Bear of the Day: Ruby Tuesday (RT) - Bear of the Day

October 25 2013 - 6:30AM

Zacks

Ruby Tuesday's (RT) turnaround is going to take a while

longer. This Zacks Rank #5 (Strong Sell) struggled in the recent

quarter and is now expected to lose money in fiscal 2014.

Ruby Tuesday operates 778 company-owned or

franchise Ruby Tuesday brand restaurants in 45 states, DC, Guam and

11 other countries.

Big Miss in the Fiscal First Quarter

On Oct 9, Ruby Tuesday reported its fiscal first

quarter 2014 earnings. It was coming off of a big miss in the prior

quarter and is in the midst of a turnaround.

The turnaround appears to be postponed. Ruby

Tuesday missed the Zacks Consensus Estimate by 21 cents. Earnings

were -$0.26 compared to the consensus of -$0.05.

Same-restaurant sales fell 11.4% at company-owned

restaurants and 8.4% at franchise restaurants. This was below the

company's expectations.

The company said that the quarter was challenging

due to the failure of the economy to improve.

It is doing a core menu transformation to spice

things up and has already added pretzel burgers and flatbreads.

Fiscal 2014 will be Challenging

Ruby Tuesday has stopped giving forward earnings

guidance while it conducts this turnaround but it does anticipate

same-restaurant sales to be down high single digits in the second

quarter with sequential improvement in the third and fourth

quarter.

Same-restaurant sales are expected to be positive

by the fourth quarter, however.

Earnings Estimates Slide

With the big miss and the lackluster guidance, the

analysts lowered both fiscal 2014 and fiscal 2015 estimates.

Zacks fiscal 2014 estimate plunged to -$0.48 from

$0.14 just 90 days before. It is an earnings decline of 308% from

fiscal 2013.

While the loss is expected to be less in fiscal

2015, the analysts still see -$0.07 in 2015.

Shares At 1-Year Lows

Investors sold off the shares on the earnings miss.

Shares have hit a 1-year low.

The Zacks Rank is a short-term recommendation. Ruby

Tuesday has a longer term turnaround plan. Still, with sales

expected to be weak over the next few quarters, the turnaround in

the shares is probably not going to be imminent.

In the casual dining sector, investors might want

to consider Red Robin Gourmet Burger (RRGB), a Zacks Rank #1

(Strong Buy), or Bob Evans Farms Inc. (BOBE), a Zacks Rank

#2 (Buy), as alternatives.

Want More of Our Best Recommendations?

Zacks' Executive VP, Steve Reitmeister, knows when key trades

are about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

Tracey Ryniec is the Value Stock Strategist for Zacks.com.

She is also the Editor of the Turnaround Trader and Value Investor

services. You can follow her on twitter at @TraceyRyniec.

BOB EVANS FARMS (BOBE): Free Stock Analysis Report

RED ROBIN GOURM (RRGB): Free Stock Analysis Report

RUBY TUESDAY (RT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

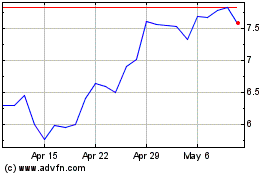

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jun 2024 to Jul 2024

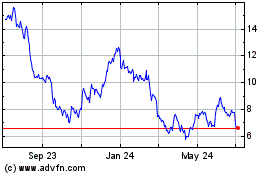

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jul 2023 to Jul 2024