Record first quarter net income and adjusted

EBITDA led by strong growth in traffic, market share and

merchandise margin

First Quarter Fiscal 2023 Highlights

- Comparable club sales, excluding gasoline sales, increased by

5.7% year-over-year

- Digitally enabled comparable sales growth was 19.0%

year-over-year

- Membership fee income increased by 6.1% year-over-year to

$102.5 million

- Merchandise gross margin rate increased 100 basis points

year-over-year

- Earnings per diluted share and adjusted earnings per diluted

share of $0.85

- Income from continuing operations increased by 3.1%

year-over-year to $116.0 million

- Adjusted EBITDA increased by 16.4% year-over-year to $257.0

million

- The Company opened two new clubs and three new gas

stations

- The Company successfully launched its co-branded credit card

with Capital One

BJ’s Wholesale Club Holdings, Inc. (NYSE: BJ) (the "Company")

today announced its financial results for the thirteen weeks ended

April 29, 2023.

“We reported a record first quarter in net income and adjusted

EBITDA, demonstrating the power of our business model and the

warehouse club channel,” said Bob Eddy, President and Chief

Executive Officer, BJ’s Wholesale Club. “We drove topline growth

bolstered by robust traffic and share gains. We also made

significant improvements on our merchandise margins largely due to

waning supply chain pressures and moderating inflation. We remain

focused on our strategic priorities and believe that we are

well-positioned to maximize long-term shareholder value.”

Key Measures for the Thirteen Weeks Ended April 29, 2023

(First Quarter Fiscal 2023):

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

(Amounts in thousands, except per share

amounts)

13 Weeks Ended April 29,

2023

13 Weeks Ended April 30,

2022

% Growth

Net sales

$

4,620,620

$

4,399,810

5.0 %

Membership fee income

102,522

96,625

6.1 %

Total revenues

4,723,142

4,496,435

5.0 %

Operating income

186,770

150,317

24.3 %

Income from continuing operations

115,988

112,457

3.1 %

Adjusted EBITDA (a)

256,983

220,801

16.4 %

Net income

116,077

112,450

3.2 %

EPS (b)

0.85

0.82

3.7 %

Adjusted net income (a)

115,646

118,426

(2.3) %

Adjusted EPS (a)

0.85

0.87

(2.3) %

Basic weighted-average shares

outstanding

133,312

134,244

Diluted weighted-average shares

outstanding

135,902

136,702

(a) See “Note Regarding Non-GAAP Financial Information.” (b) EPS

represents net income per diluted share.

Additional Highlights:

- Total comparable club sales increased by 2.0% in the first

quarter of fiscal 2023 compared to the first quarter of fiscal

2022. Excluding the impact of gasoline sales, comparable club sales

increased by 5.7% in the first quarter of fiscal 2023 compared to

the same period in fiscal 2022.

- Gross profit increased to $880.0 million in the first quarter

of fiscal 2023 from $790.6 million in the first quarter of fiscal

2022. Merchandise gross margin rate, which excludes gasoline sales

and membership fee income, increased 100 basis points over the same

quarter of fiscal 2022. Merchandise margins were impacted by

inflation, moderated supply chain costs and improved inventory

management.

- Selling, general and administrative expenses ("SG&A")

increased to $689.3 million in the first quarter of fiscal 2023

compared to $635.4 million in the first quarter of fiscal 2022. The

increase was primarily driven by increased labor and occupancy

costs as a result of new club and gas station openings in addition

to other investments to drive strategic priorities.

- Operating income increased to $186.8 million, or 4.0% of total

revenues, in the first quarter of fiscal 2023 compared to $150.3

million, or 3.3% of total revenues, in the first quarter of fiscal

2022.

- Income from continuing operations before income taxes increased

to $172.1 million in the first quarter of fiscal 2023 compared to

$142.5 million in the first quarter of fiscal 2022.

- The effective tax rate increased to 32.6% in the first quarter

of fiscal 2023 compared to 21.1% in the first quarter of fiscal

2022. Income tax expense increased to $56.1 million in the first

quarter of fiscal 2023 compared to $30.0 million in the first

quarter of fiscal 2022, as a result of higher taxable income as

well as a $21.6 million unexpected tax expense, approximately half

of which should have been applied in prior periods in immaterial

amounts.

- Net income increased to $116.1 million in the first quarter of

fiscal 2023 compared to $112.5 million in the first quarter of

fiscal 2022.

- Adjusted EBITDA increased 16.4% to $257.0 million in the first

quarter of fiscal 2023 compared to $220.8 million in the first

quarter of fiscal 2022.

- Inventory increased $69.9 million to $1.53 billion at the end

of the first quarter of fiscal 2023. Inventory balances at the end

of the first quarter of fiscal 2023 include $147.4 million of

perishable inventory related to the acquisition of four

distribution centers and related private transportation fleet from

Burris Logistics in Q2 of fiscal 2022. Excluding inventory in our

perishable distribution centers, inventory balances declined $77.5

million from Q1 fiscal 2022 to Q1 fiscal 2023.

- Under its existing share repurchase program, the Company

repurchased 204,040 shares of common stock, totaling $15.3 million

in the first quarter of fiscal 2023.

- The Company launched its new credit card program with Capital

One and Mastercard on February 27, 2023, officially named the BJ's

One Mastercard® program. We believe this program will provide a

first-class rewards and customer service experience, delivering

more value back to its members. The program will offer up to 5%

rewards on in-club earnings and up to 2% rewards on out-of-club

earnings as well as up to 15 cents off/gallon at BJ’s Gas.

Fiscal 2023 Ending February 3, 2024 Outlook

“Our fiscal 2023 outlook on our business remains unchanged given

the sustained strength in our grocery business and our gains in

market share,” said Laura Felice, Executive Vice President, Chief

Financial Officer, BJ's Wholesale Club. “We are confident that the

strength of our core business and our intense focus on delivering

value will continue to drive long-term growth.”

Conference Call Details

A conference call to discuss the first quarter of fiscal 2023

financial results is scheduled for today, May 23, 2023, at 8:00

A.M. Eastern Time. The live audio webcast of the call can be

accessed under the “Events & Presentations” section of the

Company’s investor relations website at https://investors.bjs.com

and will remain available for one year. Participants may also dial

(833) 470-1428 within the U.S. or (929) 526-1599 outside the U.S.

and reference conference ID 230611. A telephonic replay will be

available two hours after the conclusion of the call for one week

and can be accessed by dialing (929) 458-6194 or (866) 813-9403 and

referencing conference ID 817043.

About BJ’s Wholesale Club Holdings, Inc.

Headquartered in Marlborough, Massachusetts, BJ’s Wholesale Club

Holdings, Inc. (NYSE: BJ) is a leading operator of membership

warehouse clubs primarily in the Eastern United States focused on

delivering significant value to its members. The Company provides a

curated assortment of grocery, general merchandise, gasoline and

ancillary services to offer a differentiated shopping experience

that is further enhanced by its omnichannel capabilities. The

Company pioneered the warehouse club model in New England in 1984

and currently operates 237 clubs and 167 BJ's Gas® locations in 18

states. For more information, please visit us at www.bjs.com or on

Facebook, Twitter or Instagram.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements regarding our strategic priorities; our anticipated

fiscal 2023 outlook; and our future progress, as well as statements

that include the words “expect,” “intend,” “plan,” “believe,”

“project,” “forecast,” “estimate,” “may,” “should,” “anticipate”

and similar statements of a future or forward-looking nature. These

forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to:

uncertainties in the financial markets, including, without

limitation, as a result of disruptions and instability in the

banking and financial services industries, consumer and small

business spending patterns and debt levels; our dependence on

having a large and loyal membership; domestic and international

economic conditions, including inflation and exchange rates; our

ability to procure the merchandise we sell at the best possible

prices; the effects of competition and regulation; our dependence

on vendors to supply us with quality merchandise at the right time

and at the right price; breaches of security or privacy of member

or business information; conditions affecting the acquisition,

development, ownership or use of real estate; our capital spending;

actions of vendors; our ability to attract and retain a qualified

management team and other team members; costs associated with

employees (generally including health care costs), energy and

certain commodities, geopolitical conditions (including tariffs);

changes in our product mix or in our revenues from gasoline sales;

our failure to successfully maintain a relevant omnichannel

experience for our members; risks related to our growth strategy to

open new clubs; risks related to our e-commerce business; our

ability to grow our BJ's One Mastercard® program; and other

important factors discussed under the caption “Risk Factors” in our

Form 10-K filed with the U.S. Securities and Exchange Commission

(“SEC”) on March 16, 2023, which is accessible on the SEC’s website

at www.sec.gov. These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, unless

required by law, we disclaim any obligation to do so, even if

subsequent events cause our views to change. Thus, one should not

assume that our silence over time means that actual events are

bearing out as expressed or implied in such forward-looking

statements. These forward-looking statements should not be relied

upon as representing our views as of any date subsequent to the

date of this press release.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized

under United States generally accepted accounting principles

(“GAAP”). Please see “Note Regarding Non-GAAP Financial

Information" and “Reconciliation of GAAP to Non-GAAP Financial

Information” below for additional information and a reconciliation

of the Non-GAAP financial measures to the most comparable GAAP

financial measures.

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except per share

amounts)

(Unaudited)

Thirteen Weeks Ended

April 29, 2023

Thirteen Weeks Ended

April 30, 2022

Net sales

$

4,620,620

$

4,399,810

Membership fee income

102,522

96,625

Total revenues

4,723,142

4,496,435

Cost of sales

3,843,150

3,705,838

Selling, general and administrative

expenses

689,328

635,380

Pre-opening expense

3,894

4,900

Operating income

186,770

150,317

Interest expense, net

14,690

7,841

Income from continuing operations before

income taxes

172,080

142,476

Provision for income taxes

56,092

30,019

Income from continuing operations

115,988

112,457

Income (loss) from discontinued

operations, net of income taxes

89

(7)

Net income

$

116,077

$

112,450

Income per share attributable to common

stockholders - basic:

Income from continuing operations

$

0.87

$

0.84

Income from discontinued operations

—

—

Net income

$

0.87

$

0.84

Income per share attributable to common

stockholders - diluted:

Income from continuing operations

$

0.85

$

0.82

Income from discontinued operations

—

—

Net income

$

0.85

$

0.82

Weighted-average number of shares

outstanding:

Basic

133,312

134,244

Diluted

135,902

136,702

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands, except per share

amounts)

(Unaudited)

April 29, 2023

April 30, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

23,387

$

37,952

Accounts receivable, net

217,866

210,405

Merchandise inventories

1,532,006

1,462,098

Prepaid expense and other current

assets

69,048

58,814

Total current assets

1,842,307

1,769,269

Operating lease right-of-use assets,

net

2,124,621

2,177,777

Property and equipment, net

1,364,815

989,658

Goodwill

1,008,816

924,134

Intangibles, net

113,536

122,332

Deferred taxes

6,728

4,595

Other assets

33,672

22,240

Total assets

$

6,494,495

$

6,010,005

LIABILITIES

Current liabilities:

Short-term debt

$

400,000

$

80,000

Current portion of operating lease

liabilities

178,939

169,423

Accounts payable

1,281,676

1,267,102

Accrued expenses and other current

liabilities

758,724

692,530

Total current liabilities

2,619,339

2,209,055

Long-term operating lease liabilities

2,037,844

2,107,532

Long-term debt

448,004

748,987

Deferred income taxes

66,699

58,511

Other non-current liabilities

190,883

164,578

STOCKHOLDERS' EQUITY

1,131,726

721,342

Total liabilities and stockholders'

equity

$

6,494,495

$

6,010,005

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands, except per share

amounts)

(Unaudited)

Thirteen Weeks Ended April 29,

2023

Thirteen Weeks Ended

April 30, 2022

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

116,077

$

112,450

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

54,190

47,109

Amortization of debt issuance costs and

accretion of original issue discount

324

832

Stock-based compensation expense

10,007

9,115

Deferred income tax provision

14,445

6,299

Changes in operating leases and other

non-cash items

(750)

29,892

Increase (decrease) in cash due to changes

in:

Accounts receivable

21,871

(36,454)

Merchandise inventories

(153,455)

(219,163)

Accounts payable

85,979

154,319

Accrued expenses and other current

liabilities

(4,977)

(58,780)

Other operating assets and liabilities,

net

(24,579)

(1,311)

Net cash provided by operating

activities

119,132

44,308

CASH FLOWS FROM INVESTING

ACTIVITIES

Additions to property and equipment, net

of disposals and proceeds from sale leaseback transactions

(92,084)

(90,533)

Net cash used in investing activities

(92,084)

(90,533)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from revolving lines of

credit

149,000

115,000

Payments on revolving lines of credit

(154,000)

(35,000)

Net cash received from stock option

exercises

1,675

2,306

Acquisition of treasury stock

(42,369)

(51,342)

Proceeds from financing obligations

9,104

8,072

Other financing activities

(986)

(295)

Net cash (used in) provided by financing

activities

(37,576)

38,741

Net decrease in cash and cash

equivalents

(10,528)

(7,484)

Cash and cash equivalents at beginning of

period

33,915

45,436

Cash and cash equivalents at end of

period

$

23,387

$

37,952

Note Regarding Non-GAAP Financial Information

This press release includes financial measures that are not

calculated in accordance with GAAP, including adjusted net income,

adjusted net income per diluted share, adjusted EBITDA, free cash

flow, net debt and net debt to last twelve months (“LTM”) adjusted

EBITDA.

We define adjusted net income as net income attributable to

common stockholders adjusted for: acquisition and integration

costs; home office transition costs; other adjustments and the tax

impact of the foregoing adjustments on net income.

We define adjusted net income per diluted share as adjusted net

income divided by the weighted-average diluted shares

outstanding.

We define adjusted EBITDA as income from continuing operations

before interest expense, net, provision for income taxes and

depreciation and amortization, adjusted for the impact of certain

other items, including: stock-based compensation expense;

pre-opening expenses; non-cash rent; acquisition and integration

costs and other adjustments.

We define free cash flow as net cash provided by operating

activities less additions to property and equipment, net of

disposals, plus proceeds from sale leaseback transactions.

We define net debt as total debt outstanding less cash and cash

equivalents.

We define net debt to LTM adjusted EBITDA as net debt at the

balance sheet date divided by adjusted EBITDA for the trailing

twelve-month period.

We present adjusted net income, adjusted net income per diluted

share and adjusted EBITDA, which are not recognized financial

measures under GAAP, because we believe such measures assist

investors and analysts in comparing our operating performance

across reporting periods on a consistent basis by excluding items

that we do not believe are indicative of our core operating

performance. In addition, adjusted EBITDA excludes pre-opening

expenses, because we do not believe these expenses are indicative

of the underlying operating performance of our clubs. The amount

and timing of pre-opening expenses are dependent on, among other

things, the size of new clubs opened and the number of new clubs

opened during any given period.

Management believes that adjusted net income, adjusted net

income per diluted share and adjusted EBITDA are helpful in

highlighting trends in our core operating performance compared to

other measures, which can differ significantly depending on

long-term strategic decisions regarding capital structure, the tax

jurisdictions in which companies operate and capital investments.

We use adjusted net income, adjusted net income per diluted share

and adjusted EBITDA to supplement GAAP measures of performance in

the evaluation of the effectiveness of our business strategies; to

make budgeting decisions; and to compare our performance against

that of other peer companies using similar measures. We also use

adjusted EBITDA in connection with establishing discretionary

annual incentive compensation.

We present free cash flow, which is not a recognized financial

measure under GAAP, because we use it to report to our Board of

Directors and we believe it assists investors and analysts in

evaluating our liquidity. Free cash flow should not be considered

as an alternative to cash flows from operations as a liquidity

measure. We present net debt and net debt to LTM adjusted EBITDA,

which are not recognized as financial measures under GAAP, because

we use them to report to our Board of Directors and we believe they

assist investors and analysts in evaluating our borrowing capacity.

Net debt to LTM adjusted EBITDA is a key financial measure that is

used by management to assess the borrowing capacity of the

Company.

You are encouraged to evaluate these adjustments and the reasons

we consider them appropriate for supplemental analysis. In

evaluating adjusted net income, adjusted net income per diluted

share, adjusted EBITDA and net debt to LTM adjusted EBITDA, you

should be aware that in the future we may incur expenses that are

the same as or like some of the adjustments in our presentation of

these metrics. Our presentation of adjusted net income, adjusted

net income per diluted share, adjusted EBITDA, free cash flow, net

debt and net debt to LTM adjusted EBITDA should not be considered

as alternatives to any other measure derived in accordance with

GAAP and they should not be construed as an inference that the

Company’s future results will be unaffected by unusual or

non-recurring items. There can be no assurance that we will not

modify the presentation of adjusted net income, adjusted net income

per diluted share, adjusted EBITDA or net debt to LTM adjusted

EBITDA in the future, and any such modification may be material. In

addition, adjusted net income, adjusted net income per diluted

share, adjusted EBITDA, free cash flow, net debt and net debt to

LTM adjusted EBITDA may not be comparable to similarly titled

measures used by other companies in our industry or across

different industries. Additionally, adjusted net income, adjusted

net income per diluted share, adjusted EBITDA, free cash flow, net

debt and net debt to LTM adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of our results as reported under

GAAP.

Reconciliation of GAAP to Non-GAAP Financial

Information

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

Reconciliation of net income to

adjusted net income and adjusted net income per diluted

share

(Amounts in thousands, except per share

amounts)

(Unaudited)

13 Weeks Ended April

29, 2023

13 Weeks Ended April

30, 2022

Net income as reported

$

116,077

$

112,450

Adjustments:

Acquisition and integration costs (a)

—

7,879

Home office transition costs (b)

—

599

Other adjustments (c)

(601)

(165)

Tax impact of adjustments to net income

(d)

170

(2,337)

Adjusted net income

$

115,646

$

118,426

Weighted-average diluted shares

outstanding

135,902

136,702

Adjusted EPS (e)

$

0.85

$

0.87

(a) Represents costs related to the

acquisition and integration of assets from Burris Logistics,

including due diligence, legal, and other consulting expenses.

(b) Represents incremental rent expense as

the Company transitioned home office locations in fiscal 2022.

(c) Other non-cash items related to the

reclassification into earnings of accumulated other comprehensive

income/ loss associated with the de-designation of hedge accounting

and other adjustments.

(d) Represents the tax effect of the above

adjustments at a statutory tax rate of approximately 28%.

(e) Adjusted EPS is measured using

weighted-average diluted shares outstanding

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

Reconciliation to Adjusted

EBITDA

(Amounts in thousands)

(Unaudited)

13 Weeks Ended April 29,

2023

13 Weeks Ended April 30,

2022

Income from continuing

operations

$

115,988

$

112,457

Interest expense, net

14,690

7,841

Provision for income taxes

56,092

30,019

Depreciation and amortization

54,190

47,109

Stock-based compensation expense

10,007

9,115

Pre-opening expenses (a)

3,894

4,900

Non-cash rent (b)

1,551

846

Acquisition and integration costs (c)

—

7,879

Other adjustments (d)

571

635

Adjusted EBITDA

$

256,983

$

220,801

(a) Represents direct incremental costs of

opening or relocating a facility that are charged to operations as

incurred.

(b) Consists of an adjustment to remove

the non-cash portion of rent expense.

(c) Represents costs related to the

acquisition and integration of assets from Burris Logistics,

including due diligence, legal, and other consulting expenses.

(d) Other non-cash items, including

non-cash accretion on asset retirement obligations, obligations

associated with our post-retirement medical plan and incremental

rent expense as the Company transitioned home office locations in

fiscal 2022.

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

Reconciliation to Free Cash

Flow

(Amounts in thousands)

(Unaudited)

13 Weeks Ended April

29, 2023

13 Weeks Ended April

30, 2022

Net cash provided by operating

activities

$

119,132

$

44,308

Less: Additions to property and equipment,

net of disposals

92,084

90,533

Plus: Proceeds from sale leaseback

transactions

—

—

Free cash flow

$

27,048

$

(46,225)

BJ'S WHOLESALE CLUB HOLDINGS,

INC.

Reconciliation of Net Debt and Net Debt

to LTM adjusted EBITDA

(Amounts in thousands)

(Unaudited)

April 29, 2023

Total debt

$

848,004

Less: Cash and cash equivalents

23,387

Net Debt

$

824,617

Income from continuing operations

$

517,793

Interest expense, net

54,311

Provision for income taxes

202,335

Depreciation and amortization

208,015

Stock-based compensation expense

43,509

Pre-opening expenses

23,927

Non-cash rent

4,696

Acquisition and integration costs

4,445

Home office transition costs

14,706

Other adjustments

578

Adjusted EBITDA

$

1,074,315

Net debt to LTM adjusted EBITDA

0.8x

See descriptions of adjustments in the

“Reconciliation to Adjusted EBITDA (unaudited)” table above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230523005377/en/

Investor Contact: Catherine Park Vice President, Investor

Relations cpark@bjs.com 774-512-6744

Media Contact: Peter Frangie Vice President, Corporate

Communications pfrangie@bjs.com 774-512-6978

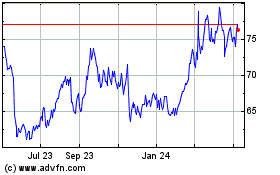

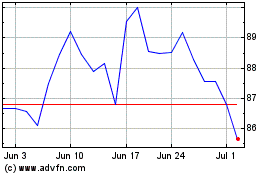

BJs Wholesale Club (NYSE:BJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

BJs Wholesale Club (NYSE:BJ)

Historical Stock Chart

From Jul 2023 to Jul 2024