U.S. Futures Show Mixed Movement, Crude Oil Prices Inch Up

April 09 2024 - 6:42AM

IH Market News

U.S. index futures show mixed movement in pre-market trading

this Tuesday, as Wall Street turns its attention to the imminent

inflation data and corporate earnings results.

At 06:01 AM, Dow Jones futures (DOWI:DJI) fell 11 points, or

0.03%. S&P 500 futures rose 0.07%, and Nasdaq-100 futures

gained 0.15%. The yield rate of 10-year Treasury bonds was at

4.396%.

In the commodities market, West Texas Intermediate crude oil for

May rose 0.25%, to $86.65 per barrel. Brent crude oil for June rose

0.30%, near $90.66 per barrel. Iron ore traded for September on the

Dalian exchange rose to $106.76 per metric ton.

European markets are mostly down in Tuesday’s trading after

gains on Monday. BP (LSE:BP.) stands out with an

increase after announcing an expectation of higher oil and gas

production, while Atos SE (EU:ATO) faces

volatility after revealing its refinancing plan.

HSBC (LSE:HSBA) announced the sale of its

Argentine operations, and Shell (LSE:SHEL) is

pondering listing options, including a possible move to New

York.

Asian markets had a mixed Tuesday, with investors reacting to

various economic indicators. Consumer confidence in Japan reached

the highest level since May 2019, while in Australia, business

conditions and confidence remained stable in March, according to

the National Australian Bank. Japan’s Nikkei 225 index showed an

increase of 1.08%, in contrast to South Korea’s Kospi, which

recorded a -0.46% drop. Hong Kong’s Hang Seng and Australia’s ASX

200 rose 0.7% and 0.45%, respectively. Other highlights include the

monetary authority of Hong Kong discussing extending financial

integration with China and Lee Boo Jin, CEO of Shilla Hotels, who

sold US$ 326 million in shares of Samsung

Electronics (USOTC:SSNHZ) to cover inheritance taxes

related to the death of her father, Lee Kun-hee.

U.S. stocks showed little variation on Monday, with the main

indexes fluctuating near stability, closing mixed. Caution

prevailed in the market ahead of important inflation data and the

Fed minutes. Sectors such as aviation and steel stood out on the

day, contrasting with a slight retraction in gold stocks.

On the quarterly earnings front, Tilray

(NASDAQ:TLRY), Cognyte Software (NASDAQ:CGNT), and

Neogen Corp (NASDAQ:NEOG), among others, are

scheduled to present financial reports before the market opens.

After the close, numbers from WD-40 Company

(NASDAQ:WDFC), PriceSmart (NASDAQ:PSMT), Smart Global

Holdings (NASDAQ:SGH), Aehr Test Systems

(NASDAQ:AEHR), RCI Hospitality Holdings

(NASDAQ:RICK), and more are awaited.

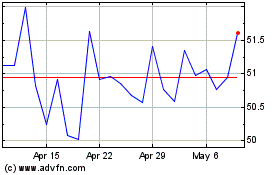

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Oct 2024 to Nov 2024

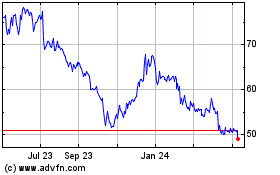

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Nov 2023 to Nov 2024