Shoals Technologies Group, Inc. (“Shoals” or the “Company”)

(Nasdaq: SHLS), a leading provider of electrical balance of system

(“EBOS”) solutions for solar, battery storage, and electric vehicle

charging infrastructure, today announced results for its second

quarter ended June 30, 2023.

“Shoals delivered another outstanding

performance in the second quarter, setting new Company records for

revenue and earnings. Revenue grew 62% year-over-year, while System

Solutions revenue increased 80% compared to the year-ago period, as

customers continue to partner with and use Shoals for their EBOS

needs. This was further illustrated in the quarter when we signed

our landmark 10-gigawatt master supply agreement with Blattner,”

said Jeff Tolnar, President of Shoals.

Mr. Tolnar added, “Backlog and awarded orders

increased 67% year-over-year to a Company record of

$546.1 million, reflecting continued robust demand for our

products. Demand for our combine-as-you-go solution remained

strong, with one new customer converting to our system during the

quarter, bringing our total number of Big Lead Assembly (BLA)

customers to 43. Quotes, awarded orders and backlog of BLA+

continue to grow as we roll out additional products within the

product family and customer adoption increases.”

“Finally, we are very excited to welcome Brandon

Moss as Shoals’ new CEO. His industry and leadership experience,

proven track record of executing strategic growth plans, and

commitment to culture, make him the ideal person to lead Shoals

through our next stage of growth. We look forward to working with

Brandon to continue our strong momentum and capitalize on our

significant market opportunity,” concluded Mr. Tolnar.

Second Quarter 2023

Financial ResultsRevenue grew 62%, to $119.2 million,

compared to $73.5 million for the prior-year period, driven by

higher sales volumes as a result of increased demand for solar EBOS

generally and the Company’s combine-as-you-go System Solutions

specifically. System Solutions revenue increased 80% compared to

the prior-year period, and represented 86% of revenue compared to

77% in the prior-year period.

Gross profit increased 77% to

$50.5 million, compared to $28.6 million in the

prior-year period. Gross profit as a percentage of revenue grew

more than 350 bps to 42.4% compared to 38.9% in the prior-year

period, driven primarily by a higher portion of overall revenue

coming from the Company’s combine-as-you-go System Solutions, which

carry higher margins than the Company’s other products, slightly

lower raw materials input costs, increased leverage on fixed costs,

and efficiencies gained in operations partially offset by $9.4

million in warranty expense.

General and administrative expenses were

$16.7 million, compared to $13.3 million during the same

period in the prior year. This increase was primarily the result of

higher non-cash stock-based compensation and planned increases in

payroll expense due to higher headcount supporting growth.

Income from operations was $31.6 million,

compared to $13.0 million during the same period in the prior

year.

Net income increased 159% to $18.9 million

compared to $7.3 million during the same period in the prior

year. Net income attributable to Shoals grew 330% to

$18.9 million compared to $4.4 million during the same

period in the prior year. Basic and diluted net income per share

was $0.11 compared to basic and diluted net income per share of

$0.04 in the prior-year period.

Adjusted EBITDA* increased 96% to

$38.7 million compared to $19.8 million for the

prior-year period.

Adjusted net income* grew 105% to

$24.0 million compared to $11.8 million during the same

period in the prior year. Adjusted diluted earnings per share was

$0.14 compared to $0.07 in the prior-year period.

* A reconciliation of the Company’s non-GAAP

measures to the most closely comparable U.S. generally accepted

accounting principles (“GAAP”) measures are found within this

release.

Backlog and Awarded OrdersThe

Company’s backlog and awarded orders as of June 30, 2023 were

$546.1 million, representing a 67% increase compared to the

same time last year and a 4% sequential increase from March 31,

2023. The increase in backlog and awarded orders reflects continued

robust demand for the Company’s solar products, including the

recently introduced BLA+.

Backlog represents signed purchase orders or

contractual minimum purchase commitments with take-or-pay

provisions and awarded orders are orders we are in the process of

documenting a contract but for which a contract has not yet been

signed.

Full Year 2023 OutlookBased on

current business conditions, business trends and other factors, the

Company is maintaining its outlook for the year ending December 31,

2023 as follows:

- Revenue to be in the range of $480

million to $510 million

- Adjusted EBITDA to

be in the range of $145 million to $160 million

- Adjusted net income

to be in the range of $92 million to $102 million

- Interest expense to

be in the range of $22 to $26 million

- Capital

expenditures to be in the range of $8 to $12 million

A reconciliation of Adjusted EBITDA and Adjusted

net income guidance, which are forward-looking measures that are

non-GAAP measures, to the most closely comparable GAAP measures is

not provided because we are unable to provide such reconciliation

without unreasonable effort. The inability to provide a

quantitative reconciliation is due to the uncertainty and inherent

difficulty in predicting the occurrence, the financial impact and

the periods in which the components of the applicable GAAP measures

and non-GAAP adjustments may be recognized. The GAAP measures may

include the impact of such items as non-cash share-based

compensation, amortization of intangible assets and the tax effect

of such items, in addition to other items we have historically

excluded from Adjusted EBITDA and Adjusted net income. We expect to

continue to exclude these items in future disclosures of these

non-GAAP measures and may also exclude other similar items that may

arise in the future.

Webcast and Conference Call

InformationCompany management will host a webcast and

conference call on August 1, 2023 at 5:00 p.m. Eastern Time,

to discuss the Company’s financial results.

Interested investors and other parties can

listen to a webcast of the live conference call by logging onto the

Investor Relations section of the Company’s website at

https://investors.shoals.com.

The conference call can be accessed live over

the phone by dialing 1-855-327-6837 (domestic) or +1-631-891-4304

(international). A telephonic replay will be available

approximately two hours after the call by dialing 1-844-512-2921 or

for international callers, +1-412-317-6671. The conference ID for

the live call and pin number for the replay is 10021930. The

telephonic replay will be available until 11:59 p.m. Eastern Time

on August 15, 2023.

About Shoals Technologies Group,

Inc.Shoals Technologies Group, Inc. is a leading provider

of electrical balance of systems (EBOS) solutions for solar,

storage, and electric vehicle charging infrastructure. Since its

founding in 1996, the Company has introduced innovative

technologies and systems solutions that allow its customers to

substantially increase installation efficiency and safety while

improving system performance and reliability. Shoals Technologies

Group, Inc. is a recognized leader in the renewable energy industry

whose solutions are deployed on over 62 GW of solar systems

globally. For additional information, please visit:

https://www.shoals.com.

Investor Relations Contact

Dhaval Patel Vice President, Investor RelationsEmail:

Dhaval.Patel@shoals.com

Forward-Looking StatementsThis

report contains forward-looking statements that are based on our

management’s beliefs and assumptions and on information currently

available to our management. Forward-looking statements include

information concerning our possible or assumed future results of

operations, business strategies, technology developments, financing

and investment plans, warranty, litigation and liability accruals

and estimates of loss or gains, competitive position, industry and

regulatory environment, potential growth opportunities and the

effects of competition. Forward-looking statements include

statements that are not historical facts and can be identified by

terms such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” "seek," “should,” “will,” “would” or similar expressions

and the negatives of those terms.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Some of the key factors that could cause actual

results to differ from our expectations include, among others,

lower than anticipated growth in demand for solar energy projects

and EV charging infrastructure; macroeconomic events, including

heightened inflation, rises in interest rates and a potential

recession; defects or performance problems in our products or their

parts, including those manufactured by third parties, and related

warranty claims; supply chain challenges, including as a result of

additional duties and charges on imports and exports; our failure

to, or incurrence of significant costs in order to, obtain,

maintain, protect, defend or enforce our intellectual property and

other proprietary rights; governmental policies and regulations,

and any subsequent changes, which may present technical, regulatory

and economic barriers; changes in the United States trade

environment; failure to integrate acquired businesses, and delays,

disruptions or quality control problems in our manufacturing

operations in part due to vendor concentration.

Other risks and uncertainties are described in

the section entitled "Item 1A. Risk Factors" of our periodic

reports filed with the Securities and Exchange Commission,

including our Annual Report on Form 10-K for the year ended

December 31, 2022 and our most recent Quarterly Report on Form

10-Q. Given these uncertainties, you should not place undue

reliance on forward-looking statements. Also, forward-looking

statements represent our management’s beliefs and assumptions only

as of the date of this report. You should read this report with the

understanding that our actual future results may be materially

different from what we expect.

Except as required by law, we assume no

obligation to update these forward-looking statements, or to update

the reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new

information becomes available in the future.

Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted Net Income and

Adjusted Diluted Earnings per Share (“EPS”)We define

Adjusted EBITDA as net income (loss) plus (i) interest expense,

net, (ii) income tax expense, (iii) depreciation expense, (iv)

amortization of intangibles, (v) equity-based compensation, and

(vi) acquisition-related expenses. We define Adjusted Net Income as

net income attributable to Shoals Technologies Group, Inc. plus (i)

net income impact from assumed exchange of Class B common stock to

Class A common stock as of the beginning of the earliest period

presented, (ii) amortization of intangibles, (iii) amortization of

deferred financing costs, (iv) equity-based compensation, and (v)

acquisition-related expenses, all net of applicable income taxes.

We define Adjusted Diluted EPS as Adjusted Net Income divided by

the diluted weighted average shares of Class A common stock

outstanding for the applicable period, which assumes the exchange

of all outstanding Class B common stock for Class A common stock as

of the beginning of the earliest period presented.

Adjusted EBITDA, Adjusted Net Income and

Adjusted Diluted EPS are intended as supplemental measures of

performance that are neither required by, nor presented in

accordance with, GAAP. We present Adjusted EBITDA, Adjusted Net

Income and Adjusted Diluted EPS because we believe they assist

investors and analysts in comparing our performance across

reporting periods on a consistent basis by excluding items that we

do not believe are indicative of our core operating performance. In

addition, we use Adjusted EBITDA, Adjusted Net Income and Adjusted

Diluted EPS: (i) as factors in evaluating management’s performance

when determining incentive compensation; (ii) to evaluate the

effectiveness of our business strategies; and (iii) because our

credit agreement uses measures similar to Adjusted EBITDA, Adjusted

Net Income and Adjusted Diluted EPS to measure our compliance with

certain covenants.

Among other limitations, Adjusted EBITDA,

Adjusted Net Income and Adjusted Diluted EPS do not reflect our

cash expenditures, or future requirements for capital expenditures

or contractual commitments; do not reflect the impact of certain

cash charges resulting from matters we consider not to be

indicative of our ongoing operations; and may be calculated by

other companies in our industry differently than we do or not at

all, which may limit their usefulness as comparative measures.

Because of these limitations, Adjusted EBITDA,

Adjusted Net Income and Adjusted Diluted EPS should not be

considered in isolation or as substitutes for performance measures

calculated in accordance with GAAP. You should review the

reconciliation of net income and net income attributable to Shoals

Technologies Group, Inc. to Adjusted EBITDA, Adjusted Net Income

and Adjusted Diluted EPS below and not rely on any single financial

measure to evaluate our business.

Shoals Technologies Group,

Inc.Condensed Consolidated Balance Sheets

(Unaudited)(in thousands, except shares and par value)

| |

|

|

|

| |

June 30,2023 |

|

December 31,2022 |

| Assets |

|

|

|

| Current Assets |

|

|

|

|

Cash and cash equivalents |

$ |

5,860 |

|

$ |

8,766 |

|

Accounts receivable, net |

|

97,099 |

|

|

50,575 |

|

Unbilled receivables |

|

21,664 |

|

|

16,713 |

|

Inventory, net |

|

68,312 |

|

|

72,854 |

|

Other current assets |

|

7,180 |

|

|

4,632 |

|

Total Current Assets |

|

200,115 |

|

|

153,540 |

| Property, plant and equipment,

net |

|

20,198 |

|

|

16,870 |

| Goodwill |

|

69,941 |

|

|

69,941 |

| Other intangible assets,

net |

|

52,542 |

|

|

56,585 |

| Deferred tax assets |

|

470,329 |

|

|

291,634 |

| Other assets |

|

5,695 |

|

|

6,325 |

| Total

Assets |

$ |

818,820 |

|

$ |

594,895 |

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current Liabilities |

|

|

|

|

Accounts payable |

$ |

16,239 |

|

$ |

9,481 |

|

Accrued expenses and other |

|

27,650 |

|

|

17,882 |

|

Deferred revenue |

|

31,298 |

|

|

23,259 |

|

Long-term debt—current portion |

|

2,000 |

|

|

2,000 |

|

Total Current Liabilities |

|

77,187 |

|

|

52,622 |

| Revolving line of credit |

|

20,000 |

|

|

48,000 |

| Long-term debt, less current

portion |

|

188,609 |

|

|

189,063 |

| Other long-term

liabilities |

|

3,619 |

|

|

4,221 |

| Total Liabilities |

|

289,415 |

|

|

293,906 |

| Commitments and

Contingencies |

|

|

|

| Stockholders’ Equity |

|

|

|

|

Preferred stock, $0.00001 par value - 5,000,000 shares authorized;

none issued and outstanding as of June 30, 2023 and December 31,

2022 |

|

— |

|

|

— |

|

Class A common stock, $0.00001 par value - 1,000,000,000 shares

authorized; 169,926,094 and 137,904,663 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively |

|

2 |

|

|

1 |

|

Class B common stock, $0.00001 par value - 195,000,000 shares

authorized; none and 31,419,913 shares issued and outstanding as of

June 30, 2023 and December 31, 2022, respectively |

|

— |

|

|

1 |

|

Additional paid-in capital |

|

461,705 |

|

|

256,894 |

|

Accumulated earnings |

|

67,698 |

|

|

34,478 |

| Total stockholders’ equity

attributable to Shoals Technologies Group, Inc. |

|

529,405 |

|

|

291,374 |

| Non-controlling interests |

|

— |

|

|

9,615 |

| Total stockholders'

equity |

|

529,405 |

|

|

300,989 |

| Total Liabilities and

Stockholders’ Equity |

$ |

818,820 |

|

$ |

594,895 |

Shoals Technologies Group,

Inc.Condensed Consolidated Statements of

Operations (Unaudited)(in thousands, except per share

amounts)

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue |

$ |

119,208 |

|

|

$ |

73,490 |

|

|

$ |

224,294 |

|

|

$ |

141,466 |

|

| Cost of

revenue |

|

68,691 |

|

|

|

44,897 |

|

|

|

125,520 |

|

|

|

86,581 |

|

| Gross

profit |

|

50,517 |

|

|

|

28,593 |

|

|

|

98,774 |

|

|

|

54,885 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

General and administrative expenses |

|

16,723 |

|

|

|

13,265 |

|

|

|

36,715 |

|

|

|

27,184 |

|

|

Depreciation and amortization |

|

2,158 |

|

|

|

2,344 |

|

|

|

4,323 |

|

|

|

4,710 |

|

|

Total operating expenses |

|

18,881 |

|

|

|

15,609 |

|

|

|

41,038 |

|

|

|

31,894 |

|

| Income from

operations |

|

31,636 |

|

|

|

12,984 |

|

|

|

57,736 |

|

|

|

22,991 |

|

| Interest expense, net |

|

(6,505 |

) |

|

|

(4,170 |

) |

|

|

(12,501 |

) |

|

|

(8,006 |

) |

| Income before income

taxes |

|

25,131 |

|

|

|

8,814 |

|

|

|

45,235 |

|

|

|

14,985 |

|

| Income tax expense |

|

(6,207 |

) |

|

|

(1,511 |

) |

|

|

(9,328 |

) |

|

|

(3,033 |

) |

| Net

income |

|

18,924 |

|

|

|

7,303 |

|

|

|

35,907 |

|

|

|

11,952 |

|

| Less: net income attributable

to non-controlling interests |

|

— |

|

|

|

2,901 |

|

|

|

2,687 |

|

|

|

4,910 |

|

| Net income

attributable to Shoals Technologies Group, Inc. |

$ |

18,924 |

|

|

$ |

4,402 |

|

|

$ |

33,220 |

|

|

$ |

7,042 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Earnings per share of

Class A common stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.11 |

|

|

$ |

0.04 |

|

|

$ |

0.21 |

|

|

$ |

0.06 |

|

|

Diluted |

$ |

0.11 |

|

|

$ |

0.04 |

|

|

$ |

0.21 |

|

|

$ |

0.06 |

|

| Weighted average

shares of Class A common stock outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

169,887 |

|

|

|

112,489 |

|

|

|

158,213 |

|

|

|

112,350 |

|

|

Diluted |

|

170,241 |

|

|

|

112,616 |

|

|

|

158,694 |

|

|

|

112,428 |

|

Shoals Technologies Group,

Inc.Condensed Consolidated Statements of Cash

Flows (Unaudited)(in thousands)

| |

|

| |

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

| Cash Flows from

Operating Activities |

|

|

|

|

Net income |

$ |

35,907 |

|

|

$ |

11,952 |

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

5,092 |

|

|

|

5,402 |

|

|

Amortization/write off of deferred financing costs |

|

692 |

|

|

|

684 |

|

|

Equity-based compensation |

|

11,968 |

|

|

|

7,896 |

|

|

Provision for credit losses |

|

296 |

|

|

|

— |

|

|

Provision for obsolete or slow-moving inventory |

|

3,140 |

|

|

|

443 |

|

|

Provision for warranty expense |

|

9,386 |

|

|

|

— |

|

|

Deferred taxes |

|

8,953 |

|

|

|

2,847 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(46,820 |

) |

|

|

(26,259 |

) |

|

Unbilled receivables |

|

(4,951 |

) |

|

|

(1,047 |

) |

|

Inventory |

|

1,402 |

|

|

|

(27,404 |

) |

|

Other assets |

|

(2,064 |

) |

|

|

(2,059 |

) |

|

Accounts payable |

|

7,014 |

|

|

|

4,060 |

|

|

Accrued expenses and other |

|

(220 |

) |

|

|

4,713 |

|

|

Deferred revenue |

|

8,039 |

|

|

|

12,029 |

|

| Net Cash Provided by

(Used in) Operating Activities |

|

37,834 |

|

|

|

(6,743 |

) |

| Cash Flows from

Investing Activities |

|

|

|

|

Purchases of property, plant and equipment |

|

(4,377 |

) |

|

|

(2,149 |

) |

| Net Cash Used in

Investing Activities |

|

(4,377 |

) |

|

|

(2,149 |

) |

| Cash Flows from

Financing Activities |

|

|

|

|

Distributions to non-controlling interests |

|

(2,628 |

) |

|

|

(4,566 |

) |

|

Employee withholding taxes related to net settled equity

awards |

|

(3,576 |

) |

|

|

(1,297 |

) |

|

Payments on term loan facility |

|

(1,000 |

) |

|

|

(1,000 |

) |

|

Proceeds from revolving credit facility |

|

5,000 |

|

|

|

38,000 |

|

|

Repayments of revolving credit facility |

|

(33,000 |

) |

|

|

(8,000 |

) |

|

Other |

|

(1,159 |

) |

|

|

— |

|

| Net Cash Provided by

(Used in) Financing Activities |

|

(36,363 |

) |

|

|

23,137 |

|

| Net Increase

(Decrease) in Cash, Cash Equivalents and Restricted

Cash |

|

(2,906 |

) |

|

|

14,245 |

|

| Cash, Cash Equivalents

and Restricted Cash—Beginning of Period |

|

8,766 |

|

|

|

9,557 |

|

| Cash, Cash Equivalents

and Restricted Cash—End of Period |

$ |

5,860 |

|

|

$ |

23,802 |

|

Shoals Technologies Group,

Inc.Adjusted EBITDA, Adjusted Net Income and

Adjusted Diluted Earnings per Share (“EPS”)

(Unaudited)

Reconciliation of Net Income to Adjusted EBITDA

(in thousands):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Net income |

$ |

18,924 |

|

$ |

7,303 |

|

$ |

35,907 |

|

$ |

11,952 |

| Interest expense, net |

|

6,505 |

|

|

4,170 |

|

|

12,501 |

|

|

8,006 |

| Income tax expense |

|

6,207 |

|

|

1,511 |

|

|

9,328 |

|

|

3,033 |

| Depreciation expense |

|

565 |

|

|

470 |

|

|

1,049 |

|

|

893 |

| Amortization of

intangibles |

|

2,021 |

|

|

2,238 |

|

|

4,043 |

|

|

4,509 |

| Equity-based compensation |

|

4,445 |

|

|

4,063 |

|

|

11,968 |

|

|

7,896 |

| Acquisition-related

expenses |

|

— |

|

|

12 |

|

|

— |

|

|

12 |

| Adjusted EBITDA |

$ |

38,667 |

|

$ |

19,767 |

|

$ |

74,796 |

|

$ |

36,301 |

Reconciliation of Net Income Attributable to

Shoals Technologies Group, Inc. to Adjusted Net Income (in

thousands):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net income attributable to

Shoals Technologies Group, Inc. |

$ |

18,924 |

|

|

$ |

4,402 |

|

|

$ |

33,220 |

|

|

$ |

7,042 |

|

| Net income impact from assumed

exchange of Class B common stock to Class A common stock (a) |

|

— |

|

|

|

2,901 |

|

|

|

2,687 |

|

|

|

4,910 |

|

| Adjustment to the provision

for income tax(b) |

|

— |

|

|

|

(686 |

) |

|

|

(653 |

) |

|

|

(1,159 |

) |

| Tax effected net income |

|

18,924 |

|

|

|

6,617 |

|

|

|

35,254 |

|

— |

|

10,793 |

|

| Amortization of

intangibles |

|

2,021 |

|

|

|

2,238 |

|

|

|

4,043 |

|

|

|

4,509 |

|

| Amortization of deferred

financing costs |

|

342 |

|

|

|

408 |

|

|

|

692 |

|

|

|

684 |

|

| Equity-based compensation |

|

4,445 |

|

|

|

4,063 |

|

|

|

11,968 |

|

|

|

7,896 |

|

| Acquisition-related

expenses |

|

— |

|

|

|

12 |

|

|

|

— |

|

|

|

12 |

|

| Tax impact of adjustments

(c) |

|

(1,688 |

) |

|

|

(1,588 |

) |

|

|

(4,092 |

) |

|

|

(3,093 |

) |

| Adjusted Net Income |

$ |

24,044 |

|

|

$ |

11,750 |

|

|

$ |

47,865 |

|

|

$ |

20,801 |

|

|

(a) |

Reflects net income to Class A common stock from assumed exchange

of corresponding shares of our Class B common stock held by the

Founder and management. There were no shares of Class B common

stock outstanding during the three months ended June 30, 2023. |

| |

|

| (b) |

Shoals Technologies Group, Inc. is subject to U.S. Federal income

taxes, in addition to state and local taxes with respect to its

allocable share of any net taxable income of Shoals Parent LLC. The

adjustment to the provision for income tax reflects the effective

tax rates below, assuming Shoals Technologies Group, Inc. owned

100% of the units in Shoals Parent LLC for all periods

presented. |

| |

|

Shoals Technologies Group,

Inc.Adjusted EBITDA, Adjusted Net Income and

Adjusted Diluted Earnings per Share (“EPS”)

(Unaudited)

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Statutory U.S. Federal income tax rate |

21.0 |

% |

|

21.0 |

% |

|

21.0 |

% |

|

21.0 |

% |

| Permanent adjustments |

0.5 |

% |

|

0.1 |

% |

|

0.4 |

% |

|

0.1 |

% |

| State and local taxes (net of

federal benefit) |

3.3 |

% |

|

2.5 |

% |

|

3.1 |

% |

|

2.5 |

% |

| Effective income tax rate for

Adjusted Net Income |

24.8 |

% |

|

23.6 |

% |

|

24.5 |

% |

|

23.6 |

% |

|

(c) |

Represents the estimated tax impact of all Adjusted Net Income

add-backs, excluding those which represent permanent differences

between book versus tax. |

Reconciliation of Diluted Weighted Average

Shares Outstanding to Adjusted Diluted Weighted Average Shares

Outstanding (in thousands, except per share):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Diluted weighted average

shares of Class A common stock outstanding, excluding Class B

common stock |

|

170,241 |

|

|

112,616 |

|

|

158,694 |

|

|

112,428 |

| Assumed exchange of Class B

common stock to Class A common stock |

|

— |

|

|

54,635 |

|

|

11,491 |

|

|

54,585 |

| Adjusted diluted weighted

average shares outstanding |

|

170,241 |

|

|

167,251 |

|

|

170,185 |

|

|

167,013 |

| |

|

|

|

|

|

|

|

| Adjusted Net Income |

$ |

24,044 |

|

$ |

11,750 |

|

$ |

47,865 |

|

$ |

20,801 |

| Adjusted Diluted EPS |

$ |

0.14 |

|

$ |

0.07 |

|

$ |

0.28 |

|

$ |

0.12 |

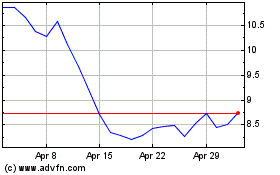

Shoals Technologies (NASDAQ:SHLS)

Historical Stock Chart

From Apr 2024 to May 2024

Shoals Technologies (NASDAQ:SHLS)

Historical Stock Chart

From May 2023 to May 2024