0001042046FALSE2022Q112/31http://fasb.org/us-gaap/2021-01-31#OtherLiabilitieshttp://fasb.org/us-gaap/2021-01-31#OtherLiabilities——00010420462022-01-012022-03-310001042046us-gaap:CommonStockMember2022-01-012022-03-310001042046afg:SubordinatedDebenturesDueInMarch2059Member2022-01-012022-03-310001042046afg:SubordinatedDebenturesDueInJune2060Member2022-01-012022-03-310001042046afg:SubordinatedDebenturesdueinDecember2059Member2022-01-012022-03-310001042046afg:SubordinatedDebenturesDueInSeptember2060Member2022-01-012022-03-3100010420462022-05-01xbrli:shares00010420462022-03-31iso4217:USD00010420462021-12-310001042046us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-03-310001042046us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-31iso4217:USDxbrli:shares00010420462021-01-012021-03-310001042046us-gaap:CommonStockMember2021-12-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-12-310001042046us-gaap:RetainedEarningsMember2021-12-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001042046us-gaap:ParentMember2021-12-310001042046us-gaap:RetainedEarningsMember2022-01-012022-03-310001042046us-gaap:ParentMember2022-01-012022-03-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001042046us-gaap:CommonStockMember2022-01-012022-03-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-01-012022-03-310001042046us-gaap:CommonStockMember2022-03-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-03-310001042046us-gaap:RetainedEarningsMember2022-03-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001042046us-gaap:ParentMember2022-03-310001042046us-gaap:CommonStockMember2020-12-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-310001042046us-gaap:RetainedEarningsMember2020-12-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001042046us-gaap:ParentMember2020-12-310001042046us-gaap:RetainedEarningsMember2021-01-012021-03-310001042046us-gaap:ParentMember2021-01-012021-03-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001042046us-gaap:CommonStockMember2021-01-012021-03-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-01-012021-03-310001042046us-gaap:CommonStockMember2021-03-310001042046us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-03-310001042046us-gaap:RetainedEarningsMember2021-03-310001042046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001042046us-gaap:ParentMember2021-03-3100010420462020-12-3100010420462021-03-310001042046afg:NewCollateralizedLoanObligationTemporaryWarehousingEntitiesMember2022-03-310001042046afg:AnnuitySubsidiariesMember2021-05-312021-05-310001042046afg:AnnuitySubsidiariesMember2021-05-310001042046us-gaap:SegmentDiscontinuedOperationsMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046afg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:NondesignatedMemberafg:AnnuitySubsidiariesMemberafg:MortgageBackedSecuritiesWithEmbeddedDerivativesMember2021-01-012021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberafg:FixedIndexedandVariableIndexedAnnuitiesEmbeddedDerivativesMemberus-gaap:NondesignatedMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:NondesignatedMemberus-gaap:CallOptionMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:NondesignatedMemberus-gaap:PutOptionMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:NondesignatedMemberafg:AnnuitySubsidiariesMemberus-gaap:OtherContractMember2021-01-012021-03-310001042046us-gaap:NondesignatedMember2021-01-012021-03-310001042046afg:VerikaiIncMember2021-12-012021-12-310001042046afg:VerikaiIncMember2021-12-31afg:segment0001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyPropertyAndTransportationInsuranceMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyPropertyAndTransportationInsuranceMember2021-01-012021-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyCasualtyInsuranceMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyCasualtyInsuranceMember2021-01-012021-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyFinancialInsuranceMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyFinancialInsuranceMember2021-01-012021-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyOtherInsuranceMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:SpecialtyOtherInsuranceMember2021-01-012021-03-310001042046afg:PropertyAndCasualtyInsuranceMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMember2021-01-012021-03-310001042046us-gaap:CorporateAndOtherMember2022-01-012022-03-310001042046us-gaap:CorporateAndOtherMember2021-01-012021-03-310001042046us-gaap:CorporateAndOtherMemberus-gaap:SegmentContinuingOperationsMemberus-gaap:RealEstateFundsMember2022-01-012022-03-310001042046us-gaap:CorporateAndOtherMemberus-gaap:SegmentContinuingOperationsMemberus-gaap:RealEstateFundsMember2021-01-012021-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:OtherLinesMember2022-01-012022-03-310001042046afg:PropertyAndCasualtyInsuranceMemberafg:OtherLinesMember2021-01-012021-03-310001042046afg:ContingentConsiderationAcquisitionsMember2022-01-012022-03-31afg:professional0001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2022-03-310001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:USTreasuryAndGovernmentMember2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-03-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CollateralizedLoanObligationsMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedLoanObligationsMember2022-03-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:CollateralizedLoanObligationsMember2022-03-310001042046us-gaap:CollateralizedLoanObligationsMember2022-03-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2022-03-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:AssetBackedSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-03-310001042046us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:CorporateDebtSecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:FixedMaturitiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2022-03-310001042046us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:FixedMaturitiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2022-03-310001042046us-gaap:EquitySecuritiesMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-03-310001042046us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:FairValueInputsLevel1Member2022-03-310001042046us-gaap:FairValueInputsLevel2Member2022-03-310001042046us-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:FairValueInputsLevel1Memberafg:ContingentConsiderationAcquisitionsMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberafg:ContingentConsiderationAcquisitionsMember2022-03-310001042046us-gaap:FairValueInputsLevel3Memberafg:ContingentConsiderationAcquisitionsMember2022-03-310001042046afg:ContingentConsiderationAcquisitionsMember2022-03-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:OtherLiabilitiesMember2022-03-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:OtherLiabilitiesMember2022-03-310001042046us-gaap:OtherLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2022-03-310001042046us-gaap:OtherLiabilitiesMember2022-03-310001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2021-12-310001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:USTreasuryAndGovernmentMember2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CollateralizedLoanObligationsMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedLoanObligationsMember2021-12-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:CollateralizedLoanObligationsMember2021-12-310001042046us-gaap:CollateralizedLoanObligationsMember2021-12-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2021-12-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:AssetBackedSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001042046us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:CorporateDebtSecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:FixedMaturitiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2021-12-310001042046us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:FixedMaturitiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2021-12-310001042046us-gaap:EquitySecuritiesMember2021-12-310001042046us-gaap:FairValueInputsLevel1Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001042046us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:FairValueInputsLevel1Member2021-12-310001042046us-gaap:FairValueInputsLevel2Member2021-12-310001042046us-gaap:FairValueInputsLevel3Member2021-12-310001042046us-gaap:FairValueInputsLevel1Memberafg:ContingentConsiderationAcquisitionsMember2021-12-310001042046us-gaap:FairValueInputsLevel2Memberafg:ContingentConsiderationAcquisitionsMember2021-12-310001042046us-gaap:FairValueInputsLevel3Memberafg:ContingentConsiderationAcquisitionsMember2021-12-310001042046afg:ContingentConsiderationAcquisitionsMember2021-12-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:FairValueInputsLevel3Member2022-03-31xbrli:pure0001042046us-gaap:USTreasuryAndGovernmentMember2022-01-012022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2022-01-012022-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2022-01-012022-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2022-01-012022-03-310001042046us-gaap:CollateralizedLoanObligationsMember2022-01-012022-03-310001042046us-gaap:AssetBackedSecuritiesMember2022-01-012022-03-310001042046us-gaap:CorporateDebtSecuritiesMember2022-01-012022-03-310001042046us-gaap:FixedMaturitiesMember2022-01-012022-03-310001042046us-gaap:EquitySecuritiesMember2022-01-012022-03-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2021-12-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2022-01-012022-03-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2022-03-310001042046us-gaap:USTreasuryAndGovernmentMember2020-12-310001042046us-gaap:USTreasuryAndGovernmentMember2021-01-012021-03-310001042046us-gaap:USTreasuryAndGovernmentMember2021-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2021-01-012021-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2021-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2021-01-012021-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2021-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2020-12-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2021-01-012021-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2021-03-310001042046us-gaap:CollateralizedLoanObligationsMember2020-12-310001042046us-gaap:CollateralizedLoanObligationsMember2021-01-012021-03-310001042046us-gaap:CollateralizedLoanObligationsMember2021-03-310001042046us-gaap:AssetBackedSecuritiesMember2020-12-310001042046us-gaap:AssetBackedSecuritiesMember2021-01-012021-03-310001042046us-gaap:AssetBackedSecuritiesMember2021-03-310001042046us-gaap:CorporateDebtSecuritiesMember2020-12-310001042046us-gaap:CorporateDebtSecuritiesMember2021-01-012021-03-310001042046us-gaap:CorporateDebtSecuritiesMember2021-03-310001042046us-gaap:FixedMaturitiesMember2020-12-310001042046us-gaap:FixedMaturitiesMember2021-01-012021-03-310001042046us-gaap:FixedMaturitiesMember2021-03-310001042046us-gaap:EquitySecuritiesMember2020-12-310001042046us-gaap:EquitySecuritiesMember2021-01-012021-03-310001042046us-gaap:EquitySecuritiesMember2021-03-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2020-12-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2021-01-012021-03-310001042046afg:AssetsOfManagedInvestmentEntitiesMember2021-03-310001042046afg:AssetsOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2020-12-310001042046afg:AssetsOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046afg:AssetsOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2021-03-310001042046afg:LiabilitiesOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2020-12-310001042046afg:LiabilitiesOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2021-01-012021-03-310001042046afg:LiabilitiesOfDiscontinuedAnnuityOperationsMemberafg:AnnuitySubsidiariesMember2021-03-310001042046us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-03-310001042046us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-03-310001042046us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001042046us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001042046us-gaap:USTreasuryAndGovernmentMember2022-03-310001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2022-03-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMember2022-03-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2022-03-310001042046us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:CollateralizedLoanObligationsMember2022-03-310001042046us-gaap:CollateralizedLoanObligationsMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:AssetBackedSecuritiesMember2022-03-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:CorporateDebtSecuritiesMember2022-03-310001042046us-gaap:CorporateDebtSecuritiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:FixedMaturitiesMember2022-03-310001042046us-gaap:FixedMaturitiesMemberus-gaap:DebtSecuritiesMember2022-03-310001042046us-gaap:USTreasuryAndGovernmentMember2021-12-310001042046us-gaap:USTreasuryAndGovernmentMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMember2021-12-310001042046us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001042046us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:CommercialMortgageBackedSecuritiesMember2021-12-310001042046us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:CollateralizedLoanObligationsMember2021-12-310001042046us-gaap:CollateralizedLoanObligationsMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:AssetBackedSecuritiesMember2021-12-310001042046us-gaap:AssetBackedSecuritiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:CorporateDebtSecuritiesMember2021-12-310001042046us-gaap:CorporateDebtSecuritiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:FixedMaturitiesMember2021-12-310001042046us-gaap:FixedMaturitiesMemberus-gaap:DebtSecuritiesMember2021-12-310001042046us-gaap:CommonStockMember2022-03-310001042046us-gaap:CommonStockMember2021-12-310001042046us-gaap:PreferredStockMember2022-03-310001042046us-gaap:PreferredStockMember2021-12-310001042046us-gaap:EquitySecuritiesMember2022-03-310001042046us-gaap:EquitySecuritiesMember2021-12-310001042046us-gaap:RealEstateFundsMember2022-03-310001042046us-gaap:RealEstateFundsMember2021-12-310001042046us-gaap:RealEstateFundsMember2022-01-012022-03-310001042046us-gaap:RealEstateFundsMember2021-01-012021-03-310001042046us-gaap:PrivateEquityFundsMember2022-03-310001042046us-gaap:PrivateEquityFundsMember2021-12-310001042046us-gaap:PrivateEquityFundsMember2022-01-012022-03-310001042046us-gaap:PrivateEquityFundsMember2021-01-012021-03-310001042046us-gaap:FixedIncomeFundsMember2022-03-310001042046us-gaap:FixedIncomeFundsMember2021-12-310001042046us-gaap:FixedIncomeFundsMember2022-01-012022-03-310001042046us-gaap:FixedIncomeFundsMember2021-01-012021-03-310001042046srt:MultifamilyMember2022-03-310001042046srt:MultifamilyMember2021-12-310001042046srt:SingleFamilyMember2022-03-310001042046srt:SingleFamilyMember2021-12-310001042046srt:OtherPropertyMember2022-03-310001042046srt:OtherPropertyMember2021-12-310001042046us-gaap:FixedMaturitiesMember2022-01-012022-03-31afg:security0001042046afg:StructuredSecuritiesMember2021-12-310001042046afg:StructuredSecuritiesMember2022-01-012022-03-310001042046us-gaap:CorporateDebtSecuritiesMember2022-01-012022-03-310001042046afg:StructuredSecuritiesMember2022-03-310001042046afg:StructuredSecuritiesMember2020-12-310001042046us-gaap:CorporateDebtSecuritiesMember2020-12-310001042046afg:StructuredSecuritiesMember2021-01-012021-03-310001042046us-gaap:CorporateDebtSecuritiesMember2021-01-012021-03-310001042046afg:StructuredSecuritiesMember2021-03-310001042046us-gaap:CorporateDebtSecuritiesMember2021-03-310001042046us-gaap:FixedMaturitiesMember2022-01-012022-03-310001042046us-gaap:FixedMaturitiesMember2021-01-012021-03-310001042046us-gaap:InvestmentIncomeMemberus-gaap:EquitySecuritiesMember2022-01-012022-03-310001042046us-gaap:InvestmentIncomeMemberus-gaap:EquitySecuritiesMember2021-01-012021-03-310001042046us-gaap:InvestmentIncomeMember2022-01-012022-03-310001042046us-gaap:InvestmentIncomeMember2021-01-012021-03-310001042046us-gaap:OtherLongTermInvestmentsMember2022-01-012022-03-310001042046us-gaap:OtherLongTermInvestmentsMember2021-01-012021-03-310001042046us-gaap:FixedMaturitiesMember2021-01-012021-03-310001042046us-gaap:EquitySecuritiesMember2022-01-012022-03-310001042046us-gaap:EquitySecuritiesMember2021-01-012021-03-310001042046afg:MortgageLoansAndOtherInvestmentsMember2022-01-012022-03-310001042046afg:MortgageLoansAndOtherInvestmentsMember2021-01-012021-03-310001042046afg:PretaxMember2022-01-012022-03-310001042046afg:PretaxMember2021-01-012021-03-310001042046afg:TaxEffectsMember2022-01-012022-03-310001042046afg:TaxEffectsMember2021-01-012021-03-310001042046afg:MarketableSecuritiesMember2022-01-012022-03-310001042046afg:MarketableSecuritiesMember2021-01-012021-03-310001042046afg:RealizedGainsLossesOnSecuritiesMember2022-01-012022-03-310001042046afg:RealizedGainsLossesOnSecuritiesMember2021-01-012021-03-310001042046us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-03-31afg:swap0001042046us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-03-31afg:collateralizedloanobligation0001042046us-gaap:SubordinatedDebtObligationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-03-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-03-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-03-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-03-310001042046us-gaap:SegmentContinuingOperationsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberafg:AnnuitySubsidiariesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-03-310001042046us-gaap:SegmentDiscontinuedOperationsMemberafg:AnnuitySubsidiariesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-03-310001042046afg:ManagedbyThirdPartiesMemberus-gaap:CollateralizedLoanObligationsMember2022-03-310001042046afg:ManagedbyThirdPartiesMemberus-gaap:CollateralizedLoanObligationsMember2021-12-310001042046srt:ParentCompanyMemberafg:SeniorNotesDueInJune2047Memberus-gaap:SeniorNotesMember2022-03-310001042046srt:ParentCompanyMemberafg:SeniorNotesDueInJune2047Memberus-gaap:SeniorNotesMember2021-12-310001042046srt:ParentCompanyMemberafg:SeniorNotesDueInAugust2026Memberus-gaap:SeniorNotesMember2022-03-310001042046srt:ParentCompanyMemberafg:SeniorNotesDueInAugust2026Memberus-gaap:SeniorNotesMember2021-12-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMemberafg:SeniorNotesDueInApril2030Member2022-03-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMemberafg:SeniorNotesDueInApril2030Member2021-12-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMemberafg:OtherLongtermDebtMember2022-03-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMemberafg:OtherLongtermDebtMember2021-12-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMember2022-03-310001042046srt:ParentCompanyMemberus-gaap:SeniorNotesMember2021-12-310001042046srt:ParentCompanyMemberus-gaap:SubordinatedDebtMemberafg:SubordinatedDebenturesDueInSeptember2060Member2022-03-310001042046srt:ParentCompanyMemberus-gaap:SubordinatedDebtMemberafg:SubordinatedDebenturesDueInSeptember2060Member2021-12-310001042046afg:SubordinatedDebenturesdueinDecember2059Membersrt:ParentCompanyMemberus-gaap:SubordinatedDebtMember2022-03-310001042046afg:SubordinatedDebenturesdueinDecember2059Membersrt:ParentCompanyMemberus-gaap:SubordinatedDebtMember2021-12-310001042046srt:ParentCompanyMemberafg:SubordinatedDebenturesDueInJune2060Memberus-gaap:SubordinatedDebtMember2022-03-310001042046srt:ParentCompanyMemberafg:SubordinatedDebenturesDueInJune2060Memberus-gaap:SubordinatedDebtMember2021-12-310001042046srt:ParentCompanyMemberafg:SubordinatedDebenturesDueInMarch2059Memberus-gaap:SubordinatedDebtMember2022-03-310001042046srt:ParentCompanyMemberafg:SubordinatedDebenturesDueInMarch2059Memberus-gaap:SubordinatedDebtMember2021-12-310001042046srt:ParentCompanyMemberus-gaap:SubordinatedDebtMember2022-03-310001042046srt:ParentCompanyMemberus-gaap:SubordinatedDebtMember2021-12-310001042046srt:ParentCompanyMember2022-03-310001042046srt:ParentCompanyMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001042046srt:ParentCompanyMembersrt:MaximumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001042046srt:ParentCompanyMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001042046srt:ParentCompanyMember2021-12-310001042046afg:VotingPreferredStockMember2022-03-310001042046afg:NonvotingPreferredStockMember2022-03-310001042046us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001042046us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-03-310001042046us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001042046us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-03-310001042046us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001042046us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001042046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001042046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-03-310001042046us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001042046us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-03-310001042046us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001042046us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310001042046us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001042046us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001042046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001042046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310001042046us-gaap:StockCompensationPlanMember2022-01-012022-03-310001042046afg:SeparateReturnLimitationYearTaxRulesMember2022-03-310001042046us-gaap:SubsequentEventMembersrt:ParentCompanyMemberafg:SeniorNotesDueInAugust2026Memberus-gaap:SeniorNotesMember2022-05-040001042046us-gaap:SubsequentEventMembersrt:ParentCompanyMemberafg:SeniorNotesDueInAugust2026Membersrt:MaximumMemberus-gaap:SeniorNotesMember2022-04-012022-06-300001042046us-gaap:SubsequentEventMember2022-05-042022-05-04

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Quarterly Period Ended March 31, 2022

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ____ to ____

Commission File No. 1-13653

AMERICAN FINANCIAL GROUP, INC.

Incorporated under the Laws of Ohio IRS Employer I.D. No. 31-1544320

301 East Fourth Street, Cincinnati, Ohio 45202

(513) 579-2121

| | | | | | | | | | | | | | | | | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

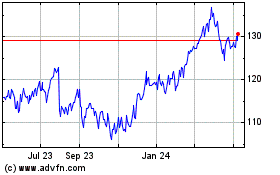

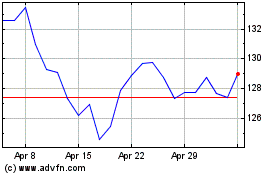

| Common Stock | | AFG | | New York Stock Exchange |

| 5.875% Subordinated Debentures due March 30, 2059 | | AFGB | | New York Stock Exchange |

| 5.625% Subordinated Debentures due June 1, 2060 | | AFGD | | New York Stock Exchange |

| 5.125% Subordinated Debentures due December 15, 2059 | | AFGC | | New York Stock Exchange |

| 4.50% Subordinated Debentures due September 15, 2060 | | AFGE | | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of May 1, 2022, there were 85,102,026 shares of the Registrant’s Common Stock outstanding, excluding 14.9 million shares owned by subsidiaries.

AMERICAN FINANCIAL GROUP, INC. 10-Q

TABLE OF CONTENTS

AMERICAN FINANCIAL GROUP, INC. 10-Q

PART I

ITEM 1. — FINANCIAL STATEMENTS

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET (UNAUDITED)

(Dollars in Millions)

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| Assets: | | | |

| Cash and cash equivalents | $ | 1,181 | | | $ | 2,131 | |

| Investments: | | | |

Fixed maturities, available for sale at fair value (amortized cost — $10,954 and $10,193; allowance for expected credit losses of $7 and $9) | 10,809 | | | 10,357 | |

| Fixed maturities, trading at fair value | 30 | | | 28 | |

| Equity securities, at fair value | 1,022 | | | 1,042 | |

| Investments accounted for using the equity method | 1,619 | | | 1,517 | |

| Mortgage loans | 784 | | | 520 | |

| Real estate and other investments | 156 | | | 150 | |

| Total cash and investments | 15,601 | | | 15,745 | |

| Recoverables from reinsurers | 3,478 | | | 3,519 | |

| Prepaid reinsurance premiums | 933 | | | 834 | |

| Agents’ balances and premiums receivable | 1,391 | | | 1,265 | |

| Deferred policy acquisition costs | 271 | | | 267 | |

| Assets of managed investment entities | 5,231 | | | 5,296 | |

| Other receivables | 645 | | | 857 | |

| Other assets | 966 | | | 902 | |

| Goodwill | 246 | | | 246 | |

| Total assets | $ | 28,762 | | | $ | 28,931 | |

| | | |

| Liabilities and Equity: | | | |

| Unpaid losses and loss adjustment expenses | $ | 10,986 | | | $ | 11,074 | |

| Unearned premiums | 3,206 | | | 3,041 | |

| Payable to reinsurers | 910 | | | 920 | |

| Liabilities of managed investment entities | 5,112 | | | 5,220 | |

| Long-term debt | 1,917 | | | 1,964 | |

| Other liabilities | 1,796 | | | 1,700 | |

| Total liabilities | 23,927 | | | 23,919 | |

| | | |

| Shareholders’ equity: | | | |

Common Stock, no par value — 200,000,000 shares authorized — 85,102,829 and 84,920,965 shares outstanding | 85 | | | 85 | |

| Capital surplus | 1,340 | | | 1,330 | |

| Retained earnings | 3,541 | | | 3,478 | |

| Accumulated other comprehensive income (loss), net of tax | (131) | | | 119 | |

| Total shareholders’ equity | 4,835 | | | 5,012 | |

| | | |

| | | |

| Total liabilities and shareholders’ equity | $ | 28,762 | | | $ | 28,931 | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF EARNINGS (UNAUDITED)

(In Millions, Except Per Share Data)

| | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| | | | | 2022 | | 2021 |

| Revenues: | | | | | | | |

| Property and casualty insurance net earned premiums | | | | | $ | 1,302 | | | $ | 1,173 | |

| Net investment income | | | | | 230 | | | 188 | |

| | | | | | | |

Realized gains (losses) on securities | | | | | (15) | | | 77 | |

| | | | | | | |

| Income of managed investment entities: | | | | | | | |

| Investment income | | | | | 46 | | | 46 | |

Gain (loss) on change in fair value of assets/liabilities | | | | | (5) | | | 2 | |

| Other income | | | | | 30 | | | 23 | |

| Total revenues | | | | | 1,588 | | | 1,509 | |

| | | | | | | |

| Costs and Expenses: | | | | | | | |

| Property and casualty insurance: | | | | | | | |

| Losses and loss adjustment expenses | | | | | 693 | | | 667 | |

| Commissions and other underwriting expenses | | | | | 414 | | | 380 | |

| Interest charges on borrowed money | | | | | 23 | | | 24 | |

| Expenses of managed investment entities | | | | | 39 | | | 39 | |

| Other expenses | | | | | 58 | | | 64 | |

| Total costs and expenses | | | | | 1,227 | | | 1,174 | |

Earnings from continuing operations before income taxes | | | | | 361 | | | 335 | |

Provision for income taxes | | | | | 71 | | | 68 | |

Net earnings from continuing operations | | | | | 290 | | | 267 | |

Net earnings from discontinued operations | | | | | — | | | 152 | |

| | | | | | | |

| | | | | | | |

Net Earnings | | | | | $ | 290 | | | $ | 419 | |

| | | | | | | |

Earnings per Basic Common Share: | | | | | | | |

| Continuing operations | | | | | $ | 3.41 | | | $ | 3.11 | |

| Discontinued operations | | | | | — | | | 1.77 | |

| Total basic earnings | | | | | $ | 3.41 | | | $ | 4.88 | |

Earnings per Diluted Common Share: | | | | | | | |

| Continuing operations | | | | | $ | 3.40 | | | $ | 3.08 | |

| Discontinued operations | | | | | — | | | 1.76 | |

| Total diluted earnings | | | | | $ | 3.40 | | | $ | 4.84 | |

| Average number of Common Shares: | | | | | | | |

| Basic | | | | | 85.0 | | | 85.9 | |

| Diluted | | | | | 85.2 | | | 86.6 | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

(In Millions)

| | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| | | | | 2022 | | 2021 |

| Net earnings | | | | | $ | 290 | | | $ | 419 | |

| | | | | | | |

Other comprehensive loss, net of tax: | | | | | | | |

| Net unrealized gains (losses) on securities: | | | | | | | |

Unrealized holding losses on securities arising during the period | | | | | (247) | | | (281) | |

Reclassification adjustment for realized (gains) losses included in net earnings | | | | | 2 | | | (11) | |

| | | | | | | |

Total net unrealized losses on securities | | | | | (245) | | | (292) | |

Net unrealized losses on cash flow hedges | | | | | (4) | | | (14) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Foreign currency translation adjustments | | | | | (1) | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other comprehensive loss, net of tax | | | | | (250) | | | (306) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Comprehensive income | | | | | $ | 40 | | | $ | 113 | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

(Dollars in Millions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Shareholders’ Equity | | | | |

| Common | | | Common Stock

and Capital | | Retained | | Accumulated

Other Comp. | | | | | | |

| Shares | | | Surplus | | Earnings | | Income (Loss) | | Total | | | | |

| Balance at December 31, 2021 | 84,920,965 | | | | $ | 1,415 | | | $ | 3,478 | | | $ | 119 | | | $ | 5,012 | | | | | |

| | | | | | | | | | | | | | |

Net earnings | — | | | | — | | | 290 | | | — | | | 290 | | | | | |

Other comprehensive loss | — | | | | — | | | — | | | (250) | | | (250) | | | | | |

Dividends ($2.56 per share) | — | | | | — | | | (217) | | | — | | | (217) | | | | | |

| Shares issued: | | | | | | | | | | | | | | |

| Exercise of stock options | 105,404 | | | | 4 | | | — | | | — | | | 4 | | | | | |

| Restricted stock awards | 151,080 | | | | — | | | — | | | — | | | — | | | | | |

| Other benefit plans | 10,607 | | | | 1 | | | — | | | — | | | 1 | | | | | |

| Dividend reinvestment plan | 6,282 | | | | 1 | | | — | | | — | | | 1 | | | | | |

| Stock-based compensation expense | — | | | | 6 | | | — | | | — | | | 6 | | | | | |

| Shares acquired and retired | (35,201) | | | | (1) | | | (4) | | | — | | | (5) | | | | | |

| Shares exchanged — benefit plans | (47,909) | | | | (1) | | | (6) | | | — | | | (7) | | | | | |

| Forfeitures of restricted stock | (8,399) | | | | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | | | | |

| Balance at March 31, 2022 | 85,102,829 | | | | $ | 1,425 | | | $ | 3,541 | | | $ | (131) | | | $ | 4,835 | | | | | |

| | | | | | | | | | | | | | |

| Balance at December 31, 2020 | 86,345,246 | | | | $ | 1,367 | | | $ | 4,149 | | | $ | 1,273 | | | $ | 6,789 | | | | | |

| | | | | | | | | | | | | | |

Net earnings | — | | | | — | | | 419 | | | — | | | 419 | | | | | |

Other comprehensive loss | — | | | | — | | | — | | | (306) | | | (306) | | | | | |

Dividends ($0.50 per share) | — | | | | — | | | (43) | | | — | | | (43) | | | | | |

| Shares issued: | | | | | | | | | | | | | | |

| Exercise of stock options | 403,012 | | | | 19 | | | — | | | — | | | 19 | | | | | |

| Restricted stock awards | 207,020 | | | | — | | | — | | | — | | | — | | | | | |

| Other benefit plans | 15,632 | | | | 2 | | | — | | | — | | | 2 | | | | | |

| Dividend reinvestment plan | 2,306 | | | | — | | | — | | | — | | | — | | | | | |

| Stock-based compensation expense | — | | | | 5 | | | — | | | — | | | 5 | | | | | |

| Shares acquired and retired | (1,757,702) | | | | (28) | | | (164) | | | — | | | (192) | | | | | |

| Shares exchanged — benefit plans | (76,984) | | | | (1) | | | (7) | | | — | | | (8) | | | | | |

| Forfeitures of restricted stock | (12,468) | | | | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | | | | |

| Balance at March 31, 2021 | 85,126,062 | | | | $ | 1,364 | | | $ | 4,354 | | | $ | 967 | | | $ | 6,685 | | | | | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(In Millions)

| | | | | | | | | | | |

| Three months ended March 31, |

| 2022 | | 2021 |

| Operating Activities: | | | |

| Net earnings | $ | 290 | | | $ | 419 | |

| Adjustments: | | | |

| Depreciation and amortization | 26 | | | 99 | |

| Annuity benefits | — | | | 161 | |

| Realized (gains) losses on investing activities | 15 | | | (158) | |

| Net purchases of trading securities | (1) | | | (3) | |

| Deferred annuity and life policy acquisition costs | — | | | (49) | |

| Change in: | | | |

| Reinsurance and other receivables | 39 | | | 275 | |

| Other assets | 1 | | | 164 | |

| Insurance claims and reserves | 77 | | | 5 | |

| Payable to reinsurers | (10) | | | (54) | |

| Other liabilities | 18 | | | (25) | |

| Managed investment entities’ assets/liabilities | 172 | | | (38) | |

| Other operating activities, net | (124) | | | (169) | |

Net cash provided by operating activities | 503 | | | 627 | |

| | | |

| Investing Activities: | | | |

| Purchases of: | | | |

| Fixed maturities | (1,682) | | | (3,443) | |

| Equity securities | (45) | | | (41) | |

| Mortgage loans | (265) | | | (35) | |

| Equity index options and other investments | (47) | | | (164) | |

| Real estate, property and equipment | (23) | | | (13) | |

| | | |

| Proceeds from: | | | |

| Maturities and redemptions of fixed maturities | 959 | | | 1,947 | |

| Repayments of mortgage loans | 1 | | | 12 | |

| Sales of fixed maturities | 17 | | | 147 | |

| Sales of equity securities | 60 | | | 350 | |

Sales and settlements of equity index options and other investments | 59 | | | 269 | |

| Sales of real estate, property and equipment | — | | | — | |

| | | |

| | | |

| Managed investment entities: | | | |

| Purchases of investments | (357) | | | (527) | |

| Proceeds from sales and redemptions of investments | 217 | | | 557 | |

| Other investing activities, net | (5) | | | 3 | |

Net cash used in investing activities | (1,111) | | | (938) | |

| | | |

| Financing Activities: | | | |

| | | |

| Reductions of long-term debt | (50) | | | — | |

| Issuances of Common Stock | 5 | | | 20 | |

| Repurchases of Common Stock | (5) | | | (192) | |

| Cash dividends paid on Common Stock | (216) | | | (43) | |

| Annuity receipts | — | | | 1,179 | |

| Ceded annuity receipts | — | | | (207) | |

| Annuity surrenders, benefits and withdrawals | — | | | (1,148) | |

| Ceded annuity surrenders, benefits and withdrawals | — | | | 167 | |

| Net transfers from variable annuity assets | — | | | 25 | |

| Issuances of managed investment entities’ liabilities | 60 | | | 752 | |

| Retirements of managed investment entities’ liabilities | (136) | | | (725) | |

| | | |

Net cash used in financing activities | (342) | | | (172) | |

| Net Change in Cash and Cash Equivalents | (950) | | | (483) | |

| Cash and cash equivalents at beginning of period | 2,131 | | | 2,810 | |

| Cash and cash equivalents at end of period | 1,181 | | | 2,327 | |

| Less: cash and cash equivalents at end of period from discontinued operations | — | | | 636 | |

| Cash and cash equivalents at end of period from continuing operations | $ | 1,181 | | | $ | 1,691 | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| | | | | | | | | | | | | | | | | |

| INDEX TO NOTES |

| | | | | |

| A. | Accounting Policies | | H. | Goodwill and Other Intangibles | |

| B. | Discontinued Operations | | I. | Long-Term Debt | |

| C. | Acquisition and Sale of Businesses | | J. | Shareholders’ Equity | |

| D. | Segments of Operations | | K. | Income Taxes | |

| E. | Fair Value Measurements | | L. | Contingencies | |

| F. | Investments | | M. | Insurance | |

| G. | Managed Investment Entities | | N. | Subsequent Events | |

| | | | | |

A. Accounting Policies

Basis of Presentation The accompanying consolidated financial statements for American Financial Group, Inc. and its subsidiaries (“AFG”) are unaudited; however, management believes that all adjustments (consisting only of normal recurring accruals unless otherwise disclosed herein) necessary for fair presentation have been made. The results of operations for interim periods are not necessarily indicative of results to be expected for the year. The financial statements have been prepared in accordance with the instructions to Form 10-Q and, therefore, do not include all information and footnotes necessary to be in conformity with U.S. generally accepted accounting principles (“GAAP”).

Certain reclassifications have been made to prior periods to conform to the current year’s presentation. All significant intercompany balances and transactions have been eliminated. The results of operations of companies since their formation or acquisition are included in the consolidated financial statements. Events or transactions occurring subsequent to March 31, 2022, and prior to the filing of this Form 10-Q, have been evaluated for potential recognition or disclosure herein.

Unless otherwise stated, the information in the Notes to the Consolidated Financial Statements relates to AFG’s continuing operations.

The preparation of the financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Changes in circumstances could cause actual results to differ materially from those estimates.

Discontinued Operations Disposals of components of an entity that represent a strategic shift and that have a major effect on a reporting entity’s operations and financial results are reported as discontinued operations.

Fair Value Measurements Accounting standards define fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants on the measurement date. The standards establish a hierarchy of valuation techniques based on whether the assumptions that market participants would use in pricing the asset or liability (“inputs”) are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect AFG’s assumptions about the assumptions market participants would use in pricing the asset or liability. AFG did not have any material nonrecurring fair value measurements in the first three months of 2022.

Investments Equity securities other than those accounted for under the equity method are reported at fair value with holding gains and losses generally recorded in realized gains (losses) on securities. However, AFG records holding gains and losses on its portfolio of limited partnerships and similar investments, which do not qualify for equity method accounting and are carried at fair value, and certain other securities classified at purchase as “fair value through net investment income” in net investment income.

Fixed maturity securities classified as “available for sale” are reported at fair value with unrealized gains and losses included in accumulated other comprehensive income (“AOCI”) in AFG’s Balance Sheet. Fixed maturity securities classified as “trading” are reported at fair value with changes in unrealized holding gains or losses during the period included in net investment income. Mortgage loans (net of any allowance) are carried primarily at the aggregate unpaid balance.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

Premiums and discounts on fixed maturity securities are amortized using the effective interest method. Mortgage-backed securities (“MBS”) are amortized over a period based on estimated future principal payments, including prepayments. Prepayment assumptions are reviewed periodically and adjusted to reflect actual prepayments and changes in expectations.

Limited partnerships and similar investments are generally accounted for using the equity method of accounting. Under the equity method, AFG records its share of the earnings or losses of the investee based on when it is reported by the investee in its financial statements rather than in the period in which the investee declares a dividend. AFG’s share of the earnings or losses from equity method investments is generally recorded on a quarter lag due to the timing of the receipt of the investee’s financial statements. AFG’s equity in the earnings (losses) of limited partnerships and similar investments is included in net investment income.

Realized gains or losses on the disposal of fixed maturity securities are determined on the specific identification basis. When a decline in the value of an available for sale fixed maturity is considered to be other-than-temporary at the balance sheet date, an allowance for credit losses (impairment), including any write-off of accrued interest, is charged to earnings (included in realized gains (losses) on securities). If management can assert that it does not intend to sell the security and it is not more likely than not that it will have to sell it before recovery of its amortized cost basis (net of allowance), then the impairment is separated into two components: (i) the allowance related to credit losses (recorded in earnings) and (ii) the amount related to all other factors (recorded in other comprehensive income). The credit-related portion is measured by comparing a security’s amortized cost to the present value of its current expected cash flows discounted at its effective yield prior to the charge. If management intends to sell an impaired security, or it is more likely than not that it will be required to sell the security before recovery, an impairment is recorded in earnings to reduce the amortized cost (net of allowance) of that security to fair value. The allowance is limited to the difference between a security’s amortized cost basis and its fair value. Subsequent increases or decreases in expected credit losses are recorded immediately in net earnings through realized gains (losses).

Credit Losses on Financial Instruments Measured at Amortized Cost Credit-related impairments for financial instruments measured at amortized cost (mortgage loans, premiums receivable and reinsurance recoverables) reflect estimated credit losses expected over the life of an exposure or pool of exposures. The estimate of expected credit losses considers historical information, current information, as well as reasonable and supportable forecasts, including estimates of prepayments. Expected credit losses, and subsequent increases or decreases in such expected losses, are recorded immediately through net earnings as an allowance that is deducted from the amortized cost basis of the financial asset, with the net carrying value of the financial asset presented on the balance sheet at the amount expected to be collected.

Derivatives Derivatives included in AFG’s Balance Sheet are recorded at fair value. Changes in fair value of derivatives are included in earnings unless the derivatives are designated and qualify as highly effective cash flow hedges. Derivatives that do not qualify for hedge accounting under GAAP consist primarily of components of certain fixed maturity securities (primarily interest-only and principal only MBS).

To qualify for hedge accounting, at the inception of a derivative contract, AFG formally documents the relationship between the terms of the hedge and the hedged items and its risk management objective. This documentation includes defining how hedge effectiveness is evaluated at the inception date and over the life of the derivative.

Changes in the fair value of derivatives that are designated and qualify as highly effective cash flow hedges are recorded in AOCI and are reclassified into earnings when the variability of the cash flows from the hedged items impacts earnings. When the change in the fair value of a qualifying cash flow hedge is included in earnings, it is included in the same line item in the statement of earnings as the cash flows from the hedged item. AFG used interest rate swaps that are designated and qualify as highly effective cash flow hedges to mitigate interest rate risk related to certain floating-rate securities.

Goodwill Goodwill represents the excess of cost of subsidiaries over AFG’s equity in their underlying net assets at the date of acquisition. Goodwill is not amortized, but is subject to an impairment test at least annually. An entity is not required to complete the quantitative annual goodwill impairment test on a reporting unit if the entity elects to perform a qualitative analysis and determines that it is more likely than not that the reporting unit’s fair value exceeds its carrying amount.

Reinsurance Amounts recoverable from reinsurers are estimated in a manner consistent with the claim liability associated with the reinsured policies. AFG reports as assets (i) the estimated reinsurance recoverable on paid and

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

unpaid losses, including an estimate for losses incurred but not reported, and (ii) amounts paid or due to reinsurers applicable to the unexpired terms of policies in force. Payable to reinsurers includes ceded premiums due to reinsurers, as well as ceded premiums retained by AFG under contracts to fund ceded losses as they become due. AFG also assumes reinsurance from other companies. Earnings on reinsurance assumed is recognized based on information received from ceding companies.

Deferred Policy Acquisition Costs (“DPAC”) Policy acquisition costs (principally commissions, premium taxes and certain underwriting and policy issuance costs) directly related to the successful acquisition or renewal of an insurance contract are deferred. DPAC is limited based upon recoverability without any consideration for anticipated investment income and is charged against income ratably over the terms of the related policies. A premium deficiency is recognized if the sum of expected claims costs, claims adjustment expenses and unamortized acquisition costs exceed the related unearned premiums. A premium deficiency is first recognized by charging any unamortized acquisition costs to expense to the extent required to eliminate the deficiency. If the premium deficiency is greater than unamortized acquisition costs, a liability is accrued for the excess deficiency and reported with unpaid losses and loss adjustment expenses.

Managed Investment Entities A company is considered the primary beneficiary of, and therefore must consolidate, a variable interest entity (“VIE”) based primarily on its ability to direct the activities of the VIE that most significantly impact that entity’s economic performance and the obligation to absorb losses of, or receive benefits from, the entity that could potentially be significant to the VIE.

AFG manages, and has investments in, collateralized loan obligations (“CLOs”) that are VIEs (see Note G — “Managed Investment Entities”). AFG has determined that it is the primary beneficiary of these CLOs because (i) its role as asset manager gives it the power to direct the activities that most significantly impact the economic performance of the CLOs and (ii) through its investment in the CLO debt tranches, it has exposure to CLO losses (limited to the amount AFG invested) and the right to receive CLO benefits that could potentially be significant to the CLOs.

Because AFG has no right to use the CLO assets and no obligation to pay the CLO liabilities, the assets and liabilities of the CLOs are shown separately in AFG’s Balance Sheet. AFG has elected the fair value option for reporting on the CLO assets and liabilities to improve the transparency of financial reporting related to the CLOs. The net gain or loss from accounting for the CLO assets and liabilities at fair value is presented separately in AFG’s Statement of Earnings.

The fair values of a CLO’s assets may differ from the separately measured fair values of its liabilities even though the CLO liabilities only have recourse to the CLO assets. AFG has set the carrying value of the CLO liabilities equal to the fair value of the CLO assets (which have more observable fair values) as an alternative to reporting those liabilities at a separately measured fair value. CLO earnings attributable to AFG’s shareholders are measured by the change in the fair value of AFG’s investments in the CLOs and management fees earned.

At March 31, 2022, assets and liabilities of managed investment entities included $167 million in assets and $137 million in liabilities of a temporary warehousing entity that was established in connection with the formation of a new CLO that is expected to close in May 2022. At closing, all warehoused assets will be transferred to the new CLO and the liabilities will be repaid.

Unpaid Losses and Loss Adjustment Expenses The net liabilities stated for unpaid claims and for expenses of investigation and adjustment of unpaid claims represent management’s best estimate and are based upon (i) the accumulation of case estimates for losses reported prior to the close of the accounting period on direct business written; (ii) estimates received from ceding reinsurers and insurance pools and associations; (iii) estimates of unreported losses (including possible development on known claims) based on past experience; (iv) estimates based on experience of expenses for investigating and adjusting claims; and (v) the current state of the law and coverage litigation. Establishing reserves for asbestos, environmental and other mass tort claims involves considerably more judgment than other types of claims due to, among other things, inconsistent court decisions, an increase in bankruptcy filings as a result of asbestos-related liabilities, novel theories of coverage, and judicial interpretations that often expand theories of recovery and broaden the scope of coverage.

Loss reserve liabilities are subject to the impact of changes in claim amounts and frequency and other factors. Changes in estimates of the liabilities for losses and loss adjustment expenses are reflected in the statement of earnings in the period in which determined. Despite the variability inherent in such estimates, management believes that the liabilities for unpaid losses and loss adjustment expenses are adequate and reasonable.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

Debt Issuance Costs Debt issuance costs related to AFG’s outstanding debt are presented in its Balance Sheet as a direct reduction in the carrying value of long-term debt and are amortized over the life of the related debt using the effective interest method as a component of interest expense. Debt issuance costs related to AFG’s revolving credit facilities are included in other assets in AFG’s Balance Sheet.

Leases Leases for terms of longer than one year are recognized as assets and liabilities for the rights and obligations created by those leases on the balance sheet based on the present value of contractual cash flows.

At March 31, 2022 AFG has a $127 million lease liability included in other liabilities and a lease right-of-use asset of $111 million included in other assets compared to $136 million and $118 million, respectively, at December 31, 2021.

Premium Recognition Property and casualty premiums are earned generally over the terms of the policies on a pro rata basis. Unearned premiums represent that portion of premiums written, which is applicable to the unexpired terms of policies in force. On reinsurance assumed from other insurance companies or written through various underwriting organizations, unearned premiums are based on information received from such companies and organizations.

Income Taxes Deferred income taxes are calculated using the liability method. Under this method, deferred income tax assets and liabilities are determined based on differences between financial reporting and tax bases and are measured using enacted tax rates. A valuation allowance is established to reduce total deferred tax assets to an amount that will more likely than not be realized. The effect of a change in tax rates on deferred tax assets and liabilities is recorded in net earnings in the period that includes the enactment date.

AFG recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained under examination by the appropriate taxing authority. Interest and penalties on AFG’s reserve for uncertain tax positions are recognized as a component of tax expense.

Stock-Based Compensation All share-based grants are recognized as compensation expense on a straight-line basis over their vesting periods based on their calculated fair value at the date of grant.

AFG records excess tax benefits or deficiencies for share-based payments through income tax expense in the statement of earnings. In addition, AFG accounts for forfeitures of awards when they occur.

Benefit Plans AFG provides retirement benefits to qualified employees of participating companies through the AFG 401(k) Retirement and Savings Plan, a defined contribution plan. AFG makes all contributions to the retirement fund portion of the plan and matches a percentage of employee contributions to the savings fund. Company contributions are expensed in the year for which they are declared. AFG and many of its subsidiaries provide health care and life insurance benefits to eligible retirees. AFG also provides postemployment benefits to former or inactive employees (primarily those on disability) who were not deemed retired under other company plans. The projected future cost of providing these benefits is expensed over the period employees earn such benefits.

Earnings Per Share Although basic earnings per share only considers shares of common stock outstanding during the period, the calculation of diluted earnings per share includes the following adjustments to weighted average common shares related to stock-based compensation plans: first three months of 2022 and 2021 — 0.2 million and 0.7 million.

There were no anti-dilutive potential common shares for the first three months of 2022 or 2021.

Statement of Cash Flows For cash flow purposes, “investing activities” are defined as making and collecting loans and acquiring and disposing of debt or equity instruments, property and equipment and businesses. “Financing activities” include obtaining resources from owners and providing them with a return on their investments, borrowing money and repaying amounts borrowed. All other activities are considered “operating.” Short-term investments having original maturities of three months or less when purchased are considered to be cash equivalents for purposes of the financial statements.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

B. Discontinued Operations

Annuity Business Effective May 31, 2021, AFG completed the sale of its Annuity business to Massachusetts Mutual Life Insurance Company (“MassMutual”). MassMutual acquired Great American Life Insurance Company (“GALIC”) and its two insurance subsidiaries, Annuity Investors Life Insurance Company and Manhattan National Life Insurance Company. In addition to AFG’s annuity operations, these subsidiaries included AFG’s run-off life and long-term care operations. Proceeds from the sale were $3.57 billion (including $34 million in post-closing adjustments) and AFG realized a $656 million net gain on the sale in the first six months of 2021. The sale continues to be subject to tax-related post-closing adjustments, which are not expected to be material and are expected to be completed in 2022.

Details of the assets and liabilities of the Annuity subsidiaries sold were as follows (in millions): | | | | | |

| May 31, 2021 |

Assets of businesses sold: | |

| Cash and cash equivalents | $ | 2,060 | |

| Investments | 38,323 | |

| Recoverables from reinsurers | 6,748 | |

Other assets | 2,152 | |

| Total assets of discontinued annuity operations | 49,283 | |

Liabilities of businesses sold: | |

| Annuity benefits accumulated | 43,690 | |

| Other liabilities | 1,813 | |

| Total liabilities of discontinued annuity operations | 45,503 | |

| |

| Reclassify AOCI | (913) | |

| Net investment in annuity businesses sold, excluding AOCI | $ | 2,867 | |

Details of the results of operations for the discontinued annuity operations were (in millions):

| | | | | | | | | |

| | | | | Three months ended March 31, 2021 |

| Net investment income | | | | | $ | 447 | |

| Realized gains on securities | | | | | 81 | |

| Other income | | | | | 32 | |

| Total revenues | | | | | 560 | |

| Annuity benefits | | | | | 161 | |

| Annuity and supplemental insurance acquisition expenses | | | | | 112 | |

| Other expenses | | | | | 46 | |

| Total costs and expenses | | | | | 319 | |

| Earnings before income taxes from discontinued operations | | | | | 241 | |

| Provision for income taxes on discontinued operations | | | | | 48 | |

| | | | | |

| | | | | |

| Tax liabilities triggered by pending sale | | | | | 41 | |

| Net earnings from discontinued operations | | | | | $ | 152 | |

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

The impact of the sale of the annuity business is shown below (in millions):

| | | | | |

| May 31, 2021 |

| Cash proceeds | $ | 3,571 | |

| Sale related expenses | (8) | |

| Total net proceeds | 3,563 | |

| |

| Net investment in annuity businesses sold, excluding AOCI | 2,867 | |

| Reclassify net deferred tax asset | (199) | |

| Pretax gain on sale | 895 | |

| Income tax expense: | |

| Reclassify net deferred tax asset | 199 | |

| Tax liabilities triggered by pending sale in the first quarter of 2021 | 41 | |

| Other | (1) | |

| Total income tax expense | 239 | |

| Net gain on sale | $ | 656 | |

Summarized cash flows for the discontinued annuity operations were (in millions):

| | | | | |

| Three months ended March 31, 2021 |

| Net cash provided by operating activities | $ | 209 | |

| Net cash used in investing activities | (734) | |

| Net cash provided by financing activities | 16 | |

Derivatives The vast majority of AFG’s derivatives that do not qualify for hedge accounting were held by the sold annuity subsidiaries. The following table summarizes the gains (losses) included in net earnings from discontinued operations for changes in the fair value of derivatives that do not qualify for hedge accounting for the first three months of 2021 (in millions):

| | | | | | | | | | | | |

| Derivative | | | | | | Three months ended March 31, 2021 |

| MBS with embedded derivatives | | | | | | $ | — | |

| | | | | | |

| Fixed-indexed and variable-indexed annuities (embedded derivative) | | | | | | (40) | |

| Equity index call options | | | | | | 114 | |

| Equity index put options | | | | | | 2 | |

| Reinsurance contract (embedded derivative) | | | | | | 1 | |

| | | | | | $ | 77 | |

C. Acquisition and Sale of Businesses

Verikai In December 2021, AFG acquired Verikai, Inc., a machine learning and artificial intelligence company that utilizes a predictive risk tool for assessing insurance risk for $120 million using cash on hand at the parent. Verikai will continue to operate as a stand-alone company to service its insurance clients. AFG expects to benefit from Verikai’s predictive risk tool and unique Marketplace solution as it enters the medical stop loss insurance business, with a primary focus on small and underserved risks. AFG may pay up to $50 million in contingent consideration based on performance measures over a multiple year period.

Expenses related to the acquisition were approximately $1 million and were expensed as incurred. The purchase price was allocated to the acquired assets and liabilities of Verikai based on management’s best estimate of fair value as of the acquisition date. While no adjustments were made during the first three months of 2022 and management does not expect significant adjustments, the purchase price allocation continues to be subject to refinement during 2022.

Annuity Operations See Note B — “Discontinued Operations,” for information on the 2021 sale of AFG’s annuity operations.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

D. Segments of Operations

Subsequent to the sale of its annuity operations, see Note B — “Discontinued Operations,” AFG manages its business as two segments: Property and casualty insurance and Other, which includes holding company costs and operations attributable to the noncontrolling interests of the managed investment entities.

AFG reports its property and casualty insurance business in the following Specialty sub-segments: (i) Property and transportation, which includes physical damage and liability coverage for buses and trucks and other specialty transportation niches, inland and ocean marine, agricultural-related products and other commercial property coverages, (ii) Specialty casualty, which includes primarily excess and surplus, executive and professional liability, general liability, umbrella and excess liability, specialty coverages in targeted markets, customized programs for small to mid-sized businesses and workers’ compensation insurance, and (iii) Specialty financial, which includes risk management insurance programs for lending and leasing institutions (including equipment leasing and collateral and lender-placed mortgage property insurance), fidelity and surety products and trade credit insurance. Premiums and underwriting profit included under Other specialty represent business assumed by AFG’s internal reinsurance program from the operations that make up AFG’s other Specialty sub-segments and amortization of deferred gains on retroactive reinsurance transactions related to the sales of businesses in prior years. AFG’s reportable segments and their components were determined based primarily upon similar economic characteristics, products and services.

The following tables (in millions) show AFG’s revenues and earnings from continuing operations before income taxes by segment and sub-segment.

| | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| | | | | 2022 | | 2021 |

| Revenues | | | | | | | |

| Property and casualty insurance: | | | | | | | |

| Premiums earned: | | | | | | | |

| Specialty | | | | | | | |

| Property and transportation | | | | | $ | 443 | | | $ | 394 | |

| Specialty casualty | | | | | 639 | | | 571 | |

| Specialty financial | | | | | 163 | | | 157 | |

| Other specialty | | | | | 57 | | | 51 | |

| | | | | | | |

| Total premiums earned | | | | | 1,302 | | | 1,173 | |

| Net investment income | | | | | 223 | | | 159 | |

| Other income | | | | | 4 | | | 4 | |

| Total property and casualty insurance | | | | | 1,529 | | | 1,336 | |

| Other | | | | | 74 | | | 67 | |

| Real estate-related entities (*) | | | | | — | | | 29 | |

| Total revenues before realized gains (losses) | | | | | 1,603 | | | 1,432 | |

Realized gains (losses) on securities | | | | | (15) | | | 77 | |

| | | | | | | |

| Total revenues | | | | | $ | 1,588 | | | $ | 1,509 | |

(*)Represents investment income from the real estate and real estate-related entities acquired from AFG’s discontinued annuity operations while they were held by those operations. Subsequent to the sale of the annuity operations, this income is included in the segment of the acquirer.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

| | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| | | | | 2022 | | 2021 |

Earnings From Continuing Operations Before Income Taxes | | | | | | |

| Property and casualty insurance: | | | | | | | |

| Underwriting: | | | | | | | |

| Specialty | | | | | | | |

| Property and transportation | | | | | $ | 62 | | | $ | 56 | |

| Specialty casualty | | | | | 124 | | | 56 | |

| Specialty financial | | | | | 29 | | | 25 | |

| Other specialty | | | | | (7) | | | (3) | |

| Other lines | | | | | (1) | | | — | |

| Total underwriting | | | | | 207 | | | 134 | |

| Investment and other income, net | | | | | 215 | | | 154 | |

| Total property and casualty insurance | | | | | 422 | | | 288 | |

| Other (a) | | | | | (46) | | | (59) | |

| Real estate-related entities (b) | | | | | — | | | 29 | |

Total earnings from continuing operations before realized gains (losses) and income taxes | | | | | 376 | | | 258 | |

Realized gains (losses) on securities | | | | | (15) | | | 77 | |

| | | | | | | |

Total earnings from continuing operations before income taxes | | | | | $ | 361 | | | $ | 335 | |

(a)Includes holding company interest and expenses, including a $2 million loss on retirement of debt in the first three months of 2022.

(b)Represents investment income from the real estate and real estate-related entities acquired from AFG’s discontinued annuity operations while they were held by those operations. Subsequent to the sale of the annuity operations, this income is included in the segment of the acquirer.

AMERICAN FINANCIAL GROUP, INC. 10-Q

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

E. Fair Value Measurements

Accounting standards for measuring fair value are based on inputs used in estimating fair value. The three levels of the hierarchy are as follows:

Level 1 — Quoted prices for identical assets or liabilities in active markets (markets in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis). AFG’s Level 1 financial instruments consist primarily of publicly traded equity securities, highly liquid government bonds for which quoted market prices in active markets are available and short-term investments of managed investment entities.

Level 2 — Quoted prices for similar instruments in active markets; quoted prices for identical or similar assets or liabilities in inactive markets (markets in which there are few transactions, the prices are not current, price quotations vary substantially over time or among market makers, or in which little information is released publicly); and valuations based on other significant inputs that are observable in active markets. AFG’s Level 2 financial instruments include corporate and municipal fixed maturity securities, asset-backed securities (“ABS”), mortgage-backed securities (“MBS”), certain non-affiliated common stocks and investments of managed investment entities priced using observable inputs. Level 2 inputs include benchmark yields, reported trades, corroborated broker/dealer quotes, issuer spreads and benchmark securities. When non-binding broker quotes can be corroborated by comparison to similar securities priced using observable inputs, they are classified as Level 2.

Level 3 — Valuations derived from market valuation techniques generally consistent with those used to estimate the fair values of Level 2 financial instruments in which one or more significant inputs are unobservable or when the market for a security exhibits significantly less liquidity relative to markets supporting Level 2 fair value measurements. The unobservable inputs may include management’s own assumptions about the assumptions market participants would use based on the best information available at the valuation date. Financial instruments whose fair value is estimated based on non-binding broker quotes or internally developed using significant inputs not based on, or corroborated by, observable market information are classified as Level 3.