UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-39519

Vitru Limited

(Exact name of registrant as specified in its

charter)

Rodovia José Carlos Daux, 5500, Torre

Jurerê A,

2nd floor, Saco Grande, Florianópolis, State of

Santa Catarina, 88032-005, Brazil

+55 (47) 3281-9500

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Vitru Limited |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Carlos Henrique Boquimpani de Freitas |

| |

|

|

|

Name: |

Carlos Henrique Boquimpani de Freitas |

| |

|

|

|

Title: |

Chief Financial and Investor Relations Officer |

Date: September 5, 2023

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

On August 23, 2021, Vitru Limited (the “Company”)

entered into a purchase agreement with the shareholders of CESUMAR - Centro de Ensino Superior de Maringá Ltda, or “Unicesumar”

through its subsidiary Vitru Brasil Empreendimentos, Participações e Comércio e S.A. or “Vitru Brasil”,

to acquire the entire share capital of Unicesumar (“the transaction”). The transaction was closed on May 20, 2022 (transaction

date), when the control of Unicesumar was transferred to the Company after fulfillment of usual precedent conditions, which included approval

by the antitrust regulatory agency and other regulatory approvals.

Unicesumar is a leading and fast-growing higher

education institution in Brazil focused on the distance learning market, founded 30 years ago in Maringá - Paraná. At acquisition

date Unicesumar had 999 centers and approximately 331 thousand students, of which 314 thousand are in digital education. Unicesumar also

has significant on-site courses in the health area, mainly Medicine, with more than 1,600 students in the 348 courses.

Set forth below are the unaudited pro forma condensed

consolidated statements of operations for the year ended December 31, 2022.

Assumptions underlying the pro forma adjustments

are described in the accompanying notes, which should be read in conjunction with this unaudited pro forma condensed consolidated financial

information.

The Company expect to incur integration costs and

synergies from the consolidation of Unicesumar. The unaudited pro forma condensed consolidated financial information does not reflect

any future integration costs or synergies that may result from the consolidation of Unicesumar.

The Unicesumar acquisition by Vitru was accounted

as a business combination in accordance with IFRS 3 — Business Combinations, using the purchase method of accounting.

The pro forma information presented, including allocation of the purchase price, is based upon our final estimates of the fair value of

the assets acquired and liabilities assumed.

Unaudited pro forma condensed consolidated statement

of profit and loss

For the year ended December 31, 2022

(Amounts in thousands of reais, except

per share data)

| |

|

Vitru

Historical | |

Unicesumar Historical | |

Pro forma adjustments | |

Note | |

Total

pro forma |

| NET REVENUE | |

| 1,317,346 | | |

| 444,126 | | |

| (98,185 | ) | |

2(c) | |

| 1,663,287 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Cost of services rendered | |

| (502,331 | ) | |

| (104,106 | ) | |

| 27,656 | | |

2(c)/(d)/(e) | |

| (578,781 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| GROSS PROFIT | |

| 815,015 | | |

| 340,020 | | |

| (70,529 | ) | |

| |

| 1,084,506 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| General and administrative expenses | |

| (179,335 | ) | |

| (148,051 | ) | |

| 8,116 | | |

2(c)/(e)/(f) | |

| (319,270 | ) |

| Selling expenses | |

| (244,836 | ) | |

| (28,730 | ) | |

| (14,361 | ) | |

2(c)/(e) | |

| (287,927 | ) |

| Net impairment losses on financial assets | |

| (187,534 | ) | |

| (18,313 | ) | |

| 4,721 | | |

2(c) | |

| (201,126 | ) |

| Other income (expenses), net | |

| (2,320 | ) | |

| (86,284 | ) | |

| (449 | ) | |

2(c) | |

| (89,053 | ) |

| Operating expenses | |

| (614,025 | ) | |

| (281,378 | ) | |

| (1,973 | ) | |

| |

| (897,376 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| OPERATING PROFIT | |

| 200,990 | | |

| 58,642 | | |

| (72,502 | ) | |

| |

| 187,130 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Financial income | |

| 64,566 | | |

| 10,182 | | |

| (2,100 | ) | |

2(c) | |

| 72,648 | |

| Financial expenses | |

| (264,437 | ) | |

| (8,252 | ) | |

| (137,864 | ) | |

2(a)/(b)/(c)/(d) | |

| (410,553 | ) |

| Financial results | |

| (199,871 | ) | |

| 1,930 | | |

| (139,964 | ) | |

| |

| (337,905 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| PROFIT (LOSS) BEFORE TAXES | |

| 1,119 | | |

| 60,572 | | |

| (212,466 | ) | |

| |

| (150,775 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Current income taxes | |

| (18,023 | ) | |

| (4,049 | ) | |

| 35,034 | | |

2 (a)/(b)/(c)/(f) | |

| 12,962 | |

| Deferred income taxes | |

| 110,224 | | |

| 1,074 | | |

| 21,430 | | |

2 (c)/(d)/(e) | |

| 132,728 | |

| Income taxes | |

| 92,201 | | |

| (2,975 | ) | |

| 56,464 | | |

| |

| 145,690 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| PROFIT (LOSS) FOR THE YEAR | |

| 93,320 | | |

| 57,597 | | |

| (156,002 | ) | |

| |

| (5,085 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Basic earnings per share (R$) | |

| 3.52 | | |

| | | |

| | | |

2(g) | |

| (0.17 | ) |

| Diluted earnings per share (R$) | |

| 3.23 | | |

| | | |

| | | |

2(g) | |

| (0.17 | ) |

Notes to unaudited pro forma condensed consolidated

financial information

(Amounts in thousands of reais, except

per share data)

The unaudited pro forma condensed consolidated

statement of operations for the year ended December 31, 2022 is based on the historical audited consolidated financial statements of Vitru

as of December 31, 2022, and the historical unaudited financial statements of Unicesumar as of June 30, 2022, and gives effect to the

Unicesumar acquisition as if it had been consummated on January 1, 2022.

The unaudited pro forma adjustments

are based upon available information and certain assumptions that are factually supportable and that we believe are reasonable under the

circumstances.

The unaudited pro forma condensed consolidated

financial information is presented for information purposes only.

The unaudited pro forma condensed consolidated

financial information does not purport to represent what our actual consolidated results of operations would have been had the Unicesumar

acquisition occurred on the dates indicated, nor are they indicative of future consolidated results of operations or financial condition.

The unaudited pro forma condensed consolidated

financial information should be read in conjunction with our historical consolidated financial statements and the historical financial

statements of Unicesumar.

The audited consolidated financial statements

and the unaudited interim condensed consolidated financial statements from which the unaudited pro forma condensed consolidated financial

information have been derived, were prepared in accordance with International Financial Reporting Standards (“IFRS”) issued

by the International Accounting Standards Board (“IASB”).

| 2. | Pro Forma adjustments and assumptions |

The total of consideration transferred

was calculated based on the terms of the agreement with the former owners of Unicesumar shares. They received cash and Vitru Ltd shares

just as determined in the terms of the business combination agreement. The following table summarizes the allocation of the purchase price

at the Closing date.

| | |

In thousands of

R$ (reais) |

| Cash consideration | |

| 2,649,829 | |

| Vitru Shares issue (7,182 thousand shares at US$ 16.00 per share) | |

| 560,544 | |

| Total consideration | |

| 3,210,373 | |

| | |

| | |

| Book value of Unicesumar's shareholders' equity at May 20, 2022 | |

| 137,050 | |

| | |

| | |

| Fair value adjustments | |

| 1,516,987 | |

| Customer relationships | |

| 294,525 | |

| Brand | |

| 352,189 | |

| Non-compete agreement | |

| 272,416 | |

| Software | |

| 33,379 | |

| Teaching-learning material (TLM) | |

| 26,584 | |

| Operation licenses for distance learning | |

| 1,206,641 | |

| Leasing contracts | |

| 57,278 | |

| Licenses to operate medical courses | |

| 55,454 | |

| Deferred taxes on temporary differences | |

| (781,479 | ) |

| Goodwill | |

| 1,556,336 | |

| Total identifiable assets + goodwill | |

| 3,073,323 | |

The final purchase price allocation

has been used to prepare pro forma adjustments in the pro forma income statement.

The pro forma adjustments are based

on currently available information and certain estimates and assumptions; therefore, the actual effects of these transactions may differ

from the pro forma adjustments. We have only included material adjustments that are directly attributable to the acquisition, factually

supportable, and, with respect to the statement of income, expected to have a continuing impact on the consolidated results. A general

description adjustment is provided as follows:

Notes to unaudited pro forma condensed consolidated

financial information

(Amounts in thousands of reais, except

per share data)

| (a) | Consideration paid was defined based on the terms of the transaction

considering that the owners of Unicesumar received cash and Vitru’s shares as agreed in the contractual terms. Consideration consists

of R$ 2,650 million (including the contingent consideration) to be paid in cash plus 7,182 thousand Vitru’s Shares, of

which 5,387 thousand were issued on the Closing Date and 1,795 have been retained 898 have been retained for a period of 3 years

and 897 have been retained for a period of 6 years (“holdback period”). The Vitru’s shares issued on the Closing date

were quoted at a market price of US$ 16.00 per share. |

| Purchase consideration | |

| 3,210,373 | | |

100,00% |

| Cash payable at the acquisition date | |

| 2,162,500 | | |

67,36% |

| Payable after 12 months (i) | |

| 456,721 | | |

14,23% |

| Contingent consideration | |

| 30,608 | | |

0,95% |

| Payable through the issuance of new Vitru shares | |

| 560,544 | | |

17,46% |

(i)

Reflects the estimated adjustment to financial expenses resulting from the interest expense from the monetary indexation by the from the

interest expense from the monetary indexation by the IPCA rate for the first 12 months and CDI rate for the remaining 12 months on the

amounts payable in installments of the purchase consideration. The estimated adjustment to financial expenses amounted to R$ 28.4 million

for the year ended December 31, 2022.

| (b) | The cash consideration paid on May 20, 2022, amounted R$ 2,163 million.

To have sufficient resources to pay the cash portion of the acquisition price, on May 19, 2022, the Company issued through its

subsidiary Vitru Brasil S.A., two series of debentures, the first series containing 500 bonds maturing between November 2023 and May 2024,

and the second series containing 1,450 bonds maturing between May 2025 and May 2027. The net proceeds from the issuance of the debentures

amounted R$ 1.906 thousand (R$ 1,950 thousand less R$ 44 thousand transaction costs). The Company used its own cash to pay the remaining

amount. |

The

interest rate of debentures is CDI+2.9% p.a. for the first series and CDI+3.20% p.a. for the second series. Thereby, the Company estimated

financial expense for such debentures obtained above in the amount of R$ 100.5 million for the period before prior the issuance in 2022.

| (c) | The adjustment reflects the elimination in the consolidated pro forma financial statements of Unicesumar

results from the date of acquisition to June 30, 2022, which were consolidated in the Vitru Limited financial statements, as the pro forma

consolidated pro forma financial condensed income statement includes the Unicesumar historical statement of profit and loss for the six

months period ended June 30, 2022. The adjustments are listed below: |

| | |

May 21, 2022 to June 30, 2022 |

| NET REVENUE | |

| 98,185 | |

| | |

| | |

| Cost of services rendered | |

| (38,248 | ) |

| | |

| | |

| GROSS PROFIT | |

| 59,937 | |

| | |

| | |

| General and administrative expenses | |

| (6,710 | ) |

| Selling expenses | |

| (6,744 | ) |

| Net impairment losses on financial assets | |

| (4,721 | ) |

| Other income (expenses), net | |

| 449 | |

| Operating expenses | |

| (17,726 | ) |

| | |

| | |

| OPERATING PROFIT | |

| 42,211 | |

| | |

| | |

| Financial income | |

| 2,100 | |

| Financial expenses | |

| (932 | ) |

| Financial results | |

| 1,168 | |

| | |

| | |

| PROFIT BEFORE TAXES | |

| 43,379 | |

| | |

| | |

| Current income taxes | |

| (121 | ) |

| Deferred income taxes | |

| (625 | ) |

| Income taxes | |

| (746 | ) |

| | |

| | |

| NET INCOME FOR THE PERIOD | |

| 42,633 | |

Notes to unaudited pro forma condensed consolidated

financial information

(Amounts in thousands of reais, except

per share data)

| (d) | The adjustment reflects amortization and the interest expense related to the estimated fair value of the

leasing contract for the right of use of certain Land and Building, signed prior to the Closing date between Unicesumar and Soedmar. |

| | |

Year ended |

| Leases | |

December 31, 2022 |

| Amortization expense | |

| 8,357 | |

| Accrued interest | |

| 19,752 | |

| Total | |

| 28,109 | |

| (e) | The adjustment reflects the amortization expense related to the

fair value of identified assets as detailed below: |

| Identifiable assets acquired | |

Expected life in years |

| Customer relationships | |

| 5.4 | |

| Brand | |

| 24.6 | |

| Non-compete agreement | |

| 7.6 | |

| Software | |

| 7.0 | |

| Teaching-learning material (TLM) | |

| 3.0 | |

| Operation licenses for distance learning | |

| - | |

| Leasing contracts | |

| 20.0 | |

| Licenses to operate medical courses | |

| - | |

| Pro forma goodwill | |

| - | |

| Total pro forma Identifiable assets + goodwill | |

| | |

| | |

Year ended |

| Identifiable assets - Amortization | |

December 31, 2022 |

| Customer relationships | |

| 54,269 | |

| Brand | |

| 14,326 | |

| Non-compete agreement | |

| 36,035 | |

| Software | |

| 4,768 | |

| Teaching-learning material (TLM) | |

| 8,861 | |

| Leasing contracts | |

| 2,864 | |

| Total | |

| 121,123 | |

| | |

| | |

| Cost of services rendered | |

| 16,493 | |

| General and administrative expenses | |

| 50,361 | |

| Selling expenses | |

| 54,269 | |

| Total | |

| 121,123 | |

The amortization is calculated using the straight-line method

over the expected life of the asset.

| (f) | The Company adjusted R$ 20,991 of transaction costs expenses incurred on the Closing date to give effect

to the Unicesumar acquisition as if it had been consummated in January 01, 2022. |

| (g) | Reflects the estimated income taxes effects on the pro forma adjustments considering the effective rate

of 34%. The following table reflects the pro forma profit and share data used in the basic and diluted pro forma earnings per share calculations: |

| | |

Year ended |

| | |

December 31, 2022 |

| Net income attributable to the shareholders of the Company | |

| (5,085 | ) |

| Weighted average number of outstanding common shares (thousands) | |

| 29,322 | |

| Weighted average number of outstanding common shares (thousands) - Effects of dilution from shared based compensation plan | |

| 1,088 | |

| Basic and diluted earnings per common share (R$) | |

| (0.17 | ) |

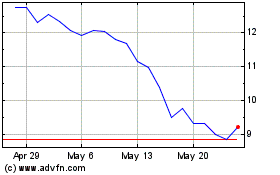

Vitru (NASDAQ:VTRU)

Historical Stock Chart

From Apr 2024 to May 2024

Vitru (NASDAQ:VTRU)

Historical Stock Chart

From May 2023 to May 2024