LOS ANGELES, July 22 /PRNewswire-FirstCall/ -- Preferred Bank

(NASDAQ:PFBC), an independent commercial bank focusing on the

Chinese-American and diversified Southern California mainstream

market, today reported net income for the quarter ended June 30,

2008. Net income totaled $449,000, an 93.6% decrease from net

income of $7.0 million for the same period in 2007 while diluted

earnings per share decreased 92.3% to $0.05 for the quarter

compared to $0.65 for the second quarter of 2007. Net income for

the quarter was negatively impacted by a provision for loan losses

of $7.2 million, a pre-tax charge to earnings of $1.9 million for

an other than temporary impairment on FHLMC preferred stock, and a

decrease in net interest income of $4.0 million as compared to the

second quarter of 2007. Mr. Li Yu, Chairman and President of

Preferred Bank commented, "The housing market has shown little

improvement during the second quarter, several loans that were 30

to 89 days past due as of March 31, 2008, have now been placed on

non-accrual status. Together with the non-accrual balance of $36.2

million at March 31, 2008 total non-accrual loans are now $54.2

million at June 30, 2008. Appropriate reserves have been

established based upon recent third party valuations. "Compared to

March 31, 2008, the 30 - 89 days past due and loans 90+ days past

due and still accruing decreased from $50.7 million to $42.5

million at June 30, 2008 which indicates that the migration into

total past due category has slowed down or at least temporarily

subsided. "More than 75% of the non-accrual loans are participation

credits with another bank as the agent bank. Resolution of those

loans typically takes a longer time as there is normally more than

one bank involved. Resolution procedures include legal action,

foreclosure or selling of the notes. We estimate at least $16

million of these loans will be resolved in early third quarter.

"During the second quarter of 2008 we have also recorded an

other-than-temporary impairment (OTTI) charge on FHLMC preferred

stock of $1.9 million. Considering the large loan loss provision of

$7.2 million and the OTTI charge, I am not totally disappointed

with the second quarter net income of $449,000 under this most

difficult environment. All other aspects of our operations remain

stable, our tier 1 and total risk-based regulatory capital ratios

increased from March 31, 2008 and we have worked to de-leverage the

balance sheet. One unfortunate aspect of newer accounting rules,

specifically Statement of Financial Accounting Standards Number

123R ("SFAS No. 123R"), requires that we continue to record the

expense of stock options even though none of our existing granted

stock options have any value in them. We urge the Financial

Accounting Standards Board ("FASB") to modify SFAS 123R to address

this situation. Like most other financial institutions, we are now

recording this theoretical expense for which there is no

corresponding benefit to our employees. "The dramatic drop in the

stock price of Preferred Bank has led to a change in the ownership

makeup of Preferred Bank. As institutional shareholders have sold

shares, members of the Board of Directors of Preferred Bank and

employees have been purchasing them. Insider ownership is now

estimated to exceed 30%. "As of June 30, 2008, our tangible equity

ratio is 9.70%. The bank's three regulatory capital ratios are

substantially above the 'well capitalized' definition." Net

Interest Income and Net Interest Margin. Net interest income before

provision for loan and lease losses decreased to $13.3 million,

compared to $17.3 million for the second quarter of 2007. The 22.9%

decrease was due primarily to the 325 basis point decrease in the

Fed Funds rate and the higher level of non-accrual loans in 2008.

The Company's net interest margin was 3.63% for the second quarter

of 2008, down from the 5.15% achieved in the second quarter of 2007

and down from the 4.11% for the first quarter of 2008. Noninterest

Income. For the second quarter of 2008 noninterest income was

$996,000 compared with $819,000 for the same quarter last year and

$782,000 for the first quarter of 2008. The increase in noninterest

income this quarter compared to last year was due mainly to an

increase in service charges to $470,000 from $395,000 in the same

period last year. Also, other income increased due to a $75,000

gain on the sale of equipment associated with a capitalized lease

which matured during the quarter. Noninterest Expense. Total

noninterest expense was $6,645,000 for the second quarter of 2008,

compared to $5,483,000 for the same period in 2007 and $5,005,000

for the first quarter of 2008. Salaries and benefits decreased by

$1,100,000 from the second quarter in 2007 due to a decrease in

bonus expense which is based on overall profitability. Occupancy

expense increased due to an adjustment of leased premises costs

associated with leases which have pre-determined escalating costs.

Professional services expense decreased due to lower costs

associated with external audit as well as reduced costs associated

with compliance with Sarbanes-Oxley Section 404. Other expense is

up over the same quarter last year due to the OTTI charge of $1.9

million on the FHLMC Preferred Stock. Operating Efficiency Ratio.

For the quarter, the operating efficiency ratio was 46.4% as

compared to 30.3% for the same quarter in 2007 and 32.0% recorded

in the first quarter of 2008. The deterioration is primarily

attributable to the $1.9 million charge recorded for OTTI. Balance

Sheet Summary Total gross loans and leases at June 30, 2008 were

$1.21 billion, a $101.8 million or 9.2% increase over the $1.11

billion at June 30, 2007 and a $24.7million or 2.0% decrease over

the $1.233 billion total as of December 31, 2007. Commercial real

estate loans were up slightly from $518.3 million as of December

31, 2007 to $523.9 million at June 30, 2008 while construction

loans decreased $10.1 million from December 31, 2007 and commercial

& industrial and international loans decreased $20.0 million

from December 31, 2007. Total deposits as of June 30, 2008 were

$1.284 billion, an increase of $30.4 million or 2.4% over the

$1.253 billion at December 31, 2007. Noninterest-bearing demand

deposits decreased by $20.2 million or 8.8%, interest-bearing

demand and savings deposits decreased by $4.1 million or 1.8% and

time deposits increased by $54.7 million or 6.9%. Total assets were

$1.525 billion, a 1.2% decrease from the total of $1.543 billion as

of December 31, 2007. Total borrowings, both overnight and term

borrowings decreased from $111 million as of December 31, 2007 to

$77 million as of June 30, 2008 as the Bank worked to restructure

the balance sheet to increase liquidity. The loan-to-deposit ratio

as of June 30, 2008 was 92.7% compared to 97.2% as of December 31,

2007 Asset Quality As of June 30, 2008 total nonaccrual loans were

$54.2 million compared to $230,000 as of June 30, 2007 and $20.9

million as of December 31, 2007. Total net charge-offs for the

second quarter of 2008 were $7.2 million. Total loans 90 days past

due and still accruing interest were $23.8 million as compared to

$0 as of December 31, 2007. Because of the increase in

non-performing loans and further deterioration in the construction

and land loan portfolio during the second quarter of 2008, the Bank

recorded a provision for loan losses of $7.2 million as compared to

$5.1 million in the first quarter of 2008 and $650,000 for the

second quarter of 2007. The allowance for loan loss at June 30,

2008 was $20.0 million or 1.65% of total loans compared to $11.2

million and 1.02%, respectively at June 30, 2007. Total

non-performing loans as of June 30, 2008 were comprised of the

following: Loan Type 90 + Days & Still Accruing Nonaccrual # $

# $ Commercial & Industrial - $ - 4 $ 3,528,000 Real Estate - -

2 1,535,000 Construction-Commercial - - - - Construction-Housing 1

2,704,000 1 15,857,000 Construction-Condo - - 4 22,125,000

Land-residential 3 15,350,000 2 11,147,000 Land-Commercial 1

5,735,000 - - 5 $23,789,000 13 $54,192,000 Preferred Bank's Inland

Empire exposure as of June 30, 2008 consisted of the following:

Loan Type Total Outstanding Total Nonaccrual & 90+ Still

Accruing # $ # $ Commercial & Industrial - $ - - $ - Real

Estate 9 15,558,000 - - Construction-Commercial 4 9,146,000 - -

Construction-Housing 1 15,857,000 1 15,857,000 Construction-Condo -

- - - Land-residential 11 15,638,000 2 11,270,000 Land-Commercial 4

15,723,000 1 5,735,000 29 $71,922,000 4 $32,862,000 Capitalization

Preferred Bank continues to be "well capitalized" under all

regulatory requirements, with a Tier 1 leverage ratio of 9.83% and

a total risk based capital ratio of 12.19% at June 30, 2008.

Conference Call and Webcast A conference call with simultaneous

webcast to discuss Preferred Bank's second quarter 2008 financial

results will be held today, July 22, at 5:00 p.m. Eastern / 2:00

p.m. Pacific. Interested participants and investors may access the

conference call by dialing (800) 218-0713 (domestic) or (303)

262-2175 (international). There will also be a live webcast of the

call available at the Investor Relations section of Preferred

Bank's web site at http://www.preferredbank.com/. Web participants

are encouraged to go to the web site at least 15 minutes prior to

the start of the call to register, download and install any

necessary audio software. Preferred Bank's Chairman, President and

CEO Li Yu, Chief Credit Officer Robert Kosof and Chief Financial

Officer Edward Czajka will be present to discuss Preferred Bank's

financial results, business highlights and outlook. After the live

webcast, a replay will remain available in the Investor Relations

section of Preferred Bank's web site. A replay of the call will be

available at 800-405-2236 (domestic) or 303-590-3000

(international) through July 29, 2008; the pass code is 11117331.

About Preferred Bank Preferred Bank is one of the largest

independent commercial banks in California focusing on the

Chinese-American market. The bank is chartered by the State of

California, and its deposits are insured by the Federal Deposit

Insurance Corporation, or FDIC, to the maximum extent permitted by

law. The Company conducts its banking business from its main office

in Los Angeles, California, and through ten full-service branch

banking offices in Alhambra, Century City, Chino Hills, City of

Industry, Torrance, Arcadia, Irvine, Diamond Bar, Santa Monica and

Valencia, California. Preferred Bank offers a broad range of

deposit and loan products and services to both commercial and

consumer customers. The bank provides personalized deposit services

as well as real estate finance, commercial loans and trade finance

to small and mid-sized businesses, entrepreneurs, real estate

developers, professionals and high net worth individuals. Preferred

Bank continues to benefit from the significant migration to

Southern California of ethnic Chinese from China and other areas of

East Asia. While its business is not solely dependent on the

Chinese-American market, it represents an important element of the

bank's operating strategy, especially for its branch network and

deposit products and services. Preferred Bank believes it is well

positioned to compete effectively with the smaller Chinese-American

community banks, the larger commercial banks and other major banks

operating in Southern California by offering a high degree of

personal service and responsiveness, experienced multi-lingual

staff and substantial lending limits. Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about

the Bank's future financial and operating results, the Bank's

plans, objectives, expectations and intentions and other statements

that are not historical facts. Such statements are based upon the

current beliefs and expectations of the Bank's management and are

subject to significant risks and uncertainties. Actual results may

differ from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government's monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank's 2007 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation which can

be found on Preferred Bank's website. The forward-looking

statements in this press release speak only as of the date of the

press release, and the Bank assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those contained in the forward-looking

statements. For additional information about Preferred Bank, please

visit the Bank's website at http://www.preferredbank.com/. AT THE

COMPANY: AT FINANCIAL RELATIONS BOARD: Edward J. Czajka Lasse

Glassen Senior Vice President General Information Chief Financial

Officer (213) 486-6546 (213) 891-1188 Financial Tables to Follow

PREFERRED BANK Condensed Statements of Income (unaudited) (in

thousands, except for net income per share and shares) For the

Three Months Ended June 30, June 30, March 31, 2008 2007 2008

Interest income: Loans, including fees $18,924 $24,518 $21,972

Investment securities 3,169 2,765 3,304 Fed funds sold 4 998 12

Total interest income 22,097 28,281 25,288 Interest expense:

Interest-bearing demand 383 727 438 Savings 349 893 554 Time

certificates of $100,000 or more 5,489 8,122 6,784 Other time

certificates 1,524 1,061 1,630 Fed funds purchased 231 2 793 FHLB

borrowings 790 185 248 Total interest expense 8,766 10,990 10,447

Net interest income 13,331 17,291 14,841 Provision for loan losses

7,200 650 5,080 Net interest income after provision for loan losses

6,131 16,641 9,761 Noninterest income: Fees & service charges

on deposit accounts 470 395 457 Trade finance income 219 262 141

BOLI income 91 86 88 Other income 216 76 96 Total noninterest

income 996 819 782 Noninterest expense: Salary and employee

benefits 1,997 3,097 2,638 Net occupancy expense 678 599 592

Business development and promotion expense 77 94 96 Professional

services 655 793 632 Office supllies and equipment expense 313 240

294 Other than temporary impairment 1,928 - - Other 997 660 753

Total noninterest expense 6,645 5,483 5,005 Income before provision

for income taxes 482 11,977 5,538 Provision for income taxes 33

4,998 2,160 Net income $449 $6,979 $3,378 Net income per share -

basic $0.05 $0.67 $0.34 Net income per share - diluted $0.05 $0.65

$0.34 Weighted-average common shares outstanding Basic 9,755,207

10,421,794 9,898,204 Diluted 9,756,471 10,680,975 9,937,828

PREFERRED BANK Condensed Statements of Income (unaudited) (in

thousands, except for net income per share and shares) For the Six

Months Ended June 30, June 30, Change 2008 2007 % Interest income:

Loans, including fees $40,896 $47,511 -13.9% Investment securities

6,473 5,492 17.9% Fed funds sold 16 1,792 -99.1% Total interest

income 47,385 54,795 -13.5% Interest expense: Interest-bearing

demand 821 1,394 -41.1% Savings 903 1,654 -45.4% Time certificates

of $100,000 or more 12,273 15,699 -21.8% Other time certificates

3,154 2,121 48.7% Fed funds purchased 479 33 1351.4% FHLB

borrowings 1,583 368 330.2% Total interest expense 19,213 21,269

-9.7% Net interest income 28,172 33,526 -16.0% Provision for credit

losses 12,280 1,250 882.4% Net interest income after provision for

loan losses 15,892 32,276 -50.8% Noninterest income: Fees &

service charges on deposit accounts 927 816 13.6% Trade finance

income 360 407 -11.6% BOLI income 178 170 4.9% Other income 312 189

65.0% Total noninterest income 1,777 1,582 12.3% Noninterest

expense: Salary and employee benefits 4,635 6,698 -30.8% Net

occupancy expense 1,270 1,190 6.7% Business development and

promotion expense 173 140 23.6% Professional services 1,287 1,312

-1.9% Office supllies and equipment expense 607 428 41.9% Other

than temporary impairment 1,928 - n/a Other 1,750 1,092 60.2% Total

noninterest expense 11,650 10,860 7.3% Income before provision for

income taxes 6,019 22,998 -73.8% Provision for income taxes 2,193

9,526 -77.0% Net income $3,826 $13,472 -71.6% Net income per share

- basic $0.39 $1.30 -70.0% Net income per share - diluted $0.39

$1.26 -69.0% Weighted-average common shares outstanding Basic

$9,800,251 $10,393,989 -5.7% Diluted $9,824,871 $10,682,186 -8.0%

PREFERRED BANK Condensed Statements of Financial Condition

(unaudited) (in thousands) June 30, December 31, June 30, 2008 2007

2007 Assets Cash and due from banks $25,639 $22,803 $38,097 Fed

funds sold 2,500 - 59,000 Cash and cash equivalents 28,139 22,803

97,097 Securities available-for-sale, at fair value 250,385 245,268

206,648 Loans and leases 1,208,430 1,233,099 1,106,586 Less

allowance for loan and lease losses (19,960) (14,896) (11,246) Less

net deferred loan fees (123) (682) (1,327) Net loans and leases

1,188,347 1,217,521 1,094,013 Other real estate owned 8,441 8,444 -

Customers' liability on acceptances 508 5,083 5,019 Bank furniture

and fixtures, net 7,219 4,721 1,666 Bank-owned life insurance 8,309

8,168 8,031 Accrued interest receivable 8,853 10,165 9,196 Federal

Home Loan Bank stock 4,828 4,700 4,277 Deferred tax assets 16,540

12,278 10,818 Other asset 3,390 3,459 579 Total assets $1,524,959

$1,542,610 $1,437,344 Liabilities and Stockholders' Equity

Liabilities: Deposits: Demand 209,900 230,083 $247,822

Interest-bearing demand 156,755 137,220 124,951 Savings 69,759

93,398 100,731 Time certificates of $100,000 or more 646,826

639,455 620,677 Other time certificates 200,285 152,954 140,822

Total deposits $1,283,525 $1,253,110 $1,235,003 Acceptances

outstanding 508 5,083 5,019 Advances from Federal Home Loan Bank

68,000 75,000 20,000 Fed funds purchased 9,000 36,000 - Accrued

interest payable 4,096 5,493 5,418 Other liabilities 11,858 14,972

13,783 Total liabilities 1,376,987 1,389,658 1,279,223 Commitments

and contingencies Stockholders' equity: Preferred stock. Authorized

5,000,000 shares; no share issued and outstanding at June 30, 2008,

December 31, 2007 and June 30, 2007 - - - Common stock, no par

value. Authorized 100,000,000 shares; issued and outstanding

9,755,207, 9,953,532 and 10,430,632 shares at June 30, 2008,

December 31, 2007 and June 30, 2007, respectively 72,009 71,863

71,378 Treasury stock (19,115) (14,976) - Additional

paid-in-capital 3,760 2,948 2,245 Retained earnings 95,667 94,595

85,151 Accumulated other comprehensive loss: Unrealized loss on

securities available-for-sale, net of tax (4,349) (1,478) (653)

Total stockholders' equity 147,972 152,952 158,121 Total

liabilities and stockholders' equity $1,524,959 $1,542,610

$1,437,344 PREFERRED BANK Selected Financial Information

(unaudited) (in thousands, except for ratios) For the Three Months

Ended June 30, March 31, December 31, June 30, 2008 2008 2007 2007

For the period: Return on average assets 0.12% 0.89% 1.56% 2.01%

Return on average equity 1.18% 8.77% 14.59% 17.96% Net interest

margin (Fully-taxable equivalent) 3.63% 4.11% 4.82% 5.15%

Noninterest expense to average assets 1.72% 1.31% 1.36% 1.58%

Efficiency ratio 46.38% 32.04% 28.39% 30.28% Net charge-offs to

average loans (annualized) 2.35% 0.00% 0.00% 0.02% Period end: Tier

1 leverage capital ratio 9.83% 9.84% 10.31% 11.61% Tier 1

risk-based capital ratio 10.94% 10.53% 10.54% 11.41% Total

risk-based capital ratio 12.19% 11.93% 11.57% 12.44% Nonperforming

assets to total assets 5.67% 2.88% 1.90% 0.02% Nonaccrual loans to

total loans 4.48% 2.95% 1.69% 0.02% Allowance for loan and lease

losses to total loans 1.65% 1.62% 1.21% 1.02% Allowance for loan

and lease losses to nonaccrual loans 36.83% 55.12% 71.28% 4889.57%

Average balances: Total loans and leases $1,235,756 $1,218,485

$1,195,870 $1,067,016 Earning assets 1,505,801 1,478,608 1,432,486

1,352,686 Total assets 1,549,392 1,531,723 1,481,506 1,392,552

Total deposits 1,265,510 1,251,993 1,205,911 1,193,701 Period end:

Loans and Leases: Real estate - multifamily/ commercial $523,875

$543,767 $518,304 $438,418 Real estate - construction* 356,630 *

350,426 366,706 330,866 Commercial and industrial 242,982 253,852

255,912 226,191 Trade finance 84,535 81,592 91,565 110,463 Other

408 503 612 648 Total gross loans and leases 1,208,430 1,230,140

1,233,099 1,106,586 Allowance for loan and lease losses (19,960)

(19,976) (14,896) (11,246) Net deferred loan fees (123) (1,154)

(682) (1,327) Net loans and leases $1,188,347 $1,209,010 $1,217,521

$1,094,013 Deposits: Noninterest-bearing demand $209,900 $213,301

$230,083 $247,822 Interest-bearing demand and savings 226,514

230,403 230,618 225,682 Total core deposits 436,414 443,704 460,701

473,504 Time deposits 847,111 821,256 792,409 761,499 Total

deposits $1,283,525 $1,264,960 $1,253,110 $1,235,003 * Real estate

- construction of $356,630 Includes commercial real estate

constuction loans totalling $93,250 DATASOURCE: Preferred Bank

CONTACT: Edward J. Czajka, Senior Vice President, Chief Financial

Officer of Preferred Bank, +1-213-891-1188; or General Information,

Lasse Glassen of Financial Relations Board, +1-213-486-6546, , for

Preferred Bank Web site: http://www.preferredbank.com/

Copyright

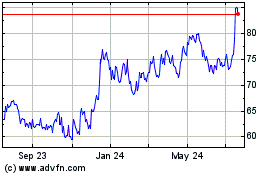

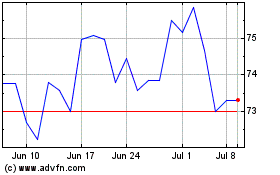

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jul 2023 to Jul 2024