Shutterfly Sets 52-Week High - Analyst Blog

April 15 2013 - 7:50AM

Zacks

Shares of Shutterfly Inc. (SFLY) hit its

52-week high of $45.90 on Apr 12 and eventually closed at $44.97,

generating a return of approximately 45.8% year-to-date.

Shutterfly’s shares have been riding high since it reported solid

fourth quarter results on Feb 5. Average volume of shares traded

over the last three months came in at approximately 895K.

Factors Driving Momentum

A strong business model, a string of acquisitions and potential

for future share growth boosted the shares of this Internet-based

social expression and personal publishing service company.

Shutterfly offers innovative products and services and has ample

manufacturing capacity. Shutterfly’s fourth-quarter 2012 earnings

of $1.40 per share breezed past the Zacks Consensus Estimate by

38.6% and the year-ago result by 44.3%. Increased revenues (up 33%)

along with efficient cost containment led to the beat.

Shutterfly is focused on growing its business through strategic

partnerships with retailers and through acquisitions. Some of

Shutterfly’s latest acquisitions include ThisLife in Jan 2013; Fuji

Film’s photo creating and sharing website SeeHere.com in Oct 2012

and Kodak Gallery online photo services (formerly known as Ofoto)

in May 2012. Management also expects Kodak to deliver a

significantly higher EBITDA margin in fiscal 2013.

The company’s market share is growing steadily. Its market

leading position is driven by its ability to launch new products

and services, expand its customer base, improve operational

efficiency and seamlessly integrate related acquisitions. According

to InfoTrends, Shutterfly accounts for around 50% to 52% of the

present market.

The increasing use of digital cameras, largely driven by price

decreases, has led to heightened demand for online photo printing

services, which leaves ample scope for Shutterfly’s expansion. The

company also remains committed towards launching services like

one-to-one greeting card service, thus beefing up its

mobile-related offerings.

Shutterfly is scheduled to report its first quarter 2013

earnings early next month. This company currently carries a Zacks

Rank #1 (Strong Buy) and a positive earnings ESP (Read: Zacks

Earnings ESP: A Better Method) of +4.88%. This indicates a likely

positive earnings surprise.

Other Stocks to Consider

Stocks that are performing well and are worth considering in the

Internet-based business services sector include Angie's

List Inc. (ANGI), Giant Interactive Group

Inc. (GA) and Perion Network Ltd

(PERI). All three stocks carry a Zacks Rank #2 (Buy).

GIANT INTERACTV (GA): Free Stock Analysis Report

PERION NETWORK (PERI): Get Free Report

SHUTTERFLY INC (SFLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

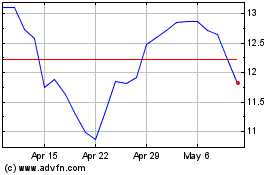

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

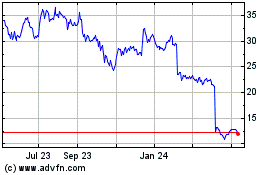

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024