Thryv Holdings Announces Public Offering of Common Stock

October 29 2024 - 4:06PM

Business Wire

Thryv Holdings, Inc. (“Thryv” or the “Company”) (NASDAQ: THRY)

announced today that it has commenced an underwritten public

offering of $75.0 million of shares of its common stock, subject to

market and other conditions. In connection with the proposed

offering, Thryv intends to grant the underwriter a 30-day option to

purchase up to an additional 15% of the shares of common stock

offered in the public offering.

Thryv intends to use the net proceeds from this offering to fund

a portion of the purchase price for its previously announced

acquisition of Infusion Software, Inc. (d/b/a Keap).

RBC Capital Markets, LLC is acting as sole book-running manager

for the offering. RBC Capital Markets may offer the shares of

common stock from time to time for sale in one or more transactions

on the Nasdaq exchange, in the over-the-counter market, through

negotiated transactions or otherwise, at market prices prevailing

at the time of sale, at prices related to prevailing market prices

or at negotiated prices.

The offering is being conducted as a public offering pursuant to

Thryv’s effective shelf registration statement on Form S-3ASR under

the Securities Act of 1933, as amended. The offering is being made

only by means of a preliminary prospectus supplement and

accompanying prospectus. A preliminary prospectus supplement and

accompanying prospectus relating to the offering will be filed with

the SEC and will be available free of charge on the SEC’s website

at http://www.sec.gov. Copies of the preliminary prospectus

supplement and accompanying prospectus relating to this offering of

securities may also be obtained from RBC Capital Markets, LLC, 200

Vesey Street, 8th Floor, New York, NY 10281, Attention: Equity

Capital Markets, Facsimile: (212) 428-6260.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities described herein,

nor shall there be any sale of the securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities law of any such jurisdiction.

ABOUT THRYV HOLDINGS

Thryv is the provider of the leading do-it-all small business

software platform that empowers small businesses to modernize how

they work. It offers small business owners everything they need to

communicate effectively, manage their day-to-day operations, and

grow — all in one place — giving up to 20 hours back in their week.

Thryv’s customizable platform features three centers: Thryv Command

Center, a freemium central communications hub, Business Center™ and

Marketing Center™. Approximately 300,000 businesses globally use

Thryv to connect with local customers and take care of everything

they do, start to finish.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding

the Company’s expectations relating to the proposed offering, the

intended use of proceeds therefrom and the Pending Acquisition.

These forward-looking statements are provided under the “safe

harbor” protection of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements generally can be

identified by phrases such as we, Thryv or management “expects,”

“anticipates,” “believes,” “estimates,” “intends,” “plans to,”

“ought,” “could,” “will,” “should,” “likely,” “appears” or other

similar words or phrases. These and other forward-looking

statements are based on management’s current views and assumptions

and involve risks and uncertainties that could significantly affect

expected results. Although we believe that our expectations are

reasonable, we can give no assurance that these expectations will

prove to be correct, and actual results may vary materially.

Results may be materially affected by factors such as: potential

volatility in the capital markets and their impact on the ability

to complete the proposed offering; risks associated with the

Pending Acquisition, including its consummation or the successful

integration of Keap with the Company; future levels of revenues

being lower than expected and costs being higher than expected;

failure or inability to implement growth strategies in a timely

manner; unfavorable reaction to the Pending Acquisition by

customers, competitors, suppliers and employees; conditions

affecting the industry generally; and conditions in the securities

market that are less favorable than expected. Except as required by

law, the Company undertakes no obligation to update, amend or

clarify any forward-looking statements to reflect changed

assumptions, the occurrence of anticipated or unanticipated events,

new information or circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029755294/en/

Media Contact: Julie Murphy Thryv, Inc. 617.967.5426

julie.murphy@thryv.com

Investor Contact: Cameron Lessard Thryv, Inc.

214.773.7022 cameron.lessard@thryv.com

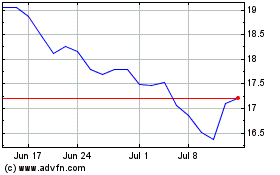

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

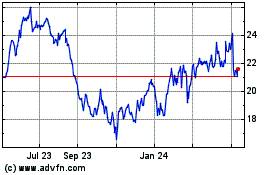

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Dec 2023 to Dec 2024