Stronghold Enters Into $15 Million Private Placement

December 22 2023 - 8:30AM

Stronghold Digital Mining, Inc. (NASDAQ:

SDIG) (“Stronghold”, or the “Company”) today announced

that it entered into a securities purchase agreement with an

existing institutional investor (the “Purchaser”) to sell 2,300,000

shares of Class A Common Stock and share equivalents, in each case

at a price of $6.71 per share equivalent (the “Private Placement”).

The Company also issued to the Purchaser warrants to purchase an

aggregate of 2,300,000 shares of Class A Common Stock, with an

initial exercise price of $7.00 per share (subject to adjustments),

and such warrants are not exercisable until six months after

issuance.

The non-brokered Private Placement was executed

on December 21, 2023, and is expected to close on December 22,

2023. Gross proceeds from the Private Placement will be $15.4

million, before deducting offering expenses. Proceeds will be used

to enhance growth and efficiency of the Company’s miner fleet,

accelerate its carbon capture initiative, and improve its working

capital position and for general corporate purposes.

Additionally, the exercise price for 1,400,000

warrants previously issued on April 21, 2023, and September 19,

2022, will be adjusted from $10.10 per share and $11.00 per share,

respectively, to $7.00 per share.

Panther Creek Operational

Update

On November 20, 2023, the Company’s wholly owned

Panther Creek Plant experienced unexpected ash silo flow issues. As

a result, the Company operated the plant at a lower output while

the plant worked to remedy the issue. From November 20, 2023,

through December 7, 2023, the Panther Creek Plant operated at

approximately 60% net capacity factor while importing the remaining

electricity necessary to fulfill its data center needs. The

Company’s data center operations were unaffected during that

period.

While progress was made, on December 8, the

Company elected to shut off the plant for what was expected to be a

short-term, unplanned outage to fully fix the ash silo. The Company

took these steps to ensure maximum uptime and availability during

the coming winter months. The repairs were not completed until

December 21, resulting in the Panther Creek Plant importing

electricity between December 8 and December 21. Between December 12

and December 20, the Panther Creek data center was unexpectedly

required to curtail load to between 10 MW and 50 MW due to PJM

system reliability issues and a transmission line outage.

In total, the Company estimates that it incurred

fuel costs and operations and maintenance expenses of approximately

$1.5 million beyond the scope of normal and expected operations.

The Panther Creek Plant has resumed operations, and the Panther

Creek data center is operating without limitations. The Panther

Creek data center recently achieved a site-record hash rate of over

2 EH/s on December 3, 2023, with 100% hash rate utilization, and

the Company expects that it will reach that level again in the near

future.

About Stronghold Digital Mining,

Inc.

Stronghold is a vertically integrated Bitcoin

mining company with an emphasis on environmentally beneficial

operations. Stronghold houses its miners at its wholly owned and

operated Scrubgrass Plant and Panther Creek Plant, both of which

are low-cost, environmentally beneficial coal refuse power

generation facilities in Pennsylvania.

Investor Contact:Matt Glover or

Alex KovtunGateway Group,

Inc.SDIG@gateway-grp.com1-949-574-3860

Media

Contactcontact@strongholddigitalmining.com

Cautionary Statement Concerning

Forward-Looking Statements:

Certain statements contained in this press release,

including guidance, constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. You can identify forward-looking statements because they

contain words such as “believes,” “expects,” “may,” “will,”

“should,” “seeks,” “approximately,” “intends,” “plans,” “estimates”

or “anticipates” or the negative of these words and phrases or

similar words or phrases which are predictions of or indicate

future events or trends and which do not relate solely to

historical matters. Forward-looking statements and the business

prospects of Stronghold are subject to a number of risks and

uncertainties that may cause Stronghold’s actual results in future

periods to differ materially from the forward-looking statements.

These risks and uncertainties include, among other things: the

recent restructuring of the Company’s debt and the performance and

satisfaction of various obligations under the agreements entered

into in order to effect such restructuring of debt; the hybrid

nature of our business model, which is highly dependent on the

price of Bitcoin; our dependence on the level of demand and

financial performance of the crypto asset industry; our ability to

manage growth, business, financial results and results of

operations; uncertainty regarding our evolving business model; our

ability to retain management and key personnel and the integration

of new management; our ability to raise capital to fund business

growth; our ability to maintain sufficient liquidity to fund

operations, growth and acquisitions; our substantial indebtedness

and its effect on our results of operations and our financial

condition; uncertainty regarding the outcomes of any investigations

or proceedings; our ability to enter into purchase agreements,

acquisitions and financing transactions; public health crises,

epidemics, and pandemics such as the coronavirus pandemic; our

ability to procure and install crypto asset mining equipment,

including from foreign-based suppliers; our ability to maintain our

relationships with our third party brokers and our dependence on

their performance; developments and changes in laws and

regulations, including increased regulation of the crypto asset

industry through legislative action and revised rules and standards

applied by The Financial Crimes Enforcement Network under the

authority of the U.S. Bank Secrecy Act and the Investment Company

Act; the future acceptance and/or widespread use of, and demand

for, Bitcoin and other crypto assets; our ability to respond to

price fluctuations and rapidly changing technology; our ability to

operate our coal refuse power generation facilities as planned; our

ability to remain listed on a stock exchange and maintain an active

trading market; our ability to avail ourselves of tax credits for

the clean-up of coal refuse piles; and legislative or regulatory

changes, and liability under, or any future inability to comply

with, existing or future energy regulations or requirements. More

information on these risks and other potential factors that could

affect our financial results is included in our filings with the

Securities and Exchange Commission, including in the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” sections of our Annual Report on Form

10-K filed on April 3, 2023 and in our subsequently filed Quarterly

Reports on Form 10-Q. Any forward-looking statement or guidance

speaks only as of the date as of which such statement is made, and,

except as required by law, we undertake no obligation to update or

revise publicly any forward-looking statements or guidance, whether

because of new information, future events, or otherwise.

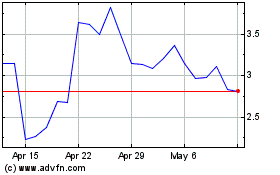

Stronghold Digital Mining (NASDAQ:SDIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stronghold Digital Mining (NASDAQ:SDIG)

Historical Stock Chart

From Apr 2023 to Apr 2024