Red Robin Gourmet Burgers, Inc., (NASDAQ: RRGB), a casual dining

restaurant chain focused on serving an innovative selection of

high-quality gourmet burgers in a family-friendly atmosphere, today

reported financial results for the 12 weeks ended July 11,

2010.

Financial and Operational Results

Results for the 12 weeks ended July 11, 2010, compared to the 12

weeks ended July 12, 2009, are as follows:

- Restaurant revenue of $198.0

million was unchanged from the prior year.

- Company-owned comparable

restaurant sales decreased 1.2% and guest counts increased

0.9%.

- Restaurant-level operating

profit decreased 7.0% to $36.2 million.

- Selling, general and

administrative expenses included a $3.3 million investment in the

Company’s TV media campaign, which contributed to the improvement

in guest counts during the quarter.

- GAAP diluted earnings per share

were $0.28 vs. $0.41 in the fiscal second quarter a year ago.

- One new company-owned Red Robin®

restaurant and two franchised restaurants opened during the fiscal

second quarter 2010.

As of the end of the fiscal second quarter 2010, there were 309

company-owned and 134 franchised Red Robin® restaurants.

“We are encouraged by the strengthening of our same store sales

and the positive impact that our limited time offer promotions and

TV media support are having on our brand awareness and Guest

traffic,” said Dennis Mullen, Red Robin Gourmet Burgers, Inc.’s

chief executive officer. “Our business trends are benefiting from

our Team Members’ hard work and commitment to making connections

with our guests and our focus on Red Robin quality, variety and

value.”

Fiscal Second Quarter 2010 Results

Comparable restaurant sales decreased 1.2% for company-owned

restaurants in the fiscal second quarter of 2010 compared to an

11.5% decrease in the fiscal second quarter of 2009. Results in the

quarter were driven by a 0.9% increase in guest counts and a 2.1%

decrease in the average guest check, which included the impact of

limited time offer (LTO) price promotions in the quarter. Fiscal

second quarter 2010 comparable restaurant sales also reflected a

sequential improvement from the Company’s comparable restaurant

sales decrease of 2.3% reported in the fiscal first quarter of

2010, the decrease of 10.5% reported in the fiscal fourth quarter

of 2009 and the decrease of 14.9% reported in the fiscal third

quarter of 2009.

Average weekly comparable sales from the 290 company-owned

comparable restaurants were $54,549 in the fiscal second quarter of

2010, compared to $56,335 for the 245 company-owned comparable

restaurants in the fiscal second quarter of 2009. Average weekly

sales for the 19 non-comparable company-owned restaurants were

$58,449 in the fiscal second quarter of 2010, compared to $56,053

for the 44 non-comparable restaurants in the fiscal second quarter

a year ago. For all company-owned restaurants, average weekly sales

were $54,786 from the 3,705 operating weeks in the fiscal second

quarter of 2010 compared to $55,973 from the 3,619 operating weeks

in the fiscal second quarter of 2009.

In the fiscal second quarter of 2010, the Company’s results were

negatively impacted by continued lower restaurant sales in

California and Arizona, which have been more heavily impacted by

macroeconomic factors. Excluding the impact from the Company’s 72

comparable restaurants in these markets, comparable restaurant

sales would have been about 1.5% higher or up approximately 0.3%

compared to the fiscal second quarter of 2009. The Company’s

comparable guest counts excluding the negative 1.6% impact from its

restaurants in California and Arizona would have been a positive

2.5% compared to the fiscal second quarter of 2009. The 72

comparable restaurants in California and Arizona represented 25% of

the Company’s total company-owned comparable restaurants in the

fiscal second quarter of 2010.

Total company revenues, which include company-owned restaurant

sales, franchise royalties and fees and other revenue, increased

slightly to $201.3 million in the fiscal second quarter of 2010,

from $201.1 million in the fiscal second quarter of 2009. Franchise

royalties and fees increased to $3.1 million or 1.4% in the fiscal

second quarter of 2010 compared to the same period a year ago.

For the fiscal second quarter of 2010, the Company’s total U.S.

franchise restaurant sales of $70.0 million increased slightly from

$69.2 million in the prior year period. Comparable sales in the

fiscal second quarter of 2010 for franchise restaurants in the U.S.

decreased 2.0% and for franchise restaurants in Canada increased

0.8% from the fiscal second quarter of 2009. Average weekly

comparable sales for the U.S. franchised restaurants were $50,622

from the 109 comparable restaurants in the fiscal second quarter of

2010, compared to $51,970 from the 100 comparable restaurants in

the fiscal second quarter of 2009. Average weekly sales in the

fiscal second quarter of 2010 for the Company’s 18 comparable

franchise restaurants in Canada were C$54,380 versus C$52,977 in

the same period last year. Canadian results are in Canadian

dollars.

Selling, general and administrative expenses were $20.0 million

in the fiscal second quarter of 2010 and $18.5 million in the

fiscal second quarter of 2009, which were 9.9% and 9.2% of total

revenue, respectively. Included in the fiscal second quarter of

2010 was a $3.3 million investment in the Company’s television

media campaign compared to $1.2 million in the fiscal second

quarter of 2009, as well as board of directors and

governance-related expenses, offset by lower performance-based

bonus expense. Beginning in the fiscal second quarter of 2010,

franchisees contributed an additional 1.25% of their revenue to the

national cable television advertising fund.

Net interest expense was $1.3 million in the fiscal second

quarter of 2010 and $1.6 million in the fiscal second quarter of

2009.

Net income for the fiscal second quarter of 2010 was $4.3

million or $0.28 per diluted share, compared to net income of $6.4

million, or $0.41 per diluted share, in the fiscal second quarter

of 2009.

For the fiscal second quarter of 2010, the Company’s effective

tax rate was 9.1% compared to an effective tax rate of 23.2% in the

fiscal second quarter of 2009. The decrease is primarily due to

more favorable general business and tax credits, primarily the FICA

Tip Tax Credit, which as a percent of current year income before

tax did not change at the same rate as the change in taxable

income. The Company anticipates that the effective tax rate for the

full fiscal year 2010 will be approximately 13.6%.

Schedule I of this earnings release defines restaurant-level

operating profit and reconciles this metric to income from

operations and net income for all periods presented. The Company’s

restaurant-level operating profit metric is designed to afford

management and investors with a basis for considering and comparing

restaurant performance. It is not calculated in conformity with

generally accepted accounting principles (“GAAP”). It is intended

to supplement, rather than replace GAAP results. Restaurant-level

operating profit is useful to management and to the Company’s

investors because it is widely regarded in the restaurant industry

as a useful metric by which to evaluate restaurant-level operating

efficiency and performance.

Balance Sheet and Liquidity

On July 11, 2010, the Company held $11.9 million in cash and

cash equivalents and had a total outstanding debt balance of $163.9

million, including $108.7 million of borrowings under its $150

million term loan, $46.9 million of borrowings under its $150

million revolving credit facility and $8.3 million outstanding for

capital leases. The Company has also issued $6.2 million of

outstanding letters of credit under its revolving credit facility.

In the fiscal second quarter of 2010, the Company paid down $8.3

million in debt, and since the end of the fiscal second quarter

2010, the Company has made additional debt repayments of $3.9

million on its revolving credit facility.

The Company is subject to a number of customary covenants under

its credit agreement, including limitations on additional

borrowings, acquisitions, dividend payments, and requirements to

maintain certain financial ratios. As of July 11, 2010, the Company

was in compliance with all of its debt covenants, and the Company

expects to remain in full compliance.

Outlook

The Company’s fiscal third quarter of 2010 is a 12-week quarter.

One new company-owned restaurant opened early in the fiscal third

quarter and seven new company-owned restaurants are currently under

construction. Three new franchised restaurants are currently under

construction. During fiscal year 2010, the Company expects to open

11 new company-owned restaurants and franchisees are expected to

open four to five new restaurants.

For the fiscal year 2010, which is a 52-week year, the Company

expects revenues of $866 million to $873 million and net income of

$0.90 to $1.10 per diluted share. These projected results are based

upon certain assumptions, including expected full fiscal year 2010

comparable restaurant sales of down 0.5% to up 0.5% compared to the

fiscal year 2009. Through August 8, 2010, the first four weeks of

the Company’s 12-week fiscal third quarter of 2010, company-owned

comparable restaurant sales increased 1.4% and guest counts

increased 4.1% from the prior year period, compared to a

year-over-year company-owned comparable restaurant sales decrease

of 15.3% and guest count decrease of 14.6% in the first four weeks

of the fiscal third quarter of 2009. The first four weeks of the

fiscal third quarter of 2010 included one week of TV advertising

compared to no TV advertising during the first four weeks of the

fiscal third quarter of 2009.

The annual financial guidance includes approximately $15.6

million that the Company expects to spend for television

advertising to support LTO promotions during fiscal year 2010,

compared to $2.5 million that the Company spent on television

advertising during fiscal year 2009. The Company’s total marketing

expense in fiscal year 2010 is expected to be about $29.3 million

compared to $17.2 million spent in fiscal year 2009 and is included

in selling, general and administrative expense.

For the remaining two quarters of fiscal year 2010, the

Company’s run rate SG&A expense is expected to be between $16.5

and $17.5 million per quarter. Adding to that will be the Company’s

portion of TV marketing expense, which is expected to be $3.3

million in the fiscal third quarter of 2010 and $2.3 million in the

fiscal fourth quarter of 2010. The SG&A estimates do not

include costs for the transition of the CEO position, which are

estimated to be between $3.5 and $4.0 million over the balance of

the year, with the majority of the expense being incurred in the

third quarter.

Based on the Company’s development plans and other

infrastructure and maintenance costs, the Company expects fiscal

year 2010 capital expenditures to be approximately $35 million to

$38 million, which the Company expects to fund entirely out of

operating cash flow. The Company also intends to make scheduled

payments of $18.7 million required by the term loan portion of its

existing credit facility from free cash flow after capital

expenditures in fiscal year 2010 and expects to use its remaining

free cash flow to make payments on the Company’s revolving credit

facility and maintain flexibility to opportunistically repurchase

shares of the Company’s common stock.

Other Events

The Company’s board of directors extended its previous

authorization for the repurchase of up to $50 million of the

Company’s common stock. Stock repurchases may be made from time to

time in open market transactions and through privately negotiated

transactions through December 31, 2011.

The Company’s board of directors also voted in favor of adopting

a shareholder rights plan to protect stockholders from

coercive or otherwise unfair takeover tactics. The board

determined, with the assistance of its legal and financial

advisors, that a shareholder rights plan will

afford stockholders appropriate protections and allow the

board time to fully execute its fiduciary obligations in a

thoughtful and measured manner.

Investor Conference Call and

Webcast

Red Robin will host an investor conference call to discuss its

fiscal second quarter 2010 results today at 5:00 p.m. ET. The

conference call number is (877) 407-0784. To access the webcast,

please visit www.redrobin.com and select the “Investors” link from

the menu. The financial information that the Company intends to

discuss during the conference call is included in this press

release and will be available on the “Investors” link of the

Company's website at www.redrobin.com following the conference

call.

About Red Robin Gourmet Burgers,

Inc. (NASDAQ: RRGB)

Red Robin Gourmet Burgers, Inc. (www.redrobin.com), a casual

dining restaurant chain founded in 1969 that operates through its

wholly-owned subsidiary, Red Robin International, Inc., serves up

wholesome, fun, feel-good experiences in a family-friendly

environment. Red Robin® restaurants are famous for serving more

than two dozen insanely delicious, high-quality gourmet burgers in

a variety of recipes with Bottomless Steak Fries®, as well as

salads, soups, appetizers, entrees, desserts, and signature Mad

Mixology® Beverages. There are more than 440 Red Robin® restaurants

located across the United States and Canada, including

company-owned locations and those operating under franchise

agreements.

Forward-Looking

Statements:

Certain information and statements contained in this press

release, including those under the heading “Outlook,” are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include statements regarding our expectations, beliefs,

intentions, plans, objectives, goals, strategies, future events or

performance and underlying assumptions and other statements which

are other than statements of historical facts. These statements may

be identified, without limitation, by the use of forward-looking

terminology such as “assumptions,” “believe,” “continue,”

“expects,” “guidance,” “ongoing,” “projected,” “will” or comparable

terms or the negative thereof. All forward-looking statements

included in this press release are based on information available

to the Company on the date hereof. Such statements speak only as of

the date hereof and we undertake no obligation to update any such

statement to reflect events or circumstances arising after the date

hereof. These statements are based on assumptions believed by us to

be reasonable, and involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those described in the statements. These risks and

uncertainties include, but are not limited to, the

following: the downturn in general economic conditions

including severe volatility in financial markets, high levels of

unemployment and decreasing consumer confidence, resulting in

changes in consumer preferences or consumer discretionary spending;

the effectiveness of our advertising strategy; potential

fluctuation in our quarterly operating results due to economic

conditions, seasonality and other factors; changes in availability

of capital or credit facility borrowings to us and to our

franchisees; the adequacy of cash flows generated by our business

to fund operations and growth opportunities; the effect of

increased competition in the casual dining market and discounting

by competitors; our ability to achieve and manage our planned

expansion, including both in new markets and existing markets;

changes in the cost and availability of building materials and

restaurant supplies; the concentration of our restaurants in the

Western United States and the associated disproportionate impact of

macroeconomic factors; changes in the availability and costs of

food; changes in labor and energy costs and changes in the ability

of our vendors to meet our supply requirements; labor shortages,

particularly in new markets; the effectiveness of our initiative to

normalize new restaurant operations; lack of awareness of our brand

in new markets; concentration of less mature restaurants in the

comparable restaurant base which impacts profitability; the ability

of our franchisees to open and manage new restaurants; health

concerns about our food products and food preparation; our ability

to protect our intellectual property and proprietary information;

the impact of federal, state or local government regulations

relating to our team members or the sale of food or alcoholic

beverages; our franchisees’ adherence to our practices, policies

and procedures; and other risk factors described from time to time

in the Company’s 10-Q and 10-K filings with the SEC.

RED ROBIN GOURMET BURGERS,

INC.CONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands, except share amounts)(Unaudited)

July 11, 2010

December 27,2009

Assets: Current Assets: Cash and cash equivalents $ 11,923 $

20,268 Accounts receivable, net 5,689 4,703 Inventories 14,761

14,526 Prepaid expenses and other current assets 6,560 6,203 Income

tax receivable 1,276 4,713 Deferred tax asset 3,080 4,127

Restricted current assets—marketing funds 4,718

665 Total current assets $ 48,007 $ 55,205

Property and equipment, net 424,146 431,536 Goodwill

61,769 61,769 Intangible assets, net 45,190 47,426 Other assets,

net 3,489 4,159 Total assets $ 582,601

$ 600,095

Liabilities and Stockholders’

Equity: Current Liabilities: Trade accounts payable $ 10,399 $

10,891 Construction related payables 4,270 3,181 Accrued payroll

and payroll related liabilities 26,670 26,912 Unearned revenue

6,139 15,437 Accrued liabilities 22,658 18,818 Accrued

liabilities—marketing funds 4,718 665 Current portion of term loan

notes payable 18,739 18,739 Current portion of long-term debt and

capital lease obligations 819 779 Total

current liabilities $ 94,412 $ 95,422 Deferred

rent 32,936 30,996 Long-term portion of term loan notes payable

89,899 103,954 Other long-term debt and capital lease obligations

54,410 67,862 Other non-current liabilities 9,807

13,239 Total liabilities $ 281,464 $ 311,473

Stockholders’ Equity:

Common stock; $0.001 par value:

30,000,000 shares authorized; 17,113,300 and 17,079,267 shares

issued; 15,621,020 and 15,586,948 shares outstanding

17 17

Preferred stock, $0.001 par value:

3,000,000 shares authorized; no shares issued and

outstanding

- - Treasury stock, 1,492,280 shares, at cost (50,125 ) (50,125 )

Paid-in capital 170,093 167,637 Accumulated other comprehensive

loss, net of tax (438 ) (1,212 ) Retained earnings 181,590

172,305 Total stockholders’ equity

301,137 288,622 Total liabilities and

stockholders’ equity $ 582,601 $ 600,095

RED ROBIN GOURMET BURGERS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share data)(Unaudited)

Twelve Weeks

Ended Twenty-eight Weeks Ended July 11, 2010

July 12, 2009 July 11, 2010 July 12,

2009 Revenues: Restaurant revenue $ 197,977 $ 197,963 $

465,482 $ 464,558 Franchise royalties and fees 3,122 3,078 7,291

7,230 Other revenue 244 47 4,080

113 Total revenues 201,343 201,088 476,853

471,901 Costs and expenses:

Restaurant operating costs

(exclusive of depreciation and amortization shown separately

below):

Cost of sales 48,697 48,228 113,709 113,511

Labor (includes $211, $137, $420,

and $1,123 of stock- based compensation, respectively)

69,488 67,679 164,849 159,950 Operating 28,976 28,590 67,615 67,005

Occupancy 14,579 14,494 34,287 33,402 Depreciation and amortization

13,185 13,066 30,436 30,703

Selling, general, and

administrative (includes $857, $615, $1,751, and $4,342 of

stock-based compensation, respectively)

20,008 18,517 50,843 46,992 Pre-opening costs 375

588 1,252 3,138 Total costs and

expenses 195,308 191,162 462,991

454,701 Income from operations 6,035 9,926 13,862 17,200

Other expense (income): Interest expense, net 1,257 1,559

3,142 3,673 Other 10 9 (20 ) 19 Total

other expenses 1,267 1,568 3,122

3,692 Income before income taxes 4,768 8,358 10,740 13,508

Provision for income taxes 435 1,937 1,455

3,242 Net income $ 4,333 $ 6,421 $ 9,285 $

10,266 Earnings per share: Basic $ 0.28 $ 0.42 $ 0.60 $ 0.67

Diluted $ 0.28 $ 0.41 $ 0.59 $ 0.66 Weighted average shares

outstanding: Basic 15,494 15,380 15,484

15,366 Diluted 15,671 15,486 15,654

15,467

Schedule I

Reconciliation of Non-GAAP

Restaurant-Level Operating Profit to Incomefrom Operations

and Net Income(In thousands, except percentage data)

The Company believes that restaurant-level operating profit is

an important measure for management and investors because it is

widely regarded in the restaurant industry as a useful metric by

which to evaluate restaurant-level operating efficiency and

performance. The Company defines restaurant-level operating profit

to be restaurant revenues minus restaurant-level operating costs,

excluding restaurant closures and impairment costs. The measure

includes restaurant level occupancy costs, which include fixed

rents, percentage rents, common area maintenance charges, real

estate and personal property taxes, general liability insurance and

other property costs, but excludes depreciation related to

restaurant buildings and leasehold improvements. The measure

excludes depreciation and amortization expense, substantially all

of which is related to restaurant level assets, because such

expenses represent historical sunk costs which do not reflect a

current cash outlay for the restaurants. The measure also excludes

selling, general and administrative costs, and therefore excludes

occupancy costs associated with selling, general and administrative

functions, pre-opening costs, reacquired franchise costs, legal

settlements and costs associated with the tender offer of stock

options attributed to non-restaurant employees. The Company

excludes restaurant closure costs as they do not represent a

component of the efficiency of continuing operations. Restaurant

impairment costs are excluded, because, similar to depreciation and

amortization, they represent a non-cash charge for the Company’s

investment in its restaurants and not a component of the efficiency

of restaurant operations. Restaurant-level operating profit is not

a measurement determined in accordance with generally accepted

accounting principles (“GAAP”) and should not be considered in

isolation, or as an alternative, to income from operations or net

income as indicators of financial performance. Restaurant-level

operating profit as presented may not be comparable to other

similarly titled measures of other companies. The table below sets

forth certain unaudited information for the 12 and 28 weeks ended

July 11, 2010, and July 12, 2009, expressed as a percentage of

total revenues, except for the components of restaurant operating

costs, which are expressed as a percentage of restaurant

revenues.

Twelve Weeks Ended

Twenty-eight Weeks Ended July 11, 2010 July

12, 2009 July 11, 2010 July 12, 2009

Restaurant revenues $ 197,977 98.3 % $ 197,963 98.4 %

$ 465,482 97.6 % $ 464,558 98.5 %

Restaurant operating costs

(exclusive ofdepreciation and amortization shown

separatelybelow):

Cost of sales 48,697 24.6 48,228 24.4 113,709 24.4 113,511 24.4

Labor 69,488 35.1 67,679 34.2 164,849 35.4 159,064 34.2 Operating

28,976 14.6 28,590 14.4 67,615 14.5 67,005 14.4 Occupancy 14,579

7.4 14,494 7.3 34,287 7.4 33,402 7.2

Tender offer stock-based

compensationexpense

- - - - - - 886 0.2 Restaurant-level

operating profit 36,237 18.3 38,972 19.7

85,022 18.3 90,690 19.5 Add – other revenues 3,366

1.7 3,125 1.5 11,371 1.5 7,343 1.5 Deduct – other operating:

Depreciation and amortization 13,185 6.5 13,066 6.5 30,436 6.4

30,703 6.5 Selling, general, and administrative 19,998 9.9 18,517

9.2 50,748 10.7 43,278 9.2 Pre-opening costs 375 0.2 588 0.3 1,252

0.3 3,138 0.7

Tender offer stock-based

compensationexpense

- - - - - - 3,116 0.7 Restaurant closure costs 10 - -

- 95 - 598 0.1 Total other operating 33,568

16.7 32,171 16.0 82,531 17.3 80,833 17.2

Income from operations 6,035 3.0 9,926 4.9 13,862 2.9 17,200

3.6 Total other expenses, net 1,267 0.6 1,568 0.8 3,122 0.7

3,692 0.8 Provision for income taxes 435 0.2 1,937

1.0 1,455 0.3 3,242 0.7 Total other 1,702 0.8 3,505

1.8 4,577 1.0 6,934 1.5 Net income $ 4,333 2.2 % $ 6,421 3.1

% $ 9,285 1.9 % $ 10,266 2.1 %

_________________________

Certain percentage amounts in the

table above do not sum due to rounding as well as the fact that

restaurantoperating costs are expressed as a percentage of

restaurant revenues, as opposed to total revenues.

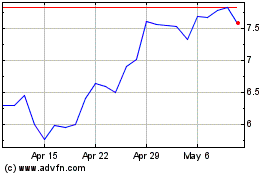

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jun 2024 to Jul 2024

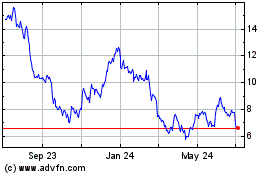

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jul 2023 to Jul 2024