment Companies" of the Investment Company Act of 1940 (the Act). We are also responsible for establishing and maintaining effective internal controls over compliance with those requirements. We have performed an evaluation of the Trust's compliance with the requirements of subsections (b) and (c) of rule 17f-2 as of May 20, 2013 and from November 28, 2012 through May 20, 2013.

Based on this evaluation, we assert that the Trust was in compliance with the requirements of subsections (b) and (c) of rule 17f-2 of the Act as of May 20, 2013 and from November 28, 2012 through May 20, 2013, with respect to securities reflected in the investment account of the Trust

2

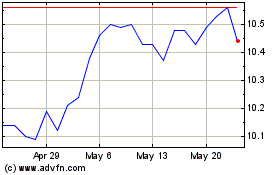

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

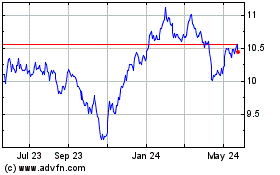

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024