Singing Machine Reports Third Quarter Earnings Report

February 21 2023 - 8:00AM

The Singing Machine Compa

ny, Inc. (“Singing

Machine” or the “Company”) (NASDAQ:

MICS) – the

worldwide leader in consumer karaoke products – today announced its

third quarter financial results for the three months ended December

31, 2022.

Third Quarter

Highlights:

-

Net sales for the quarter of $7.1 million; fiscal year-to-date

revenue of $35.9 million.

-

Gross profit for the quarter of $1.3 million.

-

Income from Operations of approximately ($2.3) million.

-

Total assets of $24.1 million as of December 31, 2022.

-

Cash on hand of $2.8 million as of December 31, 2022.

-

Net loss for the quarter of $(1.9) million; fiscal year-to-date net

loss of approximately ($1.6) million.

Management Commentary:

Gary Atkinson, Singing Machine CEO, commented,

“Despite our wholesale sell-in numbers for this quarter, consumer

demand for consumer karaoke remained very strong. The real

challenge to this quarter was timing and getting our products into

retail. Last calendar year, our traditional sales cycle was

disrupted by the lingering effects of supply chain disruptions.

There was a build-up of retail inventory on the shelves at the end

of the first quarter of calendar 2021, which slowly started to make

the major retailers gradually more cautious about inventory

throughout the rest of the year.”

Atkinson continued, “As a result, we did not get

the opportunity to sell-in to many of our retail customers with our

typical holiday bulk replenishment. Simply put, our retail

customers were backfilling the demand with the lingering inventory

from last year, or in many cases, opting to lose sales with empty

shelves. Despite our customers decisions to lower exposure to

inventory due to elevated risk factors associated with the overall

economy in the back of the year, we saw steady demand for our

products, and we believe that reflects well on our brand and our

technology. Moving forward, we expect more of a return to normal

for this coming season.”

Earnings Call Information:

The Company will host a conference call today,

Tuesday, February 21, 2023, beginning at 10:00 AM Eastern time to

discuss these results and answer questions. If you would like to

participate on the call, please dial (800) 225-9448 and use

conference ID: MICS.

An audio rebroadcast of the call will be

available later in the day after the earnings call and can be heard

at: www.singingmachine.com/investors.

About The Singing Machine

Singing Machine® is the leading provider of

karaoke products to consumers across the world. The Company offers

the industry's widest line of at-home and in-car karaoke

entertainment products, which allow consumers to find a machine

that suits their needs and skill level. The Company’s products are

sold in over 25,000 locations worldwide, including at well-known

retailers such as Amazon, Costco, Sam’s Club, Target, and Walmart.

As the most recognized brand in karaoke, Singing Machine products

incorporate the latest technology and provide access to over 70,000

songs for streaming through its mobile app and select WiFi-capable

products. To learn more, go to www.singingmachine.com.

Investor Relations Contact:Brendan Hopkins(407)

645-5295investors@singingmachine.comwww.singingmachine.comwww.singingmachine.com/investors

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Words such

as "may", "could", "expects", "projects," "intends", "plans",

"believes", "predicts", "anticipates", "hopes", "estimates" and

variations of such words and similar expressions are intended to

identify forward-looking statements. These statements involve known

and unknown risks and are based upon several assumptions and

estimates, which are inherently subject to significant

uncertainties and contingencies, many of which are beyond the

Company's control. Actual results may differ materially from those

expressed or implied by such forward-looking statements. Factors

that could cause actual results to differ materially include, but

are not limited to, the risk factors described in the Company's

filings with the Securities and Exchange Commission. The

forward-looking statements are applicable only as of the date on

which they are made, and the Company does not assume any obligation

to update any forward-looking statements.

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED BALANCE

SHEETS

|

|

|

December 31, 2022 |

|

|

March 31, 2022 |

|

|

|

|

(unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

2,795,171 |

|

|

$ |

2,290,483 |

|

|

Accounts receivable, net of allowances of $139,182 and $122,550,

respectively |

|

|

7,023,603 |

|

|

|

2,785,038 |

|

|

Due from Crestmark Bank |

|

|

- |

|

|

|

100,822 |

|

|

Accounts receivable related party - Stingray Group, Inc. |

|

|

282,317 |

|

|

|

152,212 |

|

|

Inventories, net |

|

|

10,984,742 |

|

|

|

14,161,636 |

|

|

Prepaid expenses and other current assets |

|

|

154,329 |

|

|

|

344,409 |

|

|

Deferred financing costs |

|

|

84,668 |

|

|

|

7,813 |

|

|

Total Current Assets |

|

|

21,324,830 |

|

|

|

19,842,413 |

|

| |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

540,867 |

|

|

|

565,094 |

|

| Deferred financing

costs, net of current portion |

|

|

151,694 |

|

|

|

- |

|

| Deferred tax

assets |

|

|

1,399,016 |

|

|

|

892,559 |

|

| Operating Leases -

right of use assets |

|

|

648,323 |

|

|

|

1,279,347 |

|

| Other non-current

assets |

|

|

98,724 |

|

|

|

86,441 |

|

|

Total Assets |

|

$ |

24,163,454 |

|

|

$ |

22,665,854 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,084,756 |

|

|

$ |

5,391,265 |

|

|

Accrued expenses |

|

|

3,234,714 |

|

|

|

1,732,355 |

|

|

Revolving lines of credit |

|

|

1,761,495 |

|

|

|

2,500,000 |

|

|

Refunds due to customers |

|

|

93,520 |

|

|

|

97,968 |

|

|

Reserve for sales returns |

|

|

2,935,465 |

|

|

|

990,000 |

|

|

Current portion of finance leases |

|

|

8,187 |

|

|

|

7,605 |

|

|

Current portion of installment notes |

|

|

79,119 |

|

|

|

74,300 |

|

|

Current portion of operating lease liabilities |

|

|

654,883 |

|

|

|

876,259 |

|

|

Subordinated note payable - Starlight Marketing Development,

Ltd. |

|

|

- |

|

|

|

352,659 |

|

|

Total Current Liabilities |

|

|

10,852,139 |

|

|

|

12,022,411 |

|

| |

|

|

|

|

|

|

|

|

| Finance leases, net of

current portion |

|

|

4,405 |

|

|

|

10,620 |

|

| Installment notes, net

of current portion |

|

|

78,693 |

|

|

|

138,649 |

|

| Operating lease

liabilities, net of current portion |

|

|

30,422 |

|

|

|

457,750 |

|

|

Total Liabilities |

|

|

10,965,659 |

|

|

|

12,629,430 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 1,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock $0.01 par value; 100,000,000 shares authorized;

3,148,219 and 1,221,209 shares issued and outstanding,

respectively |

|

|

31,482 |

|

|

|

12,212 |

|

|

Additional paid-in capital |

|

|

29,697,697 |

|

|

|

24,902,694 |

|

|

Accumulated deficit |

|

|

(16,531,384 |

) |

|

|

(14,878,482 |

) |

|

Total Shareholders’ Equity |

|

|

13,197,795 |

|

|

|

10,036,424 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

24,163,454 |

|

|

$ |

22,665,854 |

|

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

|

|

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

|

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Sales |

|

$ |

7,110,520 |

|

|

$ |

21,244,306 |

|

|

$ |

35,916,210 |

|

|

$ |

44,678,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

|

5,819,991 |

|

|

|

15,934,842 |

|

|

|

27,481,182 |

|

|

|

34,464,291 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

1,290,529 |

|

|

|

5,309,464 |

|

|

|

8,435,028 |

|

|

|

10,214,638 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

1,124,780 |

|

|

|

1,406,175 |

|

|

|

2,629,567 |

|

|

|

2,717,642 |

|

|

General and administrative expenses |

|

|

2,395,430 |

|

|

|

2,154,553 |

|

|

|

7,183,259 |

|

|

|

5,352,902 |

|

|

Depreciation |

|

|

52,816 |

|

|

|

55,007 |

|

|

|

173,206 |

|

|

|

190,087 |

|

| Total Operating

Expenses |

|

|

3,573,026 |

|

|

|

3,615,735 |

|

|

|

9,986,032 |

|

|

|

8,260,631 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income from

Operations |

|

|

(2,282,497 |

) |

|

|

1,693,729 |

|

|

|

(1,551,004 |

) |

|

|

1,954,007 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (Expenses)

Income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain - related party |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11,236 |

|

|

Gain from Payroll Protection Plan loan forgiveness |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

448,242 |

|

|

Gain from settlement of accounts payable |

|

|

48,650 |

|

|

|

- |

|

|

|

48,650 |

|

|

|

236,472 |

|

|

Loss from extinguishment of debt |

|

|

(183,333 |

) |

|

|

- |

|

|

|

(183,333 |

) |

|

|

- |

|

|

Interest expense |

|

|

(67,891 |

) |

|

|

(155,573 |

) |

|

|

(413,831 |

) |

|

|

(365,966 |

) |

|

Finance costs |

|

|

(17,638 |

) |

|

|

(9,375 |

) |

|

|

(25,451 |

) |

|

|

(35,672 |

) |

| Total Other (Expenses)

Income, net |

|

|

(220,212 |

) |

|

|

(164,948 |

) |

|

|

(573,965 |

) |

|

|

294,312 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income Before

Income Tax Benefit (Provision) |

|

|

(2,502,709 |

) |

|

|

1,528,781 |

|

|

|

(2,124,969 |

) |

|

|

2,248,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Tax Benefit

(Provision) |

|

|

569,343 |

|

|

|

(102,886 |

) |

|

|

472,067 |

|

|

|

(248,664 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)

Income |

|

$ |

(1,933,366 |

) |

|

$ |

1,425,895 |

|

|

$ |

(1,652,902 |

) |

|

$ |

1,999,655 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) Income per

Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.62 |

) |

|

$ |

0.80 |

|

|

$ |

(0.61 |

) |

|

$ |

1.28 |

|

|

Diluted |

|

$ |

(0.62 |

) |

|

$ |

0.80 |

|

|

$ |

(0.61 |

) |

|

$ |

1.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Common and Common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent

Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

3,125,979 |

|

|

|

1,780,342 |

|

|

|

2,699,210 |

|

|

|

1,559,585 |

|

|

Diluted |

|

|

3,125,979 |

|

|

|

1,787,846 |

|

|

|

2,699,210 |

|

|

|

1,570,329 |

|

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(Unaudited)

|

|

|

For the Nine Months Ended |

|

|

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

|

$ |

(1,652,902 |

) |

|

$ |

1,999,655 |

|

|

Adjustments to reconcile net (loss) income to net cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

173,206 |

|

|

|

190,087 |

|

|

Amortization of deferred financing costs |

|

|

25,451 |

|

|

|

35,672 |

|

|

Change in inventory reserve |

|

|

396,553 |

|

|

|

297,661 |

|

|

Change in allowance for bad debts |

|

|

16,632 |

|

|

|

168,395 |

|

|

Loss from disposal of property and equipment |

|

|

- |

|

|

|

4,394 |

|

|

Stock based compensation |

|

|

307,651 |

|

|

|

38,376 |

|

|

Change in net deferred tax assets |

|

|

(506,457 |

) |

|

|

248,773 |

|

|

Loss on debt extinguishment |

|

|

183,333 |

|

|

|

- |

|

|

Paycheck Protection Plan loan forgiveness |

|

|

- |

|

|

|

(448,242 |

) |

|

Gain - related party |

|

|

- |

|

|

|

(11,236 |

) |

|

Gain from extinguishment of accounts payable |

|

|

(48,650 |

) |

|

|

(236,472 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(4,255,197 |

) |

|

|

(10,123,571 |

) |

|

Due from Crestmark Bank |

|

|

100,822 |

|

|

|

4,557,120 |

|

|

Accounts receivable - related parties |

|

|

(130,105 |

) |

|

|

(159,125 |

) |

|

Inventories |

|

|

2,780,341 |

|

|

|

(5,933,704 |

) |

|

Prepaid expenses and other current assets |

|

|

190,080 |

|

|

|

(63,135 |

) |

|

Other non-current assets |

|

|

(12,283 |

) |

|

|

10,288 |

|

|

Accounts payable |

|

|

(3,257,859 |

) |

|

|

3,769,157 |

|

|

Accrued expenses |

|

|

1,502,359 |

|

|

|

762,252 |

|

|

Customer deposits |

|

|

- |

|

|

|

(129,544 |

) |

|

Refunds due to customers |

|

|

(4,448 |

) |

|

|

(55,333 |

) |

|

Reserve for sales returns |

|

|

1,945,465 |

|

|

|

1,962,457 |

|

|

Operating lease liabilities, net of operating leases - right of use

assets |

|

|

(17,680 |

) |

|

|

2,741 |

|

|

Net cash used in operating activities |

|

|

(2,263,688 |

) |

|

|

(3,113,334 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(148,979 |

) |

|

|

(77,599 |

) |

|

Net cash used in investing activities |

|

|

(148,979 |

) |

|

|

(77,599 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from Issuance of stock - net of transaction expenses |

|

|

3,362,750 |

|

|

|

9,000,580 |

|

|

Payment of redemption and retirement of treasury stock |

|

|

- |

|

|

|

(7,162,452 |

) |

|

Net (payment) proceeds from revolving lines of credit |

|

|

(738,505 |

) |

|

|

8,561,925 |

|

|

Payment of subordinated note payable - Starlight Marketing

Development, Ltd. |

|

|

(352,659 |

) |

|

|

(150,000 |

) |

|

Payment of deferred financing charges |

|

|

(254,000 |

) |

|

|

(37,501 |

) |

|

Payment of early termination fees on revolving lines of credit |

|

|

(183,333 |

) |

|

|

- |

|

|

Payments on installment notes |

|

|

(55,137 |

) |

|

|

(50,709 |

) |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

14,000 |

|

|

Proceeds from exercise of pre-funded warrants |

|

|

168,334 |

|

|

|

- |

|

|

Proceeds from exercise of common warrants |

|

|

975,538 |

|

|

|

- |

|

|

Payments on finance leases |

|

|

(5,633 |

) |

|

|

(6,184 |

) |

|

Net cash provided by financing activities |

|

|

2,917,355 |

|

|

|

10,169,659 |

|

| Net change in

cash |

|

|

504,688 |

|

|

|

6,978,726 |

|

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

year |

|

|

2,290,483 |

|

|

|

396,579 |

|

| Cash at end of

period |

|

$ |

2,795,171 |

|

|

$ |

7,375,305 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

456,978 |

|

|

$ |

378,076 |

|

|

Equipment purchased under capital lease |

|

$ |

- |

|

|

$ |

23,651 |

|

|

Issuance of common stock and warrants for stock issuance

expenses |

|

$ |

- |

|

|

$ |

547,838 |

|

|

Operating leases - right of use assets and lease liabilities at

inception of lease |

|

$ |

- |

|

|

$ |

16,364 |

|

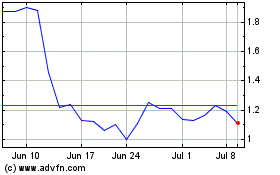

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From May 2024 to Jun 2024

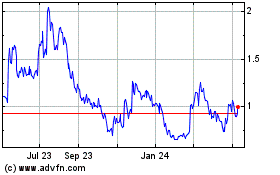

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Jun 2023 to Jun 2024