Perion Again Increases Full-Year Guidance

September 10 2012 - 10:00AM

Business Wire

Perion Network Ltd. (NASDAQ: PERI), today announced increased

guidance for the full-year 2012 based on continued improvements in

the Company’s operations.

Based on continued improvements in the Company’s back-end

systems, which are enabling a strong return on investment, and

consequently, an increase in customer acquisition spending as well

as increased search distribution partnerships, management is

raising non-GAAP guidance for 2012 for the second time this year.

Management currently expects:

- Revenues of approximately $55 million,

up from previous guidance of $50 to $52 million.

- EBITDA of approximately $12 million,

compared to previous guidance of $10.5 to $11.5 million

- Net Income of approximately $9 million,

or $0.90 per share on a non-GAAP basis, an increase compared to

previous guidance of $7.5 to $8.5 million

“Our financial performance continues to be strong and we are

seeing continued improvements, particularly with our core search

business,” commented Chief Executive Officer Josef Mandelbaum.

“Our investments in infrastructure and systems over the past year

continue to provide strong revenue momentum and increased ROI. In

addition, the improved results from Smilebox, bolsters our premium

revenue and overall profitability. As a result, we are again

increasing our full-year outlook. We currently expect a better than

55% increase in revenues in the second half of this year compared

to the second-half of last year.”

About Perion Network Ltd.,

Perion Network, Ltd. (NASDAQ: PERI) is a global internet

consumer software company that develops applications to make the

online experience of its users simple, safe and enjoyable. Perion’s

two main award winning consumer brands are: IncrediMail and

Smilebox. Together these products have had over 150 million

downloads and have an installed base of over 18 million.

IncrediMail, is a streamlined e-mail and Facebook

application with an easy-to-use interface that allows for more

personalized communications sold in over 100 countries in 8

languages and Smilebox, a leading photo sharing and social

expression product and service that lets customers quickly turn

life's moments into digital creations to share and connect with

friends and family in a fun and personal way. Perion’s applications

are monetized through a freemium model. Free versions of our

applications are monetized primarily through our toolbar which

generates search revenue, and advertising revenue generated through

impressions, while a more advanced feature rich version is

available with a premium upgrade. Perion also offers and develops a

range of products for mobile phones and tablets to answer its users

increasing mobile demands. For more information on Perion please

visit www.perion.com.

Non-GAAP measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude: Valuation adjustment on acquired deferred

product revenues, amortization of acquired intangible assets,

share-based compensation expenses, acquisition related expenses,

deferred finance expenses and non-recurring tax benefits. The

purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. Our non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Our management regularly uses our supplemental non-GAAP financial

measures internally to understand, manage and evaluate our business

and make operating decisions. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Business combination accounting rules requires us

to recognize a legal performance obligation related to a revenue

arrangement of an acquired entity. The amount assigned to that

liability should be based on its fair value at the date of

acquisition. The non-GAAP adjustment is intended to reflect the

full amount of such revenue. We believe this adjustment is useful

to investors as a measure of the ongoing performance of our

business. We believe these non-GAAP financial measures provide

consistent and comparable measures to help investors understand our

current and future operating cash flow performance. These non-GAAP

financial measures may differ materially from the non-GAAP

financial measures used by other companies.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of the

Company. The words “believe,” “expect,” “intend,” “plan,” “should”

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of the Company with respect to future events and

are subject to risks and uncertainties. Many factors could cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, including, among others, , changes in

the markets in which the Company operates and in general economic

and business conditions, loss of key customers and unpredictable

sales cycles, competitive pressures, market acceptance of new

products, inability to meet efficiency and cost reduction

objectives, changes in business strategy and various other factors,

whether referenced or not referenced in this press release. Various

other risks and uncertainties may affect the Company and its

results of operations, as described in reports filed by the Company

with the Securities and Exchange Commission from time to time,

including its annual report on Form 20-F for the year ended

December 31, 2011. The Company does not assume any obligation to

update these forward-looking statements.

Source: Perion Network Ltd.

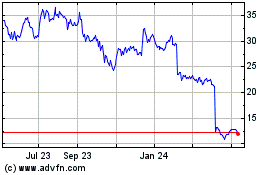

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

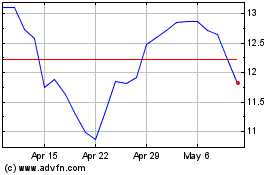

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024