ReWalk Robotics Announces $32.5 Million Registered Direct Offering Priced At Premium to Market

September 27 2021 - 8:00AM

ReWalk Robotics Ltd. (Nasdaq: RWLK) (“ReWalk” or the “Company”)

today announced that it has entered into definitive agreements with

several institutional investors providing for the issuance of

16,013,518 of the Company’s ordinary shares (or ordinary share

equivalents in lieu thereof), at an effective purchase price of

$2.035, in a registered direct offering priced at-the-market under

Nasdaq Rules. ReWalk has also agreed to issue to the investors

unregistered warrants to purchase up to an aggregate amount of

8,006,759 ordinary shares in a concurrent private

placement. The offering is expected to close on or about

September 29, 2021, subject to satisfaction of customary closing

conditions.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

The warrants will have a term of five and

one-half years, be exercisable immediately following the issuance

date and have an exercise price of $2.00 per ordinary share.

The gross proceeds from the offering are

expected to be approximately $32.5 million. The Company intends to

use the net proceeds from the offering for the following purposes:

(i) sales, marketing and reimbursement expenses related to market

development activities of the Company’s ReStore and Personal 6.0

devices, broadening third-party payor and CMS coverage for the

ReWalk Personal device and commercializing its new product lines

added through distribution agreements; (ii) research and

development of the Company’s lightweight exo-suit technology for

potential home personal health utilization for multiple indications

and future generation designs for ReWalk’s spinal cord injury

device; (iii) routine product updates; and (iv) general corporate

purposes, including working capital needs and potential

acquisitions of businesses.

The Company’s ordinary shares (or ordinary share

equivalents in lieu thereof) (but not the warrants or the ordinary

shares underlying the warrants) are being offered by ReWalk in a

registered direct offering pursuant to a “shelf” registration

statement on Form S-3 (File No. 333-231305) previously filed with

the Securities and Exchange Commission (the “SEC”) on May 9,

2019 and declared effective by the SEC on May 23, 2019.

Such ordinary shares may be offered only by means of a prospectus,

including a prospectus supplement, forming a part of the effective

registration statement. Once filed with the SEC, electronic copies

of the final prospectus supplement and accompanying prospectus

relating to the registered direct offering may be obtained, when

available, on the SEC’s website at http://www.sec.gov or

by contacting H.C. Wainwright & Co., LLC at 430 Park

Avenue, 3rd Floor, New York, NY 10022, by phone at (212)

856-5711 or email at placements@hcwco.com.

The warrants and the ordinary shares issuable

upon exercise of the warrants (as described above) are being

offered in a private placement pursuant to the exemptions provided

in Section 4(a)(2) under the Securities Act of 1933, as amended

(the “Act”), and Rule 506(b) promulgated thereunder. Neither these

warrants nor the ordinary shares issuable upon exercise of the

warrants are being registered under the Act, and may not be offered

or sold in the United States absent registration with the

SEC or an applicable exemption from such registration

requirements. This press release shall not constitute an

offer to sell, or a solicitation of an offer to buy, any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

About ReWalk Robotics Ltd.

ReWalk Robotics Ltd. develops, manufactures and

markets wearable robotic exoskeletons for individuals with lower

limb disabilities as a result of spinal cord injury or stroke.

ReWalk’s mission is to fundamentally change the quality of life for

individuals with lower limb disability through the creation and

development of market leading robotic technologies. Founded in

2001, ReWalk has headquarters in the U.S., Israel and Germany. For

more information on the ReWalk systems, please visit

www.rewalk.com.

ReWalk® is a registered trademark of ReWalk Robotics Ltd. in

Israel and the United States.

ReStore® is a registered trademark of ReWalk Robotics Ltd. in

the United States, Europe and the United Kingdom.

Forward-Looking Statements

In addition to historical information, this

press release contains forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995, Section 27A of the U.S. Securities Act of 1933, and Section

21E of the U.S. Securities Exchange Act of 1934. Such

forward-looking statements may include projections regarding

ReWalk's future performance and other statements that are not

statements of historical fact and, in some cases, may be identified

by words like "anticipate," "assume," "believe," "continue,"

"could," "estimate," "expect," "intend," "may," "plan,"

"potential," "predict," "project," "future," "will," "should,"

"would," "seek" and similar terms or phrases. The forward-looking

statements contained in this press release are based on

management's current expectations, which are subject to

uncertainty, risks and changes in circumstances that are difficult

to predict and many of which are outside of ReWalk's control.

Important factors that could cause ReWalk's actual results to

differ materially from those indicated in the forward-looking

statements include, among others: market and other conditions, the

completion of the offering, the satisfaction of customary closing

conditions related to the offering, use of proceeds, the adverse

effect that the COVID-19 pandemic has had and may continue to have

on the Company's business and results of operations; ReWalk's

ability to have sufficient funds to meet certain future capital

requirements, which could impair the Company's efforts to develop

and commercialize existing and new products; ReWalk's ability to

maintain compliance with the continued listing requirements of the

Nasdaq Capital Market and the risk that its ordinary shares will be

delisted if it cannot do so; ReWalk's ability to maintain and grow

its reputation and the market acceptance of its products; ReWalk's

ability to achieve reimbursement from third-party payors including

CMS for its products; ReWalk's limited operating history and its

ability to leverage its sales, marketing and training

infrastructure; ReWalk's expectations as to its clinical research

program and clinical results; ReWalk's expectations regarding

future growth, including its ability to increase sales in its

existing geographic markets and expand to new markets; ReWalk's

ability to obtain certain components of its products from

third-party suppliers and its continued access to its product

manufacturers; ReWalk's ability to improve its products and develop

new products; ReWalk's compliance with medical device reporting

regulations to report adverse events involving the Company's

products, which could result in voluntary corrective actions or

enforcement actions such as mandatory recalls, and the potential

impact of such adverse events on ReWalk's ability to market and

sell its products; ReWalk's ability to gain and maintain regulatory

approvals; ReWalk's expectations as to the results of, and the Food

and Drug Administration's potential regulatory developments with

respect to its mandatory 522 postmarket surveillance study;

ReWalk's ability to maintain adequate protection of its

intellectual property and to avoid violation of the intellectual

property rights of others; the risk of a cybersecurity attack or

breach of the Company's IT systems significantly disrupting its

business operations; ReWalk's ability to establish a pathway to

commercialize its products in China; the impact of substantial

sales of the Company's shares by certain shareholders on the market

price of the Company's ordinary shares; ReWalk's ability to use

effectively the proceeds of its offerings of securities; the risk

of substantial dilution resulting from the periodic issuances of

ReWalk's ordinary shares; the impact of the market price of the

Company's ordinary shares on the determination of whether it is a

passive foreign investment company; the market and other

conditions; and other factors discussed under the heading "Risk

Factors" in ReWalk's annual report on Form 10-K for the year

ended December 31, 2020 filed with the SEC and other

documents subsequently filed with or furnished to the SEC. Any

forward-looking statement made in this press release speaks only as

of the date hereof. Factors or events that could cause ReWalk's

actual results to differ from the statements contained herein may

emerge from time to time, and it is not possible for ReWalk to

predict all of them. Except as required by law, ReWalk undertakes

no obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Investor Contact:Ori GonChief Financial Officer ReWalk

Robotics Ltd.T:

+972-4-9590123 E: investorrelations@rewalk.com

ReWalk Robotics (NASDAQ:RWLK)

Historical Stock Chart

From Apr 2024 to May 2024

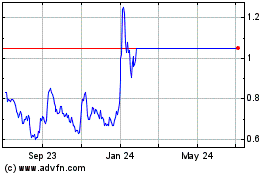

ReWalk Robotics (NASDAQ:RWLK)

Historical Stock Chart

From May 2023 to May 2024