Perion accelerates its strategic plan and

restructures its search monetization business

Perion Network Ltd. (NASDAQ: PERI) announced today its financial

results for the third quarter and nine months ended September 30,

2014.

Financial Highlights* (U.S. dollars

in thousands, except for per share data)

Three months ended September

30,

Nine months endedSeptember

30,

2013 2014 2013

2014 Non-GAAP Revenues $ 81,568 $ 87,377 $ 242,927 $

315,548 Non-GAAP Net Income $ 6,111 $ 26,647 $ 43,270 $

81,639 Adjusted EBITDA $ 12,652 $ 33,945 $ 57,226 $ 101,109

Non-GAAP Diluted earnings per share $ 0.11 $ 0.38 $ 0.78 $

1.18 GAAP Net Income (loss) $ (9,815 ) $ 16,996 $ 22,222 $

48,499 GAAP Diluted earnings per share $ 0.06 $ 0.24 $ 0.92

$ 0.69 GAAP Cash Flow from operations $ 68,866 $

47,229

* Reconciliation of GAAP to Non-GAAP

measures can be found in the last table.

Josef Mandelbaum, Perion’s CEO, commented: “I am pleased with

our third quarter results, as we delivered revenue and profits in

line with our expectations and guidance. As we mentioned last

quarter, we took decisive actions ahead of time and lowered our

marketing spend to proactively deal with the persistent industry

headwinds. In addition, we implemented a reorganization of our

search business, which included a head count reduction as well as

other cost saving measures. These actions will align costs with the

expected lower level of future search revenues.”

Mr. Mandelbaum continued, “We remain confident in our strategy,

and will use our strong cash position and continued positive cash

flow to focus on being the best in class in two main activities:

monetization solutions for developers and mobile marketing

solutions for advertisers. In regards to our mobile efforts, we

have made considerable progress and are excited to announce the

launch of our GrowMobile self-service platform next week in London.

GrowMobile Self-Serve is the first cross-network mobile advertising

platform, offering a centralized system for buying media across

hundreds of traffic sources. In addition, we are developing new

monetization products beyond search around activities like

PC2Mobile app monetization and targeted advertising for publishers.

We believe these investments will enable us to emerge a stronger

company, with a unique value proposition to publishers and

advertisers.”

In accordance with generally accepted accounting principles

(“GAAP”), the acquisition of ClientConnect by Perion, which closed

on January 2, 2014, is accounted for as a reverse acquisition.

Therefore, Perion is comparing its results to the results of

ClientConnect in 2013. The year over year growth described below is

attributable to a great extent to the fact that Perion's 2013

results are not included in the results of ClientConnect in

2013.

Non-GAAP Financial Comparison for the third Quarter of

2014:

Revenues: In the third quarter of 2014, revenues were

$87.4 million, increasing 7% compared to ClientConnect's

revenues of $81.6 million in the third quarter of 2013.

Non-GAAP revenues in the third quarter of 2014 include

$1.1 million of deferred product revenues, which in accordance

with GAAP were recorded at fair value on the acquisition date. In

the third quarter of 2013, non-GAAP revenues included

$0.6 million of revenues which in the GAAP report were

associated with discontinued operations.

Customer Acquisition Costs (“CAC”): In the third quarter

of 2014, Perion decreased its investment in CAC to

$30.0 million, representing 34% of revenues, compared to

$49.8 million, or 61% of revenues in the third quarter of 2013

by ClientConnect.

Costs and Expenses: Excluding CAC, costs and expenses in

the third quarter of 2014 were $24.1 million, or 28% of

revenues, compared to $21.7 million, or 27% of revenues, at

ClientConnect in the third quarter of 2013. Non-GAAP costs and

expenses in the third quarter of 2014 excluded $4.8 million

amortization of acquired intangible assets, $4.4 million of

share based compensation expenses and $1.0 million of

acquisition related expenses, all of which were included in the

GAAP numbers. In the third quarter of 2013, non-GAAP costs and

expenses excluded $4.1 million of share based compensation

expenses and included activities of $11.5 million which in the

GAAP report were associated with discontinued operations and

excluded from costs and expenses.

Adjusted EBITDA: In the third quarter of 2014, adjusted

EBITDA was $33.9 million, or 39% of revenues, a 168% increase

compared to $12.7 million at ClientConnect in the same quarter

last year.

Net Income: In the third quarter of 2014, net income was

$26.6 million, or 30% of revenues, compared to

$6.1 million, or 7% of revenue at ClientConnect in the third

quarter of 2013.

Non-GAAP Financial Comparison for the Nine Months ended

September 30, 2014:

Revenues: In the first nine months of 2014 revenues were

$315.5 million, increasing 30% compared to ClientConnect's

revenues of $242.9 million in the first nine months of 2013.

Non-GAAP revenues in the first nine months of 2014 include

$4.9 million of deferred product revenues, which in accordance

with GAAP were recorded at fair value on the acquisition date. In

the first nine months of 2013, non-GAAP revenues included

$1.5 million of revenue which in the GAAP report was

associated with discontinued operations.

Customer Acquisition Costs (“CAC”): In the first nine

months of 2014, Perion increased its investment in CAC to

$145.5 million, representing 46% of revenues, compared to

ClientConnect's $131.7 million in first the nine months of

2013.

Costs and Expenses: Excluding CAC, costs and expenses in

the first nine months of 2014 were $70.8 million, or 22% of

revenues, compared to $58.0 million, or 24% of revenues, at

ClientConnect in the first nine months of 2013. Non-GAAP costs and

expenses in the first nine months of 2014 excluded

$13.8 million amortization of acquired intangible assets,

$12.7 million of share based compensation expenses and

$4.4 million of acquisition related expenses, all of which

were included in the GAAP numbers. In the first nine months of

2013, non-GAAP costs and expenses excluded $9.2 million of

share based compensation expenses and included activities of $28.7

million which in the GAAP report were associated with discontinued

operations.

Adjusted EBITDA: In the first nine months of 2014,

adjusted EBITDA increased by 77%, to $101.1 million, or 32% of

revenues, compared to $57.2 million, or 24% of revenues at

ClientConnect in the same period last year.

Net Income: In the first nine months of 2014, net income

was $81.6 million, or 26% of revenues, increasing 89% from

$43.3 million at ClientConnect in the first nine months of

2013.

Cash and Cash Flow from Operations:

GAAP Cash Flow: As of September 30, 2014, cash and cash

equivalents were $96.9 million. Included in this balance is

$37.3 million of net proceeds raised in September 2014 from a

public offering in Israel of its 5% Series L Convertible Bonds, due

2020. Perion currently satisfies all of the financial covenants

associated with the bonds. Cash flow from operations in the first

nine months of 2014 was $47.2 million.

2014 Financial Outlook:

The following forward looking statements reflect management’s

expectations as of November 6, 2014:

- Reaffirmed non-GAAP Revenue will be in

the range of $380 million to $400 million, as previously

announced.

- Raised adjusted EBITDA, now expected to

be in the range of $115 million to $120 million.

- Raised non-GAAP Net Income, now

expected to be in the range of $90 million to $95 million.

Conference Call

Perion will host a conference call to discuss the results today,

November 6, 2014 at 10 a.m. ET. Details are as follows:

- Conference ID: 6100298

- Dial-in number from within the United

States: 1-888-539-3612

- Dial-in number from Israel:

1-809-245-906

- Dial-in number (other international):

1-719-325-2393

- Playback available until November 13,

2014 by calling 1-877-870-5176 (in the U.S.) or 1-858-384-5517

(international). Please use pin number 6100298 for the replay.

- A live webcast is accessible at

http://www.perion.com/events-presentations.

About Perion Network Ltd.

Perion powers innovation. We are a global performance-based

media and Internet company, providing online publishers and app

developers advanced technology and a variety of intelligent,

data-driven solutions to monetize their applications and content

and expand their reach to larger audiences, based on our own

experience as an app developer. Our leading software monetization

platform, Perion Codefuel, empowers digital businesses to optimize

installs, analyze data and maximize revenue. Our app promotion

platform, GrowMobile, enables developers to make wise decisions on

where to spend advertising budgets to produce the highest yield and

the most visibility. The Perion team brings decades of experience,

operating and investing in digitally-enabled businesses, and we

continue to innovate and create value for the app ecosystem. More

information about Perion may be found at www.perion.com.

Follow Perion on Twitter @perionnetwork.

Non-GAAP measures

Non-GAAP financial measures, as well as adjusted EBITDA, consist

of GAAP financial measures adjusted to include the results of

discontinued operations, and to exclude acquisition related

expenses, share-based compensation expenses, amortization of

acquired intangible assets and non-recurring tax expenses, as well

as certain accounting entries that are required under the business

combination accounting rules. The purpose of such adjustments is to

give an indication of our performance exclusive of non-cash charges

and other items that are considered by management to be outside of

our core operating results. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Furthermore, the non-GAAP measures are regularly

used internally to understand, manage and evaluate our business and

make operating decisions, and we believe that they are useful to

investors as a consistent and comparable measure of the ongoing

performance of our business. However, our non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP measures, and should be read only in

conjunction with our consolidated financial statements prepared in

accordance with GAAP. Additionally, these non-GAAP financial

measures may differ materially from the non-GAAP financial measures

used by other companies. A reconciliation between results on a GAAP

and non-GAAP basis is provided immediately following the Summary of

Non-GAAP Financial Results.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of Perion.

The words “will,” “believe,” “expect,” “intend,” “plan,” “should”

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of Perion with respect to future events and are

subject to risks and uncertainties. Many factors could cause the

actual results, performance or achievements of Perion to be

materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, or financial information, including,

among others, the failure to realize the anticipated benefits of

the ClientConnect transaction; risks entailed in integrating the

ClientConnect business with Perion’s other businesses, including

employee retention and customer acceptance; the risk that the

transaction will divert management and other resources from the

ongoing operations of the two businesses or otherwise disrupt the

conduct of those businesses, potential litigation associated with

the transaction, and general risks associated with the business of

Perion and with the ClientConnect business, including changes in

the markets in which the businesses operate and in general economic

and business conditions, loss of key customers, unpredictable sales

cycles, competitive pressures, market acceptance of new products,

inability to meet efficiency and cost reduction objectives, changes

in business strategy and various other factors, whether referenced

or not referenced in this press release. Various other risks and

uncertainties may affect Perion and its results of operations, as

described in reports filed by the Company with the Securities and

Exchange Commission from time to time, including its annual report

on Form 20-F for the year ended December 31, 2013 and the report on

Form 6-K filed with the SEC on September 23, 2014. Perion does not

assume any obligation to update these forward-looking

statements.

Source: Perion Network Ltd.

PERION NETWORK LTD. GAAP

FINANCIAL STATEMENTS CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) U.S. dollars and number of shares in thousands

(except per share data)

Three months ended September

30,

Nine months ended September

30,

2013 2014 2013

2014 Revenues: Search $ 68,899 $ 73,310

$ 206,162 $ 262,656 Advertising and other 12,030 12,975

35,217 47,987

Total revenues

80,929 86,285 241,379

310,643 Costs and expenses: Cost of

revenues 1,464 7,527 4,418 20,490 Customer acquisition costs 49,752

30,006 131,727 145,548 Research and development 5,530 10,873 15,773

34,832 Selling and marketing 2,349 7,617 7,297 18,126 General and

administrative 4,920 8,237 10,973 28,192

Total costs and expenses 64,015

64,260 170,188 247,188

Income from operations 16,914 22,025

71,191 63,455 Financial income (expense), net

602 (1,039 ) 2,014 (1,906 ) Income before taxes on

income 17,516 20,986 73,205 61,549 Taxes on income 13,920

3,990 22,671 13,050 Net income from continuing

operations 3,596 16,996 50,534 48,499 Net loss from discontinued

operations (13,411 ) - (28,312 ) -

Net

income (loss) $ (9,815 ) $

16,996 $ 22,222 $

48,499 Net income (loss) per share -

basic: Continuing operations $ 0.07 $ 0.25 $ 0.94

$ 0.71 Discontinued operations $ (0.25 ) $ - $

(0.53 ) $ -

Net income (loss) per share -

diluted: Continuing operations $ 0.06 $ 0.24 $

0.92 $ 0.69 Discontinued operations $ (0.25 ) $ -

$ (0.53 ) $ -

Number of shares - basic:

Continuing and discontinued operations 53,909 69,002

53,907 67,893

Number of shares -

diluted: Continuing operations 55,562 69,449

54,991 69,185 Discontinued operations 53,909 -

53,907 -

PERION NETWORK

LTD. GAAP FINANCIAL STATEMENTS CONDENSED CONSOLIDATED

BALANCE SHEETS U.S. dollars in thousands

December 31, 2013 September 30, 2014

Audited Unaudited ASSETS: Current

Assets: Cash and cash equivalents $ 949 $ 96,934 Restricted cash -

1,650 Accounts receivable, net - 34,250 Other current assets 400

7,345 Total current assets 1,349 140,179 Property and

equipment, net 2,189 11,367 Goodwill and intangible assets, net

27,520 208,027 Other assets - 2,401

Total assets

$ 31,058 $ 361,974

LIABILITIES AND STOCKHOLDERS' EQUITY: Current

Liabilities: Accounts payable $ 13,358 $ 24,982 Accrued expenses

and other liabilities 1,423 17,809 Current maturities of long term

debt - 2,300 Deferred revenues 6,250 7,090 Payment obligation

related to acquisitions - 10,191 Total current liabilities 21,031

62,372 Long-term debt - 2,525 Long-term convertible debt -

37,279 Long-Term payment obligation related to acquisition - 4,734

Other long-term liabilities - 6,080 Total liabilities 21,031

112,990 Stockholders' equity: Common stock and additional

paid-in capital 10,027 200,485 Retained earnings - 48,499 Total

stockholders' equity: 10,027 248,984

Total liabilities

and stockholders' equity $ 31,058 $

361,974 PERION NETWORK LTD. GAAP

FINANCIAL STATEMENTS CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED) U.S. dollars in thousands

Nine months ended September 30, 2013

2014

Operating

activities:

Net income $ 22,222 $ 48,499 Loss from discontinued operations, net

(28,312 ) - Net income from continuing operations 50,534

48,499 Adjustments required to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 1,536 15,641 Share based compensation 6,856 12,679

Acquisition related expenses paid by shareholders - 3,060 Accrued

interest, net 1,284 143 Accretion of payment obligation related to

acquisition - 958 Fair value revaluation of convertible debt - (584

) Capital loss from sale of property and equipment - 104 Deferred

income taxes (69 ) (3,889 ) Changes in assets and liabilities

27,584 (29,382 ) Net cash provided by continuing operating

activities 87,725 47,229 Net cash used in discontinued operations

(18,859 ) -

Net cash provided by operating activities

68,866 47,229

Investing

activities:

Purchase of property and equipment (1,226 ) (4,930 )

Restricted cash - 435 Investments in short-term bank deposits

(75,749 ) - Cash used for the acquisition of Grow Mobile LLC -

(4,322 ) Cash acquired through acquisition of Perion Network Ltd. -

23,364 Net cash provided by (used in) continuing

operations (76,975 ) 14,547 Net cash provided by discontinued

operations 922 -

Net cash provided by (used in)

investing activities (76,053 ) 14,547

Financing

activities:

Proceeds from exercise of employee options 68 1,576

Contribution by shareholders - 585 Deferred payment made in

connection with acquisition - (4,079 ) Proceeds from issuance of

convertible debt - 37,852 Repayment of long-term loans -

(1,725 )

Net cash provided by financing activities 68

34,209 Net increase (decrease) in

cash and cash equivalents (7,119 ) 95,985

Decrease in cash and cash equivalents - discontinued operations

1,699 - Cash and cash equivalents at beginning of period 78,395

949

Cash and cash equivalents at end of

period $ 72,975 $ 96,934

PERION NETWORK LTD. RECONCILIATION

OF GAAP TO NON-GAAP RESULTS (UNAUDITED) U.S. dollars and

number of shares in thousands (except per share data)

Three months ended September

30,

Nine months ended September

30,

2013 2014 2013

2014 GAAP revenues $

80,929 $ 86,285 $ 241,379

$ 310,643 Revenues from discontinued operations 639 -

1,548 - Valuation adjustment on acquired deferred product revenues

- 1,092 - 4,905

Non-GAAP

revenues $ 81,568 $ 87,377

$ 242,927 $ 315,548

GAAP costs and expenses $ 64,015

$ 64,260 $ 170,188 $

247,188 Acquisition related expenses - (1,010 ) - (4,429 )

Discontinued operations operating expenses 11,492 - 28,736 - Share

based compensation (4,088 ) (4,370 ) (9,210 ) (12,679 )

Amortization of acquired intangible assets - (4,769 ) -

(13,770 )

Non-GAAP costs and expenses $

71,419 $ 54,111 $

189,714 $ 216,310 GAAP

net income (loss) $ (9,815 ) $

16,996 $ 22,222 $ 48,499

Valuation adjustment on acquired deferred product revenues - 1,092

- 4,905 Acquisition related expenses - 1,010 - 4,429 Share based

compensation 4,088 4,370 9,210 12,679 Amortization of acquired

intangible assets - 4,769 - 13,770 Fair value revaluation -

convertible note - (584 ) - (584 ) Non-recurring tax expense 11,838

- 11,838 - Accretion of payment obligation related to acquisitions

- - - 452 Taxes related to amortization of acquired intangible

assets and share based compensation - (1,006 ) -

(2,511 )

Non-GAAP net income $ 6,111

$ 26,647 $ 43,270

$ 81,639 Non-GAAP net income

$ 6,111 $ 26,647 $ 43,270

$ 81,639 Income tax expense 2,082 4,996 10,833 15,561

Financial (income) expense, net (602 ) 1,623 (2,014 ) 2,038

Depreciation 2,504 679 4,014 1,871 Discontinued financial income,

net (24 ) - (107 ) - Discontinued tax expense 2,581 -

1,230 -

Adjusted EBITDA $ 12,652

$ 33,945 $ 57,226

$ 101,109 Non-GAAP diluted earnings

per share $ 0.11 $ 0.38

$ 0.79 $ 1.18

Shares used in computing non-GAAP diluted earnings per share

55,562 69,449 54,991

69,185

Perion Network Ltd.Deborah MargalitPerion Investor

Relations+972-73-398-1000investors@perion.comorSolebury

Communications GroupJamie Lillis+1 (203)

428-3223jlillis@soleburyir.com

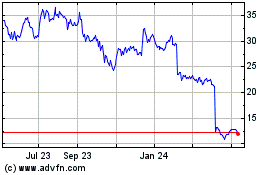

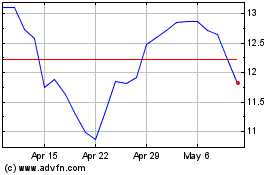

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024