UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

X

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the quarterly period ended

|

April 30, 2009

|

|

|

|

OR

|

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the transition period from

|

|

to

|

|

|

|

|

|

|

Commission file number

|

0-18370

|

|

|

|

|

MFRI, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

36-3922969

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

7720 Lehigh Avenue

|

Niles, Illinois

|

60714

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

(847) 966-1000

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

o

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

|

|

Large accelerated filer

|

[]

|

Accelerated filer

|

x

|

Non-accelerated filer

|

[]

|

Smaller reporting company

|

[]

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act) Yes

o

No

x

|

|

On May 31, 2009, there were 6,818,170 shares of the registrant’s common stock outstanding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I – FINANCIAL INFORMATION

|

|

Item 1.

|

Financial Statements

|

The accompanying interim condensed consolidated financial statements of MFRI, Inc. and subsidiaries (the “Company”) are unaudited, but include all adjustments, which the Company’s management considers necessary to present fairly the financial position and results of operations for the periods presented. These adjustments consist of normal recurring adjustments. Certain information and footnote disclosures have been condensed or omitted pursuant to Securities and Exchange Commission rules and regulations. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s annual report on Form 10-K for the year ended January 31, 2009. The results of operations for the quarter ended April 30, 2009 are not necessarily indicative of the results to be expected for the full year ending January 31, 2010.

MFRI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(In thousands, except per share information)

|

|

|

|

|

|

Three Months Ended

April 30,

|

|

|

|

|

|

|

|

2009

|

|

|

|

2008

|

|

|

Net sales

|

|

|

|

$

|

67,579

|

|

|

$

|

65,981

|

|

|

Cost of sales

|

|

|

|

|

48,852

|

|

|

|

54,838

|

|

|

Gross profit

|

|

|

|

|

18,727

|

|

|

|

11,143

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

|

|

3,099

|

|

|

|

3,726

|

|

|

General and administrative expenses

|

|

|

|

|

8,756

|

|

|

|

6,282

|

|

|

Total operating expenses

|

|

|

|

|

11,855

|

|

|

|

10,008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

|

|

6,872

|

|

|

|

1,135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from joint venture

|

|

|

|

|

0

|

|

|

|

99

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

|

|

688

|

|

|

|

623

|

|

|

Income before income taxes

|

|

|

|

|

6,184

|

|

|

|

611

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

|

|

178

|

|

|

|

188

|

|

|

Net income

|

|

|

|

$

|

6,006

|

|

|

$

|

423

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding – basic

|

|

|

|

|

6,816

|

|

|

|

6,787

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding – diluted

|

|

|

|

|

6,852

|

|

|

|

6,888

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

Net income

|

|

|

|

$

|

0.88

|

|

|

$

|

0.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share:

Net income

|

|

|

|

$

|

0.88

|

|

|

$

|

0.06

|

|

See accompanying notes to condensed consolidated financial statements.

MFRI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

(In thousands)

|

|

|

April 30, 2009

|

|

|

January 31,

2009

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

6,503

|

|

|

$

|

2,735

|

|

|

Restricted cash

|

|

|

|

848

|

|

|

|

220

|

|

|

Trade accounts receivable, less allowance for doubtful accounts of $434 at

April 30, 2009 and $473 at January 31, 2009

|

|

|

|

55,455

|

|

|

|

59,766

|

|

|

Inventories, net

|

|

|

|

46,304

|

|

|

|

52,291

|

|

|

Prepaid expenses and other current assets

|

|

|

|

9,486

|

|

|

|

8,600

|

|

|

Costs and estimated earnings in excess of billings on

uncompleted contracts

|

|

|

|

3,607

|

|

|

|

2,472

|

|

|

Deferred income taxes

|

|

|

|

2,174

|

|

|

|

2,171

|

|

|

Total current assets

|

|

|

|

124,377

|

|

|

|

128,255

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net of accumulated depreciation

|

|

|

|

47,722

|

|

|

|

47,256

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

|

Deferred tax asset

|

|

|

|

4,277

|

|

|

|

2,756

|

|

|

Cash surrender value of officers’ life insurance policies

|

|

|

|

2,600

|

|

|

|

1,677

|

|

|

Deposits

|

|

|

|

666

|

|

|

|

431

|

|

|

Patents, net of accumulated amortization

|

|

|

|

181

|

|

|

|

292

|

|

|

Other assets

|

|

|

|

465

|

|

|

|

481

|

|

|

Total other assets

|

|

|

|

8,189

|

|

|

|

5,637

|

|

|

Total assets

|

|

|

$

|

180,288

|

|

|

$

|

181,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Trade accounts payable

|

|

|

$

|

23,413

|

|

|

$

|

27,232

|

|

|

Current maturities of long-term debt

|

|

|

|

10,106

|

|

|

|

12,793

|

|

|

Customer deposits

|

|

|

|

7,091

|

|

|

|

8,206

|

|

|

Commissions

and management incentive payable

|

|

|

|

6,245

|

|

|

|

10,418

|

|

|

Other accrued liabilities

|

|

|

|

6,223

|

|

|

|

4,947

|

|

|

Billings in excess of costs and estimated earnings

on uncompleted contracts

|

|

|

|

3,686

|

|

|

|

2,586

|

|

|

Accrued compensation and payroll taxes

|

|

|

|

3,634

|

|

|

|

3,601

|

|

|

Income taxes payable

|

|

|

|

1,758

|

|

|

|

488

|

|

|

Total current liabilities

|

|

|

|

62,156

|

|

|

|

70,271

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities

|

|

|

|

42,559

|

|

|

|

42,090

|

|

|

Deferred compensation liability

|

|

|

|

3,407

|

|

|

|

2,502

|

|

|

Other long term liabilities

|

|

|

|

1,911

|

|

|

|

2,107

|

|

|

Total long-term liabilities

|

|

|

|

47,877

|

|

|

|

46,699

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

Common stock, $.01 par value, authorized 50,000 shares; 6,818 issued and outstanding at April 2009 and 6,815 issued and outstanding at January 2009

|

|

|

|

68

|

|

|

|

68

|

|

|

Additional paid-in capital

|

|

|

|

47,158

|

|

|

|

46,922

|

|

|

Retained earnings

|

|

|

|

24,929

|

|

|

|

18,923

|

|

|

Accumulated other comprehensive loss

|

|

|

|

(1,900

|

)

|

|

|

(1,735

|

)

|

|

Total stockholders’ equity

|

|

|

|

70,255

|

|

|

|

64,178

|

|

|

Total liabilities and stockholders’ equity

|

|

|

$

|

180,288

|

|

|

$

|

181,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

MFRI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

(In thousands)

|

|

|

Three Months Ended

April 30,

|

|

|

|

|

|

|

2009

|

|

|

|

2008

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

$

|

6,006

|

|

|

$

|

423

|

|

|

Adjustments to reconcile net income to net cash flows from operating

activities:

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

|

1,739

|

|

|

|

1,211

|

|

|

Deferred income taxes

|

|

|

|

(1,470

|

)

|

|

|

(213

|

)

|

|

Cash surrender value of deferred compensation plan

|

|

|

|

(922

|

)

|

|

|

(342

|

)

|

|

Stock-based compensation expense

|

|

|

|

226

|

|

|

|

167

|

|

|

Income from joint venture

|

|

|

|

0

|

|

|

|

(99

|

)

|

|

Provision for uncollectible accounts

|

|

|

|

(58

|

)

|

|

|

1

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

|

6,307

|

|

|

|

(6,434

|

)

|

|

Accounts receivable

|

|

|

|

4,486

|

|

|

|

(6,882

|

)

|

|

Accrued compensation and payroll taxes

|

|

|

|

(4,167

|

)

|

|

|

(700

|

)

|

|

Other assets and liabilities

|

|

|

|

1,782

|

|

|

|

(408

|

)

|

|

Prepaid expenses and other current assets

|

|

|

|

(1,590

|

)

|

|

|

(2,934

|

)

|

|

Income taxes receivable

|

|

|

|

1,315

|

|

|

|

608

|

|

|

Customers’ deposits

|

|

|

|

(1,052

|

)

|

|

|

3,142

|

|

|

Current liabilities

|

|

|

|

(341

|

)

|

|

|

9,627

|

|

|

Net cash provided by (used in) operating activities

|

|

|

|

12,261

|

|

|

|

(2,833

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

|

|

(1,955

|

)

|

|

|

(7,334

|

)

|

|

Net cash used in investing activities

|

|

|

|

(1,955

|

)

|

|

|

(7,334

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

|

Repayment of debt

|

|

|

|

(58,287

|

)

|

|

|

(10,435

|

)

|

|

Borrowings under revolving, term and mortgage loans

|

|

|

|

55,880

|

|

|

|

21,633

|

|

|

Net (repayment) borrowings

|

|

|

|

(2,407

|

)

|

|

|

11,198

|

|

|

Decrease in drafts payable

|

|

|

|

(3,601

|

)

|

|

|

(1,830

|

)

|

|

Payments on capitalized lease obligations

|

|

|

|

(43

|

)

|

|

|

(43

|

)

|

|

Stock options exercised

|

|

|

|

7

|

|

|

|

1

|

|

|

Tax benefit of stock options exercised

|

|

|

|

3

|

|

|

|

167

|

|

|

Net cash (used in) provided by financing activities

|

|

|

|

(6,041

|

)

|

|

|

9,493

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

|

(497

|

)

|

|

|

(28

|

)

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

|

3,768

|

|

|

|

(702

|

)

|

|

Cash and cash equivalents – beginning of period

|

|

|

|

2,735

|

|

|

|

2,665

|

|

|

Cash and cash equivalents – end of period

|

|

|

$

|

6,503

|

|

|

$

|

1,963

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information:

|

|

|

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

|

|

|

Interest, net of capitalized amounts

|

|

|

$

|

681

|

|

|

$

|

590

|

|

|

Income taxes paid

|

|

|

|

116

|

|

|

|

1

|

|

See accompanying notes to condensed consolidated financial statements.

MFRI, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

APRIL 30, 2009

(Tabular in thousands, except per share amounts)

|

1.

|

Basis of presentation:

The unaudited financial statements herein have been prepared by the Company in accordance with generally accepted accounting principles and pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, footnote disclosures which would substantially duplicate the disclosures contained in the January 31, 2009 audited financial statements have been omitted from these interim financial statements. Interim financial statements should be read in conjunction with the financial statements and the notes thereto

included in the Company’s latest Annual Report on Form 10-K. The Company’s maintains a website

www.mfri.com

.

These reports and related materials are available free of charge as soon as reasonably practicable after the Company electronically delivers such material to the SEC.

|

|

2.

|

Business Segment Reporting:

The Company has three reportable segments under the criteria of SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information.” The piping systems business engineers, designs, manufactures and sells specialty piping systems and leak detection and location systems. The filtration products business manufactures and sells a wide variety of filter elements for air filtration and particulate collection systems. The industrial process cooling equipment business engineers, designs, manufactures and sells

chillers, cooling towers, plant circulating systems and accessories for industrial process applications. Included in corporate and other activity is a subsidiary, which engages in the installation of heating, ventilation and air conditioning (“HVAC”) systems, but which is not sufficiently large to constitute a reportable segment.

|

|

|

|

Three Months Ended

April 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

Net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Piping Systems

|

$

|

32,627

|

|

|

$

|

30,677

|

|

|

|

|

|

|

|

|

|

|

Filtration Products

|

|

23,305

|

|

|

|

25,817

|

|

|

|

|

|

|

|

|

|

|

Industrial Process Cooling Equipment

|

|

5,053

|

|

|

|

9,067

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other

|

|

6,594

|

|

|

|

420

|

|

|

|

|

|

|

|

|

|

|

Total net sales

|

$

|

67,579

|

|

|

$

|

65,981

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Piping Systems

|

$

|

14,148

|

|

|

$

|

5,460

|

|

|

|

|

|

|

|

|

|

|

Filtration Products

|

|

2,646

|

|

|

|

3,269

|

|

|

|

|

|

|

|

|

|

|

Industrial Process Cooling Equipment

|

|

1,051

|

|

|

|

2,392

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other

|

|

882

|

|

|

|

22

|

|

|

|

|

|

|

|

|

|

|

Total gross profit

|

$

|

18,727

|

|

|

$

|

11,143

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Piping Systems

|

$

|

9,952

|

|

|

$

|

2,932

|

|

|

|

|

|

|

|

|

|

|

Filtration Products

|

|

(285

|

)

|

|

|

253

|

|

|

|

|

|

|

|

|

|

|

Industrial Process Cooling Equipment

|

|

(495

|

)

|

|

|

(40

|

)

|

|

|

|

|

|

|

|

|

|

Corporate and Other

|

|

(2,300

|

)

|

|

|

(2,010

|

)

|

|

|

|

|

|

|

|

|

|

Income from operations

|

$

|

6,872

|

|

|

$

|

1,135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Piping Systems

|

$

|

9,952

|

|

|

$

|

3,031

|

|

|

|

|

|

|

|

|

|

|

Filtration Products

|

|

(285

|

)

|

|

|

253

|

|

|

|

|

|

|

|

|

|

|

Industrial Process Cooling Equipment

|

|

(495

|

)

|

|

|

(40

|

)

|

|

|

|

|

|

|

|

|

|

Corporate and Other

|

|

(2,988

|

)

|

|

|

(2,633

|

)

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

$

|

6,184

|

|

|

$

|

611

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.

|

Inventories consisted of the following:

|

|

|

|

|

April 30,

2009

|

|

|

January 31,

2009

|

|

|

Raw materials

|

|

|

$

|

35,760

|

|

|

$

|

41,514

|

|

|

Work in progress

|

|

|

|

6,553

|

|

|

|

5,398

|

|

|

Finished goods

|

|

|

|

5,240

|

|

|

|

6,880

|

|

|

Sub total

|

|

|

|

47,553

|

|

|

|

53,792

|

|

|

Less: Inventory allowance

|

|

|

|

1,249

|

|

|

|

1,501

|

|

|

Inventory, net

|

|

|

$

|

46,304

|

|

|

$

|

52,291

|

|

|

4.

|

Other intangible assets with definite lives:

Patents are capitalized and amortized on a straight-line basis over a period not to exceed the legal lives of the patents. Patents were $2,499,000 at April 30, 2009 and $2,494,000 at January 31, 2009. Accumulated amortization was $2,318,000 and $2,202,000 at April 30, 2009 and January 31, 2009, respectively. Future amortization over the next five years ending January 31 will be $35,000 in the balance of 2010, $28,000 in 2011, $28,000 in 2012, $28,000 in 2013, $28,000 in 2014 and $34,000 thereafter.

|

|

5.

|

Pension Plan for Hourly-Rated Employees of Midwesco Filter Resources, Inc., Winchester, Virginia

: The market-related value of plan assets at April 30, 2009 and January 31, 2009 was $3,486,372 and $3,047,730, respectively. Net cost recognized was as follows:

|

|

|

|

|

Three Months Ended

April 30,

|

|

|

Components of net periodic benefit cost:

|

|

|

|

2009

|

|

|

|

2008

|

|

|

Service cost

|

|

|

$

|

29

|

|

|

$

|

31

|

|

|

Interest cost

|

|

|

|

65

|

|

|

|

59

|

|

|

Expected return on plan assets

|

|

|

|

(61

|

)

|

|

|

(77

|

)

|

|

Amortization of prior service cost

|

|

|

|

27

|

|

|

|

27

|

|

|

Recognized actuarial loss

|

|

|

|

25

|

|

|

|

7

|

|

|

Net periodic benefit cost

|

|

|

$

|

85

|

|

|

$

|

47

|

|

Employer contributions remaining for fiscal year ending January 31, 2010 are expected to be $261,520. For the three months ended April 30, 2009, $309,133 of contributions was made.

|

6.

|

Equity-based

compensation:

At April 30, 2009, the Company has equity-based compensation plans from which stock-based compensation awards can be granted to eligible employees, officers or directors.

|

The Company granted options to purchase 20,000 shares of common stock to two new directors during the three-month period ended April 30, 2009, in accordance with the provisions of the 2001 Independent Directors’ Stock Option Plan.

Stock-based compensation expense was as follows:

|

|

|

2009

|

|

|

2008

|

|

Three-month period ended April 30

|

$

|

226

|

|

$

|

167

|

The fair values of the option awards granted prior to, but not vested as of, April 30, 2009 and 2008 respectively, were estimated on the grant dates using the Black-Scholes option pricing model and the assumptions shown in the following table:

|

|

Three Months Ended

April 30, 2009

|

|

|

Three Months Ended

April 30, 2008

|

|

Expected volatility

|

|

51.72%-66.82%

|

|

|

|

46.81%-62.43%

|

|

Risk-free interest rate

|

|

1.88%-5.16%

|

|

|

|

2.80%-5.16%

|

|

Dividend yield

|

|

0%

|

|

|

|

0%

|

|

Expected life

|

|

5 - 7 years

|

|

|

|

5 - 7 years

|

Stock option activity for the three months ended April 30, 2009 was as follows:

|

|

Number of Options

|

|

Weighted-Average Exercise Price

|

|

Weighted-Average Remaining Contractual Term

|

|

Aggregate Intrinsic Value

|

|

Outstanding on January 31, 2009

|

550

|

$

|

14.85

|

|

|

$

|

260

|

|

Granted

|

20

|

|

6.19

|

|

|

|

|

|

Exercised

|

(3

|

)

|

2.16

|

|

|

|

10

|

|

Expired or forfeited

|

(12

|

)

|

20.17

|

|

|

|

|

|

Outstanding on April 30, 2009

|

555

|

$

|

14.49

|

|

7.1 years

|

$

|

273

|

|

|

|

|

|

|

|

|

|

|

Exercisable on April 30, 2009

|

248

|

$

|

8.86

|

|

5.2 years

|

$

|

273

|

|

Weighted-average fair value of options granted during first three months of 2009

|

|

$

|

3.64

|

|

|

|

|

The weighted-average exercise price per nonvested stock award at grant date was $6.19 per share for the nonvested stock awards granted in 2009. Nonvested stock award activity for the three months ended April 30, 2009 was as follows:

|

|

Nonvested Stock Outstanding

|

|

|

Weighted-Average Price

|

|

Outstanding on January 31, 2009

|

296

|

|

|

$ 19.95

|

|

Granted

|

20

|

|

|

6.19

|

|

Released

|

(1

|

)

|

|

16.12

|

|

Expired or forfeited

|

(9

|

)

|

|

19.92

|

|

Outstanding on April 30, 2009

|

306

|

|

|

|

$ 19.06

|

As of April 30, 2009, there was $2,181,000 of total unrecognized compensation cost related to nonvested stock-based compensation arrangements granted under the equity-based compensation plans. That cost is expected to be recognized over a period of 2.4 years.

|

7.

|

The basic weighted-average shares reconciled to diluted weighted average shares as follows:

|

|

|

Three Months Ended

April 30,

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

Net income

|

$

|

6,006

|

|

|

$

|

423

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average number of common shares outstanding

|

|

6,816

|

|

|

|

6,787

|

|

|

|

|

|

|

|

|

|

|

Dilutive effect of stock options

|

|

36

|

|

|

|

101

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding assuming full dilution

|

|

6,852

|

|

|

|

6,888

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share net income

|

$

|

0.88

|

|

|

$

|

0.06

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share net income

|

$

|

0.88

|

|

|

$

|

0.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options not included in the computation of diluted earnings per share of common stock because the option exercise prices exceeded the average market prices of the common shares

|

|

438

|

|

|

|

142

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options with an exercise price below the average market price

|

|

116

|

|

|

|

287

|

|

|

|

|

|

|

|

|

|

|

8.

|

The components of comprehensive (loss) income, net of tax, were as follows:

|

|

|

Three Months Ended

April 30,

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

Net income

|

$

|

6,006

|

|

|

$

|

423

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

(165

|

)

|

|

|

555

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income

|

$

|

5,841

|

|

|

$

|

978

|

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive loss presented on the accompanying condensed consolidated balance sheets consisted of the following:

|

|

April 30,

2009

|

|

|

January 31,

2009

|

|

|

Foreign currency translation adjustments

|

$

|

(678

|

)

|

|

$

|

(513

|

)

|

|

Pension adjustment (net of cumulative tax benefit of $749)

|

|

(1,222

|

)

|

|

|

(1,222

|

)

|

|

Accumulated other comprehensive loss

|

$

|

(1,900

|

)

|

|

$

|

(1,735

|

)

|

|

|

|

|

|

|

|

|

|

|

|

9.

|

New accounting pronouncements

: In June 2009, the Financial Accounting Standards Board (“FASB”) issued “Subsequent Events” (“SFAS 165”). SFAS 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. The effective date of SFAS 165 is interim or annual financial periods ending after June 15, 2009. The Company does not expect the adoption of SFAS 165 to have a material effect on its consolidated

financial statements.

|

In April 2008, FASB issued Staff Position SFAS 142-3 (“FSP”), “Determination of the Useful Life of Intangible Assets,” to provide guidance for determining the useful life of recognized intangible assets and to improve consistency between the period of expected cash flows used to measure the fair value of a recognized intangible asset and the useful life of the intangible asset as determined under FASB Statement 142, “Goodwill and Other Intangible Assets”(SFAS 142”). FSP requires that an entity consider its own historical experience in renewing or extending similar arrangements. However, the entity must adjust that experience based on entity-specific factors included in SFAS 142. If the company lacks historical experience to consider for similar arrangements, it would consider assumptions that market participants would use about renewal or extension, as

adjusted for the entity-specific factors under SFAS 142. The Company adopted FSP as of the required effective date of February 1, 2009. The Company expenses costs incurred to renew or extend the term of intangible assets. The Company does not assume the ability to renew any existing intangibles. Adoption of FSP SFAS 142-3 did not have a significant effect on the Company’s financial statements.

In April 2009, the FASB issued Staff Position SFAS 107-b and APB 28-a. SFAS 107-a amends SFAS 107, “Disclosures About Fair Value of Financial Instruments”, and FSP APB 28-a amends APBO 28, “Interim Financial Reporting”, to require fair value disclosures for interim financial statements. These will be effective for interim periods ending after June 15, 2009. The Company does not expect the adoption of SFAS 107-b to have a material effect on its consolidated financial statements.

In December 2008, the FASB issued “Employers’ Disclosures about Postretirement Benefit Plan Assets” (“FSP 132(R)-1”). FSP 132(R)-1 requires additional disclosures for plan assets of defined benefit pension or other postretirement plans. The required disclosures include a description of the investment policies and strategies, the fair value of each major category of plan assets, the inputs and valuation techniques used to measure the fair value of plan assets, the effect of fair value measurements using significant unobservable inputs on changes in plan assets, and the significant concentrations of risk within plan assets. FSP 132(R)-1 does not change the accounting treatment for postretirement benefit plans. FSP 132(R)-1 is effective for the Company January 31, 2010 and does not require disclosures on an interim basis.

In May 2008, the FASB issued “The Hierarchy of Generally Accepted Accounting Principles” (“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for selecting the principles used in the preparation of financial statements that are presented in conformity with generally accepted accounting principles. SFAS 162 becomes effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles”. The Company does not expect the adoption of SFAS 162 to have a material effect on its consolidated financial statements.

Other accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

|

10.

|

Debt:

On July 11, 2002, the Company entered into a secured loan and security agreement with a financial institution ("Loan Agreement"). The Loan Agreement was amended and restated on December 15, 2006. Under the terms of the Loan Agreement, which matures on November 13, 2010, the Company can borrow up to $38,000,000, subject to borrowing base and other requirements, under a revolving line of credit. The Loan Agreement covenants restrict debt, liens, and investments, do not permit payment of dividends, and require attainment of certain levels of profitability

and cash flows. At April 30, 2009 and January 31, 2009, the Company was in compliance with covenants under the Loan Agreement as defined below. Interest rates generally are based on options selected by the Company as follows: (a) a margin in effect plus a prime rate; or (b) a margin in effect plus the LIBOR rate for the corresponding interest period. At April 30, 2009, the prime rate was 3.25%, and the margins added to the prime rate and the LIBOR rate, which are determined each quarter based on the applicable financial statement ratio, were 0.25 and 1.75 percentage points, respectively. Monthly interest payments were made. As of April 30, 2009, the Company had borrowed $24,172,000 and had $4,019,000 available to it under the revolving line of credit. In addition, $425,000 of availability was used under the Loan Agreement primarily to support letters of credit to guarantee amounts committed for inventory purchases. The Loan Agreement provides that all payments by the Company's

customers are deposited in a bank account from which all funds may only be used to pay the debt under the Loan Agreement. At April 30, 2009, the amount of restricted cash was $848,000. Cash required for operations is provided by draw-downs on the line of credit.

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The statements contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and certain other information contained elsewhere in this report, which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “continue,” “remains,” “intend,” “aim,” “should,” “prospects,” “could,” “future,” “potential,” “believes,” “plans,” “likely,” and “probable,” or the negative thereof or other variations thereon or comparable terminology, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors

created thereby. These statements should be considered as subject to the many risks and uncertainties that exist in the Company’s operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to, competition, international rapid growth, changes in government policies and laws, worldwide economic conditions, government regulation, economic factors, consumer access to capital funds, backlog, financing, internal control, market demand and pricing, , global interest rates, currency exchange rates, labor relations and other risk factors.

RESULTS OF OPERATIONS

Consolidated MFRI, Inc.

MFRI, Inc. ("MFRI", the "Company" or the "Registrant") is engaged in the manufacture and sale of products in three reportable business segments: piping systems, filtration products, and industrial process cooling equipment. The Company website address is

www.mfri.com

.

This discussion should be read in conjunction with the condensed consolidated financial statements, including the notes thereto. An overview of the segment results is provided in Note 2 of the Notes to Condensed Consolidated Financial Statements (Unaudited) contained in Item 1 of this report.

Three months ended April 30, 2009 (“current quarter”) vs. Three months ended April 30, 2008 (“prior-year quarter”)

Record first quarter net sales of $67,579,000 increased 2.4% from $65,981,000 for the prior-year quarter. (See discussion of each business segment below.)

Gross profit of $18,727,000 increased 68.1% from $11,143,000 in the prior-year quarter, and increased to 27.7% of sales in the current quarter from 16.9% of sales in the prior-year quarter. Gross profit in the piping systems business rose to $14,148,000 for the current quarter from $5,460,000 in the prior-year quarter. As of April 30, 2009, the Company had successfully completed over 95% of the production on the India pipeline project. The Company would not expect a project similar to the one in India to be replaced in the 2009 backlog. (See discussion of each business segment below.)

Selling expenses decreased 16.8% to $3,099,000 for the current quarter from $3,726,000 in the prior-year quarter. This was primarily driven by the Industrial Process Cooling Equipment business, which had decreased commission expense from lower sales and a decline in compensation and related expenses due to staff reductions. (See discussion of each business segment below.)

General and administrative expenses increased 39.4% to $8,756,000 for the current quarter from $6,282,000 in the prior-year quarter. The increase was mainly due to increased profit-based management incentive expense. (See discussion of each business segment below.)

Net income rose to a record of $6,006,000 in the current quarter from $423,000 in the prior-year quarter primarily due to increased sales, the reasons summarized above and discussed in more detail below.

Piping Systems Business

Net sales increased 6.4% to $32,627,000 in the current quarter from $30,677,000 in the prior-year quarter, attributed primarily to achieving market traction in the United Arab Emirates (“U.A.E.”) and the Gulf Cooperation Council countries. The insulation of pipe for a crude oil pipeline project in India began full production in the third quarter 2008 and contributed to the increase. As of April 30, 2009, the Company had successfully completed over 95% of the production on the India pipeline project. The Company would not expect a project similar to the one in India to be replaced in the backlog in 2009.

Gross profit increased to 43.4% of sales in the current quarter from 17.8% of sales in the prior-year quarter due to production efficiencies in both the domestic and international operations. Gross profit in the U.A.E. improved with the increased volume without corresponding increases in fixed expenses, and from the India pipeline project that began full production in the summer of 2008.

Selling expenses increased to $637,000 in the current quarter from $602,000 for the prior-year quarter. Selling expense as a percentage of sales remained the same at 2.0%. This dollar increase was mainly due to increased commission expense related to higher sales.

General and administrative expenses increased to $3,560,000 or 10.9% of net sales in the current quarter from $1,926,000 or 6.3% of net sales for the prior-year quarter. The increase in general and administrative expenses was primarily due to the increased profit-based management incentive expense, administrative costs at the India facility, and increased staffing in the U.A.E.

Filtration Products Business

Net sales for the current quarter decreased 9.7% to $23,305,000 from $25,817,000 in the prior-year quarter. Sales declines were the result of both lower market demand and increased competition in cartridge filter products.

Gross profit decreased to 11.4% of sales in the current quarter from 12.7% of sales in the prior-year quarter primarily due to the highly competitive marketplace and increased cost of raw materials.

Selling expenses decreased to $1,766,000 in the current quarter from $1,966,000 for the comparable quarter last year. Selling expense as a percentage of sales remained constant at 7.6%. The dollar decrease was primarily due to fewer selling personnel.

General and administrative expenses increased to $1,165,000 or 5.0% of net sales in the current quarter from $1,050,000 or 4.1% of net sales in the prior-year quarter.

Industrial Process Cooling Equipment Business

Net sales of $5,053,000 for the current quarter decreased 44.3% from $9,067,000 for prior-year quarter due to lower demand for products in all market sectors, both domestic and international.

Gross profit decreased to 20.8% of sales from 26.4% of sales in the prior-year quarter primarily due to lower sales volume with which to spread fixed overhead expenses, and to a lesser extent, product mix.

Selling expenses decreased to $696,000 or 13.8% of net sales in the current quarter from $1,157,000 or 12.8% of net sales in the prior-year quarter. This was primarily driven by decreased commission expense from lower sales, and a decline in compensation and related expenses due to workforce reductions.

General and administrative expenses decreased in the current quarter to $849,000 or 16.8% of net sales from $1,275,000 or 14.1% of net sales in the prior-year quarter. The change in spending was a result of reduced outside product development services incurred in the current period, and lower compensation and related expenses due to workforce reductions.

General Corporate and Other

Included in corporate and other activity is a subsidiary, which engages in the sales and installation of HVAC systems, but which was not sufficiently large to constitute a reportable segment. Net sales of $6,594,000 for the current quarter increased from $420,000 in the prior-year quarter. The sales were related to various construction projects that were just starting in the first quarter 2008 and were very active in the first quarter 2009. Due to current customer financing constraints, there are currently very few opportunities to obtain new HVAC business at this time.

General and administrative expenses increased to $3,182,000 in the current quarter from $2,033,000 in the prior-year quarter, and increased as a percentage of total company net sales to 4.7% in the current quarter from 3.1% in the prior-year quarter. The increase was due mainly to increased profit-based management incentive expense, hiring of the Vice President of Human Resources and additional stock compensation expense.

Interest expense increased to $688,000 for the current quarter from $623,000 in the prior-year quarter primarily due to increased borrowings.

Income Taxes

Taxes on earnings are based on estimated annual effective rates. The 2.9% effective tax rate at April 30, 2009 was less than the statutory U.S. federal income tax rate, mainly due to the impact of income earned in the U.A.E. which was not subject to any local country tax. During the current quarter, the Company re-evaluated the need for a valuation allowance against deferred tax assets. It was determined that a partial valuation allowance of $844,000 was required, as the Company no longer believes that it is more likely than not, that the research and development credits will be utilized before January 2014.

LIQUIDITY AND CAPITAL RESOURCES

Cash and cash equivalents as of April 30, 2009 were $6,503,000 as compared to $2,735,000 at January 31, 2009. The Company’s working capital was $62,221,000 at April 30, 2009 compared to $57,984,000 at January 31, 2009. The Company provided $12,261,000 from operations during the first three months of 2009. Compared to January 31, 2009, inventories decreased by $6,307,000 mainly in the filtration products business for orders in production at January 31, 2009 and shipped in the first quarter, and trade receivables decreased by $4,486,000 mainly in the piping systems business.

Net cash used in investing activities for the three months ended April 30, 2009 consisted of $1,955,000 for capital expenditures mainly in the piping systems business. Purchases were primarily for machinery and equipment.

Debt totaled $52,665,000, a decrease of $2,218,000 since the beginning of the current fiscal year. Net cash provided by financing activities was $6,041,000. Stock option activity resulted in $10,000 of cash inflow, which included $3,000 tax benefit of stock options exercised in addition to stock option proceeds of $7,000.

On July 11, 2002, the Company entered into a secured loan and security agreement with a financial institution ("Loan Agreement"). The Loan Agreement was amended and restated on December 15, 2006. Under the terms of the Loan Agreement, which matures on November 13, 2010, the Company can borrow up to $38,000,000, subject to borrowing base and other requirements, under a revolving line of credit. The Loan Agreement covenants restrict debt, liens, and investments, do not permit payment of dividends, and require attainment of certain levels of profitability and cash flows. At April 30, 2009 and January 31, 2009, the Company was in compliance with covenants under the Loan Agreement as defined below. Interest rates generally are based on options selected by the Company as follows: (a) a margin in effect plus a prime rate; or (b) a margin in effect plus the LIBOR rate for the corresponding interest period. At

April 30, 2009, the prime rate was 3.25%, and the margins added to the prime rate and the LIBOR rate, which are determined each quarter based on the applicable financial statement ratio, were 0.25 and 1.75 percentage points, respectively. Monthly interest payments were made. As of April 30, 2009, the Company had borrowed $24,172,000 and had $4,019,000 available to it under the revolving line of credit. In addition, $425,000 of availability was used under the Loan Agreement primarily to support letters of credit to guarantee amounts committed for inventory purchases. The Loan Agreement provides that all payments by the Company's customers are deposited in a bank account from which all funds may only be used to pay the debt under the Loan Agreement. At April 30, 2009, the amount of restricted cash was $848,000. Cash required for operations is provided by draw-downs on the line of credit.

CRITICAL ACCOUNTING ESTIMATES AND POLICIES

Revenue Recognition:

The Company recognizes revenues including shipping and handling charges billed to customers, when all the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the seller’s price to the buyer is fixed or determinable, and (iii) collectability is reasonably assured. All subsidiaries of the Company, except as noted below, recognize revenues upon shipment or delivery of goods or services when title and risk of loss pass to customers.

Percentage of completion revenue recognition:

All divisions recognize revenues under the above stated revenue recognition policy except for sizable complex contracts that require periodic recognition of income. For these contracts, the Company uses "percentage of completion" accounting method. Under this approach, income

is recognized in each reporting period based on the status of the uncompleted contracts and the current estimates of costs to complete. The choice of accounting method is made at the time the contract is received based on the expected length and complexity of the project. The percentage of completion is determined by the relationship of costs incurred to the total estimated costs of the contract. Provisions are made for estimated losses on uncompleted contracts in the period in which such losses are determined. Changes in job performance, job conditions, and estimated profitability, including those arising from contract penalty provisions and final contract settlements, may result in revisions to costs and income. Such revisions are recognized in the period in which they are determined. Claims for additional compensation due the Company are recognized in contract revenues when realization is probable and

the amount can be reliably estimated.

Inventories:

Inventories are stated at the lower of cost or market. Cost is determined using the first-in, first-out method for substantially all inventories.

Stock options:

Stock

compensation expense for employee equity awards are recognized ratably over the requisite service period of the award. The Black-Scholes option-pricing model is utilized to estimate the fair value of awards. Determining the fair value of stock options using the Black-Scholes model requires judgment, including estimates for (1) risk-free interest rate – an estimate based on the yield of zero–coupon treasury securities with a maturity equal to the expected life of the option; (2) expected volatility – an estimate based on the historical volatility of the Company’s Common Stock; and (3) expected life of the option – an estimate based on historical experience including the effect of employee terminations. If any of these assumptions differ significantly from actual, stock-based

compensation expense could be impacted.

Income tax provision:

Deferred income taxes have been provided for temporary differences arising from differences in basis of assets and liabilities for tax and financial reporting purposes. Deferred income taxes on temporary differences have been recorded at the current tax rate. The Company assesses deferred tax assets for realizability at each reporting period.

New accounting pronouncements:

In June 2009, the Financial Accounting Standards Board (“FASB”) issued “Subsequent Events” (“SFAS 165”). SFAS 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. The effective date of SFAS 165 is interim or annual financial periods ending after June 15, 2009. The Company does not expect the adoption of SFAS 165 to have a material effect on its consolidated financial statements.

In April 2008, FASB issued Staff Position FAS 142-3 (“FSP”), “Determination of the Useful Life of Intangible Assets,” to provide guidance for determining the useful life of recognized intangible assets and to improve consistency between the period of expected cash flows used to measure the fair value of a recognized intangible asset and the useful life of the intangible asset as determined under FASB Statement 142, Goodwill and Other Intangible Assets (“SFAS 142”). The FSP requires that an entity consider its own historical experience in renewing or extending similar arrangements. However, the entity must adjust that experience based on entity-specific factors included in SFAS 142. If the company lacks historical experience to consider for similar arrangements, it would consider assumptions that market participants would use about renewal or extension, as adjusted for the

entity-specific factors under SFAS 142. The Company adopted FSP FAS 142-3 as of the required effective date of February 1, 2009. The Company expenses costs incurred to renew or extend the term of intangible

assets. The Company does not assume the ability to renew any existing intangibles. Adoption of FSP FAS 142-3 did not have a significant effect on the Company’s financial statements.

In April 2009, the FASB issued Staff Position SFAS 107-b and APB 28-a. FSP FAS 107-a amends SFAS 107, “Disclosures About Fair Value of Financial Instruments”, and FSP APB 28-a amends APBO 28, “Interim Financial Reporting”, to require fair value disclosures for interim financial statements. These will be effective for interim periods ending after June 15, 2009. The Company does not expect the adoption of SFAS 107-b to have a material effect on its consolidated financial statements.

In December 2008, the FASB issued “Employers’ Disclosures about Postretirement Benefit Plan Assets” (“FSP 132(R)-1”). FSP 132(R)-1 requires additional disclosures for plan assets of defined benefit pension or other

postretirement plans. The required disclosures include a description of the investment policies and strategies, the fair value of each major category of plan assets, the inputs and valuation techniques used to measure the fair value of plan assets, the effect of fair value measurements using significant unobservable inputs on changes in plan assets, and the significant concentrations of risk within plan assets. FSP 132(R)-1 does not change the accounting treatment for postretirement benefit plans. FSP 132(R)-1 is effective for the Company January 31, 2010 and does not require disclosures on an interim basis.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for selecting the principles used in the preparation of financial statements that are presented in conformity with generally accepted accounting principles. SFAS 162 becomes effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles”. The Company does not expect the adoption of SFAS 162 to have a material effect on its consolidated financial statements.

Other accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

The Company is subject to market risk associated with changes in foreign currency exchange rates, interest rates and commodity prices. Foreign currency exchange rate risk is mitigated through maintenance of local production facilities in the markets served, often, though not always, invoicing customers in the same currency as the source of the products and use of foreign currency-denominated debt in Denmark, U.A.E., India and South Africa. At times, the Company has attempted to mitigate interest rate risk by maintaining a balance of fixed-rate long-term debt and floating-rate debt.

A hypothetical ten percent change in market interest rates over the next year would increase or decrease interest expense on the Company's floating rate debt instruments by approximately $69,000.

Commodity price risk is the possibility of higher or lower costs due to changes in the prices of commodities, such as ferrous alloys which the Company uses in the production of piping systems. The Company attempts to mitigate such risks by obtaining price commitments from commodity suppliers and, when it appears appropriate, purchasing quantities in advance of likely price increases.

|

|

Item 4.

|

Controls and Procedures

|

The Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended) as of April 30, 2009. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of April 30, 2009 to ensure that information required to be disclosed in the reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms and is accumulated and communicated to the issuer’s management, including our principal executive and financial officers, to allow timely decisions regarding required disclosure.

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Under the supervision and with the participation of management, including the Chief Executive Officer and Chief Financial Officer, an evaluation of the effectiveness of internal control over financial reporting based on the framework in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission was conducted. Based on that evaluation, management concluded that internal control over financial reporting was effective as of April 30, 2009.

There has been no change in internal control over financial reporting during the quarter ended April 30, 2009 that has materially affected or is reasonably likely to materially affect, internal control over financial reporting.

PART II – OTHER INFORMATION

|

|

31

|

Rule 13a – 14(a)/15d – 14(a) Certifications

|

|

|

(1)

|

Chief Executive Officer certification pursuant to Section 302 of the Sarbanes-

|

|

|

(2)

|

Chief Financial Officer certification pursuant to Section 302 of the Sarbanes-

|

|

|

32

|

Section 1350 Certifications

|

(Chief Executive Officer and Chief Financial Officer certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

MFRI, INC.

|

Date:

|

June 8, 2009

|

/s/ David Unger

|

|

|

|

David Unger

|

|

|

|

Chairman of the Board of Directors, and

|

|

|

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

Date:

|

June 8, 2009

|

/s/ Michael D. Bennett

|

|

|

|

Michael D. Bennett

|

|

|

|

Vice President, Secretary and Treasurer

|

|

|

|

(Principal Financial and Accounting Officer)

|

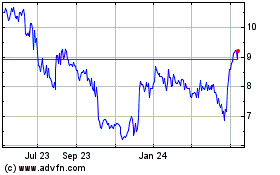

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jul 2023 to Jul 2024