Registration Statement No.333-264388

Filed Pursuant to Rule 433

Subject to Completion,

dated September 06, 2024

Pricing Supplement to the Prospectus dated May 26, 2022,

the Prospectus Supplement dated May 26, 2022 and the Product Supplement dated July 22, 2022

US$ [ ]

Senior Medium-Term Notes, Series I

Autocallable Barrier Notes due October 01, 2026

Linked to the Least Performing of the common stock of Apple Inc. and the common stock of Tesla, Inc.

| · | The notes are designed for investors who seek periodic interest payments at the interest rate (the "Interest

Rate") of at least 3.350% per quarter (approximately 13.40% per annum). Investors should be willing to have their notes automatically

redeemed prior to maturity, be willing to forego any potential to participate in the appreciation of the common stock of Apple Inc. and

the common stock of Tesla, Inc. (each, a "Reference Asset" and, collectively, the "Reference Assets") , and be willing

to lose some or all of their principal at maturity. |

| · | The notes will pay a Coupon on each Coupon Payment Date at the Interest Rate, subject to any automatic

redemption. |

| · | Beginning on December 27, 2024, if on any Call Observation Date, the closing level of each Reference

Asset is greater than or equal to its Call Level, the notes will be automatically redeemed. On the following Coupon Payment Date (the

“Call Settlement Date"), investors will receive their principal amount plus the Coupon otherwise due. After the notes are redeemed,

investors will not receive any additional payments in respect of the notes. |

| · | The notes do not guarantee any return of principal at maturity. Instead, if the notes are not automatically

redeemed, the payment at maturity will be based on the Final Level of the Least Performing Reference Asset (as defined below) and whether

the Final Level of any Reference Asset has declined from its Initial Level to below its Trigger Level on the Valuation Date (a “Trigger

Event”), as described below. |

| · | If the notes are not automatically redeemed and a Trigger Event has occurred, you will receive a delivery

of shares of the Least Performing Reference Asset (the “Physical Delivery Amount”) or, at our election, the cash equivalent

(calculated as described below, the “Cash Delivery Amount”), which will be worth less than the principal amount. Specifically,

the value of any Physical Delivery Amount or Cash Delivery Amount that you receive will decrease 1% for each 1% decrease in the level

of the Least Performing Reference Asset from its Initial Level to its Final Level. Any fractional shares included in the Physical Delivery

Amount will be paid in cash. |

| · | Investing in the notes is not equivalent to a direct investment in the Reference Assets. |

| · | The notes will not be listed on any securities exchange. |

| · | All payments on the notes are subject to the credit risk of Bank of Montreal. |

| · | The notes will be issued in minimum denominations of $1,000 and integral multiples of $1,000. |

| · | Citigroup Global Markets Inc. (“Citigroup”), is the agent for this offering. See “Supplemental

Plan of Distribution (Conflicts of Interest)” below. |

| · | The notes will not be subject to conversion into our common shares or the common shares of any of our

affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (the “CDIC Act”). |

Terms of the Notes:1

| Pricing Date: |

September 26, 2024 |

|

Valuation Date: |

September 28, 2026 |

| Settlement Date: |

October 01, 2024 |

|

Maturity Date: |

October 01, 2026 |

1Expected. See “Key Terms of the Notes” below

for additional details.

Specific Terms of the Notes:

Autocallable

Number |

Reference

Assets |

Ticker

Symbol |

Initial

Level |

Interest Rate |

Trigger

Level |

Call Level |

CUSIP |

Principal

Amount |

Price to

Public1 |

Agent’s

Commission1 |

Proceeds to

Bank of

Montreal1 |

| 553 |

The common stock of Apple Inc. |

AAPL |

[ ] |

At least 3.350% per quarter (approximately 13.40% per annum) |

[ ], 50.00% of its Initial Level |

[ ], 100.00% of its Initial Level |

06369NC41 |

[ ] |

100% |

Up to 1.75%

[ ] |

At least 98.25%

[ ] |

| The common stock of Tesla, Inc. |

TSLA |

[ ] |

[ ], 50.00% of its Initial Level |

[ ], 100.00% of its Initial Level |

1 The total “Agent’s Commission” and “Proceeds

to Bank of Montreal” to be specified above will reflect the aggregate amounts at the time Bank of Montreal establishes its hedge

positions on or prior to the Pricing Date, which may be variable and fluctuate depending on market conditions at such times. Certain dealers

who purchased the notes for sale to certain fee-based advisory accounts may forego some or all of their selling concessions, fees or commissions.

The public offering price for investors purchasing the notes in these accounts may be between $982.50 and $1,000 per $1,000 in principal

amount. We or one of our affiliates may also pay a referral fee to certain dealers in connection with the distribution of the notes.

Investing in the notes involves risks, including

those described in the “Selected Risk Considerations” section beginning on page P-5 hereof, the “Additional Risk Factors

Relating to the Notes” section beginning on page PS-6 of the product supplement, and the “Risk Factors” section beginning

on page S-1 of the prospectus supplement and on page 8 of the prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these notes or passed upon the accuracy of this document, the product

supplement, the prospectus supplement or the prospectus. Any representation to the contrary is a criminal offense. The notes will be our

unsecured obligations and will not be savings accounts or deposits that are insured by the United States Federal Deposit Insurance Corporation,

the Deposit Insurance Fund, the Canada Deposit Insurance Corporation or any other governmental agency or instrumentality or other entity.

On the date hereof, based on the terms set forth

above, the estimated initial value of the notes is $971.40 per $1,000 in principal amount. The estimated initial value of the notes on

the Pricing Date may differ from this value but will not be less than $925.00 per $1,000 in principal amount. However, as discussed in

more detail below, the actual value of the notes at any time will reflect many factors and cannot be predicted with accuracy.

CITIGROUP GLOBAL MARKETS INC.

Key Terms of the Notes:

| Reference Assets: |

The common stock of Apple Inc. (ticker symbol "AAPL") and the common stock of Tesla, Inc. (ticker symbol "TSLA"). See "The Reference Assets" below for additional information. |

| |

|

| Coupons: |

A Coupon will be paid on the corresponding Coupon Payment Date at the Interest Rate, subject to the automatic redemption feature. |

| |

|

| Interest Rate: |

At least 3.350% per quarter (approximately 13.40% per annum). Accordingly, each Coupon will equal $33.50 |

| |

|

| Call Observation Dates:1 |

Beginning on December 27, 2024, three trading days prior to each Coupon Payment Date. |

| |

|

| Coupon Payment Dates:1 |

Interest will be paid on the 1st day of each January, April, July, and October (or, if such day is not a business day, the next following business day), beginning on January 01, 2025 and ending on the Maturity Date, subject to the automatic redemption feature. |

| |

|

| Automatic Redemption: |

Beginning on December 27, 2024, if on any Call Observation Date the closing level of each Reference Asset is greater than or equal to its Call Level, the notes will be automatically redeemed. No further amounts will be owed to you under the Notes. |

| |

|

Payment upon Automatic

Redemption: |

If the notes are automatically redeemed, then, on the Call Settlement Date investors will receive their principal amount plus the Coupon otherwise due. |

| |

|

| Call Settlement Date:1 |

If the notes are automatically redeemed, the Coupon Payment Date immediately following the relevant Call Observation Date. |

| |

|

| Payment at Maturity: |

If the notes are not automatically redeemed, the payment at maturity

for the notes is based on the performance of the Reference Assets.

You will receive $1,000 for each $1,000 in principal amount of the note,

unless a Trigger Event has occurred.

If a Trigger Event has occurred, you will receive at maturity, for each

$1,000 in principal amount of your notes, a number of shares equal to the Physical Delivery Amount or, at our election, the Cash Delivery

Amount. The Physical Delivery Amount will be less than the principal amount of your notes, and may be zero.

You will also receive the final Coupon. Even with Coupons, the return

on the notes may be negative. |

| |

|

| Trigger Event: |

A Trigger Event will be deemed to occur if the Final Level of any Reference Asset is less than its Trigger Level on the Valuation Date. |

| |

|

| Least Performing Reference Asset: |

The Reference Asset with the lowest Percentage Change. |

| |

|

| Percentage Change: |

With respect to each Reference Asset, the quotient, expressed as a percentage,

of the following formula:

(Final Level - Initial Level)

Initial Level |

| |

|

| Initial Level:2 |

With respect to each Reference Asset, the closing level of that Reference Asset on the Pricing Date. |

| |

|

| Trigger Level:2 |

With respect to each Reference Asset, 50.00% of its Initial Level. |

| |

|

| Call Level:2 |

With respect to each Reference Asset, 100% of its Initial Level. |

| |

|

| Final Level:2 |

With respect to each Reference Asset, the closing level of that Reference Asset on the Valuation Date. |

| |

|

| Pricing Date:1 |

September 26, 2024 |

| |

|

| Settlement Date:1 |

October 01, 2024 |

| |

|

| Valuation Date:1 |

September 28, 2026 |

| |

|

| Maturity Date:1 |

October 01, 2026 |

| |

|

| Physical Delivery Amount:2 |

The number of shares of the Least Performing Reference Asset equal to $1,000 divided by its Initial Level. Any fractional shares will be paid in cash. |

| Cash Delivery Amount:2 |

The amount in cash equal to the product of (1) the Physical Delivery Amount and (2) the Final Level of the Least Performing Reference Asset. |

| |

|

| Calculation Agent: |

BMO Capital Markets Corp. |

| |

|

| Selling Agent: |

Citigroup |

1 Expected and subject to the occurrence of a market disruption

event, as described in the accompanying product supplement. If we make any change to the expected Pricing Date and Settlement Date, the

Coupon Payment Dates (and therefore the Call Observation Dates and potential Call Settlement Dates), the Valuation Date and Maturity Date

will be changed so that the stated term of the notes remains approximately the same.

2 As determined by the calculation agent and subject to adjustment

in certain circumstances. See "General Terms of the Notes — Anti-dilution Adjustments to a Reference Asset that is an Equity

Security (Including Any ETF)" in the product supplement for additional information.

Additional Terms of the Notes

You should read this document together with the

product supplement dated July 22, 2022, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26, 2022. This document,

together with the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements

as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for

implementation, sample structures, fact sheets, brochures or other educational materials of ours or the agent. You should carefully

consider, among other things, the matters set forth in Additional Risk Factors Relating to the Notes in the product supplement, as the

notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and

other advisers before you invest in the notes.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Product supplement dated July 22, 2022:

https://www.sec.gov/Archives/edgar/data/927971/000121465922009102/r712220424b2.htm

Prospectus supplement dated May 26, 2022 and prospectus dated

May 26, 2022:

https://www.sec.gov/Archives/edgar/data/0000927971/000119312522160519/d269549d424b5.htm

Our Central Index Key, or CIK, on the SEC website

is 927971. As used in this document, "we", "us" or "our" refers to Bank of Montreal.

We have filed a registration statement (including

a prospectus) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus in that

registration statement and the other documents that we have filed with the SEC for more complete information about us and this offering.

You may obtain these documents free of charge by visiting the SEC's website at http://www.sec.gov. Alternatively, we will arrange to send

to you the prospectus (as supplemented by the prospectus supplement and product supplement) if you request it by calling our agent toll-free

at 1-877-369-5412.

Selected Risk Considerations

An investment in the notes involves significant

risks. Investing in the notes is not equivalent to investing directly in the Reference Assets. These risks are explained in more detail

in the “Additional Risk Factors Relating to the Notes” section of the product supplement.

Risks Related to the Structure or Features of the Notes

| · | Your investment in the notes may result in a loss. — The notes do not guarantee any return of principal. If the notes

are not automatically redeemed, the payment at maturity will be based on the Final Level of the Least Performing Reference Asset and whether

a Trigger Event has occurred. If the Final Level of the Least Performing Reference Asset is less than its Trigger Level, a Trigger Event

will occur and you will lose 1% of the principal amount for each 1% that the Final Level of the Least Performing Reference Asset is less

than its Initial Level. In such a case, you will receive at maturity a delivery of shares of the Least Performing Reference Asset, or,

at our election, the cash equivalent, which will be worth less than the principal amount of the notes and may be zero. Accordingly,

even with Coupons, the return on the notes may be negative. |

| · | Your notes are subject to automatic early redemption. — We will redeem the notes if the closing level of each Reference

Asset on any Call Observation Date is greater than or equal to its Call Level. Following an automatic redemption, you will not receive

any additional Coupons and may not be able to reinvest your proceeds in an investment with returns that are comparable to the notes. Furthermore,

to the extent you are able to reinvest such proceeds in an investment with a comparable return for a similar level of risk, you may incur

transaction costs such as dealer discounts and hedging costs built into the price of the new notes. |

| · | Your return on the notes is limited to the Coupons regardless of any increase in the level of any Reference Asset — You

will not receive a payment at maturity with a value greater than your principal amount plus the final Coupon. In addition, if the notes

are automatically redeemed, you will not receive a payment greater than the principal amount plus the applicable Coupon, even if the Final

Level of the Reference Asset exceeds its Call Level by a substantial amount. Accordingly, your maximum return on the applicable notes

is limited to the potential return represented by the Coupons. |

| · | Your payment at maturity may be determined solely by reference to the Least Performing Reference Asset, even if any other Reference

Assets perform better. — If a Trigger Event occurs with respect to any Reference Asset and the Final Level of any Reference

Asset is less than its Initial Level, your payment at maturity will be determined by reference to the performance of the Least Performing

Reference Asset. Even if the levels of any other Reference Assets have increased over the term of the notes, or have experienced a decline

that is less than that of the Least Performing Reference Asset, your return at maturity will only be determined by reference to the performance

of the Least Performing Reference Asset if a Trigger Event occurs. |

| · | The payments on the notes will be determined by reference to each Reference Asset individually, not to a basket, and the payments

on the notes will be based on the performance of the Least Performing Reference Asset. — The payment at maturity if a Trigger

Event occurs, will be determined only by reference to the performance of the Least Performing Reference Asset as of the Valuation Date,

regardless of the performance of any other Reference Assets. The notes are not linked to a weighted basket, in which the risk may be mitigated

and diversified among each of the basket components. For example, in the case of notes linked to a weighted basket, the return would depend

on the weighted aggregate performance of the basket components reflected as the basket return. As a result, a decrease of the level of

one basket component could be mitigated by the increase of the level of the other basket components, as scaled by the weighting of that

basket component. However, in the case of the notes, the individual performance of each Reference Asset will not be combined, and the

performance of one Reference Asset will not be mitigated by any positive performance of any other Reference Assets. Instead, your return

at maturity will depend solely on the Final Level of the Least Performing Reference Asset if a Trigger Event occurs. |

| · | Any decline in the closing level of the Least Performing Reference Asset from the Valuation Date to the Maturity Date will reduce

the value of the Physical Delivery Amount. — If we deliver the Physical Delivery Amount on the Maturity Date instead of paying

the Cash Delivery Amount, the number of shares deliverable will be determined on the Valuation Date. The market value of the Physical

Delivery Amount on the Maturity Date may be less than the cash equivalent of such shares determined on the Valuation Date due to any decline

in the closing level of the Least Performing Reference Asset during the period between the Valuation Date and the Maturity Date. Conversely,

if we pay the Cash Delivery Amount instead of delivering the Physical Delivery Amount on the Maturity Date, the Cash Delivery Amount will

be determined on the Valuation Date and the payment that you receive on the Maturity Date may be less than the market value of such shares

that you would have received had we instead delivered such shares due to fluctuations in their market value during the period between

the Valuation Date and the Maturity Date |

| · | Your return on the notes may be lower than the return on a conventional debt security of comparable maturity. — The

return that you will receive on your notes, which could be negative, may be less than the return you could earn on other investments.

Even if your return on the notes is positive, your return may be less than the return you would earn if you bought a conventional senior

interest bearing debt security of ours with the same maturity or if you invested directly in the Reference Assets. Your investment may

not reflect the full opportunity cost to you when you take into account factors that affect the time value of money. |

| · | A higher Interest Rate or lower Trigger Levels may reflect greater expected volatility of the Reference Assets, and greater expected

volatility generally indicates an increased risk of loss at maturity. — The economic terms for the notes, including the Interest

Rate and Trigger Levels, are based, in part, on the expected volatility of the Reference Assets at the time the terms of the notes are

set. “Volatility” refers to the frequency and magnitude of changes in the level of a Reference Asset. The greater the expected

volatility of the Reference Assets as of the Pricing Date, the greater the expectation is as of that date that a Trigger Event could occur

and, as a consequence, an increased risk of loss. All things being equal, this greater expected volatility will generally be reflected

in a higher Interest Rate than the yield payable on our conventional debt securities with a similar maturity or on otherwise comparable

securities, and/or a lower Trigger Levels than those terms on otherwise comparable securities. Therefore, a relatively higher Interest

Rate may indicate an increased risk of loss. Further, a relatively lower Trigger Levels may not necessarily indicate that the notes have

a greater likelihood of a return of principal at maturity. You should be willing to accept the downside market risk of the Reference Assets

and the potential to lose a significant portion or all of your initial investment. |

Risks Related to the Reference Assets

| · | Owning the notes is not the same as owning shares of the Reference Assets or a security directly linked to the Reference Assets.

— The return on your notes will not reflect the return you would realize if you actually owned shares of the Reference Assets or

a security directly linked to the performance of the Reference Assets and held that investment for a similar period. Your notes may trade

quite differently from the Reference Assets. Changes in the level of a Reference Asset may not result in comparable changes in the market

value of your notes. Even if the levels of the Reference Assets increase during the term of the notes, the market value of the notes prior

to maturity may not increase to the same extent. It is also possible for the market value of the notes to decrease while the levels of

the Reference Assets increase. In addition, any dividends or other distributions paid on the Reference Assets will not be reflected in

the amount payable on the notes. |

| · | You will not have any shareholder rights and will have no right to receive any shares of a Reference Asset — Unless

and until we choose to deliver shares of a Reference Asset at maturity, neither you nor any other holder or owner of the notes will have

any voting rights, any right to receive dividends or other distributions, or any other rights with respect to the Reference Assets. You

will have no rights with respect to any underlying securities. |

| · | No delivery of shares of the Reference Assets. — We may choose, in our sole discretion, whether to deliver the Physical

Delivery Amount or pay the Cash Delivery Amount at maturity. You should not invest in the notes if you wish to elect whether to receive

cash or shares at maturity. |

| · | Single equity risk. — The level of each Reference Asset can rise or fall sharply due to factors specific to that Reference

Asset and the issuer of that Reference Asset (with respect to each Reference Asset, the “Reference Asset Issuer”), such as

stock price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions

and other events, as well as general market factors, such as general stock market volatility and levels, interest rates and economic and

political conditions. We urge you to review financial and other information filed periodically with the SEC by each Reference Asset Issuer.

We are not affiliated with any Reference Asset Issuer and are not responsible for any Reference Asset Issuer’s public disclosure

of information, whether contained in SEC filings or otherwise. We have not undertaken any independent review or due diligence of the SEC

filings of any Reference Asset Issuer or of any other publicly available information regarding any Reference Asset Issuer. |

| · | You must rely on your own evaluation of the merits of an investment linked to the Reference Assets. — In the ordinary

course of their businesses, we, Citigroup, and our or their affiliates from time to time may express views on expected movements in the

level of the Reference Assets. One or more of us, Citigroup, and our or their affiliates have published, and in the future may publish,

research reports that express views on the Reference Assets. However, these views are subject to change from time to time. Moreover, other

professionals who deal in the markets relating to the Reference Assets at any time may have significantly different views from those of

us, Citigroup, and our or their affiliates. You are encouraged to derive information concerning the Reference Assets from multiple sources,

and you should not rely on the views expressed by us, Citigroup, and our or their affiliates.

Neither the offering of the notes nor any views which our affiliates from time to time may express in the ordinary course of their businesses

constitutes a recommendation as to the merits of an investment in the notes. |

General Risk Factors

| · | Your investment is subject to the credit risk of Bank of Montreal. — Our credit ratings and credit spreads may adversely

affect the market value of the notes. Investors are dependent on our ability to pay any amounts due on the notes, and therefore investors

are subject to our credit risk and to changes in the market’s view of our creditworthiness. Any decline in our credit ratings or

increase in the credit spreads charged by the market for taking our credit risk is likely to adversely affect the value of the notes. |

| · | Potential conflicts. — We and our affiliates play a variety of roles in connection with the issuance of the notes, including

acting as calculation agent. In performing these duties, the economic interests of the calculation agent and other affiliates of ours

and Citigroup and any of its affiliates are potentially adverse to your interests as an investor in the notes. We, Citigroup or one or

more of our or their affiliates may also engage in trading of shares of the Reference Assets on a regular basis as part of our general

broker-dealer and other businesses, for proprietary accounts, for other accounts under management or to facilitate transactions for our

customers. Any of these activities could adversely affect the level of the Reference Assets and, therefore, the market value of, and the

payments on, the notes. We, Citigroup or one or more of our or their affiliates may also issue or underwrite other securities or financial

or derivative instruments with returns linked or related to changes in the performance of the Reference Assets. By introducing competing

products into the marketplace in this manner, we, Citigroup or one or more of our or their affiliates could adversely affect the market

value of the notes. |

| · | Our initial estimated value of the notes will be lower than the price to public. — Our initial estimated value of the

notes is only an estimate, and is based on a number of factors. The price to public of the notes will exceed our initial estimated value,

because costs associated with offering, structuring and hedging the notes are included in the price to public, but are not included in

the estimated value. These costs include any underwriting discount and selling concessions, the profits that we and our affiliates expect

to realize for assuming the risks in hedging our obligations under the notes and the estimated cost of hedging these obligations. The

initial estimated value of the notes may be as low as the amount indicated on the cover page hereof. |

| · | Our initial estimated value does not represent any future value of the notes, and may also differ from the estimated value of any

other party. — Our initial estimated value of the notes as of the date hereof is, and our estimated value as determined on the

Pricing Date will be, derived using our internal pricing models. This value is based on market conditions and other relevant factors,

which include volatility of the Reference Assets, dividend rates and interest rates. Different pricing models and assumptions could provide

values for the notes that are greater than or less than our initial estimated value. In addition, market conditions and other relevant

factors after the Pricing Date are expected to change, possibly rapidly, and our assumptions may prove to be incorrect. After the Pricing

Date, the value of the notes could change dramatically due to changes in market conditions, our creditworthiness, and the other factors

set forth herein and in the product supplement. These changes are likely to impact the price, if any, at which we, Citigroup or any of

our or their affiliates would be willing to purchase the notes from you in any secondary market transactions. Our initial estimated value

does not represent a minimum price at which we, Citigroup or our or their affiliates would be willing to buy your notes in any secondary

market at any time. |

| · | The terms of the notes are not determined by reference to the credit spreads for our conventional fixed-rate debt. —

To determine the terms of the notes, we will use an internal funding rate that represents a discount from the credit spreads for our conventional

fixed-rate debt. As a result, the terms of the notes are less favorable to you than if we had used a higher funding rate. |

| · | Certain costs are likely to adversely affect the value of the notes. — Absent any changes in market conditions, any secondary

market prices of the notes will likely be lower than the price to public. This is because any secondary market prices will likely take

into account our then-current market credit spreads, and because any secondary market prices are likely to exclude all or a portion of

any underwriting discount and selling concessions, and the hedging profits and estimated hedging costs that are included in the price

to public of the notes and that may be reflected on your account statements. In addition, any such price is also likely to reflect a discount

to account for costs associated with establishing or unwinding any related hedge transaction, such as dealer discounts, mark-ups and other

transaction costs. As a result, the price, if any, at which we, Citigroup or any of our or their affiliates or any other party may be

willing to purchase the notes from you in secondary market transactions, if at all, will likely be lower than the price to public. Any

sale that you make prior to the Maturity Date could result in a substantial loss to you. |

| · | Lack of liquidity. — The notes will not be listed on any securities exchange. Citigroup or one or more of our or their

affiliates may offer to purchase the notes in the secondary market, but none of us, Citigroup or any of our or their affiliates is required

to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because

other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade the notes is likely

to depend on the price, if any, at which we, Citigroup or one or more of our or their affiliates is willing to buy the notes. |

| · | Hedging and trading activities. — We, Citigroup or any of our or their affiliates may have carried out or may carry out

hedging activities related to the notes, including purchasing or selling shares of the Reference Assets, futures or options relating to

the Reference Assets or other derivative instruments with returns linked or related to changes in the performance on the Reference Assets

.. We, Citigroup or any of our or their affiliates may also trade in the Reference Assets, such securities, or instruments related to the

Reference Assets from time to time. Any of these hedging or trading activities on or prior to the Pricing Date and during the term of

the notes could adversely affect the payments on the notes. |

| · | Many economic and market factors will influence the value of the notes. — In addition to the levels of the Reference

Assets and interest rates on any trading day, the value of the notes will be affected by a number of economic and market factors that

may either offset or magnify each other, and which are described in more detail in the product supplement. |

| · | Significant aspects of the tax treatment of the notes are uncertain. — The tax treatment of the notes is uncertain. We

do not plan to request a ruling from the Internal Revenue Service or from any Canadian authorities regarding the tax treatment of the

notes, and the Internal Revenue Service or a court may not agree with the tax treatment described herein.

The Internal Revenue Service has released a notice that may affect the taxation of holders of “prepaid forward contracts”

and similar instruments. According to the notice, the Internal Revenue Service and the U.S. Treasury are actively considering whether

the holder of such instruments should be required to accrue ordinary income on a current basis. While it is not clear whether the notes

would be viewed as similar to such instruments, it is possible that any future guidance could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect.

Please read carefully the section entitled "U.S. Federal Tax Information" herein, the section entitled "Supplemental Tax

Considerations—Supplemental U.S. Federal Income Tax Considerations" in the accompanying product supplement, the section entitled

"United States Federal Income Taxation" in the accompanying prospectus and the section entitled "Certain Income Tax Consequences"

in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation. |

Examples of the Hypothetical Payout for a $1,000 Investment in the

Notes

The following tables illustrate the hypothetical

payments on a note, assuming different scenarios. The hypothetical payments are based on a $1,000 investment, a hypothetical Initial Level

of $100.00 for each Reference Asset, a hypothetical Trigger Level of $50.00 for each Reference Asset (50.00% of the hypothetical Initial

Level), a hypothetical Call Level of $100.00 for each Reference Asset (100.00% of the hypothetical Initial Level), a hypothetical interest

rate of 3.350% per quarter (approximately 13.40% per annum), and a range of hypothetical closing levels of the Least Performing Reference

Asset.

The hypothetical examples shown below are intended

to help you understand the terms of the notes. The number of Coupons received will depend on whether the notes are automatically redeemed

during the term of the notes. If the notes are not automatically redeemed, the actual amount of cash or shares that you will receive at

maturity will depend upon the Final Level of the Least Performing Reference Asset. The numbers appearing in the following examples have

been rounded for ease of analysis.

The table below illustrates the hypothetical total

Coupons per note over the term of the notes based on the hypothetical terms set forth above, depending on how many Coupons are paid prior

to any automatic redemption or maturity. If the notes have not been automatically redeemed, the hypothetical total Coupons paid per note

over the term of the notes will be equal to the maximum amount shown in the table below.

| Number of Coupons |

Total Coupon Payments |

| 1 |

$33.50 |

| 2 |

$67.00 |

| 3 |

$100.50 |

| 4 |

$134.00 |

| 5 |

$167.50 |

| 6 |

$201.00 |

| 7 |

$234.50 |

| 8 |

$268.00 |

The following table illustrates the hypothetical

payments on a note at maturity, assuming that the notes are not automatically redeemed. If the notes are automatically redeemed prior

to maturity, the hypothetical examples below will not be relevant, and you will receive on the applicable Call Settlement Date, for each

$1,000 principal amount, the principal amount plus the applicable final Coupon.

Hypothetical Final Level of the

Least Performing Reference Asset |

Hypothetical Final Level of the

Least Performing Reference Asset

Expressed as a Percentage of its

Initial Level |

Payment at Maturity (Excluding

Coupons)* |

| $200.00 |

200.00% |

$1,000.00 |

| $180.00 |

180.00% |

$1,000.00 |

| $160.00 |

160.00% |

$1,000.00 |

| $140.00 |

140.00% |

$1,000.00 |

| $120.00 |

120.00% |

$1,000.00 |

| $100.00 |

100.00% |

$1,000.00 |

| $90.00 |

90.00% |

$1,000.00 |

| $80.00 |

80.00% |

$1,000.00 |

| $70.00 |

70.00% |

$1,000.00 |

| $60.00 |

60.00% |

$1,000.00 |

| $50.00 |

50.00% |

$1,000.00 |

| $49.99 |

49.99% |

$499.90 |

| $40.00 |

40.00% |

$400.00 |

| $20.00 |

20.00% |

$200.00 |

| $0.00 |

0.00% |

$0.00 |

* Represents the cash value of the hypothetical

Physical Delivery Amount on the Valuation Date. We may elect to deliver either the Physical Delivery Amount or the Cash Delivery Amount.

If we elect to deliver the Physical Delivery Amount, the actual value received and your total return on the notes on the Maturity Date

will depend on the value of the Least Performing Reference Asset on the Maturity Date.

U.S. Federal Tax Information

By purchasing the notes, each holder agrees (in the absence of a change

in law, an administrative determination or a judicial ruling to the contrary) to treat each note as an investment unit consisting of a

Debt Portion and a Put Option (as such terms are defined in the accompanying product supplement) for U.S. federal income tax purposes.

In the opinion of our counsel, Mayer Brown LLP, it would generally be reasonable to treat the notes as an investment unit consisting of

a Debt Portion and a Put Option in respect of the Reference Assets for U.S. federal income tax purposes. The following table sets forth

the amount of stated interest on the notes and the portion that will be treated as an interest payment on the Debt Portion and as payment

for the Put Option for U.S. federal income tax purposes.

| Interest Rate per Annum |

Treated as an Interest Payment on

the Debt Portion |

Treated as Payment for the Put

Option |

| 13.400% |

[*]% |

[*]% |

Please see the discussion in the accompanying product

supplement under “Supplemental Tax Considerations—Supplemental U.S. Federal Income Tax Considerations — Notes Treated

as an Investment Unit Consisting of a Debt Portion and a Put Option, as a Pre-Paid Contingent Income-Bearing Derivative Contract, or as

a Pre-Paid Derivative Contract—Notes Treated as an Investment Unit Consisting of a Debt Portion and a Put Option,” which applies

to the notes, except the following disclosure which supplements, and to the extent inconsistent supersedes, the discussion in the product

supplement.

Under current Internal Revenue Service guidance,

withholding on "dividend equivalent" payments (as discussed in the product supplement), if any, will not apply to notes that

are issued as of the date of this pricing supplement unless such notes are "delta-one" instruments. Based on our determination

that the notes are not delta-one instruments, non-United States holders (as defined in the product supplement) should not generally be

subject to withholding on dividend equivalent payments, if any, under the notes.

Supplemental Plan of Distribution (Conflicts of Interest)

Citigroup will purchase the notes from us at a purchase

price reflecting the commission set forth on the cover hereof. Citigroup has informed us that, as part of its distribution of the notes,

it may reoffer the notes to other dealers who will sell them. Each such dealer, or each additional dealer engaged by a dealer to whom

Citigroup reoffers the notes, will receive a commission from Citigroup, which will not exceed the commission set forth on the cover page.

We or one of our affiliates may also pay a referral fee to certain dealers in connection with the distribution of the notes.

Certain dealers who purchase the notes for sale

to certain fee-based advisory accounts may forego some or all of their selling concessions, fees or commissions. The public offering price

for investors purchasing the notes in these accounts may be less than 100% of the principal amount, as set forth on the cover page of

this document. Investors that hold their notes in these accounts may be charged fees by the investment advisor or manager of that account

based on the amount of assets held in those accounts, including the notes.

We will deliver the notes on a date that is greater

than one business day following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade

expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than one business day prior to the issue date will

be required to specify alternative settlement arrangements to prevent a failed settlement.

We reserve the right to withdraw, cancel or modify

the offering of the notes and to reject orders in whole or in part. You may cancel any order for the notes prior to its acceptance.

You should not construe the offering of the notes

as a recommendation of the merits of acquiring an investment linked to the Reference Assets or as to the suitability of an investment

in the notes.

We, Citigroup or one or more of our or their affiliates

may, but is not obligated to, make a market in the notes. We, Citigroup and/or any of our or their affiliates will determine any secondary

market prices that it is prepared to offer in its sole discretion.

We, Citigroup or one or more of our or their affiliates

may use the final pricing supplement relating to the notes in the initial sale of the notes. In addition, we, Citigroup or one of our

or their affiliates may use the final pricing supplement in market-making transactions in any notes after their initial sale. Unless Citigroup

or we or one of our or their affiliates inform you otherwise in the confirmation of sale, the final pricing supplement is being used in

a market-making transaction.

For a period of approximately three months following

issuance of the notes, the price, if any, at which we or Citigroup or one of our or their affiliates would be willing to buy the notes

from investors, and the value that we, Citigroup or one of our or their affiliates may also publish for the notes through one or more

financial information vendors and which could be indicated for the notes on any brokerage account statements, will reflect a temporary

upward adjustment from our estimated value of the notes that would otherwise be determined and applicable at that time. This temporary

upward adjustment represents a portion of (a) the hedging profit that we or our affiliates expect to realize over the term of the notes

and (b) any underwriting discount and the selling concessions paid in connection with this offering. The amount of this temporary upward

adjustment will decline to zero on a straight-line basis over the three-month period.

The notes and the related offer to purchase notes

and sale of notes under the terms and conditions provided herein do not constitute a public offering in any non-U.S. jurisdiction, and

are being made available only to individually identified investors pursuant to a private offering as permitted in the relevant jurisdiction.

The notes are not, and will not be, registered with any securities exchange or registry located outside of the United States and have

not been registered with any non-U.S. securities or banking regulatory authority. The contents of this document have not been reviewed

or approved by any non-U.S. securities or banking regulatory authority. Any person who wishes to acquire the notes from outside the United

States should seek the advice or legal counsel as to the relevant requirements to acquire these notes.

British Virgin Islands. The notes have not

been, and will not be, registered under the laws and regulations of the British Virgin Islands, nor has any regulatory authority in the

British Virgin Islands passed comment upon or approved the accuracy or adequacy of this document. This pricing supplement and the related

documents shall not constitute an offer, invitation or solicitation to any member of the public in the British Virgin Islands for the

purposes of the Securities and Investment Business Act, 2010, of the British Virgin Islands.

Cayman Islands. Pursuant to the Companies

Law (as amended) of the Cayman Islands, no invitation may be made to the public in the Cayman Islands to subscribe for the notes by or

on behalf of the issuer unless at the time of such invitation the issuer is listed on the Cayman Islands Stock Exchange. The issuer is

not presently listed on the Cayman Islands Stock Exchange and, accordingly, no invitation to the public in the Cayman Islands is to be

made by the issuer (or by any dealer on its behalf). No such invitation is made to the public in the Cayman Islands hereby.

Dominican Republic. Nothing in this pricing

supplement constitutes an offer of securities for sale in the Dominican Republic. The notes have not been, and will not be, registered

with the Superintendence of Securities Market of the Dominican Republic (Superintendencia del Mercado de Valores), under Dominican Securities

Market Law No. 249-17 (“Securities Law 249-17”), and the notes may not be offered or sold within the Dominican Republic or

to, or for the account or benefit of, Dominican persons (as defined under Securities Law 249-17 and its regulations). Failure to comply

with these directives may result in a violation of Securities Law 249-17 and its regulations.

Israel. This pricing supplement is intended

solely for investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended. A prospectus has not been prepared

or filed, and will not be prepared or filed, in Israel relating to the notes offered hereunder. The notes cannot be resold in Israel other

than to investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended.

No action will be taken in Israel that would permit

an offering of the notes or the distribution of any offering document or any other material to the public in Israel. In particular, no

offering document or other material has been reviewed or approved by the Israel Securities Authority. Any material provided to an offeree

in Israel may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have

been provided directly by us or the selling agents.

Nothing in this pricing supplement or any other

offering material relating to the notes, should be considered as the rendering of a recommendation or advice, including investment advice

or investment marketing under the Law For Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management, 1995,

to purchase any note. The purchase of any note will be based on an investor’s own understanding, for the investor’s own benefit

and for the investor’s own account and not with the aim or intention of distributing or offering to other parties. In purchasing

the notes, each investor declares that it has the knowledge, expertise and experience in financial and business matters so as to be capable

of evaluating the risks and merits of an investment in the notes, without relying on any of the materials provided.

Mexico. The notes have not been registered

with the National Registry of Securities maintained by the Mexican National Banking and Securities Commission and may not be offered or

sold publicly in Mexico. This pricing supplement and the related documents may not be publicly distributed in Mexico. The notes may only

be offered in a private offering pursuant to Article 8 of the Securities Market Law.

Switzerland. This pricing supplement is not

intended to constitute an offer or solicitation to purchase or invest in any notes. Neither this pricing supplement nor any other offering

or marketing material relating to the notes constitutes a prospectus compliant with the requirements of articles 35 et seq. of the Swiss

Financial Services Act ("FinSA")) for a public offering of the notes in Switzerland and no such prospectus has been or will

be prepared for or in connection with the offering of the notes in Switzerland.

Neither this pricing supplement nor any other offering

or marketing material relating to the notes has been or will be filed with or approved by a Swiss review body (Prüfstelle). No application

has been or is intended to be made to admit the notes to trading on any trading venue (SIX Swiss Exchange or on any other exchange or

any multilateral trading facility) in Switzerland. Neither this pricing supplement nor any other offering or marketing material relating

to the notes may be publicly distributed or otherwise made publicly available in Switzerland.

The notes may not be publicly offered, directly

or indirectly, in Switzerland within the meaning of FinSA except (i) in any circumstances falling within the exemptions to prepare a prospectus

listed in article 36 para. 1 FinSA or (ii) where such offer does not qualify as a public offer in Switzerland, provided always that no

offer of notes shall require the Issuer or any offeror to publish a prospectus pursuant to article 35 FinSA in respect to such offer and

that such offer shall comply with the additional restrictions set out below (if applicable). The Issuer has not authorised and does not

authorise any offer of notes which would require the Issuer or any offeror to publish a prospectus pursuant to article 35 FinSA in respect

of such offer. For purposes of this provision "public offer" shall have the meaning as such term is understood pursuant to article

3 lit. g and h FinSA and the Swiss Financial Services Ordinance ("FinSO").

The notes do not constitute participations in a

collective investment scheme within the meaning of the Swiss Collective Investment Schemes Act. They are not subject to the approval of,

or supervision by, the Swiss Financial Market Supervisory Authority ("FINMA"), and investors in the notes will not benefit from

protection under CISA or supervision by FINMA.

Prohibition of Offer to Private Clients in Switzerland

- No Key Information Document pursuant to article 58 FinSA (Basisinformationsblatt für Finanzinstrumente) or equivalent document

under foreign law pursuant to article 59 para. 2 FinSA has been or will be prepared in relation to the notes. Therefore, the following

additional restriction applies: Notes qualifying as "debt securities with a derivative character" pursuant to article 86 para.

2 FinSO may not be offered within the meaning of article 58 para. 1 FinSA, and neither this pricing supplement nor any other offering

or marketing material relating to such notes may be made available, to any retail client (Privatkunde) within the meaning of FinSA in

Switzerland.

The notes may also be sold in the following jurisdictions,

provided, in each case, any sales are made in accordance with all applicable laws in such jurisdiction:

Additional Information Relating to the Estimated Initial Value of

the Notes

Our estimated initial value of the notes on the

date hereof, and that will be set forth on the cover page of the final pricing supplement relating to the notes, equals the sum of the

values of the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the notes, valued using our internal funding rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the notes. |

The internal funding rate used in the determination

of the initial estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value

of these derivative transactions is derived from our internal pricing models. These models are based on factors such as the traded market

prices of comparable derivative instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors.

As a result, the estimated initial value of the notes on the Pricing Date will be determined based on the market conditions on the Pricing

Date.

The Reference Assets

We have derived the following information from publicly

available documents. We have not independently verified the accuracy or completeness of the following information. We are not affiliated

with any Reference Asset Issuer and the Reference Asset Issuers will have no obligations with respect to the notes. This document relates

only to the notes and does not relate to the shares of the Reference Assets. Neither we nor any of our affiliates participates in the

preparation of the publicly available documents described below. Neither we, Citigroup, nor any of our or their affiliates has made any

due diligence inquiry with respect to the Reference Assets in connection with the offering of the notes. There can be no assurance that

all events occurring prior to the date hereof, including events that would affect the accuracy or completeness of the publicly available

documents described below and that would affect the trading price of the shares of any Reference Asset, have been or will be publicly

disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning any Reference

Asset could affect the price of the shares of that Reference Asset on each Call Observation Date and on the Valuation Date, and therefore

could affect the payments on the notes.

The selection of a Reference Asset is not a recommendation

to buy or sell the shares of that Reference Asset. Neither we nor any of our affiliates make any representation to you as to the performance

of the shares of any Reference Asset. Information provided to or filed with the SEC under the Exchange Act and the Investment Company

Act of 1940 relating to the Reference Assets may be obtained through the SEC’s website at http://www.sec.gov.

We encourage you to review recent levels of the

Reference Assets prior to making an investment decision with respect to the notes.

Apple Inc. is engaged in designing, manufacturing

and marketing smartphones, personal computers, tablets, wearables and accessories. Information filed by the company with the SEC under

the Exchange Act can be located by reference to its SEC file number: 001-36743, or its CIK Code: 0000320193. Its common stock is listed

on the Nasdaq Global Select Market under the ticker symbol "AAPL."

Tesla, Inc. designs, develops, manufactures, sells

and leases electric vehicles and energy generation and storage systems and offers related services. Information filed by the company with

the SEC under the Exchange Act can be located by reference to its SEC file number: 001-34756, or its CIK Code: 0001318605. Its common

stock is listed on the Nasdaq Global Select Market under the ticker symbol “TSLA.”

13

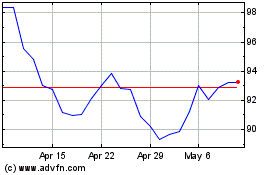

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Nov 2023 to Nov 2024