STRATTEC SECURITY CORPORATION (NASDAQ:STRT) today reported

operating results for the fiscal third quarter ended March 29,

2020.

Net sales for the Company’s third quarter ended

March 29, 2020 were $116.9 million, compared to net sales of $128.2

million for the third quarter ended March 31, 2019. Net income for

the current year quarterly period was $3.0 million, compared to net

income of $1.7 million in the prior year quarter. Diluted earnings

per share for the current year quarterly period were $0.79 compared

to diluted earnings per share of $0.46 in the prior year

quarter.

GAAP EarningsFor the nine

months ended March 29, 2020, the Company’s net sales were $343.2

million compared to net sales of $358.3 million in the prior year

nine month period. Net income during the current year nine month

period was $2.9 million compared to a net loss of $17.0 million in

the prior year nine month period. Diluted earnings per share were

$0.77 for the nine month period ended March 29, 2020 compared to

diluted loss per share of $4.62 during the nine month period ended

March 31, 2019.

Non-GAAP EarningsDuring the

first nine months of the fiscal year 2020 ended March 29, 2020, a

pre-tax non-cash compensation expense charge, occurring during the

first and second quarter of fiscal 2020, of $4.5 million reduced

the Company’s diluted earnings per share by $0.91 or $3.4 million,

on an after tax basis. Without this non-cash compensation expense

charge adjusted diluted earnings per share for the current year

nine months ended March 29, 2020 would have been $1.68.

As noted in prior Company filings with the SEC,

during the fiscal 2019 second quarter ended December 30, 2018, the

Company completed a substantial portion of terminating the STRATTEC

Pension Plan that was previously frozen on December 31, 2009. As a

result of those actions, a non-cash pre-tax pension settlement

charge of $32.4 million was recorded during our second quarter

ended December 30, 2018 that reduced diluted earnings per share by

$6.73, or $24.8 million, on an after tax basis. Without this

pension settlement charge and favorable tax adjustment related to

Tax Reform adjusted diluted earnings per share for the prior year

nine months ended March 31, 2019 would have been $2.01.

For further information on adjusted or non-GAAP

numbers included in this release, see the Non-GAAP to GAAP

reconciliation tables, along with the explanatory note following

the table, included later on in this release.

Net sales to each of our customers or customer

groups in the current year quarter and prior year quarter were as

follows (in thousands):

|

|

|

Three Months Ended |

|

|

|

March 29, 2020 |

|

|

March 31, 2019 |

|

|

|

|

|

|

|

|

Fiat Chrysler Automobiles |

$ |

26,050 |

|

$ |

29,917 |

|

General Motors Company |

|

31,656 |

|

|

30,969 |

|

Ford Motor Company |

|

15,462 |

|

|

15,942 |

|

Tier 1 Customers |

|

17,495 |

|

|

20,078 |

|

Commercial and Other OEM Customers |

|

20,184 |

|

|

22,794 |

|

Hyundai / Kia |

|

6,091 |

|

|

8,530 |

|

TOTAL |

$ |

116,938 |

|

$ |

128,230 |

During the latter part of March 2020 our OEM

customers started reducing production schedules and closed their

assembly plants due to the Coronavirus (COVID-19) pandemic. The

impact of these reductions reduced our net sales in the current

year quarter by approximately $6.7 million dollars. Sales to Fiat

Chrysler Automobiles in the current year quarter decreased in

comparison to the prior year quarter due to lower production

volumes of the vehicles we supply. The increase in sales to General

Motors Company in the current year quarter compared to the prior

year quarter related primarily to higher sales content on models

for which we supply components, in particular power access products

and latches. Sales to Ford Motor Company decreased in the current

year quarter due to lower production volumes of the vehicles we

supply compared to the prior year quarter. Sales to Tier 1

Customers decreased in the current year quarter due to lower sales

of our driver control steering column lock products. Sales to

Commercial and Other OEM Customers during the current year quarter

decreased in comparison to the prior year quarter mainly due to

decreases in sales related to key fobs sold to Harley Davidson and

related to reductions in sales of door handle and power access

products to Honda of America Manufacturing, Inc.. These Commercial

and Other OEM Customers, along with the Tier 1 Customers, primarily

represent purchasers of vehicle access control products, such as

latches, key fobs, driver controls, steering column locks and door

handles that we have developed in recent years to complement our

historic core business of locks and keys. The decreased sales to

Hyundai / Kia in the current year quarter were principally due to

lower levels of production of the Kia Sedona minivan for which we

supply primarily power sliding door components.

Gross profit margins were 14.5 percent in the

current year quarter compared to 12.2 percent in the prior year

quarter. The increase in gross profit margin in the current year

quarter compared to the prior year quarter was primarily attributed

to improved manufacturing efficiencies both at our Milwaukee and

Mexico production facilities in comparison to the prior year

quarter.

Engineering, Selling and Administrative expenses

overall were lower in the current year quarter as compared to the

prior year quarter and represented 9.2 percent in the current year

quarter as a percent of net sales compared to 9.1 percent in the

prior year quarter. The decrease in overall operating expenses in

the current year quarter was primarily due to lower outside

expenditures on new product development costs associated with

utilizing third party vendors for a portion of our development

work.

Included in Other Income, Net in the current

year quarter compared to the prior year quarter were the following

items (in thousands of dollars):

| |

|

March 29, 2020 |

|

|

March 31, 2019 |

|

|

|

|

|

|

|

|

|

|

(Loss) Equity Earnings of VAST LLC Joint Venture |

$ |

(947 |

) |

|

$ |

25 |

|

|

Net Foreign Currency Realized and |

|

|

|

|

|

|

|

Unrealized Transaction Gain (Loss) |

|

1,467 |

|

|

|

(47 |

) |

|

Other |

|

(392 |

) |

|

|

297 |

|

|

|

$ |

128 |

|

|

$ |

275 |

|

The decrease in Other Income, Net in the current

year quarter from the prior year quarter was primarily related to

lower profitability at our VAST LLC China operation due to extended

OEM customer plant shutdowns associated with the coronavirus

(COVID-19) pandemic.

Frank Krejci, President & CEO commented: “I

am pleased with the current quarter’s operating results especially

since our customer’s started closing their assembly plants at the

end of March due to the COVID-19 virus. Despite those closures

reducing our net sales by approximately $6.7 million, the

significant manufacturing improvements and cost reduction

activities at both our Milwaukee and Mexico production facilities

improved gross profit margins by over 2% in comparison to the prior

year quarter. Our VAST LLC operations experienced a net loss during

the current quarter mainly due to VAST China which was down almost

the entire month of February related to the COVID-19 virus.

However, near the end of March they were almost back to full

operations. The coming quarter will be severely impacted by our OEM

customers shutting down their North America operations for the

entire month of April. Depending on how long the COVID-19 virus

will require the industry to remain to be idle, our net sales for

next quarter could be down 50% or more, thus dramatically impacting

profitability and operating cash flow. We are presently reducing

our cost structure through layoffs, reduced hours, officer salary

cuts and escalating decisions regarding capital spending. Hopefully

this is the worst and the automotive industry can get on a path of

recovery during this coming quarter. Lastly, I would like to end on

a very positive perspective. In December 2018, we transferred our

pension plan liability to an insurance company and had excess

assets left over. If we had not, given the current situation, we

would be millions of dollars underfunded and be facing significant

contributions for years to come. Between paying down debt and

eliminating our former pension liability, we are in a much stronger

position to weather this storm and ultimately invest in our

future”.

|

STRATTEC SECURITY CORPORATION AND

SUBSIDIARIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP PERFORMANCE MEASURES TO GAAP PERFORMANCE

MEASURES |

|

(in thousands, except earnings per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

|

March 29, 2020 |

|

|

March 31, 2019 |

|

|

March 29, 2020 |

|

|

March 31, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (GAAP measure) |

$ |

17,010 |

|

$ |

15,682 |

|

$ |

43,229 |

|

$ |

43,601 |

|

| Compensation charge,

pre-tax |

|

- |

|

|

- |

|

|

2,742 |

|

|

- |

|

| Adjusted gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

(Non-GAAP measure) |

$ |

17,010 |

|

$ |

15,682 |

|

$ |

45,971 |

|

$ |

43,601 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Engineering, selling &

administrative |

|

|

|

|

|

|

|

|

|

|

|

|

expenses (GAAP measure) |

$ |

10,727 |

|

$ |

11,721 |

|

$ |

35,775 |

|

$ |

33,222 |

|

| Compensation charge,

pre-tax |

|

- |

|

|

- |

|

|

1,731 |

|

|

- |

|

| Adjusted engineering, selling

& |

|

|

|

|

|

|

|

|

|

|

|

|

administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

(Non-GAAP measure) |

$ |

10,727 |

|

$ |

11,721 |

|

$ |

34,044 |

|

$ |

33,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

(GAAP measure) |

$ |

6,283 |

|

$ |

3,961 |

|

$ |

7,454 |

|

$ |

10,379 |

|

| Compensation charge,

pre-tax |

|

- |

|

|

- |

|

|

4,473 |

|

|

- |

|

| Adjusted operating income |

|

|

|

|

|

|

|

|

|

|

|

|

(Non-GAAP measure) |

$ |

6,283 |

|

$ |

3,961 |

|

$ |

11,927 |

|

$ |

10,379 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) (GAAP

measure) |

$ |

2,994 |

|

$ |

1,730 |

|

$ |

2,897 |

|

$ |

(16,967 |

) |

| Compensation charge, net of

tax |

|

- |

|

|

- |

|

|

3,422 |

|

|

- |

|

| Pension settlement charge, net

of tax |

|

- |

|

|

- |

|

|

- |

|

|

24,812 |

|

| Favorable tax adjustment

related to |

|

|

|

|

|

|

|

|

|

|

|

|

“Tax Reform 2017” |

|

- |

|

|

- |

|

|

- |

|

|

(372 |

) |

| Adjusted net income |

|

|

|

|

|

|

|

|

|

|

|

|

(Non-GAAP measure) |

$ |

2,994 |

|

$ |

1,730 |

|

$ |

6,319 |

|

$ |

7,473 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

(GAAP measure) |

$ |

0.79 |

|

$ |

0.46 |

|

$ |

0.77 |

|

$ |

(4.62 |

) |

|

Compensation charge, net of tax |

|

- |

|

|

- |

|

|

0.91 |

|

|

- |

|

|

Pension settlement charge, net of tax |

|

- |

|

|

- |

|

|

- |

|

|

6.73 |

|

|

Favorable tax adjustment related to |

|

|

|

|

|

|

|

|

|

|

|

|

“Tax Reform 2017” |

|

- |

|

|

- |

|

|

- |

|

|

(0.10 |

) |

|

Adjusted diluted earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

(Non-GAAP measure) |

$ |

0.79 |

|

$ |

0.46 |

|

$ |

1.68 |

|

$ |

2.01 |

|

Non-GAAP Financial Measures

This press release contains financial measures

not prepared in accordance with generally accepted accounting

principles (referred to as Non-GAAP), specifically “adjusted net

income,” “adjusted gross profit,” “adjusted engineering, selling

& administrative expenses,” “adjusted operating income” and

“adjusted diluted earnings per share.” “Adjusted net income” is

defined as net (loss) income attributable to STRATTEC SECURITY

CORPORATION shareholders excluding both the pension settlement

charges and the compensation expense charges, in each case net of

tax (i.e., on an after tax basis), and excluding a favorable tax

adjustment relating to “Tax Reform 2017”. “Adjusted diluted

earnings per share” is defined as “Adjusted net income” divided by

average diluted shares of common stock outstanding during the

applicable period. “Adjusted gross profit” is defined as gross

profit excluding the compensation expense charges, all on a pre-tax

basis. “Adjusted engineering, selling & administrative

expenses” is defined as engineering, selling & administrative

expenses excluding the compensation expense charges, all on a

pre-tax basis. “Adjusted operating income” is defined as operating

income excluding the compensation expense charges, all on a pre-tax

basis. The Company believes that these Non-GAAP measures, when

presented in conjunction with comparable GAAP measures, provide

additional information for evaluating STRATTEC’s performance and

are important measures by which STRATTEC’s management is able to

assess the profitability and liquidity of STRATTEC’s business.

These Non-GAAP measures should be considered in addition to, not as

a substitute for or superior to, net income (loss) as a measure of

operating performance. These Non-GAAP measures may be different

than Non-GAAP financial measures used by other companies.

STRATTEC designs, develops, manufactures and

markets automotive Access Control Products, including mechanical

locks and keys, electronically enhanced locks and keys, steering

column and instrument panel ignition lock housings, latches, power

sliding side door systems, power lift gate systems, power deck lid

systems, door handles and related products. These products are

provided to customers in North America, and on a global basis

through a unique strategic relationship with WITTE Automotive of

Velbert, Germany and ADAC Automotive of Grand Rapids, Michigan.

Under this relationship, STRATTEC, WITTE and ADAC market each

company’s products to global customers under the “VAST Automotive

Group” brand name. STRATTEC’s history in the automotive business

spans over 110 years.

Certain statements contained in this release

contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

may be identified by the use of forward-looking words or phrases

such as “anticipate,” “believe,” “could,” “expect,” “intend,”

“may,” “planned,” “potential,” “should,” “will,” and “would.” Such

forward-looking statements in this release are inherently subject

to many uncertainties in the Company’s operations and business

environment. These uncertainties include general economic

conditions, in particular, relating to the automotive industry,

consumer demand for the Company’s and its customers’ products,

competitive and technological developments, customer purchasing

actions, changes in warranty provisions and customer product recall

policies, work stoppages at the Company or at the location of its

key customers as a result of labor disputes, foreign currency

fluctuations, uncertainties stemming from U.S. trade policies,

tariffs and reactions to same from foreign countries, the volume

and scope of product returns, adverse business and operational

issues resulting from the coronavirus pandemic, and fluctuations in

our costs of operation (including fluctuations in the cost of raw

materials). Shareholders, potential investors and other readers are

urged to consider these factors carefully in evaluating the

forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are only made as of the date of this press

release and the Company undertakes no obligation to publicly update

such forward-looking statements to reflect subsequent events or

circumstances occurring after the date of this release. In

addition, such uncertainties and other operational matters are

discussed further in the Company’s quarterly and annual filings

with the Securities and Exchange Commission.

Contact: Pat HansenSenior Vice President andChief Financial

Officer414-247-3435www.strattec.com

|

STRATTEC SECURITY CORPORATION |

|

Condensed Results of Operations |

|

(In Thousands except per share amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Third Quarter Ended |

|

Nine Months Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 29, 2020 |

|

|

March 31, 2019 |

|

|

March 29, 2020 |

|

|

|

March 31, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

116,938 |

|

|

$ |

128,230 |

|

|

$ |

343,183 |

|

|

$ |

358,302 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Goods Sold |

|

99,928 |

|

|

|

112,548 |

|

|

|

299,954 |

|

|

|

314,701 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

17,010 |

|

|

|

15,682 |

|

|

|

43,229 |

|

|

|

43,601 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engineering, Selling

& |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative Expenses |

|

10,727 |

|

|

|

11,721 |

|

|

|

35,775 |

|

|

|

33,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Operations |

|

6,283 |

|

|

|

3,961 |

|

|

|

7,454 |

|

|

|

10,379 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

(204 |

) |

|

|

(413 |

) |

|

|

(792 |

) |

|

|

(1,224 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pension Termination |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Settlement Charge |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(32,434 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income, Net |

|

128 |

|

|

|

275 |

|

|

|

1,030 |

|

|

|

2,153 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss) before

Provision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Benefit) for Income Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Non-Controlling Interest |

|

6,207 |

|

|

|

3,823 |

|

|

|

7,692 |

|

|

|

(21,126 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision (Benefit) for Income

Taxes |

|

1,294 |

|

|

|

786 |

|

|

|

1,194 |

|

|

|

(6,994 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

4,913 |

|

|

|

3,037 |

|

|

|

6,498 |

|

|

|

(14,132 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Controlling Interest |

|

(1,919 |

) |

|

|

(1,307 |

) |

|

|

(3,601 |

) |

|

|

(2,835 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) Attributable

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STRATTEC SECURITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATION |

$ |

2,994 |

|

|

$ |

1,730 |

|

|

$ |

2,897 |

|

|

$ |

(16,967 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) Per

Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.80 |

|

|

$ |

0.47 |

|

|

$ |

0.78 |

|

|

$ |

(4.62 |

) |

| Diluted |

$ |

0.79 |

|

|

$ |

0.46 |

|

|

$ |

0.77 |

|

|

$ |

(4.62 |

) |

| Average Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Outstanding |

|

3,748 |

|

|

|

3,684 |

|

|

|

3,733 |

|

|

|

3,670 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Outstanding |

|

3,768 |

|

|

|

3,728 |

|

|

|

3,752 |

|

|

|

3,670 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Expenditures |

$ |

2,923 |

|

|

$ |

4,148 |

|

|

$ |

10,307 |

|

|

$ |

13,550 |

|

|

Depreciation |

$ |

4,769 |

|

|

$ |

4,420 |

|

|

$ |

14,349 |

|

|

$ |

12,543 |

|

|

STRATTEC SECURITY

CORPORATION |

|

|

|

|

|

|

|

|

|

|

Condensed Balance Sheet

Data |

|

(In Thousands) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

March 29, 2020 |

|

June 30, 2019 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

10,173 |

|

|

$ |

7,809 |

|

|

Receivables, net |

|

72,805 |

|

|

|

84,230 |

|

|

Inventories, net |

|

58,348 |

|

|

|

47,262 |

|

|

Other current assets |

|

15,216 |

|

|

|

17,331 |

|

|

Total Current Assets |

|

156,542 |

|

|

|

156,632 |

|

|

Investment in Joint Ventures |

|

23,190 |

|

|

|

23,528 |

|

|

Other Long Term Assets |

|

10,363 |

|

|

|

14,456 |

|

|

Property, Plant and Equipment, Net |

|

107,416 |

|

|

|

118,120 |

|

|

|

$ |

297,511 |

|

|

$ |

312,736 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts Payable |

$ |

43,104 |

|

|

$ |

41,889 |

|

|

Other |

|

32,968 |

|

|

|

37,374 |

|

|

Total Current Liabilities |

|

76,072 |

|

|

|

79,263 |

|

|

Accrued Pension and Post Retirement Obligations |

|

2,403 |

|

|

|

2,425 |

|

|

Borrowings Under Credit Facility |

|

27,000 |

|

|

|

42,000 |

|

|

Other Long-term Liabilities |

|

4,781 |

|

|

|

1,232 |

|

|

Shareholders’ Equity |

|

320,289 |

|

|

|

317,681 |

|

|

Accumulated Other Comprehensive Loss |

|

(22,270 |

) |

|

|

(18,568 |

) |

|

Less: Treasury Stock |

|

(135,676 |

) |

|

|

(135,725 |

) |

|

Total STRATTEC SECURITY |

|

|

|

|

|

|

|

|

CORPORATION Shareholders’ Equity |

|

162,343 |

|

|

|

163,388 |

|

|

Non-Controlling Interest |

|

24,912 |

|

|

|

24,428 |

|

|

Total Shareholders’ Equity |

|

187,255 |

|

|

|

187,816 |

|

|

|

$ |

297,511 |

|

|

$ |

312,736 |

|

|

STRATTEC SECURITY CORPORATION |

|

Condensed Cash Flow Statement Data |

|

(In Thousands) |

|

(Unaudited) |

| |

|

|

|

|

| |

Third Quarter Ended |

|

Nine Months Ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 29, 2020 |

|

|

|

March 31, 2019 |

|

|

|

March 29, 2020 |

|

|

March 31, 2019 |

| |

|

|

|

|

| Cash Flows from Operating

Activities: |

|

|

|

|

|

Net Income (Loss) |

$ |

4,913 |

|

|

$ |

3,037 |

|

|

$ |

6,498 |

|

|

$ |

(14,132 |

) |

| Adjustment to Reconcile Net

Income (Loss) to |

|

|

|

|

|

Cash Provided by Operating Activities: |

|

|

|

|

|

Equity Loss (Earnings) in Joint Ventures |

|

921 |

|

|

|

(66 |

) |

|

|

(55 |

) |

|

|

(2,451 |

) |

|

Depreciation |

|

4,769 |

|

|

|

4,420 |

|

|

|

14,349 |

|

|

|

12,543 |

|

|

Foreign Currency Transaction (Gain) Loss |

|

(2,515 |

) |

|

|

192 |

|

|

|

(2,067 |

) |

|

|

261 |

|

|

Unrealized Loss (Gain) on Peso |

|

|

|

|

|

Forward Contracts |

|

1,048 |

|

|

|

(23 |

) |

|

|

1,048 |

|

|

|

(116 |

) |

|

Stock Based Compensation Expense |

|

165 |

|

|

|

241 |

|

|

|

789 |

|

|

|

867 |

|

|

Non-Cash Compensation Expense |

|

- |

|

|

|

- |

|

|

|

4,473 |

|

|

|

- |

|

|

Pension Settlement Charge |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

32,434 |

|

|

Deferred Income taxes |

|

- |

|

|

|

- |

|

|

|

(1,032 |

) |

|

|

(8,131 |

) |

|

Change in Operating Assets/Liabilities |

|

(1,266 |

) |

|

|

(2,805 |

) |

|

|

4,212 |

|

|

|

3,727 |

|

|

Other, net |

|

94 |

|

|

|

3 |

|

|

|

522 |

|

|

|

(281 |

) |

| |

|

|

|

|

| Net Cash Provided by Operating

Activities |

|

8,129 |

|

|

|

4,999 |

|

|

|

28,737 |

|

|

|

24,721 |

|

| |

|

|

|

|

| Cash Flows from Investing

Activities: |

|

|

|

|

|

Investment in Joint Ventures |

|

- |

|

|

|

(200 |

) |

|

|

- |

|

|

|

(200 |

) |

|

Additions to Property, Plant and Equipment |

|

(2,923 |

) |

|

|

(4,148 |

) |

|

|

(10,307 |

) |

|

|

(13,550 |

) |

|

Proceeds from Sale of Property, Plant |

|

|

|

|

|

and Equipment |

|

14 |

|

|

|

- |

|

|

|

29 |

|

|

|

12 |

|

| Net Cash Used in Investing

Activities |

|

(2,909 |

) |

|

|

(4,348 |

) |

|

|

(10,278 |

) |

|

|

(13,738 |

) |

| |

|

|

|

|

| Cash Flows from Financing

Activities: |

|

|

|

|

|

Borrowings Under Credit Facility |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,000 |

|

|

Repayment of Borrowings Under Credit Facility |

|

(5,000 |

) |

|

|

(2,000 |

) |

|

|

(15,000 |

) |

|

|

(9,000 |

) |

|

Dividends Paid to Non-Controlling |

|

|

|

|

|

Interests of Subsidiaries |

|

- |

|

|

|

(400 |

) |

|

|

(980 |

) |

|

|

(1,384 |

) |

|

Dividends Paid |

|

(525 |

) |

|

|

(517 |

) |

|

|

(1,572 |

) |

|

|

(1,546 |

) |

|

Exercise of Stock Options and |

|

|

|

|

|

Employee Stock Purchases |

|

24 |

|

|

|

172 |

|

|

|

543 |

|

|

|

244 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Cash Used In Financing

Activities |

|

(5,501 |

) |

|

|

(2,745 |

) |

|

|

(17,009 |

) |

|

|

(9,686 |

) |

| |

|

|

|

|

| Effect of Foreign Currency

Fluctuations on Cash |

|

1,169 |

|

|

|

(77 |

) |

|

|

914 |

|

|

|

(185 |

) |

| |

|

|

|

|

| Net Increase (Decrease) in

Cash & Cash Equivalents |

|

888 |

|

|

|

(2,171 |

) |

|

|

2,364 |

|

|

|

1,112 |

|

| |

|

|

|

|

| Cash and Cash

Equivalents: |

|

|

|

|

|

Beginning of Period |

|

9,285 |

|

|

|

11,373 |

|

|

|

7,809 |

|

|

|

8,090 |

|

|

End of Period |

$ |

10,173 |

|

|

$ |

9,202 |

|

|

$ |

10,173 |

|

|

$ |

9,202 |

|

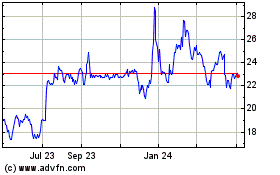

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From Apr 2023 to Apr 2024