0001830081

false

0001830081

2023-09-05

2023-09-05

0001830081

RUM:ClassCommonStockParValue0.0001PerShareMember

2023-09-05

2023-09-05

0001830081

RUM:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-09-05

2023-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

September 5, 2023

Rumble Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40079 |

|

85-1087461 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

444 Gulf of Mexico Dr

Longboat Key, FL 34228

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (941) 210-0196

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

RUM |

|

The Nasdaq Global Market |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

RUMBW |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On September 5, 2023, Rumble Inc. issued a press

release. A copy of the press release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Rumble Inc. |

| |

|

| Date: September 5, 2023 |

By: |

/s/

Michael Ellis |

| |

Name: |

Michael Ellis |

| |

Title: |

General Counsel and Corporate Secretary |

-2-

Exhibit 99.1

Chris Pavlovski, Rumble’s Founder, CEO

and Largest Shareholder, Comments on Upcoming Lock-Up Expiration

LONGBOAT KEY, Fla., Sept. 05, 2023 (GLOBE

NEWSWIRE) -- Rumble Inc. (Nasdaq: RUM), the popular video-sharing platform, today announced that the company’s Founder and CEO

Chris Pavlovski plans to continue standing firmly behind the company and its mission and will therefore not sell any of his Rumble

shares when the lock-up agreements that were part of the company’s business combination with CF Acquisition Corp. VI expire on

September 16, 2023.

“When the lock-up is lifted, it will become

evident who truly stands for free speech and who has other motivations. I, for one, remain deeply

and passionately committed to our mission to protect a free and open internet,” commented Mr. Pavlovski. “I

did not take Rumble public just to sell my shares as soon as I can, and therefore have no plans to sell.”

As presented in Rumble’s proxy statement

related to its most recent annual shareholder meeting, as of April 21, 2023, Mr. Pavlovski was the beneficial owner of 140,182,173 shares

of Rumble’s Class A Common Stock, all of which are subject to lock-up or vesting requirements, representing 44.6% beneficial ownership

of Class A Common Stock.

About Rumble

Rumble is a high-growth neutral video platform

that is creating the rails and independent infrastructure designed to be immune to cancel culture. Rumble’s mission is to restore

the Internet to its roots by making it free and open once again. For more information, visit corp.rumble.com.

Forward-Looking Statements

Certain statements in this press release and the

associated conference call constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation

Reform Act of 1995. Statements contained in this press release that are not historical facts are forward-looking statements and include,

for example, results of operations, financial condition and cash flows (including revenues, operating expenses, and net income (loss));

our ability to meet working capital needs and cash requirements over the next 12 months; statements by our CEO regarding his intentions

with respect to his company shares; and our expectations regarding future results and certain key performance indicators. Certain of these

forward-looking statements can be identified by using words such as “anticipates,” “believes,” “intends,”

“estimates,” “targets,” “expects,” “endeavors,” “forecasts,” “could,”

“will,” “may,” “future,” “likely,” “on track to deliver,” “accelerate,”

“looks forward to,” “begins to focus on,” “plans,” “projects,” “assumes,”

“should” or other similar expressions. Such forward-looking statements involve known and unknown risks and uncertainties,

and our actual results could differ materially from future results expressed or implied in these forward-looking statements. The forward-looking

statements included in this release are based on our current beliefs and expectations of our management as of the date of this release.

These statements are not guarantees or indicative of future performance. Important assumptions and other important factors that could

cause actual results to differ materially from those forward- looking statements include, but are not limited to, the possibility that

we may be adversely impacted by economic, business, and/or competitive factors; our limited operating history making it difficult to evaluate

our business and prospects; our inability to effectively manage future growth and achieve operational efficiencies; our recent and rapid

growth not being indicative of future performance; our inability to grow or maintain our active user base; our inability to achieve or

maintain profitability; our failure to comply with applicable privacy laws; occurrence of a cyber incident resulting in information theft,

data corruption, operational disruption and/or financial loss; potential liability for hosting a variety of tortious or unlawful materials

uploaded by third parties; negative publicity for removing, or declining to remove, certain content, regardless of whether such content

violated any law; impediment of access to our content and services on the Internet; significant market competition that we face; changes

to our existing content and services resulting in failure to attract traffic and advertisers or to generate revenue; our dependence on

third party vendors; our inability to realize the expected benefits of financial incentives that we offer to our content creators; potential

diversion of management’s attention and consumption of resources as a result of acquisitions of other companies and success in integrating

and otherwise achieving the benefits of recent and potential acquisitions; failure to maintain adequate operational and financial resources

or raise additional capital or generate sufficient cash flows; adverse effect on our business by compliance obligations imposed by new

privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada; regulations regarding paid endorsements

by content creators; and those additional risks, uncertainties and factors described in more detail under the caption “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Report on Form 10-Q for the quarter ended June 30, 2023,

and in our other filings with the Securities and Exchange Commission. We do not intend, and, except as required by law, we undertake no

obligation, to update any of our forward-looking statements after the issuance of this release to reflect any future events or circumstances.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Rumble Social Media

Investors and others should note that we announce

material financial and operational information to our investors using our investor relations website (investors.rumble.com), press releases,

SEC filings and public conference calls and webcasts. We also intend to use certain social media accounts as a means of disclosing information

about us and our services and for complying with our disclosure obligations under Regulation FD: the @rumblevideo X (formerly Twitter)

account (twitter.com/rumblevideo), the @rumble TRUTH Social account (truthsocial.com/@rumble), the @chrispavlovski X (formerly Twitter)

account (twitter.com/chrispavlovski), and the @chris TRUTH Social account (truthsocial.com/@chris), which Chris Pavlovski, our Chairman

and Chief Executive Officer, also uses as a means for personal communications and observations. The information we post through these

social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following

our press releases, SEC filings and public conference calls and webcasts. The social media channels that we intend to use as a means of

disclosing the information described above may be updated from time to time as listed on our investor relations website.

For investor inquiries, please contact:

Shannon Devine

MZ Group, MZ North America

203-741-8811

investors@rumble.com

Source: Rumble Inc.

v3.23.2

Cover

|

Sep. 05, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 05, 2023

|

| Entity File Number |

001-40079

|

| Entity Registrant Name |

Rumble Inc.

|

| Entity Central Index Key |

0001830081

|

| Entity Tax Identification Number |

85-1087461

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

444 Gulf of Mexico Dr

|

| Entity Address, City or Town |

Longboat Key

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

34228

|

| City Area Code |

941

|

| Local Phone Number |

210-0196

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

RUM

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

RUMBW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RUM_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RUM_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

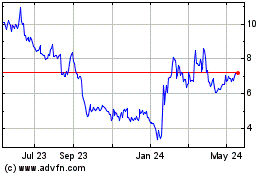

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

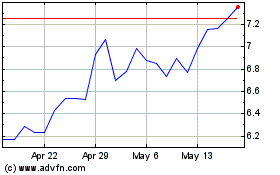

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jul 2023 to Jul 2024