UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-39155

XP Inc.

(Exact name of registrant as specified in its

charter)

20, Genesis Close

Grand Cayman, George Town

Cayman Islands KY-1-1208

+55 (11) 3075-0429

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

XP Inc. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Bruno Constantino Alexandre Santos |

| |

|

Name: |

Bruno Constantino Alexandre Santos |

| |

|

Title: |

Chief Financial Officer |

Date: June 20, 2024

EXHIBIT INDEX

Exhibit 99.1

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition

and results of operations should be read in conjunction with our unaudited interim condensed consolidated financial statements as of March

31, 2024 and for the three months ended March 31, 2024 and 2023 and the notes thereto from our Form 6-K filed with the U.S. Securities

and Exchange Commission, or the “SEC” on May 21, 2024, and "Item 5. Operating and Financial Review and Prospects"

in our Annual Report on Form 20-F for the fiscal year ended December 31, 2023, filed with the SEC on April 26, 2024 and any amendments

thereto, if any, or the “2023 Form 20-F.”

The following discussion contains forward-looking

statements that involve risks and uncertainties. Our actual results and the timing of events may differ materially from those expressed

or implied in such forward-looking statements as a result of various factors, including those set forth in “Cautionary Statement

Regarding Forward-Looking Statements” and “Item 3. Key information—D. Risk Factors” of our 2023 Form 20-F.

Key Business Metrics

The following table sets forth our key business

metrics as of and for the periods indicated. These supplemental business metrics are presented to assist investors to better understand

our business and how it operates.

| | |

As of and for the Three Months Ended

March 31, |

| | |

2024 | |

2023 |

| Operating Metrics (Unaudited) | |

| |

|

| Total Client Assets (in R$ billions) | |

| 1,141 | | |

| 954 | |

| Total Net Inflow (in R$ billions) | |

| 15 | | |

| 16 | |

| Annualized Retail Take Rate | |

| 1.24 | % | |

| 1.21 | % |

| Active clients (in thousands) | |

| 4,587 | | |

| 3,966 | |

| Headcount (EoP) | |

| 6,579 | | |

| 6,146 | |

| Total Advisors (1)(in thousands) | |

| 17.7 | | |

| 15.3 | |

| Retail DATs (in millions) | |

| 2.2 | | |

| 2.4 | |

| Retirement Plans Client Assets (in R$ billions) | |

| 73 | | |

| 62 | |

| Cards TPV (in R$ billion) | |

| 11.3 | | |

| 8.6 | |

| Loan Portfolio (in R$ billion) | |

| 22.5 | | |

| 17.5 | |

| | |

| | | |

| | |

| Financial metrics (in R$ millions) | |

| | | |

| | |

| Gross revenue and income | |

| 4,270 | | |

| 3,326 | |

| Retail (2) | |

| 3,131 | | |

| 2,569 | |

| Institutional | |

| 354 | | |

| 332 | |

| Corporate & Issuer Services(2) | |

| 509 | | |

| 266 | |

| Other | |

| 276 | | |

| 158 | |

| Total revenue and income | |

| 4,053 | | |

| 3,134 | |

| Gross Margin (%)(3) | |

| 67.5 | % | |

| 65.4 | % |

| EBT | |

| 1,088 | | |

| 816 | |

| EBT Margin (%)(4) | |

| 26.9 | % | |

| 26.0 | % |

| Net Income | |

| 1,030 | | |

| 796 | |

| Net Margin (%)(5) | |

| 25.4 | % | |

| 25.4 | % |

| (1) | Total Advisors connected to XP, which includes IFAs, XP employees who offer advisory services, Registered Investment Advisors, which

includes consultants and wealth managers, among others. |

| (2) | Revenues associated with corporate clients, companies with annual revenues above R$700 million, were segregated from retail clients,

which include individuals and companies with lower revenues. The change was motivated by the growth of the Corporate business, which was

irrelevant until the end of 2021 and gained traction throughout 2022. Revenue from Corporate clients is being reported in Corporate &

Issuer Services. |

| (3) | Calculated as total revenue and income less operating costs, including expected credit losses, and divided by total revenue and income. |

| (4) | Calculated as income before income tax divided by total revenue and income. |

| (5) | Calculated as Net Income divided by total revenue and income. |

The following table sets forth additional business

metrics as of and for the periods indicated, related to Retail AUM (as defined in our 2023 Form 20-F). These supplemental business metrics

are presented to assist investors to better understand our business and how it operates.

| | |

As of and for the Three Months Ended

March 31, |

| | |

2024 | |

2023 |

| Retail – AUM (in R$ billions) | |

| 126.4 | | |

| 135.5 | |

| Mutual and Hedge Funds | |

| 65.6 | | |

| 64.5 | |

| Hedge Funds (Fundo de Investimento Multimercado) | |

| 29.5 | | |

| 32.3 | |

| Equity Funds (Fundo de Investimento em Ações) | |

| 4.7 | | |

| 4.7 | |

| Fixed Income Funds (Fundo de Investimento Renda Fixa) | |

| 28.6 | | |

| 24.9 | |

| Other Funds | |

| 2.9 | | |

| 2.6 | |

| Private Equity Funds | |

| 3.0 | | |

| 2.7 | |

| Exclusive Funds | |

| 29.1 | | |

| 36.5 | |

| Retirement Plans Funds | |

| 23.4 | | |

| 19.0 | |

| Investment Clubs | |

| 2.3 | | |

| 2.2 | |

| Managed Portfolios | |

| 2.9 | | |

| 10.6 | |

| Total Retail – AUM as a % of Client Assets (%) | |

| 12.5 | % | |

| 15.9 | % |

| Retail – AUM Weighted Average Management Fee (% p.a.) | |

| 0.5 | % | |

| 0.5 | % |

| Mutual and Hedge Funds | |

| 0.5 | % | |

| 0.5 | % |

| Hedge Funds (Fundo de Investimento Multimercado) | |

| 0.6 | % | |

| 0.7 | % |

| Equity Funds (Fundo de Investimento em Ações) | |

| 1.0 | % | |

| 1.0 | % |

| Fixed Income Funds (Fundo de Investimento Renda Fixa) | |

| 0.3 | % | |

| 0.3 | % |

| Other Funds | |

| 0.5 | % | |

| 0.5 | % |

| Exclusive funds | |

| 1.7 | % | |

| 1.7 | % |

| Retirement Plans | |

| 0.3 | % | |

| 0.3 | % |

| Private Equity Funds | |

| 0.5 | % | |

| 0.6 | % |

| Investment Clubs | |

| 0.5 | % | |

| 0.6 | % |

| Managed Portfolios | |

| 0.4 | % | |

| 0.4 | % |

| Total management fees, gross of taxes (in R$ millions)(1) | |

| 411.0 | | |

| 382.0 | |

| From funds and portfolios managed by our asset managers | |

| 218.0 | | |

| 222.0 | |

| % of total management fees | |

| 53 | % | |

| 58 | % |

| From third party funds (distribution fees) | |

| 193.0 | | |

| 160.0 | |

| % of total management fees | |

| 47 | % | |

| 42 | % |

| (1) | Consist of (i) fixed and performance-based management fees from mutual funds managed by our asset managers and sold to our retail

clients; (ii) fees from distributions (rebates from fixed and performance-based management fees) of funds managed by third-party

asset managers to our retail clients; and (iii) fixed management fees from XP Advisory managed portfolios and exclusive funds for

high net worth retail clients. |

The chart below sets forth our loan portfolio

and NPL (non-performing loan) over 90-days for the periods indicated.

We have a diversified and adequate funding mix

with robust liquidity. The chart below sets forth our eligible quality liquid assets and liquidity coverage ratio, from March 31, 2023

through March 31, 2024, as well as our indebtedness profile as of March 31, 2024.

| (1) | Company Data based on Brazilian Central Bank Methodology. |

Moreover, the chart below sets forth our debt

maturity profile as of March 31, 2024.

Review of Results for the Three Months Ended

March 31, 2024

Retail – Our number of active clients

increased 16%, from 3,966 thousand as of March 31, 2023 to 4,587 thousand as of March 31, 2024. The daily average trades for the three

months ended March 31, 2024 was 2.2 million, 9% lower compared with the three months ended March 31, 2023. Driven by a monthly average

net inflow of R$4.8 billion, our Total Client Assets increased 20% from R$954 billion as of March 31, 2023 to R$1,141 billion as of March

31, 2024. Our AUM decreased 7%, from R$135 billion as of March 31, 2023 to R$126 billion as of March 31, 2024 (12% of our Total Client

Assets). Retail Gross Total Revenues increased 22% from R$2,569 million for the three months ended March 31, 2023 to R$3,131 million for

the three months ended March 31, 2024, attributable mostly to (1) growth in the client base and total Client Assets and (2) increased

performance from products such as fixed income and credit cards.

Institutional – gross revenues totaled

R$354 million for the three months ended March 31, 2024, a 7% increase from R$332 million for the three months ended March 31, 2023, mainly

due to an increase in trading activity and results from our fixed income, currency and commodities desk.

Corporate & Issuer Services –

gross revenues totaled R$509 million for the three months ended March 31, 2024, a 91% increase from R$266 million for the three months

ended March 31, 2023. This increase was attributable to a strong performance in Debt Capital Markets (DCM). The robust activity in DCM

was driven by favorable market conditions that allowed the company to capitalize on high demand for debt financing solutions, thereby

securing substantial deal flow and revenue. This increase in revenue was pivotal in offsetting the weaker results from Equity Capital

Markets (ECM), which continued to underperform due to less favorable conditions in the equity issuance landscape.

As a result, our total revenue and income increased

29.3%, from R$3,134 million for the three months ended March 31, 2023 to R$4,053 million for the three months ended March 31, 2024. Gross

margin increased from 65.4% to 67.5%, mainly due to a better revenue mix. The three months ended March 31, 2024 was also marked by an

increase in technology solutions associated with new products, infrastructure and also in expanding our employee base. Selling expenses

increased 114.5% to R$32 million for the three months ended March 31, 2024, compared to R$15 million for the three months ended March

31, 2023, driven mainly by investments in brand awareness and marketing campaigns. Administrative expenses increased 32.7% to R$1,452

million for the three months ended March 31, 2024, compared to R$1,094 million for the three months ended March 31, 2023, driven mainly

by higher personnel expenses and data processing expenses. The increase in expenses and revenue growth resulted in a 33.4% higher income

before income tax. Our tax expense was R$39 million higher in the period, resulting in a higher net income, from R$796 million for the

three months ended March 31, 2023 to R$1,030 million for the three months ended March 31, 2024, and a stable net margin of 25.4%.

Results of Operations

Three Months Ended March 31, 2024, Compared to the Three

Months Ended March 31, 2023

The following table sets forth our income statement

data for the three months ended March 31, 2024 and 2023:

| | |

For the Three Months Ended

March 31, |

| | |

2024 | |

2023 | |

Variation (%) |

| | |

(R$ millions, except for percentages) |

| Income Statement Data | |

| | | |

| | | |

| | |

| Net revenue from services rendered | |

| 1,624 | | |

| 1,346 | | |

| 21 | % |

| Net income from financial instruments at amortized cost and at fair value through other comprehensive income | |

| 227 | | |

| 502 | | |

| (55 | )% |

| Net income from financial instruments at fair value through profit or loss | |

| 2,202 | | |

| 1,286 | | |

| 71 | % |

| Total revenue and income | |

| 4,053 | | |

| 3,134 | | |

| 29 | % |

| Operating costs and expenses | |

| | | |

| | | |

| | |

| Operating costs | |

| (1,219 | ) | |

| (1,017 | ) | |

| 20 | % |

| Selling expenses | |

| (32 | ) | |

| (15 | ) | |

| 115 | % |

| Administrative expenses | |

| (1,452 | ) | |

| (1,094 | ) | |

| 33 | % |

| Other operating income expenses, net | |

| 9 | | |

| 19 | | |

| (51 | )% |

| Expected credit losses | |

| (97 | ) | |

| (68 | ) | |

| 43 | % |

| Interest expense on debt | |

| (181 | ) | |

| (163 | ) | |

| 11 | % |

| Share of profit or (loss) in joint venture and associates | |

| 7 | | |

| 19 | | |

| (63 | )% |

| Income before income tax | |

| 1,088 | | |

| 816 | | |

| 33 | % |

| Income tax expense | |

| (59 | ) | |

| (20 | ) | |

| 192 | % |

| Net income for the period | |

| 1,030 | | |

| 796 | | |

| 29 | % |

Total revenue and income

Total revenue and income for the three months

ended March 31, 2024 was R$4,053 million, an increase of R$919 million, or 29%, from R$3,134 million for the three months ended March

31, 2023. Net revenues from services rendered represented R$278 million of the increase in total revenue and income, driven by:

| · | a R$241 million increase in revenue from securities placements, primarily attributable to the increase in mandates where we acted

as placement agents or underwriters for third-party transactions in the domestic and international capital markets. Despite the unfavorable

scenario for equity capital markets, our debt capital markets revenue has been more relevant, as we believe it tends to be less volatile

in different macroeconomic scenarios; |

| · | a R$29 million increase in management fees, as a result of fees from distributions (rebates from management fees) of funds managed

by third-party asset managers and management fees attributable to funds managed by third parties (fees from distributions), which increased

from 42% of total management fees for the three months ended March 31, 2023 to 47% for the three months ended March 31, 2024, or R$193

million, while management fees attributable to funds and portfolios managed by our asset managers decreased from 58% of total management

fees for the three months ended March 31, 2023, to 53%, for the three months ended March 31, 2024, or R$218 million. For the three months

ended March 31, 2024, 3% of management fees were performance-based and 97% were non-performance-based (i.e., fixed annual fees); |

| · | a R$19 million increase in banking fees, mainly related to interchange fees received in credit card transactions, due to the greater

volume of these transactions; |

| · | a R$14 million increase in other services; and |

| · | a R$8 million increase in insurance brokerage fees, driven by a higher sale of retirement plans and insurance products to retail clients; |

| · | net of a R$34 million increase in taxes and contributions on services. |

Net income from financial instruments represented

R$641 million of the increase in total revenue and income, driven by the growth in our retail investment distribution platform, mainly

driven by Fixed Income (Retail Client Assets grew 19%) and our Corporate business.

Operating costs and expenses

Operating costs. Operating costs for the

three months ended March 31, 2024 were R$1,219 million, an increase of R$202 million, or 20%, from R$1,017 million for the three months

ended March 31, 2023. This increase was primarily attributable to a R$131 million increase in costs relating to commissions and incentives

payable to our IFAs as part of the growth of our omni-channel distribution network, and a R$35 million increase in clearinghouse fees.

As a percentage of total revenue and income, our operating costs decreased to 30.1% for the three months ended March 31, 2024, compared

to 32.4% for three months ended March 31, 2023.

Selling expenses. Selling expenses for

the three months ended March 31, 2024 were R$32 million, an increase of R$17 million, or 115%, from R$15 million for the three months

ended March 31, 2023, due to higher investments in brand awareness and marketing campaigns.

Administrative expenses. Administrative

expenses for the three months ended March 31, 2024 were R$1,452 million, an increase of R$358 million, or 33%, from R$1,094 million for

the three months ended March 31, 2023. This increase was primarily attributable to:

| · | a R$247 million, or 33%, increase in personnel expenses related to an increase in total employee headcount from 6,146 for the three

months ended March 31, 2023, to 6,579 for the three months ended March 31, 2024; |

| · | a R$55 million, or 35%, increase in data processing expenses, mainly related to consultancy and data services in connection with the

operation and maintenance of our platform’s software; and |

| · | a R$18 million, or 84%, increase in amortization of intangible assets. |

Other operating income (expenses), net. We

recorded other operating income, net of R$9 million for the three months ended March 31, 2024, compared to other operating income of R$19

million for the three months ended March 31, 2023.

Income before income taxes

As a result of the foregoing, income before income

taxes for the three months ended March 31, 2024 were R$1,088 million, an increase of R$272 million, or 33%, from R$816 million for the

three months ended March 31, 2023.

Income tax expense

Income tax expense for the three months ended

March 31, 2024 was R$59 million, a increase of R$39 million, or 192%, from R$20 million for the three months ended March 31, 2023. This

increase was attributable to an increase in our effective tax rate to 5.4% for the three months ended March 31, 2024, from 2.5% for the

three months ended March 31, 2023, as a result of revenues at the level of entities and investment funds which adopt different taxation

regimes according to the applicable rules in their jurisdictions.

Net income for the period

As a result of the foregoing, net income for the

three months ended March 31, 2024 was R$1,030 million, an increase of R$234 million, or 29%, from R$796 million for the three months ended

March 31, 2023.

Liquidity and Capital Resources

As of March 31, 2024, we had R$5,093 million in

cash and cash equivalents. We believe that our current available cash and cash equivalents and the cash flows from our operating activities

will be sufficient to meet our working capital requirements and capital expenditures in the ordinary course of business for the next 12 months.

The following table shows the generation and use

of cash for the periods indicated:

| | |

For the Three Months Ended

March 31, |

| | |

2024 | |

2023 |

| | |

(R$ millions) |

| Cash Flow Data | |

| | | |

| | |

| Income before income tax | |

| 1,088 | | |

| 816 | |

| Adjustments to reconcile income before income tax | |

| 649 | | |

| 99 | |

| Income tax paid | |

| (268 | ) | |

| (158 | ) |

| Interest paid | |

| (10 | ) | |

| (7 | ) |

| Changes in working capital assets and liabilities | |

| (4,805 | ) | |

| 2,678 | |

| Net cash flows from (used in) operating activities | |

| (3,346 | ) | |

| 3,428 | |

| Net cash flows from (used in) investing activities | |

| (717 | ) | |

| 9 | |

| Net cash flows from (used in) financing activities | |

| (64 | ) | |

| (809 | ) |

Our cash and cash equivalents include cash on

hand, interbank certificate deposits with banks and other highly liquid securities purchased under agreements to resell with original

maturities of nine months or less, which have an immaterial risk of change in value. For more information, see note 6 to our audited consolidated

financial statements included in our 2023 Form 20-F.

Net cash flows from (used in) operating activities

Our net cash flows used in operating activities

for the three months ended March 31, 2024 totaled R$3,346 million compared to net cash from operating activities of R$3,428 million in

the three months ended March 31, 2023, primarily driven by: (1) higher balance of securities and derivatives that we hold in the ordinary

course of our business as a retail investment distribution platform and as an institutional broker-dealer (with respect to the sale of

fixed income securities and structured notes); (2) our strategy to allocate excess cash and cash equivalents from treasury funds, from

Float Balances and from retirement plans balances to securities and other financial assets. These balances may fluctuate substantially

from quarter to quarter and were the key drivers to the net cash flow from operating activities figures; and (3) other financial assets

and liabilities as foreign exchange and energy operations portfolios, structured financing, credit card operations, among others. Our

income before tax combined with non-cash expenses consisted primarily of (a) net foreign exchange differences of R$160 million in three

months ended March 31, 2024 and R$210 million in the three months ended March 31, 2023, (b) share-based plan of R$145 million in the three

months ended March 31, 2024 and R$38 million in the three months ended March 31, 2023, (c) interest accrued of R$183 million in the three

months ended March 31, 2024 and R$154 million in the three months ended March 31, 2023, and (d) depreciation and amortization of R$68

million in the three months ended March 31, 2024 and R$48 million in the three months ended March 31, 2023. The total amount of adjustments

to reconcile income before income taxes was R$649 million in the three months ended March 31, 2024 and R$99 million in the three months

ended March 31, 2023.

Net cash flows from (used in) investing activities

Our net cash flows from investing activities for

the three months ended March 31, 2023 totaled R$9 million compared to net cash flows used in investing activities of R$717 million in

the three months ended March 31, 2024, primarily driven by: (1) R$670 million in investments in subsidiaries, associates and joint ventures,

mostly related to our asset management strategy, which increased from R$0 in the three months ended March 31, 2023; and (2) R$47 million

in investments in intangible assets and property plants and equipment, mostly IT infrastructure and capitalized software, which increased

from R$10 million in the three months ended March 31, 2023.

Net cash flows from (used in) financing activities

Our net cash flows used in financing activities

decreased from R$809 million in the three months ended March 31, 2023 to R$64 million in the three months ended March 31, 2024, primarily

due to the acquisition of treasury shares under our share buyback program in the total amount of R$916 million during the three months

ended March 31, 2023.

Indebtedness

As of March 31, 2024, we had R$2,267 million

in outstanding loans, R$265 million in lease liabilities, R$2,885 million in outstanding debentures and R$3,690 million in senior

notes issued by us. As of March 31, 2024, we were in compliance with all the covenants related to our indebtedness.

Capital Expenditures

In the three months ended March 31, 2024 and 2023,

we made capital expenditures of R$47 million and R$10 million, respectively. Total capital expenditures as a percentage of total net revenue

and income were 1.2% in the three months ended March 31, 2024 and 0.3% in the three months ended March 31, 2023. These capital expenditures

mainly include expenditures related to the upgrade and development of our IT systems, software and infrastructure, and the expansion of

our office spaces due to accelerated growth in employee headcount.

We expect to increase our capital expenditures

to support the growth in our business and operations. We expect to meet our capital expenditure needs for the foreseeable future from

our operating cash flow and our existing cash and cash equivalents. Our future capital requirements will depend on several factors, including

our growth rate, the expansion of our research and development efforts, employee headcount, marketing and sales activities, the introduction

of new features to our existing products and the continued market acceptance of our products.

Off-Balance Sheet Arrangements

As of March 31, 2024, the off-balance sheet arrangements

total an amount of R$9,026 million (compared to R$8,912.7 million as of December 31, 2023). The off-balance sheet arrangements refer to

credit card limits granted and not used by our customers. The amounts granted are linked to the value of customers’ assets held

in guarantee by XP, and may vary daily according to the variation in the credit risk of our customers, as well as the variation in the

value of the guarantees. Besides that, we offer to our customers other types of collateral agreements, such as letters of guarantee.

Quantitative and Qualitative Disclosure About Market Risk

We are exposed to market risks in the ordinary

course of our business, including the effects of interest rate changes and foreign currency fluctuations. Information relating to quantitative

and qualitative disclosures about these market risks is described below and in note 35 to our audited consolidated financial statements

included in our 2023 Form 20-F.

We conducted a sensitivity analysis for market

risks we considered relevant as of March 31, 2024. For this analysis, we adopted the following three scenarios:

| · | Scenario I, which contemplates an increase in fixed interest rate yields, exchange coupon rates and inflation of 1 basis point, and

an increase in the prices of shares and currencies of 1 percentage point. |

| · | Scenario II, which contemplates 25% increases and decreases in fixed interest rate yields, exchange coupon rates and inflation, assuming

the largest possible losses per scenario. |

| · | Scenario III, which contemplates 50% increases and decreases in pre-fixed interest rate yields, exchange coupon rates, inflation and

interest rates, assuming the largest possible losses per scenario. |

The below table sets forth the impact of each

scenario on each market risk. It does not account for the risk protocols of our risk and treasury areas, which trigger risk mitigation

measures as soon as losses are detected, minimizing the risk of significant losses:

| | |

| |

As of March 31, 2024 |

| Trading Portfolio | |

Exposures | |

Scenarios |

| Risk Factors: | |

Risk of Variation in: | |

I | |

II | |

III |

| | |

| |

(R$ millions) |

| Pre-fixed | |

Pre-fixed interest rate in reais | |

| (1,269 | ) | |

| (145,236 | ) | |

| (277,958 | ) |

| Exchange coupons | |

Foreign currencies coupon rate | |

| (146 | ) | |

| (20,990 | ) | |

| (42,454 | ) |

| Foreign currencies | |

Exchange rates | |

| (7,954 | ) | |

| 89,133 | | |

| 442,952 | |

| Price indexes | |

Inflation coupon rates | |

| (12 | ) | |

| (990 | ) | |

| (1,769 | ) |

| Shares | |

Shares prices | |

| (2,020 | ) | |

| (91,649 | ) | |

| (277,622 | ) |

| Seed money (i) | |

Seed money | |

| (2,872 | ) | |

| (71,807 | ) | |

| (143,614 | ) |

| | |

| |

| (14,273 | ) | |

| (241,539 | ) | |

| (300,465 | ) |

| | |

| |

As of December 31, 2023 |

| Trading Portfolio | |

Exposures | |

Scenarios |

| Risk Factors: | |

Risk of Variation in: | |

I | |

II | |

III |

| | |

| |

(R$ millions) |

| Pre-fixed | |

Pre-fixed interest rate in reais | |

| (258 | ) | |

| 21,269 | | |

| 22,753 | |

| Exchange coupons | |

Foreign currencies coupon rate | |

| (367 | ) | |

| (18,174 | ) | |

| (36,588 | ) |

| Foreign currencies | |

Exchange rates | |

| 331 | | |

| 343,440 | | |

| 907,349 | |

| Price indexes | |

Inflation coupon rates | |

| (103 | ) | |

| (12,998 | ) | |

| (24,579 | ) |

| Shares | |

Shares prices | |

| (3,472 | ) | |

| (251,572 | ) | |

| (289,613 | ) |

| Seed money (i) | |

Seed money | |

| (2,822 | ) | |

| (70,566 | ) | |

| (141,133 | ) |

| | |

| |

| (6,691 | ) | |

| 11,399 | | |

| 438,189 | |

| (i) | Related to seed money strategy, which includes several risk factors that are disclosed in aggregate. |

Currency Risk

We are subject to foreign currency risk as we

hold interests in XP Holding International LLC, one of our international financial holding companies in the United States, XP Advisors

Inc., our finance services consulting company in the United States, and XP Holding UK Ltd, one of our international financial holding

companies in the United Kingdom, whose equity as of March 31, 2024 was US$88.3 million, US$9.6 million and GBP13.8 million, respectively.

The foreign currency exposure risk of XP Holding

International and XP Advisors Inc. is hedged with the objective of minimizing the volatility of our functional currency (the real)

against the U.S. dollar arising from foreign investments offshore. The foreign currency exposure risk of XP Holding UK Ltd has not been

hedged.

As of March 31, 2024, we had no indebtedness denominated

in U.S. dollars.

Interest Rate Risk

Interest rate risk arises from the possibility

that we incur in gains or losses arising from fluctuations in interest rates on our financial assets and liabilities. The following are

the risk rates that we are exposed to: (1) SELIC rate; (2) IGP-M, the Brazilian general market price index (Índice

Geral de Preços do Mercado); (3) IPCA, the Brazilian national consumer price index (Índice Nacional de Preços

ao Consumidor Amplo); (4) PRE, the Brazilian required reference equity index (Patrimônio de Referência Exigido);

and (5) foreign exchange coupon.

We have floating interest rate indebtedness, so

we are exposed to interest rate risk as a result of changes in the level of interest rates, and any increase in interest rates could negatively

affect our results of operations and would increase the costs associated with financing our operations. As of March 31, 2024, and December 31,

2023, substantially all of our total indebtedness consisted of floating rate debt and was principally indexed to the CDI. Furthermore,

our exposure to interest rate risk also applies to our cash and cash equivalents deposited in interest-bearing accounts which are indexed

to the CDI, which can affect our results of operations and cash flows.

Price Risk

Price risk is the risk arising from price changes

in investment fund portfolios and shares listed on the stock exchange held in our portfolio, which may affect profit or loss. Price risk

is mitigated by our management through the diversification of our portfolio and/or through the use of derivatives contracts, such as options

or futures. We believe we adopt conservative price risk limits in our risk budget.

Liquidity Risk

Liquidity risk relates to maintaining sufficient

cash and securities through an adequate amount of committed credit facilities to meet obligations when due and to close out market positions.

We have a liquidity risk management policy, which aims to ensure a minimum level of liquidity considered adequate by our management. This

policy establishes actions to be taken in the event of liquidity contingencies, which are designed to reframe cash within required minimum

liquidity limits. Our risk department is responsible for the structure and management of risks, and is under the supervision of the board

of directors, for the avoidance of any conflicts of interest with departments requiring liquidity.

Liquidity risk control is based on forecasts of

cash and assets with credit risk. The cash forecast relies on the free funds deposited by customers, while fund allocations can be classified

according to their settlement or zero settlement periods. The stressed scenario models for delays in private credit assets and the extent

to which possible stress would affect our liquidity conditions.

Credit Risk

Credit risk is the risk of suffering financial

losses related to noncompliance by any of our clients and market counterparties with financial obligations, agreement devaluations as

a result of the deterioration in the risk rating of borrowers, reduced gains or remuneration, and concessions granted in the renegotiation

of financial arrangements and recovery costs, among others.

Credit risk includes, among other risks: (1) non-compliance

by counterparties with obligations related to the settlement of transactions in financial assets, including derivative financial instruments;

(2) losses related to non-compliance with financial obligations by borrowers located abroad, as a result of the actions taken by the government

of the country in which they reside; (3) cash disbursements to honor warranties, co-obligations, credit commitments or other transactions

of a similar nature; and (4) losses associated with non-compliance by intermediaries or borrowers with financial obligations pursuant

to financing agreements.

In our credit operations, we use client investments

as collateral to reduce potential losses and mitigate credit risk exposure by managing collateral so that they are always sufficient,

legally enforceable (effective) and viable. We also monitor the value of the collateral. The credit risk management provides recommendations

to set risk appetite strategies, to set limits, including exposure analysis and trends as well as the effectiveness of the credit policy.

We believe our credit operations have high credit quality and we often use risk mitigation measures, primarily through client investments

as collateral.

Our risk department is responsible for managing

credit risk, ensuring compliance with our credit risk policy and established operating limits. Our credit policy is based on our internal

scenario, including portfolio composition by security, issuer, rating, economic activity and duration of the portfolio, and on the external

economic scenario, including interest rates and inflation, among others. The credit analysis department is also actively involved in this

process and is responsible for assessing the credit risk of issues and issuers with which we maintain or intend to maintain credit relations.

It also recommends limiting the credit risk positions of customers.

We use both National Scale ratings from internationally

recognized Credit Rating Risk Agencies and our internal rating scales to subdivide portfolios into High, Medium and Low Risk. Management

undertakes credit quality analysis of all assets, including those that are not past due or reduced to recoverable value. For credit operations,

we often use the relevant client’s investments under custody with us as collateral to reduce potential losses and protect against

credit risk exposure, and we manage and monitor this collateral to ensure it remains sufficient, legally enforceable (effective) and viable.

Our credit risk management operations allow us to formulate risk appetite strategies and establish limits, including exposure analysis

and trends as well as the effectiveness of our credit policy. As of March 31, 2024, such assets were substantially represented by credit

operations and securities purchased under agreements to resell the counterparties, which include Brazilian banks with low credit risk,

securities issued by the Brazilian government, as well as derivative financial instruments transactions, which are mostly traded on the

B3.

Market Risk

Market risk is the risk that the fair value or

future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three main types

of risk: foreign exchange variation, interest rates and share prices. The aim of market risk management is to control exposure to market

risks, within acceptable parameters, while optimizing returns. Market risk management for operations is carried out through policies,

control procedures and prior identification of risks in new products and activities, with the purpose of maintaining market risk exposure

at levels considered acceptable by us and to meet the business strategy and limits defined by the risk committee of XP Brazil.

The main tool used to measure and control our

exposure risk to the market, mainly in relation to the trading assets portfolio, is the Maps Luna program, which calculates the capital

allocation based on the exposure risk factors in the regulations issued by the Central Bank for financial institutions, which we apply

to verify the risk exposure of our assets. In order to comply with the provisions of the Central Bank, our financial institutions monitor

our exposure and calculate it on a daily basis, in accordance with CMN Resolution No. 4,557, and submit it daily to the Central Bank.

With the formalized rules, the risk department of XP Brazil has the objective of controlling, monitoring and ensuring compliance with

the pre-established limits, and may decline, in whole or in part, to receive and/or execute the requested transactions, upon immediate

communication to customers, in addition to intervening in cases of non-compliance and reporting all unusual events to the committee.

In addition to aforementioned controls, we adopt

guidelines to control the risk of the assets that mark treasury operations so that the portfolios of the participating companies are composed

of assets that have low volatility and, consequently, less exposure to risk. In the event of non-compliance with the operational limits,

the treasury manager can take the necessary measures to remedy this as quickly as possible.

Operating Risk

Operating risk is the risk of direct or indirect

losses resulting from a variety of internal factors associated with our processes, personnel, technology and infrastructure, and with

external factors, except for credit, market and liquidity risks, such as those deriving from legal and regulatory requirements and from

generally accepted standards of business behavior. Operating risks arise from all of our operations. Our objective is to manage operating

risk to avoid financial losses and damage to our reputation, and also to seek cost efficiency, avoiding control procedures that restrict

initiatives and creativity.

The main responsibility for development and implementation

of controls to deal with operating risks is attributed to key management within each business unit, and is supported by the development

of our general standards for management of operating risks in the following areas: (1) requirements of segregation of functions, including

independent authorization for transactions; (2) requirements of reconciliation and monitoring of transactions; (3) compliance with legal

and regulatory requirements; (4) documentation of controls and procedures; (5) requirements of periodic assessment of the operating risks

faced and the adequacy of the controls and procedures for dealing with the identified risks; (6) development of contingency plans; (7)

professional training and development; and (8) ethical and business standards.

Our financial institutions, in compliance with

the provisions of CMN Resolution No. 4,557, have a process that encompasses institutional policies, procedures, systems and contingency

plans and business continuity for the occurrence of external events, in addition to formalizing the single structure required by the Central

Bank.

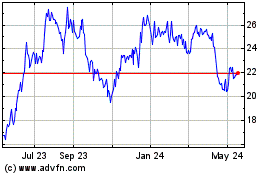

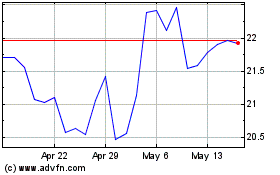

XP (NASDAQ:XP)

Historical Stock Chart

From May 2024 to Jun 2024

XP (NASDAQ:XP)

Historical Stock Chart

From Jun 2023 to Jun 2024