This is a firm commitment public offering

of 5,400,000 shares of our common stock, $0.001 par value per share, at an offering price of $10.00 per share.

Prior to this offering, shares of our

common stock were quoted on the OTC Markets Group, Inc. OTCQX Marketplace under the symbol “UGRO.”

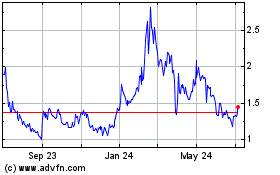

On February 9, 2021, the last reported

sale price for our common stock as reported on the OTCQX Marketplace was $50.00 per share. Our common stock has recently experienced

extreme price volatility. On January 11, 2021, the last reported sale price was $10.50 per share. From January 4, 2021 to February

9, 2021, sales of our common stock have been effected at prices as low as $4.00 and as high as $162.00. The high of $162.00 occurred

on February 5, 2021, when 63,318 shares were traded. The average daily trading volume over the past twelve months is approximately

600 shares per day. We have not experienced any material changes in our financial condition or results of operations that explain

such price volatility or trading volume. The trading price of our common stock has been, and may continue to be, subject to wide

price fluctuations in response to various factors, many of which are beyond our control, including those described in “Risk

Factors.” The public offering price was determined through negotiation between us and the representative of the underwriters

in the offering. We have received approval to list our common stock on the Nasdaq Capital Market under the symbol “UGRO.”

We are an “emerging growth company”

under the federal securities laws and have elected to comply with certain reduced public company reporting requirements.

We have granted a 45-day option to the

representative of the underwriters to purchase up to 810,000 additional shares of common stock solely to cover over-allotments,

if any.

The underwriters expect to deliver the

shares to purchasers on or about February 17, 2021.

PROSPECTUS SUMMARY

This summary highlights information

contained in greater detail elsewhere in this prospectus and does not contain all of the information that you should consider

before deciding to invest in our common stock. You should read the entire prospectus carefully, including the “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements and the related notes included in this prospectus, before making an investment decision. Some of the statements

in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Unless otherwise indicated in this prospectus, “urban-gro,” “we,” “us” and “our”

refer to urban-gro, Inc. and, where appropriate, its subsidiaries.

Our Company

urban-gro, Inc. is a leading engineering

and design services company focused on the sustainable commercial indoor horticulture market. We engineer and design indoor controlled

environment agriculture (“CEA”) facilities and then integrate complex environmental equipment systems into those facilities.

CEA is a market segment that is defined by type of facility, and has no correlation to the industry; or more specifically the

crop being grown in the facility. The CEA segment is represented by any horticultural facility that is fully self-contained, and

has a fully-controlled environment. There are three facility types that meet these qualifications:

|

|

i.

|

Indoor Facilities - new building; or the retrofit of an

existing building;

|

|

|

ii.

|

Vertical Farms – a building with a smaller footprint

that is built up vertically and we view this category as including modular container

farms; and

|

|

|

iii.

|

Greenhouses – traditional and made out of a variety

of translucent materials as to provide natural sunlight for the crop being grown.

|

While historically we have been focused

on engineering, design, and equipment integration into indoor facilities, of which some are ultimately used for the cultivation

of plant-based medicines, we are planning to expand our reach within CEA across both facility type and crop type. The term “plant-based

medicines” includes (i) a wide array of herbal supplements including but not limited to curcumin, saffron extract and ginger,

(ii) CBD based therapeutics, (iii) cannabis based therapeutics and (iv) a host of medicines derived from plants such as caffeine,

menthol, foxglove and others. We are focusing on expanding to the vertical farming CEA sub-segment, which is ultimately and predominantly

used for the cultivation of a variety of crops including, but not limited to, leafy greens, herbs, cucumbers, peppers and strawberries.

As the global horticulture market has become more focused on the safety of the food supply chain, reducing emissions with current

transportation methods associated with these crops, and, growing local, we are confident that the vertical farming CEA sub-segment

will represent a significant and increasing share of our revenue and be a significant factor in our organic growth moving forward.

Demand for Our Services

The world’s population is expected

to grow from 8 billion in 2020 to almost 10 billion by 2050. It will become increasingly difficult to satisfy the demand for food

to serve this population growth in a sustainable manner. Governments, farmers and corporate enterprises are adopting new technologically

advanced farming techniques to meet demand and alleviate supply chain risk. CEA facilities including aquaponics, aeroponics, hydroponics,

new soil-based farming and hybrid methods are emerging in urban and suburban areas. This is driving demand for indoor farms across

the globe with the CEA market estimated to grow from $4 billion in 2020 to $12.8 billion in 2026. Consequently, businesses such

as urban-gro that know how to design, supply, and service those indoor farms will be in high demand.

Population growth and climate changes

have created a surge in sustainable farming from traditional outdoor operations to indoor settings. Climate change is being blamed

for lower production yields, including the loss of arable land. The efficient management of natural resources is further driving

the growth of CEA facilities.

There is strong demand for local and safe

foods. 55% of the world’s population currently lives in urban areas and this is expected to increase to 68% by 2050. Producers

of fruits, vegetables, and other high-value crops are setting up production centers in urban areas to target this opportunity.

Further, a rise in emerging growing residential areas increases demand for CEA producers. The safe growing environment, conservation

of water and available nutrients are some of the many advantages of CEA facility derived products.

As COVID-19 has recently shown in its

disruption of global supply chains, being able to efficiently and successfully grow food year-round in areas close to existing

populations and expected population growth will allow for security in food supply that was not possible before. Our deep bench

of experience enables the creation of facilities for cultivators within CEA to reach this efficiency and success.

Our Competitive Strengths

Our custom-tailored approach to engineering

design, equipment sourcing, and the integration of complex equipment systems provides a single point of accountability across all

aspects of indoor growing operations. We help our clients achieve operational efficiency and economic advantages through a full

spectrum of solutions focused on facility optimization and environmental health, which allows clients to manage their entire cultivation

lifecycle, establishing facilities that operate and perform at high levels.

Our employees and the combination of

their educational frameworks with the practical application of their acquired industry knowledge is our most valuable asset as

an organization. Our team has designed over 300 indoor CEA projects with the highest value agriculture crop in the world and have

developed unparalleled know-how in creating an environment that is suited for the complexities of indoor agriculture.

Our Growth Strategy

Our growth is being fueled by increased

demand for sustainable CEA facilities. The introduction of new technologies, improved farming methods and a rise in entrepreneurship

combined with corporate emergence is driving organic growth. Acquisitions that complement our platform should also be a factor

contributing to growth.

As the demand for food produced from CEA

facilities continues to increase, we will market our services to these clients, hire additional sales and support employees, and

execute a focused targeting of our services to this industry to capture significant portions of this market. While we will continue

to provide our solutions to the plant-based medicine market that has been our strength, we believe that the CEA market will represent

a more significant and increasing share of our revenue and be a significant factor in our organic growth moving forward.

Complementary to the industry expansion

for our organic growth, and based on our initial success, we will continue to expand our presence and reach within Europe. We

plan on opening a headquarters office in Europe, a market where we are seeing increased demands for our expertise and solutions,

and have already signed several projects with European clients.

Another key area that will fuel sustained

and strong growth for us is in the introduction of new enhanced technology-focused equipment and system solutions. Our experienced

team of engineers and scientists are continually vetting emerging horticulture equipment solutions that may be of value to our

clients. Further, and focusing on our expanding service platform, we will continue to build out our facility commissioning and

staff training offerings. Revolving around our deep acquired knowledge base of CEA, we will grow through continued expansion of

this services program and further penetrate the market segments that we serve.

We have made investments in, and acquisitions

of, companies that are complementary to our offerings. We will look to continue to grow in this way to meet the increasing demand

for efficient and successful CEA facilities. We will continue to pursue accretive and synergetic acquisitions that utilize our

core strengths to further expand our reach into the horticulture and agriculture markets.

Recent Developments

Preliminary Financial Results for the Three Months and

Year Ended December 31, 2020 (preliminary and unaudited)

These operating results reflect our preliminary

estimates with respect to the results for the three months and year ended December 31, 2020, which are based on currently available

information and are subject to change. Our financial closing procedures for the three months and year ended December 31, 2020

are not yet complete and, as a result, our final results upon completion of our closing procedures may vary from these preliminary

estimates. These preliminary estimates should not be viewed as a substitute for interim financial statements prepared in accordance

with GAAP.

These preliminary operating results have

been prepared by, and are the responsibility of, our management. Our auditor, BF Borgers CPA PC, has not audited, reviewed, compiled

or applied agreed-upon procedures with respect to these preliminary results. Accordingly, BF Borgers CPA PC does not express an

opinion or any other form of assurance with respect thereto.

We expect our preliminary and unaudited

revenue for the three months ended December 31, 2020 to be between $9.0 million and $9.3 million, which would represent an increase

of at least 26% from revenue of $7.1 million reported for the three months ended December 31, 2019. Preliminary and unaudited

revenue for the year ended December 31, 2020 is expected to be between $25.6 million and $25.9 million, compared to $24.2 million

reported for the year ended December 31, 2019. This expected increase in revenue was driven by an increase in the shipment of

complex environmental equipment systems and sales of other cultivation equipment predominantly tied to design contracts signed.

We are entering 2021 with in excess of $14.0 million of contractually committed orders for environmental and cultivation equipment

systems for which revenue has not been recognized.

We expect our preliminary and unaudited

net loss for the three months ended December 31, 2020 to be between negative ($1.7) million and negative ($1.4) million, which

would represent an improvement of at least $0.9 million from net loss of negative ($2.6) million reported for the three months

ended December 31, 2019. This expected improvement in net loss is driven by reductions in operating expenses and increased gross

profit. Preliminary and unaudited net loss for the year ended December 31, 2020 is expected to be between negative ($5.7) million

and negative ($5.4) million, which would represent an improvement of at least $2.7 million from net loss of negative ($8.4) million

reported for the year ended December 31, 2019. This expected improvement in net loss is driven by a reduction in operating expenses.

In addition, we expect to achieve positive

Adjusted EBITDA for the three months ended December 31, 2020, with Adjusted EBITDA for the year ended December 31, 2020 expected

to be between negative ($0.9) million and negative ($0.7) million, which would represent an improvement of at least $2.3 million

from Adjusted EBITDA of negative ($3.3) million reported for the year ended December 31, 2019. See “Management’s Discussion

and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for a discussion of how

we calculate Adjusted EBITDA.

Risk Factors

An investment in our common stock involves

a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the section

titled “Risk Factors” following this prospectus summary. These risks include, but are not limited to, the following:

|

|

·

|

the effect

of the COVID-19 pandemic on our business and operations;

|

|

|

·

|

our ability to generate revenues sufficient to achieve

profitability and positive cash flow;

|

|

|

·

|

competition in our industry and our ability to compete

effectively;

|

|

|

·

|

our ability to attract, recruit, retain and develop

key personnel and qualified employees;

|

|

|

·

|

risks related to laws, regulations and industry

standards;

|

|

|

·

|

risks related to the cannabis industry;

|

|

|

·

|

reliance on significant clients and third-party

suppliers;

|

|

|

·

|

the ability of our principal stockholders to significantly

influence or control matters requiring a stockholder vote;

|

|

|

·

|

our ability to successfully identify and complete

acquisitions and effectively integrate those acquisitions into our operations;

|

|

|

·

|

our indebtedness and potential increases in our

indebtedness; and

|

|

|

·

|

the other

factors described in “Risk Factors.”

|

Our Corporate Information

We were originally formed on March 20,

2014, as a Colorado limited liability company. In March 2017, we converted to a Colorado corporation and exchanged shares of our

common stock for every member interest issued and outstanding on the date of conversion. On October 29, 2020, we reincorporated

as a Delaware corporation. In June 2018, we formed urban-gro Canada Technologies, Inc. as a wholly owned Canadian subsidiary,

which we utilize for all our Canadian sales operations. Effective March 7, 2019, we acquired 100% of the stock of Impact Engineering,

Inc., a provider of MEP engineering services. Our executive office is located at 1751 Panorama Point, Unit G, Lafayette, Colorado

80026, and our phone number is (720) 390-3880. Our principal website address is www.urban-gro.com. The information on any of our

websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

1-for-6 Reverse Stock Split

On December 31, 2020, we effected a 1-for-6

reverse stock split with respect to our common stock. Unless we indicate otherwise or the context otherwise requires, all information

in this prospectus gives effect to this reverse stock split.

Implications of Being an Emerging Growth Company

We are an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act. An emerging growth company may take advantage of specified

reduced reporting requirements that are otherwise generally applicable to public companies. As a result:

|

|

·

|

we are

required to have only two years of audited financial statements and only two years of

related selected financial data and management’s discussion and analysis of financial

condition and results of operation in this prospectus;

|

|

|

·

|

we are not required to comply with any requirement

that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding

mandatory audit firm rotation or a supplement to the auditor’s report providing

additional information about the audit and financial statements (i.e., an auditor

discussion and analysis) compliance with new or revised accounting standards until they

are made applicable to private companies;

|

|

|

·

|

we are not required to engage an auditor attestation

to report on our internal control over financial reporting pursuant to Section 404(b)

of the Sarbanes-Oxley Act of 2002;

|

|

|

·

|

we are

not required to comply with certain disclosure requirements related to executive compensation,

such as the requirement to disclose the correlation between executive compensation and

performance and the requirement to present a comparison of our Chief Executive Officer’s

compensation to our median employee compensation; and

|

|

|

·

|

we are not required to submit certain executive

compensation matters to stockholder advisory votes, such as “say on pay,”

“say on frequency” and “say on golden parachute arrangements.”

|

We may take advantage of these reduced

reporting and other requirements until December 31, 2023, or such earlier time that we are no longer an emerging growth company.

However, if certain events occur before the end of that five-year period, including if we have more than $1.07 billion in

annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion

in non-convertible debt over a three-year period, we will cease to be an emerging growth company. We may choose to take advantage

of some but not all of these reduced reporting burdens. We have elected to adopt the reduced requirements with respect to our

financial statements and the related selected financial data and Management’s Discussion and Analysis of Financial Condition

and Results of Operations disclosure. Accordingly, the information that we provide to stockholders may be different than the information

you receive from other public companies in which you hold stock.

THE OFFERING

|

Common stock offered

|

5,400,000 shares.

|

|

|

|

|

Common stock to be outstanding after this offering

|

10,112,047

shares (or 10,922,047 shares if the underwriters exercise their over-allotment option in full).

|

|

|

|

|

Over-allotment option

|

We have granted the underwriters a 45-day option to purchase up to 810,000 additional shares of our common stock

at the public offering price to cover over-allotments, if any.

|

|

|

|

|

Use of proceeds

|

We estimate that the net proceeds to us from this offering

will be approximately $50.2 million, or approximately $57.8 million if the underwriters exercise their over-allotment

option in full.

We intend to use the net proceeds of this offering

to repay outstanding indebtedness under our Credit Agreement, to expand in the European CEA market and for general corporate

purposes. See “Use of Proceeds.”

|

|

|

|

|

Risk factors

|

You should read the “Risk Factors” section of this prospectus beginning on page 8 for a

discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

|

|

|

|

Nasdaq Capital Market symbol

|

UGRO.

|

|

|

|

Our shares of common stock outstanding after this offering

is based on 4,712,047 shares currently outstanding.

Unless we indicate otherwise or the context otherwise requires,

all information in this prospectus:

|

|

·

|

assumes no exercise

by the underwriters of their over-allotment option;

|

|

|

·

|

assumes no exercise

of the representative’s warrants to be issued to the representative of the underwriters in this offering;

|

|

|

·

|

excludes 246,666 shares issuable upon conversion of Bridge Financing notes (see “Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Bridge Financing”

for a discussion of the Bridge Financing);

|

|

|

·

|

gives effect to the

1-for-6 reverse stock split with respect to our common stock, which took effect on December 31, 2020;

|

|

|

·

|

excludes 638,277 shares

of common stock issuable upon the exercise of outstanding exercisable options at a weighted exercise price of $6.30 per share;

|

|

|

·

|

excludes 202,752 shares

of common stock issuable upon the exercise of outstanding warrants at a weighted exercise price of $13.28 per share; and

|

|

|

·

|

excludes 39,482 shares

of common stock reserved for future issuance pursuant to our 2019 Equity Incentive Plan.

|

Trademarks

This prospectus includes our service marks

and trade names, including “Soleil,” “Opti-Dura,” and “urban-gro,” which are protected under

applicable intellectual property laws and are our property. This prospectus also contains trademarks, trade names and service

marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and

service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but those references are not

intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or

the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of

other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply,

a relationship with, or endorsement or sponsorship of us by, these other parties.

Market and Industry Data

Unless otherwise indicated, information

contained in this prospectus concerning our industry, competitive position and the markets in which we operate is based on information

from independent industry and research organizations, other third-party sources and management estimates. Management estimates

are derived from publicly available information released by independent industry analysts and other third-party sources, as well

as data from our internal research, and are based on assumptions we made upon reviewing such data, and our experience in, and

knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates

of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty

and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the

estimates made by the independent parties and by us.

SUMMARY HISTORICAL

CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary

historical consolidated financial data as of, and for the periods ended on, the dates indicated.

The summary consolidated statements of

operations data for the years ended December 31, 2019 and 2018 are derived from our audited consolidated financial statements

and notes that are included elsewhere in this prospectus.

The summary consolidated statements of

operations data for the three and nine months ended September 30, 2020 and 2019 and the summary consolidated balance sheet data

as of September 30, 2020 are derived from our unaudited interim consolidated financial statements and notes that are included

elsewhere in this prospectus. We have prepared the unaudited consolidated financial statements in accordance with generally accepted

accounting principles (GAAP) and on the same basis as the audited consolidated financial statements. Our historical results are

not necessarily indicative of our results in any future period and results from our interim period may not necessarily be indicative

of the results of the entire year. Pro forma share and per share amounts presented herein reflect the implementation of the 1-for-6

reverse stock split as if it had occurred at the beginning of the earliest period presented.

|

|

|

For

the

Three

Months Ended

|

|

|

For

the

Three

Months Ended

|

|

|

For

the

Nine

Months Ended

|

|

|

For

the

Nine

Months Ended

|

|

|

For

the

Fiscal

Year Ended

|

|

|

For

the

Fiscal

Year Ended

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2020

|

|

|

2019

|

|

|

2019

|

|

|

2018

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Audited)

|

|

|

(Audited)

|

|

|

Statement of operations data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

8,359,422

|

|

|

$

|

5,583,064

|

|

|

$

|

16,625,688

|

|

|

$

|

17,056,737

|

|

|

$

|

24,189,803

|

|

|

$

|

20,050,776

|

|

|

Cost of revenues

|

|

|

6,654,134

|

|

|

|

3,650,965

|

|

|

|

12,613,461

|

|

|

|

11,529,448

|

|

|

|

17,563,594

|

|

|

|

13,892,025

|

|

|

Gross Profit

|

|

|

1,705,288

|

|

|

|

1,932,099

|

|

|

|

4,012,227

|

|

|

|

5,527,289

|

|

|

|

6,626,209

|

|

|

|

6,158,751

|

|

|

Operating expenses

|

|

|

1,853,828

|

|

|

|

3,324,921

|

|

|

|

6,502,283

|

|

|

|

9,581,375

|

|

|

|

12,486,814

|

|

|

|

9,959,335

|

|

|

Income (loss) from operations

|

|

|

(148,540

|

)

|

|

|

(1,392,822

|

)

|

|

|

(2,490,056

|

)

|

|

|

(4,054,086

|

)

|

|

|

(5,860,605

|

)

|

|

|

(3,800,584

|

)

|

|

Other non-operating income (expense)

|

|

|

(545,741

|

)

|

|

|

(1,416,708

|

)

|

|

|

(1,469,826

|

)

|

|

|

(1,665,318

|

)

|

|

|

(2,489,968

|

)

|

|

|

(95,289

|

)

|

|

Net income (loss)

|

|

$

|

(694,281

|

)

|

|

$

|

(2,809,530

|

)

|

|

$

|

(3,959,882

|

)

|

|

$

|

(5,719,404

|

)

|

|

$

|

(8,350,573

|

)

|

|

$

|

(3,895,873

|

)

|

|

Income (loss) per share,

basic and diluted

|

|

$

|

(0.02

|

)

|

|

$

|

(0.11

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.22

|

)

|

|

$

|

(0.32

|

)

|

|

$

|

(0.16

|

)

|

|

Weighted average shares

outstanding, basic and diluted

|

|

|

28,888,194

|

|

|

|

26,175,098

|

|

|

|

28,706,905

|

|

|

|

25,772,134

|

|

|

|

26,318,059

|

|

|

|

24,848,293

|

|

|

Pro forma income (loss)

per share, basic and diluted (unaudited)

|

|

$

|

(0.12

|

)

|

|

$

|

(0.66

|

)

|

|

$

|

(0.84

|

)

|

|

$

|

(1.32

|

)

|

|

$

|

(1.92

|

)

|

|

$

|

(0.96

|

)

|

|

Pro forma weighted average

shares outstanding, basic and diluted (unaudited)

|

|

|

4,814,699

|

|

|

|

4,362,516

|

|

|

|

4,784,484

|

|

|

|

4,295,356

|

|

|

|

4,386,343

|

|

|

|

4,141,382

|

|

|

|

|

Historical

|

|

|

Pro

Forma

As

Adjusted (1)

|

|

|

|

|

As of

|

|

|

As of

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2020

|

|

|

2020

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Balance sheet data

|

|

|

|

|

|

|

|

Current assets

|

|

$

|

4,586,195

|

|

|

$

|

54,680,195

|

|

|

Total assets

|

|

|

7,550,138

|

|

|

|

57,644,138

|

|

|

Current liabilities

|

|

|

9,419,327

|

|

|

|

8,419,327

|

|

|

Total liabilities

|

|

|

14,254,085

|

|

|

|

14,104,085

|

|

|

Stockholders’ equity

|

|

|

(6,703,947

|

)

|

|

|

43,540,053

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

7,550,138

|

|

|

$

|

57,644,138

|

|

|

(1)

|

Gives effect to Bridge Financing transactions subsequent to September

30, 2020, the issuance and sale by us in this offering of 5,400,000 shares of our common stock at the public offering price of

$10.00 per share, after deducting the underwriting discounts and commissions and estimated offering expenses that we expect to

pay, and the application of $1.0 million of the net proceeds from this offering to repay outstanding indebtedness under our Credit

Agreement as described under “Use of Proceeds.”

|

RISK FACTORS

An investment in our common stock involves

a high degree of risk. You should carefully consider the following risks and all of the other information contained in this prospectus

before deciding whether to invest in our common stock. If any of the following risks are realized, our business, financial condition

and results of operations could be materially and adversely affected. In that event, the trading price of our common stock could

decline and you could lose all or part of your investment in our common stock. Additional risks of which we are not presently

aware or that we currently believe are immaterial may also harm our business and results of operations. Some statements in this

prospectus, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled

“Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Operations

The COVID-19 pandemic could continue to materially adversely

affect our business, financial condition, results of operations, cash flows and day-to-day operations.

The outbreak of COVID-19, a novel strain

of coronavirus first identified in China, which has spread across the globe including the U.S., has had an adverse impact on our

operations and financial condition. Most recently, the response to this coronavirus by federal, state and local governments in

the U.S. has resulted in significant market and business disruptions across many industries and affecting businesses of all sizes.

This pandemic has also caused significant stock market volatility and further tightened capital access for most businesses. Given

that the COVID-19 pandemic and its disruptions are of an unknown duration, they could have an adverse effect on our liquidity

and profitability.

As a result of these events, we assessed

our near-term operations, working capital, finances and capital formation opportunities, and implemented, in late March 2020,

a downsizing of our operations and workforce to preserve cash resources and focus our operations on client-centric sales and project

management activities. The duration and likelihood of success of this workforce reduction are uncertain; however, we have since

rehired several employees who were impacted by the downsizing effort. If this downsizing effort does not meet our expectations,

or additional capital is not available, we may not be able to continue our operations. The pandemic and its effects resulted in

temporary delays in our projects, however, work on all such projects has resumed. Other factors that will affect our ability to

continue operations include the market demand for our products and services, our ability to service the needs of our clients and

prospects with a reduced workforce, potential contract cancellations, project scope reductions and project delays, our ability

to fulfill our current backlog, management of our working capital, the availability of cash to fund our operations, and the continuation

of normal payment terms and conditions for purchase of our products. In light of these extenuating circumstances, there is no

assurance that we will be successful in growing and maintaining our business with our clients. If our clients or prospects are

unable to obtain project financing and we are unable to increase revenues, or otherwise generate cash flows from operations, we

will not be able to successfully execute on the various strategies and initiatives we have set forth in this prospectus to grow

our business.

The ultimate magnitude of COVID-19, including

the extent of its impact on our financial and operational results, which could be material, will depend on the length of time

that the pandemic continues, its effect on the demand for our products and our supply chain, the effect of governmental regulations

imposed in response to the pandemic, as well as uncertainty regarding all of the foregoing. We cannot at this time predict the

full impact of the COVID-19 pandemic, but it could have a larger material adverse effect on our business, financial condition,

results of operations and cash flows beyond what is discussed within this prospectus.

We have a relatively limited history of operations, a

history of losses, and our future earnings, if any, and cash flows may be volatile, resulting in uncertainty about our ability

to service and repay our debt when it comes due and uncertainty about our prospects generally.

We were initially organized as a limited

liability company in the State of Colorado on March 20, 2014. In March 2017, we converted into a corporation with the expectation

of becoming a public reporting, trading company.

Following is a summary of our recent historical

operating performance:

|

|

·

|

During

the nine months ended September 30, 2020, we generated revenue of $16.6 million and incurred

a net loss of $4.0 million.

|

|

|

·

|

During

the year ended December 31, 2019, we generated revenue of $24.2 million and incurred

a net loss of $8.3 million.

|

|

|

·

|

During

the year ended December 31, 2018, we generated revenue of $20.1 million and incurred

a net loss of $3.9 million.

|

|

|

·

|

During

the year ended December 31, 2017, we generated revenue of $12.3 million, and incurred

a net loss of $2.6 million.

|

Our lack of a significant history and

the evolving nature of the market in which we operate make it likely that there are risks inherent to our business that are yet

to be recognized by us or others, or not fully appreciated, and that could result in us suffering further losses. As a result

of the foregoing, and concerns regarding the economic impact from COVID-19, an investment in our securities necessarily involves

uncertainty about the stability of our operating results, cash flows and, ultimately, our ability to service and repay our debt

and our prospects generally.

We had negative cash flow for the fiscal year ended December

31, 2019 and for the nine months ended September 30, 2020.

We had negative operating cash flow of

($2.5) million for the fiscal year ended December 31, 2019 and ($3.0) million for the nine months ended September 30, 2020. To

the extent that we have negative operating cash flow in future periods, we may need to allocate a portion of our cash reserves

to fund such negative cash flow. We may also be required to raise additional funds through the issuance of equity or debt securities.

There can be no assurance that we will be able to generate positive cash flow from our operations, that additional capital or

other types of financing will be available when needed or that these financings will be on terms favorable to us.

Our engineering and design services have been used and

may continue to be contracted for use in emerging industries that may be subject to quickly changing and inconsistent laws, regulations,

practices and perceptions.

Although

the demand for our engineering and design services may be negatively impacted depending on how laws, regulations, administrative

practices, judicial interpretations, and consumer perceptions develop, we cannot reasonably predict the nature of such developments

or the effect, if any, that such developments could have on our business. We will continue to encounter risks and uncertainty

relating to our operations that may be difficult to overcome. To do so, we believe it will be important to:

|

|

·

|

Execute

our business and marketing strategy successfully;

|

|

|

·

|

Increase

and diversify our client base;

|

|

|

·

|

Extend our reach to include the global

CEA marketplace;

|

|

|

·

|

Meet client

demand with quality, timely services;

|

|

|

·

|

When appropriate,

partner with affiliate marketing companies to explore demand;

|

|

|

·

|

Leverage

initial relationships with existing clients;

|

|

|

·

|

Enhance

the solutions that we offer and focus on continually improving customer service levels;

and

|

|

|

·

|

Attract,

hire, motivate and retain qualified personnel.

|

Our business is focused on providing engineering design,

and equipment integration into facilities prior to the facility becoming operational. We do not know for certain how much of our

revenues to date have been generated from clients in the legal cannabis industry; however, we believe the majority of our revenues

to date have been generated from clients that operate in the legal cannabis industry.

We are broadening our market reach beyond

the legal cannabis industry and are placing a substantial sales effort on expansion into the rapidly growing non-cannabis CEA

vertical farming segment. However, on a historic basis, we believe our clients to whom we provide facility engineering design

and equipment integration prior to the facility becoming operational have primarily been in the legal cannabis industry. In addition

to selling to these clients, we also sell our equipment solutions to third parties, such as general contractors, and other intermediaries,

like equipment leasing companies. While we do not know for certain how much of these solutions are resold into the legal cannabis

industry, we believe that to date the majority of these solutions have been resold into the legal cannabis industry.

Now that the non-cannabis CEA

segment is gaining strong momentum, and since most all of the equipment systems that we sell originate in the general

horticulture industry and are agnostic to the crop grown in the facility, we believe that the proportion of non-cannabis

revenues will increase. However, we do not control to who such third parties resell

our solutions, and notwithstanding our expansion plans, a decrease in demand in the legal cannabis industry could have a material

adverse effect on our revenues and the success of our business.

The cannabis industry is an emerging industry and

has only been legalized in some states and remains illegal in others and under U.S. federal law, making it difficult to accurately

forecast the demand for our solutions in this specific industry, and losing clients from this industry may have a material adverse

effect on our revenues and the success of our business.

The cannabis industry is immature in the

United States and has only been legalized in some states and remains illegal in others and under U.S. federal law, making it difficult

to accurately predict and forecast the demand for our solutions. If the U.S. Department of Justice (“DOJ”) did

take action against the cannabis industry, those of our clients operating in the legal cannabis industry would be lost to

us.

To analyze this risk, we are relying heavily

upon the various U.S. federal governmental memos issued in the past (including the memorandum issued by the DOJ on October 19,

2009, known as the “Ogden Memorandum”, the memorandum issued by the DOJ on August 29, 2013, known as the “Cole

Memorandum” and other guidance), to remain acceptable to those state and federal entities that regulate, enforce, or choose

to defer enforcement of certain current regulations regarding cannabis and that the U.S. federal government will not change its

attitude to those practitioners in the cannabis industry as long as they comply with their state and local jurisdictional rules

and authorities.

The legal cannabis industry is

not yet well-developed, and many aspects of this industry’s development and evolution cannot be accurately predicted, and

therefore losing any clients may have a material adverse effect on our business. While we have attempted to identify our business

risks in the legal cannabis industry, you should carefully consider that there are other risks that cannot be foreseen

or are not described in this prospectus, which could materially and adversely affect our business and financial performance.

There is heightened scrutiny

by Canadian regulatory authorities related to the cannabis industry.

Our existing operations in the United

States, and any future operations or investments, may become the subject of heightened scrutiny by regulators and other authorities

in Canada. As a result, we may be subject to significant direct and indirect interaction with public officials. No assurance can

be provided that this heightened scrutiny will not in turn lead to the imposition of certain restrictions on our ability to operate

or invest in the United States, in addition to those described herein.

It had been reported in Canada that

the Canadian Depository for Securities Limited considered a policy shift that would see its subsidiary, CDS, refuse to settle

trades for cannabis issuers or issuers with cannabis related activities that have investments in the United States. CDS is Canada’s

central securities depository, clearing and settling trades in the Canadian equity, fixed income and money markets. The TMX Group,

the owner and operator of CDS, subsequently issued a statement on August 17, 2017 reaffirming that there is no CDS ban on the

clearing of securities of issuers with cannabis-related activities in the United States, despite media reports to the contrary

and that the TMX Group was working with regulators to arrive at a solution that will clarify this matter, which would be communicated

at a later time. On February 8, 2018, following discussions with the Canadian Securities Administrators and recognized Canadian

securities exchanges, the TMX Group announced the signing of the TMX Memorandum of Understanding (“MOU”) with Aequitas

NEO Exchange Inc., the Canadian Securities Exchange (“CSE”), the Toronto Stock Exchange, and the TSXV. The TMX MOU

outlines the parties’ understanding of Canada’s regulatory framework applicable to the rules, procedures, and regulatory

oversight of the exchanges and CDS as it relates to issuers with cannabis-related activities in the United States. The MOU confirms,

with respect to the clearing of listed securities, that CDS relies on the exchanges to review the conduct of listed issuers. As

a result, there is no CDS ban on the clearing of securities of issuers with cannabis-related activities in the United States.

However, there can be no guarantee that this approach to regulation will continue in the future. If such a ban were to be implemented

at a time when our securities are listed on a stock exchange, it would have a material adverse effect on the ability of holders

of our securities to make and settle trades. In particular, our securities would become highly illiquid until an alternative was

implemented, and investors would have no ability to effect a trade of our securities through the facilities of the CSE.

We may incur losses in the near future, which may impact

our ability to implement our business strategy and adversely affect our financial condition.

While we have focused significantly on

decreasing our operating expenses by reducing variable expenses, employee count, and marketing activities in order to become cash

flow positive, such decreases may adversely affect our operating results if we are unable to support the business effectively.

In turn, this would have a negative impact on our financial condition and potentially our share price.

We also cannot assure you that we will

be profitable or generate sufficient profits from operations in the future. If our revenues do not grow or our gross margins deteriorate

substantially, we are likely to continue to experience losses in future periods. Collectively, this may impact our ability to implement

our business strategy and adversely affect our financial condition. This potentially would have a negative impact on our share

price.

We may become subject to additional regulation of CEA

facilities.

Our engineering and design services are

focused on facilities that grow a wide variety of crops that are subject to regulation by the United States Food and Drug Administration

and other federal, state or foreign agencies. Changes to any regulations and laws that could complicate the engineering of these

CEA facilities, such as waste water treatment and electricity-related mandates, make it possible that potential related enforcement

could decrease the demand for our services, and in turn negatively impact our revenues and business opportunities.

Competition in our industry is intense.

There are many competitors in the horticulture

industry, and in particular the cannabis industry, including many who offer somewhat categorically similar products and

services as those offered by us. There can be no guarantees that in the future other companies will not enter this arena by developing

products that are in direct competition with us. We anticipate the presence as well as entry of other companies in this market

space and acknowledge that we may not be able to establish, or if established to maintain, a competitive advantage. Some of these

companies may have longer operating histories, greater name recognition, larger client bases and significantly greater financial,

technical, sales and marketing resources. This may allow them to respond more quickly than us to market opportunities. It may

also allow them to devote greater resources to the marketing, promotion and sale of their products and/or services. These competitors

may also adopt more aggressive pricing policies and make more attractive offers to existing and potential clients, employees,

strategic partners, distribution channels and advertisers. Increased competition is likely to result in price reductions, reduced

gross margins and a potential loss of market share.

A drop in the retail price of cannabis products may

negatively impact our business.

The fluctuations in economic and market

conditions that impact the prices of commercially grown cannabis, such as increases in the supply of cannabis and decreases in

demand for cannabis, could have a negative impact on our clients that are cannabis producers, and therefore could negatively impact

our business.

Our principal stockholders have the ability to significantly

influence or control matters requiring a stockholder vote and other stockholders may not have the ability to influence corporate

transactions.

As of February 9, 2021, our principal

stockholders own approximately 55% of our outstanding common stock, and following this offering, will own approximately 26% of

our outstanding common stock. As a result, they have the ability to significantly influence the outcome of all matters requiring

approval of our stockholders, including the election of directors and approval of significant corporate transactions.

We are highly dependent on our management team, and the

loss of our senior executive officers or other key employees could harm our ability to implement our strategies, impair our relationships

with clients and adversely affect our business, results of operations and growth prospects.

Our success depends, in large degree,

on the skills of our management team and our ability to retain, recruit and motivate key officers and employees. Our active senior

executive leadership team, including Jonathan Nassar, Mark Doherty, Dan Droller, Brian Zimmerman, and particularly Bradley Nattrass

and Richard Akright, have significant experience, and their knowledge and relationships would be difficult to replace. Leadership

changes will occur from time to time, and we cannot predict whether significant resignations will occur or whether we will be

able to recruit additional qualified personnel. Competition for senior executives and skilled personnel in the horticulture industry

is intense, which means the cost of hiring, paying incentives and retaining skilled personnel may continue to increase.

We need to continue to attract and retain key

personnel and to recruit qualified individuals to succeed existing key personnel to ensure the continued growth and successful

operation of our business. In addition, as a provider of custom-tailored horticulture solutions, we must attract and retain qualified

personnel to continue to grow our business, and competition for such personnel can be intense. Our ability to effectively compete

for senior executives and other qualified personnel by offering competitive compensation and benefit arrangements may be restricted

by cash flow and other operational restraints. The loss of the services of any senior executive or other key personnel, or the

inability to recruit and retain qualified personnel in the future, could have a material adverse effect on our business, financial

condition or results of operations. In addition, to attract and retain personnel with appropriate skills and knowledge to support

our business, we may offer a variety of benefits, which could reduce our earnings or have a material adverse effect on our business,

financial condition or results of operations.

Our insurance may not adequately cover our operating

risk.

We have insurance to protect our assets,

operations and employees. While we believe our insurance coverage addresses all material risks to which we are exposed and is

adequate and customary in our current state of operations, such insurance is subject to coverage limits and exclusions and may

not be available for the risks and hazards to which we are exposed. In addition, no assurance can be given that such insurance

will be adequate to cover our liabilities or will be generally available in the future or, if available, that premiums will be

commercially justifiable. If we were to incur substantial liability and such damages were not covered by insurance or were in

excess of policy limits, or if we were to incur such liability at a time when we are not able to obtain liability insurance, our

business, results of operations and financial condition could be materially adversely affected.

We are dependent upon third-party suppliers of products

we sell.

We are dependent on outside vendors for

the products we sell. For the year ended December 31, 2019, two vendors, Argus Control Systems Limited (“Argus”),

a provider of automated control systems, and Fluence Bioengineering, Inc. (“Fluence”), a provider of lighting systems,

were particularly important to our integrated sales solutions. Sales of Fluence’s LED lighting systems accounted for 25%

of our consolidated revenue for the year ended December 31, 2019. We use Fluence LED systems in our designs and then sell them

to our clients as part of our overall package. While we believe that there are sufficient sources of supply available, if the

third-party suppliers, such as Argus or Fluence, were to cease production or otherwise fail to supply us with products in sufficient

quantities on a timely basis and we were unable to contract on acceptable terms for these products with alternative suppliers,

our ability to sell these products would be materially adversely affected. If a sole source supplier was to go out of business,

we may be unable to find a replacement for such source in a timely manner or at all. If a sole source supplier were to be acquired

by a competitor, that competitor may elect not to sell to us in the future. Any inability to secure required products or to do

so on appropriate terms could have a materially adverse impact on the business, financial condition, results of operations or

prospects of urban-gro.

As indicated above, we continue to monitor

the outbreak of the COVID-19 coronavirus. Should the outbreak continue to become more widespread, it could disrupt the businesses

of our industry partners and third-party suppliers, which, in turn, could impact our ability to procure equipment and raw materials

from them and thereby negatively impact the business, financial condition, results of operations or our prospects.

We have historically been dependent on a small number

of clients for a substantial portion of our revenue. If we fail to retain or expand our client relationships, or if a significant

client were to terminate its relationship with us or reduce its purchases, our revenue could decline significantly.

One client represented 26% of our

total revenue for the nine months ended September 30, 2020 and 51% of our total revenue for the three months ended September

30, 2020. A different client represented 15% of our total revenue for the nine months ended September 30, 2019 and 17% of our

total revenue for the three months ended September 30, 2019. A third client represented 21% of our total revenue for the year

ended December 31, 2019. A fourth client represented 14% of our total revenue for the year ended December 31, 2018.

Substantially all of the revenue derived from each of these separate clients were product sales. Although we have been able

to successfully generate substantial sales to different customers over time, there can be no assurances that we will be able

to continue to do this in the future. Our operating results for the foreseeable future could continue to depend on

substantial sales to a small number of clients. Our clients have no purchase commitments and may cancel, change or delay

purchases with little or no notice or penalty. As a result of this, our revenue could fluctuate materially and could be

materially and disproportionately impacted by purchasing decisions of any significant client. There can be no assurances that

clients who represented a substantial portion of our historical revenue will continue to purchase products from us in the

future, which could cause our revenue to decline materially and materially harm our financial condition and results of

operations. If we are unable to diversify our client base, we will continue to be susceptible to risks associated with client

concentration.

Our business is dependent on our clients obtaining appropriate

licenses from various licensing agencies.

Our business is dependent on our clients

obtaining appropriate licenses from various licensing agencies. There can be no assurance that any or all licenses necessary for

our clients to operate their businesses will be obtained, retained or renewed. If a licensing body were to determine that one

of our clients had violated applicable rules and regulations, there is a risk the license granted to that client could be revoked,

which could adversely affect future sales to that client and our operations. There can be no assurance that our existing clients

will be able to retain their licenses going forward, or that new licenses will be granted to existing and new market entrants.

Our contracts may not be legally enforceable in the

United States.

Many of our historic contracts, and

those we may enter into in the future, relate to services that are ancillary to the cannabis industry and other activities that

are not legal under U.S. federal law and under some state laws. As a result, we may face difficulties in enforcing our contracts

in U.S. federal and certain state courts.

System security risks, data protection breaches, cyber-attacks

and systems integration issues could disrupt our internal operations or services provided to clients.

Experienced computer programmers and hackers

may be able to penetrate our network security and misappropriate or compromise our confidential information or that of third parties,

create system disruptions or cause shutdowns. Computer programmers and hackers also may be able to develop and deploy viruses,

worms, and other malicious software programs that attack or otherwise exploit any security vulnerabilities of the products that

we may sell in the future. Such disruptions could adversely impact our ability to fulfill orders and interrupt other processes.

Delayed sales, lower profits, or lost clients resulting from these disruptions could adversely affect our financial results, stock

price and reputation.

We may be forced to litigate to defend our intellectual

property rights, or to defend against claims by third parties against urban-gro relating to intellectual property rights.

We may be forced to litigate to enforce

or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of other parties’

proprietary rights. Any such litigation could be very costly and could distract our management from focusing on operating our

business. The existence and/or outcome of any such litigation could harm our business.

Changes in accounting standards and subjective assumptions,

estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

U.S. generally accepted accounting principles

(“GAAP”) and related pronouncements, implementation guidelines and interpretations with regard to a wide variety of

matters that are relevant to our business, such as, but not limited to, revenue recognition, stock-based compensation, trade promotions,

and income taxes are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes

to these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly

change our reported results.

Our ability to maintain our reputation is critical to

the success of our business, and the failure to do so may materially adversely affect our business and the value of our common

stock.

Our reputation is a valuable component

of our business. Threats to our reputation can come from many sources, including adverse sentiment about our industry generally,

unethical practices, employee misconduct, failure to deliver minimum standards of service or quality, compliance deficiencies,

and questionable or fraudulent activities of our clients. Negative publicity regarding our business, employees, or clients, with

or without merit, may result in the loss of clients, investors and employees, costly litigation, a decline in revenues and increased

governmental regulation. If our reputation is negatively affected, by the actions of our employees or otherwise, our business

and, therefore, our operating results and the value of our common stock may be materially adversely affected.

We may not be able to successfully identify, consummate

or integrate acquisitions or to successfully manage the impacts of such transactions on our operations.

Part of our business strategy includes

pursuing synergistic acquisitions. We have expanded, and plan to continue to expand, our business by making strategic acquisitions

and regularly seeking suitable acquisition targets to enhance our growth. Material acquisitions, dispositions and other strategic

transactions involve a number of risks, including: (i) the potential disruption of our ongoing business; (ii) the distraction

of management away from the ongoing oversight of our existing business activities; (iii) incurring additional indebtedness; (iv)

the anticipated benefits and cost savings of those transactions not being realized fully, or at all, or taking longer to realize

than anticipated; (v) an increase in the scope and complexity of our operations; and (vi) the loss or reduction of control over

certain of our assets.

The pursuit of acquisitions may pose certain

risks to us. We may not be able to identify acquisition candidates that fit our criteria for growth and profitability. Even if

we are able to identify such candidates, we may not be able to acquire them on terms or financing satisfactory to us. We will

incur expenses and dedicate attention and resources associated with the review of acquisition opportunities, whether or not we

consummate such acquisitions.

Additionally, even if we are able to acquire

suitable targets on agreeable terms, we may not be able to successfully integrate their operations with ours. Achieving the anticipated

benefits of any acquisition will depend in significant part upon whether we integrate such acquired businesses in an efficient

and effective manner. We may not be able to achieve the anticipated operating and cost synergies or long-term strategic benefits

of our acquisitions within the anticipated timing or at all. The benefits from any acquisition will be offset by the costs incurred

in integrating the businesses and operations. We may also assume liabilities in connection with acquisitions to which we would

not otherwise be exposed. An inability to realize any or all of the anticipated synergies or other benefits of an acquisition

as well as any delays that may be encountered in the integration process, which may delay the timing of such synergies or other

benefits, could have an adverse effect on our business, results of operations and financial condition.

Our indebtedness could adversely affect our financial

condition and prevent us from fulfilling our debt service and other obligations.

Our indebtedness could have significant

effects on our business. For example, it could:

|

|

·

|

make it

more difficult for us to satisfy our financial obligations, including with respect to

our indebtedness, and any failure to comply with the obligations of any of our debt agreements,

including financial and other restrictive covenants, could result in an event of default

under the agreements governing our indebtedness;

|

|

|

·

|

increase

our vulnerability to general adverse economic, industry and competitive conditions;

|

|

|

·

|

limit

our ability to borrow additional funds; and

|

|

|

·

|

limit

our financial flexibility.

|

Each of these factors may have a material

and adverse effect on our financial condition and viability. Our ability to make payments with respect to our indebtedness and

to satisfy any other debt obligations will depend on our future operating performance, which will be affected by prevailing economic

conditions and financial, business and other factors affecting us and our industry, many of which are beyond our control.

Risks Related to the Cannabis Industry

As marijuana remains illegal under United States federal

law, it is possible that we may have to stop providing products and services to companies who are engaged in marijuana cultivation

and other marijuana-related activities.

Marijuana is currently classified as

a Schedule I controlled substance under the Controlled Substances Act and is illegal under United States federal law. It is illegal

under United States federal law to grow, cultivate, sell or possess marijuana for any purpose or to assist or conspire with those

who do so. Additionally, 21 U.S.C. 856 makes it illegal to “knowingly open, lease, rent, use, or maintain any place, whether

permanently or temporarily, for the purpose of manufacturing, distributing, or using any controlled substance.” Even in

those states in which the use of marijuana has been authorized under state law, its use remains a violation of federal law. Since

federal law criminalizing the use of marijuana is not preempted by state laws that legalize its use, strict enforcement of federal

law regarding marijuana would likely result in the inability of our clients that are involved in the cannabis industry to proceed

with their operations, which would adversely affect our operations.

Our solutions are used by cannabis growers. While

we are not aware of any threatened or current federal or state law enforcement actions against any supplier of equipment that

might be used for cannabis growing, law enforcement authorities, in their attempt to regulate the illegal use of marijuana, may

seek to bring an action or actions against us under the Controlled Substances Act for assisting or conspiring with persons engaged

in the cultivation of marijuana.

There is also a risk that our activities

could be deemed to be facilitating the selling or distribution of cannabis in violation of the Controlled Substances Act. Although

federal authorities have not focused their resources on such tangential or secondary violations of the Controlled Substances Act,

nor have they threatened to do so, with respect to the sale of equipment that might be used by cannabis cultivators, or with respect

to any supplies marketed to participants in the medical and recreational cannabis industry, if the federal government were to

change its practices, or were to expend its resources investigating and prosecuting providers of equipment that could be usable

by participants in the medical or recreational cannabis industry, such actions could have a materially adverse effect on our operations,

our clients that operate in the cannabis industry, or the sales of our products and services.

As a company with clients operating in the cannabis

industry, we face many particular and evolving risks associated with that industry, including uncertainty of United States federal

enforcement and the need to renew temporary safeguards.

On January 4, 2018, former Attorney

General Sessions rescinded the previously issued memoranda (known as the Cole Memorandum) from the DOJ that had de-prioritized

the enforcement of federal law against marijuana users and businesses that comply with state marijuana laws, adding uncertainty

to the question of how the U.S. federal government will choose to enforce federal laws regarding marijuana. Former Attorney General

Sessions issued a memorandum to all United States Attorneys in which the DOJ affirmatively rescinded the previous guidance as

to marijuana enforcement, calling such guidance “unnecessary.” This one-page memorandum was vague in nature, stating

that federal prosecutors should use established principles in setting their law enforcement priorities. Under previous administrations,

the DOJ indicated that those users and suppliers of medical marijuana who complied with state laws, which required compliance

with certain criteria, would not be prosecuted. As a result, it is now unclear if the DOJ will seek to enforce the Controlled

Substances Act against those users and suppliers who comply with state marijuana laws.

Despite Attorney General Sessions’

rescission of the Cole Memorandum, the Department of the Treasury, Financial Crimes Enforcement Network, has not rescinded the

“FinCEN Memo” dated February 14, 2014, which de-prioritizes enforcement of the Bank Secrecy Act against financial

institutions and marijuana related businesses which utilize them. This memo appears to be a standalone document and is presumptively

still in effect. At any time, however, the Department of the Treasury, Financial Crimes Enforcement Network, could elect to rescind

the FinCEN Memo. This would make it more difficult for our clients and potential clients to access the U.S. banking systems and

conduct financial transactions, which would adversely affect our operations.

In 2014, Congress passed a spending

bill (“2015 Appropriations Bill”) containing a provision (“Appropriations Rider”) blocking federal funds

and resources allocated under the 2015 Appropriations Bill from being used to “prevent such States from implementing their

own State medical marijuana law.” The Appropriations Rider seemed to have prohibited the federal government from interfering

with the ability of states to administer their medical marijuana laws, although it did not codify federal protections for medical

marijuana patients and producers. Moreover, despite the Appropriations Rider, the Justice Department maintains that it can still

prosecute violations of the federal marijuana ban and continue cases already in the courts. Additionally, the Appropriations Rider

must be re-enacted every year. While it was continued in 2016, 2017, 2018, 2019 and 2020, and remains in effect, continued re-authorization

of the Appropriations Rider cannot be guaranteed. If the Appropriation Rider is no longer in effect, the risk of federal enforcement

and override of state marijuana laws would increase.

Further legislative development beneficial to our

operations is not guaranteed.

Among other things, the business of

our clients in the cannabis industry involves the cultivation, distribution, manufacture, storage, transportation and/or sale

of medical and adult use cannabis products in compliance with applicable state law. The success of our business with respect to

these clients depends on the continued development of the cannabis industry and the activity of commercial business and government

regulatory agencies within the industry. The continued development of the cannabis industry is dependent upon continued legislative

and regulatory authorization of cannabis at the state level and a continued laissez-faire approach by federal enforcement agencies.

Any number of factors could slow or halt progress in this area. Further regulatory progress beneficial to the industry cannot

be assured. While there may be ample public support for legislative action, numerous factors impact the legislative and regulatory

process, including election results, scientific findings or general public events. Any one of these factors could slow or halt

progressive legislation relating to cannabis and the current tolerance for the use of cannabis by consumers, which could adversely

affect our operations.

The cannabis industry could face strong opposition

from other industries.

We believe that established businesses

in other industries may have a strong economic interest in opposing the development of the cannabis industry. Cannabis may be

seen by companies in other industries as an attractive alternative to their products, including recreational marijuana as an alternative