Zillow Reports 4Q and FY12 Results - Analyst Blog

February 14 2013 - 4:40AM

Zacks

Zillow Inc. (Z)

fourth quarter net earnings of 2 cents breezed past the Zacks

Consensus Estimate of negative 6 cents. Results were down 33.3%

year over year from 3 cents earned in the year-ago quarter.

Quarterly Operational Update

Total revenues increased 73% year over year to $34.3 million in the

fourth quarter. This was driven by solid improvement in both

marketplace revenue (up 95.2% year over year to $26.8 million) and

display revenue (increasing 22% year over year to $7.5 million). It

surpassed the Zacks Consensus Estimate of $31 million.

Total expenses in the quarter increased 78.1% year over year to

$33.8 million.

The magnitude of increase in expenses more than offset the

magnitude of increase in total revenues, thus causing operating

income to decline year-over-year.

In the reported quarter, average unique monthly users increased 47%

year over year to 34.5 million.

Premier Agent subscribers also increased by 2,770 in the fourth

quarter. Average monthly revenue per subscriber increased 3% year

over year to $267.

Earnings before interest tax, depreciation and amortization

(EBITDA) increased 106.1% year over year to $6.8 million.

Full Year Highlights

Adjusted earnings were 18 cents per share exceeding the Zacks

Consensus Estimate of 10 cents per share. Zillow broke even in

2011.

Total revenues for full year 2012 increased 77% year over year to

$116.9 million. This was driven by strong improvement in market

place revenue (up 105% year over year to $86.7 million) and display

revenue (up 26% year over year to $30.2 million).

Earnings before interest tax, depreciation and amortization

(EBITDA) increased 111.8% year over year to $25.2 million.

Premier Agent Subscribers in 2012 numbered 29,473, up 87% year over

year.

Financial Position

Zillow exited 2012 with cash and cash equivalents of $150.0

million, up 231.9% year over year.

As of Dec 31, 2012, total assets of the company were $304.2

million, up 160.8% year over year.

Net cash flow from operating activities in 2012 was $32.3 million,

up 117.8% year over year.

Shareholders’ equity increased 177% year over year to $280.3

million at 2012 end.

Business Update

In February 2013, Zillow launched Zillow Digs– an online service in

home remodeling, which marked an expansion in its existing lines of

businesses.

In the reported quarter the company made three acquisitions -

Mortech Inc., a software and services company providing CRM and

pricing engine to the mortgage industry, HotPads, a site that

offers consumer rentals and mobile apps, and Buyfolio, an online

and mobile supported shopping means, to fortify its mortgage,

rental and real estate businesses.

Earlier this month, Zillow pronounced that Zillow Real Estate

Network will be partnering with HGTV. The deal will allow Zillow to

provide all real estate listings for HGTV’s Front Door. Zillow

Premier Agents which is expected to come into force in the second

quarter of 2013 will also be benefited from the partnership.

Zacks Rank

Zillow currently carries a Zacks Rank #4 (Sell). Perion

Network Ltd. Ord (PERI), Giant Interactive Group

Inc. (GA) and American Public Education

Inc. (APEI) with favorable Zacks Rank #1 (Strong Buy) are

expected to report their fourth quarter and full year 2012 results

shortly.

AMER PUB EDUCAT (APEI): Free Stock Analysis Report

GIANT INTERACTV (GA): Free Stock Analysis Report

(PERI): ETF Research Reports

ZILLOW INC (Z): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

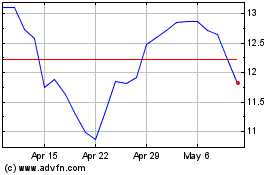

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

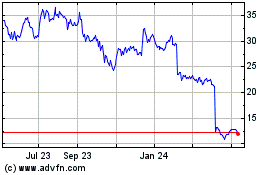

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024