Filed by JEPLAN Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AP Acquisition Corp

Commission File No.: 001-41176

Filed July 24, 2023

This material below is an English translation of

an article first published in Japanese in the September 2023 issue of Forbes Japan magazine, released in Japan on July 25, 2023, local

time. Attempts to provide an accurate translation of the original article in Japanese have been made, but due to linguistic nuances, slight

differences may exist.

This translation was made as a matter

of record only and does not constitute an offer to sell or to solicit an offer to buy securities in the United States.

TOWARDS CIRCULAR ECONOMY

Michihiko Iwamoto

Founder, Director, Executive Chairman

of JEPLAN

To be listed on the NYSE for "Above

Ground Resources."

A "hope" that companies from

around the world seek to partner with.

As we move toward a decarbonized

society, there is a Japanese venture company that is receiving an endless stream of offers of factory space and partnerships from Japan

and abroad. It all began 16 years ago with the fantasy of a salesman at a textile trading company who envisioned a world without conflict

over resources.

[graphic/photograph with caption]

Text by Forbes JAPAN photographs by Naoto Ikeda edit

by Hirokuni Kanki

MICHIHIKO IWAMOTO

Born in Kagoshima Prefecture in

1964, he graduated from the University of Kitakyushu (now the University of Kitakyushu) in 1988 and worked for a trading company specializing

in textiles, where he was engaged in sales. In 1995, he became deeply involved in textile recycling after the enactment of the Containers

and Packaging Recycling Law. In 2007, he co-founded Nihon Kankyo Sekkei (now JEPLAN) with current president Masaki Takao. In 2015, he

was elected Ashoka Fellow. In 2016, he became Director, Executive Officer, and Chairman.

If each does not do its part, the

recycling frame cannot turn.

As we were shooting

the cover photo with the bare steel frame and pipes of the plant in the background, Michihiko Iwamoto, Chairman of JEPLAN, laughed,

"A venture company shouldn't have such a huge plant." he said. Nevertheless, JEPLAN is expected to list on the New York

Stock Exchange (NYSE) within the year. The ten Japanese companies currently listed on the NYSE, including Sony, Honda, Toyota, and

MUFG, are all large corporations. If JEPLAN, a small- to medium-sized venture founded in 2007, can follow them, it would be a

historic accomplishment for the Japanese economy.

PET Refine Technology's chemical

recycling plant in Kawasaki is one of the world's largest, with an area that could fit 15 Tokyo Domes. The plant chemically processes

polyethylene terephthalate (PET) resin bottles, or PET bottles, to produce small chunks of recycled PET resin called "pellets. Beverage

manufacturers purchase these pellets to make new PET bottles. The annual production capacity of PET resin amounts to 22,000 tons.

In addition to the Kawasaki Plant,

JEPLAN operates the Kitakyushu Hibikinada Plant in Kitakyushu City, which also produces recycled polyester resin from polyester for use

in clothing. This one is for textile use, with an annual production capacity of 1,000 tons. Apparel makers can use this resin as a raw

material to make medical products. JEPLAN is currently attracting investment from around the world, as well as more than 50 factory invitations

and partnerships.

The Roadmap to World Peace"

Charted by the Two People.

The reason why JEPLAN (formerly

Nihon Kankyo Sekkei), which Iwamoto and President Masaki Takao founded in 2007 with a total of 1.2 million yen, has attracted billions

of dollars from around the world. It is because, unlike a mere recycling company, JEPLAN is a "mechanism company" that creates

"above-ground resources.

JEPLAN is not only involved in

the commercial plant and technology licensing business related to PET chemical recycling technology to recycle PET bottles and polyester

fibers, but also in the recycling of clothes, glasses, cell phones, and toys, as well as the production and sale of recovered, recycled,

and manufactured products under the "BRING" brand, which makes clothes from recovered clothes. To make this happen, JEPLAN also

has a marketing company aspect, planning and managing projects to recycle products while collaborating with domestic and international

companies across industries.

As of April 2023, 197 brands were

participating in the "BRING" project to collect unwanted clothes in stores, with 4,299 collection locations. Participating companies

include apparel manufacturers such as MUJI and MUJI brands, Patagonia, and department stores such as Takashimaya, Daimaru, and Matsuzakaya.

In August 2022, JEPLAN raised 2.4

billion yen from investment firms Baillie Gifford, MPower Partners, Tokio Marine & Nichido Fire Insurance, and others for its network

for collecting unwanted clothing, as well as its licensing of proprietary technology, expertise in laying out and operating factories,

and development of apparel brands. Iwamoto enjoys the fact that "my business partners ask me, 'What do you want to do with JEPLAN?

Iwamoto says happily.

We just want to circulate "above

ground resources.

PET and polyester fiber are made

from petroleum, and if PET bottles and 100% polyester fiber clothing can be recycled with high quality and semi-permanently, what was

once "trash" can be used as a new "aboveground resource. If aboveground resources can be recycled, CO2 emissions can be

reduced, wars and terrorism over underground resources can be reduced, and a peaceful world can be created. This is Iwamoto's vision.

He likens JEPLAN's form to that of

a "general trading company”. To understand the reason for JEPLAN's diversified business operations, one must go back 16 years

to when Iwamoto and Takao started JEPLAN.

Delusion" of cars running with

clothes as raw materials.

It was the movie "Back to

the Future Part 2" (1989) that got Iwamoto thinking about recycling. After seeing the "DeLorean," a car-type time machine

powered by garbage, Iwamoto was convinced that "In the future, garbage will become a resource. And it is Japanese technology that

will make this possible.

This desire became stronger at

the textile trading company where he found employment. He had doubts about the percentage of clothing in the total waste stream. Textiles

are technically difficult to recycle, and while about 20% is reused or recycled, the remaining 80% is buried or incinerated. It was a

one-way street: large quantities were made, used, and trashed.

Then one day in 2006, while reading

the newspaper, I learned that ethanol, a biofuel, could be produced from corn. It was possible to produce bioethanol from clothes made

from the same plant, cotton. If so, used T-shirts could be converted into a "resource" that could be sold as fuel. With this

idea in mind, I consulted Takao, a young drinking buddy of mine who was a graduate student at the University of Tokyo.

Iwamoto uses the word "delusion"

when describing his vision for JEPLAN. He says, "I have a fantasy that clothes can be used to make cars run, factories run, and fuel

to make airplanes fly. He tells his fantasy to various people, invites others to join him, and together they work to bring it to fruition,

making the most of their respective fields of expertise.

Takao was one of the

first people to go along with this fantasy. With the cooperation of Osaka University, the two succeeded in breaking down

(saccharifying) a 100% cotton T-shirt to produce bioethanol. Iwamoto said cheerfully, "I started JEPLAN by saying, 'If I had a

million yen, I could build a company. President Takao says, "I don't remember thinking too much about it," but he did see

the potential of the business. I just felt that it had the potential to expand as a business in the future in relation to the

development of the uniform recycling business, and I thought it would be interesting," he said.

As expected, JEPLAN has expanded

its business from the idea and technology of making bioethanol from cotton products, to recycling polyester fiber from polyester fibers,

and PET bottle resin from PET bottles.

The "axis" that spins

the wheel of recycling

However, "technology" is

not the only reason why JEPLAN has grown so much. JEPLAN's greatest strength lies in the fact that Iwamoto and Takao are involved in the

recycling process, while at the same time involving other companies and working together to create a form that will realize their vision

of "recycling everything," or "creating a complete recycling-oriented society. This was the most realistic, albeit puzzling,

solution they arrived at as a result of their consideration of the conventional recycling philosophy and reality.

The recycling process usually consists

of (1) manufacturers making products, (2) consumers purchasing those products, and (3) reusing the unwanted products as resources instead

of discarding them. Although manufacturers often take some measures from the perspective of laws and regulations and corporate social

responsibility (CSR), consumers actually have a greater role to play by returning unused items to manufacturers and retailers. Therefore,

a fully recycling- oriented society will not be realized unless a B2B2C structure is established in which consumers (C) participate in

the activities of companies (B2B). In reality, however, Iwamoto says, "It is difficult to turn it around. Where do we stumble? Inevitably,

people give up on the idea of recycling because of “other companies”. In recycling, there are roles to be played by manufacturers

(production), retailers (sales and collection), consumers (purchase and bringing in), and recyclers (recycling). Only then can the axis

be formed and the frame turn, but the frame did not turn because of other companies. So, even if the logic is sound and a picture is drawn,

it is difficult to realize a complete recycling-oriented society. So we decided that we had no choice but to become the hub (axis)."

JEPLAN had the technology. However,

Iwamoto also knew that technology alone was not enough to make a business run. In his book, "The 'Future of No Waste' Will Come from

This Business," Iwamoto writes, "In reality, the most difficult part of making recycling a business is not the technology. The

most important point was how to “collect” the materials, that is, to create a lead line for collecting them”.

So what did Iwamoto and Takao do?

They decided to survey consumers, who hold the key to "collection." And when asked "what" and "where" they

would like to recycle, many answered "clothing" and "at the store where I bought it". Therefore, with the cooperation

of Ryohin Keikaku, Aeon Retail, Marui Group, and others, we decided to conduct a collection experiment. When we tested how in-store clothing

collections would affect store customer traffic and sales, we found that stores with in-store collection boxes performed better. It turned

out that stores with in-store collection boxes were more profitable.

Iwamoto and his team named and

branded the clothing collection project that made this flow line collection possible, integrating it with the plastic version of the project

they started in 2012, which collects and recycles plastics, and evolving it into the aforementioned "BRING" brand.

Certainly, technology is an important

weapon. However, what differentiates us from other "recycling companies" as a business is our "structure" and "brand.

Iwamoto explains the "winning formula" as follows.

“The proprietary technology

is what made this mechanism possible. However, the technology is only one of the “cartridges” in the system. What is more

important is the mechanism to make it profitable. If we put up collection boxes, it will have a positive impact on customer attraction

and sales. Companies that understand this are paying us to recycle their brands.”

A "new planet" attracts

people, goods, and money.

When Apple introduced the iPhone,

some people said that a Japanese company could quickly create a similar product because it used many components from Japanese companies.

However, Apple differentiated itself by operating platforms such as iTunes and the App Store, and by establishing a market and structure

that facilitated developers' participation. It persistently negotiated contracts and copyrights with music labels and musicians, and offered

Apple Music for subscriptions. JEPLAN is attracting consumers.

Although JEPLAN is developing

multifaceted initiatives, Iwamoto asserts that JEPLAN's management perspective never wavers because it thinks from the same "consumer

perspective”. If we don't develop technology to do what consumers most want to recycle, they won't look at us. Our recycling of

diverse items is simply responding to consumer needs." (Iwamoto)

In order to bring

about a recycling-oriented society as quickly as possible, it is necessary to make recycling a "personal matter" for

consumers. Since 2015, Iwamoto has been conducting various marketing activities to change consumer behavior, including an event in

which consumers can drive actual cars powered by bioethanol made from cotton. He asked the U.S. film company Universal Studios for

cooperation under the guise of "efforts to create a recycling-oriented society," and with the company's official approval,

"recreated" the scene in the movie "Back to the Future Part 2" where the DeLorean arrives in the future (October

21, 2015). "The Future". Such attempts and initiatives will change consumer awareness and create incentives for

manufacturers and retailers to be more actively involved in the recycling society.

The powerful message of "creating

a recycling-oriented society" leads to business that transcends national borders. Just as Universal Studios headquarters resonated

with JEPLAN, Iwamoto says that partnerships with well-known overseas companies and numerous brands have led to increased trust and recognition

of JEPLAN in Japan. Meanwhile, the partnership with Axens, a French state-owned company, is encouraging the development of PET commercial

plant business around the world. By partnering with industry leaders, it is easier to gain the trust of other companies," Iwamoto

said. Iwamoto says that foreign investors strongly value such "involvement.

For foreign

investors, they think more about a recycling-oriented society 10 to 20 years from now than they do about profits today. One investor said

to me, “You guys have created a planet!”. The gravity of the planet sucks in people, goods, money, and information. The important

thing is not to pursue immediate sales and profits, but to create a 'new planet' on which to gather them.

Iwamoto and Takao's goal with JEPLAN

was to create a planet free of underground resources, where a recycling-oriented society revolving around above-ground resources is complete.

In the process, they found another "planet" filled with blue oceans.

The following are English translations

of captions for images included in the article:

JEPLAN Logo

JEPLAN was established in January

2007 with capital of 81,700,000 yen (including capital reserve). Formerly known as Nihon Kankyo Sekkei. Masaki Takao was appointed President

and Representative Director in 2004.

Photo Description 1

Polyester resin recycled from

polyester fibers using JEPLAN's chemical recycling technology (BHET method). In addition to reducing the use of petroleum resources required

for manufacturing, it also reduces CO2 emissions.

Photo Description 2

The DeLorean from the

"Back to the Future" movie series. PART 2 of the future version is fueled by garbage; at the 2015 event, JEPLAN recycled

collected clothing into fuel, just like in the movie, and drove the actual car.

BRING Technology Description 3

JEPLAN's patented proprietary technology

extracts BHET, the monomer that makes up PET resin, to a high degree of purity. After impurities are removed by a chemical process, they

are repolymerized into a polymer and returned to PET resin.

Photo Description 4

A project to collect used clothing

and textiles under the "BRING" brand. Collection boxes are set up in stores of participating companies, and non-polyester clothing

is also collected and recycled (with some exceptions).

Photo Description 5

JEPLAN Kitakyushu Hibikinada Plant,

completed in 2017. The plant will produce recycled resin for textiles from recovered clothing and polyester fibers from the manufacturing

process. The plant is also equipped with a line for extracting precious metals from cell phones.

Photo Description 6

The BRING Material site lists brands

and manufacturers, including Patagonia, that use BRING Material.

Photo Description 7

JEPLAN, which aims to play the

role of a hub in the "circle" of recycling, plans, manufactures, and wholesales its own brand of clothing, and operates a directly

managed BRING store (Ebisu, Tokyo).

Photo Description 8

President Takao and Chairman Iwamoto,

who founded JEPLAN in 2007, met at a cross- industrial exchange meeting. They met at a cross-industrial exchange meeting, where the president,

who took over the management baton 16 years ago, and the chairman, who supports him as a spokesperson. Takao says, "I will do everything

that Iwamoto does not do”.

Photo Description 9

In front of a bag full of recycled

PET resin awaiting shipment. Iwamoto wears a jacket, T- shirt, and jeans all made by BRING. Will the time come in Japan when a company's

attitude toward the environment = a brand that is popular among people of all ages?

Photo Description 10

In May 2023, MCC

announced a partnership with UAE-based Rebound, a company with international operations in the recycled plastics trading market, for

the construction of a PET chemical recycling plant (President Takao is on the far left).

Forward-Looking Statements

This document contains

certain forward-looking statements within the meaning of the federal securities laws with respect to a potential business

combination by and among JEPLAN Holdings, Inc., a Japanese corporation (“PubCo”), AP Acquisition Corp, a Cayman Islands

exempted company (“APAC”), JEPLAN MS, Inc., a Cayman Islands exempted company, and JEPLAN, Inc., a Japanese corporation

(“JEPLAN”) and related transactions (collectively, the “Potential Business Combination”), including

statements regarding the anticipated timing of a listing on the New York Stock Exchange, JEPLAN’s business plans and growth

strategies, the technologies and products and services offered by JEPLAN and the markets in which it operates, and JEPLAN’s

projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “forecast,” “predict,” “expect,” “anticipate,”

“estimate,” “intend,” “seek,” “strategy,” “future,”

“outlook,” “target,” “opportunity,” “plan,” “potential,”

“may,” “seem,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. Forward-looking statements include, but are not limited to, predictions,

projections and other statements about future events that are based on current expectations and assumptions of JEPLAN’s,

PubCo’s and APAC’s management, whether or not identified in this document, and, as a result, are subject to risks and

uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and

must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and

circumstances are beyond the control of JEPLAN, PubCo, and APAC. Many factors could cause actual future events to differ materially

from the forward-looking statements in this document, including, but not limited to: (i) the risk that the Potential Business

Combination may not be completed in a timely manner or at all, which may adversely affect the price of PubCo’s securities,

(ii) the risk that the Potential Business Combination may not be completed by APAC’s business combination deadline and the

potential failure to obtain an extension of the business combination deadline if sought by APAC, (iii) the failure to satisfy the

conditions to the consummation of the Potential Business Combination, including the adoption of the business combination agreement

by the respective shareholders of APAC and JEPLAN, the satisfaction of the minimum cash amount following redemptions by APAC’s

public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in

determining whether or not to pursue the Potential Business Combination, (v) the occurrence of any event, change or other

circumstance that could give rise to the termination of the business combination agreement, (vi) the effect of the announcement or

pendency of the Potential Business Combination on JEPLAN’s business relationships, performance, and business generally, (vii)

risks that the Potential Business Combination disrupts current plans of JEPLAN and potential difficulties in its employee retention

as a result of the Potential Business Combination, (viii) the outcome of any legal proceedings that may be instituted against JEPLAN

or APAC related to the business combination agreement or the Potential Business Combination, (ix) failure to realize the anticipated

benefits of the Proposed Business Combination, (x) the inability to maintain the listing of APAC’s securities or to meet

listing requirements and maintain the listing of PubCo’s securities on the New York Stock Exchange, (xi) the risk that the

price of PubCo’s securities may be volatile due to a variety of factors, including changes in the highly competitive

industries in which PubCo plans to operate, variations in performance across competitors, changes in laws, regulations,

technologies, natural disasters or health epidemics/pandemics, national security tensions, and macro-economic and social

environments affecting its business, and changes in the combined capital structure, (xii) the inability to implement business plans,

forecasts, and other expectations after the completion of the Potential Business Combination, identify and realize additional

opportunities, and manage its growth and expanding operations, (xiii) the risk that JEPLAN may not be able to successfully expand

its products and services domestically and internationally, (xiv) the risk that JEPLAN and its current and future collaborative

partners are unable to successfully market or commercialize JEPLAN’s proposed licensing solutions, or experience significant

delays in doing so, (xv) the risk that JEPLAN may never achieve or sustain profitability, (xvi) the risk that JEPLAN will need to

raise additional capital to execute its business plan, which many not be available on acceptable terms or at all, (xvii) the risk

relating to scarce or poorly collected raw materials for JEPLAN’s PET recycling business; (xviii) the risk that JEPLAN may not

be able to consummate planned strategic acquisitions, including joint ventures in connection with its proposed licensing business,

or fully realize anticipated benefits from past or future acquisitions, joint ventures, or investments; (xix) the risk that

JEPLAN’s patent applications may not be approved or may take longer than expected, and that JEPLAN may incur substantial costs

in enforcing and protecting its intellectual property; and (xx) the risk that JEPLAN may be subject to competition from current

collaborative partners in the use of jointly developed technology once applicable collaborative arrangements expire. The foregoing

list of factors is not exhaustive. You should carefully consider the foregoing factors, any other factors discussed in this document

and the other risks and uncertainties described in the “Risk Factors” sections of APAC’s Annual Report on Form

10-K for the year ended December, 31, 2022, which was filed with the U.S. Securities and Exchange Commission (the “SEC”)

on March 3, 2023 (the “2022 Form 10-K”), as such factors may be updated from time to time in APAC’s filings with

the SEC, the Registration Statement (as defined below) and proxy statement/prospectus contained therein. These filings identify and

address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. There may be additional risks that neither JEPLAN, PubCo nor APAC presently knows or that JEPLAN,

PubCo, and APAC currently believe are immaterial that could also cause actual results to differ from those contained in the

forward-looking statements. Forward-looking statements reflect JEPLAN’s, PubCo’s, and APAC’s expectations, plans,

or forecasts of future events and views only as of the date they are made. JEPLAN, PubCo, and APAC anticipate that subsequent events

and developments will cause JEPLAN’s, PubCo’s, and APAC’s assessments to change. However, while JEPLAN, PubCo, and

APAC may elect to update these forward-looking statements at some point in the future, JEPLAN, PubCo, and APAC specifically disclaim

any obligation to do so. These forward-looking statements should not be relied upon as representing JEPLAN’s, PubCo’s,

and APAC’s assessments of any date subsequent to the date of this document. Accordingly, readers are cautioned not to put

undue reliance on forward-looking statements, and JEPLAN, PubCo and APAC assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required to by

applicable securities law. Neither JEPLAN, PubCo, nor APAC gives any assurance that PubCo will achieve its expectations.

Additional Information

This document relates to the Proposed

Business Combination by and among PubCo, APAC, Merger Sub, and JEPLAN. If the Proposed Business Combination is pursued, PubCo intends

to file with the SEC a registration statement on Form F-4 relating to the Potential Business Combination (the “Registration Statement”)

that will include a proxy statement/prospectus of APAC. The proxy statement/prospectus will be sent to all APAC and JEPLAN shareholders.

PubCo and APAC also will file other documents regarding the Potential Business Combination with the SEC. Before making any voting decision,

investors and security holders of APAC and JEPLAN are urged to read the Registration Statement, the proxy statement/prospectus contained

therein and all other relevant documents filed or that will be filed with the SEC in connection with the Potential Business Combination

as they become available because they will contain important information about JEPLAN, APAC, PubCo, and the Potential Business Combination.

Investors and security holders

will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with

the SEC by PubCo and APAC through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by PubCo and APAC

may be obtained free of charge by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa, Japan or by telephone

at +81 44-223-7898, and to APAC at 10 Collyer Quay, #37-00 Ocean Financial Center, Singapore or by telephone at +65 6808-6510.

Participants in the Solicitation

JEPLAN, PubCo, and APAC and their

respective directors and officers and other members of management may, under SEC rules, be deemed to be participants in the solicitation

of proxies from APAC’s shareholders with the Potential Business Combination and the other matters set forth in the Registration

Statement. Information about APAC’s directors and executive officers and their ownership of APAC’s securities is set forth

in APAC’s filings with the SEC, including APAC’s 2022 Form 10-K. To the extent that holdings of APAC’s securities by

its directors and executive officers have changed since the amounts reflected in the 2022 Form 10-K, such changes will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other

persons who may be deemed participants in the Potential Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Potential Business Combination when it becomes available. You may obtain free copies of these documents as described in

the preceding paragraph.

No Offer or Solicitation

This document shall not constitute

a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This document shall not constitute

an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities in the Proposed Business Combination shall be made except by means of a prospectus meeting the

requirements of the U.S. Securities Act of 1933, as amended.

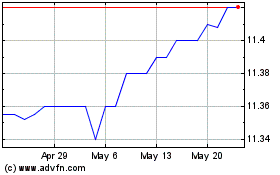

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Apr 2024 to May 2024

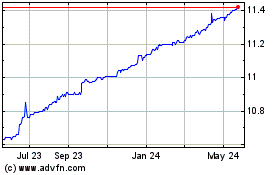

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From May 2023 to May 2024