false

0001512922

0001512922

2024-03-05

2024-03-05

0001512922

PETV:CommonStockParValue0.001Member

2024-03-05

2024-03-05

0001512922

PETV:WarrantsToPurchaseCommonStockMember

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

March

5, 2024

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55439 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

PETV |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

PETVW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events

On

March 5, 2024, we dual listed our common stock (“Common Stock”) on the Upstream stock exchange, as operated by MERJ Exchange

Ltd. (“Upstream”), and registered in the Seychelles under the Seychelles Securities Act, 2007. Our Common Stock is dual listed

and traded on Upstream as uncertificated common stock represented by MERJ Depository Interests (“MDI”) that are digital in

nature, and such MDIs represent the same class and shares of our Common Stock as currently listed and traded on Nasdaq.

Upstream

is operated as a fully regulated and licensed integrated securities exchange, clearing system and depository. Upstream/MERJ is an affiliate

of the World Federation of Exchanges (WFE), recognized by HM Revenue and Customs UK as a “Recognized Stock Exchange”, a full

member of the Association of National Numbering Agencies (ANNA) where MERJ is responsible for assigning and registering ISIN and CFI

identifiers to users, a Qualifying Foreign Exchange for OTC Markets in the U.S., and a member of the Sustainable Stock Exchanges Initiative.

MERJ is regulated in the Seychelles by the Financial Services Authority Seychelles, https://fsaseychelles.sc, an associate member

of the International Association of Securities Commissions (IOSCO). In addition, the Seychelles is a full member of the Eastern and Southern

African Anti-Money Laundering Group (ESAAMLG) and is in good standing with same and is a participating jurisdiction recognized by the

U.S. Treasury under FATCA.

The

Upstream website, policy, terms, and conditions state that if you are a U.S.-based investor, a U.S. citizen or permanent resident, you

will not be able to deposit, buy, or sell securities that were previously purchased from an issuer, stockbroker, or stock exchange where

such a securities issuer has then subsequently dual-listed on Upstream.

Upstream

is only available to non-U.S. persons. Upstream operates its KYC (“Know Your Customer”) process for on-boarding securities

traders as an “Active Confirmation” service which stipulates that a user may not trade securities until they pass KYC. As

part of Upstream KYC, a person’s citizenship and residence/domicile is determined by an Upstream KYC-reviewer, and those persons

that are either citizens of the U.S. or reside in the U.S. will not be permitted to trade securities on Upstream. After passing KYC,

all other nationalities and domiciles are permitted to freely deposit and trade securities on Upstream, notwithstanding certain jurisdictions

that the Financial Action Task Force (“FATF”) has designated as high-risk for money laundering and/or terrorist financing.

All

shares of our Common Stock have been registered with the U.S. Securities and Exchange Commission (the “Commission”), comprise

the entire number of shares issued and outstanding, and have the same CUSIP/ISIN number. There are no differences in shareholder rights,

such as transferability. Shareholders may elect to hold their shares in depositories: (i) digital book entry with our transfer agent,

(ii) free trading at a U.S. stockbroker, under “street name” Cede & Co., or (iii) free trading on Upstream, under “street

name” MERJ Dep.

Upstream

digital securities and Upstream securities are interchangeable terms that have the same meaning. Upstream securities are a digital representation

of our shares of Common Stock that have been issued and registered with the Commission. On the Upstream app’s portfolio screen,

a security balance (share count) is a 1:1 representation of our Common Stock as held by a trader, and acts as confirmation of the settlement

of either a share deposit or a share purchase in the shareholder’s name. The ownership details of an Upstream securities balance

of our Common Stock for each shareholder shall include but not be limited to:

| ● | Certificate

number |

| ● | Company

name and CUSIP/ISIN number |

| ● | Shareholder

name, domicile address and nationality |

| ● | Shareholder

Upstream account number |

| ● | Number

of shares owned |

| ● | Class

of shares |

| ● | Issue

date of shares |

| ● | Amount

paid for the shares the Upstream secondary market |

Our

Common Stock, as deposited by our shareholders to Upstream exclusively via our transfer agent, is held by MERJ Depository and Registry

Limited (“MERJ Dep.”), which is a licensed Securities Facility, in exchange for the issuance of an Upstream digital securities

share balance representing such share deposits, which are then immediately tradable on the Upstream stock exchange secondary market.

The beneficial owners of shares of our Common Stock held by the Upstream nominee, MERJ Dep., shall be entitled to vote their shares at

stockholder meetings, to receive notices and solicitation materials for stockholder meetings, receive the same dividends, and to have

all other rights conferred by our Company under state and federal laws. They are afforded these rights since they have not surrendered

or otherwise disposed of U.S. common stock and the applicable laws are the same and the shares are the same class of stock; they are

just represented digitally on the Upstream smartphone app.

In

addition, shareholders on Upstream have the right to receive confirmations, proxy statements and other documents as distributed by our

Company pursuant to its legal obligations. There are no restrictions, limitations, or other losses of rights when our Common Stock is

deposited for secondary trading on the Upstream stock exchange.

Investors

are encouraged to take note that, as in all dual listed securities that are traded on multiple marketplaces, there can be differences

in pricing as a result of different liquidity, price discovery and otherwise. Trading on foreign exchanges can expose investors to various

risks, including currency fluctuations and differences in trading rules and regulations. Here are some of the most common risks associated

with trading on foreign exchanges such as Upstream:

| 1. | Regulatory

Risk: Different countries have different rules and regulations governing securities trading,

and investors who trade on foreign exchanges may be subject to unfamiliar or complex regulations.

In some cases, foreign regulators may have different reporting requirements or different

standards for disclosure than U.S. regulators, which can make it difficult for investors

to make informed decisions. |

| 2. | Market

Risk: Foreign markets may be subject to different economic, political, or social conditions

than U.S. markets, which can affect the performance of securities traded on those markets.

Investors who trade on foreign exchanges may be exposed to higher levels of volatility and

uncertainty than they would be if they traded solely on U.S. exchanges. |

| 3. | Liquidity

Risk: Securities traded on foreign exchanges may have lower liquidity than the same securities

as traded on U.S. exchanges, which can make it more difficult for investors to buy or sell

those securities at the desired price. |

| 4. | Operational

Risk: Trading on foreign exchanges may also expose investors to operational risks, such as

delays or errors in the settlement of trades or difficulties in accessing trading platforms. |

Investors

who are considering trading on foreign exchanges, including Upstream, should carefully evaluate these and other risks and consult with

financial and legal advisors before making any investment decisions. They should also be aware of any fees, taxes, or other costs associated

with trading on foreign exchanges.

Upstream

is available from your preferred app store at https://upstream.exchange, and is activated by creating an account by tapping “sign

up” and completing a KYC identity verification process. Interested parties may download the application and will have access to

review all the securities that trade on Upstream, including trading activity, regulatory disclosures, and other corporate information.

Further, there is a direct link to information on our Company at https://upstream.exchange/petvivo. All information is available

prior to the account opening process and application. This includes a listing particulars document, which is a required disclosure as

part of the requirements of Upstream, a MERJ Exchange market, as defined by the Seychelles Securities Act, 2007 (as amended) and any

other measure prescribed thereunder by the Minister of the Securities Authority. The Upstream market is open 5 days a week, 20 hours

a day, Monday to Friday: 10:00am to 06:00am UTC+4 (1:00am to 9:00pm EST).

To

open an account on Upstream you must pass KYC. Upstream KYC does not rely on IP address monitoring or IP address analysis to identify

a U.S. person or a U.S.-originating transaction, as this is too easily spoofed using VPN technologies. All Upstream users are required

to have passed a KYC review by Upstream personnel. Upstream determines whether a person is U.S.-domiciled or is a U.S. person living

overseas and restricts the app’s functionalities accordingly. There are no defaults pending KYC review; only after a full KYC review

by Upstream personnel are any securities transactions permitted. Upstream requires the following KYC information to be supplied by users:

name, date of birth, citizenship, cell phone, email address, postal address, bank account (no 3rd party transfers), selfie,

photo ID, liveness detection in-app interview, GPS location or utility bill, and verification of an SMS code sent to the cell phone.

Post-KYC due diligence, the user’s details are also subjected to enhanced due diligence for AML, and these details are checked

against international AML lists (ref: https://amlcop.com). Users flagged U.S. persons or as an AML risk are not permitted to trade

on Upstream.

Investors

may choose to open an Upstream account and deposit their securities on Upstream exclusively using our transfer agent. Investors who elect

to transfer their shares to Upstream may withdraw their shares from Upstream back to the transfer agent if they choose instead to trade

via their U.S. broker at any time. Upstream securities held by each shareholder will be held in a segregated account of the shareholder

which is linked and administered through the Upstream app. All orders for sale are non-solicited by Upstream, and a user’s decision

to trade securities must be based on their own investment judgment.

Investors

may access detailed information on the process on how to deposit and trade shares on Upstream directly on Upstream’s website at

the following link: https://upstream.exchange/SupportCenter; non-U.S. persons only.

To

dual list on Upstream, we executed a certificate of appointment of MERJ Dep. as a Securities Facility and confirmed that the shares outstanding

on the date of the certificate execution (a) are duly authorized, validly issued, fully paid and non-assessable and any pre-emptive and

other contractual rights related to all issuances of the shares have been satisfied, and (b) have been registered under the applicable

law of the domicile of our Company or are exempt from registration. All issuances and transfers of Company shares have been, and after

the date of the certificate will be, in compliance with all applicable laws, rules and regulations. Our Company requires MERJ Dep. to

provide services (“Securities Facility Services”) as prescribed in the MERJ Dep Securities Facility Rules, including the

Directive on Depository Interests and MERJ Dep. Procedures as a requirement of its listing on Upstream.

MERJ

Dep. is a company licensed as a Securities Facility pursuant to the Seychelles Securities Act, 2007. An issuer that lists its securities

on Upstream utilizes MERJ Dep. to provide Securities Facility Services to manage its securities as prescribed in an agreement with the

issuer and pursuant to MERJ Dep.’s Securities Facility Rules, including the Directive on Depository Interests and MERJ Dep. procedures

as a requirement of its listing on Upstream. The issuer appoints MERJ Dep. to act as the Depository Nominee in respect of any securities

traded which are quoted on Upstream and grants MERJ Dep. as the Depository Nominee, pursuant to the Securities Facility Rules Directive

on Depository Interests.

MERJ

Dep. operates as a nominee account (street name) in the same manner as Cede & Co. by accepting shareholder deposits in an electronic

form from the transfer agent that facilitates the buying and selling of such shares on Upstream (e.g., by an individual name & address).

Upstream is the trading technology employed by MERJ Exchange Ltd., a regulated national stock exchange.

MERJ

Dep. maintains the MERJ Dep. Subregister of MDIs (Upstream securities). Any shareholder wishing to deposit shares with Upstream will

follow the prompts on the Upstream app to initiate and approve the transaction. Once satisfied with the legitimacy of each deposit request,

our transfer agent will make an entry in its register to give effect to the deposit by moving and vesting title in the securities in

the name of the Depository Nominee. It will also notify MERJ Dep. or its appointed agent, which will then make the MDIs available for

trading on Upstream pursuant to its rules and procedures. All resales are governed by the rules governing the activities of Upstream

and shall be reflected only on the MERJ Dep. Subregister. Title to the securities reflected as MDIs will be held in the name of MERJ

Nominees Ltd. on the books of the transfer agent. All subsequent resales of the Upstream securities are conducted in accordance with

the rules governing Upstream and will be reflected only on the MERJ Dep. Subregister.

Shares

may only be deposited onto Upstream through our transfer agent, Equity Stock Transfer, utilizing the Upstream app. Existing, non-U.S.

shareholders may transfer their shares by opening Upstream, tapping Investor, then Manage Securities, then Deposit Securities, then entering

the ticker symbol and the number of shares to deposit, and then tapping Submit. Next, they enter their brokerage firm name and brokerage

account number, and tap Submit. Finally, they tap Add E-Signature, sign their name on the screen using their finger, tap Done, and then

tap Sign. Shareholders will receive a push notification once the shares are deposited and available for trading on Upstream. After completion

of the deposit request on Upstream, shareholders will receive via email an executed deposit form to submit to their current brokerage

firm to initiate a withdrawal to the transfer agent. Shares will not be transferred without notifying the current broker and requesting

a withdrawal. On listing day, shareholders will receive a push notification once the shares are deposited and available for trading on

Upstream.

Investors

may withdraw shares from Upstream directly from the Upstream app. The Upstream app has a function under Investor Services, Manage Securities,

Withdraw Securities. The shareholder then enters the ticker symbol and the number of shares to be withdrawn and taps “Notarize”

to cryptographically sign this transaction. The shares are removed from the user’s Upstream portfolio, and an email is sent to

the transfer agent with a share withdrawal request whereafter the transfer agent will liaise directly with the shareholder to ensure

the share balance is entered in “book entry” into the user’s name & address. Third party share withdrawals from

Upstream are not permitted; the share withdrawal request name and address (as retrieved from the Upstream KYC information by Upstream

compliance) is required to be the same name and address that will be entered in the transfer agent’s “book entry” for

this shareholder.

Upstream

only offers self-directed trading. Upstream users create a trading account using the Upstream smartphone app, with a random-generated

username (in the form of an address comprising a 42-character hexadecimal address derived from the last 20 bytes of a random public key)

and a password (in the form of a random cryptographic private key). The public and private key (the cryptographic keypair) is

generated locally on the smartphone and only the public key is ever known to Upstream, MERJ Dep., or peer-to-peer trading counterparties

on Upstream. Only the individual users hold their private keys. This privacy ensures that only the Upstream user can cryptographically

sign a securities transaction (deposit/withdraw/bid/offer/buy/sell/cancel) for it to be executed on Upstream; that is, all transactions

such as share sales are self-directed, peer-to-peer, and instantly settled using the Upstream distributed ledger platform.

In

order to buy, sell, deposit or withdraw shares on Upstream, an Upstream user that has created its account as outlined in the previous

paragraph is required to submit know your customer (KYC) information for the Upstream compliance team to review. KYC information is then

linked to the user’s public key, and if the user passes KYC review, then the user’s cryptographic keypairs transactions will

be accepted as legitimate self-directed securities transaction requests to Upstream for execution on the platform.

It

should be noted that the Upstream technology will reject securities deposits or buy orders from cryptographic keypairs that, pursuant

to their KYC review, come from U.S. persons. No securities buy orders are accepted without a user having successfully undergone the Upstream

KYC review process.

It

should be also noted that individual shares traded on the Upstream secondary market are not reflected in the transfer agent’s books

and records. They are recorded inside the street name depository of MERJ Dep. The MERJ Dep. nominee books and records service will only

accept self-directed, cryptographically signed, executed securities sales from the Upstream app and adjust the share counts accordingly.

Therefore, the securities are held at the nominee, and are moved between accounts inside the nominee’s omnibus solution pursuant

to a cryptographically signed, self-directed instruction from the shareholder as executed by the Upstream matching-engine and notified

to MERJ Dep.

Lost

certificates on Upstream can occur if a shareholder loses its smartphone. Upon notification of the loss of the Upstream app (and its

corresponding signing keys), each separate share balance and shareholder name, address, and tax ID is communicated by Upstream to each

of the affected transfer agents. The transfer agent then instructs Upstream to withdraw the lost shares back to the transfer agent, where

they are deposited directly in book entry in the transfer agent’s books and records in the shareholder’s name and address.

The lost shares have now been recovered. Note that the share count for MERJ Dep., street-name, is decremented by the number of shares

recovered. It is up to the individual shareholder to inform the transfer agent on whether it wishes to leave its shares in book entry,

to deposit for secondary trading at Upstream again, or to deposit for secondary trading at a U.S. brokerage.

HOW

TO DEPOSIT SHARES

Upstream

can accept the shares that non-U.S. investors hold in their current brokerage account, shares that are held directly at the transfer

agent in digital book entry, or their physical stock certificates. Shares can also be moved out of Upstream back to U.S. markets. The

following steps detail how investors can deposit their shares onto Upstream.

STEP

1. CREATE AN ACCOUNT ON UPSTREAM & VERIFY YOUR IDENTITY

| ● | Download

the Upstream app and tap Sign Up. This will create your Upstream profile and ‘signing

key’. |

| ● | Complete

KYC. To complete KYC identity verification, tap the settings icon in the top right of the

navigation, then tap KYC. Be sure to have a valid form of ID and banking details handy. It

is important that bank account information matches your name exactly. |

| ● | Once

your account is approved, and you are not a U.S. person, and if you already own shares and

wish to transfer them to Upstream for trading, then you may initiate a request to deposit

your shares using the Upstream app. |

STEP

2. TRANSFER SHARES TO TRANSFER AGENT

If

your shares are already held at the transfer agent, then skip to STEP 3 below. However, if your shares are currently in your brokerage

account, then please transfer your shares to the transfer agent as described below. Note that the terminology for this is to have shares

held as “direct registration” in “book entry” at the transfer agent.

To

make this transfer request, most of the time all you need to do is contact your brokerage firm by email and ask them to transfer your

shares back to “book entry” at the transfer agent. The brokerage firm will know what to do, and they will let you know how

long it will take, but typically you should allow 48 hours for your request to be processed.

Some

brokerage firms may ask you to fill out their particular share transfer form. Upstream can be contacted at servicedesk@upstream.exchange

if you need assistance in completing a share transfer form from your brokerage firm.

It

is important that the investor’s name, address, and tax ID under which their shares are registered at the brokerage firm match

the information that they provided when opening their account on Upstream. If their address at the brokerage firm is out of date, then

the investor will need to update their address with their brokerage firm BEFORE they transfer their shares to the transfer agent. Note

that if the address does not match the investor’s address on Upstream, then their share deposit to Upstream will be delayed by

the transfer agent.

STEP

3. REQUEST TO DEPOSIT SHARES USING THE UPSTREAM APP (NON-U.S. ONLY)

For

non-U.S. persons only: Open the Upstream app, tap Investor, then Manage Securities, then Deposit Securities. Next, enter the Company’s

Ticker Symbol and Number of Shares you are requesting to deposit. Confirm whether your shares are free trading or restricted, then tap

Submit.

The

value of each share deposit request on the Upstream app may not exceed $100,000. This value is determined by the closing price of the

security on the previous trading day multiplied by the number of shares being deposited.

Once

the investor makes the share deposit request using the Upstream app, and the transfer agent has their shares in “book entry”,

then most of the time the Upstream deposit process typically completes within 48 hours (Monday to Friday, excluding U.S. holidays).

However,

if the transfer agent requires further information regarding their share transfer, then the investor will receive an email with a form

to complete. The form will be pre-populated with the Upstream account information.

Once

the transfer is complete, the investor will receive a push notification in the Upstream app and will see the share deposit in their Upstream

Portfolio.

STEP

4. TRADING ON UPSTREAM

Once

the shares are in the investor’s account, they may trade on Upstream. Investors may view their shares in the Upstream Portfolio.

For more information on trading, visit Upstream’s support center at https://upstream.exchange/SupportCenter.

Transfer

agent information

Equity

Stock Transfer

237

W. 37th St. Suite 602

New

York, NY 10018

www.equitystock.com

212.575.5757

HOW

TO MOVE SHARES BACK TO U.S. MARKETS (NON-U.S. ONLY)

Step

1. Open the Upstream app, tap Investor, then tap Withdraw Securities. Enter Ticker Symbol and the Number of Shares you wish to withdraw,

then tap Submit.

Step

2. The transfer agent will receive the investor’s shares immediately and will hold them in digital book entry in their name.

Step

3. The transfer agent will provide the investor via regular U.S. mail a DRS Advice (Statement) that shows their shares are now held

at the transfer agent in book entry. If an investor would like to move the shares back to their U.S. brokerage account, they will need

to contact their broker, provide them with a copy of their DRS Advice and have them request that the transfer agent send back the investor’s

shares. The broker will provide the investor with appropriate forms to complete.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO

HOLDINGS, INC. |

| |

|

|

| Date:

March 6, 2024 |

By:

|

/s/

John Lai |

| |

Name:

|

John

Lai |

| |

Title:

|

Chief

Executive Officer |

Exhibit

99.1

5251

Edina Industrial Blvd. Minneapolis, MN 55439 | (952) 405-6216 | www.petvivo.com

PRESS

RELEASE:

PetVivo

Holdings, Inc. Commences Trading on Upstream Under PETV

PetVivo

Dual Lists on Upstream’s Global Securities Trading App

MINNEAPOLIS,

March 5, 2024 — PetVivo Holdings, Inc. (NASDAQ: PETV & PETVW) (“PetVivo”) an emerging biomedical device company

focused on the commercialization of innovative medical therapeutics for pets announced today that it will become available on March 5,

2024 at 10:00am EST under the ticker symbol “PETV” on Upstream, a MERJ Exchange market and global securities trading app.

The dual listing on Upstream works to provide digital-first investors around the world with streamlined access to PetVivo shares using

just an app. PetVivo’s free digital collectible NFT commemorating the dual listing is also available for all Upstream participants

to claim with the claim code PETV.

Investors

outside the U.S. can now deposit or trade PetVivo securities by downloading Upstream from their preferred app store at https://upstream.exchange/,

creating an account by tapping sign up, and completing a simple KYC identity verification. Then investors may either deposit their

PetVivo shares, or fund their account with credit, debit, PayPal, USD, or USDC to buy PetVivo shares. Note, U.S. persons may not deposit,

buy, or sell securities on Upstream. Trading will commence when an existing shareholder places an offer for sale on Upstream establishing

the first trade.

Details

on the PetVivo listing, detailed deposit and trading instructions, and how to claim the free commemorative NFT can be found at www.petvivo.com.

The Upstream market is open 5 days a week 20 hours a day, Monday to Friday: 10:00am to 06:00am UTC+4 (1:00am to 9:00pm EST). Traders

on Upstream’s smart-contract powered market will experience real-time trading and settlement, and a transparent orderbook which

does not permit common market manipulations.

Existing

global (non-U.S.) shareholders may transfer their shares by opening Upstream, tapping Investor, Manage Securities, Deposit Securities,

then entering the ticker symbol and the number of shares to deposit, and tapping Submit. Next, shareholders enter the brokerage firm

name and brokerage account number and tap Submit. Finally, they tap Add E-Signature, sign their name on the screen using their finger,

tap Done, and then tap Sign. Shareholders will receive via email an executed deposit form to submit to their current brokerage firm to

initiate a withdrawal to the transfer agent. Shareholders will receive a push notification once the shares are deposited and available

for trading on Upstream.

“We

are thrilled to dual list on Upstream’s next generation marketplace,” says John Lai, Chief Executive Officer of PetVivo Holdings,

Inc. “We are adding new value to our shareholders while expanding our company and mission to a modern, global investor-base.”

About

PetVivo Holdings, Inc.

PetVivo

Holdings Inc. (NASDAQ: PETV & PETVW) is an emerging biomedical device company currently focused on the manufacturing, commercialization

and licensing of innovative medical devices and therapeutics for companion animals. The Company’s strategy is to leverage human

therapies for the treatment of companion animals in a capital and time efficient way. A key component of this strategy is the accelerated

timeline to revenues for veterinary medical devices, which enter the market much earlier than more stringently regulated pharmaceuticals

and biologics.

PetVivo

has a robust pipeline of products for the treatment of animals and people. A portfolio of twenty-one patents protects the Company’s

biomaterials, products, production processes and methods of use. The Company’s lead product SPRYNG™ with OsteoCushion™

technology, a veterinarian-administered, intra-articular injection for the management of lameness and other joint related afflictions,

including osteoarthritis, in cats, dogs and horses, is currently available for commercial sale.

For

more information about PetVivo Holdings, Inc. and our revolutionary product, Spryng with OsteoCushion Technology, please contact info1@petvivo.com

or visit https://petvivo.com/ or http://www.sprynghealth.com.

CONTACT:

John

Lai, CEO

PetVivo

Holdings, Inc.

Email:

info1@petvivo.com

(952)

405-6216

About

Upstream

Upstream,

a MERJ Exchange market (https://merj.exchange/), is a global securities trading app. Powered by a proprietary, transparency-first,

matching engine, Upstream allows investors outside of the U.S. to trade securities using just an app. For more information, please visit

https://upstream.exchange/. Upstream is currently accepting applications to dual list at https://upstream.exchange/getlisted.

Disclaimers

U.S.

persons may not deposit, buy, or sell securities on Upstream.

This

communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction

where such offer or solicitation is not permitted. All orders for sale are non-solicited by Upstream and a user’s decision to trade

securities must be based on their own investment judgment.

Upstream

is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National

Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/,

an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and

digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair

and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does

not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations

of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without

aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site

or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for

investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage

companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular

company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to

afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate

obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative

and qualitative listing standards.

Forward-Looking

Statements:

The

foregoing material may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements include all statements that do not

relate solely to historical or current facts, including without limitation the Company’s proposed development and commercial timelines,

and can be identified by the use of words such as “may,” “will,” “expect,” “project,”

“estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,”

“continue” or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees

of future actions or performance. These forward-looking statements are based on information currently available to the Company and its

current plans or expectations and are subject to a number of uncertainties and risks that could significantly affect current plans. Risks

concerning the Company’s business are described in detail in the Company’s Annual Report on Form 10-K for the year ended

March 31, 2023 and other periodic and current reports filed with the Securities and Exchange Commission. The Company is under no obligation

to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information,

future events or otherwise.

v3.24.0.1

Cover

|

Mar. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity File Number |

001-40715

|

| Entity Registrant Name |

PETVIVO

HOLDINGS, INC.

|

| Entity Central Index Key |

0001512922

|

| Entity Tax Identification Number |

99-0363559

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

5251

Edina Industrial Blvd.

|

| Entity Address, City or Town |

Edina

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55439

|

| City Area Code |

(952)

|

| Local Phone Number |

405-6216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.001 |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

PETV

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

PETVW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

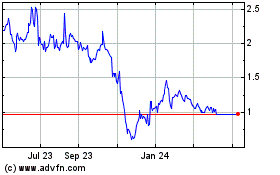

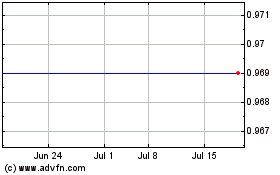

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024