| PROSPECTUS |

Filed pursuant

to Rule 424(b)(4) |

| |

Registration No. 333-282040 |

3,172,948 Shares

Reborn

Coffee, Inc.

This prospectus relates to the resale, from time

to time, by the selling securityholders named in this prospectus (the “Selling Stockholder”)

of up to 3,172,948 of our shares of our common stock, par value $0.0001 per share (“Common Stock”).

The

shares of Common Stock to which this prospectus relates consist of shares that have been or may be issued to the Selling Stockholders

pursuant to: (1) a Standby Equity Purchase Agreement between us and YA II PN, LTD. (“YA II PN”) dated February 12, 2024 (the

“SEPA”); (2) a Convertible Promissory Note issued by us to YA II PN dated May 20, 2024 (the “May Note”) and related

warrant (the “Warrant”) to purchase 175,000 shares (the “Warrant Shares”) of the Common Stock; (3) a Convertible

Promissory Note issued by us to a different Selling Stockholder dated August 29, 2024 (the “August Note”); and (4) shares

of Common Stock issued to accredited investors in private placements at various times in 2024 (the “2024 Shares”).

In

connection with the SEPA, we committed to issue to YA II PN 64,656 shares of common stock within three trading days (any day during which

the Nasdaq Capital Market is open for business, a “Trading Day”) of the execution of the SEPA (the “Commitment Shares”).

The

shares of Common Stock being registered for resale hereby were issued to, purchased by or will be purchased by the Selling Stockholders

for the following consideration: (i) a price of $2.32 per share for the Commitment Shares; (ii) a purchase price yet to be determined

for the Advance Shares under the SEPA (as described herein); (iii) a purchase price of $2.29 per share of Common Stock for conversion

of the May Note (as may be adjusted as described herein); (iv) a purchase price of $3.36 per share of Common Stock for conversion of

the August Note; (v) a purchase price of $2.25 for 444,445 of the 2024 Shares purchased in February 2024; (vi) a purchase price of $2.75

for 181,819 of the 2024 Shares purchased in May 2024; and (vii) a purchase price of $3.00 for 200,000 of the 2024 Shares purchased in

June 2024. The shares of Common Stock underlying the Warrant will be purchased, if at all, by such holders at the $2.29 exercise price

of the Warrant.

We are not selling any securities under this

prospectus and we will not receive any proceeds from the sale of the shares by the Selling Stockholders, except we will receive cash

proceeds from the exercise of the Warrant. In addition, the SEPA provides that we may sell up to an aggregate of $5,000,000 of our Common

Stock to YA II PN under the SEPA, from time to time in our discretion after the date the registration statement that includes this prospectus

is declared effective and after satisfaction of other conditions in the SEPA.

YA

II PN is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities

Act”). The Selling Stockholders may sell the shares of Common Stock described in this prospectus in a number of different ways

and at varying prices. See “Plan of Distribution” for more information about how the Selling Stockholders may sell

the shares of Common Stock being registered pursuant to this prospectus.

We

will pay the expenses of registering the Common Stock offered by this prospectus, but all selling and other expenses incurred by the

Selling Stockholders will be paid by the Selling Stockholders. The Selling Stockholders may sell our shares of Common Stock offered by

this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any

other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling Stockholders

may sell shares will be determined by the prevailing market price for our Common Stock or in negotiated transactions.

We

are a “smaller reporting company” as defined under the federal securities laws and, under applicable Securities and Exchange

Commission rules, we have elected to comply with certain reduced public company reporting and disclosure requirements.

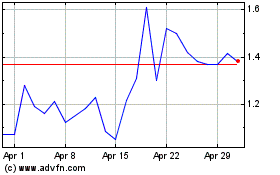

Our Common Stock is listed on Nasdaq under the

symbol “REBN.” The last reported closing price for our Common Stock on Nasdaq on September 26, 2024 was $3.02 per share.

As of September

26, 2024, there were 3,509,754 shares of Common Stock outstanding. If all shares being registered hereby were sold, it would comprise

approximately 47.5% of our total shares of Common Stock outstanding. Because the shares registered hereunder comprise a significant portion

of our outstanding shares, any sales by the Selling Stockholders, or the perception that such sales may occur, could have a significant

negative impact on the trading price of our Common Stock. Given the current market price of our Common Stock, certain of the Selling

Stockholders who paid less for their shares than such current market price will receive a higher rate of return on any such sales than

the public securityholders who purchased Common Stock in our initial public offering or any Selling Stockholder who paid more for their

shares than the current market price.

We

have not registered the sale of the shares under the securities laws of any state. Brokers or dealers effecting transactions in the shares

of Common Stock offered hereby should confirm that the shares have been registered under the securities laws of the state or states in

which sales of the shares occur as of the time of such sales, or that there is an available exemption from the registration requirements

of the securities laws of such states.

We

have not authorized anyone, including any salesperson or broker, to give oral or written information about this offering, Reborn Coffee,

Inc., or the shares of Common Stock offered hereby that is different from the information included in this prospectus. You should not

assume that the information in this prospectus, or any supplement to this prospectus, is accurate at any date other than the date indicated

on the cover page of this prospectus or any supplement to it.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus to read

about factors you should consider before investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of the disclosures in the prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 4, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement on Form S-1 of which this prospectus forms a part and that we have filed with the U.S. Securities and Exchange

Commission (the “SEC”), includes exhibits that provide more detail of the matters discussed in this prospectus. You should

read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading

“Where You Can Find More Information.”

You

should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto,

or to which we have referred you, before making your investment decision. Neither we, nor the Selling Stockholders named herein (the

“Selling Stockholders”), nor any financial advisor engaged by us or the Selling Stockholders in connection with this offering,

have authorized anyone to provide you with additional information or information different from that contained in this prospectus. To

the extent there is a conflict between the information contained in this prospectus and any prospectus supplement having a later date,

the statement in the prospectus supplement having the later date modifies or supersedes the earlier statement.

You

should not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information

we have previously filed with the SEC, is accurate as of any date other than the date on the front cover of the applicable document.

Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus is an offer

to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

The

Selling Stockholders are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale

is not permitted. Neither we nor the Selling Stockholders have done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe

any restrictions relating to this offering and the distribution of this prospectus applicable to that jurisdiction.

If

required, each time the Selling Stockholders offer shares of Common Stock, we will provide you with, in addition to this prospectus,

a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize the Selling Stockholders

to use one or more free writing prospectuses to be provided to you that may contain material information relating to that offering. We

may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained

in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements,

any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information

relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made

in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement.

Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under

the section entitled “Incorporation of Certain Information by Reference” before buying any of the securities offered.

Unless

the context otherwise requires, the terms “Reborn,” “Reborn Coffee,” “the Company,” “we,”

“us” and “our” refer to Reborn Coffee, Inc.

Unless

otherwise indicated, information contained in this prospectus or incorporated by reference herein concerning our industry and the markets

in which we operate is based on information from independent industry and research organizations, other third-party sources (including

industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information

released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions

made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe

the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections,

assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject

to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special

Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed

in the estimates made by the independent parties and by us.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the

information set forth under the headings “Risk Factors” as included elsewhere in this prospectus and our financial

statements and the related notes and the section entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations”, in our Annual Report on Form 10-K/A for the year ended December 31, 2023, our Quarterly Report on

Form 10-Q for the period ended March 31, 2024, our Quarterly Report on Form 10-Q for the period ended June 30, 2024, which are incorporated

by reference herein.

Overview

of Our Company

Reborn

is focused on serving high quality, specialty-roasted coffee at retail locations, kiosks and cafes. We are an innovative company that

strives for constant improvement in the coffee experience through exploration of new technology and premier service, guided by traditional

brewing techniques. We believe Reborn differentiates itself from other coffee roasters through its innovative techniques, including sourcing,

washing, roasting, and brewing our coffee beans with a balance of precision and craft.

Founded

in 2015 by Jay Kim, our Chief Executive Officer, Mr. Kim and his team launched Reborn with the vision of using the finest pure ingredients

and pristine water. We currently serve customers through our retail store locations in California, Korea, and Malaysia.

Reborn

continues to elevate the high-end coffee experience and we received first place traditional still in “America’s Best Cold

Brew” competition by Coffee Fest in 2017 in Portland and 2018 in Los Angeles.

The

source of coffee is pinnacle to specialty coffee. The coffee industry has gone through various phases including the first, second, third

and fourth wave. In the first and second waves of coffee, the single-origin source and type of the coffee is not necessarily in the forefront

during the sourcing process. As such, much of the coffee may be a blend with various sources and a mix of Robusta and Arabica coffee

beans. The third wave of coffee focuses on a single-origin source and one variety of coffee bean (specifically Arabica beans). Single-origin

beans can focus on specific countries and can also have hyper-focused on specific regions in the third wave of coffee, such as Coban

in Guatemala. Arabia beans are considered premier due to the specific requirements for growth and the high-quality flavor they produce.

Arabica coffee is required to be grown in higher, cooler elevations in regions.

Differentiated

from other coffee companies, the Reborn Wash Process is the key to creating the clean flavor of our coffee. Our Wash Process is distinguished

by the use of magnetized water to wash our green coffee beans when they arrive at the Reborn facility, in order to extract impurities

and enhance hydration before the roasting process. Magnetizing water is a process that converts the particles of water, which can naturally

appear in various sizes, into evenly sized particles. As a result of this process, we believe that the water increases its hydration

and ability to absorb into organic material. Our water is created through a water magnetizing device in which water is flowed through

the device and magnetizes the water on-site immediately prior to use.

After

the wash, we roast our washed-green beans based on the profile of each single-origin. After the coffee beans are roasted, they are then

packaged into various products such as whole bean coffee, pour over packs, and cold brew packs. Additionally, whole bean inventory is

also supplied to the kiosk and cafes. A portion of the roasted coffee is also allotted to create our award-winning cold brew concentrate.

Our cold brew production is created using a proprietary percolation technique, also using magnetized water at each step to enhance the

flavor of the cold brew.

We

continually innovate in the way we serve coffee. At our cafes, we serve customers our award-winning coffee through cold brew taps in

addition to freshly ground coffee beans in espresso-made drinks. Other brew methods, such as an in-house pour over and drip coffee, are

also available.

In

August 2022, we consummated our initial public offering (the “IPO”) of 1,440,000 shares of our common stock at a public offering

price of $5.00 per share, generating gross proceeds of $7,200,000. Net proceeds from the IPO was approximately $6.2 million after deducting

underwriting discounts and commissions and other offering expenses of approximately $998,000.

We

had granted the underwriters a 45-day option to purchase up to 216,000 additional shares (equal to 15% of the shares of common stock

sold in the offering) to cover over-allotments. In addition, we had agreed to issue to the representative of the several underwriters

warrants to purchase the number of shares of common stock in the aggregate equal to five percent (5%) of the shares of common stock to

be issued and sold in the IPO. The warrants are exercisable for a price per share equal to 125% of the public offering price. No over-allotment

option or representative’s warrants have been exercised.

On

August 12, 2022, our stock began trading on the Nasdaq Capital Market under the symbol “REBN”.

The

Experience, Reborn

We

believe that we are the leading pioneers of the emerging “Fourth Wave” movement and that our business is redefining specialty

coffee as an experience that demands much more than premium quality. We consider ourselves leaders of the “fourth wave”

coffee movement because we are constantly developing our bean processing methods, researching design concepts, and reinventing new ways

of drinking coffee. For instance, the current transition from the K-Cup trend to the pour over drip concept allowed us to reinvent the

way people consume coffee, by merging convenience and quality. We took the pour over drip concept and made it available and affordable

to the public through our Reborn Coffee Pour Over packs. Our Pour Over Packs allow our consumers to consume our specialty coffee outdoors

and on-the-go.

Our

success in innovating within the “Fourth Wave” coffee movement is measured by our success in B2B sales with our introduction

of Reborn Coffee Pour Over Packs to hotels. With the introduction of our Pour Over Packs to major hotels (including one hotel company

with 7 locations), our B2B sales increased as these companies recognized the convenience and functionality our Pour Over Packs serve

to their customers.

Centered

around its core values of service, trust, and well-being, we deliver an appreciation of coffee as both a science and an art. Developing

innovative processes such as washing green coffee beans with magnetized water, we challenge traditional preparation methods by focusing

on the relationship between water chemistry, health, and flavor profile. Leading research studies, testing brewing equipment, and refining

roasting/brewing methods to a specific, we proactively distinguish exceptional quality from good quality by starting at the foundation

and paying attention to the details. Our mission places an equal emphasis on humanizing the coffee experience, delivering a fresh take

on “farm-to-table” by sourcing internationally. In this way, we create opportunities to develop transparency by paying homage

to origin stories and spark new conversations by building cross-cultural communities united by a passion for the finest coffee.

Through

a broad product offering, Reborn provides customers with a wide variety of beverages and coffee options. As a result, we believe we can

capture share of any experience where customers seek to consume great beverages whether in our inviting store atmospheres which are designed

for comfort, or on the go through our pour over packs, or at home with our whole bean ground coffee bags. We believe that the retail

coffee market in the US is large and growing. According to IBIS, in 2021, the retail market for coffee in the United States is expected

to be $46.2 billion. This is expected to grow due to a shift in consumer preferences to premium coffee, including specialized blends,

espresso-based beverages, and cold brew options. Reborn aims to capture a growing portion of the market as we expand and increase consumer

awareness of our brand.

Branding

Reborn

Coffee focuses on two key features in our branding, including “Introducing the Fourth Wave” and “America’s Best

Cold Brew.” These phrases encapsulate the quality of the Reborn Process of sourcing, washing, roasting, and brewing coffee and

the quality of the product that we create.

The

Reborn brand is essential to our marketing strategy, as it allows us to stand out compared to our competitors. The products aim to make

customers feel “reborn” after drinking a cup of coffee.

Our

Menu and Products

We

purchase and roast high-quality coffees that we sell, along with handcrafted coffee, tea and other beverages and a variety of high-quality

food items. We believe in offering customers the same great taste and quality whether served in store or on the go. We also partner with

third-party importers and exporters to purchase and import our green coffee beans. Through these relationships, we source high-quality

coffee beans from across the globe, including Mexico, Ethiopia, Colombia, Guatemala, Brazil, and Honduras.

Franchise

Operations

In

January 2021, the Company formed Reborn Coffee Franchise LLC in the State of California in order to begin franchising Reborn Coffee retail

stores and kiosks. The Company plans to charge future franchisees a non-refundable franchise fee and certain marketing and royalty fees

based on gross sales, however we presently have no contractual commitments or other agreements to do so. We expect to begin franchise

sales in 2024. We believe that our team’s prior experience building a large, global foodservice business will allow us to rapidly

scale our future franchise effort. In addition, we have formed a franchise council consisting of a team of franchise experts to advise

us. We plan to expand beyond California to additional states to create a national and global presence.

Expanding

Sales Channels

Today,

we sell a variety of our coffee and tea products through the enterprise, or commercial, channel, which we refer to as “B2B”,

as well as direct-to-consumer via our website. We expect to increase our channel presence by increasing the availability of Reborn Coffee

in businesses and enterprises, and expand upon the partnerships we have in place with hotel operators to increase the use and brand awareness

in hospitality. We also expect to grow our online sales through new partnerships with third-party retailers. Our products are available

in various form factors, such as whole bean roasted coffee bags, single-serve drip bags, and pour over packs. We are exploring partnerships

with grocery operators and foodservice providers to expand the Reborn Coffee brand.

Experienced

Leadership Team

Our

relentless commitment to excellence is driven by our passionate management team under the leadership of Founder and Chief Executive Officer

Jay Kim. Jay launched Reborn Coffee with the vision to provide the best coffee using the purest ingredients. Jay is focused on the expansion

of Reborn and he has surrounded himself with leaders with direct experience in beverage and retail. Stephan Kim, our Chief Financial

Officer, has 20 years of experience in public accounting and consulting. Other members of our executive leadership team bring high growth,

franchise and sector expertise.

Our

Commitment to Our Team

Reborn

Coffee believes in mentoring the developing the next generation of premium coffee baristas. Through our in-depth training, we aim to

train dedicated employees who understand the science and art behind every cup of coffee. We also expect to form a training school specializing

in creating passionate baristas and coffee connoisseurs, by educating its students about coffee processes and preparation methods. The

efforts for the training school are underway and we expect to launch the program in 2024.

Our

Highly Engaged Customers

Reborn

Coffee customers are loyal to our brand due to our intense focus on premium coffee and customer service. Community engagement is another

essential element of Reborn Coffee’s in-person marketing strategy. Reborn hosts on-site engagements, such as event sponsorships,

and engages with local Chambers of Commerce. Previously, we have worked with Lululemon to host yoga sessions outside of our retail locations,

creatively engaging the community while simultaneously promoting Reborn as an active lifestyle. We have also hosted pop-up locations

on the Facebook campus, further expanding our outreach and introducing our brand name to different communities. We further engage with

the community by organizing our own latte art competitions, in which baristas can compete for prizes and customers in the audience can

witness the competitive passion Reborn Coffee encompasses.

Digital

Channels

Reborn

Coffee focuses on many digital channels in its marketing strategy. Social media is an important leg that creates engagement and education

of Reborn Coffee’s brand. Customers primarily engage the brand on Instagram, where we host giveaways, share new store openings,

and promote seasonal menus. Through our unique, modern aesthetic and intense focus on high-quality coffee, we are able to share the quality

and essence of Reborn Coffee on display inside of our retail locations with existing and future customers on social media platforms.

For

both the in-store café channel and the e-commerce channel, SMS & email marketing are used for reengagement and communication

of new products and offerings.

Digital

advertising channels are also used, primarily to engage the online market audience. Google and Facebook are the primary paid ad channels

that we currently utilize. Yelp advertising is also used to engage local customers and tourists who visit specific areas where Reborn

Coffee retail locations are located.

In-Person

Marketing Engagement

Engaging

customers in-store with a marketing plan is essential for customer retention and new customer generation. Reborn Coffee’s customer

loyalty program provides free drinks for every 10 drinks purchased. Additionally, store customers may participate in promotional deals,

especially during the holidays and new item releases, to try new innovative items created in-house. We also offer coffee samples of our

pour over packs as well as new beans to our retail location customers. The distribution of coffee samples has expanded customers’

knowledge of our products and, led to increased contributing to whole bean sales.

Reborn

Coffee locations are located in heavily trafficked areas as well as popular malls. As such, the potential for marketing and branding

is very high in these locations. Signage and promotional deals with giveaways are essential to attracting new customers.

Growth

Strategies

Corporate

and Franchise Expansion

Reborn

Coffee plans to expand across the Unites States with company operated locations and franchise locations to share the quality of specialty

coffee. Reborn Coffee aims to accelerate our growth through our franchise program. Reborn Coffee will continue to innovate in the coffee

industry by making the industry more personal to the consumers, prospective franchisees, and employees. This goal will be achieved through

the continued innovation in our products, sourcing directly from farms, and giving customers choices in how their coffee is served to

them. As Reborn expands, we hope to show the world that expanding in volume and size does not diminish the quality and personal element

that is instilled in the coffee industry.

We

have started to scale our logistics and supply chain to provide support for our rapid growth, including for our future franchisees. We

have increased roasting capacity and our paper goods supplies, including an emphasis on eco-friendly products.

B2B

Strategy

Reborn

Coffee products are unique given their potential to engage with business partners for large wholesale orders. Currently, Reborn Coffee

builds strong relationships with hotel management companies within California and out-of-state. We currently work with several hotels,

providing pour over packs and cold brew packs to cater to their customer needs. Reborn Coffee plans to continue growing its B2B marketing

and sales strategy through active outreach and advertising to potential partners. We believe that access to large-scale distribution

channels such as hotels increases consumer awareness of our brand while providing us access to large enterprise customers. Gift giving

comprises a large percentage of winter B2B sales at Reborn Coffee. During the holidays, Reborn Coffee’s B2B marketing strategy

focuses on targeting companies, and specific teams within companies, that are seeking to provide end of the year gifts to their clients

and customers. Reborn Coffee provides customized gift sets to each customer’s needs. Word-of-mouth marketing has grown our B2B

holiday gift giving accounts greatly, forging opportunities to have worked with companies like Google to provide gift sets for their

clients. Reborn Coffee plans to expand not only by growing its retail location footprint, but also through the development of more hotel

partnerships, expansion into grocery stores and markets, expansion of our e-commerce and wholesale.

Reborn

Coffee believes the grocery market is another major channel through which we expect to access. Through both bulk sales of roasted beans

and in-store kiosks, as well sales of pre-packaged products, Reborn Coffee will access customers who purchase both in volume and for

those customers looking for a handcrafted beverage during their in-store shopping experience. We are exploring discussions with a variety

of retailers and expect to access these additional sales channels in 2023.

Legal

Proceedings

The

Company is subject to various legal proceedings from time to time as part of its business. We are not presently a party to any legal

proceedings that, if determined adversely to us, we believe would individually or in the aggregate have a material adverse effect on

our business, results of operations, financial condition or cash flows. However, legal proceedings are inherently uncertain. As a result,

the outcome of a particular matter or a combination of matters may be material to our results of operations for a particular period,

depending upon the size of the loss or our income for that particular period.

Employees

and Human Capital

As of September 26, 2024 we had 19 full-time

employees. We believe in mentoring and developing the next generation of premium coffee baristas.

Through our in-depth training, we aim to train dedicated employees who understand the science and art behind every cup of coffee. We

also expect to form a training school specializing in creating passionate baristas and coffee connoisseurs, by educating its students

about coffee processes and preparation methods. The efforts for the training school are underway and we expect to launch the program

in 2024.

Properties

We

have a production and distribution center at our headquarters that we use to process and roast coffee for wholesale and retail distribution.

We consider our current office space adequate for our

current operations.

As

of the date of this prospectus, we have twelve retail coffee locations:

| ● | La

Floresta Shopping Village in Brea, California; |

| ● | La

Crescenta, California; |

| ● | Corona

Del Mar, California; |

| ● | Home

Depot Center in Laguna Woods, California; |

| ● | Manhattan

Village at Manhattan Beach, California. |

| ● | Huntington

Beach, California; |

| ● | Galleria

at Tyler in Riverside, California; |

| ● | Intersect

in Irvine, California; |

| ● | Diamond

Bar, California; |

Corporate

Information

Our

principal executive offices are located at 580 N. Berry Street, Brea, CA 92821. Our telephone number is (714) 784-6369. Our website address

is http://www.reborncoffee.com.

Available

Information

Our

website address is http://www.reborncoffee.com. Any information contained on, or that can be accessed through, our website is

not incorporated by reference into, nor is it in any way part of this prospectus and should not be relied upon in connection with making

any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy statements

and other information with the SEC. You may obtain any of the documents filed by us with the SEC, at no cost from the SEC’s website

at www.sec.gov.

Implications

of Being an Smaller Reporting Company

To

the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the

Exchange Act, we will continue to be permitted to make certain reduced disclosures in our periodic reports and other documents that we

file with the Securities and Exchange Commission (“SEC”).

Reverse

Stock Split

On

January 12, 2024, we filed a Certificate of Amendment to our Certificate of Incorporation to effect a reverse stock split of our issued

Common Stock in the ratio of 1-for-8 (the “Reverse Stock Split”). The Common Stock began trading on the Nasdaq Capital Market

on a Reverse Stock Split-adjusted basis at the market open on Monday, January 22, 2024. Unless otherwise noted, all share and per share

information relating our Common Stock in this prospectus has been adjusted to reflect the Reverse Stock Split.

THE

OFFERING

| Shares of Common

Stock offered by us |

|

Up to 3,172,948 shares

of our Common Stock, consisting of: |

| |

|

● |

64,656 shares of Common Stock we issued to YA II PN as consideration for its commitment

to purchase shares of our Common Stock under the SEPA (the “Commitment Shares”); |

| |

|

|

|

| |

|

● |

Up to a maximum of 1,670,844

shares of Common Stock that we may sell to YA II PN from time to time at our sole discretion, pursuant to the SEPA, as described

below; |

| |

|

|

|

| |

|

● |

Up to 462,374 shares of Common Stock

(the “May Note Shares”) issuable to YA II PN upon conversion of the Convertible Promissory Note issued by us to YA

II PN dated May 20, 2024 (the “May Note”) and/or issuable to YA II PN (the “Warrant Shares”) upon exercise

of a warrant to purchase common stock issued on May 20, 2024 in connection with the May Note (the “Warrant”); |

| |

|

|

|

| |

|

● |

Up to 148,810 shares of

Common Stock (the “August Note Shares,” and together with the May Note Shares, the “Note Shares”) issuable

to a Selling Stockholder upon conversion of the Convertible Promissory Note issued by us to such Selling Stockholder dated August

29, 2024 (the “August Note,” and together with the August Note, the “Notes”); and |

| |

|

|

|

| |

|

● |

826,264 shares of Common

Stock (the “2024 Shares”) issued to certain Selling Stockholders in 2024. |

| Common Stock

outstanding |

|

3,509,754 shares

of Common Stock. |

| |

|

|

| Common Stock outstanding after this offering |

|

5,856,438

shares of Common Stock. |

| |

|

|

| Use of proceeds |

|

We will not receive any

proceeds from the sale by the Selling Stockholders of the shares of Common Stock being offered by this prospectus. However, we may

receive gross proceeds of up to $5,000,000 from the sale of our Common Stock to the YA II PN under the SEPA. We did not receive any

cash proceeds from the issuance of the Commitment Shares to YA II PN under the SEPA. In addition, we may receive proceeds from the

cash exercise of the Warrant, which, if fully exercised in cash at the current exercise price with respect to the Warrant, would

result in gross proceeds to us of approximately $400,750. We intend to use any proceeds from YA II PN that we receive under

the SEPA and the Warrant exercises for working capital, strategic and general corporate purposes. See “Use of Proceeds”

on page 19 for more information. |

| |

|

|

| Risk factors |

|

An investment in our securities

is highly speculative and involves substantial risk. Please carefully consider the risks described under the heading “Risk

Factors” on page 8 and other information included and incorporated by reference in this prospectus for a discussion of

factors to consider before deciding to invest in the securities offered hereby. Additional risks and uncertainties not presently

known to us or that we currently deem to be immaterial may also impair our business and operations. |

| |

|

|

| Transfer agent and registrar |

|

The registrar and transfer

agent for our Common Stock is Securities Transfer Corporation. The transfer agent’s address is 15500 Roosevelt Blvd, Suite

104, Clearwater, Florida 33760 and the telephone number is (469) 633-0101. |

| |

|

|

| Nasdaq symbol and trading |

|

Our Common Stock is listed

on Nasdaq under the symbol “REBN.” |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risks described below and those discussed under the Section captioned “Risk Factors” contained in our Annual

Report on Form 10-K/A for the year ended December 31, 2023, as revised or supplemented by our subsequent quarterly reports on Form 10-Q

or our current reports on Form 8-K, each as filed with the SEC and which are incorporated by reference in this prospectus, together with

other information in this prospectus, the information and documents incorporated by reference herein, and in any free writing prospectus

that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition,

results of operations or cash flow could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting

in a loss of all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking

Statements.”

Risks

Related to This Offering

It

is not possible to predict the actual number of shares we will sell under the SEPA to YA II PN, or the actual gross proceeds resulting

from those sales.

Subject

to certain limitations in the SEPA and compliance with applicable law, we have the discretion to deliver notices to YA II PN at any time

throughout the term of the SEPA. The actual number of shares of Common Stock are sold to YA II PN may depend based on a number of factors,

including the market price of our Common Stock during the sales period. Actual gross proceeds may be less than $5.0 million, which may

impact our future liquidity. Because the price per share of each share sold to YA II PN will fluctuate during the sales period, it is

not currently possible to predict the number of shares that will be sold or the actual gross proceeds to be raised in connection with

those sales.

Moreover,

although the SEPA provides that we may sell up to an aggregate of $5.0 million of our Common Stock to YA II PN, we are registering 1,670,844

shares of our Common Stock (the “Advance Shares”). If we elect to sell to YA II PN all of the Advance Shares being registered

for resale under this prospectus that are available for sale by us to YA II PN under the SEPA, depending on the market prices of our

Common Stock for each purchase made pursuant to the SEPA, the actual gross proceeds from the sale of the shares may be substantially

less than the $5.0 million total commitment available to us under the SEPA. If it becomes necessary for us to issue and sell to YA II

PN under the SEPA more shares than the Advance Shares being registered for resale under this prospectus in order to receive aggregate

gross proceeds equal to $5.0 million under the SEPA, we must file with the SEC one or more additional registration statements to register

under the Securities Act the resale by YA II PN of any such additional shares of our Common Stock over the Advance Shares registered

in this Registration Statement that we wish to sell from time to time under the SEPA, which the SEC must declare effective, in each case

before we may elect to sell any additional shares of our Common Stock to YA II PN under the SEPA.

Any

issuance and sale by us under the SEPA of a substantial amount of shares of Common Stock in addition to the Advance Shares being registered

for resale by YA II PN under this prospectus could cause additional substantial dilution to our stockholders. The number of shares of

our Common Stock ultimately offered for sale by YA II PN is dependent upon the number of shares of Common Stock, if any, we ultimately

sell to YA II PN under the SEPA.

Investors

who buy shares in this offering at different times will likely pay different prices.

Investors

who purchase shares of Common Stock in this offering at different times will likely pay different prices, and so may experience different

levels of dilution and different outcomes in their investment results. In connection with the SEPA, we will have discretion, subject

to market demand, to vary the timing, prices, and numbers of shares of Common Stock sold to YA II PN. Similarly, YA II PN may sell such

shares at different times and at different prices. Investors may experience a decline in the value of the shares they purchase from YA

II PN in this offering as a result of sales made by us in future transactions to YA II PN at prices lower than the prices they paid.

The

issuance of Common Stock to the Selling Stockholders may cause substantial dilution to our existing shareholders and the sale of such

shares acquired by the Selling Stockholders could cause the price of our Common Stock to decline.

We are registering for resale by the Selling

Stockholders up to 3,172,948 shares of Common Stock. The number of shares of our Common Stock ultimately offered for resale by the Selling

Stockholders under this prospectus is dependent upon the number of shares of Common Stock issued to the Selling Stockholders pursuant

to the SEPA, the Notes, and the Warrant. Depending on a variety of factors, including market liquidity of our Common Stock, the issuance

of shares to the Selling Stockholders may cause the trading price of our Common Stock to decline.

If

and when we elect to sell Common Stock to YA II PN, sales of newly issued Common Stock by us to YA II PN could result in substantial

dilution to the interests of existing holders of our Common Stock. Additionally, the sale of a substantial number of Common Stock to

YA II PN, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future

at a time and at a price that we might otherwise wish to effect sales.

We

expect to grant equity awards to employees and directors under our equity incentive plans. We may also raise capital through equity financings

in the future. As part of our business strategy, we may make or receive investments in companies, solutions or technologies and issue

equity securities to pay for any such acquisition or investment. Any such issuances of additional share capital may cause shareholders

to experience significant dilution of their ownership interests and the per share value of our Common Stock to decline.

We

may require additional financing to sustain our operations and without it we may not be able to continue operations.

Subject

to the terms and conditions of the SEPA, we may, at our discretion, direct YA II PN to purchase up to $5.0 million of shares of our Common

Stock under the SEPA from time-to-time. The purchase price per share for the shares of Common Stock that we may elect to sell to YA II

PN under the SEPA will fluctuate based on the market prices of our Common Stock for each purchase made pursuant to the SEPA, if any.

Accordingly, it is not currently possible to predict the number of shares that will be sold to YA II PN, the actual purchase price per

share to be paid by YA II PN for those shares, if any, or the actual gross proceeds to be raised in connection with those sales.

The

extent to which we rely on YA II PN as a source of funding will depend on a number of factors including, the prevailing market price

of our Common Stock and the extent to which we are able to secure working and other capital from other sources. If obtaining sufficient

funding from YA II PN were to prove unavailable or prohibitively dilutive, we may need to secure another source of funding in order to

satisfy our working and other capital needs. Even if we were to sell to YA II PN all of the shares of Common Stock available for sale

to YA II PN under the SEPA, we may still need additional capital to fully implement our business, operating and development plans. Should

the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences

may be a material adverse effect on our business, operating results, financial condition and prospects.

Future

sales and issuances of our Common Stock or other securities might result in significant dilution and could cause the price of our Common

Stock to decline.

To

raise capital, we may sell Common Stock, convertible securities or other equity securities in one or more transactions other than those

contemplated by the SEPA, at prices and in a manner we determine from time to time. We may sell shares or other securities in another

offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares

or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may be higher or lower

than the price per share paid by investors in this offering.

We

cannot predict what effect, if any, sales of shares of our Common Stock in the public market or the availability of shares for sale will

have on the market price of our Common Stock. However, future sales of substantial amounts of our Common Stock in the public market,

including shares issued upon exercise of outstanding options, warrants and convertible preferred shares, or the perception that such

sales may occur, could adversely affect the market price of our Common Stock.

Our

management will have broad discretion over the use of the net proceeds from our sale of shares of Common Stock to YA II PN, and you may

not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our

management will have broad discretion with respect to the use of proceeds from the sale of any shares of our Common Stock to YA II PN,

including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.” You will

be relying on the judgment of our management regarding the application of the proceeds from the sale of any shares of our Common Stock

to YA II PN. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do

not agree with or that do not improve our results of operations or enhance the value of our Common Stock. Our failure to apply these

funds effectively could harm our business, delay the development of our pipeline product candidates and cause the price of our Common

Stock to decline.

It

is not possible to predict the actual number of shares of Common Stock, if any, we will issue upon conversion of the Notes to the Selling

Stockholders.

We

do not have the right to control the timing and amount of any conversions of principal under the Notes by the Selling Stockholders. The

number of shares that we issue to the Selling Stockholders pursuant to the Notes, if any, will depend upon market conditions and other

factors to be determined by the Selling Stockholders. The Selling Stockholders may ultimately decide to convert none or a portion of

the principal amount of the Notes.

The

number of shares of Common Stock ultimately offered for sale by the Selling Stockholders is dependent upon the number of shares, if any,

we ultimately issue upon conversion of the Notes. However, even if the Selling Stockholders elect to convert the entire principal amount

of the Notes, the Selling Stockholders may resell all, some or none of such shares at any time or from time to time in its sole discretion

and at different prices.

The

terms of our indebtedness, including the covenants and the dates on which principal and interest payments on our indebtedness are due,

increases the risk that we will be unable to continue as a going concern.

As

of December 31, 2023, and June 30, 2024 we had $1.48 million, and $1.57 million in outstanding short-term borrowing. In addition, on

May 20, 2024, we issued the May Note which has a principal balance of $800,000 and, beginning on August 15, 2024, requires monthly principal

and interest payments in excess of $266,667, and on August 29, 2024, we issued the August Note which has a principal balance of $500,000.

The terms of our indebtedness, including the covenants and the dates on which principal and interest payments on our indebtedness are

due, increases the risk that we will be unable to continue as a going concern. To continue as a going concern over the next twelve months,

we must make payments on our debt as they come due and comply with the covenants in the agreements governing our indebtedness or, if

we fail to do so, to (i) negotiate and obtain waivers of or forbearances with respect to any defaults that occur with respect to our

indebtedness, (ii) amend, replace, refinance or restructure any or all of the agreements governing our indebtedness, and/or (iii) otherwise

secure additional capital. However, we cannot provide any assurances that we will be successful in accomplishing any of these plans.

We

do not intend to apply for any listing of the Notes or the Warrant on any exchange or nationally recognized trading system, and we do

not expect a market to develop for the unregistered securities.

We

do not intend to apply for any listing of the Notes or the Warrant on Nasdaq or any other securities exchange or nationally recognized

trading system, and we do not expect a market to develop for the Notes or the Warrant. Without an active market, the liquidity of the

Notes and the Warrant will be limited. Further, the existence of the Notes and Warrant may act to reduce both the trading volume and

the trading price of our common stock.

Due

to the recent implementation of the Reverse Stock Split, the liquidity of our common stock may be adversely effected.

Our

common stock began trading on Nasdaq on a Reverse Stock Split-adjusted basis beginning on January 22, 2024. The liquidity of the

shares of our common stock may be affected adversely by any reverse stock split given the reduced number of shares of our common stock

that are outstanding following the Reverse Stock Split, especially if the market price of our common stock does not increase as a result

of the Reverse Stock Split. Following the Reverse Stock Split, the resulting market price of our common stock may not attract new investors

and may not satisfy the investing requirements of those investors. Although we believe that a higher market price of our common stock

may help generate greater or broader investor interest, there can be no assurance that the Reverse Stock Split resulted in a share price

that will attract new investors, including institutional investors. In addition, there can be no assurance that the market price of our

common stock will satisfy the investing requirements of those investors. As a result, the trading liquidity of our common stock may not

necessarily improve.

If

we are unable to satisfy the applicable continued listing requirements of Nasdaq, our common stock could be delisted.

On

June 21, 2024, we received a written notice (the “Notice”) from the Listing Qualifications Department of Nasdaq indicating

that Nasdaq had determined that we had failed to comply with certain Nasdaq Listing Rules because

we had not yet filed our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024.

As

previously announced, on May 15, 2024, we were required to dismiss BF Borgers CPA PC as the Company’s independent registered public

accounting firm. We had to appoint a new independent registered public accounting firm in order to complete and file the Form 10-Q, and

on May 14, 2024, the Audit Committee approved the engagement of BCRG Group (“BCRG”) as our new independent registered public

accounting firm. Due to the timing of the appointment of BCRG, we were unable without unreasonable effort and expense to complete the

review of our financial statements for the quarter ended March 31, 2024 before the required filing date for the Quarterly Report on Form

10-Q.

A

Nasdaq Hearings Panel (the “Panel”) had previously placed us on a Discretionary Panel Monitor for a period of one year or

until May 16, 2025 after we regained compliance with previous Nasdaq listing deficiencies, which would require Nasdaq to issue a Delist

Determination Letter in the event that we failed to maintain compliance with any continued listing requirement (the “Panel Monitor”).

Due to the Panel Monitor, we requested an appeal of determination to the Panel, and request a stay of the suspension pending a hearing.

On July 19, 2024, we filed Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024.

Although

we anticipate complying with Nasdaq’s Listing Rules going forward, there can be no assurance that we will be able to meet continued

listing requirements in the future. In determining whether to afford a company a cure period prior to commencing suspension or delisting

procedures, Nasdaq analyzes all relevant facts including any past deficiencies, and thus our prior deficiencies could be used as a factor

by Nasdaq in any future decision to delist our securities from trading on its exchange.

If

our Common Stock is delisted, it could reduce the price of our Common Stock and the levels of liquidity available to our stockholders.

In addition, the delisting of our Common Stock could materially adversely affect our access to the capital markets and any limitation

on liquidity or reduction in the price of our Common Stock could materially adversely affect our ability to raise capital. Delisting

from Nasdaq could also result in other negative consequences, including the potential loss of confidence by suppliers, customers and

employees, the loss of institutional investor interest and fewer business development opportunities.

Because

the currently outstanding shares of Common Stock that are being registered in this prospectus represent a substantial percentage of our

outstanding Common Stock, the sale of such securities could cause the market price of our Common Stock to decline significantly.

This prospectus relates to the offer and sale

from time to time by the Selling Stockholders of an aggregate of up to 890,290 shares of our currently outstanding Common Stock. This

prospectus also relates to the offer and sale from time to time by the Selling Stockholders of up to 2,282,028 shares of Common Stock

issuable by us, consisting of (i) up to 1,670,844 shares of Common Stock that we may sell to YA II PN, from time to time at our sole

discretion, pursuant to the SEPA; (ii) up to 462,374 shares of Common Stock issuable to YA II PN upon conversion of the May Note and/or

exercise of the Warrant; and (iii) up to 148,810 shares of Common Stock issuable upon conversion of the August Note.

The number of shares of Common Stock that the

Selling Stockholders can sell into the public markets pursuant to this prospectus represents a significant amount of our outstanding

shares of Common Stock. As of September 26, 2024, there were 3,509,754 shares of Common Stock outstanding. If all shares being registered

hereby were sold, it would comprise approximately 47.5% of our total shares of Common Stock outstanding. Given the substantial number

of shares of Common Stock registered pursuant to this prospectus, the sale of Common Stock by the Selling Stockholders, or the perception

in the market that the Selling Stockholders of a large number of shares of Common Stock intend to sell Common Stock, could increase the

volatility of the market price of our Common Stock or result in a significant decline in the public trading price of our Common Stock.

In addition, certain Selling Stockholders have

an incentive to sell because they have purchased their Common Stock at prices lower than the public investors or the current trading

price of the Common Stock, and they may profit significantly so even under circumstances in which our public stockholders or certain

other Selling Stockholders would experience losses in connection with their investment. The securities being registered for resale were

issued to, purchased by or will be purchased by the Selling Stockholders for the following consideration: (i) a price of $2.32 per share

for the Commitment Shares; (ii) a purchase price yet to be determined for the Advance Shares under the SEPA (as described herein); (iii)

a purchase price of $2.29 per share of Common Stock for conversion of the May Note (as may be adjusted as described herein); (iv) a purchase

price of $3.36 per share of Common Stock for conversion of the August Note; (v) a purchase price of $2.25 for 444,445 of the 2024 Shares

purchased in February 2024; (vi) a purchase price of $2.75 for 181,819 of the 2024 Shares purchased in May 2024; and (vii) a purchase

price of $3.00 for 200,000 of the 2024 Shares purchased in June 2024. The shares of Common Stock underlying the Warrant will be purchased,

if at all, by such holders at the $2.29 exercise price of the Warrant. If the Selling Stockholders were to sell the shares of Common

Stock at a price of $3.02 per share (the last reported sale price of our Common Stock on September 26, 2024), they would recognize a

profit or loss as follows: (i) a profit of approximately $0.70 per share of Common Stock for the Commitment Shares; (ii) a profit of

approximately $0.73 per share of Common Stock for the shares underlying the May Note; (iii) a loss of approximately $0.34 per share of

Common Stock for shares underlying the August Note; (iv) a profit of approximately $0.77 per share of Common Stock for the 2024 Shares

purchased in February 2024; (v) a profit of approximately $0.27 per share of Common Stock for the 2024 Shares purchased in May 2024;

and (vi) a profit of approximately $0.02 per share of Common Stock for the 2024 Shares purchased in June 2024.

Public

stockholders of Common Stock may have paid more than certain of the Selling Stockholders for their Common Stock and would not expect

to see a positive return unless the price of the Common Stock appreciates above the price at which such stockholders purchased their

Common Stock. Investors who purchase Common Stock on open market may not experience a similar rate of return on the Common Stock they

purchase due to differences in the purchase prices and the current trading price referenced above. In addition, sales by the Selling

Stockholders may cause the trading prices of our securities to experience a decline. As a result, the Selling Stockholders may effect

sales of Common Stock at prices below the current market price, which could cause market prices to decline further.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains various forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act, which represent our expectations or beliefs concerning future events that are based on our management’s beliefs and

assumptions and on information currently available to management, and which statements involve substantial risk and uncertainties. All

statements contained in this prospectus other than statements of historical fact, including statements regarding our future operating

results and financial position, our business strategy and plans, market growth and trends, and objectives for future operations are forward-looking

statements. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases,

you can identify forward-looking statements because they contain words such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,”

or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy,

plans or intentions.

These

risks and uncertainties include, among other things:

| ● | our

ability to continue as a going concern; |

| ● | our

reliance on third party vendors; |

| ● | our

dependence on our executive officers; |

| ● | our

financial performance guidance; |

| ● | material

weaknesses in our internal control over financial reporting; |

| ● | regulatory

developments in the United States and foreign countries; |

| ● | the

impact of laws, regulations, accounting standards, regulatory requirements, judicial decisions

and guidance issued by authoritative bodies; |

| ● | our

estimates regarding expenses, future revenue and cash flow, capital requirements and needs

for additional financing; |

| ● | our

financial performance; |

| ● | the

ability to recognize the anticipated benefits of our business combination and/or divestitures;

and |

| ● | the

effect of COVID-19 on the foregoing. |

You

should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained

in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our

business, financial condition, results of operations, and prospects. The outcome of the events described in these forward-looking statements

is subject to risks, uncertainties, and other factors described elsewhere in this prospectus and in the section titled “Risk Factors”

and elsewhere in our Annual Report on Form 10-K/A for the year ended December 31, 2023.

THE

SEPA TRANSACTION

On

February 12, 2024, we entered into the Standby Equity Purchase Agreement (the “SEPA”) with YA II PN. Pursuant to the SEPA,

we may sell to YA II PN up to $5,000,000, of shares of Common Stock (the “Advance Shares”), from time to time during the

term of the SEPA. The SEPA contains customary representations, warranties, conditions and indemnification obligations of the parties.

Pursuant to the SEPA, we also agreed to file a registration statement with the SEC, covering the resale of Advance Shares issued or sold

to YA II PN under the SEPA under the Securities Act.

In consideration for YA II PN’s execution

and delivery of the SEPA, we issued to YA II PN 64,656 (the “Commitment Shares”).

We

cannot sell any additional shares to YA II PN until the date that the registration statement which contains this prospectus is declared

effective by the SEC and a final prospectus in connection therewith is filed and all of the other conditions set forth in the SEPA are

satisfied (the “Commencement Date”). From and after such time, we will control the timing and amount of any sales of our

Common Stock to YA II PN. Actual sales of shares of our Common Stock to YA II PN under the SEPA will depend on a variety of factors to

be determined by us from time to time, including, among others, market conditions, the trading price of the Common Stock and determinations

by us as to the appropriate sources of funding for our company and our operations.

Beginning

on the Commencement Date and until February 12, 2027, under the terms and subject to the conditions of the SEPA, from time to time, at

our discretion, we have the right, but not the obligation, to issue to YA II PN, and YA II PN is obligated to purchase, the Advance Shares,

subject to certain limitations set forth in the SEPA. The purchase price of the Advance Shares will be at one of two prices, as chosen

by us in our sole discretion and specified in the notice given to YA II PN (each, a “SEPA Advance Notice”): (i)

95% of the Market Price (as defined below) for any period commencing (1) if submitted to YA II PN prior

to 9:00 a.m. Eastern Time on a trading day, the open of trading on such day or (2) if submitted to YA II PN after

9:00 a.m. Eastern Time on a trading day, upon receipt by us of written confirmation of acceptance of such SEPA Advance Notice

by YA II PN (or the open of regular trading hours,

if later), and in either case, ending on 4:00 pm New York Citytime on the applicable trading day (the “Option 1 Pricing Period”),

and (ii) 96% of the Market Price for any three consecutive trading days commencing on the SEPA Advance Notice date

(the “Option 2 Pricing Period,” and each of the Option 1 Pricing Period and the Option 2 Pricing Period, a “Pricing

Period”). “Market Price” is defined as, for any Option 1 Pricing Period, the VWAP of the Common Stock on Nasdaq during

the Option 1 Pricing Period, and for any Option 2 Pricing Period, the lowest VWAP of the Common Stock on the Nasdaq during the Option

2 Pricing Period.

Our

ability to issue Advance Shares under the SEPA are subject to certain limitations, including that YA

II PN cannot purchase any shares that would result in it beneficially owning more than 4.99% of

the our Common Stock at the time of us issuing a SEPA Advance Notice. Additionally, if the

total number of shares of Common Stock traded on Nasdaq during the applicable Pricing Period is less than the Volume Threshold (as defined

below), then the number of shares of Common Stock issued and sold pursuant to such SEPA Advance Notice will

be reduced to the greater of (a) 30% of the trading volume of the Common Stock on Nasdaq during the relevant Pricing Period as reported

by Bloomberg L.P., or (b) the number of shares of Common Stock sold by YA II PN during such Pricing Period. “Volume Threshold”

is defined as a number of shares of Common Stock equal to the quotient of (a) the number of shares in the SEPA Advance Notice

requested by the company divided by (b) 0.30.

Under the applicable rules of Nasdaq and pursuant

to the SEPA, in no event were we permitted to issue to YA II PN more than 19.99% of the shares of the Common Stock outstanding immediately

prior to the execution of the SEPA unless we obtained stockholder approval to issue shares of Common Stock in excess of such amount.

On May 10, 2024, our stockholders approved the issuance of Common Stock in excess of 19.99% of the shares of the Common Stock outstanding

immediately prior to the execution of the SEPA.

The

net proceeds from sales, if any, under the SEPA, will depend on the frequency and prices at which we sell shares of Common Stock to YA

II PN. To the extent we sell shares under the SEPA, we currently plan to use any proceeds therefrom for costs of this transaction, for

working capital, strategic and other general corporate purposes.

The

SEPA does not include any of the following: (i) limitations on our use of amounts we receive as the purchase price for shares of Common

Stock sold to YA II PN; (ii) financial or business covenants, except that we may not effect any consolidation or transfer of substantially

all of our assets while a SEPA Advance Notice is outstanding; (iii) restrictions on future financings; (iv) rights of first refusal;

or (v) participation rights or penalties.

As of September 26, 2024, there were 3,509,754

shares of our Common Stock outstanding. Although the SEPA provides that we may sell up to an aggregate of $5,000,000 of shares of our

Common Stock to YA II PN, only 1,670,844 shares of our Common Stock are being registered for resale under this prospectus that we may

issue and sell to YA II PN in the future under the SEPA, if and when we elect to sell shares of our Common Stock to YA II PN under the

SEPA. Depending on the market prices of our Common Stock at the time we elect to issue and sell shares of our Common Stock to YA II PN

under the SEPA, we may need to register for resale under the Securities Act additional shares of our Common Stock in order to receive

aggregate gross proceeds equal to the $5,000,000 total commitment available to us under the SEPA. If all of such 1,670,844 shares of

our Common Stock offered hereby were issued and outstanding as of the date of this prospectus, such shares would represent approximately

28.5% of the total number of outstanding shares of Common Stock, and approximately 35.6% of the total number of outstanding shares of

Common Stock held by non-affiliates, in each case as of the date of this prospectus. If we elect to issue and sell to YA II PN under

the SEPA more than the 1,670,844 shares of our Common Stock being registered for resale by YA II PN under this prospectus, which we have

the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares of our

Common Stock, which could cause additional substantial dilution to our shareholders. The number of shares of our Common Stock ultimately

offered for sale by YA II PN is dependent upon the number of shares purchased by YA II PN under the SEPA.

Issuances

of our Common Stock to YA II PN under the SEPA will not affect the rights or privileges of our existing shareholders, except that the

economic and voting interests of each of our existing shareholders will be diluted as a result of any such issuance. Although the number

of shares of our Common Stock that our existing shareholders own will not decrease, the shares of our Common Stock owned by our existing

shareholders will represent a smaller percentage of our total outstanding shares of our Common Stock after any such issuance of shares

of our Common Stock to YA II PN under the SEPA. There are substantial risks to our shareholders as a result of the sale and issuance

of Common Stock to YA II PN under the SEPA. See “Risk Factors.”

Conditions

to Commencement and for Delivery of SEPA Advance Notices

Our

ability to deliver SEPA Advance Notices to YA II PN under the SEPA are subject to the satisfaction by us, of certain conditions, all

of which are entirely outside of YA II PN’s control, including, but not limited to, the following:

| |

● |

the accuracy in all material

respects of our representations and warranties included in the SEPA on the date of the SEPA and the date of each closing of a purchase

and sale under the SEPA of; |

| |

● |

we having performed, satisfied

and complied in all material respects with all covenants, agreements and conditions required by the SEPA to be performed, satisfied

or complied with by us; |

| |

● |

the registration statement

that includes this prospectus (and amendment or supplement thereto) shall have been declared effective and remain effective for the

offering and sale of the shares and (i) we shall not have received notice that the SEC has issued or intends to issue a stop order

with respect to such registration statement or that the SEC otherwise has suspended or withdrawn the effectiveness of such registration

statement, either temporarily or permanently, or intends or has threatened to do so and (ii) no other suspension of the use of, or

withdrawal of the effectiveness of, such registration statement or the prospectus shall exist. YA II PN shall not have received any

notice from us that the registration statement, prospectus and/or any prospectus supplement or amendment thereto fails to meet the

requirements of Section 5(b) or Section 10 of the Securities Act; |

| |

● |

the number of shares then

to be purchased by YA II PN shall not exceed the number of such shares that, when aggregated with all other shares of Common Stock

then owned by YA II PN beneficially or deemed beneficially owned by YA II PN, would result in YA II PN owning more than the beneficial

ownership limitation; |

| |

● |

trading in the Common Stock

shall not have been suspended by the SEC or the Nasdaq, or otherwise halted for any reason, and the Common Stock shall have been

approved for listing or quotation on and shall not have been delisted from or no longer quoted on the Nasdaq. |

| |

● |

the issuance of shares of Common Stock to YA II PN, including the Commitment Shares, shall not exceed

19.99% of the shares of the Common Stock outstanding immediately prior to the execution of the SEPA, if applicable, subject to appropriate

adjustment for any stock dividend, stock split, stock combination, rights offerings, reclassification or similar transaction that

proportionately decreases or increases the Common Stock unless holders of a majority of our outstanding voting common stock that

are present or represented by proxy at a meeting, to effectuate the transactions contemplated by the SEPA; |

| |

● |

the absence of any statute,

rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or adopted by any court

or governmental authority of competent jurisdiction that prohibits or directly and materially adversely affects any of the transactions

contemplated by the SEPA and the exhibits thereto, and no proceeding shall have been commenced that may have the effect of prohibiting

or materially adversely affecting any of the transactions contemplated by the SEPA and the exhibits thereto; |

| |

● |

the Common Stock must be

DWAC Eligible and not subject to a “DTC chill”; |

| |

● |

the issuance of the Advance

Shares shall not violate the shareholder approval requirements of Nasdaq; and |

| |

● |

all reports, schedules,

registrations, forms, statements, information and other documents required to have been filed by us with the SEC pursuant to the

reporting requirements of the Exchange Act shall have been filed with the SEC. |

Termination

of the SEPA

Unless

earlier terminated as provided in the SEPA, the SEPA will terminate automatically on the earliest to occur of:

| |

● |

the date on which YA II

PN shall have purchased Advance Shares for an aggregate purchase price of $5,000,000. |

No

Short-Selling or Hedging by YA II PN

YA

II PN has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling our Common Stock during

any time prior to the termination of the SEPA.

Effect

of Performance of the SEPA on our Shareholders

All