Stock Market News for May 14, 2013 - Market News

May 14 2013 - 5:36AM

Zacks

Major indices finished mixed

following better-than-expected retail sales data and discouraging

economic reports from China. Investors are also concerned that, in

light of encouraging economic data, the Federal Reserve might

withdraw the monetary stimulus implemented since 2008. Of the top

ten S&P 500 industry groups, health care stocks were the

biggest gainers while materials stocks lost the most.

The Dow Jones Industrial Average

(DJI) lost 0.2% to close the day at 15,091.68. The S&P 500

gained 0.07 points to finish yesterday’s trading session at

1,633.77. The tech-laden Nasdaq Composite Index rose 0.1% to end at

3,438.79. The fear-gauge CBOE Volatility Index (VIX) decreased 0.3%

to settle at 12.55. Consolidated volumes on the New York Stock

Exchange, American Stock Exchange and Nasdaq were roughly 5.3

billion shares, well below 2013’s average of 6.36 billion shares.

Declining stocks outnumbered the advancers. For the 37% that

advanced, 59% declined.

According to the U.S. Department of

Commerce, retail sales for the month of April increased to 0.1%

compared to the consensus estimate of a decline of 0.3%. This was

also better than the previous month’s decline of 0.5%. Retail sales

grew unexpectedly on the back of robust car sales and expenditure

incurred on building supplies. Car sales, without which retail

sales would have declined by 0.1%, grew 1.0% in April. While

expenditure on gardening materials and building materials grew

4.7%, growth in departmental store sales increased 0.3%. Sales at

grocery stores decreased 1.2% while at gasoline stations by

4.7%.

According to another report

released by the U.S. Department of Commerce, manufacturers’ and

trade inventories in March remained flat on a sequential basis.

This data came in below the consensus estimate of 0.3%. However, on

a year over year basis it grew 4.5%. The inventory/sales ratio

increased to 1.29 from March 2012’s figure of 1.26.

According to a Wall Street Journal

report released over the weekend, the Federal Reserve is looking to

create an “exit strategy” for its monetary stimulus program. Since

2008, the Federal Reserve has been purchasing $85 billion worth of

treasuries and mortgage-backed-securities every month to boost the

economy. Now that the unemployment level is the same as it was in

the pre-recessionary period and important economic indicators have

remained positive over past two quarters, the Fed is considering

discontinuing or changing the pace of its monetary stimulus.

No specific timeline has been

provided by the Fed for these changes. However, last month the

Central bank did declare its willingness to "increase or reduce the

pace" of monetary stimulus. The increase or decrease of the

stimulus will depend on unemployment and the inflation numbers,

released from time to time. Currently, officials are deciding on

their future course of action. This is to ensure that panic does

not dominate the markets while withdrawing or changing the pace of

stimulus.

On the international front, China

released a bunch of discouraging economic reports. Industrial

output increased 9.3% year over year, higher than previous month’s

figure of 8.9%, but lower than the expected figure of 9.5%. Factory

orders for the world’s second largest economy dropped in April.

Decrease in new export orders is largely responsible for the

contraction.

A sub-index which measures new

export orders contracted to 48.4. This is the first time since

October 2012 that the index has fallen below 50. Non-rural fixed

asset investment from January to April period came in at 20.6%,

compared to estimates of 21% and also below January to March’s

figure of 20.9%. A string of discouraging numbers recently reported

by China has reinforced fears of a global slowdown in the minds of

investors.

On the earnings front, shares of

Perion Network Ltd (NASDAQ:PERI) surged 10.6% after its earnings

comfortably surpassed the Street’s expectations. The company

reported earnings of $0.22 a share, higher than the $0.04 cents a

share reported in the previous year. Strong earnings of the company

are attributable to its new Incredimail unified messaging

application for Apple Inc.'s iPad.

Of the top ten S&P 500 industry

groups, health care stocks gained the most. The Health Care SPDR

(XLV) gained 0.8%. Stocks such Johnson & Johnson (NYSE:JNJ),

Pfizer Inc. (NYSE:PFE), Merck & Co., Inc. (NYSE:MRK), Gilead

Sciences, Inc. (NASDAQ:GILD) and Amgen, Inc. (NASDAQ:AMGN)

increased 0.1%, 2.3%, 0.5%, 3.0% and 0.2%, respectively.

Materials stocks were the biggest

losers. The Materials Select Sector SPDR (XLB) lost 0.7%. Stocks

such as Monsanto Company (NYSE:MON), E I Du Pont De Nemours And Co.

(NYSE:DD), FMC Corp. (NYSE:FMC), the Dow Chemical Company

(NYSE:DOW) and Praxair, Inc. (NYSE:PX) lost 1.2%, 1.0%, 2.0%, 0.3%

and 0.8%, respectively.

AMGEN INC (AMGN): Free Stock Analysis Report

DU PONT (EI) DE (DD): Free Stock Analysis Report

DOW CHEMICAL (DOW): Free Stock Analysis Report

FMC CORP (FMC): Free Stock Analysis Report

GILEAD SCIENCES (GILD): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

MONSANTO CO-NEW (MON): Free Stock Analysis Report

MERCK & CO INC (MRK): Free Stock Analysis Report

PERION NETWORK (PERI): Get Free Report

PFIZER INC (PFE): Free Stock Analysis Report

PRAXAIR INC (PX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

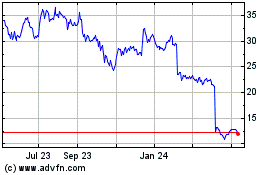

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

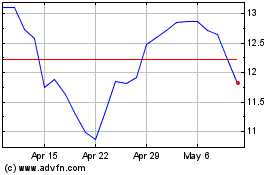

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024