TrueCar’s ALG Forecasts New Car Auto Sales Increase for the Third Quarter; Annual SAAR Remains on Pace for 17M Units

September 25 2019 - 9:00AM

TrueCar, Inc.’s (NASDAQ: TRUE) data and analytics subsidiary, ALG,

projects total new vehicle sales will reach 1,288,972 units in

September, down 2.2% from a year ago when adjusted for the same

number of selling days. For the third quarter, total vehicle sales

are forecast to be 4,334,457 units, up 1% from a year ago when

adjusted for the same number of selling days, which would mark the

first quarter in 2019 to show an increase in sales year-over-year.

This month’s seasonally adjusted annualized rate (SAAR) for total

light vehicle sales is an estimated 17.4 million units, with ALG

projecting 2019 new car sales to continue to stay on course to

reach 17M units as initially forecast in January. Excluding fleet

sales, ALG expects U.S. retail deliveries of new cars and light

trucks to be 1,075,416 million units, a decrease of 4.4% from a

year ago when adjusted for the same number of selling days.

“Despite a slight rebound in consumer confidence in September,

overall auto sales are expected to decline given that Labor Day

weekend fell into August this year,” said Oliver Strauss, Chief

Economist for ALG, a subsidiary of TrueCar. “Nevertheless, the

third quarter was up and auto sales remain on pace to hit 17

million units for 2019 aided by more fleet and incremental

incentives.”

Additional Takeaways & Trends: (Forecast by

ALG)Month:

- Hyundai stood out for sales growth up 9.2% for total unit sales

and 7.5% for retail sales year-over-year, continuing to see strong

performance in its all-new Palisade model.

- Despite having no product launches, Honda is also expected to

be up 7.4% on total vehicle sales and 6.6% on retail sales

year-over-year, aided by strong Civic performance as well as

increased incentive spend and fleet sales.

- Tesla continues to show strong sales growth, up 26.7% in total

units year-over-year spurred by enduring popularity of its Model

3.

- Automaker average incentive spend should reach $3,975, up 4.9%

or $184 dollars year-over-year, and up 0.3% or $12 from August

2019. The most notable declines in incentive spend are expected

from Daimler, Hyundai, and BMW. Meanwhile Subaru, GM, and Honda are

expected to have double-digit incentive increases.

"Subaru has long been an all-star when it comes to

incentives discipline, and while the YOY spending is up nearly 50%,

with an aging portfolio and new entries in hyper-competitive

segments, the brand is still performing as the industry's MVP with

regard to vehicle discounting," said Eric Lyman, Chief Industry

Analyst at ALG, a subsidiary of TrueCar.

- Average transaction price (ATP) should continue to rise, up 2%

or $672 year-over-year. ATP is expected to increase for the 9th

consecutive month this year when compared to the prior year.

- Incentives as a percentage of average transaction price are

expected to be 11.5%, up 2.8% from a year ago and down 0.8% from

August 2019.

- In ALG’s brand strength metric, Retail Health Index (RHI), BMW

and Mercedes-Benz stood out, driven by lower incentives and strong

new product performance in the BMW X7, Mercedes-Benz GLS and

CLS.

- Used vehicle sales for September are expected to reach

3,415,427 up 3.4% from a year ago and up 0.1% from August

2019.

"Mercedes-Benz and BMW are growing retail share while

simultaneously pulling back on incentives, a feat that is boosting

performance in our Retail Health Index,” added Lyman.

“Historically, these German rivals kick their sales efforts into

overdrive in Q4, but new product, rather than discounting, could be

the catalyst for strong market performance as we enter the final

stretch of 2019."

Third Quarter:

- Retail unit sales for the third quarter should reach 3,767,621,

down 3.1% compared with the same period last year adjusted for the

same number of selling days.

- TrueCar and ALG also assessed brand retention performance

through the replacement vehicle indicated via TrueCar’s consumer

trade experience for Q3.

- Toyota had the highest indicated brand retention at 43%. Honda

and Chevrolet tied for second at 42% followed by Subaru at 40% and

Ram at 37%.

- At the model level, the Chevrolet Corvette had the highest

indicated brand retention at 49% followed by the Subaru Forester

and the Jeep Wrangler Unlimited each with 29%.

- Used vehicle sales for the third quarter are expected to reach

10,260,316 up 1.8% year-over-year and down 3.9% from Q2 2019.

Retail Health Index (Forecast)

RHI measures the changes

in retail market share relative to

changes in incentive spending and transaction price to gauge

whether OEMs are "buying" retail share through increased

incentives, or whether share increases are largely

demand-driven. An OEM with a positive RHI score is

demonstrating a healthy balance of incentive spend relative to

market share, either by holding incentive spending flat and

increasing share or by increasing incentives with a higher positive

increase in retail share.

September 2019 forecasts for the 13 largest

manufacturers by volume: (Adjusted for same selling days

as August 2018. Tesla forecast included since March 2019.)

Total Unit Sales

|

Manufacturer |

Sept 2019 |

Sept 2018 |

YoY % Change |

|

BMW |

28,759 |

29,470 |

6.1% |

|

Daimler |

25,338 |

30,715 |

-10.3% |

|

FCA |

171,397 |

199,819 |

-6.8% |

|

Ford |

171,511 |

196,496 |

-5.1% |

|

GM |

214,346 |

234,043 |

-0.5% |

|

Honda |

131,043 |

132,668 |

7.4% |

|

Hyundai |

57,621 |

57,359 |

9.2% |

|

Kia |

47,729 |

51,503 |

0.7% |

|

Nissan |

105,158 |

122,819 |

-6.9% |

|

Subaru |

49,558 |

57,044 |

-5.6% |

|

Tesla |

16,439 |

14,100 |

26.7% |

|

Toyota |

182,979 |

203,098 |

-2.1% |

|

Volkswagen Group |

46,681 |

55,224 |

-8.1% |

|

Industry |

1,288,972 |

1,432,069 |

-2.2% |

Incentive Spending (Per Unit)

|

Manufacturer |

Sept 2019 |

Sept

2018 |

YOY %

Change |

|

BMW |

$5,307 |

$5,676 |

-6.5% |

|

Daimler |

$5,372 |

$5,943 |

-9.6% |

|

FCA |

$5,055 |

$4,604 |

9.8% |

|

Ford |

$4,914 |

$4,776 |

2.9% |

|

GM |

$5,200 |

$4,451 |

16.8% |

|

Honda |

$2,336 |

$2,036 |

14.7% |

|

Hyundai |

$2,655 |

$2,869 |

-7.5% |

|

Kia |

$3,619 |

$3,792 |

-4.6% |

|

Nissan |

$4,589 |

$4,468 |

2.7% |

|

Subaru |

$1,860 |

$1,252 |

48.5% |

|

Toyota |

$2,743 |

$2,645 |

3.7% |

|

Volkswagen Group |

$3,607 |

$3,844 |

-6.2% |

|

Industry |

$3,975 |

$3,791 |

4.9% |

Average Transaction Price

(ATP)

|

Manufacturer |

Sept 2019 |

Sept 2018 |

Aug 2019 |

YOY % change |

MOM % change |

|

BMW |

$54,463 |

$51,599 |

$52,750 |

5.6% |

3.2% |

|

Daimler |

$57,165 |

$55,156 |

$55,391 |

3.6% |

3.2% |

|

FCA |

$36,994 |

$34,948 |

$36,211 |

5.9% |

2.2% |

|

Ford |

$39,062 |

$38,140 |

$38,400 |

2.4% |

1.7% |

|

GM |

$38,751 |

$37,810 |

$38,323 |

2.5% |

1.1% |

|

Honda |

$28,320 |

$29,022 |

$28,178 |

-2.4% |

0.5% |

|

Hyundai |

$24,213 |

$22,169 |

$24,800 |

9.2% |

-2.4% |

|

Kia |

$24,266 |

$22,592 |

$24,006 |

7.4% |

1.1% |

|

Nissan |

$26,939 |

$27,414 |

$27,199 |

-1.7% |

-1.0% |

|

Subaru |

$29,500 |

$29,305 |

$29,322 |

0.7% |

0.6% |

|

Toyota |

$32,261 |

$32,360 |

$32,673 |

-0.3% |

-1.3% |

|

Volkswagen Group |

$41,612 |

$40,487 |

$40,640 |

2.8% |

2.4% |

|

Industry |

$34,709 |

$34,038 |

$34,327 |

2.0% |

1.1% |

Total Unit Sales Third

Quarter

|

Manufacturer |

Q3 2019 |

Q3 2018 |

YoY % Change |

|

BMW |

84,204 |

83,599 |

0.7% |

|

Daimler |

83,102 |

77,965 |

6.6% |

|

FCA |

555,187 |

564,507 |

-1.7% |

|

Ford |

574,184 |

606,939 |

-5.4% |

|

GM |

740,330 |

694,054 |

6.7% |

|

Honda |

446,341 |

419,173 |

6.5% |

|

Hyundai |

182,064 |

166,653 |

9.2% |

|

Kia |

161,864 |

158,479 |

2.1% |

|

Nissan |

331,268 |

343,987 |

-3.7% |

|

Subaru |

183,703 |

180,558 |

1.7 % |

|

Tesla |

42,439 |

38,800 |

9.4% |

|

Toyota |

640,517 |

634,923 |

0.9% |

|

Volkswagen Group |

164,528 |

166,799 |

-1.4% |

|

Industry |

4,334,457 |

4,290,142 |

1.0% |

Retail Market Share Third Quarter

|

Manufacturer |

Q3 2019 |

Q3 2018 |

YoY % Change |

|

BMW |

1.9% |

1.9% |

2.2% |

|

Daimler |

2.1% |

1.9% |

2.2% |

|

FCA |

11.8% |

12.8% |

12.7% |

|

Ford |

11.8% |

13.6% |

12.2% |

|

GM |

16.2% |

15.5% |

16.6% |

|

Honda |

11.7% |

10.6% |

11.1% |

|

Hyundai |

4.2% |

3.9% |

3.9% |

|

Kia |

3.7% |

3.4% |

3.6% |

|

Nissan |

7.3% |

7.6% |

6.8% |

|

Subaru |

4.7% |

4.5% |

4.6% |

|

Tesla |

1.1% |

1.0% |

1.0% |

|

Toyota |

15.7% |

15.3% |

14.9% |

|

Volkswagen Group |

4.0% |

4.1% |

4.0% |

|

|

|

|

|

For additional data visit the ALG Newsroom.

(Note: This forecast is based solely on ALG’s

analysis of industry sales trends and conditions and is not a

projection of the company’s operations.)

TrueCar Trade data reflects consumers trading in a

vehicle and the percentage that chose the same brand

when indicating a replacement vehicle. The replacement

vehicle was not necessarily a new car. Data sourced Aug

2018 vs. Aug 1-26th 2019.

About TrueCarTrueCar, Inc. (NASDAQ: TRUE) is a

digital automotive marketplace that provides comprehensive pricing

transparency about what other people paid for their cars and

enables consumers to engage with TrueCar Certified Dealers who are

committed to providing a superior purchase experience. TrueCar

operates its own branded site and its nationwide network of more

than 16,500 Certified Dealers also powers car-buying programs for

some of the largest U.S. membership and service organizations,

including USAA, AARP, American Express, AAA and Sam's Club. Nearly

half of all new car buyers engage with the TrueCar network during

their purchasing process. TrueCar is headquartered in Santa Monica,

California, with an office in Austin, Texas.

For more information, please visit www.truecar.com, and follow

us on Facebook or Twitter. TrueCar media line: +1-844-469-8442 (US

toll-free) | Email: pressinquiries@truecar.com

About ALGFounded in 1964 and headquartered in

Santa Monica, California, ALG is an industry authority on

automotive residual value projections in both the United States and

Canada. By analyzing nearly 2,500 vehicle trims each year to assess

residual value, ALG provides auto industry and financial services

clients with market industry insights, residual value forecasts,

consulting and vehicle portfolio management and risk services. ALG

is a wholly-owned subsidiary of TrueCar, Inc., a digital automotive

marketplace that provides comprehensive pricing transparency about

what other people paid for their cars. ALG has been publishing

residual values for all cars, trucks and SUVs in the U.S. for over

50 years and in Canada since 1981.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5f018ffb-f9e9-43ad-8957-305cad031360

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bb7c6de-6043-44e4-a2c4-cb7543d31a52

TrueCar and ALG PR Contact:

Shadee Malekafzali

shadee@truecar.com

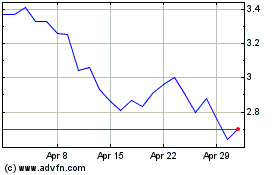

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

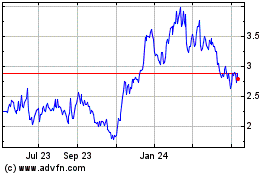

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Apr 2023 to Apr 2024