Fourth graph, second sentence of release should read: Including

the goodwill impairment charge, the fourth quarter of 2008 net loss

was $827,000, or $0.12 earnings per share basic and diluted, versus

a net loss of $3,762,000 in the prior-year�s fourth quarter, or

$0.56 per share basic and diluted. (sted Excluding the goodwill

impairment charge, the fourth quarter of 2008 had a net loss of

$827,000, or $0.12 earnings per share basic and diluted, versus a

net loss of $3,762,000 in the prior-year�s fourth quarter, or $0.56

per share basic and diluted.).

The corrected release reads:

MFRI ANNOUNCES RECORD 2008 SALES,

EARNINGS AND EARNINGS PER SHARE DESPITE FOURTH QUARTER NON-CASH

GOODWILL CHARGE

MFRI, Inc. (Nasdaq:MFRI) announced today record sales for the

fiscal year ended January 31, 2009 (�2008�). Net sales were

$303,066,000, up 26.5% from $239,487,000 in the prior year. Net

income in 2008 rose to $6,689,000 or $0.98 earnings per share basic

and diluted, versus a net loss of $298,000 for 2007, or $0.04 per

share basic and diluted. The 2008 net income was reduced by a

fourth quarter non-cash goodwill impairment charge of $2,788,000.

This charge net of tax impact reduced earnings per share by $0.27

basic and diluted. Net income for 2008 without the goodwill

impairment charge would have been $8,529,000, or $1.25 earnings per

share basic and $1.24 diluted.

Gross margin for 2008 increased to 19.5% from 17.2% in 2007. Net

sales increased primarily due to a higher starting backlog, the

growing success of the piping systems business in the United Arab

Emirates, progress on the crude oil pipeline project in India and

the start of field work on buildings in the heating, ventilation

and air conditioning (�HVAC�) backlog. Due to the increased net

sales and gross margin, 2008 gross profit of $58,948,000 was 42.9%

higher than 2007 gross profit of $41,249,000.

Net sales in 2008 for the piping systems business increased by

45.6%, the filtration products business increased by 8.5%, while

the industrial process cooling equipment business decreased by

12.6%. The HVAC business, included in corporate and other, grew

over 700 % as work ramped up on projects. In the fourth quarter

2008, the Company recognized a non-cash goodwill impairment charge

of $2,788,000, or net of tax impact at $0.27 earnings per share

basic, which was recorded in continuing operations. The goodwill

impairment charge eliminated all remaining Company goodwill and was

related to the Company�s filtration products and industrial process

cooling equipment businesses.

Net sales for the fourth quarter of 2008 were $82,623,000, or

41.2% greater than the $58,503,000 for the prior-year�s quarter.

Including the goodwill impairment charge, the fourth quarter of

2008 net loss was $827,000, or $0.12 earnings per share basic and

diluted, versus a net loss of $3,762,000 in the prior-year�s fourth

quarter, or $0.56 per share basic and diluted. Net income for the

fourth quarter of 2008 without the goodwill impairment charge net

of tax impact would have been $1,013,000, or $0.15 per share

basic.

Net sales for the fourth quarter of 2008 compared to the

prior-year�s fourth quarter increased by 73.7% in the piping

systems business, increased by 6.5% in the filtration products

business and decreased by 23.6% in the industrial process cooling

business. The HVAC business, included in corporate and other,

increased eleven fold as field work progressed steadily during the

2008 quarter compared to the 2007 quarter.

As previously announced, the piping systems business is

performing the insulating and jacketing services for a 600

kilometer (370 mile), 600 millimeter (24 inch) diameter heat-traced

crude oil pipeline. This work is being performed at a facility in

Mundra, India on the premises of Jindal Saw Ltd, one of India�s

largest steel pipe producers. As of January 31, 2009, the Company

had completed production on approximately sixty percent of the

India pipeline contract.

The Company�s backlog on January 31, 2009 was $108 million, down

24.8% from the prior year but still the second highest in Company

history. Part of the backlog decline was due to the normal progress

on specific projects such as the pipeline in India. The Company

would not expect a project similar to this one to be replaced in

the backlog in sequential years. Additionally, the difficult

worldwide economic environment has caused some orders to be

postponed or cancelled and has reduced the opportunities to obtain

new work. As a favorable sign, quoting activity has been maintained

at a reasonably high level but decision making by customers is

slow, most likely due to general financial constraints and caution

on expenditures.

David Unger, CEO said, �Total annual sales have more than

doubled from 2003 to 2008. Our global expansion strategy of

manufacturing our products in foreign countries to serve their

local markets has resulted in higher sales, earnings and backlog

for our Company. In 2008, 51.5% of the Company�s employees were

located outside the United States and 35% of the Company�s sales

were to customers outside the United States. We expect a mix of

domestic and global sales will continue to support our Company�s

growth.�

Brad Mautner, President and COO said, �Overall, 2008 was a very

good year. The piping systems business had a terrific year driven

by strong domestic activity and very robust performance in the

Middle East supplemented by project revenue in India. The

filtration products business grew the net sales nicely but

operating profit (not including the non-cash goodwill charge) was

down due to reduced margin from the marketplace and some higher

expenses for relocating a U.S. operation to a more efficient

manufacturing facility. This move will serve us well over the long

term. The industrial process cooling equipment business faced a

very difficult fourth quarter as the markets it serves were deeply

impacted by the global recession. Yet, excluding the non-cash

goodwill charge, the group still improved profitability compared to

the prior year. The HVAC business worked actively on project

backlog and via solid execution, delivered a nice profit for the

year. Turning to 2009, all the business units are focused on

maximizing the results from existing backlog while adjusting cost

structures to the new realities brought on by the uncertain depth

and duration of a global recession. Even in the most challenging

business climate in decades we are fortunate to have a strong

leadership team for each of our segments to navigate the challenges

ahead.�

MFRI, Inc. is a multi-line company engaged in the following

businesses: pre-insulated specialty piping systems for oil and gas

gathering, district heating and cooling and other applications;

custom-designed industrial filtration products to remove

particulates from dry gas streams; industrial process cooling

equipment to remove heat from molding, printing and other

industrial processes; and installation of heating, ventilation and

air conditioning for large buildings.

Form 10-K for the period ended January 31, 2009 will be

accessible at http://www.sec.gov/. For more information visit the

Company's website www.mfri.com or contact the company directly.

Statements and other information contained in this announcement

which can be identified by the use of forward-looking terminology

such as "anticipate," "may," "will," "expect," "continue,"

"remain," "intend," "aim," "should," "prospects," "could,"

"future," "potential," believes," "plans," "likely," and

"probable," or the negative thereof or other variations thereon or

comparable terminology, constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934 as

amended and are subject to the safe harbors created thereby. These

statements should be considered as subject to the many risks and

uncertainties that exist in the Company's operations and business

environment. Such risks and uncertainties include, but are not

limited to, economic conditions, market demand and pricing,

competitive and cost factors, raw material availability and prices,

global interest rates, currency exchange rates, labor relations and

other risk factors.

MFRI, INC. AND SUBSIDIARIES

Condensed Statements of Operations and Related Data

(In $000�s except per share data)

Three Months Ended

January 31,

�

Fiscal Year Ended

January 31,

2009 2008 �

2009 2008 Net sales: Piping

Systems

$ 44,725

$ 25,746 $ 151,792 $ 104,273

Filtration Products 25,976 24,389 105,390 97,120 Industrial Process

Cooling Equipment 6,006 7,865 31,738 36,327 Corporate and Other (1)

5,916 � 503 � 14,146 � 1,767 � Totals 82,623 � 58,503 � 303,066 �

239,487 � Gross profit: Piping Systems 11,891 2,484 37,871 18,952

Filtration Products 1,325 3,024 11,424 13,776 Industrial Process

Cooling Equipment 1,321 1,424 7,919 8,508 Corporate and Other (1)

768 � 48 � 1,734 � 13 � Totals 15,305 � 6,980 � 58,948 � 41,249 �

Income (loss) from operations (2): Piping Systems 7,570 372 24,037

10,623 Filtration Products (3,694 ) 47 (2,936 ) 2,220 Industrial

Process Cooling Equipment (1,784 ) (838 ) (1,765 ) (1,227 )

Corporate and Other (1) (1,881 ) (2,347 ) (8,544 ) (8,720 ) Totals

211 � (2,766 ) 10,792 � 2,896 � � Income from joint venture 5 23

104 23 � Interest expense � net 813 657 2,834 2,408 � (Loss) income

before income taxes (597 ) (3,400 ) 8,062 511 � Income tax expense

230 362 1,373 809 � � � � Net (loss) income

$ (827 )

$ (3,762 ) $ 6,689 � $ (298 ) � Weighted average number of

common shares outstanding - basic 6,808 6,707 6,797 6,627 Earnings

per share - basic net (loss) income

$ (0.12 )

$ (0.56

) $ 0.98 $ (0.04 ) � Weighted average number of common shares

outstanding - diluted 6,808 6,707 6,853 6,627 Earnings per share -

diluted net (loss) income

$ (0.12 )

$ (0.56 ) $ 0.98

$ (0.04 )

Backlog: 1/31/09 � � 1/31/08 Piping Systems $

52,385 $ 65,810 Filtration Products 35,549 38,161 Industrial

Process Cooling Equipment 3,835 6,315 Corporate and Other (1) �

16,051 � 33,179 Total Backlog $ 107,820 $ 143,465

1. Corporate and Other includes activity for the installation of

heating, ventilation and air conditioning systems.

2. Income (loss) from operations for fourth quarter and full

year 2009 results includes the goodwill impairment charge totaling

$2,788,000 of which $1,688,000 was in the filtration products

business and $1,100,000 was in the industrial process cooling

equipment business.

See the Company�s Form 10-K for the period for notes to

financial statements.

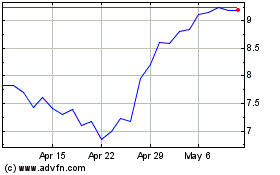

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

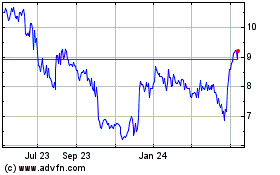

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jul 2023 to Jul 2024