2024Q1false0001169445--12-31xbrli:shares00011694452024-01-012024-03-310001169445us-gaap:CommonStockMember2024-01-012024-03-310001169445tbrg:CommonStockPurchaseRightsMember2024-01-012024-03-3100011694452024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the quarterly period ended March 31, 2024

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-49796

TRUBRIDGE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | | 74-3032373 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| |

54 St. Emanuel Street, Mobile, Alabama | | 36602 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(251) 639-8100

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, par value $.001 per share | TBRG | The NASDAQ Stock Market LLC |

| Common Stock Purchase Rights | N/A | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | | | Accelerated filer | | |

| | | |

| Non-accelerated filer | | | | Smaller reporting company | | ☐ |

| | | | | | |

| Emerging growth company | | ☐ | | | | |

| | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of May 9, 2024, there were 15,007,262 shares of the issuer’s common stock outstanding.

EXPLANATORY NOTE

TruBridge, Inc. (the “Company,” “we,” “us” or “our”) is filing this Amendment No. 1 on Form 10-Q/A (this “Amendment No. 1”) to amend and restate certain portions of the Company’s Quarterly Report on Form 10-Q for the fiscal period ended March 31, 2024, as originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 10, 2024 (the “Original Filing”), as a result of the identification of the material weakness in internal control (as described in Part I, Item 4 of this Amendment No. 1). Specifically, the Company is filing this Amendment No. 1 to (i) revise the disclosure on the effectiveness of our disclosure controls and procedures in Part I, Item 4 of the Original Filing to reflect management’s conclusion that our disclosure controls and procedures were not effective at March 31, 2024, (ii) revise the risk factor related to a failure to maintain effective internal control over financial reporting.

Pursuant to Rule 12b-15 promulgated under the Securities Exchange Act of 1934, as amended, we have included the entire text of Part I, Item 4 and Part II, Item 1A of the Original Filing in this Amendment No. 1. There have been no changes to the text of Part I, Item 4 or Part II, Item 1A other than the changes stated in the immediately preceding paragraph. Furthermore, there have been no changes to the XBRL data filed in Exhibit 101 of the Original Filing. Other than as described above and through the inclusion with this Amendment No. 1 of new certifications by management and related amendments to the list of exhibits contained in Part II, Item 6 of the Original Filing, this Amendment No. 1 speaks only as of the date of the Original Filing and does not amend, supplement, or update any information contained in the Original Filing to give effect to any subsequent events (including with respect to the cover page of the Original Filing, which has been updated only to present this filing as Amendment No. 1). Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing and our reports filed with the SEC subsequent to the Original Filing.

This Amendment No. 1 does not change our condensed consolidated financial statements as set forth in the Original Filing.

TRUBRIDGE, INC.

Quarterly Report on Form 10-Q

(For the three months ended March 31, 2024)

TABLE OF CONTENTS

| | | | | |

| Item No. | Page No. |

| PART I | |

| 4. Controls and Procedures | |

PART II | |

| 1A. Risk Factors | |

| |

| 6. Exhibits | |

| |

| SIGNATURE | |

PART I

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to provide reasonable assurance that the information required to be disclosed by us in reports that we file or submit under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), is recorded, processed, summarized and reported within the time periods specified in the rules and forms promulgated by the Securities and Exchange Commission, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Because of the inherent limitations to the effectiveness of any system of disclosure controls and procedures, no evaluation of disclosure controls and procedures can provide absolute assurance that all control issues and instances of fraud, if any, with a company have been prevented or detected on a timely basis. Even disclosure controls and procedures determined to be effective can only provide reasonable assurance that their objectives are achieved.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) pursuant to Rule 13a-15 of the Exchange Act. At the time of the Original Filing, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective at the reasonable assurance level as of March 31, 2024. Subsequent to that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, due to the material weakness in our internal control over financial reporting described below, our disclosure controls and procedures were not effective as of March 31, 2024.

Material Weakness in Internal Control over Financial Reporting

A material weakness is a significant deficiency, or combination of significant deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. Subsequent to the Company issuing its earnings press release for the fiscal quarter ended June 30, 2024, the Company’s management concluded that there was a deficiency in the Company’s internal control over financial reporting related to the Company’s procedures for processing customer contract changes and terminations and issuing credits to customers. It was determined that this deficiency existed as of December 31, 2023 and continued through June 30, 2024, and it was determined to be a material weakness.

Despite the existence of this material weakness, we believe that the condensed consolidated financial statements included in this report present fairly, in all material respects, our financial position, results of operations, and cash flows for the periods presented, in conformity with accounting principles generally accepted in the United States of America. However, this material weakness could result in a material misstatement of the Company’s interim or annual consolidated financial statements that would not be prevented or detected.

Management’s Remediation Efforts

The Company’s management, under the leadership of the new Chief Financial Officer since January 1, 2024, has worked to strengthen the Company’s internal controls and improve its procedures for processing customer contract changes and terminations and issuing credits to customers, including adding key personnel to the Company’s finance team. Specifically, the Company has redesigned existing, and implemented additional, controls and procedures to ensure the timely processing of customer contract changes and terminations. Additionally, the Company has established strong channels of communication and enhanced coordination between functions. As a result of such measures and the focus of the Company’s management, we have seen a substantially diminished need for the issuance of customer credits. Finally, we are evaluating the use of technology and automation to enhance further preventative controls and ensure we have established a complete and up-to date inventory of customer contract

modifications. We believe that the foregoing actions will support the improvement of our internal control over financial reporting, and, through our continuous efforts to identify, design, and implement the necessary control activities, will be effective in remediating the material weakness described above. We will continue to devote time and attention to these remediation efforts. As we continue to evaluate and work to improve our internal control over financial reporting, management may determine to take additional measures to address the material weakness or determine to modify the remediation plan described above.

Changes in Internal Control over Financial Reporting

On October 16, 2023, we acquired Viewgol, as further described in Note 3 - Revenue Recognition of the consolidated financial statements. We continue to integrate policies, processes, people, technology and operations for our combined operations, and will continue to evaluate the impact of any related changes to internal controls over financial reporting during the fiscal year.

Other than the changes related to Viewgol described above, there were no changes in the Company’s internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) during the quarter ended March 31, 2024 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II

Item 1A. Risk Factors.

In addition to the other information set forth in this report, you should carefully consider the factors discussed in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which could materially affect our business, financial condition or future results. The risks described in our Annual Report on Form 10-K are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem immaterial also may materially adversely affect our business, financial condition or operating results. There have been no material changes to the risk factors disclosed in Part 1, “Item 1A. Risk Factors” in our Annual Report on Form 10-K and Part II, “Item 1A. Risk Factors” in our subsequent Quarterly Reports on Form 10-Q other than as described in the risk factor below.

RISKS RELATED TO OUR COMMON STOCK AND OTHER GENERAL RISKS

We identified a material weakness in our internal control over financial reporting as of December 31, 2023 and continuing as of the date hereof. If we fail to remedy this weakness or otherwise fail to achieve and maintain effective internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may adversely affect investor confidence in us and may adversely affect our business, financial condition and results of operations.

We are required under Section 404 of the Sarbanes-Oxley Act to furnish a report by management on the effectiveness of our internal control over financial reporting and to include a report by our independent auditors attesting to such effectiveness. Any failure by us to maintain effective internal control over financial reporting could adversely affect our ability to report accurately our financial condition or results of operations.

As reported in our Quarterly Report on Form 10-Q for the period ended September 30, 2023, we identified a material weakness in our internal control over financial reporting in the third quarter of 2023, as our controls over debt covenant monitoring and compliance were not operating with sufficient precision and timeliness. As of December 31, 2023, this weakness had been remediated with more robust and timely review controls over the related covenant calculations. However, subsequent to the Company issuing its earnings press release for the fiscal quarter ended June 30, 2024, we identified a material weakness in our internal control over financial reporting as of December 31, 2023, related to the Company’s procedures for processing customer contract changes and terminations and issuing credits to customers.

If we are unable to develop and maintain effective internal control over financial reporting, or if the Company’s management concludes that we have any additional material weaknesses in our internal control over financial reporting, we could lose investor confidence in the accuracy and completeness of our financial reports, the market price of our common stock could decline, and we could be subject to sanctions or investigations by the Securities and Exchange Commission (“SEC”) or other regulatory authorities. Failure to remedy any material weakness in our internal control over financial reporting, or to implement or maintain other effective control systems required of public companies, also could restrict our future access to the capital markets.

Our Rights Agreement includes terms and conditions that could discourage a takeover or other transaction that stockholders may consider favorable.

On March 26, 2024, the Company entered into the Rights Agreement (as amended on April 22, 2024, the “Rights Agreement”), by and between the Company and Computershare Trust Company, N.A., as rights agent. Pursuant to the Rights Agreement, the Board of Directors declared a dividend of one right (each, a “Right”) for each share of our common stock outstanding at the close of business on April 4, 2024. Each Right initially entitles the registered holder, subject to the terms of the Rights Agreement, to purchase from the Company one half of a share of common stock, at a price of $28.00 for each one half of a share of common stock (equivalent to $56.00 for each whole share of common stock), subject to certain adjustments. Subject to the terms of the Rights Agreement, the Rights will

expire on March 25, 2025. Additional information regarding the Rights Agreement is contained in Forms 8-K filed with the SEC on March 26, 2024 and April 23, 2024.

The Rights Agreement will cause substantial dilution to any person or group that acquires beneficial ownership of 15% or more of our common stock without the approval of the Board of Directors. As a result, the overall effect of the Rights Agreement and the issuance of the Rights may be to discourage any person, entity or group from gaining a control or control-like position in the Company or engaging in other tactics, potentially disadvantaging the interests of the Company’s stockholders, without negotiating with the Board of Directors and without paying an appropriate control premium to all stockholders. The Rights Agreement is similar to plans adopted by other public companies, and it is intended to protect stockholders’ interests, including protecting stockholders from any efforts at negative control (that is, the ability to exercise influence sufficient to control or block certain important corporate actions). The Rights Agreement is intended to position the Board of Directors to fulfill its duties by ensuring that the Board of Directors has sufficient time to make informed judgments that are in the best interests of the Company and its stockholders. Nevertheless, the Rights Agreement may be considered to have certain anti-takeover effects, including potentially discouraging a takeover attempt that stockholders may consider favorable or that could result in a premium over the market price of our common stock. Even in the absence of a takeover attempt, the Rights Agreement may adversely affect the prevailing market price of our common stock if it is viewed as discouraging takeover attempts in the future.

Item 6. Exhibits.

Effective as of March 4, 2024, we changed our name to TruBridge, Inc. By operation of law, any reference to “CPSI” in these exhibits should be read as “TruBridge” as set forth in the Exhibit List below.

| | | | | |

Exhibit Number | Description |

| |

| Stock Purchase Agreement, dated as of January 16, 2024, by and among Computer Programs and System, Inc., PointClickCare Technologies USA Corp., Healthland, Inc., and American HealthTech, Inc. (incorporated by reference to Exhibit 2.1 of TruBridge, Inc.’s Current Report on Form 8-K filed January 17, 2024) |

| |

| |

| |

|

reference) |

| |

| |

| |

| |

| |

4.2 | |

| |

| 10.1 | |

| |

| 10.2 | |

| |

| 10.3 | Third Amendment, dated as of January 12, 2024, to the Amended and Restated Credit Agreement, dated as of June 16, 2020, by and among Computer Programs and Systems, Inc., certain of its subsidiaries, as guarantors, certain lenders named therein, and Regions Bank, as administrative agent and collateral agent (incorporated by reference to Exhibit 10.1 of TruBridge, Inc.’s Current Report on Form 8-K filed January 17, 2024) |

| |

| 10.4 | Fourth Amendment, dated as of February 29, 2024, to the Amended and Restated Credit Agreement, dated as of June 16, 2020, by and among Computer Programs and Systems, Inc., certain of its subsidiaries, as guarantors, certain lenders named therein, and Regions Bank, as administrative agent and collateral agent (incorporated by reference to Exhibit 10.1 of TruBridge, Inc.’s Current Report on Form 8-K filed February 29, 2024) |

| |

31.1 | |

| |

31.2 | |

| |

32.1 | |

| | | | | |

| 101 | The following financial statements from the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, formatted in inline eXtensible Business Reporting Language (iXBRL): (i) Condensed Consolidated Balance Sheets, (ii) Condensed Consolidated Statements of Income, (iii) Condensed Consolidated Statement of Stockholders' Equity, (iv) Condensed Consolidated Statements of Cash Flows, and (v) Notes to Condensed Consolidated Financial Statements (incorporated by reference to Exhibit 101 to TruBridge’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024) |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

* Certain annexes and schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby agrees to furnish supplementally copies of any of the omitted documents to the SEC upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | TRUBRIDGE, INC. |

| | |

8/14/2024 | | By: | | /s/ Christopher L. Fowler |

| | | | Christopher L. Fowler |

| | | | President and Chief Executive Officer |

| | |

Exhibit 31.1

CERTIFICATION

I, Christopher L. Fowler, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of TruBridge, Inc.; and

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Date: August 14, 2024 By: /s/ Christopher L. Fowler

Christopher L. Fowler

Chief Executive Officer

Exhibit 31.2

CERTIFICATION

I, Vinay Bassi, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of TruBridge, Inc.; and

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Date: August 14, 2024 By: /s/ Vinay Bassi

Vinay Bassi

Chief Financial Officer

Exhibit 32.1

Certifications of Chief Executive Officer

and Chief Financial Officer

Pursuant to

18 U.S.C. Section 1350,

As Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Quarterly Report on Form 10-Q/A of TruBridge, Inc. (the “Company”) for the quarter ending March 31, 2024, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), Christopher L. Fowler, President and Chief Executive Officer of the Company, and Vinay Bassi, Chief Financial Officer of the Company, each hereby certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

1. The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

Dated: August 14, 2024

By: /s/ Christopher L. Fowler

Christopher L. Fowler

Chief Executive Officer

By: /s/ Vinay Bassi

Vinay Bassi

Chief Financial Officer

v3.24.2.u1

COVER - shares

|

3 Months Ended |

|

Mar. 31, 2024 |

May 09, 2024 |

| Document Information [Line Items] |

|

|

| Document Type |

10-Q/A

|

|

| Document Quarterly Report |

true

|

|

| Document Period End Date |

Mar. 31, 2024

|

|

| Document Transition Report |

false

|

|

| Entity File Number |

000-49796

|

|

| Entity Registrant Name |

TRUBRIDGE, INC.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity Tax Identification Number |

74-3032373

|

|

| Entity Address, Address Line One |

54 St. Emanuel Street

|

|

| Entity Address, City or Town |

Mobile

|

|

| Entity Address, State or Province |

AL

|

|

| Entity Address, Postal Zip Code |

36602

|

|

| City Area Code |

251

|

|

| Local Phone Number |

639-8100

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Accelerated Filer

|

|

| Entity Small Business |

false

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

15,007,262

|

| Document Fiscal Year Focus |

2024

|

|

| Document Fiscal Period Focus |

Q1

|

|

| Amendment Flag |

false

|

|

| Central Index Key |

0001169445

|

|

| Current Fiscal Year End Date |

--12-31

|

|

| Common Stock, par value $.001 per share |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

|

| Trading Symbol |

TBRG

|

|

| Security Exchange Name |

NASDAQ

|

|

| Common Stock Purchase Rights |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Common Stock Purchase Rights

|

|

| No Trading Symbol Flag |

true

|

|

| Security Exchange Name |

NASDAQ

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tbrg_CommonStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

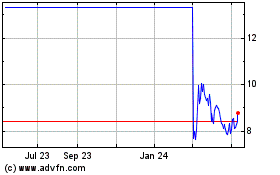

TruBridge (NASDAQ:TBRG)

Historical Stock Chart

From Jul 2024 to Aug 2024

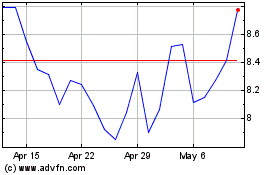

TruBridge (NASDAQ:TBRG)

Historical Stock Chart

From Aug 2023 to Aug 2024