0001622345

false

0001622345

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

POLAR

POWER, INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-37960 |

|

33-0479020 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

249

E. Gardena Boulevard, Gardena, California 90248

(Address

of Principal Executive Offices) (Zip Code)

(310)

830-9153

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.0001 per share |

|

POLA |

|

The NASDAQ Stock Market,

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2023, Polar Power, Inc. issued a press release announcing its financial results for the three and six months ended June 30,

2023. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

except as expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

August 14, 2023

| |

POLAR POWER, INC. |

| |

|

|

| |

By: |

/s/ Arthur

D. Sams |

| |

|

Arthur D. Sams President, Chief Executive Officer and

Secretary |

Exhibit

99.1

Polar

Power Reports Second Quarter 2023 Financial Results

GARDENA,

CA – August 14, 2023 – Polar Power, Inc. (“Polar Power” or the “Company”) (NASDAQ: POLA), a global

provider of prime, backup and solar hybrid DC power solutions, today reported its financial results for the three and six months ended

June 30, 2023.

Key

Q2 2023 Results and Highlights:

Financial

Results for the Three and Six Months Ended June 30, 2023

| ● | Net

sales for Q2 2023 were $5.5 million, a 31% increase compared to $4.2 million in the same

period last year. Net sales for the six months ended June 30, 2023 were $9.7 million, a 22%

increase, as compared to $7.9 million in the same period last year. |

| | |

| ● | Gross

profit during the Q2 2023 increased 39%, to $1.4 million, as compared to $1.0 million in

the same period in 2022. Gross margins during Q2 2023 increased to 26.4%, as compared to

24.8% during Q2 2022. Gross profit during the six months ended June 30, 2023, increased 13%,

to $2.2 million, as compared to $1.9 million for the same period in 2022. The increases in

gross profit during the three- and six-months periods ended June 30, 2023 were primarily

a result of improved labor efficiencies in manufacturing and utilization of previously written

off obsolete inventory of $173,000 during Q2 2023 and $195,000 during the six-month period

ended June 30, 2023. |

| | |

| ● | Operating

expenses remained constant at $1.7 million during Q2 2023, as compared to $1.7 million for

Q2 2022. Operating expenses for the six months ended June 30, 2023 decreased 6% to $3.5 million,

as compared to $3.7 million for the same period in 2022. The decrease was primarily due to

staff reductions in sales and engineering. |

| | |

| ● | Net

loss for Q2 2023 totaled $436,000, or $(0.03) per basic and diluted share, compared to a

net loss of $739,000, or $(0.06) per basic and diluted share in Q2 2022. Net loss for the

six months ended June 30, 2023 totaled $1.5 million, or $(0.12) per basic and diluted share,

compared to a net loss of $1.8 million, or $(0.15) per basic and diluted share during the

same period in 2022. |

| | |

| ● | Cash

and cash equivalents at June 30, 2023 were $292,000, as compared to $211,000 at December

31, 2022. We had $17.7 million in inventory at June 30, 2023, as compared to $15.4 million

at December 31, 2022. Working capital was $15.4 million at June 30, 2023, as compared to

$17.3 million at December 31, 2022 |

| | |

| ● | Backlog

as of the end of Q2 2023 was $5.9 million, of which 68% is from orders of the Company’s

DC power generators from telecommunications customers in the U.S., 23% from telecommunications

customers in international markets, 6% from customers in the military market, 2% from customers

in the marine market, and 3% from customers in other markets. |

Management

Commentary

The

Company’s net sales increased 31% in Q2 2023, as compared to Q2 2022, and gross profit increased 39% during Q2 2023 when compared

to Q2 2022. During Q2 2023, sales to telecommunications customers in the U.S. represented 68% of total net sales, sales to telecommunications

customers outside the U.S. represented 29%, sales to customers in the military market represented 2%, and sales to other markets represented

less than 1%. During Q2 2022, sales to telecommunications customers in the U.S. represented 97% of total net sales, sales to telecommunications

customers outside the U.S. represented 2%, and sales customers other markets represented less than 2%.

For

the six months ended June 30, 2023, the Company’s net sales increased 22% when compared to the same period in 2022, and gross profit

increased 13% for the six months ended June 30, 2023, as compared to the same period in 2022. During the six months ended

June 30, 2023, sales to telecommunications customers in the U.S. represented 68% of total net sales, sales to telecommunications customers

outside the U.S. represented 28%, sales to customers in the military market represented 3%, and sales to other markets represented less

than 1%. During the six-month period ended June 30, 2022, sales to telecommunications customers in the U.S. represented 98% of

total net sales, sales to telecommunications customers outside the U.S. represented 1%, and sales to customers in other markets represented

less than 1%.

The

Company’s ongoing sales and marketing efforts overseas resulted in an increase of approximately 2100% in sales of DC generators

to telecommunications customers in international markets during the three- and six-months ended June 30, 2023, as compared to the same

periods in 2022. The Company has several telecommunications customers in the south pacific region using the Company’s DC generators

to develop the telecommunications infrastructure in this region and supply rural areas with broadband services. As of June 30, 2023,

25% of the total backlog, or $1.5 million, represents

purchase orders of DC generators for customers in international markets.

Telecommunications

customers in international markets are primarily purchasing the Company’s DC generators for off-grid (i.e., areas where wireless

towers are not connected to an electrical grid) and bad-grid (i.e., areas where wireless towers are connected to an electrical grid that

loses power more than eight hours) applications. The Company’s solar hybrid power systems, which integrate solar energy storage

with natural gas/LPG powered generators, are ideal for off-grid and bad-grid applications. The Company’s backlog as of June 30,

2023, includes approximately $1.1 million in orders for solar hybrid power systems, which are expected to ship during the Q3 2023.

The

Company believes the implementation and ongoing development of 5G networks along with programs to develop the telecommunications infrastructure

in rural and underdeveloped countries will continue to fuel the Company’s growth in the telecommunications market over the next

five to ten years.

The

Company launched the Toyota 1KS during Q1 2023. The Company believes the Toyota prime power engines, when configured into generators,

will provide strong opportunities for growth and diversification in line with the Company’s long-term plan. This engine platform

is expected to easily facilitate the shift from diesel to natural gas and LPG (liquid petroleum gas, aka propane or butane). LPG and

natural gas fuel reduce carbon emissions between 16% to 27% and, when combined with the increased fuel efficiency of DC generators and

solar technologies, emissions become very minimal. The Toyota 1KS prime power engines have much lower maintenance requirements when compared

to diesel engines and the current LPG and natural gas backup generators from the major brands. The Toyota 1KS engine will be focused

on applications in telecommunications, microgrids, electric vehicle (“EV”) charging, and CHP (combined heat and power).

Company

has purchased a large number of Toyota engines over the last three years in anticipation of launching the Toyota engine, requiring significant

working capital, but believes it is well positioned to meet anticipated demand. This inventory is expected to convert back to cash as

product sales accelerate. As a hedge against the world supply chain problems, Polar Power has maintained large inventory levels on critical

items.

The

Company is in the process of upgrading its mobile EV charging systems to the universal combined charging system standard (CCS)

to reach the mobile EV charging market. The Company is taking orders for the Company’s new line of EV chargers and expects to have

them available before the end of the first quarter of 2024. Mobile EV chargers are used for emergency roadside service, providing a fast-charging

solution for EVs that have run out of charge before reaching a stationary charging facility.

About

Polar Power, Inc.

Gardena,

California-based Polar Power, Inc. (NASDAQ: POLA), designs, manufactures and sells direct current, or DC, power systems, lithium battery

powered hybrid solar systems for applications in the telecommunications market and, in other markets, including military, EV charging,

cogeneration, distributed power and uninterruptable power supply. Within the telecommunications market, Polar Power’s systems provide

reliable and low-cost energy for applications for off-grid and bad-grid applications with critical power needs that cannot be without

power in the event of utility grid failure. For more information, please visit www.polarpower.com. or follow us on www.linkedin.com/company/polar-power-inc/.

Safe

Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This

news release contains certain statements of a forward-looking nature relating to future events or future business performance. Forward-looking

statements can be identified by the words “expects,” “anticipates,” “believes,” “intends,”

“estimates,” “plans,” “will,” “outlook” and similar expressions. Forward-looking statements

are based on management’s current plans, estimates, assumptions and projections, and speak only as of the date they are made. With

the exception of historical information, the matters discussed in this press release including, without limitation, Polar Power’s

belief that the implementation and ongoing development of 5G networks along with programs to develop the telecommunications infrastructure

in rural and underdeveloped countries will continue to fuel the Company’s growth in the telecommunications market over the next

five to ten years; Polar Power’s belief that Toyota prime power engines will provide strong opportunities for growth and diversification;

Polar Power’s expectation that its line of EV chargers will be available in the year 2024; and Polar Power’s expectations

that it’s large investments in inventory, including engines, will convert back to cash as product sales accelerate are forward-looking

statements and considerations that involve a number of risks and uncertainties. The actual future results of Polar Power could differ

from those statements. Factors that could cause or contribute to such differences include, but are not limited to, adverse domestic and

foreign economic and market conditions, including demand for its solar hybrid power systems and mobile EV chargers; trade tariffs on

raw materials; changes in domestic and foreign governmental regulations and policies; the impact of inflation and changing prices on

raw materials; supply chain constraints causing significant delays in sourcing raw materials; labor shortages as a result of the pandemic,

low unemployment rates, or other factors limiting the availability of qualified workers; and other events, factors and risks. It undertakes

no obligation to update any forward-looking statement in light of new information or future events, except as otherwise required by law.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and are generally beyond

Polar Power’s control. Actual results or outcomes may differ materially from those implied by the forward-looking statements as

a result of the impact of a number of factors, many of which are discussed in more detail in Polar Power’s reports filed with the

Securities and Exchange Commission.

Company

Contact:

Polar

Power, Inc.

249

E. Gardena Blvd.

Gardena,

CA 90248

Tel:

310-830-9153

ir@polarpowerinc.com

www.polarpower.com

POLAR

POWER, INC.

CONDENSED

BALANCE SHEETS

(in

thousands, except share and per share data)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 292 | | |

$ | 211 | |

| Accounts receivable | |

| 3,718 | | |

| 2,230 | |

| Inventories, net | |

| 17,689 | | |

| 15,460 | |

| Prepaid expenses | |

| 1,050 | | |

| 2,629 | |

| Employee retention credit receivable | |

| 2,000 | | |

| 2,000 | |

| Income taxes receivable | |

| 787 | | |

| 787 | |

| Total current assets | |

| 25,536 | | |

| 23,317 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 2,178 | | |

| 240 | |

| Property and equipment, net | |

| 505 | | |

| 538 | |

| Deposits | |

| 93 | | |

| 93 | |

| | |

| | | |

| | |

| Total assets | |

$ | 28,312 | | |

$ | 24,188 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,429 | | |

$ | 230 | |

| Customer deposits | |

| 1,535 | | |

| 2,126 | |

| Accrued liabilities and other current liabilities | |

| 1,242 | | |

| 1,231 | |

| Operating lease liabilities, current portion | |

| 717 | | |

| 268 | |

| Notes payable-related party, current portion | |

| 160 | | |

| — | |

| Notes payable, current portion | |

| 135 | | |

| 211 | |

| Line of credit | |

| 4,927 | | |

| 1,884 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 10,145 | | |

| 5,950 | |

| | |

| | | |

| | |

| Notes payable, net of current portion | |

| 8 | | |

| 57 | |

| Operating lease liabilities, net of current portion | |

| 1,527 | | |

| — | |

| | |

| | | |

| | |

| Total liabilities | |

| 11,680 | | |

| 6,007 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.0001 par value, 50,000,000 shares authorized, 12,967,027 shares issued and 12,949,550 shares outstanding on June 30, 2023, and 12,967,027 shares issued and 12,949,550 shares outstanding on December 31, 2022 | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 37,331 | | |

| 37,331 | |

| Accumulated deficit | |

| (20,660 | ) | |

| (19,111 | ) |

| Treasury Stock, at cost (17,477 shares) | |

| (40 | ) | |

| (40 | ) |

| Total stockholders’ equity | |

| 16,632 | | |

| 18,181 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 28,312 | | |

$ | 24,188 | |

POLAR

POWER, INC.

UNAUDITED

CONDENSED STATEMENTS OF OPERATIONS

(in

thousands, except share and per share data)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net Sales | |

$ | 5,587 | | |

$ | 4,274 | | |

$ | 9,777 | | |

$ | 7,983 | |

| Cost of Sales | |

| 4,112 | | |

| 3,213 | | |

| 7,548 | | |

| 6,017 | |

| Gross profit | |

| 1,475 | | |

| 1,061 | | |

| 2,229 | | |

| 1,966 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 310 | | |

| 400 | | |

| 642 | | |

| 805 | |

| Research and development | |

| 338 | | |

| 350 | | |

| 684 | | |

| 826 | |

| General and administrative | |

| 1,137 | | |

| 1,036 | | |

| 2,248 | | |

| 2,167 | |

| Total operating expenses | |

| 1,785 | | |

| 1,786 | | |

| 3,574 | | |

| 3,798 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (310 | ) | |

| (725 | ) | |

| (1,345 | ) | |

| (1,832 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Interest expense and finance costs | |

| (126 | ) | |

| (14 | ) | |

| (204 | ) | |

| (27 | ) |

| Total other income (expenses), net | |

| (126 | ) | |

| (14 | ) | |

| (204 | ) | |

| (27 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (436 | ) | |

$ | (739 | ) | |

$ | (1,549 | ) | |

$ | (1,859 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.03 | ) | |

$ | (0.06 | ) | |

$ | (0.12 | ) | |

$ | (0.15 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 12,949,550 | | |

| 12,788,203 | | |

| 12,949,550 | | |

| 12,788,203 | |

POLAR

POWER, INC.

UNAUDITED

CONDENSED STATEMENTS OF CASH FLOW

(in

thousands)

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (1,549 | ) | |

$ | (1,859 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 226 | | |

| 264 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (1,488 | ) | |

| 249 | |

| Inventories | |

| (2,229 | ) | |

| (2,968 | ) |

| Prepaid expenses | |

| 1,579 | | |

| (380 | ) |

| Decrease in operating lease right-of-use asset | |

| 454 | | |

| 334 | |

| Accounts payable | |

| 1,199 | | |

| (193 | ) |

| Customer deposits | |

| (591 | ) | |

| 2,588 | |

| Accrued expenses and other current liabilities | |

| 11 | | |

| 8 | |

| Decrease in operating lease liability | |

| (416 | ) | |

| (354 | ) |

| Net cash used in operating activities | |

| (2,804 | ) | |

| (2,311 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (194 | ) | |

| (15 | ) |

| Net cash used in investing activities | |

| (194 | ) | |

| (15 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from advances from credit facility | |

| 3,044 | | |

| — | |

| Proceeds from notes payable, related party | |

| 160 | | |

| — | |

| Repayment of notes payable | |

| (125 | ) | |

| (119 | ) |

| Net cash provided by (used in) financing activities | |

| 3,079 | | |

| (119 | ) |

| | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 81 | | |

| (2,445 | ) |

| Cash and cash equivalents, beginning of period | |

| 211 | | |

| 5,101 | |

| Cash and cash equivalents, end of period | |

$ | 292 | | |

$ | 2,656 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

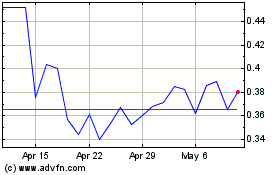

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Apr 2024 to May 2024

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From May 2023 to May 2024