UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by

the Registrant ☒

Filed by

party other than the registrant ☐

Check the

appropriate box:

| ☐ Preliminary Proxy Statement |

☐ Confidential, for use of the Commission only |

| |

(as permitted by Rule 14a-6(e)(2)). |

| ☐ Definitive Proxy Statement |

|

| |

|

| ☒ Definitive additional materials. |

|

| |

|

| ☐ Soliciting material under Rule 14a-12. |

|

VERTEX

ENERGY, INC.

(Name of

Registrant as Specified in Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ No

fee required

☐ Fee

paid previously with preliminary materials

☐ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 12, 2024

EXPLANATORY NOTE

On April 29, 2024, Vertex

Energy, Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) a definitive

proxy statement on Schedule 14A (the “Proxy Statement”) relating to the Company’s Annual Meeting of Stockholders

(the “Special Meeting”) to be held on Wednesday, June 12, 2024, commencing at 10:00 a.m., Houston time.

Capitalized terms used in

this supplement to the Proxy Statement (the “Supplement”) without definition have the same meanings as set forth in

the Proxy Statement.

This Supplement is being filed

to correct an inadvertent error in the “Summary Executive Compensation Table” included on page 30 of the Proxy Statement

(the “Compensation Table”). The Compensation Table included in the Proxy Statement inadvertently disclosed that none

of the Company’s Named Executive Officers would be receiving an annual bonus for fiscal 2023; however, while no bonuses for fiscal

2023 have been granted to date (except as otherwise discussed in the Compensation Table), the Compensation Committee and Board of Directors

has not yet determined whether or not to grant bonuses to Named Executive Officers for fiscal 2023. As such, and because the amount of

bonus earned in 2023 is not calculable through the date the Proxy Statement was filed, that should have been footnoted in the Compensation

Table.

This Supplement should be

read in conjunction with the Proxy Statement. Except as specifically amended or supplemented by the information contained herein, this

Supplement does not otherwise modify, amend or supplement the Proxy Statement, and the information contained in the Proxy Statement should

be considered in voting your shares. If you have already returned your proxy card or provided voting instructions, you do not need to

take any action unless you wish to change your vote. Capitalized terms used but not defined herein have the meanings set forth in the

Proxy Statement.

The Compensation Table on

page 30 of the Proxy is amended and restated to read as follows (changes are marked in bold and underline):

Summary Executive Compensation Table

The following table sets forth

information concerning the compensation of (i) all individuals serving as the Company’s principal executive officer or acting in

a similar capacity during the last completed fiscal year (“PEO”), regardless of compensation level; (ii) all individuals

serving as the Company’s principal financial officer or acting in a similar capacity during the last completed fiscal year (“PFO”),

regardless of compensation level; (iii) the Company’s three most highly compensated executive officers other than the PEO and PFO

who were serving as executive officers at the end of the last completed fiscal year (provided that the Company only had five total executive

officers as of the end of December 31, 2023); and (iv) up to two additional individuals for whom disclosure would have been provided

pursuant to paragraph (iii) of but for the fact that the individual was not serving as an executive officer of the Company at the end

of the last completed fiscal year (collectively, the “Named Executive Officers”), for the years ended December 31,

2023, 2022, and 2021.

Name and

Principal

Position |

|

Year Ended

December 31 |

|

Salary ($) |

|

|

Bonus ($) |

|

|

Option

Awards

($)(1) |

|

|

All Other

Compensation

($)(2) |

|

Total ($) |

|

| Benjamin P. |

|

2023 |

|

$ |

521,116 |

|

|

$ |

202,000 |

(11)(*) |

|

|

$ |

228,000 |

|

|

|

$ |

51,922 |

(4) |

|

$ |

1,003,071 |

|

| Cowart |

|

2022 |

|

$ |

476,675 |

|

|

$ |

782,100 |

(3) |

|

|

$ |

264,711 |

|

|

|

$ |

47,152 |

(4) |

|

$ |

1,570,438 |

|

| Chairman, |

|

2021 |

|

$ |

366,180 |

|

|

$ |

205,900 |

|

|

|

$ |

120,138 |

|

|

|

$ |

38,777 |

(5) |

|

$ |

730,995 |

|

| CEO, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| and President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chris Carlson |

|

2023 |

|

$ |

322,402 |

|

|

$ |

101,000 |

(11)(*) |

|

|

$ |

124,000 |

|

|

|

$ |

51,388 |

(6) |

|

$ |

598,789 |

|

| Chief |

|

2022 |

|

$ |

297,864 |

|

|

$ |

461,888 |

(3) |

|

|

$ |

199,289 |

|

|

|

$ |

49,709 |

(6) |

|

$ |

1,008,750 |

|

| Financial |

|

2021 |

|

$ |

238,680 |

|

|

$ |

127,112 |

|

|

|

$ |

107,056 |

|

|

|

$ |

49,662 |

(5) |

|

$ |

522,510 |

|

| Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| James Rhame |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chief |

|

2023 |

|

$ |

320,375 |

|

|

$ |

(*) |

|

|

|

$ |

150,000 |

|

|

|

$ |

40,897 |

(8) |

|

$ |

511,272 |

|

| Operating |

|

2022 |

(a) |

$ |

272,357 |

(7) |

|

$ |

309,000 |

|

|

|

$ |

— |

|

|

|

$ |

23,497 |

(8) |

|

$ |

604,854 |

|

| Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| John |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Strickland |

|

2022 |

(a) |

$ |

245,819 |

|

|

$ |

225,000 |

|

|

|

$ |

— |

|

|

|

$ |

36,867 |

(9) |

|

$ |

507,686 |

|

| Former Chief |

|

2021 |

|

$ |

245,820 |

|

|

$ |

252,000 |

|

|

|

$ |

67,323 |

|

|

|

$ |

38,977 |

(5) |

|

$ |

604,120 |

|

| Operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alvaro Ruiz |

|

2023 |

|

$ |

306,181 |

|

|

$ |

(*) |

|

|

|

$ |

114,000 |

|

|

|

$ |

38,648 |

(10) |

|

$ |

507,686 |

|

| Chief |

|

2022 |

(b) |

$ |

270,872 |

|

|

$ |

1,306,000 |

(3) |

|

|

$ |

— |

|

|

|

$ |

31,320 |

(10) |

|

$ |

1,608,192 |

|

| Strategy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Douglas Haugh |

|

2023 |

(c) |

$ |

390,981 |

|

|

$ |

(*) |

|

|

|

$ |

703,666 |

|

|

|

$ |

16,540 |

(12) |

|

$ |

1,111,187 |

|

| Chief Commercial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) The amount of each Named

Executive’s annual 2023 bonuses have not yet been determined by the Compensation Committee and/or the Board of Directors as of the

date of this Proxy Statement (except for certain transaction based bonuses discussed in footnote 11), and are therefore not included in

the table above. The amount of each Named Executive’s annual bonuses for fiscal 2023, if any, will be disclosed in a separate filing

under Item 5.02(f) of Form 8-K within four days of the date finalized by the Compensation Committee and/or the Board of Directors. Such

bonuses may be in the form of cash or equity or a combination of cash and equity. The Compensation Committee does not have a specific

date when such bonus information is expected to be available, but expects such bonus to be determined in 2024.

(a) On, and effective on, June 10, 2022, Mr. John

Strickland resigned as Chief Operating Officer and Vice President of the Company. Mr. Strickland continues to serve as Vice President,

Black Oil Operations for the Company, in a non-executive position. Effective on June 10, 2022, the Board of Directors of the Company appointed

Mr. James Rhame, as the Chief Operating Officer (COO) of the Company, to fill the vacancy left by Mr. Strickland’s resignation.

(b) Effective on June 10, 2022, the Board of Directors

of the Company appointed Mr. Alvaro Ruiz as the Chief Strategy Officer of the Company.

(c) Effective on April 14, 2023, the Board of

Directors of the Company appointed Mr. Douglas S. Haugh, as the Chief Commercial Officer (CCO) of the Company.

(1) Represents the fair value of the grant of

certain options to purchase shares of our common stock calculated in accordance with Financial Accounting Standards Board Accounting Standards

Codification Topic 718. The assumptions used in the valuation of these awards are set forth in the notes to our consolidated financial

statements, which are included in the footnotes to our consolidated financial statements in our annual reports on Form 10-K for the years

ended December 31, 2023, December 31, 2022, and December 31, 2021. These amounts do not necessarily correspond to the actual value

that may be recognized by the Named Executive Officers, which depends, among other things, on the market value of our common stock appreciating

from that on the grant date(s) of the option(s).

(2) Does not include perquisites and other personal

benefits, or property, unless the aggregate amount of such compensation is more than $10,000. None of our executive officers received

any stock awards, non-equity incentive plan compensation or any change in pension value and nonqualified deferred compensation during

the periods presented.

(3) Includes certain amounts paid to the executives

as bonuses in connection with the Mobile Refinery acquisition - Mr. Cowart ($331,062); Mr. Carlson ($281,000) and Mr. Ruiz ($500,000).

(4) Includes (a) $13,200 of 401(k) contributions

and $29,755 of health insurance premiums paid on behalf of Mr. Cowart, and $9,000 of car allowance paid to Mr. Cowart (2023); and (b)

$11,634 of 401(k) contributions and $28,168 of health insurance premiums paid on behalf of Mr. Cowart, and $7,350 of car allowance paid

to Mr. Cowart (2022).

(5) Other compensation includes health insurance

premiums, a monthly car allowance and 401(k) contributions.

(6) Includes (a) $13,200 of 401(k) contributions,

$29,188 of health insurance premiums paid on behalf of Mr. Carlson, and $9,000 of car allowance paid to Mr. Carlson (2023); and (b) $11,941

of 401(k) contributions, $28,168 of health insurance premiums paid on behalf of Mr. Carlson, and $9,600 of car allowance paid to Mr. Carlson

(2022).

(7) Includes $36,575 of compensation paid as a

consultant prior to employment.

(8) Includes (a) $13,200 of 401(k) contributions

and $18,697 of health insurance premiums paid on behalf of Mr. Rhame and $9,000 of car allowance paid to Mr. Rhame (2023); and (b) $7,292

of 401(k) contributions and $11,705 of health insurance premiums paid on behalf of Mr. Rhame and $4,500 of car allowance paid to Mr. Rhame

(2022).

(9) Includes $9,076 of 401(k) contributions, $19,991

of health insurance premiums paid on behalf of Mr. Strickland, and $7,800 of car allowance paid to Mr. Strickland.

(10) Includes (a) $12,938 of 401(k) contributions,

$16,710 of health insurance premiums paid on behalf of Mr. Ruiz, and $9,000 of car allowance paid to Mr. Ruiz (2023); and (b) $9,622 of

401(k) contributions, $13,898 of health insurance premiums paid on behalf of Mr. Ruiz, and $7,800 of car allowance paid to Mr. Ruiz (2022).

(11) Bonus paid in connection with the closing

of the February 2023 sale by the Company of all of its equity interests in Vertex Refining OH, LLC, which owned the Heartland refinery

located in Columbus, Ohio.

(12) Includes $6,000 of car allowance and $10,540

of health insurance premiums.

Separately, the first paragraph

of the Pay Versus Performance section on Page 47 of the Proxy Statement is amended and restated to include two additional sentences as

follows (changes marked in bold and underline), to clarify that such Pay Versus Performance calculations do not include any 2023 annual

bonuses which may be granted:

Pay Versus Performance

The following table provides

information required by Item 402(v) of Regulation S-K, and sets forth information about the relationship between executive compensation

actually paid and certain financial performance of the Company. Compensation Actually Paid (CAP) in the table below does not necessarily

represent cash and/or equity value transferred to the applicable named executive officer without restriction, but rather is a valuation

calculated under applicable SEC rules. In general, CAP is calculated as summary compensation table total compensation adjusted to include

the fair market value of equity awards as of December 31, 2023 or, if earlier, the vesting date (rather than the grant date) and factor

in dividends and interest accrued with respect to such awards (if any). For purposes of the disclosure below, no pension valuation adjustments

were required and no dividends or interest were accrued. For the purposes of the disclosure below, the 2023 annual bonus grants

of Named Executive Officers are set at $0 (note certain transaction bonuses paid for 2023 as discussed in the “Summary Compensation

Table” above have been included as set forth above though), as each Named Executive’s annual 2023 bonus has not yet been determined

by the Compensation Committee and/or the Board of Directors as of the date of this Proxy Statement. If such bonuses are granted by the

Compensation Committee and/or the Board of Directors in the future, it may materially change the calculations of the (a) Summary Compensation

Table Total for PEO; (b) Compensation Actually Paid to PEO; (c) Average Summary Compensation Table Total for non-PEO Named Executive Officers;

and (d) Average Compensation Actually Paid to non-PEO Named Executive Officers, as set forth below.

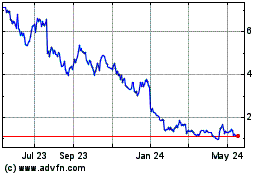

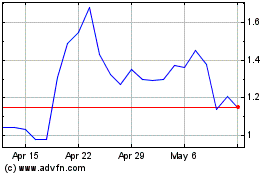

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From May 2024 to Jun 2024

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Jun 2023 to Jun 2024