UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ________)*

Quhuo Limited

(Name of Issuer)

Class A Ordinary Shares, par value US$0.0001

per share

(Title of Class of Securities)

74841Q

209**

(CUSIP Number)

Genan Tech Limited

Craigmuir Chambers, Road Town

Tortola, VG 1110, British Virgin Islands

Attention: Ahmed Mohamed Aly Mohamed

+852 2134-9819

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications)

August 8, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Sections 240.13d-1(e), Sections 240.13d-1(f) or Sections 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

Section 240.13d-7 for other parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

| ** | This

CUSIP applies to the American Depositary Shares (“ADSs”) of Issuer, each of which represents ten Class A ordinary shares

of Issuer, par value 0.0001 per share (“Class A Ordinary Shares”). No CUSIP has been assigned to the Class A Ordinary

Shares. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject

to all other provisions of the Exchange Act (however, see the Notes).

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Genan Tech Limited |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

| |

(see instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| |

|

|

|

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

British Virgin Islands |

|

|

| |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

7 |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

265,158,422 Class A Ordinary Shares |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

265,158,422 Class A Ordinary Shares (1) |

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

265,158,422 Class A Ordinary Shares (1) |

| |

|

| 12 |

CHECK IF THE

AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ¨ |

| |

(see instructions) |

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

Approximately 29.77% of total outstanding ordinary shares of Issuer (“Ordinary Shares” which comprise Class A Ordinary Shares and/or Class B ordinary shares, par value US$0.0001 per share (“Class B Ordinary Shares”), of Issuer), assuming conversion of all outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares (2) |

| |

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

| |

CO |

| |

|

| (1) | Consists of 265,158,422 Class A Ordinary Shares held

by Genan Tech Limited, which were acquired by Genan Tech Limited on August 8, 2024. Ahmed Mohamed Aly Mohamed holds a 100% equity

interest in Genan Tech Limited, serves as its director, and is deemed to beneficially own the 265,158,422 Class A Ordinary Shares

held by Genan Tech Limited. |

| (2) | Percentage calculated

based on existing 896,950,139 Ordinary Shares as a single class (including 890,653,509 Class A Ordinary Shares and 6,296,630 Class B

Ordinary Shares outstanding as of September 6, 2024, as reported in Issuer’s Form F-3 filed with the U.S. Securities

and Exchange Commission (“SEC”) on September 6, 2024). |

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Ahmed Mohamed Aly Mohamed |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| |

|

|

|

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

Egypt |

|

|

| |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

7 |

SOLE VOTING POWER |

| |

|

| |

|

| 8 |

SHARED VOTING POWER |

| |

265,158,422 Class A Ordinary Shares (1) |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

265,158,422 Class A Ordinary Shares (1) |

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

265,158,422 Class A Ordinary Shares |

| |

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ¨ |

| |

(see instructions) |

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

Approximately 29.77% of total outstanding Ordinary Shares, assuming conversion of all outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares (2) |

| |

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

| |

IN |

| |

|

| (1) | Consists of 265,158,422 Class A Ordinary Shares held

by Genan Tech Limited, which were acquired by Genan Tech Limited on August 8, 2024. Ahmed Mohamed Aly Mohamed beneficially holds

a 100% equity interest in Genan Tech Limited and serves as its director, and is deemed to beneficially own the 265,158,422 Class A

Ordinary Shares held by Genan Tech Limited. |

| (2) | Percentage calculated

based on existing 896,950,139 Ordinary Shares as a single class (including 890,653,509 Class A Ordinary Shares and 6,296,630 Class B

Ordinary Shares outstanding as of September 6, 2024, as reported in Issuer’s Form F-3 filed with the SEC on September 6,

2024). |

| Item 1. Security and Issuer. |

This Schedule 13D relates to the Class A

Ordinary Shares. Issuer’s principal executive office address is 3F, Building A, Xin’anmen,

No. 1 South Bank, Huihe South Street, Chaoyang District. Beijing, People’s Republic of China. Issuer’s ADSs representing

Class A Ordinary Shares are listed on the Nasdaq Global Market under the symbol “QH.”

The information set forth in response to each

Item below shall be deemed to be a response to all Items where such information is relevant.

| Item 2. Identity and Background. |

| (a) | This Schedule 13D is being filed jointly by (1) Genan

Tech Limited, a company incorporated in BVI and (2) Ahmed Mohamed Aly Mohamed, the beneficial owner of 100% equity interest and

sole director of Genan Tech Limited (together, the “Reporting Persons”). |

| (b) | The address of the principal office of Genan Tech Limited

is Craigmuir Chambers, Road Town, Tortola, VG 1110, BVI.

The business address of Ahmed Mohamed Aly Mohamed is 9 Darb EI Ibiari EL Darb EI Ahma Egyptian. |

| (c) | Genan Tech Limited is engaged in vehicle import and export

business.

Ahmed Mohamed Aly Mohamed is the beneficial owner of 100% equity interest in and the sole director of Genan Tech Limited. |

| (d) | During the last five years, none of the Reporting Persons

named in this Item 2 has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| (e) | During the last five years, none of the Reporting Persons

named in this Item 2 has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a

result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| (f) | Genan Tech Limited is a corporation incorporated under BVI

laws. Ahmed Mohamed Aly Mohamed is a citizen of Egypt. |

The Reporting Persons have executed

a Joint Filing Agreement, dated October 15, 2024, with respect to the joint filing of this Schedule 13D, and any amendment or amendments

hereto, a copy of which is attached hereto as Exhibit 1.

| Item 3. Source and Amount of Funds or Other Consideration. |

The Reporting Persons acquired the Class A

Ordinary Shares reported herein in exchange for consideration under the Acquisition (defined below) in the amount of $9,306,000. The information

set forth in Item 4 is incorporated by reference in its entirety into this Item 3.

| Item 4. Purpose of Transaction. |

On July 1, 2024, Genan Tech Limited entered

into an equity acquisition agreement (the “Acquisition Agreement”) with Issuer, among other parties, pursuant to which Issuer

acquired approximately 9.90 % equity interest in Quhuo International Trade (HK) Limited from Genan Tech Limited (the “Acquisition”),

for a total consideration of US$9,306,000, which was paid by Issuer by issuing a senior convertible promissory note (the “Convertible

Note”) to Genan Tech Limited in the principal amount of US$9,306,000.

Subsequently, on August 8, 2024, Genan Tech

Limited elected to convert the principal under Convertible Note into Class A Ordinary Shares, at the fixed conversion price as contemplated

in the Convertible Note, resulting in an issuance of a total of 265,158,422 Class A Ordinary Shares to Genan Tech Limited on the

same day.

The Reporting Persons acquired the securities

because of the belief that the Class A Ordinary Shares represent an attractive investment opportunity. The Reporting Persons may,

from time to time, take such actions regarding their investment in Issuer as they deem appropriate. These actions may include purchasing

or selling securities of Issuer depending upon an ongoing evaluation of the investment in these securities, prevailing market conditions,

other investment opportunities, other investment considerations and/or other factors.

Based on the transactions and relationships described

herein, the Reporting Persons may be deemed to constitute a “group” for purposes of Section 13(d)(3) of the Exchange

Act. The filling of this Schedule 13D shall not be construed as an admission that the Reporting Persons are a group, or have agreed to

act as a group, and the existence of any such group is expressly disclaimed.

| Item 5. Interest in Securities of the Issuer. |

| (a) | See rows (11) and (13) of the cover pages to this Schedule

13D for the aggregate number of Class A Ordinary Shares and percentages of the Class A Ordinary Shares beneficially owned by

each of the Reporting Persons. Percentage calculated based on existing 896,950,139 Ordinary Shares

as a single class (including 890,653,509 Class A Ordinary Shares and 6,296,630 Class B Ordinary Shares outstanding as of September 6,

2024, as reported in Issuer’s Form F-3 filed with the SEC on September 6, 2024). |

(1) Sole Voting Power: 0

(2) Shared Voting Power: 265,158,422 Class A Ordinary

Shares

(3) Sole Dispositive Power: 0

(4) Shared Dispositive Power: 265,158,422 Class A

Ordinary Shares

Ahmed Mohamed Aly Mohamed:

(1) Sole Voting Power: 0

(2) Shared Voting Power: 265,158,422 Class A Ordinary

Shares

(3) Sole Dispositive Power: 0

(4) Shared Dispositive Power: 265,158,422 Class A

Ordinary Shares

| (c) | Except as described in this Schedule 13D, during the past

60 days, none of the Reporting Persons has effected any transactions in the Class A Ordinary Shares. |

| Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Other than the exhibits hereto, there are no contracts,

arrangements, understandings or relationships (legal or otherwise) among the Reporting Persons named in Item 2 hereof and between such

Reporting Persons and any person with respect to any securities of Issuer, including but not limited to transfer or voting of any other

securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, divisions of profits

or loss, or the giving or withholding of proxies.

| Item 7. Material to be Filed as Exhibits. |

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Genan Tech Limited |

| |

|

| |

/s/ Ahmed Mohamed Aly Mohamed |

| |

Name |

| |

|

| |

Director |

| |

Title |

| |

|

| |

October 15, 2024 |

| |

Date |

| |

Ahmed Mohamed Aly Mohamed |

| |

|

| |

/s/ Ahmed Mohamed Aly Mohamed |

| |

Name |

| |

|

| |

October 15, 2024 |

| |

Date |

Exhibit 1

JOINT FILING AGREEMENT

AGREEMENT

dated as of October 15, 2024 by and between Genan Tech Limited, a British Virgin Islands company, and Ahmed Mohamed Aly Mohamed

(together, the “Parties”).

Each

Party hereto represents to the other Party that it is eligible to use Schedule 13D to report its beneficial ownership of Class A

ordinary shares, $0.0001 par value per share, of Quhuo Limited. Each Party hereto agrees that the Schedule 13D, dated October 15, 2024, relating to such beneficial ownership, is filed on behalf of each of them.

Each of the Parties agrees

to be responsible for the timely filing of the Schedule 13D and any and all amendments thereto and for the completeness and accuracy of

the information concerning itself contained in the Schedule 13D, and the other Party to the extent it knows or has reason to believe that

any information about the other Party is inaccurate.

| Date: October 15,

2024 |

GENAN TECH

LIMITED |

| |

|

|

| |

By: |

/s/

Ahmed Mohamed Aly Mohamed |

| |

|

Name: Ahmed

Mohamed Aly Mohamed |

| |

|

Title: Director |

| Date:

October 15, 2024 |

|

/s/

Ahmed Mohamed Aly Mohamed |

| |

|

Ahmed

Mohamed Aly Mohamed |

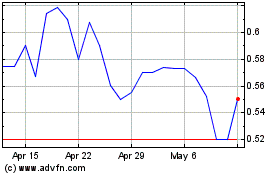

Quhuo (NASDAQ:QH)

Historical Stock Chart

From Feb 2025 to Mar 2025

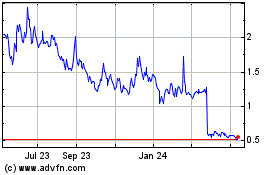

Quhuo (NASDAQ:QH)

Historical Stock Chart

From Mar 2024 to Mar 2025