Written Communication Relating to an Issuer or Third Party (sc To-c)

July 14 2022 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1)

OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

THERAVANCE BIOPHARMA, INC.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

3.25% CONVERTIBLE SENIOR NOTES DUE 2023

(Title of Class of Securities)

88339K AA0

(CUSIP Number of Class of Securities)

Brett Grimaud

General Counsel

c/o Theravance Biopharma US, Inc.

901 Gateway Boulevard

South San Francisco, California 94080

(650) 808-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Amr Razzak

Skadden, Arps, Slate, Meagher & Flom

LLP

525 University Avenue

Suite 1400

Palo Alto, CA 94301

x Check the box if

the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. ☐

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 13d-1(d) (Cross-Border Third-Party Tender Offer) |

The pre-commencement communication filed under cover of this Schedule

TO relates to preliminary communications made before the commencement of a planned tender offer (the “Offer”) by Theravance

Biopharma, Inc., a Cayman Islands exempted company (the “Company”), to retire the approximately $230 million in principal

amount of the Company’s 3.25% Convertible Senior Notes Due 2023 (the “Notes”), at par.

The tender offer for the Notes referenced in this document has not

yet commenced. This document is for informational purposes only, is not a recommendation and is neither an offer to purchase nor a solicitation

of an offer to sell the Notes or any other securities. At the time the tender offer is commenced, the Company will file with the Securities

and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule TO. The solicitation and the offer to purchase the

Notes will only be made pursuant to the offer to purchase and related documents filed with such Schedule TO. COMPANY NOTEHOLDERS ARE

URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE AND CERTAIN OTHER TENDER OFFER DOCUMENTS), AS IT MAY BE AMENDED

FROM TIME TO TIME, WHEN SUCH DOCUMENTS BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY

BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Company noteholders and other investors can obtain the Tender Offer Statement

and other filed documents for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company

will be available free of charge on the Company’s website, investor.theravance.com, under “SEC Filings” or by contacting

the Company’s investor relations department at (650) 808-4045. In addition, Company noteholders may obtain free copies of the tender

offer materials by contacting the information agent for the tender offer that will be named in the Tender Offer Statement.

Forward-looking Statements

This document contains and the conference call will contain certain

"forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among

other things, statements relating to goals, plans, objectives, expectations and future events. Theravance Biopharma intends such forward-looking

statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange

Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Examples of such statements include statements relating

to: the expected closing of the transaction and the timing thereof, the Company's goals, designs, strategies, plans and objectives, the

impact of the Company’s restructuring plan, ability to provide value to shareholders, the timing of clinical studies, the potential

that the Company's research programs will progress product candidates into the clinic, the Company's expectations regarding its allocation

of resources, potential regulatory actions, product sales or profit share revenue and the Company's expectations for its future financial

performance and expectations as to future cash flows. These statements are based on the current estimates and assumptions of the management

of Theravance Biopharma as of the date of this document and the conference call and are subject to risks, uncertainties, changes in circumstances,

assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected

in the forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such

forward-looking statements include, among others, risks related to: whether the milestone thresholds can be achieved, delays or difficulties

in commencing, enrolling or completing clinical studies, the potential that results from clinical or non-clinical studies indicate the

Company's product candidates are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable

to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals

for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products,

and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise

and supporting infrastructure, ability to retain key personnel, the impact of the Company’s restructuring actions on its employees,

partners and others. In addition, while we expect the effects of COVID-19 to continue to adversely impact our business operations and

financial results, the extent of the impact on our ability to generate revenue from YUPELRI® (revefenacin), and the value of and

market for our ordinary shares, will depend on future developments that are highly uncertain and cannot be predicted with confidence

at this time. Other risks affecting Theravance Biopharma are in the Company's, Form 10-Q filed with the SEC on May 6, 2022, and other

periodic reports filed with the SEC. In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other

unknown or unpredictable factors also could affect Theravance Biopharma's results. No forward-looking statements can be guaranteed, and

actual results may differ materially from such statements. Given these uncertainties, you should not place undue reliance on these forward-looking

statements. Theravance Biopharma assumes no obligation to update its forward-looking statements on account of new information, future

events or otherwise, except as required by law.

EXHIBIT INDEX

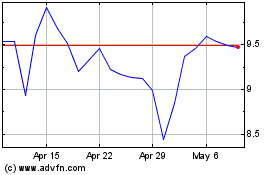

Theravance Biopharma (NASDAQ:TBPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Theravance Biopharma (NASDAQ:TBPH)

Historical Stock Chart

From Apr 2023 to Apr 2024