Stronghold Digital Mining, Inc. (NASDAQ:

SDIG) (“Stronghold”, the “Company”, or “we”) today

announced the following:

Recent Operational and Financial Highlights

-

Stronghold’s Beneficial Use Ash Can Capture Carbon Dioxide

(CO2). Following four months of extensive testing,

third-party lab results indicate that Stronghold’s beneficial use

ash, a natural byproduct of its mining-waste-to-power process, can

capture CO2 from ambient air at a capacity of up to 12% by weight

of starting ash. The process results in permanent and stable

storage of the CO2.

- Initial

Phase of Carbon Capture Project Underway at the Scrubgrass

Plant. Stronghold and third-party engineering, design, and

construction partners have developed direct air capture (“DAC”)

technology to utilize the beneficial use ash to capture CO2. Field

testing is in progress with initial results expected by December of

2023.

- Reiterating

Q4 2023 Hash Rate Guidance. The Company is committed to

Bitcoin mining and expects at least 20% sequential growth in hash

rate going into the fourth quarter of 2023.

- Procured

3,135 High-Spec Bitcoin Miners (358 PH/s, >114 TH/s per miner,

28.7 J/T) Since the End of Q2 2023. The Company is taking

a disciplined approach to the Bitcoin event in April of 2024, with

no incremental capital currently committed to purchase additional

miners.

- Signed

Managed Services Agreement with Frontier Outpost 8, LLC (“Frontier

Mining”) to optimize Bitcoin mining operations and

profitability of Stronghold’s data centers.

- Fixed Costs

Were Down ~$31 Million for the First Three Quarters of 2023 Versus

the First Three Quarters of 2022, Representing a ~56%

Reduction. Fixed costs include operations &

maintenance expense and general & administrative expense,

excluding stock-based compensation and a one-time accounts

receivable adjustment.

- Generated 620

Bitcoin during the third quarter of 2023, which was nearly flat

versus the second quarter of 2023 and represented approximately 9%

and 41% growth compared to the third and fourth quarters of 2022,

respectively.

- The Company

generated revenues of $17.7 million, net loss of $22.3 million, and

non-GAAP Adjusted EBITDA loss of $2.4 million during the third

quarter of 2023. Excluding the adjustment to accounts receivable,

the non-GAAP Adjusted EBITDA loss would have been $1.6 million.

Revenues comprised $12.7 million from cryptocurrency self-mining,

$3.8 million from cryptocurrency hosting, and $1.2 million from the

sale of energy.1

Stronghold Carbon Capture

Initiative

On November 10, 2023, Stronghold launched the

first phase of its carbon capture project at the Scrubgrass Plant.

The design and process follow four months of third-party laboratory

tests, conducted by Karbonetiq, Inc. (“Karbonetiq”) at their Santa

Barbara, California lab, utilizing a variety of testing

methodologies. Stronghold’s beneficial use ash naturally contains

reactive calcium oxide as a result of including limestone in the

fuel mix to reduce sulfur dioxide emissions given high sulfur

content in mining waste. Calcium oxide can, under the right

conditions, bond with CO2 to form calcium carbonate, effectively

absorbing CO2 out of ambient air and permanently storing it in a

geologically stable solid. Karbonetiq’s lab results demonstrated

that Stronghold’s beneficial use ash can potentially capture CO2 at

a capacity of approximately 12% by weight of starting ash with the

use of their proprietary, patent pending, direct air capture

technology. We believe that the carbonation will occur in no more

than two weeks based on the lab results. As part of the first phase

of development, Stronghold aims to confirm that laboratory results

are replicable and scalable in the field. The Company expects to

use third-party labs with industry-standard thermogravimetric

analysis - mass spectrometry (TGA-MS) measurements to test ash

samples following exposure to Karbonetiq’s proprietary, patent

pending process. Stronghold expects that development will be

iterative, as the Company works to optimize processes around ash

movement, composition, rate of capture, time to capture and cost,

among other variables. The cost of equipment for the first phase is

expected to be less than $100,000, and the Company believes that

the scaled project will cost approximately $50-125 per annual ton

of CO2 capture capacity, assuming the laboratory results are

validated.

Stronghold’s two mining-waste-to-power

facilities produce approximately 800,000 to 900,000 tons of

beneficial use ash per year at baseload capacity utilization.

Extrapolating the potential 12% CO2 capture capacity from

Scrubgrass ash lab tests, this would imply potential to capture

approximately 100,000 tons of CO2 per year. In September of 2023,

Stronghold engaged third-party consultant Carbonomics to advise on

the verification of its carbon removals for private-market

monetization. The Company believes that its process will qualify

for the Carbonated Materials Methodology for CO2 Removal on the

Puro Registry, and the average transaction price for Puro’s Carbon

Removal Certificates has ranged from approximately $130 to 190 per

ton of CO2 removed during 2023. Stronghold expects to submit a

Project Design Document to Puro by the first quarter of 2024.

Additionally, the Company intends for its process to qualify for

the direct air capture standard under the recently enacted Internal

Revenue Service (“IRS”) Section 45Q and the Inflation Reduction

Act, which can provide for up to $180/ton tax credits based on

existing incentives. The Company is currently exploring whether its

carbon capture initiatives would be able to qualify for Section 45Q

tax credits.

“Our focus on improving the environment is a key

component of our business,” said Greg Beard, chairman and chief

executive officer of Stronghold. “Mining waste piles, if left in

their dormant states, will remain ‘forever emitters’ of greenhouse

gasses, including CO2, methane, and other air pollutants. In the

last year, multiple third-party studies found that greenhouse gas

emissions from unabated mining waste piles greatly exceeds the

corresponding emissions under the controlled and regulated

conditions of mining-waste-to-power CFB and similar facilities.

Specifically, one study estimates that mining-waste-to-power

facilities in Pennsylvania and West Virginia alone ‘reduce the

equivalent net GHG emissions that would otherwise be emitted from

the same amount of coal refuse by over 20 million tons of CO2e in a

single year’. This is an exciting affirmation of our efforts, and,

with the deployment of our carbon capture project, we have the

opportunity to make even more progress in combating greenhouse gas

emissions.

“While it is early, if the lab results are

replicable in the field using direct air capture technology, when

scaled, our carbon capture deployment has the potential to be one

of the ten largest DAC projects currently announced in the U.S.,”

Beard continued. “We are optimistic that this meaningful project

can become operational for a fraction of the cost of the other

announced projects and believe that it could be deployed at scale

on a shorter timeline. We look forward to providing updates as we

receive test results and the project progresses.”

Bitcoin Mining Update

Stronghold generated 620 Bitcoin during the third quarter of

2023, which was nearly flat versus the second quarter 2023 and

represented approximately 9% and 41% growth compared to the third

and fourth quarters of 2022, respectively. The Company achieved

this growth despite the average network hash rate in the third

quarter of 2023 being 83% and 52% higher than the average network

hash rate in the third quarter and fourth quarter of 2022,

respectively. Network hash rate grew ~9% sequentially from the

second quarter of 2023 to the third quarter 2023.

The Panther Creek Plant entered its planned 15-day outage on

October 28, 2023, and the Company intended to import electricity

from the PJM grid to power its Panther Creek data center during

that time. The Panther Creek Plant notified PJM of this outage, as

is customary. Shortly after the outage began, the Panther Creek

Plant was notified by PJM that there was a reliability issue

elsewhere in the region that would constrain Panther Creek’s

electricity imports to 30 megawatts through its outage, less than

half of its need. As a result, the Company took steps to shorten

the outage, and the Panther Creek Plant restarted on November 9,

2023, and the data center resumed unconstrained operations shortly

thereafter.

Liquidity and Capital

Resources

As of September 30, 2023, and

November 10, 2023, we had approximately $5.6 million and

$5.2 million, respectively, of cash and cash equivalents and

Bitcoin on our balance sheet, which included 24 Bitcoin and 12

Bitcoin, respectively. Additionally, Stronghold has $3.8 million of

contracted receivables that it expects to receive in the next 30

days, including approximately $2.7 million related to the sale of

2022 waste coal tax credits and approximately $0.8 million related

to the sale of renewable energy credits. As of September 30,

2023, and November 10, 2023, the Company had principal amount

of outstanding indebtedness of approximately $59.7 million and

$59.6 million, respectively. As of November 10, 2023, Stronghold

had approximately $6.1 million of capacity remaining of its

at-the-market offering agreement (“ATM”) with H.C. Wainwright &

Co., LLC. Stronghold has issued approximately $8.9 million of Class

A common stock at an average price of $6.96 per share under its ATM

for approximately $8.6 million of net proceeds, with approximately

$0.3 million paid in commissions. The Company has not sold any of

its shares under the ATM since the end of the third quarter of

2023.

Analyst & Investor Day

On December 12, 2023, Stronghold will host an

analyst and investor day in New York, NY to discuss the carbon

capture initiative and other items. In-person attendance is by

invitation only to institutional investors and analysts.

Presentations are expected to begin at 1:00 p.m. ET, and the event

is expected to conclude at 3:00 p.m. ET. For those who would like

to attend the event in-person, please contact Stronghold’s investor

relations team SDIG@gateway-grp.com for additional details and

instructions. A webcast will also be available on Stronghold’s

investor relations website.

Conference Call

Stronghold will host a conference call today,

November 14, 2023, at 11:00 a.m. Eastern Time (7:00 a.m.

Pacific Time) with an accompanying presentation to discuss these

results. A question-and-answer session will follow management's

presentation.

To participate, a live webcast of the call will

be available on the Investor Relations page of the Company’s

website at ir.strongholddigitalmining.com. To access the call by

phone, please use the following link Stronghold Digital Mining

Third Quarter 2023 Earnings Call. After registering, an email will

be sent, including dial-in details and a unique conference call

access code required to join the live call. To ensure you are

connected prior to the beginning of the call, please register a

minimum of 15 minutes before the start of the call.

A replay will be available on the Company's

Investor Relations website shortly after the event at

ir.strongholddigitalmining.com.

About Stronghold Digital Mining,

Inc.

Stronghold is a vertically integrated Bitcoin

mining company with an emphasis on environmentally beneficial

operations. Stronghold houses its miners at its wholly owned and

operated Scrubgrass and Panther Creek plants, both of which are

low-cost, environmentally beneficial coal refuse power generation

facilities in Pennsylvania.

Cautionary Statement Concerning

Forward-Looking Statements and Disclaimer

Certain statements contained in this press

release, including guidance, constitute “forward-looking

statements.” within the meaning of the Private Securities

Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,”

“expects,” “may,” “will,” “should,” “seeks,” “approximately,”

“intends,” “plans,” “estimates” or “anticipates” or the negative of

these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. Forward-looking statements and

the business prospects of Stronghold are subject to a number of

risks and uncertainties that may cause Stronghold’s actual results

in future periods to differ materially from the forward-looking

statements, including with respect to its potential carbon capture

initiative. These risks and uncertainties include, among other

things: the hybrid nature of our business model, which is highly

dependent on the price of Bitcoin; our dependence on the level of

demand and financial performance of the crypto asset industry; our

ability to manage growth, business, financial results and results

of operations; uncertainty regarding our evolving business model;

our ability to retain management and key personnel and the

integration of new management; our ability to raise capital to fund

business growth; our ability to maintain sufficient liquidity to

fund operations, growth and acquisitions; our substantial

indebtedness and its effect on our results of operations and our

financial condition; uncertainty regarding the outcomes of any

investigations or proceedings; our ability to enter into purchase

agreements, acquisitions and financing transactions; public health

crises, epidemics, and pandemics such as the coronavirus pandemic;

our ability to procure crypto asset mining equipment from

foreign-based suppliers; our ability to maintain our relationships

with our third party brokers and our dependence on their

performance; our ability to procure crypto asset mining equipment;

developments and changes in laws and regulations, including

increased regulation of the crypto asset industry through

legislative action and revised rules and standards applied by The

Financial Crimes Enforcement Network under the authority of the

U.S. Bank Secrecy Act and the Investment Company Act; the future

acceptance and/or widespread use of, and demand for, Bitcoin and

other crypto assets; our ability to respond to price fluctuations

and rapidly changing technology; our ability to operate our coal

refuse power generation facilities as planned; our ability to

remain listed on a stock exchange and maintain an active trading

market; our ability to avail ourselves of tax credits for the

clean-up of coal refuse piles; legislative or regulatory changes,

and liability under, or any future inability to comply with,

existing or future energy regulations or requirements; our ability

to replicate and scale the carbon capture project; our ability to

manage costs related to the carbon capture project; and our ability

to monetize our carbon capture project, including through the

private market and our ability to qualify for, obtain, monetize or

otherwise benefit from Section 45Q tax credits. More information on

these risks and other potential factors that could affect our

financial results is included in our filings with the Securities

and Exchange Commission, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of our Annual Report on Form 10-K

filed on April 3, 2023, and in our subsequently filed Quarterly

Reports on Form 10-Q. Any forward-looking statement or guidance

speaks only as of the date as of which such statement is made, and,

except as required by law, we undertake no obligation to update or

revise publicly any forward-looking statements or guidance, whether

because of new information, future events, or otherwise.

In January 2021, the IRS issued final

regulations under Section 45Q of the Internal Revenue Code, which

provides a tax credit disposed of in secure geological storage (in

the event of direct air capture that results in secure geological

storage, credits are valued at $180 per ton of CO2 captured) or

utilized in a manner that satisfies a series of regulatory

requirements (in the event of direct air capture that results in

utilization, credits are valued at $130 per ton of CO2 captured).

We may benefit from Section 45Q tax credits only if we satisfy the

applicable statutory and regulatory requirements, and we cannot

make any assurances that we will be successful in satisfying such

requirements or otherwise qualifying for or obtaining the Section

45Q tax credits currently available or that we will be able to

effectively benefit from such tax credits. Additionally, the amount

of Section 45Q tax credits from which we may benefit is dependent

upon our ability to satisfy certain wage and apprenticeship

requirements, which we cannot assure you that we will satisfy. We

are currently exploring whether our carbon capture initiatives

discussed herein would be able to qualify for any Section 45Q tax

credit. It is not entirely clear whether we will be able to meet

any required statutory and regulatory requirements, and

qualification for any amount of Section 45Q credit may not be

feasible with our currently planned direct air capture initiative.

Additionally, the availability of Section 45Q tax credits may be

reduced, modified or eliminated as a matter of legislative or

regulatory policy. Any such reduction, modification or elimination

of Section 45Q tax credits, or our inability to otherwise benefit

from Section 45Q tax credits, could materially reduce our ability

to develop and monetize our carbon capture program. These and any

other changes to government incentives that could impose additional

restrictions or favor certain projects over our projects could

increase costs, limit our ability to utilize tax benefits, reduce

our competitiveness, and/or adversely impact our growth. Any of

these factors may adversely impact our business, results of

operations and financial condition.

|

STRONGHOLD DIGITAL MINING, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(UNAUDITED) |

| |

| |

September 30, 2023 |

|

December 31, 2022 |

| ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

4,979,299 |

|

|

$ |

13,296,703 |

|

|

Digital currencies |

|

641,999 |

|

|

|

109,827 |

|

|

Accounts receivable |

|

486,706 |

|

|

|

10,837,126 |

|

|

Inventory |

|

3,143,284 |

|

|

|

4,471,657 |

|

|

Prepaid insurance |

|

1,842,250 |

|

|

|

5,471,498 |

|

|

Due from related parties |

|

97,288 |

|

|

|

73,122 |

|

|

Other current assets |

|

1,137,834 |

|

|

|

1,381,737 |

|

|

Total current assets |

|

12,328,660 |

|

|

|

35,641,670 |

|

|

Equipment deposits |

|

— |

|

|

|

10,081,307 |

|

|

Property, plant and equipment, net |

|

156,481,678 |

|

|

|

167,204,681 |

|

|

Operating lease right-of-use assets |

|

1,552,735 |

|

|

|

1,719,037 |

|

|

Land |

|

1,748,440 |

|

|

|

1,748,440 |

|

|

Road bond |

|

211,958 |

|

|

|

211,958 |

|

|

Security deposits |

|

348,888 |

|

|

|

348,888 |

|

|

Other noncurrent assets |

|

155,992 |

|

|

|

— |

|

| TOTAL

ASSETS |

$ |

172,828,351 |

|

|

$ |

216,955,981 |

|

|

LIABILITIES: |

|

|

|

|

Accounts payable |

$ |

14,666,753 |

|

|

$ |

27,540,317 |

|

|

Accrued liabilities |

|

9,638,819 |

|

|

|

8,893,248 |

|

|

Financed insurance premiums |

|

1,112,558 |

|

|

|

4,587,935 |

|

|

Current portion of long-term debt, net of discounts and issuance

fees |

|

1,654,634 |

|

|

|

17,422,546 |

|

|

Current portion of operating lease liabilities |

|

748,369 |

|

|

|

593,063 |

|

|

Due to related parties |

|

451,367 |

|

|

|

1,375,049 |

|

|

Total current liabilities |

|

28,272,500 |

|

|

|

60,412,158 |

|

|

Asset retirement obligation |

|

1,062,677 |

|

|

|

1,023,524 |

|

|

Warrant liabilities |

|

5,434,420 |

|

|

|

2,131,959 |

|

|

Long-term debt, net of discounts and issuance fees |

|

57,653,823 |

|

|

|

57,027,118 |

|

|

Long-term operating lease liabilities |

|

899,576 |

|

|

|

1,230,001 |

|

|

Contract liabilities |

|

560,510 |

|

|

|

351,490 |

|

|

Total liabilities |

|

93,883,506 |

|

|

|

122,176,250 |

|

| COMMITMENTS AND

CONTINGENCIES (NOTE 10) |

|

|

|

| REDEEMABLE COMMON

STOCK: |

|

|

|

|

Common Stock – Class V; $0.0001 par value; 34,560,000 shares

authorized; 2,405,760 and 2,605,760 shares issued and outstanding

as of September 30, 2023, and December 31, 2022,

respectively. |

|

10,563,277 |

|

|

|

11,754,587 |

|

|

Total redeemable common stock |

|

10,563,277 |

|

|

|

11,754,587 |

|

| STOCKHOLDERS’ EQUITY

(DEFICIT): |

|

|

|

|

Common Stock – Class A; $0.0001 par value; 685,440,000 shares

authorized; 7,876,688 and 3,171,022 shares issued and outstanding

as of September 30, 2023, and December 31, 2022,

respectively. |

|

788 |

|

|

|

317 |

|

|

Series C convertible preferred stock; $0.0001 par value; 23,102

shares authorized; 21,572 and 0 shares issued and outstanding as of

September 30, 2023, and December 31, 2022,

respectively. |

|

2 |

|

|

|

— |

|

|

Accumulated deficits |

|

(321,126,596 |

) |

|

|

(240,443,302 |

) |

|

Additional paid-in capital |

|

389,507,374 |

|

|

|

323,468,129 |

|

|

Total stockholders' equity |

|

68,381,568 |

|

|

|

83,025,144 |

|

|

Total redeemable common stock and stockholders' equity |

|

78,944,845 |

|

|

|

94,779,731 |

|

| TOTAL LIABILITIES,

REDEEMABLE COMMON STOCK AND STOCKHOLDERS' EQUITY |

$ |

172,828,351 |

|

|

$ |

216,955,981 |

|

|

STRONGHOLD DIGITAL MINING, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(UNAUDITED) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

| OPERATING

REVENUES: |

|

|

|

|

|

|

|

|

Cryptocurrency mining |

$ |

12,684,894 |

|

|

$ |

12,283,695 |

|

|

$ |

37,764,990 |

|

|

$ |

50,715,424 |

|

|

Energy |

|

1,210,811 |

|

|

|

13,071,894 |

|

|

|

4,682,590 |

|

|

|

29,807,512 |

|

|

Cryptocurrency hosting |

|

3,789,375 |

|

|

|

93,279 |

|

|

|

9,195,072 |

|

|

|

282,327 |

|

|

Capacity |

|

— |

|

|

|

878,610 |

|

|

|

1,442,067 |

|

|

|

4,591,038 |

|

|

Other |

|

41,877 |

|

|

|

39,171 |

|

|

|

142,194 |

|

|

|

91,941 |

|

|

Total operating revenues |

|

17,726,957 |

|

|

|

26,366,649 |

|

|

|

53,226,913 |

|

|

|

85,488,242 |

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

Fuel |

|

8,556,626 |

|

|

|

10,084,466 |

|

|

|

22,262,141 |

|

|

|

29,292,616 |

|

|

Operations and maintenance |

|

6,961,060 |

|

|

|

19,528,088 |

|

|

|

24,206,080 |

|

|

|

47,449,177 |

|

|

General and administrative |

|

6,598,951 |

|

|

|

11,334,212 |

|

|

|

25,145,444 |

|

|

|

32,848,291 |

|

|

Depreciation and amortization |

|

9,667,213 |

|

|

|

12,247,245 |

|

|

|

26,025,021 |

|

|

|

37,234,126 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

461,940 |

|

|

|

108,367 |

|

|

|

2,231,540 |

|

|

Realized gain on sale of digital currencies |

|

(131,706 |

) |

|

|

(185,396 |

) |

|

|

(725,139 |

) |

|

|

(936,506 |

) |

|

Realized loss on sale of miner assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,012,248 |

|

|

Impairments on miner assets |

|

— |

|

|

|

11,610,000 |

|

|

|

— |

|

|

|

16,600,000 |

|

|

Impairments on digital currencies |

|

357,411 |

|

|

|

465,651 |

|

|

|

683,241 |

|

|

|

8,176,868 |

|

|

Impairments on equipment deposits |

|

5,422,338 |

|

|

|

— |

|

|

|

5,422,338 |

|

|

|

12,228,742 |

|

|

Total operating expenses |

|

37,431,893 |

|

|

|

65,546,206 |

|

|

|

103,127,493 |

|

|

|

193,137,102 |

|

| NET OPERATING

LOSS |

|

(19,704,936 |

) |

|

|

(39,179,557 |

) |

|

|

(49,900,580 |

) |

|

|

(107,648,860 |

) |

| OTHER INCOME

(EXPENSE): |

|

|

|

|

|

|

|

|

Interest expense |

|

(2,441,139 |

) |

|

|

(3,393,067 |

) |

|

|

(7,428,530 |

) |

|

|

(10,813,302 |

) |

|

Loss on debt extinguishment |

|

— |

|

|

|

(28,697,021 |

) |

|

|

(28,960,947 |

) |

|

|

(28,697,021 |

) |

|

Impairment on assets held for sale |

|

— |

|

|

|

(4,159,004 |

) |

|

|

— |

|

|

|

(4,159,004 |

) |

|

Gain on extinguishment of PPP loan |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

841,670 |

|

|

Changes in fair value of warrant liabilities |

|

(180,838 |

) |

|

|

1,302,065 |

|

|

|

5,580,453 |

|

|

|

1,302,065 |

|

|

Realized gain on sale of derivative contract |

|

— |

|

|

|

90,953 |

|

|

|

— |

|

|

|

90,953 |

|

|

Changes in fair value of forward sale derivative |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,435,639 |

|

|

Changes in fair value of convertible note |

|

— |

|

|

|

(1,204,739 |

) |

|

|

— |

|

|

|

(2,167,500 |

) |

|

Other |

|

15,000 |

|

|

|

20,000 |

|

|

|

45,000 |

|

|

|

50,000 |

|

|

Total other income (expense) |

|

(2,606,977 |

) |

|

|

(36,040,813 |

) |

|

|

(30,764,024 |

) |

|

|

(40,116,500 |

) |

| NET LOSS |

$ |

(22,311,913 |

) |

|

$ |

(75,220,370 |

) |

|

$ |

(80,664,604 |

) |

|

$ |

(147,765,360 |

) |

| NET LOSS attributable

to noncontrolling interest |

|

(5,188,727 |

) |

|

|

(44,000,155 |

) |

|

|

(26,663,731 |

) |

|

|

(86,435,347 |

) |

| NET LOSS attributable

to Stronghold Digital Mining, Inc. |

$ |

(17,123,186 |

) |

|

$ |

(31,220,215 |

) |

|

$ |

(54,000,873 |

) |

|

$ |

(61,330,013 |

) |

| NET LOSS attributable

to Class A common shareholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

(2.26 |

) |

|

$ |

(12.67 |

) |

|

$ |

(8.93 |

) |

|

$ |

(28.17 |

) |

|

Diluted |

$ |

(2.26 |

) |

|

$ |

(12.67 |

) |

|

$ |

(8.93 |

) |

|

$ |

(28.17 |

) |

| Weighted average

number of Class A common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

7,569,511 |

|

|

|

2,463,163 |

|

|

|

6,047,891 |

|

|

|

2,177,206 |

|

|

Diluted |

|

7,569,511 |

|

|

|

2,463,163 |

|

|

|

6,047,891 |

|

|

|

2,177,206 |

|

|

STRONGHOLD DIGITAL MINING, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(UNAUDITED) |

|

|

|

|

Nine Months Ended |

| |

September 30, 2023 |

|

September 30, 2022 |

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

Net loss |

$ |

(80,664,604 |

) |

|

$ |

(147,765,360 |

) |

|

Adjustments to reconcile net loss to cash flows from operating

activities: |

|

|

|

|

Depreciation and amortization |

|

26,025,021 |

|

|

|

37,234,126 |

|

|

Accretion of asset retirement obligation |

|

39,153 |

|

|

|

18,253 |

|

|

Gain on extinguishment of PPP loan |

|

— |

|

|

|

(841,670 |

) |

|

Loss on disposal of fixed assets |

|

108,367 |

|

|

|

2,231,540 |

|

|

Realized loss on sale of miner assets |

|

— |

|

|

|

8,012,248 |

|

|

Change in value of accounts receivable |

|

1,867,506 |

|

|

|

— |

|

|

Amortization of debt issuance costs |

|

161,093 |

|

|

|

2,681,039 |

|

|

Stock-based compensation |

|

7,603,859 |

|

|

|

9,123,124 |

|

|

Loss on debt extinguishment |

|

28,960,947 |

|

|

|

28,697,021 |

|

|

Impairment on assets held for sale |

|

— |

|

|

|

4,159,004 |

|

|

Impairments on equipment deposits |

|

5,422,338 |

|

|

|

12,228,742 |

|

|

Impairments on miner assets |

|

— |

|

|

|

16,600,000 |

|

|

Changes in fair value of warrant liabilities |

|

(5,580,453 |

) |

|

|

(1,302,065 |

) |

|

Changes in fair value of forward sale derivative |

|

— |

|

|

|

(3,435,639 |

) |

|

Realized gain on sale of derivative contract |

|

— |

|

|

|

(90,953 |

) |

|

Forward sale contract prepayment |

|

— |

|

|

|

970,000 |

|

|

Changes in fair value of convertible note |

|

— |

|

|

|

2,167,500 |

|

|

Other |

|

(229,485 |

) |

|

|

— |

|

|

(Increase) decrease in digital currencies: |

|

|

|

|

Mining revenue |

|

(43,778,958 |

) |

|

|

(50,715,424 |

) |

|

Net proceeds from sale of digital currencies |

|

42,563,545 |

|

|

|

46,209,822 |

|

|

Impairments on digital currencies |

|

683,241 |

|

|

|

8,176,868 |

|

|

(Increase) decrease in assets: |

|

|

|

|

Accounts receivable |

|

8,129,033 |

|

|

|

1,336,817 |

|

|

Prepaid insurance |

|

1,399,254 |

|

|

|

5,321,521 |

|

|

Due from related parties |

|

(91,617 |

) |

|

|

(58,735 |

) |

|

Inventory |

|

1,328,373 |

|

|

|

55,538 |

|

|

Other assets |

|

9,666 |

|

|

|

(866,298 |

) |

|

Increase (decrease) in liabilities: |

|

|

|

|

Accounts payable |

|

(1,445,109 |

) |

|

|

4,878,600 |

|

|

Due to related parties |

|

(239,230 |

) |

|

|

781,485 |

|

|

Accrued liabilities |

|

875,203 |

|

|

|

(407,909 |

) |

|

Other liabilities, including contract liabilities |

|

(211,225 |

) |

|

|

(55,742 |

) |

| NET CASH FLOWS USED IN

OPERATING ACTIVITIES |

|

(7,064,082 |

) |

|

|

(14,656,547 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

Purchases of property, plant and equipment |

|

(14,743,269 |

) |

|

|

(68,052,422 |

) |

|

Proceeds from sale of equipment deposits |

|

— |

|

|

|

13,844,780 |

|

|

Equipment purchase deposits - net of future commitments |

|

— |

|

|

|

(13,656,428 |

) |

| NET CASH FLOWS USED IN

INVESTING ACTIVITIES |

|

(14,743,269 |

) |

|

|

(67,864,070 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

Repayments of debt |

|

(3,196,644 |

) |

|

|

(34,490,545 |

) |

|

Repayments of financed insurance premiums |

|

(1,474,889 |

) |

|

|

(3,992,336 |

) |

|

Proceeds from debt, net of issuance costs paid in cash |

|

(147,385 |

) |

|

|

97,337,454 |

|

|

Proceeds from private placements, net of issuance costs paid in

cash |

|

9,824,567 |

|

|

|

8,599,440 |

|

|

Proceeds from ATM, net of issuance costs paid in cash |

|

8,483,982 |

|

|

|

— |

|

|

Proceeds from exercise of warrants |

|

316 |

|

|

|

— |

|

| NET CASH FLOWS

PROVIDED BY FINANCING ACTIVITIES |

|

13,489,947 |

|

|

|

67,454,013 |

|

| NET DECREASE IN CASH

AND CASH EQUIVALENTS |

|

(8,317,404 |

) |

|

|

(15,066,604 |

) |

| CASH AND CASH

EQUIVALENTS - BEGINNING OF PERIOD |

|

13,296,703 |

|

|

|

31,790,115 |

|

| CASH AND CASH

EQUIVALENTS - END OF PERIOD |

$ |

4,979,299 |

|

|

$ |

16,723,511 |

|

| |

Use and Reconciliation of Non-GAAP

Financial Measures

This press release and our related earnings call

contain certain non-GAAP financial measures, including Adjusted

EBITDA, as a measure of our operating performance. Adjusted EBITDA

is a non-GAAP financial measure. We define Adjusted EBITDA as net

income (loss) before interest, taxes, depreciation and

amortization, further adjusted by the removal of one-time

transaction costs, impairments on digital currencies, realized

gains and losses on the sale of long-term assets, expenses related

to stock-based compensation, gains or losses on derivative

contracts, gains or losses on extinguishment of debt, realized

gains or losses on sale of digital currencies, or changes in fair

value of warrant liabilities in the period presented. See

reconciliation below.

Our board of directors and management team use

Adjusted EBITDA to assess our financial performance because they

believe it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense and

income), asset base (such as depreciation, amortization,

impairments, and realized gains and losses on the sale of long-term

assets) and other items (such as one-time transaction costs,

expenses related to stock-based compensation, and gains and losses

on derivative contracts) that impact the comparability of financial

results from period to period. We present Adjusted EBITDA because

we believe it provides useful information regarding the factors and

trends affecting our business in addition to measures calculated

under GAAP. Adjusted EBITDA is not a financial measure presented in

accordance with GAAP. We believe that the presentation of this

non-GAAP financial measure will provide useful information to

investors and analysts in assessing our financial performance and

results of operations across reporting periods by excluding items

we do not believe are indicative of our core operating performance.

Net income (loss) is the GAAP measure most directly comparable to

Adjusted EBITDA. Our non-GAAP financial measure should not be

considered as an alternative to the most directly comparable GAAP

financial measure. You are encouraged to evaluate each of these

adjustments and the reasons we consider them appropriate for

supplemental analysis. In evaluating Adjusted EBITDA, you should be

aware that in the future we may incur expenses that are the same as

or similar to some of the adjustments in such presentation. Our

presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items. There can be no assurance that we will not

modify the presentation of Adjusted EBITDA in the future, and any

such modification may be material. Adjusted EBITDA has important

limitations as an analytical tool, and you should not consider

Adjusted EBITDA in isolation or as a substitute for analysis of our

results as reported under GAAP and should be read in conjunction

with the financial statements furnished in our Form 10-Q for the

quarter ended September 30, 2023, expected to be filed on or

prior to November 14, 2023. Because Adjusted EBITDA may be

defined differently by other companies in our industry, our

definition of this non-GAAP financial measure may not be comparable

to similarly titled measures of other companies, thereby

diminishing its utility.

|

STRONGHOLD DIGITAL MINING, INC. |

|

RECONCILIATION OF ADJUSTED EBITDA |

| |

| |

Three Months Ended |

|

Nine Months Ended |

|

(in thousands) |

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

Net Loss (GAAP) |

$ |

(22,312 |

) |

|

$ |

(75,220 |

) |

|

$ |

(80,665 |

) |

|

$ |

(147,765 |

) |

| Plus: |

|

|

|

|

|

|

|

|

Interest expense |

|

2,441 |

|

|

|

3,393 |

|

|

|

7,429 |

|

|

|

10,813 |

|

|

Depreciation and amortization |

|

9,667 |

|

|

|

12,247 |

|

|

|

26,025 |

|

|

|

37,234 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

28,697 |

|

|

|

28,961 |

|

|

|

28,697 |

|

|

Impairment on assets held for sale |

|

— |

|

|

|

4,159 |

|

|

|

— |

|

|

|

4,159 |

|

|

Impairments on equipment deposits |

|

5,422 |

|

|

|

— |

|

|

|

5,422 |

|

|

|

12,229 |

|

|

Impairments on miner assets |

|

— |

|

|

|

11,610 |

|

|

|

— |

|

|

|

16,600 |

|

|

Impairments on digital currencies |

|

357 |

|

|

|

466 |

|

|

|

683 |

|

|

|

8,177 |

|

|

Non-recurring expenses1 |

|

1,216 |

|

|

|

8,218 |

|

|

|

1,853 |

|

|

|

14,781 |

|

|

Stock-based compensation |

|

788 |

|

|

|

3,377 |

|

|

|

7,604 |

|

|

|

9,123 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

462 |

|

|

|

108 |

|

|

|

2,232 |

|

|

Realized loss on sale of miner assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,012 |

|

|

Realized gain on sale of digital currencies |

|

(132 |

) |

|

|

(185 |

) |

|

|

(725 |

) |

|

|

(937 |

) |

|

Changes in fair value of forward sale derivative |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,436 |

) |

|

Gain on extinguishment of PPP loan |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(842 |

) |

|

Changes in fair value of convertible note |

|

— |

|

|

|

1,205 |

|

|

|

— |

|

|

|

2,168 |

|

|

Changes in fair value of warrant liabilities |

|

181 |

|

|

|

(1,302 |

) |

|

|

(5,580 |

) |

|

|

(1,302 |

) |

|

Realized gain (loss) on sale of derivative contract |

|

— |

|

|

|

(91 |

) |

|

|

— |

|

|

|

(91 |

) |

|

Accretion of asset retirement obligation |

|

13 |

|

|

|

— |

|

|

|

39 |

|

|

|

— |

|

|

Adjusted EBITDA (Non-GAAP) |

$ |

(2,357 |

) |

|

$ |

(2,965 |

) |

|

$ |

(8,846 |

) |

|

$ |

(148 |

) |

1 Includes the following non-recurring expenses:

out-of-the-ordinary major repairs and upgrades to the power plant

and other one-time items.

Investor Contact:

Matt Glover or Alex KovtunGateway Group, Inc.

SDIG@gateway-grp.com1-949-574-3860

Media Contact:

contact@strongholddigitalmining.com

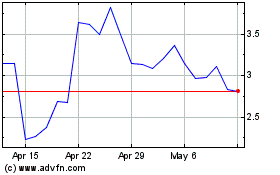

Stronghold Digital Mining (NASDAQ:SDIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stronghold Digital Mining (NASDAQ:SDIG)

Historical Stock Chart

From Apr 2023 to Apr 2024