Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 10 2023 - 12:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Dated February 10, 2023

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED

COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE,

RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

þ Form 40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Report on Form 6-K contains a Stock Exchange Announcement

dated 10 February 2023 entitled ‘VODAFONE CLOSES U.S. $1.2 BILLION DEBT SECURITIES OFFERING’.

VODAFONE CLOSES U.S.$1.2 BILLION DEBT SECURITIES

OFFERING

On 10 February 2023, Vodafone Group Plc ("Vodafone")

closed a U.S.$1.2 billion debt securities offering. The securities offering included an offering of U.S.$700,000,000 5.625% Notes due

February 2053 and U.S.$500,000,000 5.750% Notes due February 2063. Vodafone has applied to list the securities on the Nasdaq

Global Market.

Vodafone has generated net proceeds of U.S.$1,183,901,000

from the sale of the debt securities. Vodafone intends to use these net proceeds (i) to fund the purchase of its 5.250% Notes due

May 2048, 4.375% Notes due February 2043 and 5.000% Notes due May 2038 (collectively, the “Tender Offer Notes”),

that are validly tendered (and not validly withdrawn) pursuant to its offers to purchase any and all of such Tender Offer Notes up to

a cap of U.S.$2.0 billion aggregate principal amount of the Tender Offer Notes and (ii) for general corporate purposes.

IMPORTANT INFORMATION

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any securities, nor does it constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale is unlawful. The offering to which this media release relates was made pursuant to an effective

registration statement that Vodafone filed with the US Securities and Exchange Commission (the "SEC") and only by means of a

prospectus supplement and accompanying base prospectus. Vodafone has filed with the SEC a final prospectus supplement to the base prospectus

for the offering. You can obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Copies of the prospectus

supplement, the accompanying base prospectus and the final prospectus relating to the offering can be obtained from Vodafone at its registered

address, any underwriter or any dealer participating in the offering (BofA Securities, Inc. at 1-800-294-1322, Citigroup Global Markets

Inc. at 1-800-831-9146, Goldman Sachs & Co. LLC at 1-866-471-2526, SMBC Nikko Securities America, Inc. at 1-888-868-6856

and TD Securities (USA) LLC at 1-855-495-9846).

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| | | VODAFONE GROUP |

| | | PUBLIC LIMITED COMPANY |

| | | (Registrant) |

| | | |

| Date: February 10, 2023 | By: | /s/ R E S MARTIN |

| | Name: | Rosemary E S Martin |

| | Title: | Group General

Counsel and Company Secretary |

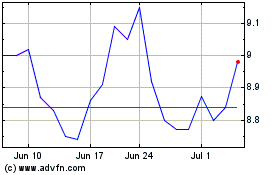

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

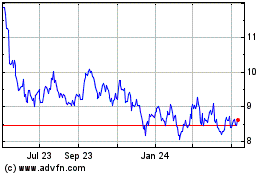

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024