Cosmetics Stocks Sag Amid Mask-Wearing -- WSJ

September 02 2020 - 3:02AM

Dow Jones News

By Veronica Dagher

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 2, 2020).

The coronavirus pandemic is changing the face of the makeup

business, but sales are expected to bounce back once there is a

vaccine.

As more women work from home and wear masks when they go out,

their desire for color cosmetics such as lipstick and blush has

plummeted. It has accelerated two trends in the industry: a focus

on skin care and "try-on" technology.

With no clear end date to coronavirus restrictions in sight,

makeup sales are likely to remain depressed and will continue to

weigh on the results of beauty companies.

Last week, Ulta Beauty Inc. reported that makeup sales, which

accounts for about half of the retailer's revenue, are still below

pre-pandemic levels. It declined to 43% of the retailer's sales in

its fiscal second quarter, down 4 percentage points from last year.

Despite weak makeup sales, the company posted better-than-expected

profit, as consumers made fewer trips to the store but spent more

when they shopped. Ulta said it earned 73 cents a share on sales of

$1.2 billion, down 28% from a year ago.

Makeup sales were already softening for about the past two years

partly because of some consumers' increasing preference for a more

natural look. According to research firm Mintel, U.S. retail sales

of color cosmetics are projected to be down 10.6% in 2020.

A lack of blockbuster makeup trends -- such as contouring, which

helped boost industry sales about five years ago -- hasn't given

consumers much to get excited about. Now, fewer social occasions,

remote work and increased demands for women with children are

further curbing interest in products.

In the past, women typically continued to buy small items such

as lipstick during an economic downturn. That was even when they

couldn't afford far more expensive luxuries such as vacations. In

the industry, this is known as the "lipstick index." Masks appear

to have shifted that behavior.

On its recent fiscal fourth-quarter earnings call, beauty giant

Estée Lauder Cos. also pointed to weaker makeup sales. Estée's

makeup sales fell 61%, because of the impact of Covid-19 on

consumer preferences, the company reported.

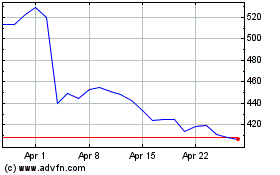

Ulta's stock has been volatile. Shares sank to $128.52 on March

18 but rebounded to $252.08 on June 5. On Monday, Ulta shares

closed down 2% to $232.18.

Estée Lauder shares sank to $144.38 on March 23 but the stock's

rebound has generally been steady since mid-May. Shares closed

Monday down 0.54% to $221.72.

For both stocks, and other beauty companies such as Coty Inc.,

skin care has been a bright spot. Some consumers have used having

more time at home to develop skin-care regimens using face creams,

lotions and serums.

"The lipstick index has been substituted by the moisturizer

index," Fabrizio Freda, chief executive of Estée Lauder, said on

the company's earnings call.

Burgeoning online sales have also been a growth driver for many

beauty companies. Ulta said e-commerce sales soared more than 200%

in its fiscal second quarter. The use of technology that enables

consumers to virtually "try on" makeup or take makeup classes is

also helping these companies stay engaged with consumers

online.

Demand for makeup for the coming holiday season may be soft if

social distancing curtails in-person parties and consumers'

spending is reduced. In addition, a generally downbeat outlook for

travel may continue to dampen makeup sales at airport duty-free

stops for the rest of the year, some analysts say.

The hope is that much of this may abate once the pandemic ends.

Certain shifts caused by the pandemic are likely to remain,

however, especially if changes such as working from home are

permanent.

Consumers' increased appetite for skin-care products is likely

to still grow, says Erinn Murphy, managing director at Piper

Sandler & Co. Curbside pick up, where customers buy items

online and pick them up outside the store, is poised to continue,

too.

Still, this sector relies on touch. So long as health and safety

concerns persist, consumers may be less likely to try new brands

and experiment with new products, analysts say. Without a vaccine,

social occasions and fresh innovation, makeup sales are likely to

stay depressed.

"The pandemic has given women permission to wear less makeup,"

said Stephanie Wissink, equity analyst at Jefferies.

Write to Veronica Dagher at veronica.dagher@wsj.com

(END) Dow Jones Newswires

September 02, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

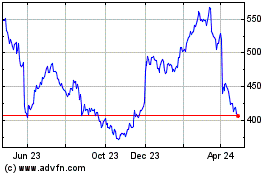

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Apr 2023 to Apr 2024