RumbleOn Announces Subscription Price for its $100.0 Million Rights Offering

November 09 2023 - 8:00AM

Business Wire

RumbleOn, Inc. (NASDAQ: RMBL) (the “Company” or “RumbleOn”)

announced today that it has set a subscription price of $5.50 per

share (the “Subscription Price”) of the Company’s Class B common

stock to be paid upon exercise of the Subscription Rights (as

defined below) to be distributed to the holders of its Class A

common stock and Class B common stock (together, the “Eligible

Stockholders”) pursuant to its previously announced $100.0 million

rights offering (the “Rights Offering”). The Subscription Price was

determined by a special committee of the Company’s Board of

Directors, with the advice and input of senior management of the

Company and D.A. Davidson & Co., as financial advisor to the

special committee.

Under the terms of the Rights Offering, the Company expects to

distribute non-transferable subscription rights to purchase shares

of Class B common stock (the “Subscription Rights”) to the Eligible

Stockholders as of November 13, 2023 (the “Record Date”). In

particular, the Company will distribute one Subscription Right for

each share of the Company’s Class A common stock and Class B common

stock held by an Eligible Stockholder on the Record Date. Each

Subscription Right will entitle such Eligible Stockholder to

purchase 1.078444 shares of the Company’s Class B common stock at

the Subscription Price. The subscription period for the Rights

Offering is expected to commence on or about November 13, 2023 and

end on November 28, 2023, unless extended. The Rights Offering is

fully backstopped pursuant to a standby purchase agreement between

the Company and certain of its stockholders.

Other Important Information

The Registration Statement relating to the Rights Offering has

been filed with the U.S. Securities and Exchange Commission

(“SEC”), but has not yet become effective. The Company intends to

make the Rights Offering pursuant to such Registration Statement

and a final prospectus to be filed with the SEC as soon as

practicable on or after the Record Date. The securities may not be

sold nor may offers to buy be accepted prior to the time the

Registration Statement becomes effective.

The Company reserves the right to cancel or terminate the Rights

Offering at any time. This press release does not constitute an

offer to sell or the solicitation of an offer to buy any

Subscription Rights or any other securities to be issued in the

Rights Offering or any related transactions, nor shall there be any

offer, solicitation or sale of Subscription Rights or any other

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Copies of the prospectus, when it becomes available, will be

mailed to all Eligible Stockholders as of the Record Date and may

also be obtained free of charge at the website maintained by the

SEC at www.sec.gov or by contacting the information agent for the

Rights Offering, Broadridge Corporate Issuer Solutions, LLC, at

(888)789-8409 (toll-free).

About RumbleOn

RumbleOn is the largest powersports retailer in North America,

offering a wide selection of new and used motorcycles, all-terrain

vehicles, utility terrain vehicles, personal watercraft and other

powersports products, including parts, apparel, accessories and

aftermarket products from a wide range of manufacturers. We operate

more than 55 retail locations, each equipped with full service

departments, as well as five regional fulfillment centers. Our

retail locations are primarily located in the Sun Belt of the

United States. To learn more please visit us online at https://www.rumbleon.com/.

Cautionary Note on Forward-Looking Statements

The Company’s press release contains statements that constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, those regarding the

Company’s plans to launch a Rights Offering, the transactions

contemplated by the standby purchase agreement, the anticipated

final terms, timing and completion of the Rights Offering and

backstop private placement, and the use of proceeds from the Rights

Offering and backstop private placement. Forward-looking statements

generally can be identified by words such as “anticipates,”

“believes,” “continues,” “could,” “estimates,” “expects,”

“intends,” “hopes,” “may,” “plan,” “possible,” “potential,”

“predicts,” “projects,” “should,” “targets,” “would” and similar

expressions, although not all forward-looking statements contain

these identifying words. Such statements are subject to numerous

important factors, risks and uncertainties that may cause actual

events or results to differ materially from current expectations

and beliefs, including, but not limited to, risks and uncertainties

related to: whether the Rights Offering and backstop private

placement contemplated by the standby purchase agreement will be

completed in a timely manner, or at all; the risk that all of the

closing conditions under the standby purchase agreement will not be

satisfied; the occurrence of any event, change or other

circumstance that could cause the Company not to proceed with the

Rights Offering or give rise to the termination of the standby

purchase agreement; the determination of the final terms of the

Rights Offering and backstop private placement; the satisfaction of

customary closing conditions related to the Rights Offering; risks

related to the diversion of management’s attention from RumbleOn’s

ongoing business operations; the impact of general economic,

industry or political conditions in the United States or

internationally, as well as the other risk factors set forth under

the caption “Risk Factors” in the Registration Statement, as

amended, and in RumbleOn’s Annual Report for the year ended

December 31, 2022 and Quarterly Reports on Form 10-Q for the

quarters ended March 30, 2023, June 30, 2023, and September 30,

2023 and in any other subsequent filings made with the SEC by

RumbleOn. There can be no assurance that RumbleOn will be able to

complete the Rights Offering and backstop private placement on the

anticipated terms, or at all. Any forward-looking statements

contained in this press release speak only as of the date hereof,

and RumbleOn specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109212716/en/

Investor Inquiries: Will

Newell investors@rumbleon.com

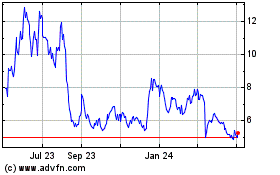

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

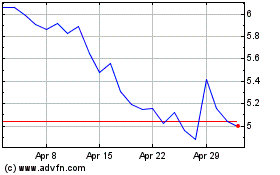

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025