false000145586300014558632023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 2, 2023

Americold Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Maryland | 001-34723 | 93-0295215 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 10 Glenlake Parkway, | South Tower, Suite 600 | |

|

| Atlanta, | Georgia | | 30328 |

(Address of principal executive offices) | | (Zip Code) |

(678) 441-1400

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

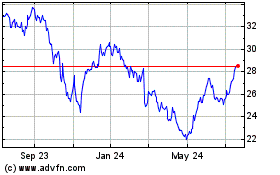

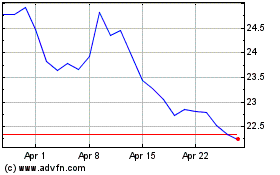

| Common Stock, $0.01 par value per share | | COLD | | New York Stock Exchange |

Item 2.02 — Results of Operations and Financial Condition.

On November 2, 2023, Americold Realty Trust, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the third quarter ended September 30, 2023. A copy of the press release as well as a copy of the supplemental information referred to in the press release are available on the Company’s website and are attached hereto as Exhibits 99.1 and 99.2 and incorporated herein by reference.

The foregoing information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition”. The information in Item 2.02 of this Current Report on Form 8-K and the exhibits furnished therewith shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 7.01 — Regulation FD Disclosure.

The information set forth in Item 2.02 is incorporated by reference into this Item 7.01. The information in Items 2.20 and 7.01 of this Current Report on Form 8-K and the exhibits furnished therewith shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 — Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | Press Release dated November 2, 2023 for the third quarter ended September 30, 2023. |

| | Supplemental Information Package for the third quarter ended September 30, 2023. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 2, 2023

| | | | | | | | |

| AMERICOLD REALTY TRUST, INC. |

| | |

| By: | /s/ Marc J. Smernoff |

| | Name: Marc J. Smernoff |

| | Title: Chief Financial Officer, Treasurer and Executive Vice President |

| | |

Exhibit 99.1

AMERICOLD REALTY TRUST, INC. ANNOUNCES THIRD QUARTER 2023 RESULTS

Delivers Strong Operational Results and Raises Annual Guidance

Raises Common Equity to Support New Growth Initiatives

Atlanta, GA, November 2, 2023 - Americold Realty Trust, Inc. (NYSE: COLD) (the “Company”), a global leader in temperature-controlled logistics, real estate, and value-added services focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, today announced financial and operating results for the third quarter ended September 30, 2023.

George Chappelle, Chief Executive Officer of Americold Realty Trust, stated, “We are pleased with our third quarter results where we delivered AFFO per share of $0.32, an increase of over 10% versus prior year’s quarter. This performance was primarily driven by our global warehouse same store pool, which generated NOI growth of 5.3%, on a constant currency basis. Our strong same-store pool results were the result of meaningful economic occupancy growth and our continued pricing initiatives. Our same store economic occupancy increased 345 basis points over prior year to 84.0%, a record-setting third quarter level. Additionally, this quarter, we derived 50.4% of rent and storage revenue from fixed commitment storage contracts, which is another record-setting level for Americold. Lastly, in the face of a challenging throughput volume environment, we made progress on our Services margins through aggressive variable cost management.”

“During the quarter, we successfully raised $419 million in common equity by issuing 13.2 million shares at a weighted average price of $31.63 per share through our ATM program. This capital raise improved our balance sheet by reducing leverage and provides the fuel for growth in support of our development and M&A initiatives. Additionally, we are excited to announce an $85 million expansion of our Allentown, Pennsylvania facility, an example where we are seeing very strong demand from our customer base in key distribution markets within our network. We continue to evaluate development opportunities across three primary areas of focus: expansion projects; customer-dedicated, build-to-suit developments; and our CPKC and DP World collaborations. Also, today, we announced the strategic, tuck-in acquisition of Safeway Freezers, a temperature-controlled company located in Southern New Jersey for a total investment of approximately $37 million. New Jersey is a strategic market for Americold where we own 15 facilities, and this acquisition complements our existing portfolio in this market.”

“As a result of the progress we have made around economic occupancy and pricing combined with our ability to manage all aspects of our variable cost structure within our same store pool, and the reduction of our interest expense due to the pay down of debt, we are raising our full year 2023 AFFO per share guidance to a new range of $1.24 to $1.30, and increase of $0.02 at the midpoint.”

Third Quarter 2023 Highlights

•Total revenue decreased 11.9% to $667.9 million.

•Total NOI increased 4.4% to $189.1 million.

•Net loss of $2.1 million, or $0.01 loss per diluted common share.

•Core EBITDA increased 9.2% to $144.0 million, and increased 9.9% on a constant currency basis.

•Core FFO of $69.6 million, or $0.25 per diluted common share.

•AFFO of $88.2 million, or $0.32 per diluted common share.

•Global Warehouse segment revenue increased 0.6% to $602.6 million.

•Global Warehouse segment NOI increased 6.7% to $177.8 million.

•Global Warehouse segment same store revenue was flat on an actual basis, or, decreased 0.6% on a constant currency basis, Global Warehouse segment same store NOI increased by 4.5%, or 5.3% on a constant currency basis.

•On July 7, we completed the acquisition of a cold storage facility in Brisbane (Ormeau), Australia for approximately A$36.1 million.

•Completed the expansion projects for Spearwood, Australia and Russellville, Arkansas for approximately A$63 million and $84 million respectively. The Spearwood and Russellville facilities consist of 3.3 million cubic feet and 20,000 pallet positions, and 13 million cubic feet and 42,000 pallet positions respectively.

•Issued 13.2 million shares for net proceeds of $412.9 million, which was used to repay a portion of outstanding revolver borrowings.

Year to Date 2023 Highlights

•Total revenue decreased 9.1% to $1.99 billion.

•Total NOI increased 10.4% to $560.7 million.

•Net loss of $109.4 million, or $0.40 loss per diluted common share.

•Core EBITDA increased 13.5% to $411.8 million, or 14.8% on a constant currency basis.

•Core FFO of $192.9 million, or $0.71 per diluted common share.

•AFFO of $243.6 million, or $0.89 per diluted common share.

•Global Warehouse segment revenue increased 4.4% to $1.78 billion.

•Global Warehouse segment NOI increased 13.3% to $525.5 million.

•Global Warehouse segment same store revenue increased 4.3%, or 5.4% on a constant currency basis, Global Warehouse segment same store NOI increased 13.5%, or 14.6% on a constant currency basis.

Third Quarter 2023 Total Company Financial Results

Total revenue for the third quarter of 2023 was $667.9 million, a 11.9% decrease, which was driven by decreases in our Third-party managed and Transportation segments, largely offset by growth within our Global Warehouse segment. The growth within our Global Warehouse segment was driven by our pricing initiatives, rate escalations, improvements in economic occupancy and incremental revenue from recently completed expansion and development projects, partially offset by a decline in throughput due to consumer buying habits, and the unfavorable impact of foreign currency translation.

Total NOI for the third quarter of 2023 was $189.1 million, an increase of 4.4% from the same quarter of the prior year. This increase is a result of the improvement in our Global Warehouse segment as previously mentioned above, partially offset by ongoing inflationary pressure on operating costs.

For the third quarter of 2023, the Company reported net loss of $2.1 million, or $0.01 loss per diluted share, compared to net loss of $8.9 million, or $0.03 loss per diluted share, for the comparable quarter of the prior year.

Core EBITDA was $144.0 million for the third quarter of 2023, compared to $131.9 million for the comparable quarter of the prior year. This reflects a 9.2% increase over prior year on an actual basis, and 9.9% on a constant currency basis. The increase is due to the same factors driving the increase in NOI mentioned above.

For the third quarter of 2023, Core FFO was $69.6 million, or $0.25 per diluted share, compared to $67.1 million, or $0.25 per diluted share, for the third quarter of 2022.

For the third quarter of 2023, AFFO was $88.2 million, or $0.32 per diluted share, compared to $79.3 million, or $0.29 per diluted share, for the same quarter of the prior year.

Please see the Company’s supplemental financial information for the definitions and reconciliations of non-GAAP financial measures to the most comparable GAAP financial measures.

Third Quarter 2023 Global Warehouse Segment Results

For the third quarter of 2023, Global Warehouse segment revenue was $602.6 million, an increase of $3.6 million, or 0.6%, compared to $599.0 million for the third quarter of 2022. This growth was principally driven by growth from our same store pool resulting from higher economic occupancy, our pricing initiative, and rate escalations. Additionally, our non-same store pool contributed revenue from our recently completed development projects and acquisitions. This was partially offset by lower throughput pallets due to consumer buying habits and the unfavorable impact of foreign currency translation.

Global Warehouse segment contribution (NOI) was $177.8 million for the third quarter of 2023 as compared to $166.7 million for the third quarter of 2022. Global Warehouse segment contribution (NOI) increased due to the drivers of warehouse revenue increase mentioned above, partially offset by the impact of inflationary pressures, start-up costs for our developments, and the unfavorable impact of foreign currency translation. Global Warehouse segment margin was 29.5% for the third quarter of 2023, a 169 basis point increase compared to the same quarter of the prior year.

We had 219 same store warehouses for the three months ended September 30, 2023. The following table presents revenues, contribution (NOI) and margins for our same store and non-same store warehouses with a reconciliation to the total financial metrics of our warehouse segment for the three months ended September 30, 2023. Refer to our “Real Estate Portfolio” section below for the composition of our non-same store pool.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | | | |

| Dollars and units in thousands, except per pallet data | 2023 Actual | | 2023 Constant Currency(1) | | 2022 Actual | | Actual | | Constant Currency | | | | | | |

| | | | | | | | | | | | | | | |

| TOTAL WAREHOUSE SEGMENT | | | | | | | | | | | | | | | |

| Number of total warehouses | 238 | | | | 240 | | n/a | | n/a | | | | | | |

| | | | | | | | | | | | | | | |

| Rent and storage | $ | 278,508 | | | $ | 280,319 | | | $ | 260,248 | | | 7.0 | % | | 7.7 | % | | | | | | |

| Warehouse services | 324,097 | | | 324,974 | | | 338,729 | | | (4.3) | % | | (4.1) | % | | | | | | |

| Total revenue | $ | 602,605 | | | $ | 605,293 | | | $ | 598,977 | | | 0.6 | % | | 1.1 | % | | | | | | |

| Global Warehouse contribution (NOI) | $ | 177,832 | | | $ | 178,570 | | | $ | 166,662 | | | 6.7 | % | | 7.1 | % | | | | | | |

| Global Warehouse margin | 29.5 | % | | 29.5 | % | | 27.8 | % | | 169 bps | | 168 bps | | | | | | |

| | | | | | | | | | | | | | | |

| Global Warehouse rent and storage metrics: | | | | | | | | | | | | | | | |

| Average economic occupied pallets | 4,512 | | | n/a | | 4,356 | | | 3.6 | % | | n/a | | | | | | |

| Average physical occupied pallets | 4,061 | | | n/a | | 4,043 | | | 0.5 | % | | n/a | | | | | | |

| Average physical pallet positions | 5,435 | | | n/a | | 5,441 | | | (0.1) | % | | n/a | | | | | | |

| Economic occupancy percentage | 83.0 | % | | n/a | | 80.1 | % | | 293 bps | | n/a | | | | | | |

| Physical occupancy percentage | 74.7 | % | | n/a | | 74.3 | % | | 42 bps | | n/a | | | | | | |

| Total rent and storage revenue per average economic occupied pallet | $ | 61.73 | | | $ | 62.13 | | | $ | 59.73 | | | 3.3 | % | | 4.0 | % | | | | | | |

| Total rent and storage revenue per average physical occupied pallet | $ | 68.57 | | | $ | 69.02 | | | $ | 64.37 | | | 6.5 | % | | 7.2 | % | | | | | | |

| Global Warehouse services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 9,370 | | | n/a | | 10,214 | | | (8.3) | % | | n/a | | | | | | |

| Total warehouse services revenue per throughput pallet | $ | 34.59 | | | $ | 34.68 | | | $ | 33.16 | | | 4.3 | % | | 4.6 | % | | | | | | |

| | | | | | | | | | | | | | | |

| SAME STORE WAREHOUSE | | | | | | | | | | | | | | | |

| Number of same store warehouses | 219 | | | | 219 | | n/a | | n/a | | | | | | |

| Global Warehouse same store revenue: | | | | | | | | | | | | | | | |

| Rent and storage | $ | 257,914 | | | $ | 260,225 | | | $ | 245,608 | | | 5.0 | % | | 6.0 | % | | | | | | |

| Warehouse services | 308,740 | | | 310,129 | | | 321,220 | | | (3.9) | % | | (3.5) | % | | | | | | |

| Total same store revenue | $ | 566,654 | | | $ | 570,354 | | | $ | 566,828 | | | — | % | | 0.6 | % | | | | | | |

| Global Warehouse same store contribution (NOI) | $ | 173,099 | | | $ | 174,348 | | | $ | 165,574 | | | 4.5 | % | | 5.3 | % | | | | | | |

| Global Warehouse same store margin | 30.5 | % | | 30.6 | % | | 29.2 | % | | 134 bps | | 136 bps | | | | | | |

| | | | | | | | | | | | | | | |

| Global Warehouse same store rent and storage metrics: | | | | | | | | | | | | | | | |

| Average economic occupied pallets | 4,230 | | | n/a | | 4,131 | | | 2.4 | % | | n/a | | | | | | |

| Average physical occupied pallets | 3,816 | | | n/a | | 3,839 | | | (0.6) | % | | n/a | | | | | | |

| Average physical pallet positions | 5,036 | | | n/a | | 5,130 | | | (1.8) | % | | n/a | | | | | | |

| Economic occupancy percentage | 84.0 | % | | n/a | | 80.5 | % | | 345 bps | | n/a | | | | | | |

| Physical occupancy percentage | 75.8 | % | | n/a | | 74.8 | % | | 93 bps | | n/a | | | | | | |

| Same store rent and storage revenue per average economic occupied pallet | $ | 60.98 | | | $ | 61.52 | | | $ | 59.45 | | | 2.6 | % | | 3.5 | % | | | | | | |

| Same store rent and storage revenue per average physical occupied pallet | $ | 67.58 | | | $ | 68.19 | | | $ | 63.98 | | | 5.6 | % | | 6.6 | % | | | | | | |

| Global Warehouse same store services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 8,798 | | | n/a | | 9,665 | | | (9.0) | % | | n/a | | | | | | |

| Same store warehouse services revenue per throughput pallet | $ | 35.09 | | | $ | 35.25 | | | $ | 33.24 | | | 5.6 | % | | 6.1 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | | | | | |

| Dollars and units in thousands, except per pallet data | 2023 Actual | | 2023 Constant Currency(1) | | 2022 Actual | | Actual | | Constant Currency | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| NON-SAME STORE WAREHOUSE | | | | | | | | | | | | | | | |

Number of non-same store warehouses(2) | 19 | | | | 21 | | n/a | | n/a | | | | | | |

| Global Warehouse non-same store revenue: | | | | | | | | | | | | | | | |

| Rent and storage | $ | 20,594 | | | $ | 20,094 | | | $ | 14,640 | | | n/r | | n/r | | | | | | |

| Warehouse services | 15,357 | | | 14,845 | | | 17,509 | | | n/r | | n/r | | | | | | |

| Total non-same store revenue | $ | 35,951 | | | $ | 34,939 | | | $ | 32,149 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store contribution (NOI) | $ | 4,733 | | | $ | 4,222 | | | $ | 1,088 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store margin | 13.2 | % | | 12.1 | % | | 3.4 | % | | n/r | | n/r | | | | | | |

| | | | | | | | | | | | | | | |

| Global Warehouse non-same store rent and storage metrics: | | | | | | | | | | | | | | |

| Average economic occupied pallets | 282 | | | n/a | | 226 | | | n/r | | n/a | | | | | | |

| Average physical occupied pallets | 245 | | | n/a | | 204 | | | n/r | | n/a | | | | | | |

| Average physical pallet positions | 399 | | | n/a | | 311 | | | n/r | | n/a | | | | | | |

| Economic occupancy percentage | 70.6 | % | | n/a | | 72.5 | % | | n/r | | n/a | | | | | | |

| Physical occupancy percentage | 61.5 | % | | n/a | | 65.5 | % | | n/r | | n/a | | | | | | |

| Non-same store rent and storage revenue per average economic occupied pallet | $ | 73.08 | | | $ | 71.31 | | | $ | 64.83 | | | n/r | | n/r | | | | | | |

| Non-same store rent and storage revenue per average physical occupied pallet | $ | 83.99 | | | $ | 81.95 | | | $ | 71.83 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 572 | | | n/a | | 550 | | | n/r | | n/a | | | | | | |

| Non-same store warehouse services revenue per throughput pallet | $ | 26.84 | | | $ | 25.95 | | | $ | 31.85 | | | n/r | | n/r | | | | | | |

(1) The adjustments from our U.S. GAAP operating results to calculate our operating results on a constant currency basis are the effect of changes in foreign currency exchange rates relative to the comparable prior period.

(2) Refer to our “Real Estate Portfolio” section below for the composition of our non-same store pool.

(n/a = not applicable)

(n/r = not relevant)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, | | Change | | | | |

| Dollars in thousands | 2023 Actual | | 2023 Constant Currency(1) | | 2022 Actual | | Actual | | Constant currency | | | | | | |

| | | | | | | | | | | | | | | |

| TOTAL WAREHOUSE SEGMENT | | | | | | | | | | | | | | | |

| Number of total warehouses | 238 | | | | 240 | | n/a | | n/a | | | | | | |

| Global Warehouse revenue: | | | | | | | | | | | | | | | |

| Rent and storage | $ | 825,100 | | | $ | 834,559 | | | $ | 732,356 | | | 12.7 | % | | 14.0 | % | | | | | | |

| Warehouse services | 953,727 | | | 962,963 | | | 971,925 | | | (1.9) | % | | (0.9) | % | | | | | | |

| Total revenue | $ | 1,778,827 | | | $ | 1,797,522 | | | $ | 1,704,281 | | | 4.4 | % | | 5.5 | % | | | | | | |

| Global Warehouse contribution (NOI) | $ | 525,501 | | | $ | 530,610 | | | $ | 463,905 | | | 13.3 | % | | 14.4 | % | | | | | | |

| Global Warehouse margin | 29.5 | % | | 29.5 | % | | 27.2 | % | | 232 bps | | 230 bps | | | | | | |

| Units in thousands except per pallet data | | | | | | | | | | | | | | | |

| Global Warehouse rent and storage metrics: | | | | | | | | | | | | | | | |

| Average economic occupied pallets | 4,548 | | | n/a | | 4,245 | | | 7.1 | % | | n/a | | | | | | |

| Average physical occupied pallets | 4,146 | | | n/a | | 3,912 | | | 6.0 | % | | n/a | | | | | | |

| Average physical pallet positions | 5,425 | | | n/a | | 5,437 | | | (0.2) | % | | n/a | | | | | | |

| Economic occupancy percentage | 83.8 | % | | n/a | | 78.1 | % | | 575 bps | | n/a | | | | | | |

| Physical occupancy percentage | 76.4 | % | | n/a | | 72.0 | % | | 447 bps | | n/a | | | | | | |

| Total rent and storage revenue per average economic occupied pallet | $ | 181.41 | | | $ | 183.49 | | | $ | 172.51 | | | 5.2 | % | | 6.4 | % | | | | | | |

| Total rent and storage revenue per average physical occupied pallet | $ | 199.01 | | | $ | 201.29 | | | $ | 187.22 | | | 6.3 | % | | 7.5 | % | | | | | | |

| Global Warehouse services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 28,140 | | | n/a | | 30,128 | | | (6.6) | % | | n/a | | | | | | |

| Total warehouse services revenue per throughput pallet | $ | 33.89 | | | $ | 34.22 | | | $ | 32.26 | | | 5.1 | % | | 6.1 | % | | | | | | |

| | | | | | | | | | | | | | | |

| SAME STORE WAREHOUSE | | | | | | | | | | | | | | | |

| Number of same store warehouses | 219 | | | | 219 | | n/a | | n/a | | | | | | |

| Global Warehouse same store revenue: | | | | | | | | | | | | | | | |

| Rent and storage | $ | 769,873 | | | $ | 778,983 | | | $ | 691,118 | | | 11.4 | % | | 12.7 | % | | | | | | |

| Warehouse services | 913,832 | | | 922,704 | | | 922,730 | | | (1.0) | % | | — | % | | | | | | |

| Total same store revenue | $ | 1,683,705 | | | $ | 1,701,687 | | | $ | 1,613,848 | | | 4.3 | % | | 5.4 | % | | | | | | |

| Global Warehouse same store contribution (NOI) | $ | 523,395 | | | $ | 528,519 | | | $ | 461,213 | | | 13.5 | % | | 14.6 | % | | | | | | |

| Global Warehouse same store margin | 31.1 | % | | 31.1 | % | | 28.6 | % | | 251 bps | | 248 bps | | | | | | |

| Units in thousands except per pallet data | | | | | | | | | | | | | | | |

| Global Warehouse same store rent and storage metrics: | | | | | | | | | | | | | | | |

| Average economic occupied pallets | 4,286 | | | n/a | | 4,032 | | | 6.3 | % | | n/a | | | | | | |

| Average physical occupied pallets | 3,918 | | | n/a | | 3,713 | | | 5.5 | % | | n/a | | | | | | |

| Average physical pallet positions | 5,074 | | | n/a | | 5,136 | | | (1.2) | % | | n/a | | | | | | |

| Economic occupancy percentage | 84.5 | % | | n/a | | 78.5 | % | | 597 bps | | n/a | | | | | | |

| Physical occupancy percentage | 77.2 | % | | n/a | | 72.3 | % | | 493 bps | | n/a | | | | | | |

| Same store rent and storage revenue per average economic occupied pallet | $ | 179.61 | | | $ | 181.74 | | | $ | 171.41 | | | 4.8 | % | | 6.0 | % | | | | | | |

| Same store rent and storage revenue per average physical occupied pallet | $ | 196.47 | | | $ | 198.80 | | | $ | 186.14 | | | 5.6 | % | | 6.8 | % | | | | | | |

| Global Warehouse same store services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 26,543 | | | n/a | | 28,444 | | | (6.7) | % | | n/a | | | | | | |

| Same store warehouse services revenue per throughput pallet | $ | 34.43 | | | $ | 34.76 | | | $ | 32.44 | | | 6.1 | % | | 7.2 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, | | Change | | | | | | |

| Dollars in thousands | 2023 Actual | | 2023 Constant Currency(1) | | 2022 Actual | | Actual | | Constant currency | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| NON-SAME STORE WAREHOUSE | | | | | | | | | | | | | | | |

Number of non-same store warehouses(2) | 19 | | | | 21 | | n/a | | n/a | | | | | | |

| Global Warehouse non-same store revenue: | | | | | | | | | | | | | | | |

| Rent and storage | $ | 55,227 | | | $ | 55,576 | | | $ | 41,239 | | | n/r | | n/r | | | | | | |

| Warehouse services | 39,895 | | | 40,259 | | | 49,194 | | | n/r | | n/r | | | | | | |

| Total non-same store revenue | $ | 95,122 | | | $ | 95,835 | | | $ | 90,433 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store contribution (NOI) | $ | 2,106 | | | $ | 2,092 | | | $ | 2,692 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store margin | 2.2 | % | | 2.2 | % | | 3.0 | % | | n/r | | n/r | | | | | | |

| Units in thousands except per pallet data | | | | | | | | | | | | | | | |

| Global Warehouse non-same store rent and storage metrics: | | | | | | | | | | | | | | |

| Average economic occupied pallets | 262 | | | n/a | | 213 | | | n/r | | n/a | | | | | | |

| Average physical occupied pallets | 228 | | | n/a | | 199 | | | n/r | | n/a | | | | | | |

| Average physical pallet positions | 351 | | | n/a | | 300 | | | n/r | | n/a | | | | | | |

| Economic occupancy percentage | 74.6 | % | | n/a | | 71.0 | % | | n/r | | n/a | | | | | | |

| Physical occupancy percentage | 64.9 | % | | n/a | | 66.2 | % | | n/r | | n/a | | | | | | |

| Non-same store rent and storage revenue per average economic occupied pallet | $ | 210.92 | | | $ | 212.25 | | | $ | 193.39 | | | n/r | | n/r | | | | | | |

| Non-same store rent and storage revenue per average physical occupied pallet | $ | 242.65 | | | $ | 244.18 | | | $ | 207.38 | | | n/r | | n/r | | | | | | |

| Global Warehouse non-same store services metrics: | | | | | | | | | | | | | | | |

| Throughput pallets | 1,597 | | | n/a | | 1,683 | | | n/r | | n/a | | | | | | |

| Non-same store warehouse services revenue per throughput pallet | $ | 24.98 | | | $ | 25.21 | | | $ | 29.22 | | | n/r | | n/r | | | | | | |

(1) The adjustments from our U.S. GAAP operating results to calculate our operating results on a constant currency basis are the effect of changes in foreign currency exchange rates relative to the comparable prior period.

(2) Refer to our “Real Estate Portfolio” section below for the composition of our non-same store pool.

(n/a = not applicable)

(n/r = not relevant)

Fixed Commitment Rent and Storage Revenue

As of September 30, 2023, $550.7 million of the Company’s annualized rent and storage revenue were derived from customers with fixed commitment storage contracts. This compares to $521.3 million at the end of the second quarter of 2023 and $379.3 million at the end of the third quarter of 2022. We continue to make progress on commercializing business under this type of arrangement. On a combined pro forma basis, assuming a full twelve months of acquisitions revenue, 50.4% of rent and storage revenue was generated from fixed commitment storage contracts.

Economic and Physical Occupancy

Contracts that contain fixed commitments are designed to ensure the Company’s customers have space available when needed. For the third quarter of 2023, economic occupancy for the total warehouse segment was 83.0% and warehouse segment same store pool was 84.0%, representing a 828 basis point and 821 basis point increase above physical occupancy, respectively. Economic occupancy for the total warehouse segment increased 293 basis points, and the warehouse segment same store pool increased 345 basis points as compared to the third quarter of 2022. The growth in occupancy reflects our customer service initiatives, paired with customers’ increased food production levels throughout the end of 2022 and 2023.

Real Estate Portfolio

As of September 30, 2023, the Company’s portfolio consists of 243 facilities. The Company ended the third quarter of 2023 with 238 facilities in its Global Warehouse segment portfolio and five facilities in its Third-party managed segment. The same store population consists of 219 facilities for the quarter ended September 30, 2023. The remaining 19 non-same store population consists of: two sites acquired through acquisition, 11 sites in the expansion and development phase, three leased sites that we purchased, one temporarily leased facility in Australia, one leased facility we ceased operations during fourth quarter of 2022 in anticipation of the upcoming lease maturity, and one leased site we exited in preparation to lease to a third party.

Balance Sheet Activity and Liquidity

As of September 30, 2023, the Company had total liquidity of approximately $823.8 million, including cash and capacity on its revolving credit facility. Total debt outstanding was $3.2 billion (inclusive of $234.5 million of financing leases/sale lease-backs and exclusive of unamortized deferred financing fees), of which 93% was in an unsecured structure. At quarter end, net debt to pro forma Core EBITDA was approximately 5.7x. The Company’s total debt outstanding includes $2.9 billion of real estate debt, which excludes sale-leaseback and financing lease obligations. The Company’s real estate debt has a remaining weighted average term of 5.5 years and carries a weighted average contractual interest rate of 3.8%. As of September 30, 2023, 89.0% of the Company’s total debt outstanding was at a fixed rate, inclusive of hedged variable-rate for fixed-rate debt. The Company has no material debt maturities until 2026, inclusive of extension options.

Dividend

On September 1, 2023, the Company’s Board of Directors declared a dividend of $0.22 per share for the third quarter of 2023, which was paid on October 13, 2023 to common stockholders of record as of September 30, 2023.

2023 Outlook

The Company is maintaining its annual AFFO per share guidance to be within the range of $1.24 - $1.30. Refer to page 40 of this Financial Supplement for the details of our annual guidance. The Company’s guidance is provided for informational purposes based on current plans and assumptions and is subject to change. The ranges for these metrics do not include the impact of acquisitions, dispositions, or capital markets activity beyond that which has been previously announced.

Investor Webcast and Conference Call

The Company will hold a webcast and conference call on Thursday, November 2, 2023 at 5:00 p.m. Eastern Time to discuss its third quarter 2023 results. A live webcast of the call will be available via the Investors section of Americold Realty Trust’s website at www.americold.com. To listen to the live webcast, please go to the site at least fifteen minutes prior to the scheduled start time in order to register, download and install any necessary audio software. Shortly after the call, a replay of the webcast will be available for 90 days on the Company’s website.

The conference call can also be accessed by dialing 1-877-407-3982 or 1-201-493-6780. The telephone replay can be accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing the conference ID#13740732. The telephone replay will be available starting shortly after the call until November 16, 2023.

The Company’s supplemental package will be available prior to the conference call in the Investors section of the Company’s website at http://ir.americold.com.

About the Company

Americold is a global leader in temperature-controlled logistics real estate and value added services. Focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, Americold owns and/or operates 243 temperature-controlled warehouses, with approximately 1.5 billion refrigerated cubic feet of storage, in North America, Europe, Asia-Pacific, and South America. Americold’s facilities are an integral component of the supply chain connecting food producers, processors, distributors and retailers to consumers.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including NAREIT FFO, core FFO, AFFO, EBITDAre, Core EBITDA; same store segment revenue, contribution (NOI), margin, and maintenance capital expenditures. Definitions of these non-GAAP metrics are included in our quarterly financial supplement, and reconciliations of these non-GAAP measures to their most comparable GAAP metrics are included herein. Each of the non-GAAP measures included in this press release has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of the Company’s results calculated in accordance with GAAP. In addition, because not all companies use identical calculations, the Company’s presentation of non-GAAP measures in this press release may not be comparable to similarly titled measures disclosed by other companies, including other REITs.

Forward-Looking Statements

This press release contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include the following: rising inflationary pressures, increased interest rates and operating costs; labor and power costs; labor shortages; our relationship with our associates, the occurrence of any work stoppages or any disputes under our collective bargaining agreements and employment related litigation; the impact of supply chain disruptions, including, among others, the impact on labor availability, raw material availability, manufacturing and food production and transportation; risks related to rising construction costs; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns within expected time frames, or at all, in respect thereof; uncertainty of revenues, given the nature of our customer contracts; acquisition risks, including the failure to identify or complete attractive acquisitions or the failure of acquisitions to perform in accordance with projections and to realize anticipated cost savings and revenue improvements; our failure to realize the intended benefits from our recent acquisitions including synergies, or disruptions to our plans and operations or unknown or contingent liabilities related to our recent acquisitions; difficulties in expanding our operations into new markets, including international markets; uncertainties and risks related to public health crises, such as the COVID-19 pandemic; a failure of our information technology systems, systems conversions and integrations, cybersecurity attacks or a breach of our information security systems, networks or processes could cause business disruptions, loss of critical and confidential information, an adverse impact on our results and reputation, incurring additional and significant costs to address any malicious attack including costs to remediate and implement proactive, preventative actions against cyber breaches, including those related to the cyber matter which occurred on April 26, 2023; disruption caused by implementation of the new

ERP system, potential cost overruns, timing and control risks and failure to recognize anticipated cost savings and increased productivity from the implementation of the new ERP system; defaults or non-renewals of significant customer contracts; risks related to privacy and data security concerns, and data collection and transfer restrictions and related foreign regulations; changes in applicable governmental regulations and tax legislation, including in the international markets; risks related to current and potential international operations and properties; actions by our competitors and their increasing ability to compete with us; changes in foreign currency exchange rates; the potential liabilities, costs and regulatory impacts associated with our in-house trucking services and the potential disruptions associated with our use of third-party trucking service providers to provide transportation services to our customers; liabilities as a result of our participation in multi-employer pension plans; risks related to the partial ownership of properties, including as a result of our lack of control over such investments, financial condition of JV partners, disputes with JV partners, regulatory risks, brand recognition risks and the failure of such entities to perform in accordance with projections; risks related to natural disasters such as fires, floods, tornadoes, hurricanes and earthquakes; adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; changes in real estate and zoning laws and increases in real property tax rates; general economic conditions; risks associated with the ownership of real estate generally and temperature-controlled warehouses in particular; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; uninsured losses or losses in excess of our insurance coverage; financial market fluctuations; our failure to obtain necessary outside financing; risks related to, or restrictions contained in, our debt financings; decreased storage rates or increased vacancy rates; the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our stockholders to replace our directors and affect the price of our common stock; the potential dilutive effect of our common stock offerings; the cost and time requirements as a result of our operation as a publicly traded REIT; and our failure to maintain our status as a REIT.

Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near-term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements included in this press release include those regarding our 2023 outlook and our migration of our customers to fixed commitment storage contracts. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023, and other reports filed with the Securities and Exchange Commission, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Contacts:

Americold Realty Trust, Inc.

Investor Relations

Telephone: 678-459-1959

Email: investor.relations@americold.com

| | | | | | | | | | | |

| Americold Realty Trust, Inc. and Subsidiaries |

| Condensed Consolidated Balance Sheets (Unaudited) |

| (In thousands, except shares and per share amounts) |

| September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Property, buildings and equipment: | | | |

| Land | $ | 794,776 | | | $ | 786,975 | |

| Buildings and improvements | 4,390,940 | | | 4,245,607 | |

| Machinery and equipment | 1,501,899 | | | 1,407,874 | |

| Assets under construction | 452,557 | | | 526,811 | |

| 7,140,172 | | | 6,967,267 | |

| Accumulated depreciation | (2,107,133) | | | (1,901,450) | |

| Property, buildings and equipment – net | 5,033,039 | | | 5,065,817 | |

| | | |

| Operating lease right-of-use assets | 342,031 | | | 352,553 | |

| Accumulated depreciation – operating leases | (88,851) | | | (76,334) | |

| Operating leases – net | 253,180 | | | 276,219 | |

| Financing leases: | | | |

| Buildings and improvements | 13,548 | | | 13,546 | |

| Machinery and equipment | 137,038 | | | 127,009 | |

| 150,586 | | | 140,555 | |

| Accumulated depreciation – financing leases | (71,121) | | | (57,626) | |

| Financing leases – net | 79,465 | | | 82,929 | |

| | | |

| Cash, cash equivalents and restricted cash | 53,831 | | | 53,063 | |

| | | |

Accounts receivable – net of allowance of $18,470 and $15,951 at September 30, 2023 and December 31, 2022, respectively | 424,540 | | | 430,042 | |

| Identifiable intangible assets – net | 897,238 | | | 925,223 | |

| Goodwill | 1,022,989 | | | 1,033,637 | |

| Investments in partially owned entities and other | 36,249 | | | 78,926 | |

| Other assets | 213,188 | | | 158,705 | |

| | | |

| Total assets | $ | 8,013,719 | | | $ | 8,104,561 | |

| | | |

| Liabilities and equity | | | |

| Liabilities: | | | |

| Borrowings under revolving line of credit | $ | 359,201 | | | $ | 500,052 | |

| Accounts payable and accrued expenses | 501,662 | | | 557,540 | |

Senior unsecured notes and term loans – net of deferred financing costs of $11,173 and $13,044, in the aggregate, at September 30, 2023 and December 31, 2022, respectively | 2,560,927 | | | 2,569,281 | |

| Sale-leaseback financing obligations | 164,372 | | | 171,089 | |

| Financing lease obligations | 70,170 | | | 77,561 | |

| Operating lease obligations | 245,034 | | | 264,634 | |

| Unearned revenue | 29,865 | | | 32,046 | |

| Pension and postretirement benefits | 2,398 | | | 1,531 | |

| Deferred tax liability – net | 125,890 | | | 135,098 | |

| Multi-employer pension plan withdrawal liability | 7,550 | | | 7,851 | |

| | | |

| Total liabilities | 4,067,069 | | | 4,316,683 | |

| | | |

| Equity | | | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value per share – 500,000,000 authorized shares; 283,517,013 and 269,814,956 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 2,835 | | | 2,698 | |

| Paid-in capital | 5,622,152 | | | 5,191,969 | |

| Accumulated deficit and distributions in excess of net earnings | (1,706,591) | | | (1,415,198) | |

| Accumulated other comprehensive loss | 11,459 | | | (6,050) | |

| Total stockholders’ equity | 3,929,855 | | | 3,773,419 | |

| Noncontrolling interests: | | | |

| Noncontrolling interests in Operating Partnership | 16,795 | | | 14,459 | |

| Total equity | 3,946,650 | | | 3,787,878 | |

| | | |

| Total liabilities and equity | $ | 8,013,719 | | | $ | 8,104,561 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Americold Realty Trust, Inc. and Subsidiaries |

| Condensed Consolidated Statements of Operations (Unaudited) |

| (In thousands, except per share amounts) |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Rent, storage and warehouse services | $ | 602,605 | | | $ | 598,977 | | | $ | 1,778,827 | | | $ | 1,704,281 | |

| Transportation services | 55,642 | | | 76,367 | | | 181,792 | | | 237,168 | |

| Third-party managed services | 9,692 | | | 82,436 | | | 33,419 | | | 251,782 | |

| | | | | | | |

| Total revenues | 667,939 | | | 757,780 | | | 1,994,038 | | | 2,193,231 | |

| Operating expenses: | | | | | | | |

| Rent, storage and warehouse services cost of operations | 424,773 | | | 432,315 | | | 1,253,326 | | | 1,240,376 | |

| Transportation services cost of operations | 45,983 | | | 65,531 | | | 150,664 | | | 204,218 | |

| Third-party managed services cost of operations | 8,063 | | | 78,776 | | | 29,311 | | | 240,900 | |

| | | | | | | |

| Depreciation and amortization | 89,728 | | | 83,669 | | | 259,644 | | | 248,979 | |

| Selling, general and administrative | 52,383 | | | 57,119 | | | 169,023 | | | 170,994 | |

| Acquisition, cyber incident and other, net | 13,931 | | | 4,874 | | | 48,313 | | | 20,612 | |

| Impairment of indefinite and long-lived assets | — | | | 6,616 | | | — | | | 6,616 | |

| Loss (gain) from sale of real estate | 78 | | | 5,710 | | | (2,259) | | | 5,710 | |

| Total operating expenses | 634,939 | | | 734,610 | | | 1,908,022 | | | 2,138,405 | |

| | | | | | | |

| Operating income | 33,000 | | | 23,170 | | | 86,016 | | | 54,826 | |

| | | | | | | |

| Other (expense) income: | | | | | | | |

| Interest expense | (35,572) | | | (30,402) | | | (106,426) | | | (82,720) | |

| Loss on debt extinguishment, modifications and termination of derivative instruments | (683) | | | (1,040) | | | (1,855) | | | (2,284) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (Loss) gain from investments in partially owned entities | (259) | | | 44 | | | (1,616) | | | (779) | |

| Impairment of related party loan receivable | — | | | — | | | (21,972) | | | — | |

| Loss on put option | — | | | — | | | (56,576) | | | — | |

| | | | | | | |

| Other, net | 723 | | | (2,593) | | | 1,741 | | | (1,197) | |

| Loss from continuing operations before income taxes | (3,514) | | | (8,228) | | | (102,429) | | | (30,957) | |

| | | | | | | |

| Income tax (expense) benefit: | | | | | | | |

| Current | (1,981) | | | (1,006) | | | (5,881) | | | (3,004) | |

| Deferred | 2,473 | | | 4,374 | | | 7,553 | | | 19,149 | |

| Total income tax benefit | 492 | | | 3,368 | | | 1,672 | | | 16,145 | |

| | | | | | | |

| Net (loss) income: | | | | | | | |

| Loss from continuing operations | (3,022) | | | (4,860) | | | (100,757) | | | (14,812) | |

| Gain (loss) from discontinued operations, net of tax | 203 | | | (1,484) | | | (10,453) | | | (6,420) | |

| Net loss | $ | (2,819) | | | $ | (6,344) | | | $ | (111,210) | | | $ | (21,232) | |

| Net loss attributable to noncontrolling interests | (8) | | | (25) | | | (95) | | | (45) | |

| Net loss attributable to Americold Realty Trust, Inc. | $ | (2,811) | | | $ | (6,319) | | | $ | (111,115) | | | $ | (21,187) | |

| | | | | | | |

| Weighted average common stock outstanding – basic | 278,137 | | | 269,586 | | | 273,217 | | | 269,467 | |

| Weighted average common stock outstanding – diluted | 278,137 | | | 269,586 | | | 273,217 | | | 269,467 | |

| | | | | | | |

| Net loss per common share from continuing operations - basic | $ | (0.01) | | | $ | (0.03) | | | $ | (0.36) | | | $ | (0.06) | |

| Net loss per common share from discontinued operations - basic | $ | — | | | $ | — | | | $ | (0.04) | | | $ | (0.02) | |

Basic loss per share(1) | $ | (0.01) | | | $ | (0.03) | | | $ | (0.40) | | | $ | (0.08) | |

| | | | | | | |

| Net loss per common share from continuing operations - diluted | $ | (0.01) | | | $ | (0.03) | | | $ | (0.36) | | | $ | (0.06) | |

| Net loss per common share from discontinued operations - diluted | $ | — | | | $ | — | | | $ | (0.04) | | | $ | (0.02) | |

Diluted loss per share(1) | $ | (0.01) | | | $ | (0.03) | | | $ | (0.40) | | | $ | (0.08) | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net (Loss) Income to NAREIT FFO, Core FFO, and AFFO | |

| (In thousands, except per share amounts) | |

| | Three Months Ended | | YTD |

| Q3 23 | Q2 23 | Q1 23 | Q4 22 | Q3 22 | | 2023 | |

| Net (loss) income | $ | (2,096) | | $ | (104,802) | | $ | (2,571) | | $ | 2,955 | | $ | (8,937) | | | $ | (109,469) | | |

| Adjustments: | | | | | | | | |

| Real estate related depreciation | 56,373 | | 54,740 | | 54,541 | | 53,094 | | 53,139 | | | 165,654 | | |

| Loss (gain) on sale of real estate | 78 | | (2,528) | | 191 | | (21) | | 5,710 | | | (2,259) | | |

| Net (gain) loss on asset disposals | (25) | | — | | — | | 175 | | 893 | | | (25) | | |

| | | | | | | | |

| Impairment charges on real estate assets | — | | — | | — | | — | | 3,407 | | | — | | |

| Our share of reconciling items related to partially owned entities | 290 | | 232 | | 903 | | 1,209 | | 822 | | | 1,425 | | |

| | | | | | | | |

| | | | | | | | |

NAREIT FFO(b) | $ | 54,620 | | $ | (52,358) | | $ | 53,064 | | $ | 57,412 | | $ | 55,034 | | | $ | 55,326 | | |

| Adjustments: | | | | | | | | |

| Net (gain) loss on sale of non-real estate assets | (296) | | 289 | | 420 | | 2,274 | | 310 | | | 413 | | |

| Acquisition, cyber incident and other, net | 13,931 | | 27,235 | | 7,147 | | 11,899 | | 4,874 | | | 48,313 | | |

| Goodwill impairment | — | | — | | — | | — | | 3,209 | | | — | | |

| | | | | | | | |

| Loss on debt extinguishment, modifications and termination of derivative instruments | 683 | | 627 | | 545 | | 933 | | 1,040 | | | 1,855 | | |

| | | | | | | | |

| Foreign currency exchange loss (gain) | 705 | | 212 | | (458) | | (2,477) | | 2,487 | | | 459 | | |

| | | | | | | | |

| | | | | | | | |

| Our share of reconciling items related to partially owned entities | 147 | | (27) | | 128 | | 127 | | 136 | | | 248 | | |

| (Loss) gain from discontinued operations, net of tax | (203) | | 8,275 | | — | | — | | — | | | 8,072 | | |

| Impairment of related party loan receivable | — | | 21,972 | | — | | — | | — | | | 21,972 | | |

| Loss on put option | — | | 56,576 | | — | | — | | — | | | 56,576 | | |

| Gain on sale of LATAM JV | — | | (304) | | — | | — | | — | | | (304) | | |

Core FFO(b) | $ | 69,587 | | $ | 62,497 | | $ | 60,846 | | $ | 70,168 | | $ | 67,090 | | | $ | 192,930 | | |

| Adjustments: | | | | | | | | |

| Amortization of deferred financing costs and pension withdrawal liability | 1,286 | | 1,279 | | 1,240 | | 1,305 | | 1,222 | | | 3,805 | | |

| Amortization of below/above market leases | 369 | | 375 | | 402 | | 534 | | 540 | | | 1,146 | | |

| Non-real estate asset impairment | — | | — | | — | | 764 | | — | | | — | | |

| Straight-line net rent | 544 | | 361 | | (491) | | 333 | | 133 | | | 414 | | |

| Deferred income tax benefit | (2,473) | | (1,459) | | (3,621) | | (3,412) | | (4,374) | | | (7,553) | | |

| Share-based compensation expense | 6,203 | | 4,639 | | 6,970 | | 5,036 | | 6,720 | | | 17,812 | | |

| Non-real estate depreciation and amortization | 33,355 | | 30,152 | | 30,483 | | 29,373 | | 30,530 | | | 93,990 | | |

| | | | | | | | |

| Maintenance capital expenditures | (20,907) | | (22,590) | | (16,244) | | (26,701) | | (22,586) | | | (59,741) | | |

| Our share of reconciling items related to partially owned entities | 198 | | 303 | | 304 | | 819 | | 57 | | | 805 | | |

Adjusted FFO(b) | $ | 88,162 | | $ | 75,557 | | $ | 79,889 | | $ | 78,219 | | $ | 79,332 | | | 243,608 | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) to NAREIT FFO, Core FFO, and AFFO (continued) |

| (In thousands except per share amounts) |

| Three Months Ended | | YTD |

| Q3 23 | Q2 23 | Q1 23 | Q4 22 | Q3 22 | | 2023 | |

| | | | | | | | |

NAREIT Funds from operations(b) | $ | 54,620 | | $ | (52,358) | | $ | 53,064 | | $ | 57,412 | | $ | 55,034 | | | $ | 55,326 | | |

| | | | | | | | |

Core FFO(b) | $ | 69,587 | | $ | 62,497 | | $ | 60,846 | | $ | 70,168 | | $ | 67,090 | | | $ | 192,930 | | |

Adjusted FFO(b) | $ | 88,162 | | $ | 75,557 | | $ | 79,889 | | $ | 78,219 | | $ | 79,332 | | | $ | 243,608 | | |

| | | | | | | | |

| Reconciliation of weighted average shares: | | | | | | | | |

| Weighted average basic shares for net income calculation | 278,137 | | 270,462 | | 270,230 | | 269,826 | | 269,586 | | | 273,217 | | |

| Dilutive stock options and unvested restricted stock units | 519 | | 695 | | 778 | | 944 | | 1,105 | | | 388 | | |

| Weighted average dilutive shares | 278,656 | | 271,157 | | 271,008 | | 270,770 | | 270,691 | | | 273,605 | | |

| | | | | | | | |

NAREIT FFO - basic per share(b) | $ | 0.20 | | $ | (0.19) | | $ | 0.20 | | $ | 0.21 | | $ | 0.20 | | | $ | 0.20 | | |

NAREIT FFO - diluted per share(b) | $ | 0.20 | | $ | (0.19) | | $ | 0.20 | | $ | 0.21 | | $ | 0.20 | | | $ | 0.20 | | |

| | | | | | | | |

Core FFO - basic per share (b) | $ | 0.25 | | $ | 0.23 | | $ | 0.23 | | $ | 0.26 | | $ | 0.25 | | | $ | 0.71 | | |

Core FFO - diluted per share(b) | $ | 0.25 | | $ | 0.23 | | $ | 0.22 | | $ | 0.26 | | $ | 0.25 | | | $ | 0.71 | | |

| | | | | | | | |

Adjusted FFO - basic per share (b) | $ | 0.32 | | $ | 0.28 | | $ | 0.30 | | $ | 0.29 | | $ | 0.29 | | | $ | 0.89 | | |

Adjusted FFO - diluted per share(b) | $ | 0.32 | | $ | 0.28 | | $ | 0.29 | | $ | 0.29 | | $ | 0.29 | | | $ | 0.89 | | |

| | | | | | | | |

(a)Maintenance capital expenditures include capital expenditures made to extend the life of, and provide future economic benefit from, our existing temperature-controlled warehouse network and its existing supporting personal property and information technology.

(b)During the three months ended June 30, 2023, management excluded losses from discontinued operations from Core FFO applicable to common stockholders, and Adjusted FFO applicable to common stockholders and included certain losses from discontinued operations for NAREIT FFO and all of the related per share amounts for Core, NAREIT, and Adjusted FFO. For purposes of comparability using this same approach, the following adjusted historical results recasted are as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended - Recasted | | YTD Recasted |

(In thousands except per share amounts) | | Q1 23 | Q4 22 | Q3 22 | | 2023 |

| NAREIT FFO | | $ | 52,432 | | $ | 56,457 | | $ | 54,466 | | | $ | 54,694 | |

| Core FFO | | $ | 62,547 | | $ | 71,157 | | $ | 68,004 | | | $ | 194,631 | |

| Adjusted FFO applicable to common shareholders | | $ | 81,506 | | $ | 78,717 | | $ | 80,207 | | | $ | 245,225 | |

| | | | | | |

| NAREIT FFO - basic per share | | $ | 0.19 | | $ | 0.21 | | $ | 0.20 | | | $ | 0.20 | |

| NAREIT FFO - diluted per share | | $ | 0.19 | | $ | 0.21 | | $ | 0.20 | | | $ | 0.20 | |

| | | | | | |

| Core FFO - basic per share | | $ | 0.23 | | $ | 0.26 | | $ | 0.25 | | | $ | 0.71 | |

| Core FFO - diluted per share | | $ | 0.23 | | $ | 0.26 | | $ | 0.25 | | | $ | 0.71 | |

| | | | | | |

| Adjusted FFO - basic per share | | $ | 0.30 | | $ | 0.29 | | $ | 0.30 | | | $ | 0.90 | |

| Adjusted FFO - diluted per share | | $ | 0.30 | | $ | 0.29 | | $ | 0.30 | | | $ | 0.90 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net (Loss) Income to EBITDA, NAREIT EBITDAre, and Core EBITDA |

| (In thousands) |

| | Three Months Ended | | Trailing Twelve Months Ended |

| Q3 23 | Q2 23 | Q1 23 | Q4 22 | Q3 22 | | Q3 23 |

| Net (loss) income | $ | (2,096) | | $ | (104,802) | | $ | (2,571) | | $ | 2,955 | | $ | (8,937) | | | $ | (106,514) | |

| Adjustments: | | | | | | | |

| Depreciation and amortization | 89,728 | | 84,892 | | 85,024 | | 82,467 | | 83,669 | | | 342,111 | |

| Interest expense | 35,572 | | 36,431 | | 34,423 | | 33,407 | | 30,402 | | | 139,833 | |

| Income tax (benefit) expense | (492) | | 464 | | (1,644) | | (2,691) | | (3,368) | | | (4,363) | |

| EBITDA | $ | 122,712 | | $ | 16,985 | | $ | 115,232 | | $ | 116,138 | | $ | 101,766 | | | $ | 371,067 | |

| Adjustments: | | | | | | | |

| Loss (gain) on sale of real estate | 78 | | (2,528) | | 191 | | (21) | | 5,710 | | | (2,280) | |

| Adjustment to reflect share of EBITDAre of partially owned entities | 1,495 | | 3,085 | | 2,883 | | 5,019 | | 3,383 | | | 12,482 | |

NAREIT EBITDAre(a) | $ | 124,285 | | $ | 17,542 | | $ | 118,306 | | $ | 121,136 | | $ | 110,859 | | | $ | 381,269 | |

| Adjustments: | | | | | | | |

| Acquisition, cyber incident and other, net | 13,931 | | 27,235 | | 7,147 | | 11,899 | | 4,874 | | | 60,212 | |

| Loss from investments in partially owned entities | 259 | | 709 | | 3,029 | | 2,101 | | 1,440 | | | 6,098 | |

| Impairment of indefinite and long-lived assets | — | | — | | — | | 764 | | 6,616 | | | 764 | |

| Foreign currency exchange loss (gain) | 705 | | 212 | | (458) | | (2,477) | | 2,487 | | | (2,018) | |

| Share-based compensation expense | 6,203 | | 4,639 | | 6,970 | | 5,036 | | 6,720 | | | 22,848 | |

| Loss on debt extinguishment, modifications and termination of derivative instruments | 683 | | 627 | | 545 | | 933 | | 1,040 | | | 2,788 | |

| (Loss) gain on real estate and other asset disposals | (321) | | 289 | | 420 | | 2,449 | | 1,203 | | | 2,837 | |

| | | | | | | |

| | | | | | | |

| Reduction in EBITDAre from partially owned entities | (1,495) | | (3,085) | | (2,883) | | (5,019) | | (3,383) | | | (12,482) | |

| Gain from sale of partially owned entities | — | | (304) | | — | | — | | — | | | (304) | |

| (Loss) gain from discontinued operations, net of tax | (203) | | 8,275 | | — | | — | | — | | | 8,072 | |

| Impairment of related party loan receivable | — | | 21,972 | | — | | — | | — | | | 21,972 | |

| Loss on put option | — | | 56,576 | | — | | — | | — | | | 56,576 | |

| Core EBITDA | $ | 144,047 | | $ | 134,687 | | $ | 133,076 | | $ | 136,822 | | $ | 131,856 | | | 548,632 | |

(a)During the three months ended June 30, 2023, management included certain losses from discontinued operations in NAREIT EBITDAre. For purposes of comparability using this same approach, the following adjusted historical results recasted are as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended - Recasted | | Trailing Twelve Months Ended - Recasted |

| (In thousands) | | Q1 23 | Q4 22 | Q3 22 | | Q3 2023 |

| NAREIT EBITDAre | | $116,872 | $117,602 | $108,487 | | $376,301 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Segment revenues: | | | | | | | |

| Warehouse | $ | 602,605 | | | $ | 598,977 | | | $ | 1,778,827 | | | $ | 1,704,281 | |

| Transportation | 55,642 | | | 76,367 | | | 181,792 | | | 237,168 | |

| Third-party managed | 9,692 | | | 82,436 | | | 33,419 | | | 251,782 | |

| | | | | | | |

| Total revenues | 667,939 | | | 757,780 | | | 1,994,038 | | | 2,193,231 | |

| | | | | | | |

| Segment contribution: | | | | | | | |

| Warehouse | 177,832 | | | 166,662 | | | 525,501 | | | 463,905 | |

| Transportation | 9,659 | | | 10,836 | | | 31,128 | | | 32,950 | |

| Third-party managed | 1,629 | | | 3,660 | | | 4,108 | | | 10,882 | |

| | | | | | | |

| Total segment contribution | 189,120 | | | 181,158 | | | 560,737 | | | 507,737 | |

| | | | | | | |

| Reconciling items: | | | | | | | |

| Depreciation and amortization | (89,728) | | | (83,669) | | | (259,644) | | | (248,979) | |

| Selling, general and administrative | (52,383) | | | (57,119) | | | (169,023) | | | (170,994) | |

| Acquisition, cyber incident and other, net | (13,931) | | | (4,874) | | | (48,313) | | | (20,612) | |

| | | | | | | |

| (Loss) gain from sale of real estate | (78) | | | (5,710) | | | 2,259 | | | (5,710) | |

| Interest expense | (35,572) | | | (30,402) | | | (106,426) | | | (82,720) | |

| Loss on debt extinguishment, modifications and termination of derivative instruments | (683) | | | (1,040) | | | (1,855) | | | (2,284) | |

| Other, net | 723 | | | (2,593) | | | 1,741 | | | (1,197) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (Loss) gain from investments in partially owned entities | (259) | | | 44 | | | (1,616) | | | (779) | |

| Impairment of related party receivable | — | | | — | | | (21,972) | | | — | |

Loss on put option | — | | | — | | | (56,576) | | | — | |

| | | | | | | |

| | | | | | | |

| Loss from continuing operations before income taxes | $ | (2,791) | | | $ | (10,821) | | | $ | (100,688) | | | $ | (32,154) | |

We view and manage our business through three primary business segments—warehouse, transportation, third-party managed. Our core business is our warehouse segment, where we provide temperature-controlled warehouse storage and related handling and other warehouse services. In our warehouse segment, we collect rent and storage fees from customers to store their frozen and perishable food and other products within our real estate portfolio. We also provide our customers with handling and other warehouse services related to the products stored in our buildings that are designed to optimize their movement through the cold chain, such as the placement of food products for storage and preservation, the retrieval of products from storage upon customer request, case-picking, blast freezing, produce grading and bagging, ripening, kitting, protein boxing, repackaging, e-commerce fulfillment, and other recurring handling services.

In our transportation segment, we broker and manage transportation of frozen and perishable food and other products for our customers. Our transportation services include consolidation services (i.e., consolidating a customer’s products with those of other customers for more efficient shipment), freight under management services (i.e., arranging for and overseeing transportation of customer inventory) and dedicated transportation services, each designed to improve efficiency and reduce transportation and logistics costs to our customers. We provide these transportation services at cost plus a service fee or, in the case of our consolidation or dedicated services, we may charge a fixed fee. We supplemented our regional, national and truckload consolidation services with the transportation operations from various warehouse acquisitions. We also provide multi-modal global freight forwarding services to support our customers’ needs in certain markets.

Under our third-party managed segment, we manage warehouses on behalf of third parties and provide warehouse management services to leading food manufacturers and retailers in their owned facilities. We believe using our third-party management services allows our customers to increase efficiency, reduce costs, reduce supply-chain risks and focus on their core businesses. We also believe that providing third-party management services allows us to offer a complete and integrated suite of services across the cold chain.

| | |

| Notes and Definitions |

| We use the following non-GAAP financial measures as supplemental performance measures of our business: NAREIT FFO, Core FFO, Adjusted FFO, EBITDAre, Core EBITDA and net debt to pro-forma Core EBITDA. |

| We calculate funds from operations, or FFO, in accordance with the standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT defines FFO as net income or loss determined in accordance with U.S. GAAP, excluding extraordinary items as defined under U.S. GAAP and gains or losses from sales of previously depreciated operating real estate and other assets, plus specified non-cash items, such as real estate asset depreciation and amortization impairment charge on real estate related assets and our share of reconciling items for partially owned entities. We believe that FFO is helpful to investors as a supplemental performance measure because it excludes the effect of depreciation, amortization and gains or losses from sales of real estate, all of which are based on historical costs, which implicitly assumes that the value of real estate diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. |

We calculate core funds from operations, or Core FFO, as NAREIT FFO adjusted for the effects of gain or loss on the sale of non-real estate assets, acquisition, cyber incident and other, net, goodwill impairment (when applicable), loss on debt extinguishment, modifications and termination of derivative instruments, foreign currency exchange losses, gain or loss from discontinued operations held for sale, impairment of related party loan receivable, loss on fair value of put, gain on extinguishment of New Market Tax Credit structure, loss on deconsolidation of subsidiary contributed to LATAM joint venture,

and gain from sale of LATAM joint venture. We also adjust for the impact of Core FFO on our share of reconciling items for partially owned entities, and gain from disposition of partially owned entities. We believe that Core FFO is helpful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our core business operations. We believe Core FFO can facilitate comparisons of operating performance between periods, while also providing a more meaningful predictor of future earnings potential. |

| However, because NAREIT FFO and Core FFO add back real estate depreciation and amortization and do not capture the level of maintenance capital expenditures necessary to maintain the operating performance of our properties, both of which have material economic impacts on our results from operations, we believe the utility of NAREIT FFO and Core FFO as a measure of our performance may be limited. |

| We calculate adjusted funds from operations, or Adjusted FFO, as Core FFO adjusted for the effects of amortization of deferred financing costs and pension withdrawal liability, amortization of above or below market leases, non-real estate asset impairment, straight-line net rent, benefit from deferred income taxes, stock-based compensation expense, non-real estate depreciation and amortization and maintenance capital expenditures. We also adjust for AFFO attributable to our share of reconciling items of partially owned entities and discontinued operations. We believe that Adjusted FFO is helpful to investors as a meaningful supplemental comparative performance measure of our ability to make incremental capital investments in our business and to assess our ability to fund distribution requirements from our operating activities. |

| FFO, Core FFO and Adjusted FFO are used by management, investors and industry analysts as supplemental measures of operating performance of equity REITs. FFO, Core FFO and Adjusted FFO should be evaluated along with U.S. GAAP net income and net income per diluted share (the most directly comparable U.S. GAAP measures) in evaluating our operating performance. FFO, Core FFO and Adjusted FFO do not represent net income or cash flows from operating activities in accordance with U.S. GAAP and are not indicative of our results of operations or cash flows from operating activities as disclosed in our consolidated statements of operations included in our quarterly and annual reports. FFO, Core FFO and Adjusted FFO should be considered as supplements, but not alternatives, to our net income or cash flows from operating activities as indicators of our operating performance. Moreover, other REITs may not calculate FFO in accordance with the NAREIT definition or may interpret the NAREIT definition differently than we do. Accordingly, our FFO may not be comparable to FFO as calculated by other REITs. In addition, there is no industry definition of Core FFO or Adjusted FFO and, as a result, other REITs may also calculate Core FFO or Adjusted FFO, or other similarly-captioned metrics, in a manner different than we do. The table above reconciles FFO, Core FFO and Adjusted FFO to net (loss) income, which is the most directly comparable financial measure calculated in accordance with U.S. GAAP. |

| We calculate EBITDA for Real Estate, or EBITDAre, in accordance with the standards established by the Board of Governors of NAREIT, defined as, earnings before interest expense, taxes, depreciation and amortization, net gain on sale of real estate, net of withholding taxes, and adjustment to reflect share of EBITDAre of partially owned entities. EBITDAre is a measure commonly used in our industry, and we present EBITDAre to enhance investor understanding of our operating performance. We believe that EBITDAre provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and useful life of related assets among otherwise comparable companies. |

We also calculate our Core EBITDA as EBITDAre further adjusted for acquisition, cyber and other, net, loss from investments in partially owned entities, impairment of indefinite and long-lived assets (when applicable), foreign currency exchange loss or gain, stock-based compensation expense, loss on debt extinguishment, modifications and termination of derivative instruments, net gain on other asset disposals, reduction in EBITDAre from partially owned entities, discontinued operations, impairment of related party loan receivable, loss on fair value of put, gain on extinguishment of new market tax credit structure, and loss on deconsolidation of subsidiary contributed to LATAM joint venture.. We believe that the presentation of Core EBITDA provides a measurement of our operations that is meaningful to investors because it excludes the effects of certain items that are otherwise included in EBITDAre but which we do not believe are indicative of our core business operations. EBITDAre and Core EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDAre and Core EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDAre and Core EBITDA as alternatives to net income or cash flows from operating activities determined in accordance with U.S. GAAP. Our calculations of EBITDAre and Core EBITDA have limitations as analytical tools, including: |

•these measures do not reflect our historical or future cash requirements for maintenance capital expenditures or growth and expansion capital expenditures;

•these measures do not reflect changes in, or cash requirements for, our working capital needs;

•these measures do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness;

•these measures do not reflect our tax expense or the cash requirements to pay our taxes; and

•although depreciation and amortization are non-cash charges, the assets being depreciated will often have to be replaced in the future and these measures do not reflect any cash requirements for such replacements.

| | |

| We use Core EBITDA and EBITDAre as measures of our operating performance and not as measures of liquidity. The table on page 21 of our financial supplement reconciles EBITDA, EBITDAre and Core EBITDA to net income, which is the most directly comparable financial measure calculated in accordance with U.S. GAAP. |

| Net debt to proforma Core EBITDA is calculated using total debt, plus capital lease obligations, less cash and cash equivalents, divided by pro-forma Core EBITDA. We calculate pro-forma Core EBITDA as Core EBITDA further adjusted for acquisitions, dispositions and for rent expense associated with lease buy-outs and lease exits. The pro-forma adjustment for acquisitions reflects the Core EBITDA for the period of time prior to acquisition. The pro-forma adjustment for leased facilities exited or purchased reflects the add-back for the related lease expense from the last year. The pro-forma adjustment for dispositions reduces Core EBITDA for the earnings of facilities disposed of or exited during the year, including the strategic exit of certain third-party managed business. |

We define our “same store” population once a year at the beginning of the current calendar year. Our same store population includes properties that were owned or leased for the entirety of two comparable periods and that have reported at least twelve months of consecutive normalized operations prior to January 1 of the prior calendar year. We define “normalized operations” as properties that have been open for operation or lease after development or significant modification, including the expansion of a warehouse footprint or a warehouse rehabilitation subsequent to an event, such as a natural disaster or similar event causing disruption to operations. In addition, our definition of “normalized operations” takes into account changes in the ownership structure (e.g., purchase of acquired properties will be included in the “same store” population if owned by us as of the first business day of each year, of the prior calendar year and still owned by us as of the end of the current reporting period, unless the property is under development). The “same store” pool is also adjusted to remove properties that were sold or entering development subsequent to the beginning of the current calendar year. As such, the “same store” population for the period ended December 31, 2022 includes all properties that we owned at January 2, which had both been owned and had reached “normalized operations” by January 2, 2022. |

| We calculate “same store revenue” as revenues for the same store population. We calculate “same store contribution (NOI)” as revenues for the same store population less its cost of operations (excluding any depreciation and amortization, impairment charges, corporate-level selling, general and administrative expenses, corporate-level acquisition, cyber incident and other, net and gain or loss on sale of real estate). In order to derive an appropriate measure of period-to-period operating performance, we also calculate our same store contribution (NOI) on a constant currency basis to remove the effects of foreign currency exchange rate movements by using the comparable prior period exchange rate to translate from local currency into U.S. dollars for both periods. We evaluate the performance of the warehouses we own or lease using a “same store” analysis, and we believe that same store contribution (NOI) is helpful to investors as a supplemental performance measure because it includes the operating performance from the population of properties that is consistent from period to period and also on a constant currency basis, thereby eliminating the effects of changes in the composition of our warehouse portfolio and currency fluctuations on performance measures. Same store contribution (NOI) is not a measurement of financial performance under U.S. GAAP. In addition, other companies providing temperature-controlled warehouse storage and handling and other warehouse services may not define same store or calculate same store contribution (NOI) in a manner consistent with our definition or calculation. Same store contribution (NOI) should be considered as a supplement, but not as an alternative, to our results calculated in accordance with U.S. GAAP. The tables beginning on page 33 of our financial supplement provide reconciliations for same store revenues and same store contribution (NOI). |