UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

|

Check the appropriate box:

|

| ☒ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

|

Sunshine Biopharma, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required. |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

|

| |

1. |

|

Title of each class of securities to which transaction applies:

|

| |

2. |

|

Aggregate number of securities to which transaction applies:

|

| |

3. |

|

Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (Set forth amount on which filing fee is calculated and state how it was determined):

|

| |

4. |

|

Proposed maximum aggregate value of transaction:

|

| |

5. |

|

Total fee paid:

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offering fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of the filing.

|

| |

1. |

|

Amount previously paid:

|

| |

2. |

|

Form, Schedule or Registration Statement No.:

|

| |

3. |

|

Filing Party:

|

| |

4. |

|

Date Filed: |

| |

|

|

|

PRELIMINARY COPY

SUNSHINE BIOPHARMA, INC.

(a Colorado corporation)

Notice of Special Meeting of Warrant Holders

and

Proxy Statement

SUNSHINE BIOPHARMA, INC.

6500 Trans-Canada Highway

4th Floor

Pointe-Claire, Quebec, Canada H9R 0A5

August __, 2023

NOTICE OF SPECIAL MEETING OF WARRANT HOLDERS

TO BE HELD ON THURSDAY, OCTOBER 12, 2023

Dear Warrant Holders:

Notice is hereby given that a special virtual

meeting of the holders (the “Warrant Holders”) of the outstanding warrants (the “Warrant Holders Meeting”) issued

by the Company on February 17, 2022 (the “Tradeable Warrants”) of Sunshine Biopharma, Inc. (the “Company”),

will be held on Thursday, October 12, 2023, at 10:00 a.m. Eastern Time, for the purpose of approving an amendment (the “Warrant

Amendment”) to the Warrant Agent Agreement, dated February 17, 2022 (the “Warrant Agent Agreement”), between the Company

and Equiniti Trust Company (“the Warrant Agent”) to (i) reduce the exercise price of the Tradeable Warrants to $0.11, subject

to further adjustment as provided therein, and (ii) eliminate the provision under the Warrant Agent Agreement that prohibits the Company’s

chief executive officer, Dr. Steve N. Slilaty, from exercising his voting rights under his Series B Preferred Stock of the Company.

You are cordially invited to attend the meeting

on October 12, 2023 at 10:00 a.m. Eastern Time (the “Warrant Holders Meeting”). We are furnishing proxy materials to some

of the Warrant Holders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, as well as (if requested) mailing

or emailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs Warrant Holders to a website where

they can access our proxy materials, including our proxy statement, and view instructions on how to vote via the Internet, a mobile device,

or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our

proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

It is important that your Tradeable Warrants be

represented. Whether or not you plan to attend the Warrant Holders Meeting, please vote using the procedures described on the Notice of

Internet Availability of Proxy Materials which include a proxy card. Your vote will mean that you are represented at the Warrant Holders

Meeting regardless of whether or not you attend such meeting. Returning the proxy does not deprive you of your right to attend the Warrant

Holders Meeting and change your vote if you so desire.

Holders of our Tradeable Warrants at the close

of business on August 25, 2023 (the “Record Date”), are entitled to attend and vote at the Warrant Holders Meeting.

The Company urges Warrant Holders to vote “FOR” approval of the Warrant Amendment.

A Proxy Statement describing the matters to be considered at the Warrant

Holders Meeting is attached to this Notice.

By Order of the Board of Directors

Sincerely,

/s/ Dr. Steve N. Slilaty

Chief Executive Officer

Sunshine Biopharma, Inc.

PROXY STATEMENT

FOR THE SPECIAL MEETING OF WARRANT HOLDERS

To Be Held Thursday, October 12, 2023

This proxy statement is furnished to holders of

the Company’s Tradeable Warrants in connection with the solicitation of proxies by the Board of Directors of Sunshine Biopharma,

Inc. (the “Company”, “we”, “our”, or “us”) in connection with the Special Meeting of Warrant

Holders of the Company to be held on Thursday, October 12, 2023, at 10:00 a.m. Eastern Time virtually via the Internet.

The Warrant Holders Meeting will be held as a

virtual meeting of Warrant Holders by webcast. You are entitled to participate in the Warrant Holders Meeting only if you were a holder

of the Company’s Tradeable Warrants (“Warrant Holders”) as of the close of business on the Record Date.

You will be able to attend the Warrant Holders

Meeting virtually online. As an online attendee, you may submit your questions during the Warrant Holders Meeting by visiting https://materials.proxyvote.com/867781.

You also will be able to vote your Tradeable Warrants online by attending the Warrant Holders Meeting virtually by webcast by visiting

https://www.virtualshareholdermeeting.com/SBFM2023.

To participate in the Warrant Holders Meeting

you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy

materials. Please note you will need your 16-digit control number included on your proxy card.

The online meeting will begin promptly at 10:00

a.m. Eastern Time. We encourage you to attend by accessing the meeting prior to the start time leaving ample time for check-in. Please

follow the registration instructions as outlined in this proxy statement.

QUESTIONS AND ANSWERS ABOUT THE MEETING

What is this proxy statement?

You have received this proxy statement because

our Board of Directors is soliciting your proxy to vote your Tradeable Warrants at the Warrant Holders Meeting. This proxy statement includes

information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”)

and that is designed to assist you in voting your Tradeable Warrants.

What is the purpose of the Warrant Holders

Meeting?

At the Warrant Holders Meeting our Warrant Holders

will act on approval of the Warrant Amendment as further described in this proxy statement.

What are the Board’s recommendations?

Our Board recommends that you vote FOR

approval of the Warrant Amendment.

Will there be any other business on the

agenda?

The Company knows of no other matters that are

likely to be brought before the Warrant Holders Meeting. If any other matters properly come before the Warrant Holders Meeting, however,

the persons named in the enclosed proxy, or their duly appointed substitute acting at the Warrant Holders Meeting will be authorized

to vote or otherwise act on those matters in accordance with their judgment.

Who is entitled to attend and vote at the

Meetings?

Only Warrant Holders at the close of business

on August 25, 2023, which we refer to as the Record Date, are entitled to receive notice of, attend, and vote at the Warrant Holders Meeting.

As of the Record Date there were 963,693 outstanding Tradeable Warrants. Warrant Holders as of the Record Date are entitled to one vote

for each Tradeable Warrant.

A list of Warrant Holders entitled to vote at

the Warrant Holders Meeting will be available at the Warrant Holders Meeting and for 10 days prior to the Warrant Holders Meeting, at

the principal executive office of the Company for inspection by Warrant Holders during ordinary business hours for any purpose germane

to the Warrant Holders Meeting.

What is the difference between holding securities as a holder

of record and as a beneficial owner?

Holder of Record. If your securities are

registered directly in your name you are considered, with respect to those securities, the “holder of record.”

Beneficial Owner. If your securities are

held in a brokerage account or by a bank or other nominee (as is the case with respect to all of the Tradeable Warrants), you are considered

the “beneficial owner” of securities held in street name. This proxy has been forwarded to you by your broker, bank or nominee

who is considered, with respect to those securities, the holder of record. As the beneficial owner you have the right to direct your broker,

bank or nominee how to vote your securities by using the voting instructions included with your proxy materials.

How do I vote my Tradeable Warrants?

Warrant Holders can vote live at the Warrant Holders Meeting or by

proxy. You may vote by proxy in one of four ways:

By Telephone — Warrant Holders can vote by telephone by calling

the number in your proxy card that you have received. Use any touch-tone telephone to transmit your voting instructions up until 11:59

p.m. Eastern Time on October 11, 2023. Have your proxy card in hand when you call and then follow the instructions.

Vote at the Meeting — If you plan to attend the virtual meeting

online, visit the following website and note you will need your control number to vote electronically at the meeting: https://www.virtualshareholdermeeting.com/SBFM2023.

By Internet Before the Meeting — You can

vote over the Internet up until 11:59 p.m. Eastern Time on October 11, 2023. To vote, go to the link below and follow the pre-registration

instructions provided in “How do I attend a Meeting and Pre-Register to Vote?”

https://www.virtualshareholdermeeting.com/SBFM2023

By Mail — You can vote by mail by marking your vote, signing,

dating and returning your proxy card in the postage-paid envelope provided.

If you vote by proxy the individuals named on

the proxy card (your “proxy”) will vote your Tradeable Warrants (as in the manner you have indicated). If you grant a proxy

without indicating your instructions, your warrants will be voted for the approval of the Warrant Amendment.

What is required to approve the Warrant

Amendment?

The approval by the holders of a majority of the

Tradeable Warrants outstanding on the Record Date is required for approval of the Warrant Amendment.

For the purpose of determining whether the Warrant

Holders have approved the Warrant Amendment, abstentions have the same effect as a negative vote.

How will Tradeable Warrants represented

by properly executed proxies be voted?

All Tradeable Warrants represented by proper proxies

will be voted in accordance with the instructions indicated in such proxies. If you do not provide voting instructions your Tradeable

Warrants will be voted in accordance with the Board’s recommendations as set forth herein.

Can I change my vote or revoke my proxy?

Any Warrant Holder executing a proxy has the power

to revoke such proxy at any time prior to its exercise by attending and voting at the Warrant Holders Meeting.

Who paid for this proxy solicitation?

The cost of preparing, printing, assembling and mailing this proxy

statement and other material furnished to Warrant Holders in connection with the solicitation of proxies is borne by us.

How do I learn the results of the voting at the Meeting?

Preliminary results will be announced at the respective Warrant Holders

Meeting. Final results will be published in a Current Report on Form 8-K filed with the SEC within four business days of the Warrant Holders

Meeting.

How are proxies solicited?

In addition to the mail solicitation of proxies,

our officers, directors, employees and agents may solicit proxies by written communication, telephone or personal call. These persons

will receive no special compensation for any solicitation activities. We will reimburse banks, brokers and other persons holding Tradeable

Warrants for their expenses in forwarding proxy solicitation materials to beneficial owners of our Tradeable Warrants.

OWNERSHIP OF TRADEABLE WARRANTS

As of the Record Date there were 963,693 outstanding

Tradeable Warrants. No officer of director of the Company beneficially owns any outstanding Tradeable Warrants. To our knowledge, beneficial

holders of 5% or more of our outstanding Tradeable Warrants consist of: (i) Event Driven, which beneficially owns 94,940 (or 9.9%) of

the outstanding Tradeable Warrants, (ii) 9058-8799 QUEBEC INC, which beneficially owns 59,747 (or 6.2%) of the outstanding Tradeable Warrants,

and (iii) Michael R. Clark, who beneficially owns 49,389 (or 5.1%) of the outstanding Tradeable Warrants.

PRINCIPAL SHAREHOLDERS

The following table sets forth certain information

regarding the ownership of our common stock as of August 25, 2023, by (i) each of our directors, (ii) each of our executive officers,

(iii) all of our directors and executive officers as a group; and (iv) any person or group as those terms are used in Section 13(d)(3)

of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), believed by us to beneficially own more than 5% of

our common stock. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power.

The percentages listed are based upon 25,746,302 shares issued and outstanding as of August 25, 2023.

| Title of Class |

|

Name and Address of Beneficial Owner |

|

Amount and Nature of Beneficial Ownership |

|

% of Class |

| |

|

|

|

|

|

|

| Common |

|

Dr. Steve N. Slilaty(1) |

|

121,024 |

|

0.45% |

| |

|

579 Rue Lajeunesse |

|

|

|

|

| |

|

Laval, Quebec H7X 3K4, Canada |

|

|

|

|

| Series B Preferred |

|

|

|

10,000(2) |

|

100% |

| |

|

|

|

|

|

|

| Common |

|

Camille Sebaaly(1) |

|

174,465 |

|

0.68% |

| |

|

3040 Levesque West |

|

|

|

|

| |

|

Suite 506 |

|

|

|

|

| |

|

Laval, Quebec H7V 2G3, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

Dr. Abderrazzak Merzouki(1) |

|

116,720 |

|

0.45% |

| |

|

731 Place de l’Eeau Vive |

|

|

|

|

| |

|

Laval, Quebec H7Y 2E1, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

Dr. Rabi Kiderchah(1) |

|

1,625 |

|

0.01% |

| |

|

6500 Trans-Canada Highway |

|

|

|

|

| |

|

4th Floor |

|

|

|

|

| |

|

Pointe-Claire, Quebec H9R 0A5, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

Dr. Andrew Keller(1) |

|

0 |

|

0% |

| |

|

c/o Sunshine Biopharma, Inc. |

|

|

|

|

| |

|

6500 Trans-Canada Highway, 4th |

|

|

|

|

| |

|

Floor Pointe-Claire, Quebec H9R |

|

|

|

|

| |

|

0A5, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

David Natan(1) |

|

0 |

|

0% |

| |

|

c/o Sunshine Biopharma, Inc. |

|

|

|

|

| |

|

6500 Trans-Canada Highway, 4th |

|

|

|

|

| |

|

Floor Pointe-Claire, Quebec H9R |

|

|

|

|

| |

|

0A5, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

Malek Chamoun |

|

3,700,000(3) |

|

14.37% |

| |

|

1730 Rue Saint Patrick |

|

|

|

|

| |

|

Suite 601 |

|

|

|

|

| |

|

Montreal, Quebec H3K 2H2, Canada |

|

|

|

|

| |

|

|

|

|

|

|

| Common |

|

All of our Officers and |

|

4,113,834(3) |

|

16% |

| |

|

Directors as a Group (6 persons) |

|

|

|

|

| Series B Preferred |

|

|

|

10,000(2) |

|

100% |

| (1) | Officer

and/or director of our Company. |

| (2) | Dr.

Slilaty will only be able to vote these shares if the Warrant Amendment is adopted herein

or no Tradeable Warrants remain outstanding. |

| (3) | Includes

3,700,000 common shares owned by Malek Chamoun, the President of Nora Pharma Inc., a company

acquired by the Company in October 2022. Mr. Chamoun is not an officer or director of the

Company. Dr. Slilaty controls the voting of Mr. Chamoun’s shares through a voting agreement

between Mr. Chamoun and Dr. Slilaty dated October 20, 2022. |

APPROVAL OF WARRANT AMENDMENT

General

Our Board of Directors has unanimously approved

an amendment (the “Warrant Amendment”) to the Warrant Agent Agreement, dated February 17, 2022 (the “Warrant Agent Agreement”),

between the Company and Equiniti Trust Company (“the Warrant Agent”) to (i) reduce the exercise price of the Tradeable Warrants

to $0.11, subject to further adjustment as provided therein, and (ii) eliminate the provision under the Warrant Agent Agreement that prohibits

the Company’s Chief Executive Officer, Dr. Steve N. Slilaty, from exercising his voting rights under his Series B Preferred Stock

of the Company. The full text of the Warrant Amendment is set forth in Appendix A to this proxy statement. Effectuating the Warrant Amendment

requires approval of the holders of a majority of the outstanding Tradeable Warrants.

Background

On February 17, 2022, the Company closed an underwritten

public offering, pursuant to which the Company issued and sold an aggregate of 1,882,353 units for aggregate gross proceeds of $8 million,

prior to deducting underwriting discounts, commissions and other estimated offering expenses. Each unit consists of (i) one share of the

Company’s common stock; and (ii) two warrants to purchase one share each of common stock at an initial exercise price of $4.25 per

share (the “Tradeable Warrants”).

The Tradeable Warrants were exercisable immediately

and expire five years from the date of issuance. The Tradeable Warrants are listed on the Nasdaq Capital Market under the symbol “SBFMW”.

The Tradeable Warrants may be exercised on a cashless basis when there is no effective registration statement for the issuance of the

underlying shares. Upon the closing of the Company's private placement on March 14, 2022, the exercise price of the Tradeable Warrants

was reduced to $2.22, in accordance with the terms thereof.

In connection with the public offering, Dr. Steve

N. Slilaty, the Company’s Chief Executive Officer, returned to the Company 990,000 shares of the Company’s Series B Preferred

Stock and retained 10,000 shares of the Company’s Series B Preferred Stock. The Series B Preferred Stock votes as one class with

the holders of the common stock and entitles the holder to 1,000 votes for each share of Series B Preferred Stock.

In connection with the public offering, on February

17, 2022, the Company entered into the Warrant Agent Agreement with the Warrant Agent, to serve as the Company’s warrant agent for

the Tradeable Warrants. Pursuant to the Warrant Agent Agreement, Dr. Slilaty is prohibited from exercising his voting rights under his

Series B Preferred Stock so long as any of the Tradeable Warrants are outstanding. Amending the Warrant Agent Agreement requires the consent

of the holders of a majority of the outstanding Tradeable Warrants.

Authorized and Outstanding Capital

Our Articles of Incorporation currently authorize us to issue a maximum

of 3,000,000,000 shares of common stock, par value $0.001 per share, and 30,000,000 shares of preferred stock, par value $0.10 per share.

Our issued and outstanding securities, as of August 25, 2023, are as follows:

| · | 25,746,302 shares of common stock; |

| · | 10,000 shares of Series B preferred stock; |

| · | An aggregate of 23,395,046 warrants with exercise prices of between $0.59 and $3.76; and |

| · | 2,346,000 pre-funded warrants with an exercise price of $0.001. |

Purpose of the Warrant Amendment

The purpose of the Warrant Amendment is to

allow Dr. Slilaty to vote his shares of Series B Preferred Stock and thus facilitate shareholder approval for actions the Board of Directors

believes to be in the best interests of the Company, including the Company’s proposed authorization of a reverse stock split of

the Company’s common stock, as previously disclosed in the Company’s preliminary proxy statement for the Company’s

2023 annual shareholder meeting. The reduction of the exercise price under the Warrant Amendment is intended to incentivize the Warrant

Holders to vote in favor of the Warrant Amendment. The reduced exercise price will only be effective if the prohibition on Dr. Slilaty’s

voting of his Series B Preferred Stock is eliminated.

RECOMMENDATION OF THE BOARD FOR PROPOSAL TO

APPROVE WARRANT AMENDMENT

Our

Board of Directors unanimously recommend A VOTE FOR APPROVAL OF THE WARRANT AMENDMENT

where

you can find additional information

We are subject to the informational reporting

requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are available

over the Internet at the SEC’s website at http://www.sec.gov.

PROXY --- Sunshine Biopharma, Inc.

--- PROXY

The undersigned hereby appoints Dr. Steve N. Slilaty

with power of substitution, as proxy to vote the Tradeable Warrants of the undersigned in Sunshine Biopharma, Inc. at the Special Meeting

of Warrant Holders to be held virtually on Tuesday, October 12, 2023, at 10:00 a.m. Eastern Time, and at any adjournments or postponements

thereof upon all business that may properly come before the meeting, including the business identified (and in the manner indicated) on

this proxy and described in the proxy statement furnished herewith. Indicate your vote by a þ.

It is recommended that you vote FOR all items.

| 1. |

To approve the Warrant Amendment. |

| ☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

THIS PROXY IS SOLICITED ON BEHALF OF THE COMPANY’S BOARD OF DIRECTORS

WHO RECOMMEND VOTING FOR ALL ITEMS. IT WILL BE VOTED AS SPECIFIED. IF NOT SPECIFIED, THE SECURITIES REPRESENTED BY THIS

PROXY WILL BE VOTED FOR ALL ITEMS.

| _____/_____/_____ |

________________________________________ |

| Date |

Signature |

| |

|

| _________________________ |

________________________________________ |

| No. of Tradeable Warrants |

Printed Name |

Please sign exactly as name(s) appear on this proxy. If joint account,

each joint owner should sign. If signing for a corporation or partnership or as agent, attorney or fiduciary, indicate the capacity in

which you are signing.

| ADDITIONAL SIGNATURES: |

_______________________________________ |

| (if necessary) |

Signature |

| |

|

| |

________________________________________ |

| |

Printed Name |

PLEASE DATE AND SIGN THE ACCOMPANYING PROXY CARD

AND EITHER MAIL OR EMAIL IT PROMPTLY TO THE STREET OR E-MAIL ADDRESS AS PROVIDED HEREIN. IF BY REGULAR MAIL, PLEASE SEND TO THE ATTENTION

OF Steve Nutt, Broadridge Financial Solutions LLC, ______________________________________________. IF BY EMAIL, PLEASE EMAIL YOUR SCANNED

PROXY CARD TO: steve.nutt@broadridge.com.

Appendix A

Form of Warrant Amendment

AMENDMENT NO. 1 TO WARRANT AGENT AGREEMENT

This Amendment No. 1 to Warrant Agent Agreement (this “Amendment”)

dated this __ day of ______, 2023, by and among Sunshine Biopharma, Inc., a Colorado corporation (the “Company”) and Equiniti

Trust Company (the “Warrant Agent”).

WHEREAS, the Company and the Warrant Agent are parties to

the warrant agent agreement, dated February 17, 2022 (the “Warrant Agent Agreement”);

WHEREAS, the Company and the Warrant Agent desire

to amend the Warrant Agent Agreement as more particularly set forth below;

WHEREFORE, the parties do hereby agree as follows:

1. Section 3.1 of the Warrant

Agent Agreement is hereby amended and restated to read as follows:

3.1. Exercise Price. Each

Warrant shall entitle the Holder, subject to the provisions of the applicable Warrant Certificate and of this Warrant Agreement, to purchase

from the Company the number of shares of Common Stock stated therein, at the price of $0.001 per whole share, with respect to the Pre-Funded

Warrants, or $0.11 with respect to the Tradeable Warrants, subject to the subsequent adjustments provided in the Global Warrant. The term

“Exercise Price” as used in this Warrant Agreement refers to the price per share at which shares of Common Stock may

be purchased at the time a Warrant is exercised.

2. Section 6.2 of the Warrant

Agent Agreement is hereby amended and restated to read as follows:

6.2 Reserved.

3. Except as modified herein,

the terms of the Warrant Agent Agreement shall remain in full force and effect.

4. This

Amendment may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and shall be

binding upon all parties, their successors and assigns, and all of which taken together shall constitute one and the same Amendment. A

signature delivered by facsimile or email shall constitute an original.

IN WITNESS WHEREOF, the parties

have executed this Amendment as of the date first written above.

SUNSHINE BIOPHARMA, INC.

By:_______________

Name:

Title:

EQUINITI TRUST COMPANY

By:____________

Name:

Title:

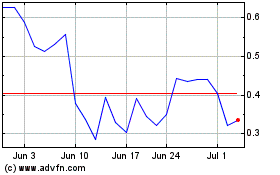

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Apr 2024 to May 2024

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From May 2023 to May 2024