Filed Pursuant to Rule 424(b)(3)

Registration No. 333-280061

PROSPECTUS SUPPLEMENT NO. 1

(To Prospectus dated June 24, 2024)

Plus Therapeutics Inc.

Up to 10,774,596 Shares of Common Stock

This prospectus supplement updates and supplements the prospectus, dated June 24, 2024 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-280061). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 14, 2024 (the “Form 10-Q”). Accordingly, we have attached the Form 10-Q to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to 10,774,596 shares of our common stock, par value $0.001 (“Common Stock”), consisting of: (i) up to 1,439,988 shares of Common Stock; (ii) up to 2,151,544 shares of Common Stock issuable upon exercise of pre-funded warrants; (iii) up to 3,591,532 shares of common stock issuable upon exercise of Series A Common Stock warrants; and (iv) up to 3,591,532 shares of Common Stock issuable upon exercise of Series B common stock warrants, originally issued to the selling stockholders in the May 2024 PIPE Financing, as described in the Prospectus.

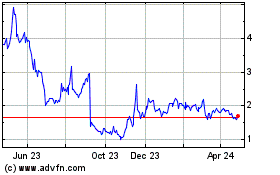

Our Common Stock is listed on The Nasdaq Capital Market LLC under the symbols “PSTV”. On August 13, 2024, the closing price of our Common Stock was $1.49.

We are a “smaller reporting company” for purposes of federal securities laws and are subject to reduced public company reporting requirements. Accordingly, the information in the Prospectus and this prospectus supplement may not be comparable to information provided by companies that are not smaller reporting companies.

Our business and investment in our Common Stock involve significant risks. These risks are described in the section titled “Risk Factors” beginning on page 13 of the Prospectus and in the “Risk Factors” section of the Form 10-Q.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 14, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-34375

PLUS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

33-0827593 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

4200 MARATHON BLVD., SUITE 200, AUSTIN, TX |

|

78756 |

(Address of principal executive offices) |

|

(Zip Code) |

(737) 255-7194

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.001 |

PSTV |

Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

Non-Accelerated Filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financing accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 9, 2024 , there were 5,896,333 shares of the registrant’s common stock outstanding.

PLUS THERAPEUTICS, INC.

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q and the exhibits incorporated herein by reference contain “forward-looking statements” which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements other than statements of historical fact constitute “forward-looking statements.” These forward-looking statements do not constitute guarantees of future performance. These forward-looking statements may be identified by terms such as “intend,” “expect,” “project,” “believe,” “anticipate,” “initiate,” “will,” “should,” “would,” “could,” “may,” “designed,” “potential,” “evaluate,” “hypothesize,” “plan,” “progressing,” “proceeding,” “exploring,” “opportunity,” “hopes,” “suggest,” and similar expressions, or the negative of such expressions. Such statements are based upon certain assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

These statements include, without limitation, statements about our anticipated expenditures, including research and development, and general and administrative expenses; our strategic collaborations and license agreements, intellectual property, U.S. Food and Drug Administration and European Medicines Agency approvals and interactions and government regulation; the potential size of the market for our product candidates; our research and development efforts; results from our pre-clinical and clinical studies and the implications of such results regarding the efficacy or safety of our product candidates; the safety profile, pathways, and efficacy of our product candidates and formulations; anticipated advantages of our product candidates over other products available in the market and being developed; the populations that will most benefit from our product candidates and indications that will be pursued with each product candidate; anticipated progress in our current and future clinical trials; plans and strategies to create novel technologies; our IP strategy; competition; future development and/or expansion of our product candidates and therapies in our markets; sources of competition for any of our product candidates; our pipeline; our ability to generate product or development revenue and the sources of such revenue; our ability to effectively manage our gross profit margins; our ability to obtain and maintain regulatory approvals; expectations as to our future performance; portions of the “Liquidity and Capital Resources” section of this quarterly report on Form 10-Q, including our potential need for additional financing and the availability thereof; our ability to integrate into our business and operations, develop, fully utilize and monetize acquired assets; our ability to reclassify warrants as equity in our financial statements; our ability to continue as a going concern; our ability to remain listed on the Nasdaq Capital Market; our ability to repay or refinance some or all of our outstanding indebtedness and our ability to raise capital in the future; our ability to transfer the drug and medical device product manufacturing to a contract drug and medical device manufacturing organization; and the potential enhancement of our cash position through development, marketing, and licensing arrangements; and a material security breach or cybersecurity attack affecting our operations and property. The forward-looking statements included in this quarterly report on Form 10-Q are also subject to a number of additional material risks and uncertainties, including but not limited to the risks described under “Part I – Item 1A – Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, in other subsequent filings with the Securities and Exchange Commission, and under “Part II – Item 1A – Risk Factors” in this quarterly report on Form 10-Q. These risks and uncertainties could cause actual results to differ materially from expectations or those expressed in these forward-looking statements.

Our actual results may differ, including materially, from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, the following: the early stage of our product candidates and therapies, the results of our research and development activities, including uncertainties relating to the clinical trials of our product candidates and therapies; our liquidity and capital resources and our ability to raise additional cash, the outcome of our partnering/licensing efforts, risks associated with laws or regulatory requirements applicable to us, market conditions, product performance, potential litigation, our ability to integrate into our business and operations, develop, fully utilize and monetize acquired assets, and competition within the radiotherapeutics, and more generally, oncological medicine fields, among others. The forward-looking statements included in this quarterly report on Form 10-Q are also subject to a number of additional material risks and uncertainties, including but not limited to the risks described under “Part I – Item 1A – Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and under “Part II – Item 1A – Risk Factors” in this quarterly report on Form 10-Q. These risks and uncertainties could cause actual results to differ materially from expectations or those expressed in these forward-looking statements.

We encourage you to read the risks described under “Part II – Item 1A – Risk Factors” in this quarterly report on Form 10-Q carefully. We caution you not to place undue reliance on the forward-looking statements contained in this quarterly report on Form 10-Q. These statements, like all statements in this quarterly report on Form 10-Q, speak only as of the date of this quarterly report on Form 10-Q (unless an earlier date is indicated) and the Company undertakes no obligation to update or revise the statements except as required by law. Such forward-looking statements are not guarantees of future performance.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except share and par value data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,912 |

|

|

$ |

8,554 |

|

Investments |

|

|

3,523 |

|

|

|

— |

|

Other current assets |

|

|

945 |

|

|

|

1,280 |

|

Total current assets |

|

|

9,380 |

|

|

|

9,834 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

732 |

|

|

|

906 |

|

Operating lease right-of-use assets |

|

|

139 |

|

|

|

202 |

|

Goodwill |

|

|

372 |

|

|

|

372 |

|

Intangible assets, net |

|

|

557 |

|

|

|

42 |

|

Other assets |

|

|

32 |

|

|

|

32 |

|

Total assets |

|

$ |

11,212 |

|

|

$ |

11,388 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

6,946 |

|

|

$ |

6,631 |

|

Operating lease liability |

|

|

92 |

|

|

|

120 |

|

Warrant liability |

|

|

6,160 |

|

|

|

— |

|

Deferred grant liability |

|

|

2,297 |

|

|

|

— |

|

Line of credit |

|

|

3,292 |

|

|

|

— |

|

Term loan obligation, current |

|

|

— |

|

|

|

3,976 |

|

Total current liabilities |

|

|

18,787 |

|

|

|

10,727 |

|

|

|

|

|

|

|

|

Noncurrent operating lease liability |

|

|

50 |

|

|

|

85 |

|

Deferred grant liability |

|

|

— |

|

|

|

1,924 |

|

Total liabilities |

|

|

18,837 |

|

|

|

12,736 |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; 1,952 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 5,962,644 and 5,704,219 issued and outstanding at June 30, 2024, and 4,522,656 issued and 4,444,097 outstanding as of December 31, 2023, respectively |

|

|

6 |

|

|

|

5 |

|

Treasury stock (at cost, 258,425 and 78,559 shares as of June 30, 2024 and December 31, 2023, respectively) |

|

|

(500 |

) |

|

|

(126 |

) |

Additional paid-in capital |

|

|

479,571 |

|

|

|

479,274 |

|

Accumulated deficit |

|

|

(486,702 |

) |

|

|

(480,501 |

) |

Total stockholders’ deficit |

|

|

(7,625 |

) |

|

|

(1,348 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

11,212 |

|

|

$ |

11,388 |

|

See Accompanying Notes to these Condensed Consolidated Financial Statements

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Grant revenue |

|

$ |

1,279 |

|

|

$ |

1,854 |

|

|

$ |

2,956 |

|

|

$ |

2,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,773 |

|

|

|

1,420 |

|

|

|

5,536 |

|

|

|

4,403 |

|

General and administrative |

|

|

2,203 |

|

|

|

1,924 |

|

|

|

4,416 |

|

|

|

4,169 |

|

Total operating expenses |

|

|

4,976 |

|

|

|

3,344 |

|

|

|

9,952 |

|

|

|

8,572 |

|

Loss from operations |

|

|

(3,697 |

) |

|

|

(1,490 |

) |

|

|

(6,996 |

) |

|

|

(6,212 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Financing expense |

|

|

(3,545 |

) |

|

|

— |

|

|

|

(3,545 |

) |

|

|

— |

|

Change in fair value of warrants |

|

|

4,694 |

|

|

|

— |

|

|

|

4,694 |

|

|

|

— |

|

Warrant issuance costs |

|

|

(432 |

) |

|

|

— |

|

|

|

(432 |

) |

|

|

— |

|

Interest income |

|

|

67 |

|

|

|

120 |

|

|

|

139 |

|

|

|

171 |

|

Interest expense |

|

|

(27 |

) |

|

|

(112 |

) |

|

|

(61 |

) |

|

|

(246 |

) |

Total other income (expense) |

|

|

757 |

|

|

|

8 |

|

|

|

795 |

|

|

|

(75 |

) |

Net loss |

|

$ |

(2,940 |

) |

|

$ |

(1,482 |

) |

|

$ |

(6,201 |

) |

|

$ |

(6,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock - basic |

|

$ |

(0.45 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.15 |

) |

|

$ |

(2.60 |

) |

Weighted average number of shares of common stock outstanding - basic |

|

|

6,500,831 |

|

|

|

2,509,378 |

|

|

|

5,411,382 |

|

|

|

2,415,221 |

|

Net loss per share of common stock - diluted |

|

$ |

(0.71 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.45 |

) |

|

$ |

(2.60 |

) |

Weighted average number of shares of common stock outstanding - diluted |

|

|

10,742,924 |

|

|

|

2,509,378 |

|

|

|

7,532,428 |

|

|

|

2,415,221 |

|

See Accompanying Notes to these Condensed Consolidated Financial Statements

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(UNAUDITED)

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|

Preferred stock |

|

preferred stock |

|

|

Common stock |

|

|

Treasury Stock |

|

|

paid-in |

|

|

Accumulated |

|

|

stockholders’ |

|

|

Shares |

|

|

Amount |

|

Shares |

|

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

(deficit)/equity |

|

Balance at December 31, 2022 |

|

— |

|

$ |

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

2,240,092 |

|

$ |

|

2 |

|

|

|

— |

|

$ |

|

— |

|

$ |

|

473,628 |

|

$ |

|

(467,185 |

) |

$ |

|

6,445 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

140 |

|

|

|

— |

|

|

|

140 |

|

Sale of common stock, net |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

168,164 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

895 |

|

|

|

— |

|

|

|

895 |

|

Issuance of Series F preferred stock |

|

1 |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

Net loss |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,805 |

) |

|

|

(4,805 |

) |

Balance at March 31, 2023 |

|

1 |

|

$ |

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

2,408,256 |

|

$ |

|

2 |

|

|

|

— |

|

$ |

|

— |

|

$ |

|

474,664 |

|

$ |

|

(471,990 |

) |

$ |

|

2,676 |

|

Redemption of Series F preferred stock |

|

(1 |

) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Fractional adjustment |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

(1,310 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Sale of common stock, net |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

472,674 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1,327 |

|

|

|

— |

|

|

|

1,328 |

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

140 |

|

|

|

— |

|

|

|

140 |

|

Net loss |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,482 |

) |

|

|

(1,482 |

) |

Balance at June 30, 2023 |

|

— |

|

|

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

2,879,620 |

|

$ |

|

3 |

|

|

|

— |

|

$ |

|

— |

|

$ |

|

476,131 |

|

$ |

|

(473,472 |

) |

$ |

|

2,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2023 |

|

— |

|

$ |

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

4,522,656 |

|

$ |

|

5 |

|

|

|

(78,559 |

) |

$ |

|

(126 |

) |

$ |

|

479,274 |

|

$ |

|

(480,501 |

) |

$ |

|

(1,348 |

) |

Stock-based compensation |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

146 |

|

|

|

— |

|

|

|

146 |

|

Purchase of treasury stock |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(179,866 |

) |

|

|

(374 |

) |

|

|

— |

|

|

|

— |

|

|

|

(374 |

) |

Net loss |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,261 |

) |

|

|

(3,261 |

) |

Balance at March 31, 2024 |

|

— |

|

$ |

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

4,522,656 |

|

$ |

|

5 |

|

|

|

(258,425 |

) |

$ |

|

(500 |

) |

$ |

|

479,420 |

|

$ |

|

(483,762 |

) |

$ |

|

(4,837 |

) |

Issuance of common stock |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

1,439,988 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

151 |

|

|

|

— |

|

|

|

151 |

|

Net loss |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,940 |

) |

|

|

(2,940 |

) |

Balance at June 30, 2024 |

|

— |

|

$ |

|

— |

|

|

1,952 |

|

|

$ |

|

— |

|

|

|

5,962,644 |

|

$ |

|

6 |

|

|

|

(258,425 |

) |

$ |

|

(500 |

) |

$ |

|

479,571 |

|

$ |

|

(486,702 |

) |

$ |

|

(7,625 |

) |

See Accompanying Notes to these Condensed Consolidated Financial Statements

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows used in operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(6,201 |

) |

|

$ |

(6,287 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

325 |

|

|

|

318 |

|

Amortization of deferred financing costs and debt discount |

|

|

20 |

|

|

|

119 |

|

Share-based compensation expense |

|

|

297 |

|

|

|

280 |

|

Accretion of discount on short-term investments |

|

|

(23 |

) |

|

|

— |

|

Non-cash financing expense |

|

|

3,545 |

|

|

|

— |

|

Change in fair value of warrants |

|

|

(4,694 |

) |

|

|

— |

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

2 |

|

Amortization of operating lease right-of-use assets |

|

|

63 |

|

|

|

57 |

|

Increases (decreases) in cash caused by changes in operating assets and liabilities: |

|

|

|

|

|

|

Grant receivable |

|

|

— |

|

|

|

718 |

|

Other current assets |

|

|

335 |

|

|

|

1,510 |

|

Accounts payable and accrued expenses |

|

|

360 |

|

|

|

(3,589 |

) |

Change in operating lease liabilities |

|

|

(63 |

) |

|

|

(56 |

) |

Deferred grant liability |

|

|

373 |

|

|

|

(1,643 |

) |

Net cash used in operating activities |

|

|

(5,663 |

) |

|

|

(8,571 |

) |

|

|

|

|

|

|

|

Cash flows used in investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(121 |

) |

|

|

(108 |

) |

Purchase of short-term investments |

|

|

(3,500 |

) |

|

|

— |

|

Purchase of intangible assets |

|

|

(545 |

) |

|

|

— |

|

Net cash used in investing activities |

|

|

(4,166 |

) |

|

|

(108 |

) |

|

|

|

|

|

|

|

Cash flows provided by financing activities: |

|

|

|

|

|

|

Principal payments of term loan obligation |

|

|

(3,996 |

) |

|

|

(804 |

) |

Proceeds from credit facility |

|

|

3,292 |

|

|

|

— |

|

Purchase of treasury stock |

|

|

(374 |

) |

|

|

— |

|

Proceeds from sale of common stock, warrants and pre-funded warrants, net |

|

|

7,265 |

|

|

|

2,258 |

|

Net cash provided by financing activities |

|

|

6,187 |

|

|

|

1,454 |

|

Net decrease in cash and cash equivalents |

|

|

(3,642 |

) |

|

|

(7,225 |

) |

Cash and cash equivalents at beginning of period |

|

|

8,554 |

|

|

|

18,120 |

|

Cash and cash equivalents at end of period |

|

$ |

4,912 |

|

|

$ |

10,895 |

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flows information: |

|

|

|

|

|

|

Cash paid during period for: |

|

|

|

|

|

|

Interest |

|

$ |

32 |

|

|

$ |

135 |

|

Supplemental schedule of non-cash investing and financing activities: |

|

|

|

|

|

|

Unpaid offering cost |

|

$ |

375 |

|

|

$ |

35 |

|

See Accompanying Notes to these Condensed Consolidated Financial Statements

PLUS THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2024

(UNAUDITED)

1. Basis of Presentation and New Accounting Standards

The accompanying unaudited condensed consolidated financial statements for the three and six months ended June 30, 2024 and 2023 have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for annual financial statements. The condensed balance sheet at December 31, 2023 has been derived from the audited financial statements at December 31, 2023, but does not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements.

On May 17, 2024, Plus Therapeutics, Inc. (the “Company”) established a wholly owned subsidiary, CNSide Diagonistics, LLC (“CNSide LLC”), a Delaware limited liability company. CNSide LLC was set up to implement the Company’s business plan for developing the CNSide diagnostic portfolio alongside its lead radiotherapeutic candidate, rhenium (186Re) obisbemeda, using the intellectual property of Biocept, Inc. (“Biocept”) acquired by the Company in April 2024 (Note 8).

In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of the financial position and results of operations of the Company and its wholly owned subsidiary have been included. Operating results for the three and six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the remainder of the year ending December 31, 2024. These condensed consolidated financial statements should be read in conjunction with the financial statements and notes therein included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 5, 2024.

Amendments to Certificate of Incorporation and Reverse Stock Split

At the Annual Meeting of Stockholders of the Company held on April 20, 2023 (the “2023 Annual Meeting”), the stockholders of the Company approved an amendment to the Company’s Certificate of Incorporation, as amended (the “Charter”) to implement a reverse stock split of the Company’s then issued and outstanding common stock, par value $0.001 per share, with the ratio to be determined by the Board of Directors (the “Board”) of the Company, within a range of not less than 1-for-3 and not greater than 1-for-15. Subsequently, on April 21, 2023, the Board determined to fix the ratio for the reverse stock split at 1-for-15, without any change to its par value (the “Reverse Stock Split”).

On April 27, 2023, following stockholder and Board approval, the Company filed a Certificate of Amendment to its Charter (the “Amendment”), with the Secretary of State of the State of Delaware to effectuate the Reverse Stock Split. The Amendment became effective on May 1, 2023. Upon effectiveness of the Reverse Stock Split, the number of shares of the Company’s common stock (x) issued and outstanding decreased from approximately 37.4 million shares to approximately 2.5 million shares; (y) reserved for issuance upon exercise of outstanding warrants and options decreased from approximately 2.0 million shares to approximately 0.1 million shares, and (z) reserved but unallocated under the Company’s current equity incentive plans decreased from approximately 3.0 million shares of common stock to approximately 0.2 million shares of common stock. The Company’s common stock began trading on the Nasdaq Capital Market (“Nasdaq”) on a post-split basis on May 1, 2023. The Company’s 5,000,000 shares of authorized Preferred Stock were not affected by the Reverse Stock Split. No fractional shares were issued in connection with the Reverse Stock Split, and accordingly, the outstanding number of shares post Reverse Stock Split was adjusted down by approximately 1,310 (post-effect of the Reverse Stock Split) shares. Proportional adjustments for the Reverse Stock Split were made to the Company’s outstanding stock options, warrants and equity incentive plans for the period ended March 31, 2023 as presented in the condensed consolidated financial statements in this quarterly report on Form 10-Q. The Company’s consolidated financial statements, and all references thereto have been retroactively adjusted to reflect the Reverse Stock Split unless specifically stated otherwise.

Grant Revenue Recognition

In applying the provisions of Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers (“ASC 606”), the Company has determined that government grants are out of the scope of ASC 606 because the funding entities do not meet the definition of a “customer”, as defined by ASC 606, as the Company does not consider there to be a transfer of control of goods or services. With respect to each grant, the Company determines if it has a collaboration in accordance with ASC Topic 808, Collaborative Arrangements (“ASC 808”). For grants outside the scope of ASC 808, the Company applies International Accounting Standards No. 20 (“IAS 20”), Accounting for Government Grants and Disclosure of Government Assistance, by analogy, and revenue is recognized when the Company incurs expenses related to the grant for the amount the Company is entitled to under the provisions of the contract.

The Company also considers the guidance in ASC Topic 730, Research and Development, which requires an assessment, at the inception of each grant, of whether each grant agreement is a liability. If the Company is obligated to repay funds received regardless of the outcome of the related research and development activities, then the Company is required to estimate and recognize that liability. Alternatively, if the Company is not required to repay the funds, then payments received are recorded as revenue or contra-expense as the expenses are incurred.

Deferred grant liability represents grant funds received or receivable for which the allowable expenses have not yet been incurred as of the balance sheet date.

Warrants

Warrants are accounted for as either derivative liabilities or as equity instruments depending on the specific terms of the agreement in accordance with applicable accounting guidance provided in ASC Topic 815 - Derivatives and Hedging. Equity-classified instruments are recorded in additional paid-in capital at issuance and are not subject to remeasurement. Liability-classified warrants are recorded at fair value at each reporting period with any change in fair value recognized as a component of change in fair value of derivative liabilities in the condensed consolidated statements of operations. The Company periodically evaluates changes in facts and circumstances that could impact the classification of warrants.

Segment Information

Prior to the establishment of CNSide LLC, the Company operated its business in one operating and reportable segment, which includes all activities related to the research and development of the Company’s research programs. From inception of CNSide LLC through June 30, 2024, the Company commenced certain set up and compliance activities of CNSide LLC with immaterial financial statement impact. The Company expects CNSide LLC to initiate commercial operations starting in the fourth quarter of 2024 related to laboratory testing, and that CNSide LLC will become a separate operating segment starting in the quarter ending December 31, 2024.

The Company’s chief operating decision-maker (“CODM”), the Chief Executive Officer, reviews the operating results including revenue and direct expenses of the Company’s operating segments for resource allocation and other management decisions.

Available-for-Sale Securities

The Company’s available-for-sale securities consist of U.S. government and agency securities. Securities with maturities from the date of purchase of less than three months are included in cash equivalents. The Company classifies its marketable securities as available-for-sale and records such assets at estimated fair value in the condensed consolidated balance sheets, with unrealized gains and losses, if any, reported as a component of other comprehensive income (loss) within the condensed consolidated statements of operations and comprehensive income/loss and as a separate component of stockholders’ equity. Realized gains and losses are calculated on the specific identification method and recorded as interest income (loss). At each balance sheet date, the Company assesses available-for-sale securities in an unrealized loss position to determine whether the decline in fair value below amortized cost is a result of credit losses or other factors, whether the Company expects to recover the amortized cost of the security, the Company’s intent to sell and if it is more likely than not that the Company will be required to sell the securities before the recovery of amortized cost. The Company records changes in allowance for expected credit loss in other income (expense). There has been no allowance for expected credit losses recorded during any of the periods presented.

Any premium arising at purchase is amortized to the earliest call date and any discount arising at purchase is accreted to maturity. Accretion of discounts are recorded in interest income in the condensed consolidated statements of operations and comprehensive income/loss.

During the three and six months ended June 30, 2024, the unrealized gain on the Company’s available-for-sale securities was less than $1,000, and not presented separately in the condensed consolidated statement of operations.

Recently Issued Accounting Pronouncements

In December 2023, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (ASU) No. 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosure. This ASU includes amendments that further enhance income tax disclosures, primarily through standardization and disaggregation of rate reconciliation categories and income taxes paid by jurisdiction. The ASU is effective for years beginning after December 15, 2024, but early adoption is permitted. This ASU should be applied on a prospective basis, although retrospective application is permitted. Management is currently evaluating the impact of the changes required by the new standard on the Company’s consolidated financial statements and related disclosures.

In November 2023, the FASB issued Accounting Standard Update (ASU) No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The new standard is intended to improve annual and interim reportable segment disclosure requirements regardless of number of reporting units, primarily through enhanced disclosures of significant expenses. The amendment requires public entities to disclose significant segment expenses that are regularly provided to the

CODM and included within each reported measure of segment profit and loss. This update is effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years starting after December 15, 2024. This ASU must be applied retrospectively to all prior periods presented. Management is currently evaluating the impact of the changes required by the new standard on the Company’s consolidated financial statements and related disclosures.

2. Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions affecting the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. The Company’s most significant estimates and critical accounting policies involve reviewing assets for impairment and determining the assumptions used in measuring stock-based compensation expense and warrant liability.

3. Liquidity and Going Concern

The Company incurred a net loss of $6.2 million for the six months ended June 30, 2024. The Company had an accumulated deficit of $486.7 million as of June 30, 2024. Additionally, the Company used net cash of $5.7 million to fund its operating activities for the six months ended June 30, 2024.

To date, the Company’s operating losses have been funded primarily from outside sources of invested capital from issuance of its common and preferred stocks, proceeds from its term loan, line of credit facility and grant funding. However, the Company has had, and will continue to have, an ongoing need to raise additional cash from outside sources to fund its future clinical development programs and other operations. There can be no assurance that the Company will be able to continue to raise additional capital in the future. The Company’s inability to raise additional cash would have a material and adverse impact on its operations and could cause the Company to default on its term loan. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

At the closing of the May 2024 Private Placement, the Company received aggregate upfront gross proceeds of approximately $7.3 million, before deducting fees and other expenses associated with the closing of the May 2024 Private Placement. None of the Warrants issued in the May 2024 Private Placement have been exercised as of the filing of this quarterly report on Form 10-Q. See Note 12 to the unaudited condensed consolidated financial statements, Stockholders' Deficit - May 2024 Private Placement, for further information regarding the May 2024 Private Placement.

Nasdaq Listing Compliance

On March 8, 2024, the Company received a letter (the “Notice”) from the Listing Qualifications staff of Nasdaq, notifying the Company that it no longer complied with the requirement under Nasdaq Listing Rule 5550(b)(1) to maintain a minimum of $2.5 million in stockholders’ equity for continued listing on Nasdaq or the alternative requirements of having a market value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal year or two of the last three most recently completed fiscal years (the “Alternative Standards”). The Notice stated that as of March 8, 2024, the Company did not meet the Alternative Standards.

On April 22, 2024, the Company provided Nasdaq with its plan to achieve and sustain compliance with the stockholders’ equity requirement and requested that Nasdaq grant the Company an extension of time until September 4, 2024, to provide evidence of compliance with the stockholders’ equity requirement. Nasdaq has not yet responded to the Company’s plan, and there can be no assurance that Nasdaq will grant an extension or that the Company will be able to comply with the applicable listing standards of Nasdaq.

The Company continues to seek additional capital from financing alternatives and other sources in order to ensure adequate funding is available to allow the Company to continue research and product development and other operating activities at their current levels. If sufficient capital is not raised, the Company will at a minimum need to significantly reduce or curtail its research and development and other operations, and this would negatively affect its ability to achieve corporate growth goals.

Should the Company fail to raise additional cash from outside sources, it would have a material adverse impact on its operations.

The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue to operate as a going concern, which contemplates the realization of assets and settlement of liabilities in the normal course of business, and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from uncertainty related to its ability to continue as a going concern.

4. Fair Value Measurements

Fair value measurements are market-based measurements, not entity-specific measurements. Therefore, fair value measurements are determined based on the assumptions that market participants would use in pricing the asset or liability. The Company follows

a three-level hierarchy to prioritize the inputs used in the valuation techniques to derive fair values. The basis for fair value measurements for each level within the hierarchy is described below:

•Level 1: Quoted prices in active markets for identical assets or liabilities.

•Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets.

•Level 3: Valuations derived from valuation techniques in which one or more significant inputs are unobservable in active markets.

Money market funds are valued at the closing price reported by the fund sponsor from an actively traded exchange. Money market funds and U.S. Treasury bills were included in cash equivalents in the consolidated balance sheets for the periods presented. The Company obtains the fair value of its Level 2 cash equivalents from third-party pricing services. The pricing services utilize industry standard valuation models whereby all significant inputs, including benchmark yields, reported trades, broker/dealer quotes, issuer spreads, bids, offers, or other market-related data, are observable.

The following table summarizes the Company’s fair value hierarchy for its financial assets measured at fair value on a recurring basis as of June 30, 2024 and December 31, 2023, respectively (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using |

|

June 30, 2024 |

Fair Value |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Money market |

$ |

2,415 |

|

$ |

2,415 |

|

$ |

— |

|

$ |

— |

|

Treasury bills and government agency bonds |

|

3,523 |

|

|

— |

|

|

3,523 |

|

|

— |

|

|

$ |

5,938 |

|

$ |

2,415 |

|

$ |

3,523 |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using |

|

December 31, 2023 |

Fair Value |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Money market |

$ |

5,449 |

|

$ |

5,449 |

|

$ |

— |

|

$ |

— |

|

During the six months ended June 30, 2024, the Company issued common stock warrants which are classified as liabilities under authoritative accounting standards (Note 12). Those common stock warrants are valued using the Black Scholes model, with level 3 inputs such as expected volatility, risk-free interest rate, and expected term that are not observable in active markets.

The table below summarizes key inputs used in the valuation of the liability classified warrants as of the issuance date and as of June 30, 2024:

|

|

|

|

|

|

|

|

|

As of issuance date |

|

As of June 30, 2024 |

|

Expected term |

|

1.1 - 5.0 years |

|

1.0 to 4.8 years |

|

Common stock market price |

|

$2.01 - $2.27 |

|

$ |

1.47 |

|

Risk-free interest rate |

|

4.5% - 5.1% |

|

4.3% - 5.1% |

|

Expected volatility |

|

117.0% - 127.2% |

|

105.6% - 121.0% |

|

The table below provides a summary of the fair value of the Company's warrant liability during the six months ended June 30, 2024 (in thousands). As of June 30, 2023, the fair value of liability classified warrants was immaterial, and the change in the fair value of liability classified warrants during the three and six months ended June 30, 2023 was immaterial.

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

Warrant liability |

|

2024 |

|

Beginning balance |

|

$ |

— |

|

Issuance of warrants |

|

|

10,854 |

|

Change in fair value of warrants |

|

|

(4,694 |

) |

Ending balance |

|

$ |

6,160 |

|

5. Term Loan Obligations

On May 29, 2015, the Company entered into the Loan and Security Agreement (the “Loan and Security Agreement”), pursuant to which Oxford Finance, LLC (“Oxford”) funded an aggregate principal amount of $17.7 million (the “Term Loan”), subject to the terms and conditions set forth in the Loan and Security Agreement.

Pursuant to the Loan and Security Agreement, as amended, the Company made interest only payments through May 1, 2021, and thereafter was required to make payments of principal and accrued interest in equal monthly installments sufficient to amortize

the Term Loan through June 1, 2024, the maturity date. On June 3, 2024, the Company paid off the Term Loan by making a final payment in an aggregate amount equal to approximately $3.3 million, which included both the balance of outstanding principal and interest and the final payment fee due. The repayment in full of the Term Loan terminated Oxford’s security interest in the Company’s existing and after-acquired assets, as well as all other certain restrictions and covenants under the Term Loan.

6. Line of Credit Facility

On May 31, 2024, the Company drew down $3.3 million on its new margin loan facility under a line of credit (the “Pershing Credit Facility”) with Pershing LLC (“Pershing”), an affiliate of The Bank of New York Mellon Corporation. The available credit line limit under the Pershing Credit Facility fluctuates based on the Company’s request for extensions from time to time, subject to the value of the collateralized marketable securities the Company holds with Pershing, provided that the amount available to draw under the Pershing Credit Facility cannot exceed 91.5% of the value of the collateralized marketable securities deposited with Pershing. Depending on the value of the marketable securities the Company holds with Pershing, Pershing may require the Company from time-to-time to deposit additional funds or marketable securities in order to restore the level of collateral to an acceptable level. The amounts borrowed under the Pershing Credit Facility are due on demand.

Borrowings under the Pershing Credit Facility bear interest at the target interest rate set by the Federal Open Market Committee, subject to a floor of 5.5%, plus a spread of 1.75% and applicable fees of 0.5%, subject to a maximum interest rate of the then applicable Prime Rate as published in The Wall Street Journal plus 3.0%. Interest payments thereunder are calculated on a monthly basis and, unless paid, are added to the outstanding balance under the Pershing Credit Facility. The proceeds under the Pershing Credit Facility are available for working capital needs and other general corporate purposes. Volatility in the global markets could cause the interest rate to fluctuate from time to time increasing the Company’s costs, or could cause Pershing to terminate the Company’s ability to borrow funds. In addition, borrowings under the Pershing Credit Facility have the effect of limiting the Company’s use of cash and marketable securities.

7. Loss per Share

Basic per share data is computed by dividing net income or loss applicable to common stockholders by the weighted average number of common shares outstanding during the period. Diluted per share data is computed by dividing net income or loss applicable to common stockholders by the weighted average number of common shares outstanding during the period increased to include, if dilutive, the number of additional common shares that would have been outstanding as calculated using the treasury stock method. Potential common shares were related to outstanding but unexercised options, multiple series of convertible preferred stock, and warrants for all periods presented.

The Company considers Series A Warrants and Series B Warrants issued in connection with the private placement completed in May 2024 (Note 12) to be participating securities because holders of such instruments participate in the event a dividend is paid on common stock. The holders of the Series A Warrants and Series B Warrants do not have a contractual obligation to share in the Company's losses. As such, losses are attributed entirely to common stockholders and for periods in which the Company has reported a net loss.

As of June 30, 2024, 2,151,544 Pre-Funded Warrants to purchase common stock, issued in connection with the May 2024 Private Placement (Note 12), were included in the basic and diluted net loss per share calculation.

The following table sets forth the computation of basic and diluted net loss per common share for the periods indicated, in thousands except share and per share data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Basic and diluted net loss per common share calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,940 |

) |

|

$ |

(1,482 |

) |

|

$ |

(6,201 |

) |

|

$ |

(6,287 |

) |

Change in fair value of warrants |

|

|

(4,694 |

) |

|

|

— |

|

|

|

(4,694 |

) |

|

|

— |

|

Net loss attributable to common stockholders - diluted |

|

$ |

(7,634 |

) |

|

$ |

(1,482 |

) |

|

$ |

(10,895 |

) |

|

$ |

(6,287 |

) |

Weighted average common shares outstanding - basic |

|

|

6,500,831 |

|

|

|

2,509,378 |

|

|

|

5,411,382 |

|

|

|

2,415,221 |

|

Net loss per share of common stock - basic |

|

$ |

(0.45 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.15 |

) |

|

$ |

(2.60 |

) |

Weighted average common shares outstanding - diluted |

|

|

10,742,924 |

|

|

|

2,509,378 |

|

|

|

7,532,428 |

|

|

|

2,415,221 |

|

Net loss per share of common stock - diluted |

|

$ |

(0.71 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.45 |

) |

|

$ |

(2.60 |

) |

The following were excluded from the diluted loss per share calculation for the periods presented because their effect would be anti-dilutive:

|

|

|

|

|

|

|

|

|

|

As of June 30, |

|

|

2024 |

|

|

2023 |

|

Outstanding stock options |

|

|

336,928 |

|

|

|

128,582 |

|

Preferred stock |

|

|

28,190 |

|

|

|

28,190 |

|

Outstanding warrants |

|

|

142,733 |

|

|

|

142,733 |

|

Total |

|

|

507,851 |

|

|

|

299,505 |

|

8. Biocept Asset Acquisitions

On April 26, 2024, the Company acquired from Biocept, for a total cash payment of $400,000, substantially all of the right, title and interest in CNSide intellectual property (“CNSide IP”), including (i) intellectual property, (ii) inventory and raw materials, and (iii) data, information, results and reports pertaining to the completed and on-going clinical studies involving the use of the CNSide IP (including, but not limited to, the FOERSEE clinical study that was being conducted by Biocept), related to the development, making, selling, and exporting or importing of the CNSideTM (as defined below), after having its bid accepted by the United States Bankruptcy Court for the District of Delaware.

The Company concluded that the acquisition of Biocept assets was not a business combination, as Biocept did not meet the definition of a business in ASC 805, Business Combination. The Company accounted for the asset purchase transaction under the authoritative guidance for asset acquisitions, and allocated the costs of acquisitions of approximately $45,000 among the assets acquired based on the relative fair value of such assets, which is predominately concentrated in the intellectual property acquired including patents and trademarks. The intangible assets acquired from Biocept are capitalized and amortized over a useful life of four years.

9. Grant Revenue

On September 19, 2022, the Company entered into that certain Cancer Research Grant Contract (the “CPRIT Contract”), effective as of August 31, 2022, with the Cancer Prevention and Research Institute of Texas (“CPRIT”), pursuant to which CPRIT provides the Company with a CPRIT grant (“CPRIT Grant”) over a three-year period to fund the continued development of rhenium (186Re) obisbemeda for the treatment of patients with leptomeningeal metastases (“LM”). The CPRIT Grant is subject to customary CPRIT funding conditions, including, but not limited to, a matching fund requirement (one dollar for every two dollars awarded by CPRIT), revenue sharing obligations upon commercialization of rhenium (186Re) obisbemeda based on specific dollar thresholds and tiered low single digit royalty rates until CPRIT receives the aggregate amount of 400% of the proceeds awarded under the CPRIT Grant, and certain reporting requirements.

The CPRIT Contract will terminate on August 30, 2025, unless terminated earlier by (a) the mutual written consent of all parties to the CPRIT Contract, (b) CPRIT for an event of default by the Company, (c) CPRIT, if the funds allocated to the CPRIT Grant become legally unavailable during the term of the CPRIT Contract and CPRIT is unable to obtain additional funds for such purposes, and (d) the Company for convenience. CPRIT may require the Company to repay some or all of the disbursed CPRIT Grant proceeds (with interest not to exceed 5% annually) in the event of the early termination of the CPRIT Contract by CPRIT for an event of default by the Company or by the Company for convenience, or if the Company relocates its principal place of business outside of the state of Texas during the CPRIT Contract term or within three years after the final payment of the grant funds.

The Company retains ownership over any intellectual property developed under the CPRIT Contract (each, a “Project Result”). With respect to non-commercial use of any Project Result, the Company granted to CPRIT a nonexclusive, irrevocable, royalty-free, perpetual, worldwide license with right to sublicense any necessary additional intellectual property rights to exploit all Project Results by CPRIT, other governmental entities and agencies of the State of Texas, and private or independent institutions of higher education located in Texas, for education, research and other non-commercial purposes.

The Company recognized $1.3 million and $1.9 million, and $3.0 million and $2.4 million in grant revenue from the CPRIT Contract during the three and six months ended June 30, 2024 and 2023, respectively.

10. Commitments and Contingencies

Leases

The Company leases laboratory, office and storage facilities in San Antonio, Texas, under operating lease agreements that expire in 2025. The Company also leases certain office space in Austin, Texas under a month-to-month operating lease agreement and certain office space in Charlottesville, Virginia (the “Charlottesville Lease”). The Charlottesville Lease has a term of 12 months and the Company has the ability to renew for three additional one-year periods. On March 31, 2023, Company believed that it

was reasonably certain that the Charlottesville Lease will be renewed through March 31, 2026, and as a result, it remeasured the related lease liability as of March 31, 2023 to be $80,000 using the then-in-effect discount rate of 12.76%. Effective July 1, 2023, the Company added additional office lease premises in Charlottesville, which was accounted for as a separate operating lease contract with a lease liability and corresponding right-of-use asset of $19,000, as a discount rate of 13.47%.

Other commitments and contingencies

The Company has entered into agreements with various research organizations for pre-clinical and clinical development studies, which have provisions for cancellation. Under the terms of these agreements, the vendors provide a variety of services including conducting research, recruiting and enrolling patients, monitoring studies and data analysis. Payments under these agreements typically include fees for services and reimbursement of expenses. The timing of payments due under these agreements is estimated based on current study progress. As of June 30, 2024, the Company did not have any clinical research study obligations.

Legal proceedings

From time to time, the Company is subject to legal proceedings and claims, whether asserted or unasserted, that arise in the ordinary course of business. Due to their nature, such legal proceedings involve inherent uncertainties including, but not limited to, court rulings, negotiations between affected parties and governmental actions. Management assesses the probability of loss for such contingencies and accrues a liability and/or discloses the relevant circumstances, as appropriate.

11. License Agreements

Biocept License Agreement

On September 7, 2023, the Company entered into a Non-Exclusive License and Services Agreement with Biocept, pursuant to which Biocept granted the Company a non-exclusive license to use the Biocept proprietary cell enumeration test, CNSideTM (“CNSideTM”). In exchange for the license, the Company issued to Biocept 53,381 unregistered shares, the fair value of which was $75,000.

On October 16, 2023, Biocept filed a voluntary petition for relief under the provisions of Chapter 7 of Title 11 of the United States Bankruptcy Code. See Note 8 for further information regarding the Company’s acquisition of substantially all right, title and interest in the CNSide IP.

University of Texas Health Science Center at San Antonio (“UTHSCSA”) License Agreement

On December 31, 2021, the Company entered into a Patent and Know-How License Agreement with UTHSCSA, pursuant to which UTHSCSA granted the Company an irrevocable, perpetual, exclusive, fully paid-up license, with the right to sublicense and to make, develop, commercialize and otherwise exploit certain patents, know-how and technology related to the development of biodegradable alginate microspheres (“BAM”) containing nanoliposomes loaded with imaging and/or therapeutic payloads.

NanoTx License Agreement

On March 29, 2020, the Company and NanoTx, Corp. (“NanoTx”) entered into a Patent and Know-How License Agreement, pursuant to which NanoTx granted the Company an irrevocable, perpetual, exclusive, fully paid-up license, with the right to sublicense and to make, develop, commercialize and otherwise exploit certain patents, know-how and technology related to the development of radiolabeled nanoliposomes.

The transaction terms included an upfront payment of $0.4 million in cash and $0.3 million in the Company’s voting stock. The transaction terms also included success-based milestone and royalty payments contingent on key clinical, regulatory and sales milestones, as well as the requirement to pay 15% of any non-dilutive monetary awards or grants received from external agencies to support product development of the nanoliposome encapsulated BMEDA-chelated radioisotope, which includes grants from CPRIT. As of June 30, 2024, the Company accrued $0.5 million of payments due to NanoTx as a result of the CPRIT grant received (see Note 9, Grant Revenue of the condensed consolidated financial statements for additional information).

12. Stockholders' Deficit

Preferred Stock

The Company has authorized 5,000,000 shares of preferred stock, par value $0.001 per share. The Company’s Board is authorized to designate the terms and conditions of any preferred stock the Company issues without further action by the common stockholders.

Series F Preferred Stock

On March 3, 2023, the Company filed a certificate of designation (the “Certificate of Designation”) with the Secretary of State of the State of Delaware, effective as of the time of filing, designating the rights, preferences, privileges and restrictions of the Series F Preferred Stock, with the total authorization of one (1) share of Series F Preferred Stock. The Certificate of Designation provided that the share of Series F Preferred Stock would have 50,000,000 votes per share of Series F Preferred Stock and would vote together with the Company’s common stock, as a single class exclusively with respect to any proposal to amend the Company’s Charter to effect the Reverse Stock Split. On March 3, 2023, the Company entered into a subscription and investment representation agreement with Richard J. Hawkins, chairman of the board of the Company, who is an accredited investor (the “Series F Preferred Stock Purchaser”), pursuant to which the Company agreed to issue and sell one (1) share of the Company’s Series F Preferred Stock, par value $0.001 per share, to the Series F Preferred Stock Purchaser for $1,000 in cash. The sale closed on March 3, 2023.

The outstanding share of Series F Preferred Stock was redeemed in whole, automatically effective upon the approval by the Company’s stockholders of the Reverse Stock Split in April 2023. Upon such redemption, the holder of the Series F Preferred Stock received consideration of $1,000 in cash.

Series B and C Preferred Stock

As of June 30, 2024, there were 938 outstanding shares of Series C Preferred Stock that can be converted into an aggregate of 27,792 shares of common stock, and 1,014 shares of Series B Convertible Preferred Stock that can be converted into an aggregate of 398 shares of common stock.

Warrants

The Company issued pre-funded warrants and warrants to purchase its common stock in connection with the May 2024 Private Placement. See the section below on Common Stock for additional details.

On September 25, 2019, the Company completed an underwritten public offering. The Company issued 19,266 shares of its common stock, along with pre-funded warrants to purchase 180,733 shares of its common stock and Series U Warrants to purchase 230,000 shares of its common stock. The Series U Warrants have a term of five years from the issuance date. In addition, the Company issued warrants to H.C. Wainwright & Co., LLC, as representatives of the underwriters, to purchase 5,000 shares of its common stock with a term of five years from the issuance date, in the form of Series U Warrants (the “Representative Warrants”). As of June 30, 2024, there were 142,733 outstanding Series U Warrants and Representative Warrants which can be exercised into an aggregate of 142,733 shares of common stock at a weighted average exercise price of $34.10 per share.

Common Stock

May 2024 Private Placement