BlackRock, Inc. today announced that its Closed-End Fund Board

of Directors/Trustees (the “Board”) has recently approved changes

to certain non-fundamental investment policies for each of

BlackRock Preferred Income Strategies Fund (NYSE: PSY), BlackRock

Preferred & Corporate Income Strategies Fund (NYSE: PSW),

BlackRock Preferred Opportunity Trust (NYSE: BPP) and BlackRock

Preferred & Equity Advantage Trust (NYSE: BTZ) (collectively,

the “Funds”). As a result of these policy changes, the Funds will

no longer focus their investments primarily on preferred

securities. Instead, each Fund will transition into portfolios

investing in a broader spectrum of securities across the capital

structure. With regard to BTZ, the Fund will no longer invest a

substantial portion of its assets in equity securities, nor will it

utilize an option-writing strategy.

The Funds’ current and amended non-fundamental policies are as

follows:

Non-Fundamental Investment Policy with Respect to

Preferred Securities Ticker Current

Amended (same for all Funds) PSY Under normal market

conditions, at least 80% of the Fund’s total assets will be

invested in preferred securities. Under normal market

conditions, at least 80% of the Fund’s total assets will be

invested in credit-related securities, including, but not limited

to, investment grade corporate bonds, high yield bonds, bank loans,

preferred securities or convertible bonds or derivatives with

economic characteristics similar to these credit-related

securities. PSW Under normal market conditions, at least 80%

of the Fund’s total assets will be invested in a portfolio of

preferred securities and corporate debt securities. Under normal

market conditions, the Fund will invest at least 65% of its total

assets in preferred securities and may invest up to 35% of its

total assets in debt securities. BPP Under normal market

conditions, at least 80% of the Fund’s total assets will be

invested in preferred securities. BTZ Under normal market

conditions, at least 80% of the Fund’s total assets will be

invested in preferred and equity securities and derivatives with

economic characteristics similar to individual or groups of equity

securities.

The Board has taken these actions in response to BlackRock’s

perception of the current and prospective market environment for

preferred securities, including recent changes to the criteria that

govern the ratings of the Funds’ preferred shares. BlackRock and

the Board believe the amended policies will better position the

Funds to achieve their investment objectives and are in the best

interests of the Funds’ shareholders. The approved changes will not

alter any Fund’s investment objective and each Fund will continue

to be managed in accordance with its investment objectives.

In addition to the foregoing, the Board also approved changes to

each Fund’s restriction on credit quality of eligible investments.

Previously, each Fund was restricted to investing, under normal

market conditions, no more than 20% of its total assets in

securities rated below investment grade at the time of purchase.

The amended policy allows each Fund to invest, under normal market

conditions, without limitation in securities rated below investment

grade at the time of purchase. While this policy affords the Funds

additional flexibility to invest in securities rated below

investment grade at time of purchase, it is anticipated, under

current market conditions, that each of the Funds will have an

average credit quality of at least investment grade.

As disclosed in its prospectus, each Fund is required to provide

shareholders 60 days notice of a change to its current

non-fundamental policy with respect to investing in preferred

securities. Accordingly, a notice describing the changes discussed

above will be mailed to shareholders of record as of September 4,

2009. Following the prescribed 60-day notice period, BlackRock

anticipates that it will gradually reposition the Funds’ portfolios

over time, and that during such period, each Fund may continue to

hold a substantial portion of its assets in preferred securities.

The notice will also generally describe certain risks relating to

each Fund’s new investment policy. At this time, it is uncertain

how long the repositioning may take, and the Funds may continue to

be subject to risks associated with investing a substantial portion

of their assets in preferred securities until the repositioning is

complete. No action is required by shareholders of the Funds in

connection with this change.

In connection with this change in non-fundamental policy, each

of the Funds will undergo a name change to reflect its new

portfolio characteristics. The new names of the Funds will be

announced at or prior to the expiration of the 60-day notice

period. Each Fund will continue to trade on New York Stock Exchange

under its current ticker symbol.

About BlackRock

BlackRock is one of the world’s largest publicly traded

investment management firms. At June 30, 2009, BlackRock’s assets

under management were $1.373 trillion. The firm manages assets on

behalf of institutions and individuals worldwide through a variety

of equity, fixed income, cash management and alternative investment

products. In addition, a growing number of institutional investors

use BlackRock Solutions® investment system, risk management and

financial advisory services. The firm is headquartered in New York

City and has employees in 21 countries throughout the U.S., Europe

and Asia Pacific. For additional information, please visit the

firm's website at www.blackrock.com.

Forward-Looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified

by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,”

“achieve,” and similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “may” or similar

expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

With respect to each Fund, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes in political,

economic or industry conditions, the interest rate environment or

financial and capital markets, which could result in changes in the

Fund’s net asset value; (2) the performance of the Fund’s

investments; (3) the impact of increased competition; (4) the

extent and timing of any distributions or share repurchases; (5)

the impact of legislative and regulatory actions and reforms and

regulatory, supervisory or enforcement actions of government

agencies relating to the Fund or BlackRock, as applicable; (6)

BlackRock’s ability to attract and retain highly talented

professionals; and (7) the impact of legislative and regulatory

actions and reforms and regulatory, supervisory or enforcement

actions of government agencies relating to BlackRock, Barclays PLC,

Bank of America, Merrill Lynch or PNC.

The Annual and Semi-Annual Reports and other regulatory filings

of the Funds with the SEC are accessible on the SEC's website at

www.sec.gov and on BlackRock’s website at

www.blackrock.com, and may discuss these or other factors

that affect the Funds. The information contained on our website is

not a part of this press release.

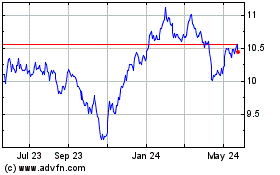

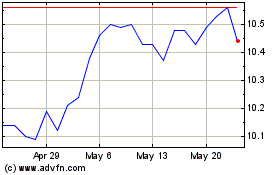

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024