United-Guardian Reports 2022 Financial Results

March 17 2023 - 9:00AM

United-Guardian, Inc. (NASDAQ:UG) reported that net income for FY

2022 decreased by 45% compared to FY 2021. Net sales for the year

decreased by 9% from $13,929,629 in 2021 to $12,698,503 in 2022,

generating net income of $2,569,512 ($0.56 per share) in 2022

compared to $4,658,542 ($1.01 per share) in 2021.

Beatriz Blanco, President of United-Guardian, stated, “The

decrease in the Company’s net income was primarily caused by a

decrease in revenue of our cosmetic ingredients combined with

increased losses from our marketable securities portfolio. The main

factors which negatively impacted the sales of our cosmetic

ingredients were 1) overstocking by certain contract manufactures

in 2021, in an effort to avoid potential supply chain issues in

2022, and 2) lower demand in Asia, especially in China, due to

China’s zero-COVID mandate that was in place for much of 2022. Our

pharmaceutical and medical lubricants business remained strong in

2022. We believe that there is potential to continue growing our

cosmetic ingredients and medical lubricants business through new

product development, new product applications, and technical

collaboration with our customers and distributors. The cornerstone

of United-Guardian is product innovation and we are continuing to

focus our efforts on expanding our line of naturally-derived

hydrogels in all markets. United-Guardian continues to have a solid

foundation of high-quality innovative hydrogel technologies, as

well as an outstanding and experienced team at all levels.”

United-Guardian is a manufacturer of cosmetic ingredients,

medical lubricants, and pharmaceutical products.

| |

|

Contact:

Beatriz Blanco(631) 273-0900 |

NOTE: This press release contains both

historical and "forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements about the company’s expectations or beliefs concerning

future events, such as financial performance, business prospects,

and similar matters, are being made in reliance upon the “safe

harbor” provisions of that Act. Such statements are subject to a

variety of factors that could cause the company’s actual results or

performance to differ materially from the anticipated results or

performance expressed or implied by such forward-looking

statements. For further information about the risks and

uncertainties that may affect the company’s business please refer

to the company's reports and filings with the Securities and

Exchange Commission.

FINANCIAL RESULTS FOR THE YEARS

ENDEDDECEMBER 31, 2022, AND DECEMBER 31,

2021

STATEMENTS OF INCOME

| |

|

Years ended December 31 |

|

|

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Net sales |

$ |

12,698,503 |

|

$ |

13,929,629 |

|

| |

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

Cost of sales |

|

5,996,376 |

|

|

5,747,931 |

|

|

Operating expenses |

|

2,174,127 |

|

|

2,035,970 |

|

|

Research and development |

|

490,770 |

|

|

478,642 |

|

|

Total costs and expenses |

|

8,661,273 |

|

|

8,262,543 |

|

|

Income from operations |

|

4,037,230 |

|

|

5,667,086 |

|

| Other (loss) income: |

|

|

|

|

|

|

|

Investment income |

|

236,695 |

|

|

233,857 |

|

|

Net loss on marketable securities |

|

(1,046,245 |

) |

|

(23,018 |

) |

|

Total other (loss) income |

|

(809,550 |

) |

|

210,839 |

|

| |

|

|

|

|

|

|

|

Income before provision for income taxes |

|

3,227,680 |

|

|

5,877,925 |

|

| |

|

|

|

|

|

|

| Provision for income

taxes |

|

658,168 |

|

|

1,219,383 |

|

|

Net income |

$ |

2,569,512 |

|

$ |

4,658,542 |

|

| |

|

|

|

|

|

|

| Earnings per common share

(basic and diluted) |

$ |

0.56 |

|

$ |

1.01 |

|

| |

|

|

|

|

|

|

| Weighted average shares (basic

and diluted) |

|

4,594,319 |

|

|

4,594,319 |

|

| |

|

|

|

|

|

BALANCE SHEET

DATA(condensed)

| |

| |

|

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current assets |

|

$ |

9,970,630 |

|

$ |

11,583,390 |

| Deferred income taxes,

net |

|

|

110,544 |

|

|

--- |

| Property, plant, and equipment

(net of depreciation) |

|

|

559,161 |

|

|

658,862 |

|

Total assets |

|

|

10,640,335 |

|

|

12,242,252 |

| |

|

|

|

|

|

|

| Current liabilities |

|

|

1,373,691 |

|

|

2,337,761 |

| Deferred income taxes

(net) |

|

|

--- |

|

|

83,222 |

|

Total liabilities |

|

|

1,373,691 |

|

|

2,420,983 |

| |

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

9,266,644 |

|

|

9,821,269 |

|

Total liabilities and stockholders’ equity |

|

|

10,640,335 |

|

|

12,242,252 |

| |

|

|

|

|

|

|

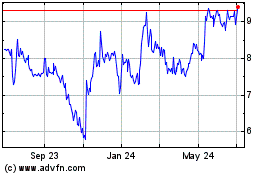

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Apr 2024 to May 2024

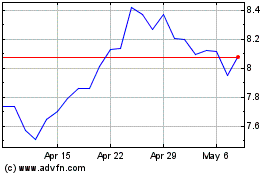

United Guardian (NASDAQ:UG)

Historical Stock Chart

From May 2023 to May 2024