0001409171false00014091712024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

Of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2024

TITAN MACHINERY INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | | | | |

|

| | |

| 001-33866 | | 45-0357838 |

| (Commission File Number) | | (IRS Employer

Identification No.) |

644 East Beaton Drive

West Fargo, North Dakota 58078

(Address of Principal Executive Offices) (Zip Code)

(701) 356-0130

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share | TITN | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by a check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On August 14, 2024, Titan Machinery Inc. (the “Company”) issued a press release announcing its preliminary financial results for the three months ended July 31, 2024. The full text of the press release is set forth in Exhibit 99.1 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements: None

(b) Pro forma financial information: None

(c) Shell Company Transactions: None

(d) Exhibits: See “Exhibit Index” on page immediately prior to signatures.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| |

| | | |

| | TITAN MACHINERY INC. |

| | |

| Date: | August 14, 2024 | By | /s/ Robert Larsen |

| | | Robert Larsen |

| | | Chief Financial Officer |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

EXHIBIT INDEX

to

FORM 8-K

TITAN MACHINERY INC.

| | | | | |

|

| |

| Date of Report: | Commission File No.: |

| August 14, 2024 | 001-33866 |

| | | | | | | | |

| | |

| | |

| Exhibit No. | | ITEM |

| | | |

| | Press Release dated August 14, 2024 |

| 104 | | Cover page interactive data file (embedded within the Inline XBRL document) |

Titan Machinery Inc. Announces Preliminary Results for Fiscal Second Quarter Ended July 31, 2024

– Updates Fiscal 2025 Modeling Assumptions –

– Company to Hold Conference Call to Discuss Fiscal Second Quarter Results on August 29, 2024 –

WEST FARGO, N.D., August 14, 2024 (GLOBE NEWSWIRE) -- Titan Machinery Inc. (Nasdaq: TITN) (the “Company”), a leading network of full-service agricultural and construction equipment stores, today announced preliminary results for the fiscal second quarter ended July 31, 2024.

“Lower commodity prices and sustained high interest rates, along with mixed growing conditions across our footprint, have negatively affected farmer sentiment resulting in lower agriculture equipment sales in our fiscal second quarter,” commented Bryan Knutson, Titan Machinery's President and Chief Executive Officer. “Commodity prices for most key cash crops in our footprint have steadily declined since the beginning of the year and retreated by an additional 10 to 20% in the second quarter. As we navigate the current contractionary cycle, we are focused on reducing inventory levels, particularly used equipment, implementing cost controls and supporting our customer care strategy to grow our parts and service businesses. We are confident in our long-term customer-centric strategy and believe that our business model, which has integrated numerous efficiencies and process improvements since the last industry downturn, positions us well to manage through the current challenging environment.”

Preliminary Expected Fiscal 2025 Second Quarter Results

For the second quarter of fiscal 2025, revenue is expected to be approximately $634 million, primarily reflecting lower than expected equipment revenues due to incrementally softer retail demand.

This is preliminarily expected to result in adjusted pre-tax income for the second quarter of fiscal 2025 of approximately $6.9 million ($4.3 million pre-tax loss on a GAAP reported basis) and adjusted earnings per diluted share of approximately $0.17 ($0.19 loss per diluted share on a GAAP reported basis), on approximately 22.6 million weighted average diluted common shares outstanding. The adjusted pre-tax income and adjusted earnings per diluted share exclude a non-cash sale-leaseback financing expense of an estimated $11.2 million or $0.36 per diluted share, as discussed below.

The Company has not yet completed preparation of its interim financial statements for the second quarter of fiscal 2025 and the information presented herein is preliminary and subject to finalization. The Company will provide full financial results when it reports its results for the second quarter of fiscal 2025 on Thursday, August 29, 2024.

Second Quarter Sale-Leaseback Expense

The estimated adjusted earnings discussed above excludes the accounting impact of the Company's umbrella purchase for 13 of its leased facilities. The purchase closing date for each leased facility will occur on or before the expiration of the respective lease, all of which expire over the next several years through calendar year 2030. This is estimated to result in recording approximately $11.2 million of one-time, non-cash sale-leaseback financing expense in the second quarter, which was not originally contemplated in the Company’s fiscal 2025 modeling assumptions. While the initial impact of this purchase agreement temporarily reduces GAAP reported earnings, the transaction is strategic and supports the Company’s long-

term customer care strategy by investing in facilities and shop space required for continued growth in its high margin parts and service businesses.

Fiscal 2025 Modeling Assumptions

Bo Larsen, Titan Machinery's Chief Financial Officer, stated, “We are proactively updating our full year fiscal 2025 modeling assumptions to reflect the preliminary second quarter results, our latest view on the industry environment and adjust for the non-cash sale-leaseback financing expense. Retail demand has softened further over the last several months, and our updated guidance reflects demand that remains at these subdued levels. We continue to prioritize managing inventory down to targeted levels, and we expect this lower demand environment will require further reduction in equipment margin versus our previous assumptions. We now anticipate these margins may approach the historical lows the Company realized in fiscal years 2016 and 2017. However, our proactive approach to managing inventory, despite the short-term impact on margins, is strategically aimed at shortening the duration of this downturn compared to previous cycles. We believe these deliberate actions will help compress the impact of this contractionary cycle on our performance, potentially accelerating our return to a more normalized margin profile. Additionally, because of the sales softness and the commensurate impact on inventory levels versus our initial assumptions, we are incurring higher floorplan interest expense which is exacerbating the decline in earnings per share. We will discuss second quarter results and expectations for the rest of the year in more detail during our earnings call on August 29th.”

The following are the Company's current expectations for fiscal 2025 modeling assumptions.

| | | | | | | | | | | |

| Previous Assumptions | | Current Assumptions |

| Segment Revenue | | | |

| Agriculture | Down 2.5% - Up 2.5% | | Down 5% - Down 10% |

| Construction | Flat - Up 5% | | Down 2.5% - Up 2.5% |

| Europe | Down 5% - Flat | | Down 12% - Down 17% |

| Australia | $240M - $260M USD | | $230M - $250M USD |

| | | |

| Diluted Earnings (Loss) Per Share | $2.25 - $2.75 | | ($0.36) - $0.14 |

| Adjusted Diluted Earnings Per Share | $2.25 - $2.75 | | $0.00 - $0.50* |

*Adjusted for an estimated ($0.36) impact for non-cash sale-leaseback financing expense in the fiscal second quarter as described in more detail above.

Conference Call and Presentation Information

The Company will release its finalized financial results for the second quarter ended July 31, 2024, on August 29, 2024, followed by an investor conference call at 7:30 a.m. Central time (8:30 a.m. Eastern time).

Investors interested in participating in the live call can dial (877) 704-4453 from the U.S. International callers can dial (201) 389-0920. A telephone replay will be available approximately three hours after the call concludes and will be available through September 12, 2024, by dialing (844) 512-2921 from the U.S., or (412) 317-6671 from international locations, and entering confirmation code 13747715.

There also will be a simultaneous, live webcast available on the Investor Relations section of the Company's web site at www.titanmachinery.com. The webcast will be archived for 30 days.

About Titan Machinery Inc.

Titan Machinery Inc., founded in 1980 and headquartered in West Fargo, North Dakota, owns and operates a network of full service agricultural and construction equipment dealer locations in North America, Europe and Australia, servicing farmers, ranchers, and commercial applicators. The network consists of US locations in Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, South Dakota, Washington, Wisconsin, and Wyoming. The international network includes European stores located in Bulgaria, Germany, Romania, and Ukraine and Australian stores located in New South Wales, South Australia, and Victoria in Southeastern Australia. The Titan Machinery locations represent one or more of the CNH Industrial Brands, including Case IH, New Holland Agriculture, Case Construction, New Holland Construction, and CNH Industrial Capital. Additional information about Titan Machinery Inc. can be found at www.titanmachinery.com.

Forward Looking Statements

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words "potential," "believe," "estimate," "expect," "intend," "may," "could," "will," "plan," "anticipate," and similar words and expressions are intended to identify forward-looking statements. These statements are based upon the current beliefs and expectations of our management. Forward-looking statements made in this release, which include statements regarding modeling assumptions, expected results of operations for the quarter ended July 31, 2024, expected results of operations for the fiscal year ending January 31, 2025, statements regarding the Company's ability to generate improved financial results, and may include statements regarding Agriculture, Construction, Europe and Australia segment initiatives and improvements, segment revenue realization, growth and profitability expectations, inventory availability and consumer demand expectations, and agricultural and construction equipment industry conditions and trends, involve known and unknown risks and uncertainties that may cause Titan's actual results in future periods to differ materially from the forecasted assumptions and expected results. The Company's risks and uncertainties include, among other things, our ability to successfully integrate, and realize growth opportunities and synergies in connection with the O'Connors acquisition and the risk that we have assumed unforeseen or other liabilities in connection with the O'Connors acquisition. In addition, risks and uncertainties also include the impact of the Russia-Ukraine conflict on our Ukrainian subsidiary, our substantial dependence on CNH Industrial including CNH Industrial's ability to design, manufacture and allocate inventory to our stores necessary to satisfy our customers' demands, supply chain disruptions impacting our suppliers, including CNH Industrial, the continued availability of organic growth and acquisition opportunities, potential difficulties integrating acquired stores, industry supply levels, fluctuating agriculture and construction industry economic conditions, the success of recently implemented initiatives within the Company's operating segments, the uncertainty and fluctuating conditions in the capital and credit markets, difficulties in conducting international operations, foreign currency risks, governmental agriculture policies, seasonal fluctuations, the ability of the Company to reduce current inventory levels successfully and the impact of that reduction on equipment margins, weather conditions, disruption in

receiving ample inventory financing, and increased competition in the geographic areas served. These and other risks are more fully described in Titan's filings with the Securities and Exchange Commission, including the Company's most recently filed Annual Report on Form 10-K, as updated in subsequently filed Quarterly Reports on Form 10-Q, as applicable. Titan conducts its business in a highly competitive and rapidly changing environment. Accordingly, new risks and uncertainties may arise. It is not possible for management to predict all such risks and uncertainties, nor to assess the impact of all such risks and uncertainties on Titan's business or the extent to which any individual risk or uncertainty, or combination of risks and uncertainties, may cause results to differ materially from those contained in any forward-looking statement. Other than as required by law, Titan disclaims any obligation to update such risks and uncertainties or to publicly announce results of revisions to any of the forward-looking statements contained in this release to reflect future events or developments.

Investor Relations Contact:

ICR, Inc.

Jeff Sonnek, jsonnek@icrinc.com.

Managing Director

646-277-1263

| | | | | | | | |

| TITAN MACHINERY INC. |

| Non-GAAP Reconciliations |

| (in thousands, except per share data) |

| (Unaudited) |

| | |

| | Preliminary Results

Three Months Ended |

| | July 31, 2024 |

| Adjusted Income Before Income Taxes | | |

| Income Before Income Taxes | | $ | (4,250) | |

| Adjustments | | |

| Estimated impact of sale-leaseback financing expense | | 11,159 | |

| Total Adjustments | | 11,159 | |

| Adjusted Income Before Income Taxes | | $ | 6,909 | |

| | |

| Adjusted Diluted EPS | | |

| Diluted EPS | | $ | (0.19) | |

| Adjustments | | |

| Estimated impact of sale-leaseback financing expense | | 0.48 | |

| Total Pre-Tax Adjustments | | 0.48 | |

| Less: Tax Effect of Adjustments | | (0.12) | |

| Total Adjustments | | 0.36 | |

| Adjusted Diluted EPS | | $ | 0.17 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

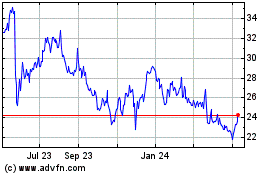

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Jul 2024 to Aug 2024

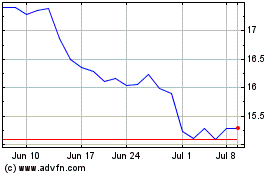

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Aug 2023 to Aug 2024