LOS ANGELES, Oct. 23 /PRNewswire-FirstCall/ -- Preferred Bank

(NASDAQ:PFBC), an independent commercial bank focusing on the

Chinese-American and diversified Southern California mainstream

market, today reported results for the quarter ended September 30,

2008. Preferred Bank reported a net loss of $3.4 million or $0.35

per diluted share compared to net income of $7.2 million or $0.67

per diluted share for the same period in 2007. Results for the

quarter were negatively impacted by a charge of $4.4 million for an

other than temporary impairment ("OTTI") charge on FHLMC preferred

stock, an OTTI charge of $1.6 million on other securities and a

provision for loan losses of $3.7 million. Net income excluding the

OTTI charges was $2.0 million or $0.21 per diluted share for the

quarter ended September 30, 2008. Mr. Li Yu, Chairman and President

of Preferred Bank commented, "Under an unprecedented challenging

environment for financial firms, we concluded the Third Quarter

2008 with an improvement in our tier 1 leverage capital ratio from

9.81% as of June 30, 2008 to 10.01% as of September 30, 2008.

"Although the Emergency Economic Stabilization Act ("EESA")

provides that losses on FNMA and FHLMC preferred stock are now to

be treated as an ordinary loss for tax purposes which would allow a

tax benefit for us, the EESA was not enacted until October 3, 2008

and thus we have to treat the FHLMC charge as a capital item and

record no tax benefit on the writedown in the third quarter. In the

fourth quarter of 2008, we will be able to record a tax benefit of

$2.6 million for the change in the tax treatment of the FHLMC

writedowns that we took in the third quarter ($4.4 million) and

that we took in the second quarter ($1.9 million). "Non-performing

loans (past due more than 90 days) and delinquent loans (past due

for 30 to 89 days) decreased moderately during the quarter but was

offset by increases in other real estate owned ("OREO"). I

personally consider the trend to be slightly encouraging. For the

second quarter in a row, the migration into delinquent loan status

has slowed down and there are more non-performing assets now in the

position to be disposed of. A non-performing real estate loan

usually takes at least 120 days to foreclose on after the work out

process. The timetable is even longer with bankruptcy proceedings

or litigation. There are also unpredictable delays during the

disposition process which we have also experienced in this quarter.

"Appropriate loan losses were provided on all classified loans

based upon recent appraisals/valuations. We also have a large

reserve (0.84%) on our pass portfolio which we believe is one of

the largest among our peer group. Our total provision for loan loss

plus writedowns on OREO in the third quarter of 2008 remained

large, but less than that of the second quarter of 2008. "During

the quarter we have also reduced the Bank's exposure in for-sale

housing construction loans and residential use land loans by $34.2

million or 13.7% and by $13.3 million or 13.9% from June 30, 2008,

respectively. "The State of California Department of Financial

Institutions has just concluded examination field work of Preferred

Bank on October 2, 2008." Net Interest Income and Net Interest

Margin. Net interest income before provision for loan and lease

losses decreased to $12.0 million, compared to $17.7 million for

the third quarter of 2007. The 32.3% decrease was due primarily to

the 300 basis points decrease in the Fed Funds rate and Prime rate

and the higher level of non-accrual loans in 2008. The Company's

net interest margin was 3.40% for the third quarter of 2008, down

from the 5.11% achieved in the third quarter of 2007 and down from

the 3.64% for the second quarter of 2008. Of the 24 basis points

decrease in the margin on a linked quarter basis, 22 basis points

of this was due to non accrual loans. Noninterest Income. For the

third quarter of 2008 noninterest income was $762,000 compared with

$753,000 for the same quarter last year and $995,000 for the second

quarter of 2008. The decrease in noninterest income this quarter

compared to the second quarter of 2008 was due mainly to a decrease

in service charges to $370,000 from $470,000 and due to a $75,000

gain on the sale of equipment associated with a capitalized lease

during the second quarter. Noninterest Expense. Total noninterest

expense was $12.0 million for the third quarter of 2008, compared

to $5.5 million for the same period in 2007 and $6.6 million for

the second quarter of 2008. Salaries and benefits decreased by

$1.17 million from the third quarter of 2007 due primarily to a

decrease in bonus expense which is based on overall profitability.

Occupancy expense increased due to an adjustment of leased premises

costs associated with leases which have pre-determined escalating

costs. Professional services expense increased due to an increase

in legal costs associated with non-performing loans. Noninterest

expense is up over the same quarter of last year due to the OTTI

charges of $6.0 million as well as OREO expenses of $777,000

($527,000 of which was a valuation writedown) in the third quarter

of 2008 compared to none in the third quarter of 2007. Operating

Efficiency Ratio. For the quarter, the operating efficiency ratio

was 94.2% as compared to 29.9% for the same quarter in 2007 and

46.4% recorded in the second quarter of 2008. The deterioration in

the efficiency ratio is primarily attributable to the $6.0 million

charge recorded for OTTI. Excluding the FHLMC preferred stock OTTI

charge and the OREO writedown of $527,000, the efficiency ratio for

the third quarter of 2008 was 55.8%. Balance Sheet Summary Total

gross loans and leases at September 30, 2008 were $1.197 billion, a

$36.5 million or 3.0% decrease from the $1.23 billion at December

31, 2007. Commercial real estate loans were up from $518.3 million

as of December 31, 2007 to $538.8 million at September 30, 2008

while construction loans decreased $33.2 million from December 31,

2007 and commercial & industrial and international loans

decreased $23.8 million from December 31, 2007. Total deposits as

of September 30, 2008 were $1.226 billion, a decrease of $27.5

million or 2.2% from the $1.253 billion at December 31, 2007. As of

September 30, 2008 compared to December 31, 2007;

noninterest-bearing demand deposits decreased by $32.3 million or

14.0%, interest-bearing demand and savings deposits decreased by

$39.5 million or 17.1% and time deposits increased by $44.3 million

or 5.6%. During the third quarter, the Bank decreased its total

collateralized governmental agency deposits by approximately $123

million and also sold approximately $114 million in securities that

were securing those deposits. Total assets were $1.447 billion, a

$95.2 million or 6.2% decrease from the total of $1.543 billion as

of December 31, 2007. Total borrowings, both overnight and term

borrowings decreased from $111 million as of December 31, 2007 to

$63 million as of September 30, 2008 as the Bank worked to

restructure the balance sheet to increase liquidity. The

loan-to-deposit ratio as of September 30, 2008 was 97.6% compared

to 98.4% as of December 31, 2007. Asset Quality As of September 30,

2008 total nonaccrual loans were $61.8 million compared to $8.9

million as of September 30, 2007 and $20.9 million as of December

31, 2007. Total loans 90 days past due and still accruing decreased

to $0 as compared to $23.8 million as of June 30, 2008. Total loans

30-89 days past due decreased from $18.7 million as of June 30,

2008 to $11.9 million as of September 30, 2008. Total net

charge-offs for the third quarter of 2008 were $8.4 million

compared to $7.2 million for the second quarter of 2008. Based on a

detailed analysis of all impaired and classified loans, as well as

an analysis of other qualitative factors, the Bank recorded a

provision for loan losses of $3.7 million as compared to $7.2

million in the second quarter of 2008 and $750,000 for the third

quarter of 2007. The allowance for loan loss at September 30, 2008

was $15.2 million or 1.27% of total loans compared to $15.0 million

and 1.21%, respectively at December 31, 2007. Total past due loans

as of September 30, 2008 were comprised of the following: Loan Type

30-89 Days Past Due 90 + Still Accruing Nonaccrual # $ # $ # $

Commercial & Industrial - $ - - $ - 4 $ 6,685,000 Real Estate 1

709,000 - 5 8,906,000 Construction-Commercial - - - - - -

Construction-Housing - - - - 1 10,615,000 Construction-Condo 1

3,961,000 - - 5 28,104,000 Land-residential 2 7,230,000 - - 1

7,520,000 Land-Commercial - - - - - - Total as of September 30,

2008 4 $11,900,000 - $ - 16 $61,830,000 Total as of June 30, 2008 4

$18,689,000 5 $23,789,000 13 $54,192,000 Below is a summary of the

change in our residential land and residential construction loans

during the quarter: (In thousands) 9-30-08 6-30-08 $ Change %

Change Residential Construction Attached $172,536 $202,657

$(30,121) (14.9%) Detached 42,663 46,779 (4,116) (8.8%) Total

215,199 249,436 (34,237) (13.7%) Land Zoned For Residential Use

82,602 95,899 (13,297) (13.9%) Total Residential Construction and

Residential Land Loans $297,801 $345,335 $(47,534) (13.8%) Inland

Empire As of September 30, 2008, the Bank's Inland Empire loan

exposure was $56.4 million of which $13.2 million was in

non-accrual status and reserved for based on the underlying

property's recent appraised value. Of the remaining $43.2 million,

$4.1 million was residential land, $13.3 million was commercial

construction and the remaining was commercial real estate. Our

total Inland Empire loan exposure as of June 30, 2008 was $71.9

million. Real Estate Owned Total OREO increased to $26.5 million as

of September 30, 2008 compared to $8.4 million as of September 30,

2007 and December 31, 2007. The foreclosed properties include: -- A

construction project in Oakland, California of which the Bank is in

the process to attempt to rezone part of the project to higher

density to enhance the property value. We have written down the

property value from $8.44 million to $7.91 million to conform to

appraised "as-is" value concluded in late September. -- A $3.52

million condo land parcel located in prime area of Westside of Los

Angeles. We are currently negotiating for best prices among

multiple proposals. -- A $1.81 million participation of tract home

land in Carson City, Nevada. The lead bank has reported that they

have initiated negotiations with a major home builder. -- A $5.73

million participation of freeway adjacent commercial zoned land in

Beaumont, California. Carrying cost is 55% of appraisal value. -- A

$7.50 million participation of freeway adjacent residential land in

Beaumont, California. Carrying cost is 42% of appraisal value.

Items #2 to #5 above are the new additions to OREO during the

quarter. Capitalization Preferred Bank continues to be "well

capitalized" under all regulatory requirements, with a Tier 1

leverage ratio of 10.01% and a total risk based capital ratio of

12.30% at September 30, 2008. Conference Call and Webcast A

conference call with simultaneous webcast to discuss Preferred

Bank's third quarter 2008 financial results will be held today,

October 23, at 5:00 p.m. Eastern / 2:00 p.m. Pacific. Interested

participants and investors may access the conference call by

dialing (877) 326-9970 (domestic) or (303) 205-0066

(international). There will also be a live webcast of the call

available at the Investor Relations section of Preferred Bank's web

site at http://www.preferredbank.com/. Web participants are

encouraged to go to the web site at least 15 minutes prior to the

start of the call to register, download and install any necessary

audio software. Preferred Bank's Chairman, President and CEO Li Yu,

Chief Credit Officer Robert Kosof and Chief Financial Officer

Edward Czajka will be present to discuss Preferred Bank's financial

results, business highlights and outlook. After the live webcast, a

replay will remain available in the Investor Relations section of

Preferred Bank's web site. A replay of the call will be available

at 800-405-2236 (domestic) or 303-590-3000 (international) through

October 31, 2008; the pass code is 11121375. About Preferred Bank

Preferred Bank is one of the largest independent commercial banks

in California focusing on the Chinese-American market. The bank is

chartered by the State of California, and its deposits are insured

by the Federal Deposit Insurance Corporation, or FDIC, to the

maximum extent permitted by law. The Company conducts its banking

business from its main office in Los Angeles, California, and

through ten full-service branch banking offices in Alhambra,

Century City, Chino Hills, City of Industry, Torrance, Arcadia,

Irvine, Diamond Bar, Santa Monica and Valencia, California.

Preferred Bank offers a broad range of deposit and loan products

and services to both commercial and consumer customers. The bank

provides personalized deposit services as well as real estate

finance, commercial loans and trade finance to small and mid-sized

businesses, entrepreneurs, real estate developers, professionals

and high net worth individuals. Preferred Bank continues to benefit

from the significant migration to Southern California of ethnic

Chinese from China and other areas of East Asia. While its business

is not solely dependent on the Chinese-American market, it

represents an important element of the bank's operating strategy,

especially for its branch network and deposit products and

services. Preferred Bank believes it is well positioned to compete

effectively with the smaller Chinese-American community banks, the

larger commercial banks and other major banks operating in Southern

California by offering a high degree of personal service and

responsiveness, experienced multi-lingual staff and substantial

lending limits. Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about the Bank's future

financial and operating results, the Bank's plans, objectives,

expectations and intentions and other statements that are not

historical facts. Such statements are based upon the current

beliefs and expectations of the Bank's management and are subject

to significant risks and uncertainties. Actual results may differ

from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government's monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank's 2007 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation which can

be found on Preferred Bank's website. The forward-looking

statements in this press release speak only as of the date of the

press release, and the Bank assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those contained in the forward-looking

statements. For additional information about Preferred Bank, please

visit the Bank's website at http://www.preferredbank.com/. For

Further Information: AT THE COMPANY: AT FINANCIAL RELATIONS BOARD:

Edward J. Czajka Lasse Glassen Executive Vice President General

Information Chief Financial Officer (213) 486-6546 (213) 891-1188

Financial Tables to Follow PREFERRED BANK Condensed Consolidated

Statements of Income (unaudited) (in thousands, except for net

income per share and shares) For the Three Months Ended September

30, September 30, June 30, 2008 2007 2008 Interest income: Loans,

including fees $17,184 $25,954 $18,924 Investment securities 2,660

2,838 3,169 Fed funds sold 41 441 4 Total interest income 19,885

29,233 22,097 Interest expense: Interest-bearing demand 288 684 383

Savings 278 1,105 349 Time certificates of $100,000 or more 4,269

7,878 5,489 Other time certificates 2,318 1,465 1,524 Fed funds

purchased 46 14 790 FHLB borrowings 693 380 231 Total interest

expense 7,892 11,526 8,766 Net interest income 11,993 17,707 13,331

Provision for loan losses 3,680 750 7,200 Net interest income after

provision for loan losses 8,313 16,957 6,131 Noninterest income:

Fees & service charges on deposit accounts 370 426 470 Trade

finance income 180 200 219 BOLI income 91 86 91 Other income 121 41

215 Total noninterest income 762 753 995 Noninterest expense:

Salary and employee benefits 1,861 3,030 1,997 Net occupancy

expense 897 621 678 Business development and promotion expense 55

96 77 Professional services 815 658 655 Office supllies and

equipment expense 300 267 313 Other than temporary impairment 5,971

- 1,928 Other 2,120 847 997 Total noninterest expense 12,019 5,519

6,645 Income/(loss) before provision for income taxes (2,944)

12,191 481 Provision for income taxes 457 5,031 463 Net

income/(loss) $(3,401) $7,160 $18 Net income per share - basic

$(0.35) $0.69 $ - Net income per share - diluted $(0.35) $0.67 $ -

Weighted-average common shares outstanding Basic 9,755,207

10,380,279 9,755,207 Diluted 9,763,960 10,653,108 9,756,471

PREFERRED BANK Condensed Consolidated Statements of Income

(unaudited) (in thousands, except for net income per share and

shares) For the Nine Months Ended September 30, September 30,

Change 2008 2007 % Interest income: Loans, including fees $58,080

$73,465 -20.9% Investment securities 9,133 8,330 9.6% Fed funds

sold 57 2,233 -97.5% Total interest income 67,270 84,028 -19.9%

Interest expense: Interest-bearing demand 1,109 2,078 -46.6%

Savings 1,181 2,759 -57.2% Time certificates of $100,000 or more

16,542 23,576 -29.8% Other time certificates 5,472 3,587 52.5% Fed

funds purchased 525 748 -29.8% FHLB borrowings 2,276 47 4742.0%

Total interest expense 27,105 32,795 -17.4% Net interest income

40,165 51,233 -21.6% Provision for credit losses 15,960 2,000

698.0% Net interest income after provision for loan losses 24,205

49,233 -50.8% Noninterest income: - - Fees & service charges on

deposit accounts 1,297 1,241 4.5% Trade finance income 540 608

-11.1% BOLI income 270 256 5.5% Other income 432 229 88.7% Total

noninterest income 2,539 2,334 8.8% Noninterest expense: Salary and

employee benefits 6,497 9,728 -33.2% Net occupancy expense 2,167

1,811 19.6% Business development and promotion expense 228 236

-3.3% Professional services 2,102 1,969 6.7% Office supllies and

equipment expense 907 694 30.7% Other than temporary impairment

7,899 - 100.0% Other 3,870 1,939 99.6% Total noninterest expense

23,669 16,377 44.5% Income before provision for income taxes 3,075

35,190 -91.3% Provision for income taxes 3,080 14,558 -78.8% Net

income $(5) $20,632 -100.0% Net income per share - basic $(0.00)

$1.99 -100.0% Net income per share - diluted $(0.00) $1.93 -100.0%

Weighted-average common shares outstanding Basic 9,802,699

10,389,369 -5.6% Diluted 9,828,087 10,672,565 -7.9% PREFERRED BANK

Condensed Consolidated Statements of Financial Condition

(unaudited) (in thousands) September 30, December 31, September 30,

2008 2007 2007 Assets Cash and due from banks $26,136 $22,803

$31,389 Fed funds sold 38,000 - 40,550 Cash and cash equivalents

64,136 22,803 71,939 Securities available-for-sale, at fair value

119,416 245,268 201,722 - - Loans and leases 1,196,577 1,233,099

1,187,903 Less allowance for loan and lease losses (15,240)

(14,896) (11,996) Less net deferred loan fees (55) (682) (1,081)

Net loans and leases 1,181,282 1,217,521 1,174,826 Other real

estate owned 26,470 8,444 - Customers' liability on acceptances 318

5,083 11,355 Bank furniture and fixtures, net 7,005 4,721 1,576

Bank-owned life insurance 8,381 8,168 8,099 Accrued interest

receivable 7,243 10,165 9,524 Federal Home Loan Bank stock 5,781

4,700 4,330 Deferred tax assets 17,535 12,278 12,183 Other asset

9,872 3,459 10,693 Total assets $1,447,439 $1,542,610 $1,506,247

Liabilities and Stockholders' Equity Liabilities: Deposits: Demand

197,831 $230,083 $224,099 Interest-bearing demand 127,723 137,220

137,799 Savings 63,391 93,398 116,171 Time certificates of $100,000

or more 465,716 639,455 622,936 Other time certificates 370,944

152,954 146,741 Total deposits $1,225,605 $1,253,110 $1,247,746

Acceptances outstanding 318 5,083 11,355 Advances from Federal Home

Loan Bank 63,000 75,000 65,000 Fed funds purchased - 36,000 -

Accrued interest payable 4,394 5,493 5,599 Other liabilities 12,711

14,972 15,721 Total liabilities 1,306,028 1,389,658 1,345,421

Commitments and contingencies Stockholders' equity: Preferred

stock. Authorized 5,000,000 shares; no share issued and outstanding

at September 30, 2008, December 31, 2007 and September 30, 2007 - -

- Common stock, no par value. Authorized 100,000,000 shares; issued

72,009 71,863 71,732 and outstanding 9,755,207, 9,953,532 and

10,346,332 shares at September 30, 2008, - - - December 31, 2007

and September 30, 2007, respectively - - - Treasury stock (19,115)

(14,976) (3,843) Additional paid-in-capital 4,170 2,948 2,591

Retained earnings 90,979 94,595 90,536 Accumulated other

comprehensive loss: - - - Unrealized loss on securities - - -

available-for-sale, net of tax (6,632) (1,478) (190) Total

stockholders' equity 141,411 152,952 160,826 Total liabilities and

stockholders' equity $1,447,439 $1,542,610 $1,506,247 PREFERRED

BANK Selected Consolidated Financial Information (unaudited) (in

thousands, except for ratios) For the Three Months Ended September

30, June 30, December 31, September 30, 2008 2008 2007 2007 For the

period: Return on average assets -0.90% 0.00% 1.56% 1.99% Return on

average equity -9.22% 0.05% 14.59% 17.76% Net interest margin

(Fully-taxable equivalent) 3.40% 3.64% 4.82% 5.11% Noninterest

expense to average assets 1.89% ** 1.22% * 1.36% 1.53% Efficiency

ratio 55.80% ** 32.93% * 28.39% 29.89% Net charge-offs to average

loans (annualized) 2.78% 2.35% 0.00% 0.00% Period end: Tier 1

leverage capital ratio 10.01% 9.81% 10.31% 11.30% Tier 1 risk-based

capital ratio 11.17% 10.94% 10.54% 11.03% Total risk-based capital

ratio 12.30% 12.20% 11.57% 11.86% Nonperforming assets to total

assets 6.10% 5.67% 1.90% 0.59% Nonaccrual loans to total loans

5.17% 4.48% 1.69% 0.75% Allowance for loan and lease losses to

total loans 1.27% 1.65% 1.21% 1.01% Allowance for loan and lease

losses to nonaccrual loans 24.65% 36.83% 71.28% 134.62% Average

balances: Total loans and leases 1,201,270 $1,235,756 $1,195,870

$1,137,769 Earning assets 1,431,265 1,501,873 1,432,486 1,381,068

Total assets 1,495,939 1,549,386 1,481,506 1,424,938 Total deposits

1,255,020 1,265,510 1,205,911 1,201,761 Period end: Loans and

Leases: Real estate - multifamily/commercial $538,779 $523,875

$518,304 $417,162 Real estate - construction 333,473 356,630

366,706 437,460 Commercial and industrial 245,223 242,982 255,912

218,853 Trade finance 78,553 84,535 91,565 113,956 Other 549 408

612 472 Total gross loans and leases 1,196,577 1,208,430 1,233,099

1,187,903 Allowance for loan and lease losses (15,240) (19,960)

(14,896) (11,996) Net deferred loan fees (55) (123) (682) (1,081)

Net loans and leases $1,181,282 $1,188,347 $1,217,521 $1,174,826

Deposits: Noninterest-bearing demand $197,831 $209,900 $230,083

$224,099 Interest-bearing demand and savings 191,114 226,514

230,618 253,970 Total core deposits 388,945 436,414 460,701 478,069

Time deposits 836,660 847,111 792,409 769,677 Total deposits

$1,225,605 $1,283,525 $1,253,110 $1,247,746 *Excluding OTTI charge

on the FHLMC preferred stock **Excluding OTTI charge on the FHLMC

preferred stock and OREO write down DATASOURCE: Preferred Bank

CONTACT: Edward J. Czajka, Executive Vice President, Chief

Financial Officer of Preferred Bank, +1-213-891-1188; or General

Information, Lasse Glassen, +1-213-486-6546, , for Preferred Bank

Web site: http://www.preferredbank.com/

Copyright

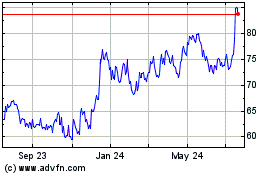

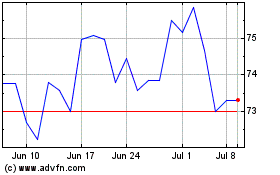

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jul 2023 to Jul 2024